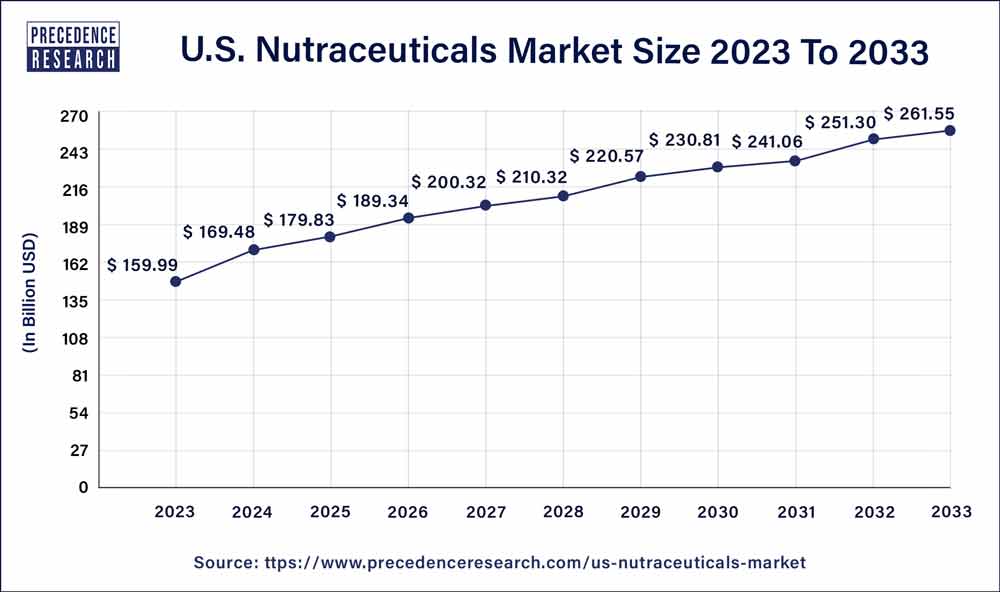

The U.S. nutraceuticals market size surpassed USD 159.99 billion in 2023 and is predicted to hit around USD 260.70 billion by 2033, growing at a CAGR of 5% from 2024 to 2033. The U.S. nutraceuticals market is driven by the increasing need for preventative healthcare strategies and the growing prevalence of chronic diseases.

Key Takeaways

- By type, the functional food segment dominated the market in 2023.

- By type, the dietary supplements segment is observed to grow at a faster rate during the forecast period.

- By form, the tablets & soft gels segment dominated the U.S. nutraceuticals market in 2023.

- By sales channel, the offline segment dominated the market in 2023.

- By sales channel, the online segment is expected to witness the fastest rate of expansion during the forecast period.

U.S. Nutraceuticals Market Overview

The sports nutrition market is expanding significantly due to the emergence of fitness trends and growing public awareness of nutrition's role in athletic performance. Athletes and fitness enthusiasts can benefit from nutraceutical goods such as protein powders, sports drinks, and supplements that enhance performance. Anti-aging and skin health-promoting nutraceuticals are becoming more popular.

Collagen peptides, hyaluronic acid, vitamins C and E, biotin, and antioxidants are frequently included in beauty supplements that aim to improve the skin's suppleness, hydration, and wrinkle reduction. Consumers are adopting clean-label formulations with natural and organic components as they become pickier about the ingredients in their nutraceutical products. Purchasing decisions are influenced by sustainability, ethical sourcing, and transparency.

The American Heart Association estimates that 42% of Americans suffer from obesity in 2023, a rise of about 10% from the previous ten years. According to a recent study, over 50% of adult US citizens said they take dietary supplements because they think they can help avoid cardiovascular disease (CVD). Pharmacists are expected to encounter patients who are seeking guidance on the numerous nutritional supplements promoted for the promotion of cardiovascular health, as cardiovascular disease (CVD) remains the leading cause of preventable mortality among men and women in every ethnic and racial background in the United States and worldwide.

- In 2022, During the Covid-19 pandemic, Amazon's growth for dietary supplements increased dramatically. With yearly sales of over $10 billion, it leads the dietary supplement sector.

Growth Factors

- An increasing emphasis on individualized nutrition and preventive healthcare drives demand for items targeting specific health issues.

- E-commerce platforms make products more easily accessible and convenient for customers, which increases sales.

- The pandemic's increased emphasis on immunity and general health could support growth.

- Nutraceuticals tailored to sports performance are in high demand due to growing interest in fitness and athletic performance.

- The use of nutraceuticals could be encouraged by government programs and insurance policies that support preventative care.

- Nutraceuticals are no exception to the consumer preference for natural, organic, and minimally processed goods.

- The market reach and credibility of nutraceutical companies can be increased by collaboration with medical professionals.

U.S. Nutraceuticals Market Scope

| Report Coverage | Details |

| U.S. Market Size in 2023 | USD 159.99 Billion |

| U.S. Market Size by 2033 | USD 260.70 Billion |

| Growth Rate from 2024 to 2033 | CAGR of 5% |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Type, By Form, and By Sales Channel |

U.S. Nutraceuticals Market Dynamics

Drivers

Rising demand for proactive health management

Nutraceuticals are becoming increasingly popular among consumers as a proactive approach to wellness as they become more conscious of the significance of preserving general health and preventing illnesses. These products promote multiple facets of health, including heart health, immunological function, and cognitive function, and offer preventive advantages.

Natural and plant-based products are becoming increasingly preferred by consumers over synthetic ones since they are considered safer and more sustainable. Herbs, botanicals, and plant extracts are natural sources of nutraceuticals that appeal to this trend and fit with consumer desires for holistic approaches to health and wellness. Thereby, the rising demand for proactive health management is observed to act as a driver for the U.S. nutraceuticals market.

Growing awareness of personalized nutrition

Personalized nutrition considers each person's particular nutritional requirements based on their genetics, way of life, and medical problems. The demand for customized nutraceutical goods is rising as people become more aware of the possible advantages of customizing their diets to meet their unique demands. This trend is encouraging businesses in the nutraceutical sector to create cutting-edge goods and services that meet each client's unique dietary needs and propel the market forward. Furthermore, technological developments like genetic testing and digital health platforms make it easier to customize nutrition, driving the growth of the U.S. nutraceuticals market.

Restraint

Insurance coverage and affordability

Nutraceuticals are generally not covered by health insurance plans, even though they are frequently regarded as a preventative measure or a supplement to conventional therapy. Customers' inability to pay out-of-pocket due to this lack of coverage restricts accessibility, particularly for those with limited funds or disposable income. Furthermore, affordability becomes a worry for many consumers when faced with expensive pricing for high-quality products, as nutraceuticals are often perceived as supplements rather than necessary drugs. Therefore, constraints to affordability and restricted insurance coverage prevent nutraceuticals from being widely adopted and accessed.

Opportunities

Focus on mental wellbeing

The connection between mental health and nutrition is becoming more widely recognized. There's been an increase in demand for nutraceutical goods designed to address this requirement as consumers look for natural solutions to enhance their mental well-being. A more holistic approach to health is being adopted by consumers, who understand the connection between psychological and physical wellness. Nutraceutical businesses can benefit from this trend by providing goods that support mental health and general wellness.

Integration with digital health

Digital health platforms can provide individualized nutraceutical recommendations by analyzing personal health data, including genetics, lifestyle, and food habits. The items' efficacy and customer happiness increase with this customized strategy. Through subscription services, telemedicine consultations, and online marketplaces, digital platforms facilitate consumer access to nutraceuticals. Customers will find this improved accessibility handy and an extension of the market reach. Thereby, the integration of digital health platforms is observed to offer lucrative opportunities for the U.S. nutraceuticals market.

Type Insights

The functional food segment dominated the U.S. nutraceuticals market in 2023. Demand for foods with additional health advantages, such as probiotics, antioxidants, omega-3 fatty acids, and fortified minerals, is driven by growing knowledge of and emphasis on health and wellness. The functional food market includes a broad spectrum of goods, such as snacks, dairy products, baked goods, and beverages that have been fortified, giving customers more options to include in their diets.

Functional foods provide easy-to-use alternatives for people who want to get healthier without making significant dietary or lifestyle changes. Products that cater to busy lives include probiotic-infused yogurt, protein bars, and fortified cereals.

The dietary supplements segment is the fastest growing in the U.S. nutraceuticals market during the forecast period. As consumers become more aware of their health, they look for supplements to enhance their diets and well-being. Supplements are now widely available to customers thanks to aggressive marketing campaigns, online sales platforms, and the availability of supplements in a variety of forms (pills, powders, and gummies). People have turned to supplements to support their health goals and cover nutritional gaps caused by stress, poor eating habits, and busy lifestyles.

- The FDA lacks the jurisdiction to verify the efficacy and safety of dietary supplements or to authorize their labeling prior to their distribution to the general population.

Form Insights

The tablets segment dominated the U.S. nutraceuticals market in 2023. Tablets are widely used because they are simple to incorporate into everyday routines. Because it usually has a longer shelf life than other nutraceuticals, retailers, and customers find them appealing. It provides a range of supplements that address different health needs and preferences, such as vitamins, minerals, herbal extracts, and other nutrients.

Sales Channel Insights

The offline segment dominated in the U.S. nutraceuticals market in 2023. Customers frequently value the individualized shopping experience provided by physical businesses, where they can speak with friendly employees and get recommendations based on their requirements. Customers can try items before they buy them in physical locations, which can significantly impact their decision to buy, especially in the nutraceuticals sector, where taste and efficacy are important considerations. When buying health supplements, many customers trust physical locations more than internet retailers.

The online segment is the fastest growing the U.S. nutraceuticals market during the forecast period. Through online platforms, consumers can conveniently peruse, evaluate, and buy nutraceutical items at home or on the go. Unlike physical businesses, online platforms offer customers more accessibility to nutraceutical items regardless of where they are. Online shoppers have easy access to comprehensive product details, user reviews, and professional advice, enabling them to make well-informed purchases.

Recent Developments

- In December 2023, USV Pvt Ltd and Biogenomics launched Insuquick, a biosimilar Insulin Aspart intended for Indian patients with diabetes.

- In May 2022, Unilever announced an agreement to purchase a majority stake in Nutrafol, a well-known supplier of hair wellness products. Through Unilever Ventures, Unilever now has a minority share (13.2%) in Nutrafol.

U.S. Nutraceuticals Market Companies

- DSM

- Amway

- Pfizer Inc.

- Nestle

- Nature's Bounty

- General Mills Inc.

- Danone

- The Kraft Heinz Company

- The Hain Celestial Group, Inc.

- Tyson Foods

Segments Covered in the Report

By Type

- Dietary Supplements

- Vitamins

- Botanicals

- Minerals

- Proteins & Amino Acids

- Fibers & Specialty Carbohydrates

- Omega Fatty Acids

- Others

- Functional Beverages

- Energy Drinks

- Sports Drinks

- Functional Juices

- Others

- Functional Food

- Carotenoids

- Dietary Fibers

- Fatty Acids

- Minerals

- Prebiotics & Probiotics

- Vitamins

- Others

- Personal Care

By Form

- Tablets

- Hard Capsules

- Soft Capsules

- Oil

- Powder

- Others

By Sales Channel

- Offline

- Specialty Stores

- Supermarkets/Hypermarkets

- Convenience Stores

- Drug Stores/Pharmacies

- Online Retail Stores

Get a Sample

Get a Sample

Table Of Content

Table Of Content