What is Nutritional Supplements Market Size?

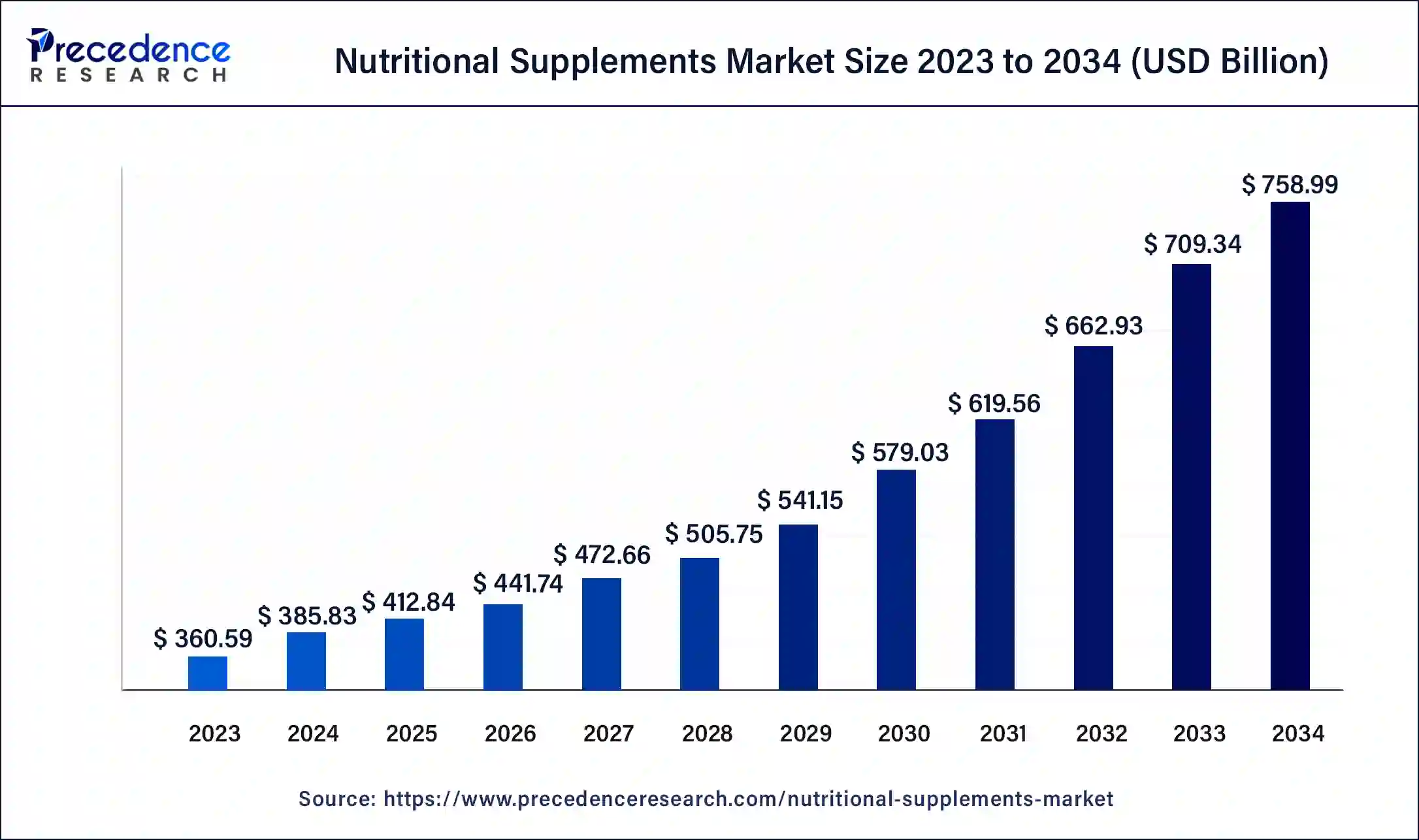

The global nutritional supplements market size accounted for USD 412.84 billion in 2025 and is expected to reach around USD 808.64 billion by 2035, expanding at a CAGR of 6.95% from 2026 to 2035. The nutritional supplements market is driven by the rising need for personalized nutrition, fitness, and even immunity-boosting items, alongside the aging population.

Market Highlights

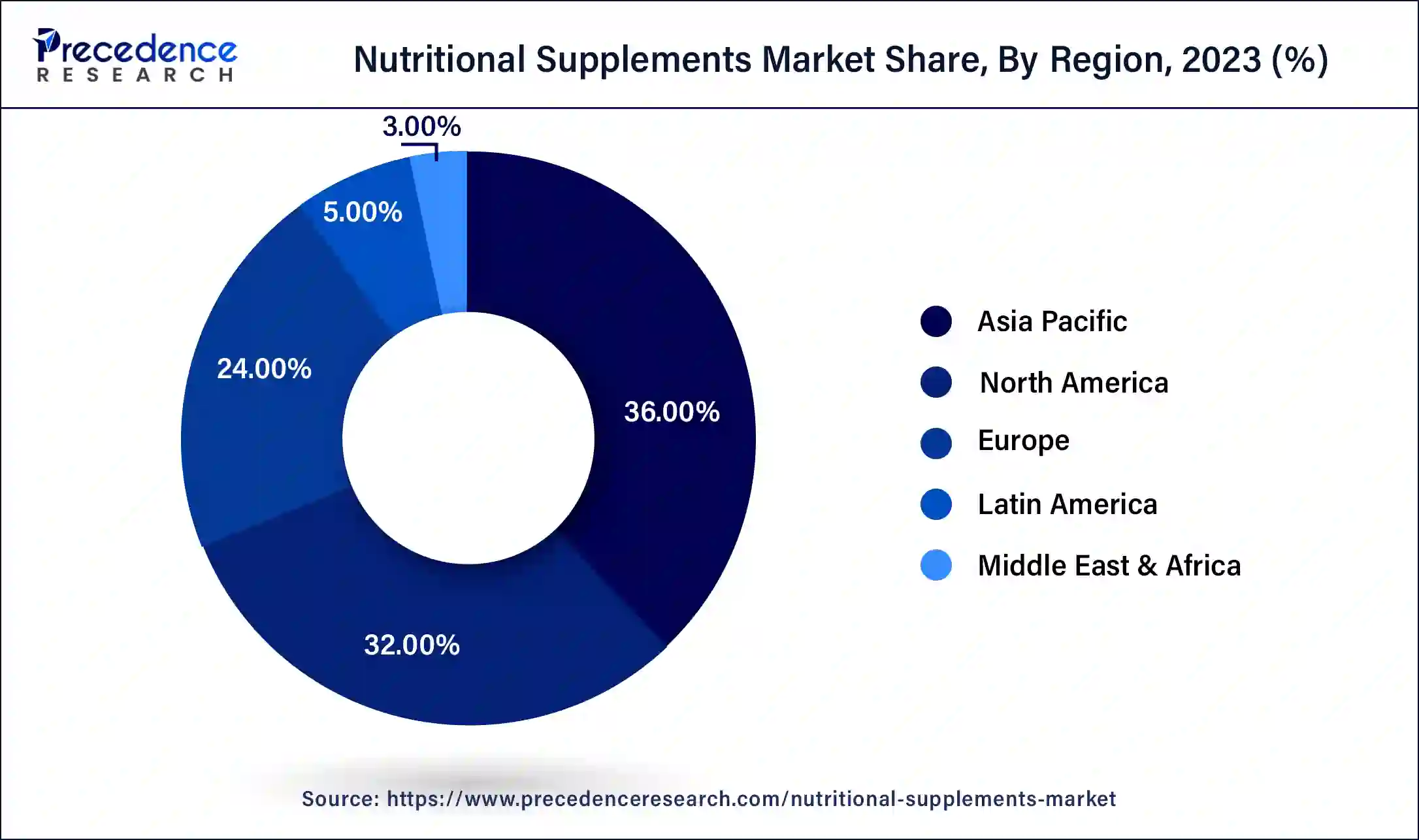

- Asia Pacific led the global market with the highest market share of 36% in 2025.

- By product, the functional foods and beverages segment held a market share of 56% in 2025.

- By formulation, the powder formulations segment has generated a market share of 37% in 2025.

- By sales channel, the brick and mortar segment has contributed a market share of 71% in 2025.

- By consumer group, the adults segment has captured a market share of over 26% in 2025.

Market overview

The nutritional supplements market is remarkable because of its role in understanding nutritional deficiencies, encouraging overall health, along with supporting specific health goals. Supplements are increasingly used to support numerous aspects of health, including immune function, digestive health, energy levels, and mental well-being. Increased knowledge about the importance of nutrition as well as preventive healthcare is a major contributor to market expansion, as people seek to proactively handle their health and well-being.

How is AI enhancing the nutritional supplements industry?

Artificial intelligence is revolutionizing the nutritional supplements industry by permitting personalized product development, streamlining R&D, and improving customer experiences. AI determines individual health data, including genetic data and lifestyle factors, to offer personalized supplement recommendations. AI speeds up the research process by determining vast datasets of scientific literature and detecting potential new bioactive compounds. AI creates engaging as well as intuitive shopping platforms, making it easier for users to find and purchase relevant supplements.

Nutritional Supplements Market Growth Factors

The global burden of malnutrition is increasing day by day. According to UNICEF, around 149.0 million of the children that are under 5 years of age are stunted, 40.1 million are overweight, and 49.5 million are wasted, in 2020. Further, the prevalence of overweight and obesity is rapidly rising in almost all the nations of the world. The low income countries are mostly affected by the issue of underweight whereas, wealthier countries are stricken by the overweight and obesity issues. Around 677.6 million global adults are obese, in 2020. Consumption of nutritional food and maintaining a healthy diet helps to build a strong immune system that provides strength to fight various diseases. This is a major factor that fuels the demand for the nutritional diets among the global population.

The changing consumption pattern, increased consumption of fast-foods, sedentary lifestyle of the consumer, busy and hectic schedule, and lack of maintaining proper diet are the factors responsible for the growing need for the nutritional supplements. The growing health consciousness, rising disposable income, rising consumer expenditure on health and wellness products, and demand for healthy and active lifestyle are the major factors boosting the growth of the global nutritional supplements markets. In 2020, the outbreak of COVID-19 resulted in an increased consumption of nutritional supplements among the consumers for maintaining strong immunity. The North American and European countries witnessed a strong spike in the demand for the nutritional supplements in 2020 and this trend is expected to sustain during the forecast period.

Nutritional Supplements Market Major Trends

- Dynamic Product Personalization: The increase in demand for customized nutrition products, from gender to sport to age, is influencing the product portfolio of companies and consumers' interest in adopting wellness products.

- Plant-Based & Clean Labels are Gaining Popularity: With increasing allergen concerns, a growing emphasis on sustainability, and a pursuit of holistic health, consumers are becoming more interested in protein sources that come from plants and have clean labels.

- Expansion of E-Commerce and Digital Sales Channels: Increased usage of e-commerce platforms and social commerce. Direct-to-consumer sales are expanding convenience for consumers while increasing brand visibility and personalized marketing capabilities.

- Inclusion of Indigenous Botanicals: Companies around Latin America and other regions are incorporating native botanicals such as Maca Root, Yerba Mate, and Guarana into their mainstream supplement offerings.

- Improved Ingredient Transparency: Increased consumer education, coupled with regulatory changes, has resulted in a growing demand from consumers for scientifically supported, evidence-based, and clear provenance ingredients.

Market Outlook

- Market Growth Overview: The nutritional supplements market is expected to grow significantly between 2025 and 2034, driven by growing health consciousness, growing incidence of lifestyle-related diseases, and the expansion of e-commerce.

- Sustainability Trends: Sustainability trends involve plant-based and natural ingredients, ethical sourcing practices, and eco-friendly packaging.

- Major Investors: Major investors in the market include Nestlé Health Science, Unilever, Bayer AG, Abbott Laboratories, Kirin Holdings, and L Catterton.

- Startup Economy: The startup economy is focused on ethical sourcing and certification, eco-friendly packaging, transparency, and technology.

Market Scope

| Report Highlights | Details |

| Market Size in 2025 | USD 412.84 Billion |

| Market Size in 2026 | USD 441.74 Billion |

| Market Size by 2035 | USD 808.64 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 6.95% |

| Largest Market | Asia Pacific |

| Fastest Growing Market | Latin America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Form, Product, Age Group, Distribution Channel, Region |

| Regions Covered | Asia Pacific, North America, Europe, Latin America, Middle East and Africa |

Market Dynamics

Drivers

How are evolving consumer lifestyles driving the growth of the nutritional supplements market?

Evolving consumer lifestyles, particularly increased health awareness, busy schedules, and a desire for personalized solutions, are driving the growth of the nutritional supplements market. Consumers are becoming more proactive regarding health and are seeking ways to prevent disease and improve their overall well-being.

This includes a greater understanding of the importance of nutrition in maintaining health and even a desire to tackle potential deficiencies via supplements. The growth of e-commerce platforms has made it easier for users to access a broad variety of nutritional supplements.

Restraint

How are potential safety concerns restricting the growth of the nutritional supplements market?

Potential safety concerns are indeed impacting the growth of the nutritional supplements market by creating user hesitation and contributing to increased regulatory scrutiny. Excessive intake of a few vitamins and minerals can contribute to adverse health effects, like liver damage from excessive consumption of vitamin A or digestive issues from too much iron. The shortage ofuniform regulations across different countries creates difficulties for international businesses and has even led to consumer confusion and distrust.

Opportunity

How does targeting specific health needs act as an opportunity for the growth of the nutritional supplements market?

Targeting specific health needs presents a significant growth opportunity for the nutritional supplements market by enabling personalized solutions, catering to diverse consumer demands, and driving innovation. Targeting specific health needs permits firms to cater to a broader range of consumers, which includes those with unique dietary requirements or health goals. The need for natural and organic ingredients has contributed to innovation in sourcing, along with formulation, with a greater impact on vegan, plant-based, and sustainable options.

Segment Insights

Form Insights

By form, the powder segment led the global nutritional supplement market with a remarkable revenue share of around 37% in 2025 and is anticipated to retain its dominance throughout the forecast period. This is attributed to the higher consumption of the powder form of nutritional supplement owing to its easy availability and higher commercial presence in the market. Moreover, rising popularity of green tea, dietary fibers, and protein powders are fostering the segment growth across the globe.

On the other hand, the capsules segment is expected to be the most opportunistic segment during the forecast period. This is attributed to the ease and convenience associated with the consumption of capsules. The hectic and busy schedules of the consumer results in the lack of proper diet and therefore, capsules serve the need for the consumers to fulfill their daily nutritional requirements.

Product Type Insights

By product type, the functional food segment led the global nutritional supplement market with remarkable revenue share of over 56% in 2025 and is anticipated to retain its dominance throughout the forecast period. This is attributed to the rising disposable income coupled with increased health awareness among the consumers. Consumers are now increasingly preferring the consumption of food and beverages items that are incorporated with functional benefits such as minerals, vitamins, fibers, and omega-3. This factor is propelling the growth of this segment.

On the other hand, the sports nutrition segment is expected to be the fastest-growing segment owing to an increase in the sports participation by the youth across the globe. Further, the growing popularity of fitness centers and gyms among the youth is fostering the sales of the sports nutritional supplements.

The sports nutrition segment is the fastest growing in the nutritional supplements market during the forecast period. This growth is boosted by increasing knowledge of health and fitness, a growth in the popularity of sports together with fitness activities, and the expanding e-commerce market. Consumers are more aware of the advantages of sports nutrition for performance improvement, muscle growth, along with recovery, contributing to greater adoption. Supportive government policies and initiatives encouraging sports and fitness also led to the increasing need for sports nutrition products.

Age Group Insights

By age group, the adult segment led the market with revenue share in 2025 and is anticipated to retain its dominance throughout the forecast period. This is attributed to the rise in the number of employed adults including men and women and the higher preference for the nutritional supplements in developed countries. Moreover, the rising prevalence of obesity, rising demand for functional food, and desire to stay healthy and active is propelling the growth of this segment.

On the other hand, the kids segment is estimated to be the most opportunistic segment owing to the rising awareness regarding the health benefits of the nutritional supplements among the parents. It is estimated that around 21% of the global population are baby boomers in 2020.

The kids segment is the fastest growing in the nutritional supplements market during the forecast period. This growth is fueled by increasing parental knowledge of children's nutritional needs and the growing demand for supplements to tackle deficiencies and support overall health together with development. Parents are increasingly recognizing the significance of accurate nutrition for their children's growth and development, which includes cognitive function, immunity, and physical well-being.

Distribution Channel Insights

By distribution channel, the specialty stores segment led the market with largest revenue share in 2025 and is anticipated to retain its dominance throughout the forecast period. The specialty stores offers a wide variety of supplements along with numerous brands. Further, the consultation offered by the sales person regarding the needs of the consumers facilitates the buyer to decide the type of supplement to be bought.

On the other hand, e-commerce is estimated to be the most opportunistic segment, owing to the growing penetration of e-commerce platforms. Further, easy refund and replacements, easy payment option, and heavy discounts on various brands offered is boosting the growth of this segment.

The e-commerce segment is the fastest growing in the nutritional supplements market during the forecast period. E-commerce platforms make it easier for users to access a broader variety of supplements, regardless of their location. It permits supplement companies to reach a wider audience, including those in remote areas or with restricted access to physical stores.

Regional Insights

Asia Pacific Nutritional Supplements Market Size and Growth 2026 to 2035

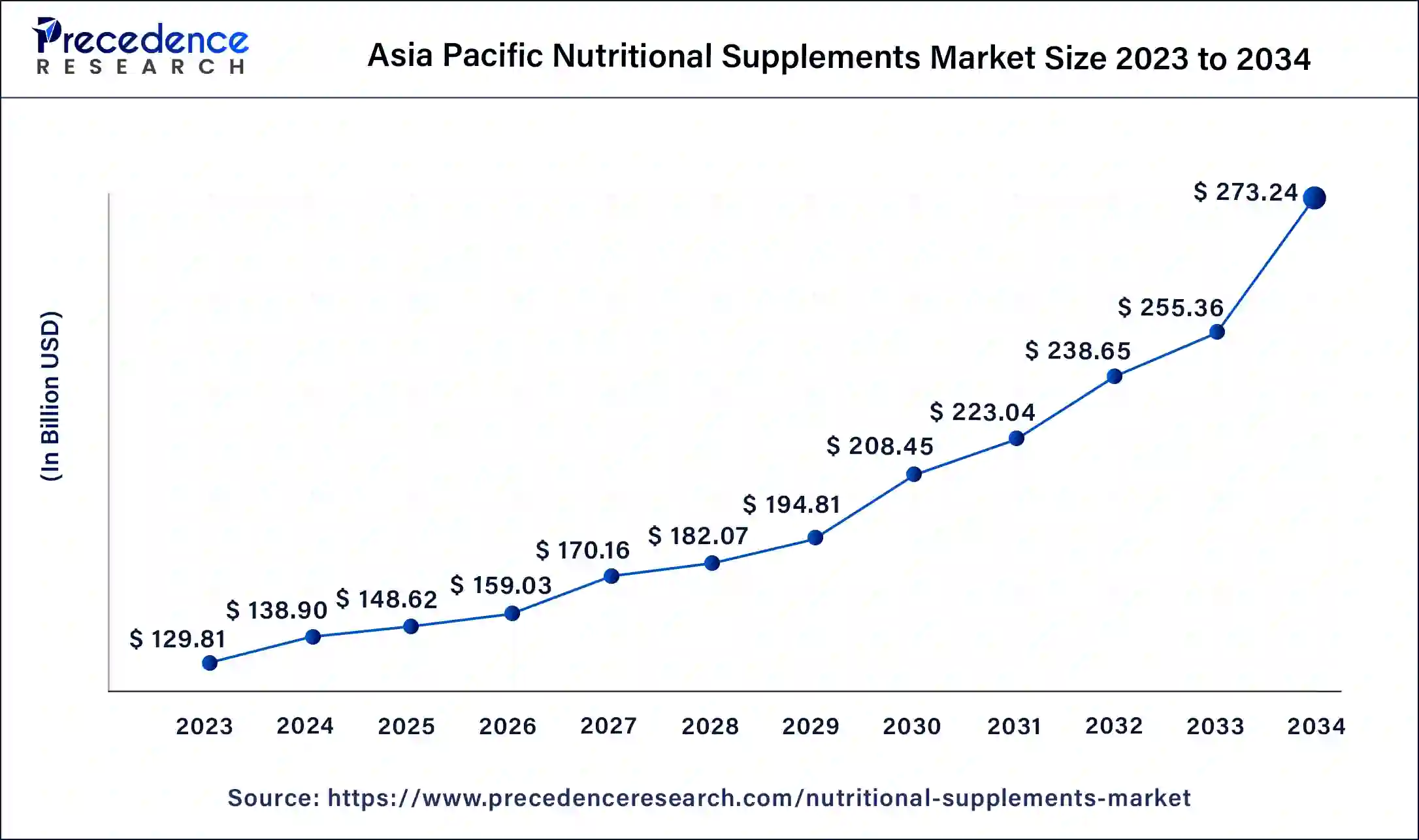

The Asia Pacific nutritional supplements market size is estimated at USD 148.62 billion in 2025 and is predicted to be worth around USD 291.12 billion by 2035, at a CAGR of 7.2% from 2026 to 2035.

Based on the region, the Asia Pacific dominated the global nutritional supplements market in 2025, in terms of revenue and is estimated to sustain its dominance during the forecast period. This is attributed to the growing health consciousness of the consumers regarding the health benefits of the nutritional supplements. Moreover, the rising investments of the key manufacturers in the research and development of various new products. The economies like China and India are becoming the manufacturing hub and the research and development center for the nutritional supplements.

On the other hand, the Latin America is estimated to be the most opportunistic market for the nutritional supplements. Nations like Brazil and Argentina are expected to witness considerable growth in the demand for the nutritional supplements. This owing to the factors such as rising disposable income, rising health consciousness, and rising consumer expenditure on health and wellness products.

Asia Pacific dominated the nutritional supplements market in 2025. This is largely because of a large consumer base, rising health consciousness, and the acceptance of both conventional and modern wellness practices. The rising elderly population in countries such as Japan and China fuels the need for nutritional supplements for preventative care along with improved quality of life. Both online and offline retail channels, that includes brick-and-mortar stores, led to the market's reach.

What Is Driving Growth in the European Nutritional Supplements Market?

The European nutritional supplements market is expected to witness significant growth over the forecast period. Regulatory authorities such as the European Food Safety Authority (EFSA) are an important part of the security and quality of nutritional supplements. Also, supplementation is becoming more convenient and attractive with new shapes of products like gummies, powders, and tailor-made nutrition packs.

The UK Nutritional Supplements Market Trends

In 2024, the United Kingdom dominated the European market. The drivers behind this are increased mental and digestive health dish phenomenon, and more plant-based and also functional ingredients. The ease that e-commerce and subscriptions of supplement services provide has also added to these sales. Further, the Food Standards Agency (FSA) of the UK offers a strong framework governing structure that assures the quality and safety of goods, which spurs trust in the buyers.

Europe is the fastest growing in the nutritional supplements market during the forecast period. Consumers are increasingly focused on health and wellness, contributing to higher requirements for supplements. There's an increasing trend of people accepting preventative healthcare measures, that include the usage of supplements.

Europe: Wellness Evolution with Smart Supplement Choices

The landscapes of nutritional supplements within Europe are developed upon an extensive level of regulation, to create and maintain safe/quality products; therefore, creating a sense of trust within consumers. In many of the major markets, such as Germany, Great Britain, and France, there is a continuing trend for increased demand for healthful products as it is related to improving health, functionality in food, and the need for health maintenance/prevention within the growing number of active as well as the aging population of today.

China Nutritional Supplements Market Trends

China's market growth is driven by the aging population and increased health awareness, particularly among younger consumers. The shift towards preventive healthcare and a preference for natural, traditional Chinese medicine-based ingredients. E-commerce dominates as the primary sales channel, with brands leveraging online platforms and social media to reach consumers.

Latin America Emerges as the Nutritional Supplements Powerhouse

On the other hand, the Latin America is estimated to be the most opportunistic market for the nutritional supplements. Nations like Brazil and Argentina are expected to witness considerable growth in the demand for the nutritional supplements. This owing to the factors such as rising disposable income, rising health consciousness, and rising consumer expenditure on health and wellness products.

Latin America: Rapid Growth & Local Innovation:

The rise of Latin America as a region with rapid growth is being driven by an increase in health awareness among consumers, the growth in spending power of the growing middle class, as well as the rapid digitalisation and e-commerce capabilities that are making health-focused products more readily available to consumers on a national and global platform.

As a result of the developing e-commerce solutions, more and more consumers are purchasing plant-derived supplements, immune support, and lifestyle-related items.

Middle East & Africa (MEA): Expanding Footprint in Health & Wellness:

As the Middle East and Africa region is becoming well acquainted with nutritional supplements through the expansion of retail frameworks and e-commerce platforms, the key growth areas for this region are Saudi Arabia, the United Arab Emirates, Egypt, and South Africa, where preventative nutrition, fitness, and lifestyle products are becoming mainstream health products among health-conscious consumers.

Value Chain Analysis of the Nutritional Supplements Market

- Raw Material Sourcing

This initial stage involves the procurement of active ingredients, excipients, and other raw materials used in supplement formulation.

Key Players: DSM-Firmenich AG and Archer Daniels Midland Company (ADM) - Manufacturing and Formulation

The manufacturing stage involves processing the raw materials into finished supplement products, such as tablets, capsules, powders, and gummies.

Key Players: Bayer AG, Amway Corp, Abbott Laboratories, and Velnex Medicare - Distribution and Logistics

After manufacturing, products are transported and distributed to various sales channels.

Key Players: Herbalife International - Retail and Marketing

This final stage involves selling products to end consumers and promoting the benefits of supplements.

Key Players: GNC, Amazon, HealthKart, Optimum Nutrition (ON), and MuscleBlaze

Key Players in Nutritional Supplements Market & Their Offerings

- Abbott Nutrition: As a global healthcare leader, Abbott produces a wide range of science-based nutritional products for all ages, contributing significantly through brands like Ensure and PediaSure.

- Amway: Amway contributes significantly through its Nutrilite brand, which is a global leader in the direct selling segment of vitamins and dietary supplements.

- Nestle: As a major food and beverage corporation, Nestle contributes via its Health Science division, which develops consumer-focused and medical nutrition products.

- Glanbia Plc: Glanbia is a global nutrition company that contributes through its performance nutrition brands, such as Optimum Nutrition and BSN, targeting fitness enthusiasts and athletes.

- Herbalife International of America: Herbalife contributes to the market through a direct-selling business model, offering a comprehensive line of meal replacements, weight management products, and dietary supplements.

- Archer Daniels Midland (ADM): ADM is a major player in the raw materials stage, supplying a vast array of high-quality ingredients, including vitamins, proteins, and fibers, to supplement manufacturers worldwide.

- GlaxoSmithKline (GSK): GSK contributes through its consumer healthcare division (now largely part of Haleon), which offers well-known over-the-counter vitamins and mineral supplements.

- Nature's Bounty Co.: This company contributes by manufacturing a wide variety of products across different price points and channels, including brands like Nature's Bounty, Solgar, and Pure Protein. They excel in market segmentation and providing a diverse product portfolio to meet various consumer health needs.

- Arkopharma Laboratories Pharmaceutiques: A European leader in natural medicine and herbal supplements, Arkopharma contributes by focusing heavily on plant-based health products, particularly through their Arkocaps range. Their expertise in phytotherapy provides consumers with science-based alternative and complementary health solutions.

- DuPont (now part of IFF Nutrition & Biosciences): DuPont contributed significantly as a key supplier of high-value ingredients like probiotics, prebiotics, and specialty enzymes to supplement manufacturers globally.

- American Health, Inc.: This company contributes by providing a range of nutritional supplements with a focus on digestive health, immune support, and essential vitamins under brands like Ester-C and American Health.

- Pfizer, Inc.: While primarily a pharmaceutical giant, Pfizer contributed to the supplement market through consumer health brands like Centrum, before spinning off the consumer division into what is now Haleon.

- Stepan Company: Stepan contributes as a key supplier of functional ingredients, particularly specialized lipids and emulsifiers used in the formulation of soft gels and other delivery formats.

Recent Developments

- In June 2024, Steadfast Nutrition launched three new products: Whey Protein, LIV Raw, and a vegetarian Multivitamin mega pack containing 180 tablets. The new products will help fulfil the protein and nutrient needs of sportspeople and health-conscious individuals alike. The launch took place at Asia's largest health and fitness expo, the International Health, Sports and Fitness Festival (IHFF).

- In May 2023, Launch Hydrate, a leading brand in the sports nutrition market, partnered with Perfect Game, a softball and baseball organization. The purpose of their collaboration was to provide Players of Perfect Game with several sports drink options.

- In April 2023, Hemperella launched a host of hemp-based products, including protein powder, hemp muesli, and protein bars. Given the number of different flavors available, they expect to entice the consumer and drive segment growth.

- The market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting strategies, such as investments, partnerships, and acquisitions & mergers. Companies are also spending on the development of improvedproducts. Moreover, they are also focusing on maintaining competitive pricing.

- In March 2018, Fonterra entered into a partnership with Foodspring, a startup company in the operating in the active ingredients industry. The various developmental strategies by the key market players significantly contributes towards the development of the global nutritional supplements market.

Segments Covered in the Report

By Form

- Powder

- Tablets

- Capsules

- Liquid

- Soft gels

- Others

By Product Type

- Sports Nutrition

- Dietary Supplements

- Fat Burner

- Functional Food

- Others

By Age Group

- Kids

- Adults

- Geriatric

By Distribution Channel

- Supermarkets/Hypermarkets

- Specialty Stores

- Pharmacies

- E-commerce

- Others

By Region

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting