What is the Nutraceuticals Market Size?

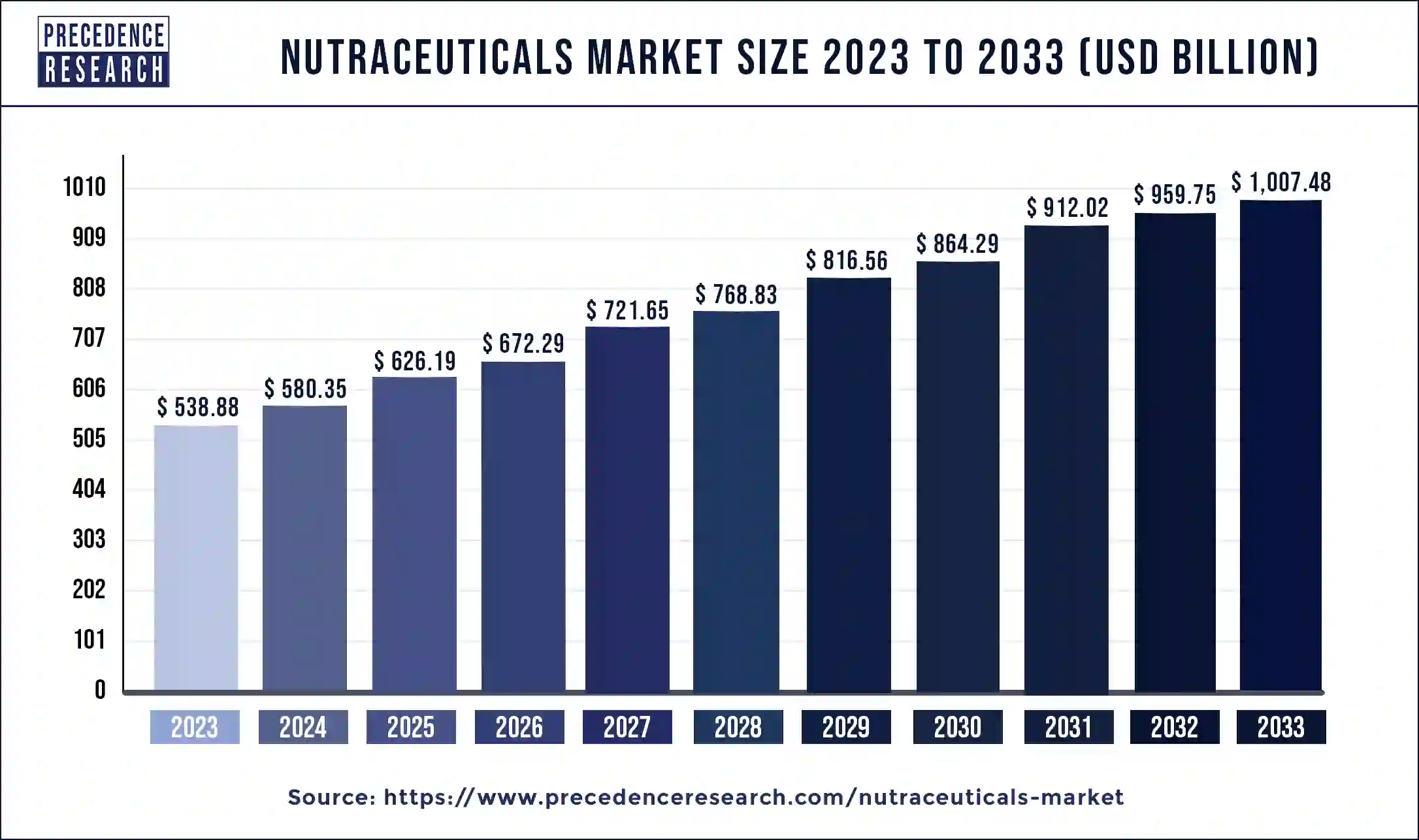

The global nutraceuticals market size was accounted at USD 626.19 billion in 2025 and predicted to increase from USD 672.29 billion in 2026 to approximately USD 1,102.94 billion by 2035, representing a CAGR of 5.82% from 2026 to 2035.

Nutraceuticals Market Key Takeaways

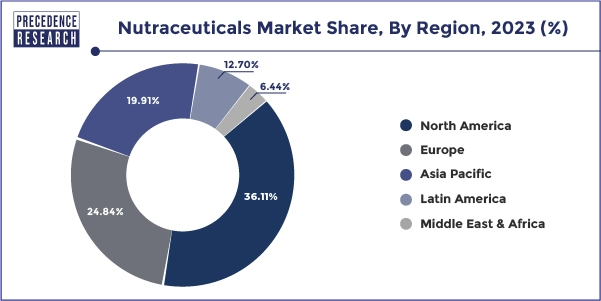

- North America dominated the market with the largest share of 36.11% in 2025.

- Asia Pacific segment is expected to grow at the fastest rate in the market during the forecast period of 2026 to 2035.

- By type, the functional beverages segment is projected to experience the highest growth rate in the market between 2026 and 2035.

- By sales channel, the online/e-commerce segment is set to experience the fastest rate of market growth from 2026 to 2035.

Market Overview

Nutraceuticals is a comprehensive umbrella term which is used to label any product acquired from food origin with additional health advantages over and above the basic nutritious value available in foods. Nutraceuticals can be regarded as non-precise biological remedies used to boost general health, regulate indications and avert malignant developments. The explanation of nutraceuticals and allied output generally relies on the origin. Nutraceuticals can be segmented on the foundation of their natural basis, pharmacological circumstances, as well as chemical structure of the products. Most often nutraceuticals are organized in the following classes: functional food, dietary supplements, pharmaceuticals, and medicinal food.

How are AI technologies benefiting the nutraceuticals market?

Artificial intelligence is increasingly becoming a cornerstone of innovation in the nutraceuticals industry, particularly for product discovery and regulatory acceleration. As highlighted by industry consultant Ryan Sproull at Vitafoods Asia 2024, AI platforms like Nutrify Today analyse data from research literature, plant genomics, and traditional medicine knowledge bases to uncover bioactive compounds and ingredient combinations with higher potential for efficacy and safety. This approach enables faster identification and moves from concept to commercialization more rapidly. Simultaneously. AI-driven solutions are enhancing quality control and operational efficiency. By employing machine vision, predictive analytics, and process automation, supplement firms can detect manufacturing deviations, ensure consistency in formulation, and reduce production costs. Early adopters of these technologies are setting new benchmarks in operational excellence while gaining a competitive advantage in speed, reliability, and compliance.

Nutraceuticals Market Growth Factors

- Development of function-specific antioxidants.

- Increasing disposable income.

- Increasing need for preventive healthcare.

- Growing awareness regarding health and well-being.

- Constant innovations.

- Increasing prevalence of lifestyle related disorders.

- Increasing number of fitness centers in developing regions.

- Rise of e-commerce industry.

Market Scope

| Report Highlights | Details |

| Market Size in 2025 | USD 626.19 Billion |

| Market Size in 2026 | USD 672.29 Billion |

| Market Size by 2035 | USD 1,102.94 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 5.82% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Form,Sales Channel |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, Middle East & Africa (MEA) |

Market Dynamics

Drivers

Increasing use of Nutraceuticals for their potential therapeutic outcomes in various diseases and ailments

Over the few years, nutraceuticals have been increasingly used in various therapeutic outcomes. Nutraceutical products are not only used for better health outcomes but to reduce the risk of heart diseases, cancer, and other related diseases like insomnia, cataracts, weakened memory, menopausal symptoms, and gastrointestinal problems. Nutraceuticals products, such as those derived from a combination of ginger, garlic, and honey, are effective in treating headaches and migraines caused by stress. Other nutraceutical products like green tea, Vitamin E, and Vitamin C are being used for various purposes, such as improving hair health and complexion and treating conditions like varicose veins, alcoholism, depression, and lethargy, among others.

Increasing prevalence of chronic diseases

There has been a rise in chronic diseases such as diabetes, cardiovascular diseases, cancer, and Obesity. According to WHO, the mortality rate each year due to chronic illness is equivalent to 74%. About 17 million die due before the age of 70;86% of these premature deaths occur in low-and middle-income countries. CVD accounts for the most deaths, 17.9 million people annually, followed by cancers (9.3), chronic respiratory diseases (4.1 million), and diabetes (2.0 million including kidney disease deaths caused by diabetes). These group of diseases accounts for over 80% of all premature Chronic disease deaths. As the prevalence of chronic diseases continues to rise, consumers are increasingly turning to nutraceuticals as a part of their preventive or complementary healthcare strategies. Nutraceuticals are gaining popularity as a complementary or alternative approach for managing these chronic conditions, as they are often perceived as safer with fewer side effects compared to conventional pharmaceuticals.

Development of function-specific antioxidants

Antioxidants are compounds that help neutralize harmful free radicals in the body, which cause oxidative stress and contribute to various health issues such as aging, inflammation, and chronic diseases. The development of function-specific antioxidants, such as polyphenols, flavonoids, and carotenoids, with targeted health benefits, is driving the nutraceuticals market. For instance, antioxidants derived from green tea, berries, and other plant-based sources are being formulated into nutraceutical products that are marketed for their potential anti-aging, anti-inflammatory, and immune-boosting properties, among others.

Restraints

Safety Concerns

Although nutraceuticals are known to have numerous benefits that continue to expand, there is a certain side effects as well. Thus, a safety concern arises. Major safety concern includes ingredient safety. Nutraceuticals contains a wide range of ingredients, including herbs, botanicals, vitamins, minerals, and other bioactive compounds. However, not all ingredients used in nutraceuticals are safe for everyone. Some nutraceuticals induce allergic reactions. Another factor that raises safety concerns is dosage level, manufacturing processes, and lack of standardized safety assessments. Excessive or inappropriate use of nutraceuticals can result in adverse effects, and inconsistencies in manufacturing practices and quality control standards can impact product quality and safety. Additionally, the lack of standardized safety assessments can create uncertainties regarding safety profiles and potential interactions. Addressing these concerns through proper dosage guidelines, rigorous quality control measures, and standardized safety assessments is crucial to ensure the safe use of nutraceuticals by consumers.

Competition from conventional pharmaceuticals

Nutraceuticals face competition from conventional pharmaceuticals that are backed by extensive research, regulatory approvals, and established marketing channels. In some cases, consumers opt for conventional pharmaceuticals over nutraceuticals for acute or severe health conditions, where pharmaceuticals are perceived to offer more immediate and proven benefits. This competition from pharmaceuticals poses a challenge for the nutraceuticals market, particularly in areas where there is limited scientific evidence supporting the efficacy of nutraceuticals.

Opportunity

Nutraceuticals in the treatment of Prostate Cancer

The nutraceuticals market is poised for substantial growth over the next few years, driven by two major emerging opportunities. First, the rapid advancement of personalized nutrition fuelled by AI, wearable health tech, and microbiome testing is creating a surge in demand for tailored supplements based on individual biomarkers and lifestyle data. Second, rising consumer interest in plant-based and clean label ingredients, especially among Millennials and Gen Z, is pushing companies to innovate with sustainable botanicals, adaptogens, and fermented compounds. These trends are further amplified by growing global health awareness, especially in developing economies where nutraceuticals are becoming a preventive healthcare solution.

Segment Insights

Type Insights

Functional Food Segment Reported Foremost Market Stake in 2025

The functional food segment dominated the nutraceuticals market in 2024, the segment is observed to sustain the position throughout the forecast period. With a growing aging population worldwide, there is a rising demand for functional foods that support healthy aging, address age-related health concerns, and improve overall well-being. This demographic shift contributes to the dominance of the functional food segment in the nutraceuticals market. Ongoing research and innovation drive the development of new functional food products with enhanced health benefits. Companies invest in R&D to identify novel ingredients, formulations, and delivery systems that address specific health concerns, further driving market growth.

The functional beverages segment is projected to experience the highest growth in the nutraceuticals market between 2026 and 2035. These drinks, which include enhanced waters, energy drinks, probiotic beverages, and vitamin-infused drinks, are increasingly preferred by health-conscious consumers seeking convenient, on-the-go wellness solutions. The demand is particularly strong among millennials and Gen Z, who prioritize hydration, immunity, gut health, and mental clarity. The COVID-19 pandemic has further accelerated the shift toward beverages that claim to boost immunity or contain natural ingredients like adaptogens and botanicals. Brands are innovating rapidly with plant-based, surge-free, and clean-label formulations that align with current consumer values. With aggressive marketing, flavour innovation, and the growing popularity of personalized nutrition, the functional beverages segment is outpacing traditional nutraceuticals like pills or powders.

Sales Insights

The online/e-commerce sales channel is set to experience the fastest rate of market growth in the nutraceuticals industry from 2026 to 2035. Digital commerce has revolutionized consumer access to health and wellness products, allowing for convenience, wider product availability, and tailored marketing. The increasing use of smartphones and digital payment platforms, especially in developing economies, is creating massive potential for online nutraceutical sales. Additionally, social media and influencer marketing have made it easier for consumers to discover and trust new brands, especially those focused on niche areas such as vegan, keto, or hormone balancing supplements. Subscription-based models, direct-to-consumer (DTC) strategies, and personalized nutrition services are further propelling online sales.

The tablets segment dominated the nutraceuticals market

The tablets segment dominated the nutraceuticals market in 2025. Easy availability of tablets for multiple end-users in the market globally, has supported the dominance of the segments in the market. Moreover, the cost-effectiveness of tablets used for dietary supplements and vitamin- deficiency has offered expansion to the market in past years. Consumers are seen adding tablets as supplementary solutions into their diets. The growing promotion of vitamin and other supplements by governments in multiple countries is seen to promote the growth of the segment.

Regional Insights

U.S. Nutraceuticals Market Size and Growth 2026 to 2035

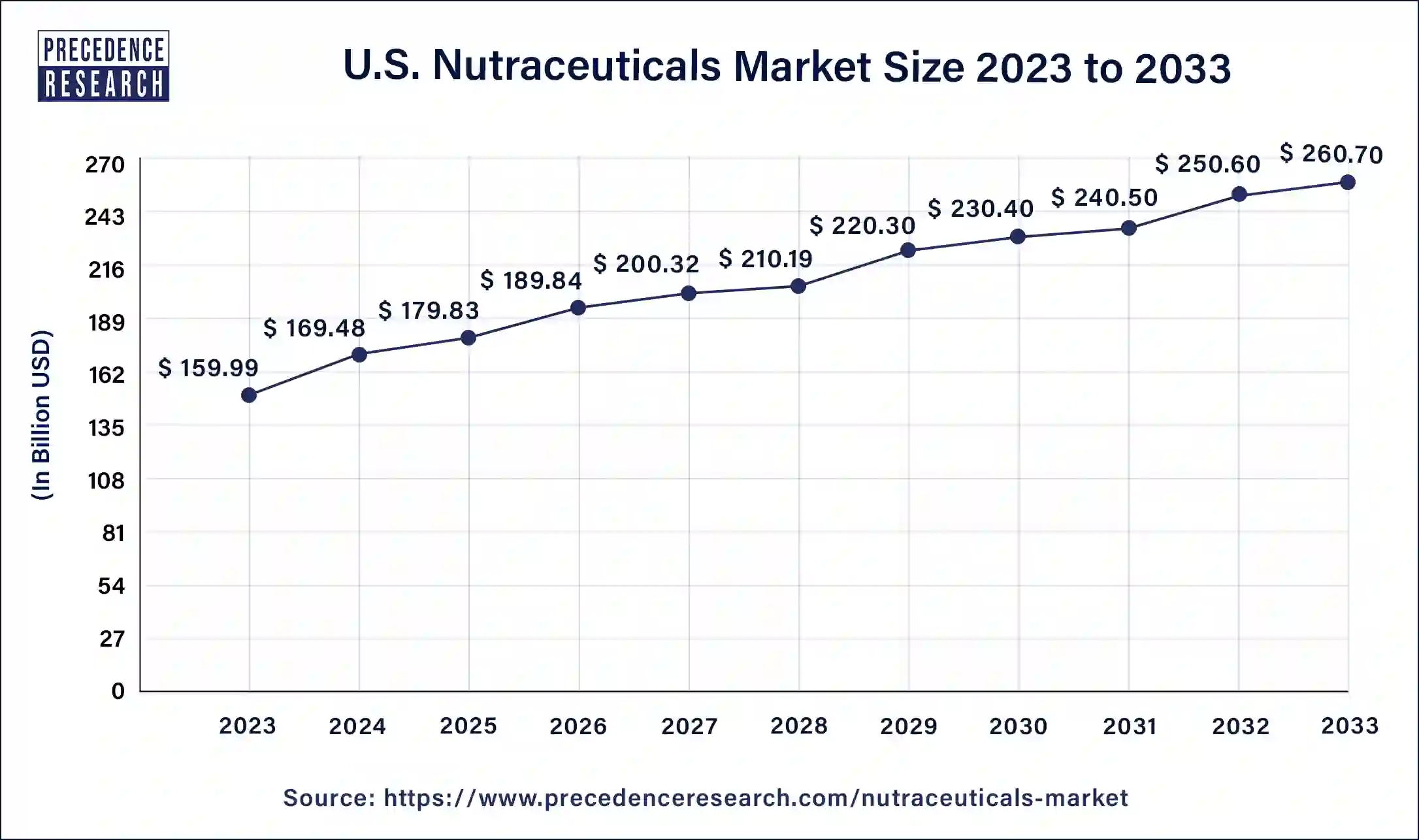

The U.S. nutraceuticals market size was valued at USD 179.83 billion in 2025 and is expected to reach around USD 280.90 billion by 2035 with a CAGR of 4.56% from 2026 to 2035.

The comprehensive research account covers substantial projections and inclinations of nutraceuticals throughout chief regions encompassing Africa, Asia Pacific, Europe, Latin America, North America, Middle East.

The North America region is growing due to presence of major manufacturers, high disposable income, and increasing focus on physical appearance. In 2023, North America dominated the nutraceuticals market due to increasing health awareness, rising disposable incomes, a growing aging population, and increasing sales. Prior to the onset of the pandemic, the U.S. witnessed a steady increase of 5% ($345 million) in dietary supplement sales in 2019 compared to the previous year. However, during the first wave of the pandemic, specifically in the six weeks preceding April 5th, 2020, there was a significant surge of 44% ($435 million) in sales, indicating a heightened demand for dietary supplements. Notably, multivitamins experienced a substantial spike in demand in March 2020, with sales rising by 51.2% and total sales of vitamins and supplements reaching nearly 120 million units for that period alone. This highlights the increased consumer interest in and reliance on dietary supplements during the early stages of the pandemic in the U.S.

U.S. Market Analysis

The U.S. nutraceuticals market is growing due to increasing consumer focus on preventive healthcare and overall wellness. The rising prevalence of lifestyle-related diseases, an aging population, and strong demand for dietary supplements and functional foods are key drivers. Additionally, high disposable income, product innovation, and wide availability through retail and e-commerce channels continue to support market expansion.

What Influences the Market in Europe?

Europe reported succeeding highest share predominantly owing to greater elderly population and growing occurrence of chronic ailments. Asia Pacific is projected to advance at the highest compounded annual growth rate majorly owing to increasing popularity ofe-commerce websites, growing awareness about importance of well-being and health, and the rising middle-class populace. Middle East, Latin America, and African region is expected to exhibit note-worthy growth in the projected time-frame.

UK Maret Analysis

The UK nutraceuticals market is expanding due to growing awareness of health and nutrition, increasing adoption of preventive healthcare, and rising demand for functional foods and dietary supplements. An aging population, growing focus on immune health, and strong retail and e-commerce distribution channels are further supporting market growth across the country.

What Potentiates the Market Within Asia Pacific?

The nutraceuticals market within Asia Pacific is expected to grow at a notable rate during the projection period. This is mainly due to rising health awareness, increasing disposable incomes, and a rapidly expanding middle-class population. The growing prevalence of lifestyle-related diseases is boosting the demand for dietary supplements and functional foods, contributing to the market. Moreover, the rapid growth of e-commerce platforms and improved healthcare infrastructure across the region are influencing the market.

India Market Analysis

India's nutraceuticals market is expanding due to rising health awareness, increasing preventive healthcare adoption, and a rapidly expanding middle-class population. Growth in lifestyle-related diseases, higher disposable incomes, and strong demand for dietary supplements, functional foods, and herbal products are further supported by e-commerce expansion and favorable government initiatives.

Top Companies Operating in the Market & Their Offerings

- Abbott Laboratories: Abbott develops and markets a wide range of nutritional products, dietary supplements, and functional foods targeting adults, children, and medical patients, focusing on immune health, digestive wellness, and overall preventive healthcare solutions globally.

- Amway Corporation:Amway offers dietary supplements, vitamins, and wellness products under the Nutrilite brand, emphasizing plant-based ingredients, immune support, and overall health, catering to consumers worldwide through direct selling and e-commerce channels.

- Glanbia Nutritionals:Glanbia Nutritionals provides performance and functional nutrition solutions, including protein powders, supplements, and fortified foods, serving sports, lifestyle, and wellness markets with a focus on innovation and high-quality nutraceutical ingredients.

- Bayer AG:Bayer produces vitamins, dietary supplements, and nutritional products under brands like One A Day, promoting cardiovascular health, immune support, and overall well-being while integrating scientific research for safe and effective nutraceutical solutions.

- Nestle S.A.: Nestle offers nutritional supplements, fortified foods, and functional beverages aimed at improving health, wellness, and immunity, with a strong focus on research-driven formulations and sustainable, consumer-friendly packaging.

- Herbalife Nutrition Ltd.:Herbalife provides protein shakes, dietary supplements, and wellness products targeting weight management, energy, and overall nutrition, leveraging direct selling and personalized nutrition coaching for global consumer markets.

- Pfizer Inc.:Pfizer develops nutritional supplements and functional health products alongside its pharmaceutical portfolio, focusing on immunity, general wellness, and disease prevention with research-backed ingredients and high-quality production standards.

- NOW Foods:NOW Foods offers a broad range of vitamins, minerals, herbal supplements, and functional foods with a focus on natural, non-GMO, and eco-friendly formulations for health-conscious consumers globally.

Other Major Companies

- Archer Daniels Midland Company

- General Mills, Inc.

- I. du Pont de Nemours and Company

- Aland (Jiangsu) Nutraceutical Co., Ltd.

- BASF SE

- Cargill, Incorporated

- Royal DSM N.V.

- Groupe Danone S.A.

- PepsiCo Inc.

Recent Developments

- In November 2024, Danone expanded its STÃ…ÂK Cold Brew brand by launching STÃ…ÂK Cold Brew Energy to tap into the growing functional beverage sector. Combining coffee with energy-boosting ingredients like 195mg caffeine, B vitamins, ginseng, and guarana, the product targets consumers seeking both caffeine and enhanced performance.

(Source: https://agronfoodprocessing.com) - In October 2024, TopGum Industries Ltd. introduced liquid honey-based gummy supplements, offering a higher honey content than traditional powdered versions. The range features five functional gummies designed to support different health needs.

(Source: https://www.prnewswire.com) - At Vitafoods Europe 2025 (May 2022 in Barcelona), DSM-Firmenich unveiled its Healthy Longevity platform, a comprehensive suite of scientifically driven ingredients and formulation services focused on cellular aging and gut health. Featured innovations include Humiome B2 with Microbiome Targeted Technology (Vitamin B2 delivery to the colon), ampli-D (fast-acting vitamin D), and life's OMEGA algal omega-3s for immunity, inflammation, and aging support, positioning DSM-Firmenich as a leader in health expectancy solutions.

- In a major industry move, Sabinsa finalized the acquisition of U.S.-based Ayurvedic dietary supplements brand Nature's Formulary in early February 2025. Nature's Formulary founder PK Dave has been appointed CEO of Sabinsa's Consumer Goods Division, which now includes America's Finest, Sanutra Wellness, and Nature's Formulary. This acquisition broadens Sabina's finished product footprint and vertical integration strategy.

Segments Covered in the Report

By Type

- Dietary Supplements

- Vitamins

- Botanicals

- Minerals

- Proteins & Amino Acids

- Fibers & Specialty Carbohydrates

- Omega Fatty Acids

- Others

- Functional Beverages

- Energy Drinks

- Sports Drinks

- Functional Juices

- Others

- Functional Food

- Carotenoids

- Dietary Fibers

- Fatty Acids

- Minerals

- Prebiotics & Probiotics

- Vitamins

- Others

By Form

- Tablets

- Hard Capsules

- Soft Capsules

- Oil

- Powder

- Others

By Sales Channel

- Offline

- Specialty Stores

- Supermarkets/Hypermarkets

- Convenience Stores

- Drug Stores/Pharmacies

- Online Retail Stores

- Other

- Online

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting