What is Sports Nutrition Supplements Market Size?

Uncover market opportunities in the sports nutrition supplements market fueled by innovation, e-commerce growth, and increasing fitness awareness. The market growth is attributed to increasing consumer emphasis on health and fitness.

Market Highlights

- North America dominated the sports nutrition supplements market in 2024.

- Asia Pacific is expected to grow at the fastest CAGR from 2025 to 2034.

- By product type, the protein supplements segment dominated the market, under which the whey protein sub-segment held a major market share in 2024.

- By product type, the plant-based protein segment is projected to grow at the highest CAGR between 2025 and 2034.

- By form, the powder segment contributed the biggest market share in 2024.

- By form, the ready-to-drink (RTD) segment is expanding at a significant CAGR.

- By consumer group, the athletes/bodybuilders segment led the market in 2024.

- By consumer group, the lifestyle users segment is expected to grow at a significant CAGR over the projected period.

- By distribution channel, online retail segments contributed the biggest market share in 2024.

- By distribution channel, the direct-to-consumer segment is expected to grow at a notable CAGR from 2025 to 2034.

- By end use, the muscle growth segment held the major market share in 2024.

- By end use, the recovery segment is projected to grow at a significant CAGR between 2025 and 2034.

What is the impact of AI-driven technology on sports nutrition supplements?

The sports nutrition supplements market is rapidly changing due to the adoption of Artificial Intelligence, which allows brands to become more data-driven and customize their products. Using machine learning algorithms, companies are examining consumer health data, exercise objectives, and food preferences to develop and tailor specific supplement solutions. AI aids in reducing manufacturing efforts to provide precision of ingredients and consistency of products on a large scale. Moreover, quality control is also increased since AI allows identifying possible flaws in the formulation before product launch. AI-driven insights help manufacturers develop targeted products that cater to specific athlete needs, enhancing performance and recovery.

What are sports nutrition supplements?

The sports nutrition supplements market refers to the industry segment focused on products that enhance athletic performance, physical endurance, muscle growth, recovery, and overall energy. These supplements include powders, bars, capsules, tablets, and ready-to-drink formats, designed to meet the nutritional needs of athletes, bodybuilders, fitness enthusiasts, and active individuals. The market includes a variety of supplement categories, such as protein, amino acids, creatine, pre-workouts, post-workouts, weight management products, and hydration supplements.

The market is driven by increasing health awareness, a growing fitness culture, rising participation in sports activities, and the expanding consumer base beyond professional athletes to recreational users and lifestyle consumers. Increased scientific credibility, with more peer-reviewed studies on the safety, efficacy, and metabolic effects of supplements, is also fueling the market.

Sports Nutrition Supplements MarketGrowth Factors

- Rising Popularity of Hybrid Fitness Programs: The growing adoption of mixed-modality training like HIIT, CrossFit, and yoga-athletic hybrids is fueling demand for targeted nutrition solutions to support diverse performance goals.

- Boosting Influence of Sports Nutrition in Preventive Health: Increasing alignment between fitness-focused supplements and chronic disease prevention is driving new consumer segments into the sports nutrition category.

- Driving Adoption Among Senior Demographics: The shift toward active aging and mobility maintenance is expanding supplement use among adults over 50, supported by clinical recommendations from institutions such as the Cleveland Clinic.

- Growing Demand for Personalized Nutrition: Rising interest in DNA-based fitness planning and AI-driven supplement personalization is boosting interest in customized sports nutrition products.

- Expanding Role of Digital Health Integration: Fitness apps and wearables that sync dietary guidance with real-time performance tracking are propelling supplement usage among tech-savvy consumers.

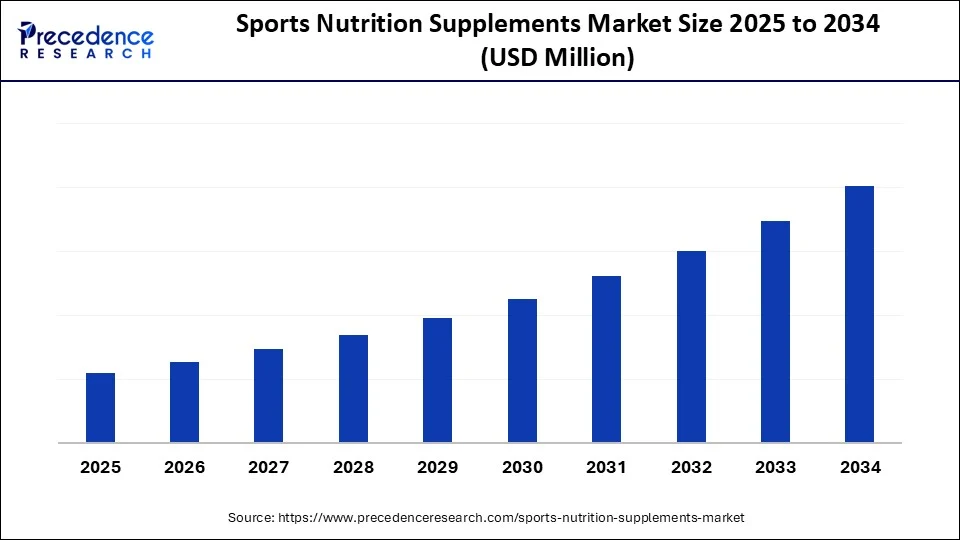

Market Outlook

- Industry Growth Overview: The sports nutrition supplements market is growing, driven by rising fitness awareness, the rise of online retail, and an increasing consumer base that involves both professional athletes and lifestyle consumers.

- Global Expansion: The sports nutrition supplements market is growing worldwide, driven by brands expanding beyond outdated powders to include convenient options such as ready-to-drink (RTD) shakes and energy bars with additional functional advantages. North America is dominated in the market due to supportive retailing infrastructure, and the Asia Pacific is the fastest growing in the market due to increasing middle-class earnings.

- Major investors: Major investors in sports nutrition supplements include large multinational organizations such as Abbott and PepsiCo, private equity firms such as CVC Capital Partners, Bain Capital, and PAI Partners, and venture capital-backed companies such as Herbalife Nutrition and GNC Holdings.

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Form, Consumer Group, Distribution Channel, End Use and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

How is Rising Health and Fitness Awareness Reshaping Consumer Demand for Sports Nutrition Supplements?

The rising health and fitness awareness is expected to drive the market. There has been an increased emphasis on physical performance, muscle recovery, and endurance by consumers, which is boosting the demand for specialty sports supplements. The role of influencers, athletes, and professionals who deal with health-related wellness and fitness living is critical in popularizing the use of supplements in a holistic approach to fitness. The increasing popularity of fitness-focused lifestyles is promoting a sustainable need to consume functional, goal-oriented supplements.

The Council for Responsible Nutrition (CRN) estimates that more than 77% of U.S. adults used dietary supplements in 2024, compared to 67% in 2017, which was one of the top growth categories in sports nutrition. The populace in the U.S. is actively involved in routine aerobic exercises, which further strengthens the relationship between physical exercise and nutritional supplements. Furthermore, food producers such as Nestle Health Science, Glanbia PLC, and Herbalife Nutrition Ltd. introduced new product ranges in 2024 in line with consumer preferences for clean-label products and higher performance, thus further boosting the market.

Restraint

Growing Concerns Over Adulteration and Mislabeling Undermine Consumer Trust in Sports Nutrition Supplements

Growing concerns over adulteration and product mislabeling are anticipated to hinder the sports nutrition supplements market. Increasing apprehensions of adulteration and mislabeling of products are expected to dent customer perceptions against sports nutrition supplements. Research reported in ClinicalTrials.gov and examined by the NIH observed numerous instances of non-reported stimulants and poor dosing of over-the-counter sports supplements. Furthermore, this has made consumers doubt the reliability of the brands, particularly in niches such as pre-workouts and fat burners.

Opportunity

In what Ways Innovations in Ingredient Sourcing and Formulation is Likely to Enhance Product Appeal in the Sports Nutrition Supplements Market?

Innovation in ingredient sourcing and formulation creates numerous opportunities in several ways. Firstly, the shift toward sourcing ingredients from sustainable and ethical origins resonates with the growing consumer demand for transparency and environmental responsibility. Products that can highlight their commitment to these practices, such as through certifications or clear labeling, are likely to attract a more conscious consumer base.

Secondly, advancements in formulation are allowing for the development of more effective and palatable products. This includes the use of novel ingredients with enhanced bioavailability, meaning the body can absorb and utilize them more efficiently. Brands are moving away from traditional proteins and stimulants, focusing instead on plant compounds such as adaptogens and nootropics, along with bioactive ingredients with proven clinical benefits. This shift aligns with the growing consumer demand for clean-label, vegan, and eco-friendly products that are free of artificial ingredients.

In 2024, the European Food Safety Authority (EFSA) approved several novel food ingredients, including fermented botanical extracts and precision-fermented proteins, now incorporated into next-generation sports formulations. Companies are also innovating with advanced product formats like gummies, patches, and powders, using rapid absorption technologies, which is expected to drive market growth in the coming years.

Segment Insights

Product Type Insights

Why Did the Protein Supplements Segment Dominate the Sports Nutrition Supplements Market in 2024?

The protein supplements segment dominated the market, under which whey protein as a sub-segment held the maximum share in 2024. Whey-based formulations, known for their high absorption rate, complete amino acid balance, and clinical trial-backed muscle-building nutrients, continue to be a top choice for athletes and fitness enthusiasts. The widespread availability through online and specialized retail channels has also supported the whey protein's market dominance. Additionally, the increasing investment in precision fermentation of whey-derived ingredients further boosts this segment.

The plant-based protein sub-segment is projected to grow at the fastest rate in the coming years, owing to the growing popularity of veganism, lactose intolerance, and sustainability concerns. Companies are launching products that contain a mixture of pea, brown rice, and hemp protein, targeting athletes and consumers seeking dairy-free options. The younger generations, such as millennials and Generation Z, are shifting towards plant-based products due to concerns about their health and ethics. Furthermore, the growing enhancement in flavor, texture, and bioavailability facilitates the development of these products, further supporting segmental growth in the coming years.

On the other hand, the casein protein sub-segment is projected to grow at a notable rate in the coming years due to the increasing demand for slow-digesting, night-time recovery supplements. Athletes and endurance sports enthusiasts are turning to casein to support overnight muscle maintenance and reduce catabolism. The rise of casein protein is driven by the demand for protein diversity, especially among educated consumers. Furthermore, regulatory approvals from agencies like Health Canada and the MHRA (UK) have expanded casein-based formulations, enhancing its retail presence.

Form Insights

How Does the Powder Segment Dominate the Market in 2024?

The powder segment dominated the sports nutrition supplements market with the largest revenue share in 2024. This is mainly due to its ability to be easily incorporated into food, longer life span, and low cost. Customizable serving sizes and suitability with a wide variety of diet regimes are the driving factors behind the popularity of the powdered format. In 2024, the Council for Responsible Nutrition (CRN) conducted a survey and found that more than 75% of frequent supplement users in the U.S. regularly used them. Brands like Optimum Nutrition, Myprotein, and MusclePharm Corporation are producing sophisticated non-stim blend supplements. Transparent labeling, supported by the FDA and Health Canada, has increased consumer confidence and driven retailer adoption. The availability of powdered supplements in gyms, specialty stores, and online platforms further fuels this segment.

The ready-to-drink (RTD) segment is projected to grow at the fastest rate in the coming years due to the increasing demand for convenient, on-the-go nutrition. Urban dwellers and busy professionals frequently consume RTD products for pre- and post-workout needs without any preparation. The preference for RTD products with protein, electrolytes, and adaptogens is on the rise. The availability of RTD products in vending machines, convenience stores, and gyms is consolidating this trend, further driving segment growth.

Consumer Group Insights

What Made Athletes/Bodybuilders the Leading Consumer Group in 2024?

The athletes/bodybuilders segment dominated the sports nutrition supplements market in 2024, driven by their consistent need for high-performance nutrition and specific supplementation. Their rigorous training programs require precise macronutrient support for muscle rebuilding, strength, and endurance. Sports institutions and federations collaborated with manufacturers to develop products compliant with anti-doping regulations, further strengthening the product appeal among professional and semi-professional users, thus facilitating segment growth.

The lifestyle users segment is expected to expand at the fastest rate in the coming years due to the trend of using sports supplements to maintain a healthy body and functional fitness. These consumers prioritize convenience and clean-label products that align with their lifestyles, such as plant-based or brain-enhancing options. The Council for Responsible Nutrition (CRN) noted strong growth in first-time supplement users aged 25-40 who engage in casual fitness activities like yoga, HIIT, or amateur sports.

- In April 2025, Herbalife Nutrition Ltd. launched Sleep Enhance, a lifestyle-focused supplement formulated with an emphasis on natural flavors, reduced sugar content, and multifunctional benefits. The product aims to support improved sleep quality as part of the company's broader wellness portfolio.

The wider spectrum of botanical and adaptogen-based ingredients was also approved by regulatory agencies such as Health Canada and the Therapeutic Goods Administration (TGA) Australia. These plant-derived antioxidants are considered lifestyle products, with EFSA approving health claims for several hydration and recovery products. The nutrition trends highlighting supplements further drive segment growth.

Distribution Channel Insights

Why Did the Online Retail Segment Dominate the Sports Nutrition Supplements in 2024?

The online retail segment held the largest revenue share in the sports nutrition supplements market in 2024 due to the irreplaceable convenience of a greater variety of products from multiple brands offered by online platforms. Customers also went online to use e-commerce services to purchase sports nutrition supplements and obtain the advantages of subscription services.Major players like Amazon, iHerb, and Flipkart Health+ have expanded their offerings with certified brands, increasing access and confidence. The surge in purchases from online pharmacies by fitness-focused consumers, especially millennials and Gen Z, boosts the online market.

The direct-to-consumer (DTC) segment is expected to grow at the fastest rate, since more people are demanding a more personalized experience, product authenticity, and exclusivity. The large number of consumers who want to purchase goods in brand-run stores where they access top product lines, limited-edition productions, and professional advice continues to rise. Furthermore, the DTC experience was also enhanced with the use of consumer engagement tools, including mobile applications and loyalty ecosystems, thus further driving the segment in the coming years.

End Use Insights

What Made Muscle Growth the Dominant End Use Segment in 2024?

The muscle growth segment dominated the sports nutrition supplements market in 2024 due to the increased demand for sports nutrition from athletes and bodybuilders to enhance strength and performance. The targeted products are used by individuals seeking hypertrophy and lean mass gains. Several studies have verified the superior supplementation of high-quality protein and amino acids in maximizing muscle protein synthesis following resistance training. Furthermore, mass-gain formulas, which include rapid-absorption technologies and clinically supported ingredients, are now available in the market from brands such as Optimum Nutrition, MuscleTech, and Glanbia PLC.

The recovery segment is projected to grow at the fastest rate during the forecast period as consumers become more aware of the significance of repairing their bodies after exercising. A strong focus on a holistic approach in recovery management has increased the demand for recovery-specific formulas composed of specific ingredients. Firms like Herbalife Nutrition Ltd., NOW Foods, and Nutramax Laboratories have marketed product lines that support overnight muscle recovery. Furthermore, older individuals and those returning to play after musculoskeletal injuries have expanded the consumer population beyond athletes, further boosting market expansion.

Regional Insights

What Made North America the Dominant Region in the Global Sports Nutrition Supplements Market in 2024?

North America dominated the sports nutrition supplements market, capturing the largest revenue share in 2024 due to consumer awareness, high regulatory controls, and a supportive retailing infrastructure. Performance-based health routine marketing in the U.S. and Canada led to the widespread use of sports nutrition supplements across all demographic groups.

In 2024, regulatory agencies like the FDA, NIH Office of Dietary Supplements (ODS), and Health Canada enforced vigorous compliance systems, which facilitated transparent labeling and ingredient sourcing. E-commerce saw massive penetration, with iHerb, Amazon, and Walmart Health featuring sports nutrition sections and subscription discount programs. Digital-first brands also received a boost as Meta and Google released new advertising policies in this region, further propelling the market.

Asia Pacific: Technological leadership and innovation

Asia Pacific is expected to grow at the fastest rate in the market during the forecast period due to growing participation in fitness, rising middle-class incomes, and increasing urbanization in major economies. Countries like China, India, Japan, and Australia are also seeing considerable investment in health clubs, sporting activities, and online fitness communities. In 2024, TGA Australia, EFSA, and FSSAI of India simplified importation and regulatory processes, enabling faster market entry for brands like Herbalife Nutrition Ltd., MuscleTech, and Myprotein.

In 2024, the World Health Organization (WHO) and Harvard T.H. Chan School of Public Health highlighted a movement in Asian consumer behavior towards the use of supplementation. Leading companies such as PepsiCo Inc., Danone S.A., and Nestle Health Science established local production and distribution centers in Asia to match local culinary trends. Fitness culture through influencers grew rapidly on Douyin (TikTok China) and Instagram India, stimulating direct-to-consumer supplement sales and rapidly fueling the market in this region.

Europe: High consumer health awareness

Europe is expected to grow at a significant rate due to the increasing interest in active lifestyles, premium quality diets, and sustainable supplement formulas. German, UK, French, and Nordic health-conscious consumers were increasing their interest in sports nutrition supplements. The European Food Safety Authority (EFSA) enhanced product credibility by providing guidelines on health claims in protein metabolism, amino acids, and energy-yielding nutrients. Moreover, the introduction of QR-based digital labeling of products to enhance transparency to the consumer further boosts market reliability and growth.

U.S.: Well-established fitness culture

The U.S. has a strong and broad culture of fitness and health, with a high contribution to sports, gym activities, and recreational fitness plans. This has expanded the customer base beyond professional athletes and bodybuilders to comprise everyday people seeking wellness and performance improvement.

India: Rising disposable incomes

In India, enhanced performance in professional sports is related to a more scientific strategy to nutrition, and this is trickling down to the amateur level. Online platforms have made sports nutrition products more available to customers in the country, contributing significantly to sales growth. An increase in gym memberships and participation in different fitness activities, from traditional sports to marathons, drives demand for supplements.

UK: Growing e-commerce dominance

The UK has high e-commerce penetration for sports nutrition products, with major online retailers and brand-owned websites making products broadly accessible. The convenience of online shopping, value comparison, and subscription solutions has drives important online sales growth. UK customers scrutinize product labels and show a partiality for products with easy-to-understand, clear ingredients and clean label certifications.

Sports Nutrition Supplements Market- Value Chain Analysis

- R&D: The major R&D processes for sports nutrition supplements include multi-stages, from initial concept and research to testing, industrial, and market launch, all while adhering to strict quality and government standards.

Key Players: Bosch and Parker Hannifin Corporation - Clinical Trials: Clinical trials of sports nutrition supplements include a structured strategy to ensure safety and effectiveness, beginning with preclinical research and shifting through several human clinical trial phases

Key Players: Stanley Black & Decker - Consumer Services: It includes guiding customers through the purchasing journey, confirming product satisfaction, and building long-term loyalty.

Key Players: Ingersoll Rand and Atlas Copco

Top Vendors in the Sports Nutrition Supplements Market & Their Offerings

|

Company |

Headquarters |

Key Strengths |

Latest Info (2025) |

|

Abbott Laboratories |

Illinois |

A strong global presence in over 160 countries |

Abbott grows innovative and science-based nutrition products that offer nutritional support for patient growth, recovery, and sustainability. |

|

Bodybuilding.com Signature Series |

United States |

High manufacturing standards |

It provides protein powder, pre-workout, vitamins, BCAAs, and more with free shipping on qualified orders. |

|

BPI Sports LLC |

Florida |

Strong brand recognition |

All BPI Sports products are manufactured at FSSAI-approved manufacturing facilities. |

|

BSN |

United States. |

great-tasting products |

Bio-Engineered Supplements and Nutrition are worldwide leaders in scientifically engineered sports nutrition. |

|

Cellucor |

Texas |

Superior Taste and Mixability |

With over 3 billion servings sold worldwide, Cellucor sports nutrition & workout supplements are designed to make performance energy accessible to all. |

Recent Development

- In June 2024, dsm-firmenich announced a strategic collaboration with the Team dsm-firmenich PostNL cycling team to co-develop a new line of up4 sports nutrition products, aiming to enhance both athletic performance and overall health.

- In March 2025, GNC India, through Guardian Healthcare Pvt. Ltd., launched Pro Performance 100% Whey + Nitro Surge, an indigenously developed protein supplement combining performance enhancement with cardiovascular support.

- In May 2025, Edible Garden AG Inc. launched the first phase of its Kick. Sports Nutrition line on Amazon, in partnership with e-commerce agency Pirawna, marking its entry into the competitive sports nutrition segment.

(Source:https://our-company.dsm-firmenich.com)

(Source: https://www.business-standard.com)

(Source: https://www.globenewswire.com)

Latest Announcement by Industry Leader

- In January 2025, Cizzle Brands Corporation (“Cizzle Brands” or the “Company”), a leading name in the sports nutrition industry, has announced the official launch of its premium NSF Certified for Sport nutraceutical line, Spoken Nutrition (“Spoken”). Designed to meet the rigorous standards of professional athletes, Spoken aims to make elite-level supplements accessible to a broader athletic community. John Celenza, Chairman and Chief Executive Officer of Cizzle Brands, commented, “The supplements and nutrition products that are actually used by the world's top athletes aren't typically known by name to the general public, as they tend to be niche products which are usually only sold through specialty distributors within the sports nutrition profession. With Spoken, we are making these supplements available to athletes at all levels as well as their coaches and trainers.” Mr. Celenza further emphasized the strength of the Spoken team, noting their over 100 years of combined experience in training and nutritional consulting for elite athletes. This expertise positions Spoken Nutrition to build strong relationships with key decision-makers responsible for team purchases. As a complementary addition to its flagship CWENCH Hydration™ brand, Spoken strengthens Cizzle Brands' strategic foothold in the competitive sports nutrition landscape.

(Source: https://www.businesswire.com)

Segments covered in the report

By Product Type

- Protein Supplements

- Whey Protein

- Casein Protein

- Plant-based Protein

- Blended Protein

- Amino Acids

- BCAAs (Branched Chain Amino Acids)

- EAAs (Essential Amino Acids)

- Glutamine

- Creatine

- Pre-Workout Supplements

- Post-Workout Supplements

- Weight Management Supplements

- Fat Burners

- Carb Blockers

- Appetite Suppressants

- Hydration and Electrolyte Supplements

- Meal Replacement Products

- Vitamin & Mineral Supplements

- Others (Nitric Oxide boosters, Testosterone boosters, etc.)

By Form

- Powder

- Capsule/Tablet

- Ready-to-Drink (RTD)

- Bars/Gummies

- Others (Soft gels, syrups, etc.)

By Consumer Group

- Athletes/Bodybuilders

- Recreational Users

- Lifestyle Users

- Fitness Enthusiasts

By Distribution Channel

- Online Retail

- Supermarkets/Hypermarkets

- Specialty Stores

- Fitness Centers/Health Clubs

- Pharmacies/Drug Stores

- Direct to Consumer (DTC) Brand Stores

By End Use

- Muscle Growth

- Endurance Improvement

- Weight Loss

- Energy Boosting

- Recovery

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting