What is the Sports Nutrition Market Size?

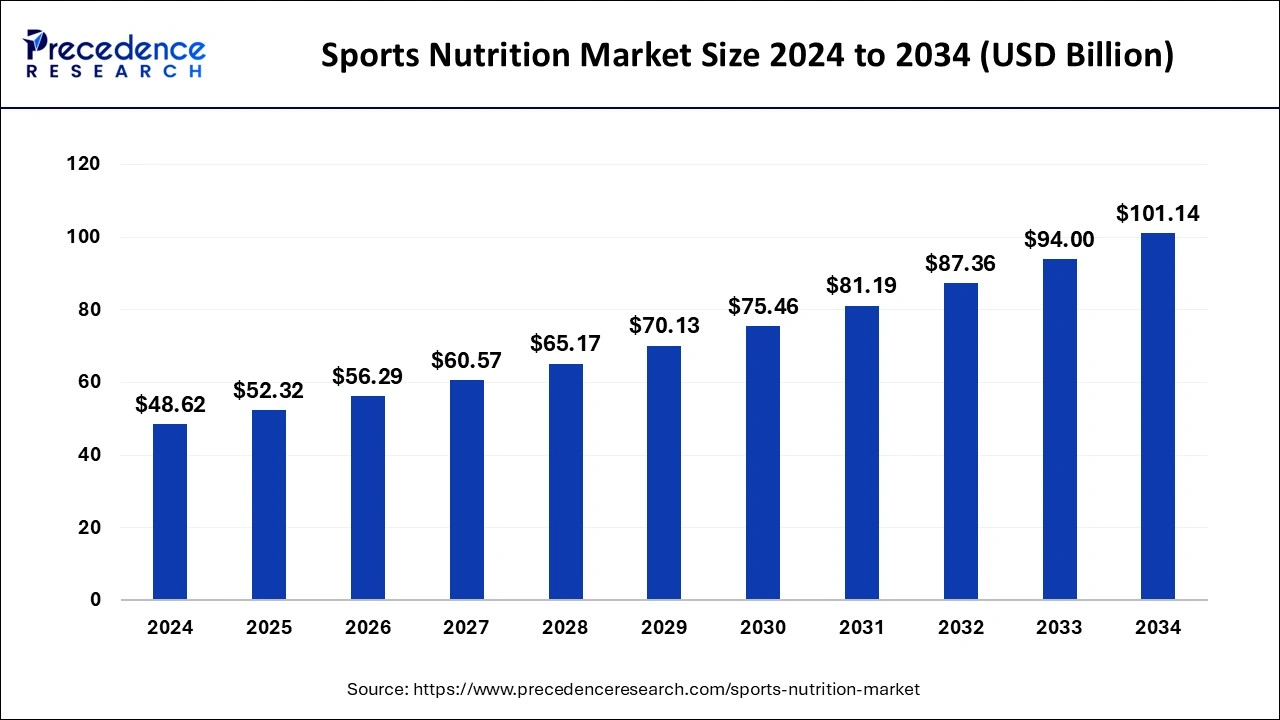

The global sports nutrition market size is calculated at USD 52.32 billion in 2025 and is predicted to increase from USD 56.29 billion in 2026 to approximately USD 107.95 billion by 2035, expanding at a CAGR of 7.51% from 2026 to 2035.

Market Highlights

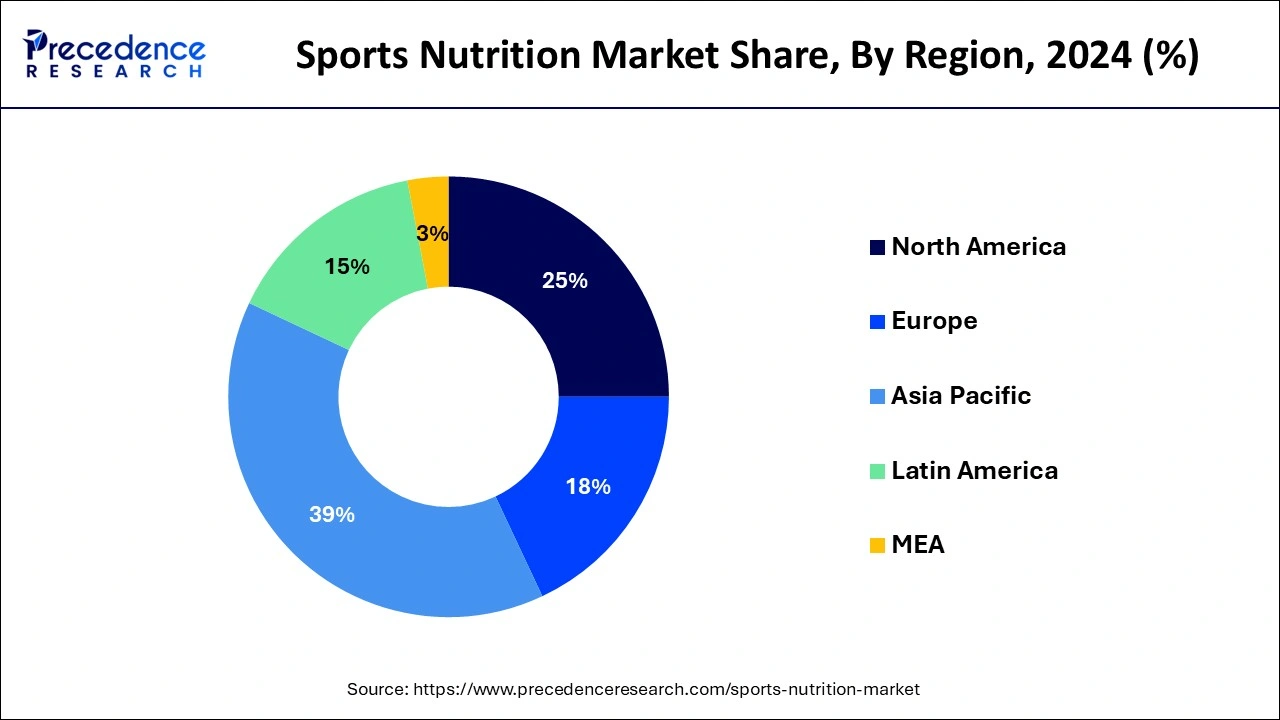

- Asia Pacific dominated the global sports nutrition market with the largest market share of 39% in 2025.

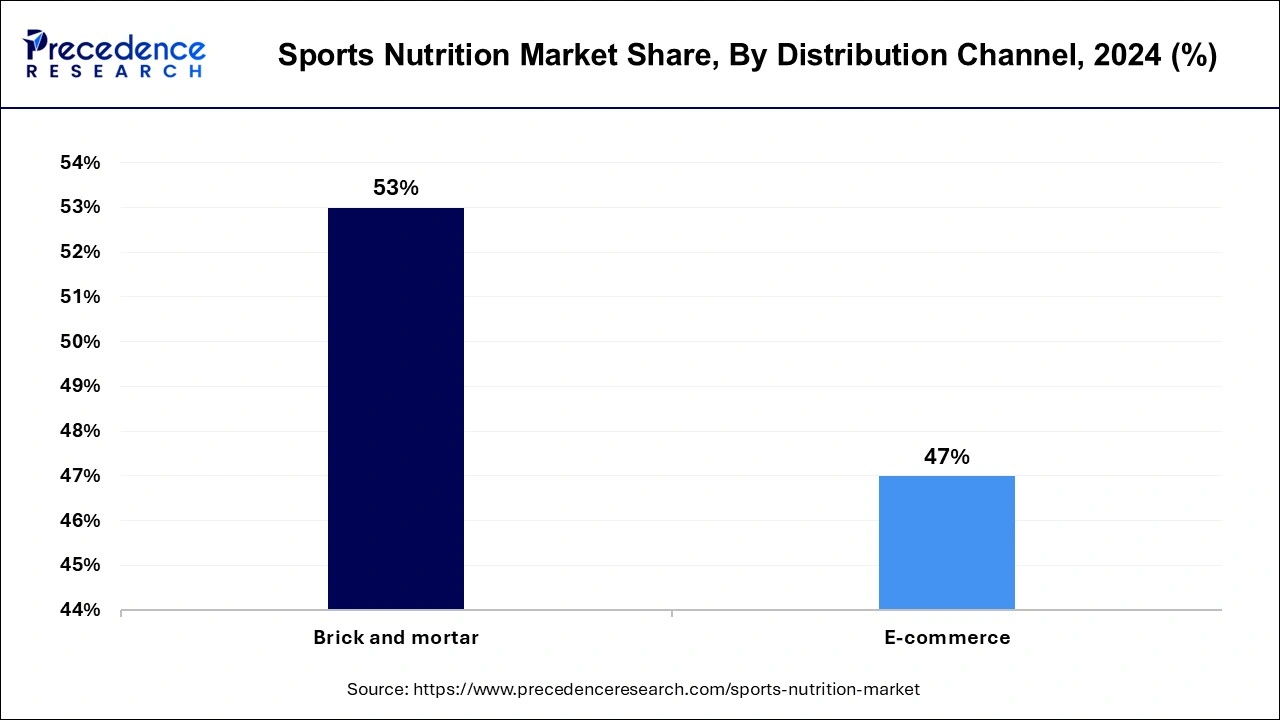

- By distribution channel, the brick and mortar segment contributed the highest market share of 53% in 2025.

- By distribution channel, the E-commerce segment is projected to grow at a solid CAGR during the forecast period.

- By product type, the sports supplement segment led the global market in 2025.

- By application , the Post-workout segment is expected to grow at a notable CAGR during the forecast period.

Market Overview

Optimum Sports nutrition helps in providing benefits from the training. It helps in increasing the recovery from the workouts and maintenance and achievement of body weight. It also helps in reducing the injuries to the body and speedy recovery from the same. During the pandemic, there was a decline in the sports supplements as the demand for various essential goods had increased during the pandemic. There was a temporary decline in the demand for the sports supplement owing to limited amount of money to spend on these products. The lockdown resulted in closing down of the sports institutes, health clubs or gyms and other fitness centers. Therefore, the market had dropped. But the sales of the supplements had increased through the online websites. In order to avoid the crowded places and in order to maintain hygiene, there was a shift to the e-commerce websites. An increased awareness regarding healthy lifestyle has led to a demand in the sports nutrition.

How does AI impact the Sports Nutrition Market?

The rise of technologies like artificial intelligence (AI) and machine learning (ML) is significantly contributing to the growth of the sports nutrition market. AI has made it possible to create personalized nutritional plans by analyzing individual dietary patterns, fitness levels, and health goals. This personalization further allows fitness enthusiasts to optimize their performance. Moreover, AI helps in developing innovative products by identifying new ingredients and formulations that can improve product performance.

What are the Growth Factors in the Sports Nutrition Market?

- The rise of social media contributes to market expansion. Social media influencers play a key role in promoting sports nutrition products.

- With the growing fitness trends, there has been a significant increase in the number of people going to the gym. This, in turn, boosts the demand for sports nutrition products.

- The rising disposable incomes positively impact the market. High disposable income encourages individuals to spend on nutritional products.

- With the rising prevalence of obesity, diabetes, and other chronic diseases, there is a high demand for products that enhance performance and endurance, significantly boosting the market's growth.

- The rising women's participation in sports is boosting the growth of the market. For instance, the Paris 2024 Olympics had an equal number of female participants to the men.

Sports Nutrition Market Outlook

- Industry Growth Overview: Sports nutrition has been experiencing rapid growth from 2025 to 2030, with the increasing interest in fitness, increased participation in gyms, and increased interest in performance-focused products driving this growth. This trend continued and was supported by consumers shifting towards high protein, clean label ingredients, and functional supplements (primarily in North America and the Asia Pacific).

- Sustainability Trends: Sustainability has increased in importance to the industry over time. This trend has created increased demand for products made using sustainable plant-based proteins, clean ingredients, and environmentally friendly packaging.The importance of sustainability is being recognized by consumers as brands embrace environmentally responsible product offerings (eco-friendly packaging, plant-based protein, etc.) that align with consumer values regarding environmental stewardship.

- Global Expansion: There has been considerable expansion of sports nutrition companies into the Asia Pacific, Eastern Europe, and Latin America due in part to large increases in the amount of fitness consumers in these areas, as well as favourable regulation for these companies. Many of the larger sports nutrition brands have significantly scaled their manufacturing and distribution partnerships to allow them to be closer to their customers. Emerging markets will provide growth opportunities for global brands via product formulations that are customized to each region's needs, strategic partnerships and employing a digital-first approach to tap into previously unrecognized consumer segments.

- Major Investments: Large investment companies and strategic investors have shown interest in this area because they could see profitable revenue potential, high interest from both professional athletes and non-athletes alike, and significant demand stemming from recent trends toward healthy living.

- Startup Ecosystem: Over the last few years, there has been a considerable increase in the number of sports nutrition startups that are developing products with new ingredients. Companies focused on creating plant-based protein sources, creating new personalized nutrition products, creating products that improve hydration, and improving physical performance through the gut-brain connection attracted significant investments, in particular in the USA, India, and Europe. Startups continue to bring excitement to the market by offering personalized nutrition, clean-label products and technology-enabled subscription services that further contribute to innovation and create greater competition in the market.

Major Trends in the Sports Nutrition Market

- Increasing Use of Plant-Based & Functional Ingredients: Depending on the clean label and digestibility, plant-based protein sources such as pea, hemp, and algae are being incorporated into sports nutrition products at an increasing rate, along with functional components, including probiotics, adaptogens, nootropics, etc.

- Artificial Intelligence (AI)-Driven Personalization: With the introduction of data analytics and artificial intelligence in the sports nutrition industry, we have seen an increase in brands customizing their nutrition plans to fit their customers' biometrics, fitness, and lifestyle goals. This will lead to a much greater level of consumer engagement and differentiation of products.

- Hybrid Supplement Products: There is a growing trend toward hybrid products that combine elements of performance nutrition and holistic wellness (protein along with components to support cognitive function, for example).

- Convenience Consumption Format: Ready-to-drink products, protein shots, and bars specifically designed for convenience are driving broader adoption by consumers with busy lifestyles.

- Collaborations for Flavor Innovation: More and more sports nutrition companies are forming partnerships with well-known food brands to develop new and exciting flavors that will appeal to consumers beyond the traditional athletic segments of the market.

Government Initiatives Influencing the Growth in the Sports Nutrition Market

- India's National Sports Policy 2025 has been approved by the central cabinet to develop the governing infrastructure and systems within the country, to embrace technology (such as artificial intelligence) to keep track of an athlete's activities, and to develop strong partnerships between the public and private sectors, which benefit an athlete's nutritional and physical fitness awareness.

- For the first time, the Indian Ministry of Youth Affairs and Sports has created a network of referral laboratories to examine the safety of nutritional supplements and build a solid manufacturing presence for locally made products.

- Russia has introduced new mandatory labelling guidelines for sports nutrition supplements that require compliance from October 2025 to promote product clarity to consumers.

- The Sport Integrity Commission (New Zealand) is focused on educating athletes and coaches about the need for anti-doping education and assisting in the oversight of supplement use.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 52.32 Billion |

| Market Size in 2026 | USD56.29 Billion |

| Market Size by 2035 | USD107.95 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 7.51% |

| Base Year | 2025 |

| Largest Market | Asia Pacific |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Application, Formulation, Consumer Group, Consumer Group by Activity, Distribution Channel, Geography |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increased Participation in Sports

With the increasing number of sports leagues and tournaments, there is a significant rise in sports participation. This, in turn, boosts the adoption of sports nutrition among sportspersons. Sports nutrition delays the onset of fatigue, maintains a healthy immune system, enhances performance, improves recovery, improves body composition, and reduces the potential for injury. Moreover, the increasing awareness of the importance of sports nutrition and the rising demand for personalized nutrition among sportspersons drive the growth of the market.

Expansion of the E-commerce Sector

Sports nutrition products have gained significant popularity in developed nations. However, there is a significant increase in the adoption of sports nutrition in developing nations due to the rapid expansion of e-commerce businesses. E-commerce platforms have expanded the reach of sports nutrition in various regions. The availability of a wide range of sports nutrition products from various brands and doorstep delivery attract more consumers.

Restraint

High Cost

Despite the increasing awareness about the importance of nutrition, high costs associated with nutritional products, including sports nutrition, discourage potential buyers from purchasing them. This, in turn, limits the growth of the market. Moreover, stringent regulations regarding labeling and ingredient safety hamper market growth.

Opportunity

Increasing R&D and Product Innovation

Key players operating in the market are focusing on developing innovative, low-cost sports nutrition, which the low-income population can avail. They are also investing heavily in R&D to explore new ingredients. Key market players are innovating functional beverages, which will positively impact the market. The rise of social media has led to the increased adoption of clean-label products, leading to the increased demand for plant-based products among health-conscious consumers. Thus, market players are developing plant-based sports nutrition to fulfill the overall growing demand of health-conscious consumers.

Segment Insights

Product Insights

The sports supplement segment led the global market in 2025 and it shall grow during the forecast period as there is an increase in the consumption of protein supplements. The availability of various plant proteins like pumpkin seed, hemp, rice, tea and soy the market segment is expected to grow. There's a great demand for protein supplements like the whey protein. In order to strengthen the muscles of the athletes and the gym goers, there's an increasing consumption of these sports supplements. It has a wide range of availability in the market in many physical stores and also they are available on the online platforms.

The sports food segment is also expected to rise during the forecast period. Energy bars and the protein bars are gaining popularity in the snacks segment of the sports nutrition. Healthy snacking for weight management is in great demand and it shall grow during the forecast period especially in the younger population. The prevalence of obesity is leading to a growth in the market. Many companies are investing in the innovation of sports nutrition products to offer to the market in the coming years.

Application Insights

The Post-workout segment is expected to grow at a notable CAGR during the forecast period. The supplements which are used post workout offer benefits in repairing the muscles it helps in recovery and maintenance and also hence enhances the muscle gain during the process. The post workout supplements are estimated to help in the growth of the market. The different post workout supplements like the Casein, glutamine, and the amino acidswill have a good growth during the forecast period. An increased awareness regarding these post workout supplements will lead to a growth in the market during the coming years. The consumers that have an active lifestyle are also expected to support the growth of sports nutrition market during the forecast.

Distribution Channels Insights

The brick and mortar segment contributed the highest market share of 53% in 2025. and it is expected to grow during the forecast. Large number of products is available in these stores. The various physical stores like the Specialty stores, retail stores, grocery stores, general discount stores and fitness institutes offer sports nutritions. They also provide with membership benefits and loyalty programs, which help in providing better consumer service. Large amount of revenue is generated through these stores in the sports nutrition market.

The online segment for distribution of sports nutrition had seen a major breakthrough during the pandemic. Due to the lockdown, the sale of Sports Nutrition had increased on the online channels. Various ecommerce retailers had entered into the sports nutrition segment. The discounted offers, which are provided on the online stores, has generated a great income even during the pandemic.

End User Insights

Depending upon the end user, the sports nutrition market had number of consumers from the lifestyle users. These people are the people who casually exercise in order to stay fit and want to consume healthy food. The demand in the lifestyle segment has grown due to awareness in the consumers and this segment has seen a growth in the plant based sports nutrition due to awareness regarding the benefits of these products.

Regional Insights

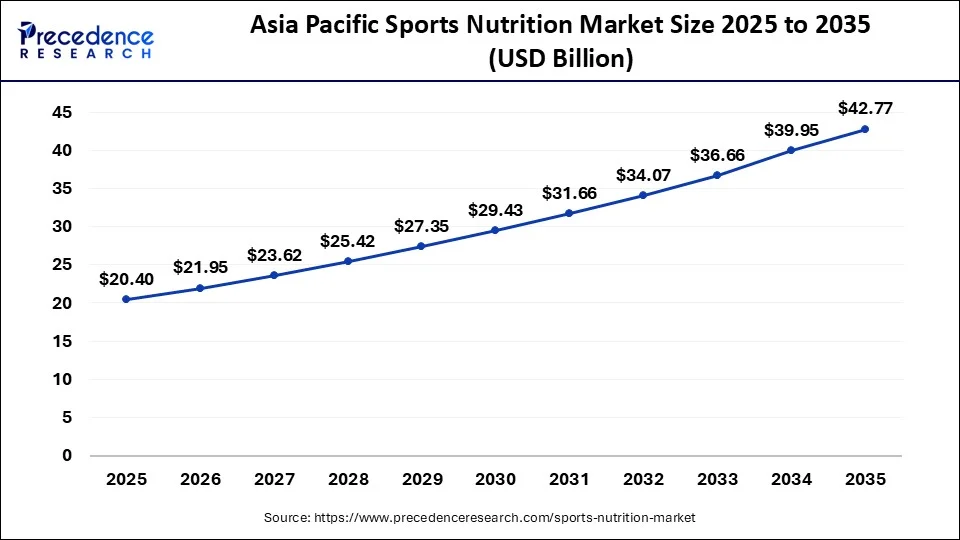

Asia Pacific Sports Nutrition Market Size and Growth 2026 to 2035

The Asia Pacific sports nutrition market size is estimated at USD 20.40 billion in 2025 and is anticipated to surpass around USD 42.77 billion by 2035, rising at a CAGR of 7.68% from 2026 to 2035.

Asia Pacific dominated the global sports nutrition market with the largest market share of 39% in 2025. Increase demand and adoption of supplementsin US has resulted in the growth of the marketshare. Awareness regarding the well-being and the health of the consumershasalsoresulted in the growthof the market in this region. Many companies or major market players are located in the North American region and therefore the market is expected to grow during the future.

The sports nutrition market demonstrates its highest activity in North America because of dedicated fitness traditions and several individuals focused on health. People keep expanding their interest in performance-enhancing sports supplements, drinks, and foods as the market demonstrates continuous growth. Dropship retail solutions, both in traditional store settings and e-stores, have been developed to offer simple accessibility to these products through specific retail channels and digital marketplaces. The sports nutrition market in North America will sustain its worldwide leadership position as main industry players actively develop innovations that follow upcoming market trends.

- In March 2023, Ready Athletes, Ready, one of the fastest-growing sports nutrition companies in America, announced the release of a light version of Ready Sports Drink. The company is co-owned by Aaron Donald and Giannis Antetokounmpo, and the Ready product line is powered by science to help maximize energy production and replenish fluids for anything where hydration and energy are needed.

How is Asia-Pacific leading in the Sports Nutrition Market?

Asia-Pacific globally is at the forefront of the global sports nutrition market, which is largely due to urbanization, an increase in disposable income, and fitness culture becoming more popular among people. The younger population is more likely to use supplements not only for better performance but also for general health. Both local and international brands are competing by not only introducing plant-based and protein-rich products but also by offering online retail and influencer marketing to ensure that they are recognized and easily accessible in the emerging economies.

China Sports Nutrition Market Trends:

The expansion in China's market is basically changing lifestyles, plus government policies that promote physical activities. The population getting more active in sports and exercise classes is now looking for easy-to-use, protein-based food. What's more, consumers are really open to creative ways of consuming protein, like drinks with benefits and nutrition on the fly. Online shopping is the king in sales, and customers receive personalized tips along with easy access to a huge variety of local and global brands.

How is North America performing in the Sports Nutrition Market?

North America holds the title of the fastest-growing sports nutrition market, characterized by high levels of consumer awareness, a strong fitness culture, and innovations in functional ingredients. The area tends to favor clean-label and plant-based goods. The market's accessibility is ensured through both offline retail and e-commerce channels. The fitness and general health sectors have experienced growth as a result of continuous product diversification and the adoption of technology.

United States Sports Nutrition Market Trends:

The United States market is notably propelled by increased health awareness and the rising demand for performance and recovery products. Consumers are more demanding than ever of high-protein, low-sugar, and functional formulations. Digital fitness platforms are not only making products visible but also driving the adoption of personalized nutrition. The stiff competition among well-established brands is leading to innovations in the types, flavors, and delivery formats of products, which in turn is promoting market maturity and consumer loyalty.

What are the driving factors of the Sports Nutrition Market in Europe?

Europe is a powerful and versatile market that considers the above characteristics as its major factors, like getting more of a natural, plant-based, and low-sugar formulation, growing consumer awareness, and preference. The market is not only growing with professional athletes but also targeting the everyday fitness and wellness consumer. The use of technology, even in wearable fitness gadgets, has a direct impact on consumer choice. However, different national regulations on labeling and claims hurt the establishment of consistent market penetration across countries.

Europe Sports Nutrition Market Trends:

Europe is a mature, yet innovative, sports nutrition industry, backed by strong regulations and a more educated consumer base. Demand is growing for products made from organic, plant-based ingredients and free from allergens, with Germany, the UK and France being the largest markets.

End-users have a greater emphasis on product transparency, living up to clinical claims, and having sustainable sourcing practices than ever before. The region has a great retail framework and cross-border trade opportunities for existing and emerging brands to scale across multiple European markets.

United Kingdom Sports Nutrition Market Trends:

UK consumers lean towards power-packed and functional supplements in the active lifestyle category. The pull of clean labels and low-sugar products on the part of consumers is getting stronger. Sugary products are still in vogue, but with non-protein offerings that include hydration and energy blends, brands are innovating in proteinless ways too. The presence of a market in traditional retail and online sales is also well-balanced, and the latter is slowly taking up the former's share. Consumer health awareness campaigns and product variety are continuously contributing to the market's steady growth.

Why did Latin America grow at a rapid rate in the Sports Nutrition Market?

Growth in Latin America has been rapid due to a greater acceptance of fitness culture, leading to an increased number of individuals embracing healthier lifestyles. In addition, many countries experience economic growth, which has resulted in consumers spending more for nutritional products such as protein powders, pre-workout drinks, and recovery supplements. With fitness-related trends promoted through social media outlets, brands have gained access to younger consumers at an increasing pace.Furthermore, opportunities exist to develop localized and affordable supplements, in addition to creating sports drinks designed for hot climates.

Latin America Sports Nutrition Market Trends:

Latin America is showing continuous development in the sports nutrition market as a result of the population becoming more urbanized and more youth becoming a part of fitness culture. The increase in the number of gym memberships and increased levels of sporting activity within Brazil and Mexico are driving the demand for protein supplements/performance enhancers.

The improvement of the market has come about through affordable product innovations and an increase in e-commerce penetration, creating easier access to these products. In addition, local companies are creating more regionalized products through the development of regionally developed flavours and formulations that are price-sensitive and meet the ever-changing needs of their consumer base.

Brazil Sports Nutrition Market Trends

Brazil is by far the leading country in this region due to its robust sports culture, large number of gym members per capita, and massive population. As a result, trends in bodybuilding and fitness are now widespread throughout Brazil's urban centers, driving increased demand for protein powders and pre-workout supplements. In fact, due to the affordability of the products and their tropical taste, local brands are becoming increasingly popular. With the rise of e-commerce, access to these products is becoming easier and driving strong sales.

Why did the Middle East and Africa grow at a rapid rate in the Sports Nutrition Market?

Factors contributing to the growth of the Middle East and Africa region include increased urbanization, expansion of gyms, and a growing interest in fitness among young people. The region will also see a rise in the demand for hydration and energy products as a result of the warmer weather. The Middle East and Africa region has become home to many international brands that are either entering the region through retail chains or through e-commerce. There are a multitude of opportunities for halal-certified sport supplements, affordable protein powder products, and ready-to-drink products.

The UAE Sports Nutrition Market Trends

The UAE has been leading the Middle East and Africa region due to its strong gym culture, multinational workforce, and many high-end retail outlets. Consumers tend to gravitate towards higher-quality protein supplements, energy drinks, and advanced performance products. The growth of fitness events, marathons, and sports clubs created an increasing interest in nutrition products. The UAE has also developed into a key distribution hub for many global brands due to its exemplary logistical support systems and high consumer purchasing power.

Value Chain Analysis

- Raw Material Sourcing and Ingredients: We source Whey Protein, Plant Protein and Micronutrient ingredients that have been produced with high Quality control standards and traceability.

- Product Manufacturing and Branding: Utilization of advanced manufacturing techniques; innovation in flavor profiles; and effective branding all contribute toward creating unique, high-end products within a highly competitive marketplace.

- Distribution and Consumer Access: Implementing multimodal distribution strategies, including a combination of online, specialty retail and gym channels, provides maximum access to the consumer market.

Companies Positive Info

Abbott Nutrition Inc.

Abbott Nutrition Inc. operates its ZonePerfect brand, which provides sports nutrition products that meet the specific requirements of various lifestyles. Their products contain exact macronutrient formulas that adequately serve numerous nutritional requirements under the guidance of registered dietitians, food scientists, and nutritionists. They developed different nutritional options through several taste variations, which come in multiple formats to suit individual needs.

Coca-Cola:

POWERADE from Coca-Cola active sports nutrition operates through multiple ready-to-drink zero-sugar sports drink lineups with lemon-lime options. Each beverage comes with creatine that is stabilized through shelf-life methods while using natural compounds that originate from amino acids in muscles.

MusclePharm Corporation:

MusclePharm Corporation operates as a leading American sports nutrition business that creates and distributes functional energy drinks and sports nutrition products available to the public market. It meets its customers by providing primary product sections that include Sport Series, Essentials Series, Natural Series, along with FitMiss supplements for female athletic competitors.

Sports Nutrition Market Companies

- MusclePharm

- The Bountiful Company

- Iovate Health Sciences

- Abbott

- Cliff Bar

- The Coca-Cola Company

- Quest Nutrition

- PepsiCo

- Post Holdings

- BA Sports Nutrition

- Cardiff Sports Nutrition

Recent Developments

- On September 22, 2025, Ronnie Coleman Signature Series entered into a strategic collaboration with the Indian wellness platform HealthKart. This partnership is aimed at expanding the availability of fitness-oriented supplements in the fast-growing Indian sports nutrition market.

(Source- https://economictimes.indiatimes.com ) - In January 2025, Dymatize launched Performance Protein Shakes and Energyze Pre-Workout, delivering targeted muscle recovery support and sustained energy with unique flavors.

- In August 2024, Denzour Nutrition launched herbal nutraceuticals, featuring benefits like improved blood flow, stress management, restful sleep, detoxification, and enhanced vitality for comprehensive wellness. This new product line caters to athletes as well as other population seeking to elevate their health and fitness.

- In October 2024, Reebok formed a sports nutrition product collaboration with Generation Joy to release vitamin and protein supplement items. The purpose is to improve fitness opportunities for everyone. Reebok draws on its heritage as a sports company to join forces with Generation Joy, which specializes in field and life-oriented wellness solutions.

- In April 2023, the Indian market received high-quality sports nutrition supplements from Genetic Nutrition when it expanded to India. Genetic Nutrition develops its entire product selection from protein powders through amino acids and vitamins with the best possible active ingredients and production systems for maximum effectiveness.

- In May 2023, Sirio Europe introduced two collagen-based gummy supplements at the Vitafoods Europe trade show, which took place in Geneva, Switzerland, at booth I40 from May 9-12. The two main segments for this company are sports nutrition supplements and aesthetic products. The products contain UC-II undenatured type II collagen ingredient produced by Lonza (Basel, Switzerland).

- In October 2025, Isopure launched its whey protein and collagen products in the UK after success in the U.S. The range features Whey Protein with 25 grams of protein and collagen for skin health.

- In July 2025, Team Picnic PostNL and dsm-firmenich announce the public launch of their up4™ Sports Nutrition range, previously exclusive to the team, ahead of the upcoming Tour de France.

Value Chain Analysis:

- Raw Material Procurement: Harvesting superior-quality raw materials from agricultural and aquatic sources to create nutrient-rich and protein-filled products.

Key Players: Glanbia Nutritionals - Processing and Preservation: The conversion of unprocessed ingredients into hygienic and stable forms through the drying, mixing, and pasteurizing processes.

Key players: MuscleBlaze, MuscleTech, and IsoPure - Quality Testing and Certification: Performing laboratory tests and issuing certifications that confirm the product's purity, safety, and accuracy of the labels.

Key Players: NSF Certified for Sport, and BSCG - Packaging and Branding: Creating packaging that is not only protective and informer but also eco-friendly and that contributes to the development of a unique brand identity.

- Cold Chain Logistics and Storage: The use of temperature-controlled transport and storage to ensure that the products retain their quality and freshness.

Key players: Optimum Nutrition, BSN, Cold Chain Technologies - Retail Sales and Marketing: The marketing of products is done through both online and offline channels with the help of well-planned, targeted strategies.

Key Players: MyProtein, Nutrabay, GNC - Waste Management and Recycling: The company is collecting and recycling waste materials as a way of supporting eco-friendly practices in its production.

Key Players: Recykal, Attero Recycling

Segments covered in the report

By Product

- Sports Supplements

- Protein Supplements

- Vitamins

- Minerals

- Amino Acids

- Probiotics

- Omega -3 Fatty Acids

- Carbohydrates

- Detox Supplements

- Electrolytes

- Others

- Sports Drinks

- Isotonic

- Hypotonic

- Hypertonic

- Sports Food

- Protein Bars

- Energy Bars

- Protein Gels

- Meal Replacement Products

- Weight Loss Products

By Application

- Pre-workout

- Post-workout

- Weight Loss

- Others

By Formulation

- Tablets

- Capsules

- Powder

- Softgels

- Liquid

- Gummies

By Consumer Group

- Children

- Adult

- Geriatric

By Consumer Group by Activity

- Heavy Users

- Light Users

By Distribution Channel

- Brick and mortar

- Specialty Stores

- Small Retail Stores

- Fitness Institutes

- Grocery Stores

- General Discount Stores

- Discount Clothing Retailers

- E-commerce

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting