Dietary Fibers Market Size and Forecast 2025 to 2034

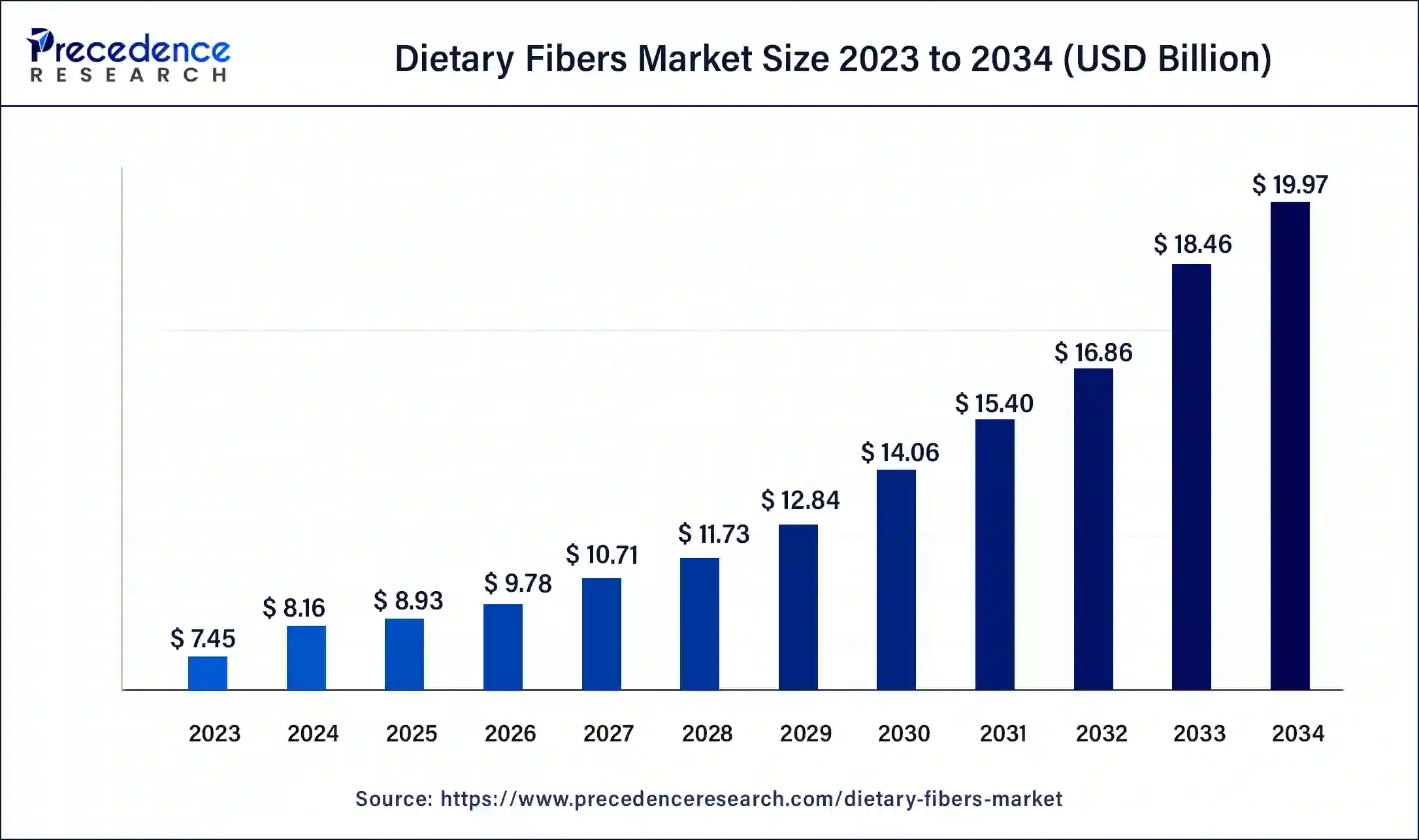

The global dietary fibers market size is valued at USD 8.93 billion in 2025 and is predicted to increase from USD 9.78 billion in 2026 to approximately USD 19.97 billion by 2034, expanding at a CAGR of 9.4% from 2025 to 2034.

Dietary Fibers Market Key Takeaways

- In terms of revenue, the market is valued at $8.93 billion in 2025.

- It is projected to reach $19.97 billion by 2034.

- The market is expected to grow at a CAGR of 9.4% from 2025 to 2034.

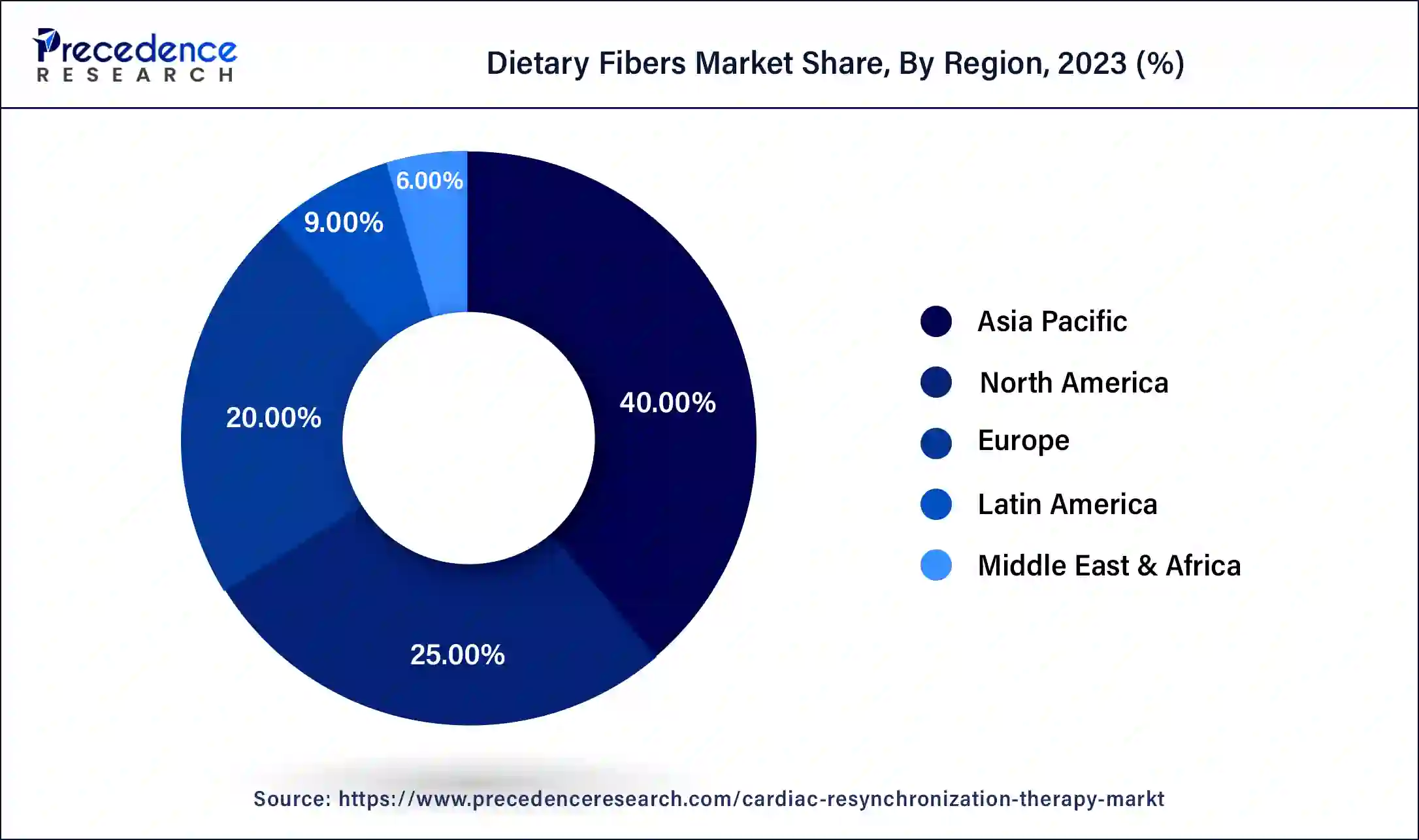

- Asia Pacific has accounted highest market share 43% in 2024.

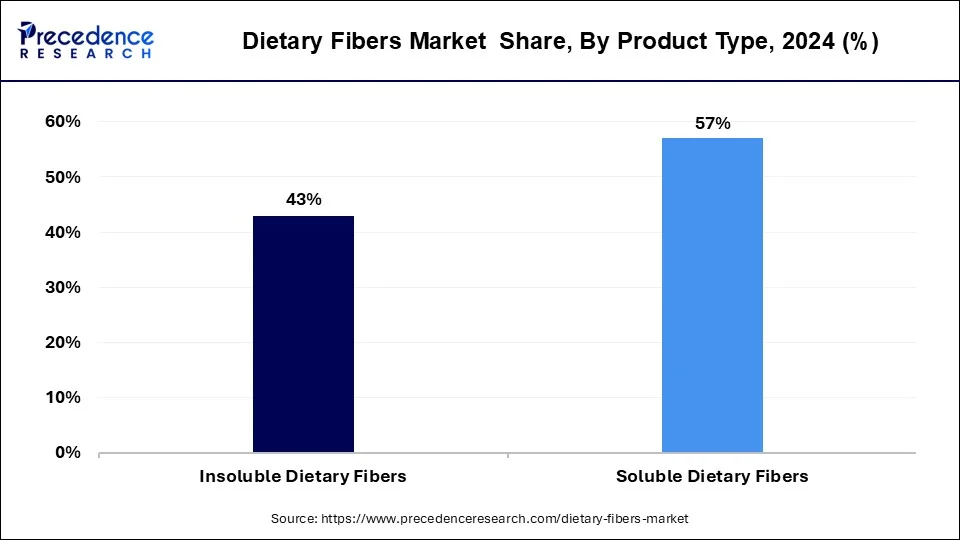

- By product, the soluble dietary fibers segment contributed 57% of the market share in 2024.

- The food & beverage application segment registered a 46% market share in 2024.

- The animal feed application is expected to reach a CAGR of 10% over the forecast period 2025 to 2034

The Growing Market for Dietary Fiber Products Worldwide

Dietary fibers are carbohydrate polysaccharides that, when consumed, are not completely broken down by gastrointestinal enzymes. As a result, they absorb water and ferment, which encourages the growth of good bacteria in the colon. Whole grain foods, fruit, and vegetables all include dietary fiber. Plant chemicals or inedible components are used to make fiber. Dietary fibers are found in many different types of food and are mostly produced from plant foods including fruits, vegetables, and legumes. These fibers aid in the body's waste removal, lower blood sugar and cholesterol levels to lower the risk of diabetes and heart disease and maintain healthy weight. Various businesses, including medicines, food & beverage, and animal feed, can benefit from dietary fibers.

Increased public knowledge of the health benefits of dietary fiber, along with an increase in the number of urban residents, is anticipated to create a sizable growth opportunity. Because more women are working and have more disposable income, the market for dietary fibers is anticipated to expand.

Growing consumer awareness of the importance of eating well and leading an active lifestyle is predicted to increase product demand, which will fuel market expansion in the years to come. The prevalence of heart disease, cancer, and diabetes has raised customer preference for fiber-based dietary items with additional health advantages.

Market Outlook

- Industry Growth Offerings- The market is growing due to rising health awareness, increasing demand for functional foods and beverages, innovations in fiber-enriched products, expanding nutraceutical applications, and the adoption of clean-label and plant-based ingredients by food manufacturers worldwide.

- Global Expansion- The global market is expanding as manufacturers target emerging economies, driven by rising health consciousness, increasing functional food consumption, and the entry of international players. Growth is supported by improved distribution channels and rising demand for fiber-enriched products worldwide.

- Starup Ecosystem- The startup ecosystem is growing with companies developing innovative plant-based, soluble, and functional fiber solutions. Focus areas include gut health, clean-label products, and nutraceutical applications, supported by venture funding, partnerships, and rising consumer demand for healthier diets.

Dietary Fibers Market Growth Factors

The proportion of the gut flora is regulated by soluble dietary fibers, which also serve as prebiotics. These dietary fibers contain hypocholesterolemic properties that aid in regulating and lowering blood sugar and cholesterol levels. Nuts, cereals like oats, and fruits and vegetables are the main sources of soluble dietary fibers.

It is anticipated that the demand for dietary fiber would increase as people throughout the world become more aware of its health advantages. Additionally, it was anticipated that the market for dietary fiber would expand as consumer demand for fiber supplements grew as a result of health issues. The rising public preference for a healthier way of life has significantly contributed to the market's expansion. With the growth of the food and nutrition industry, dietary fiber is in greater demand on the global market. As a result, it is anticipated that in the years to come, there will be an increase in global demand for dietary fiber. The work of nutritionists and doctors to promote the value of having a balanced diet has been mirrored in the rising demand for healthy foods. Pediatricians urge parents to feed their children foods high in dietary fiber. Additionally, it is anticipated that the dietary fiber industry will be considerably impacted by changes in consumer behavior brought on by higher disposable income. Men are greatly affected by obesity and diabetes because of their busy consumer lifestyles. This has increased people's knowledge of wholesome foods and supplements. This dominates the market for dietary fiber. Additionally, the introduction of functional foods into eating habits, the scarcity of high-quality fruits and vegetables, and the global demand.

A growing number of consumers are becoming health-conscious, and the market has increased its application base due to the ease with which production may be started. Other significant factors include increased demand for fiber supplements, changing lifestyles, and higher disposable income.

Dietary fibers are advantageous for muscle performance, endurance, and muscle regeneration before to, during, and following exercise. Dietary fiber producers are now having access to markets in the nutraceutical andsports nutritionsectors thanks to dietary fiber-rich meals. That helps in growing the dietary fiber market.

Dietary Fibres Market Trends

- Consumer shift towards nutraceuticals such as dietary fiber supplements and products.

- Increased investments in R&D activities for exploring new sources of dietary fibers and developing innovation extraction methods and processing techniques for developing innovative dietary fiber ingredients as well as for expansion of product portfolios by manufacturers.

- Growing consumer awareness for maintaining gut health and increasing dietary fibre intake is driving the demand for prebiotics and fiber-rich ingredients.

- Rising consumer demand for naturally derived and clean label products is driving manufacturers to source dietary fibers from natural sources and reducing the use of artificial additives.

- Surging adoption of dietary fibers for animal health to promote healthy digestion and weight management in livestock and pets.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 19.97 Billion |

| Market Size in 2026 | USD 9.78 Billion |

| Market Size in 2025 | USD 8.93 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 9.4% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Raw Material, Product, Application, Processing Treatment, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Product Insights

Depending upon the product type, the soluble segment is the dominant player and is anticipated to have the biggest impact on dietary fiber. This kind of fiber breaks down in water to create a gel-like substance. It can aid in lowering blood sugar and cholesterol levels. Oats, peas, beans, apples, citrus fruits, carrots, barley, and psyllium all contain soluble fiber. reducing fat absorption and aiding in weight management Soluble fiber inhibits fats that might otherwise be digested and absorbed by forming a thick, spread-out gel. Soluble fiber slows down the digestion of other nutrients, including carbohydrates, while preventing the absorption of lipids. Soluble fiber-rich meals can potentially reduce high blood sugar spikes by making them less likely to occur.

Due to the expanding popularity of functional foods, rising consumer health consciousness, and changing dietary habits, insoluble dietary fibers are anticipated to grow at the quickest rate throughout the forecast period. Additionally, insoluble dietary fibers from oats, wheat, maize, potatoes, peas, rice, and legumes help lower the risk of developing a number of health conditions, including obesity, hyperglycemia, constipation, high cholesterol, and high blood pressure. Various food applications, including those involving chicken items, baked foods, and meat products, use cellulose. Here, cellulose fibers with a high ability to hold water and oil are used in applications involving processed meat to maintain moisture levels in the end products, whereas cellulose with a low capacity to absorb water is used to provide fiber to items like bread, cakes, and pastries.

Application Insights

During the projected period, the pharmaceuticals segment is anticipated to be the largest in the dietary fibers market. The processes of absorption and plasma clearance, which can be impacted by the presence of specific dietary components in the gastrointestinal tract, are what determine how bioavailable medications are when taken orally. Over the past few years, knowledge about how food affects medicine absorption has grown. More individuals are living sedentary lifestyles as a result of increased urbanization, which is raising the incidence of obesity and chronic diseases. By regulating how the body uses sugar, foods high in soluble fiber, such as oatmeal, beans, almonds, apples, and many others, help to control blood sugar levels and appetite. In order to lead a healthy lifestyle, dietary fiber consumption is increasing, which will drive the market for the product. Hence, the demand of dietary fibers in pharmaceutical industry is increasing.

The market is significantly led by the application category for food and beverages. One of the main elements driving up demand for the product is consumer faith in the health advantages of dietary fiber. Furthermore, over the coming few years, the market is expected to be driven by the rising need for nutritious and useful food products. Due to their increased nutritional profile, breakfast cereals are in high demand in the food industry. The strong demand is also attributed to customers' growing health worries about the negative impacts of processed food and fast food as well as excessive calorie consumption.

Regional Insights

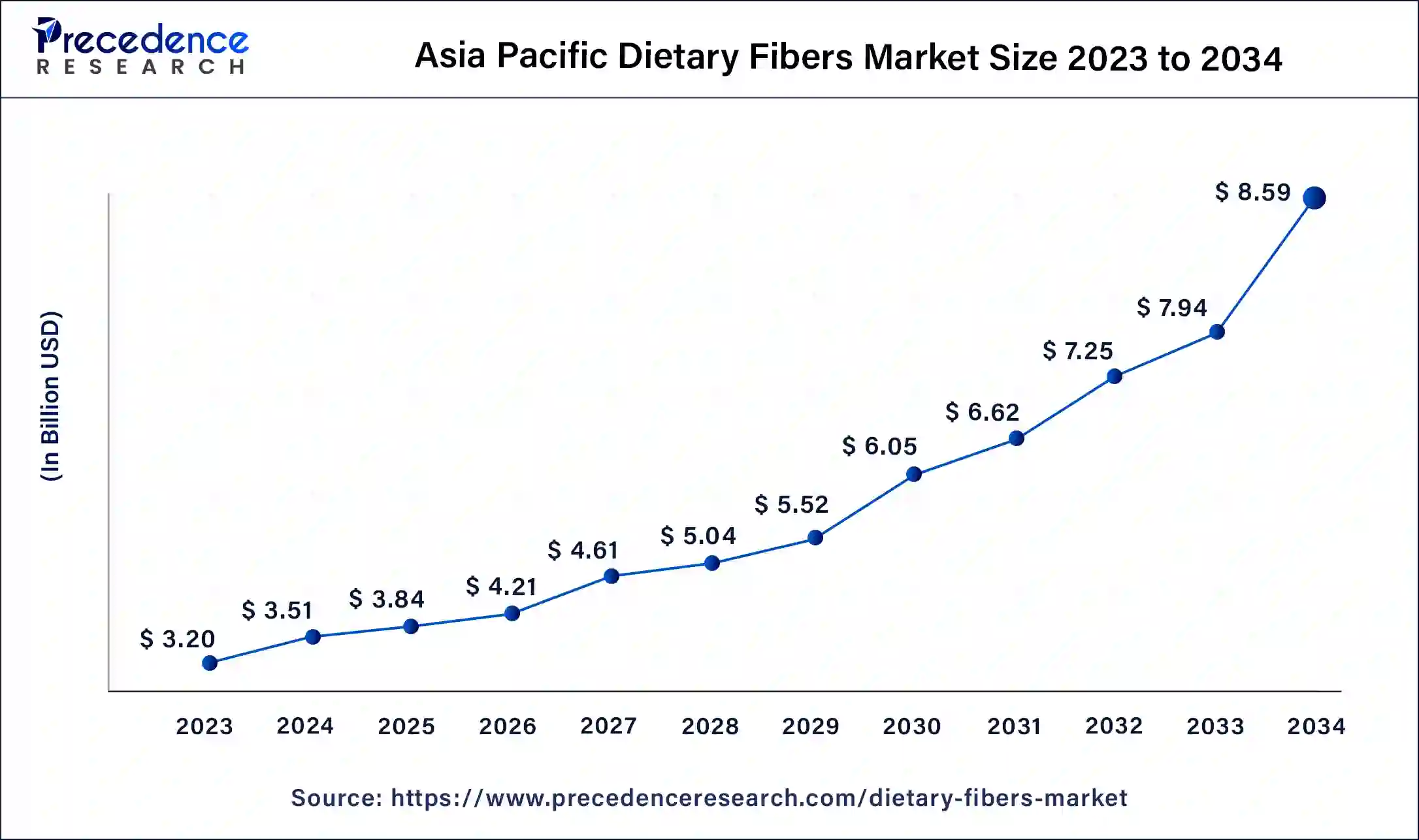

Asia Pacific Dietary Fibers Market Size and Growth 2025 to 2034

The Asia Pacific dietary fibers market size is estimated at USD 3.84 billion in 2025 and is predicted to be worth around USD 8.59 billion by 2034, at a CAGR of 10% from 2025 to 2034.

Why is North America Leading the Dietary Fibers Market?

The highest market share and dominant position in the dietary fibers industry belongs to North America due to high demand for dietary fiber products in the region. This region includes U.S. and Canada. It is projected that the market in North America would expand. This can be ascribed to the increase in the intake of food products with nutritional additives. In addition, the region's urban population is expanding and recent economic development has resulted in significant changes in dietary and lifestyle habits. The market in North America is being driven by a number of important factors, including the rise in fiber consumption and the encouraging trend in the manufacture of functional foods.

U.S. Consumers Drive Growth in Dietary Fiber Market

The U.S. market is expanding due to rising consumer focus on gut health, weight management, and prevention of chronic diseases such as diabetes and heart conditions. Increasing demand for functional foods, fiber-enriched beverages, and bakery products drives adoption. Growth is further supported by product innovation, strong retail and e-commerce channels, and awareness campaigns promoting healthy diets. Additionally, government initiatives and investments by key manufacturers in research and development are boosting the availability and variety of dietary fiber products nationwide.

How Are Charging Consumer Lifestyles Driving Dietary Fiber Demand in Asia Pacific?

During the anticipated period, Asia Pacific held a sizable market share for dietary fibers. Over the coming few years, it is anticipated that nations like China, Japan, and Indonesia would be the top manufacturers of foods and beverages. Over the projected period, it is predicted that promising trends in the Asia Pacific food and beverage industry would boost product demand. Over the next several years, it is anticipated that rising health consciousness among consumers and the expansion of fitness centers in India will drive the market. Additionally, the Indian government's adoption of the National Food Security Act has been crucial in altering dietary habits. The rise in consumer purchasing power is anticipated to enhance demand for nutritious and useful foods that are high in fiber.

China Dietary Fivers Market Booms With Health-Conscious Consumers

China's market is growing due to rising health awareness, increasing prevalence of lifestyle diseases like diabetes, heart disease, and obesity, and a shift toward functional foods. Rapid urbanization, higher disposable incomes, and changing dietary habits are driving demand for fiber-enriched products. Expansion of the food and beverage, nutraceutical, and animal feed industries further supports market growth. Additionally, government initiatives promoting healthy eating and the entry of international fiber product manufacturers are accelerating market adoption.

For instance, in September 2024, ZBiotics, a biotechnology company focused on developing purpose-built genetically modified probiotics, launched Sugar-to-Fiber Probiotic Drink Mix which is a bioengineered probiotic designed specifically for addressing American diet deficiencies by conversion of dietary sugar (sucrose) into a special type of prebiotic fiber (levan) continuously all day long.

Europe Embraces Fiber-Enriched Foods for Health and Wellness

The Europe market is increasing due to growing health-consciousness among consumers and rising prevalence of lifestyle-related diseases like obesity, diabetes, and cardiovascular conditions. Demand for functional foods, fortified beverages, and fiber-enriched bakery products is rising. Manufacturers are investing in innovative fiber formulations and clean-label solutions to meet consumer preferences. Strong retail and online distribution channels, coupled with supportive government initiatives promoting healthy diets, further accelerate market growth across European countries, driving steady adoption of dietary fiber products.

UK Market Expands as Plant-Based Fibers Gain Popularity

The UK market is growing as consumers increasingly seek natural and plant-based ingredients for overall wellness. Rising interest in gut microbiome health, immunity support, and functional nutrition is boosting demand. Food and beverage manufacturers are introducing fortified products, snacks, and beverages with added fiber. Additionally, partnerships between startups and established brands, growing online sales, and marketing campaigns highlighting the benefits of fibers are contributing to broader adoption and steady market expansion across the UK.

Value Chain Analysis

Raw Material Procurement

- Sourcing involves plant-based materials such as cereals, fruits, vegetables, and agro-industrial byproducts.

- Raw materials are processed into refined fiber powders for applications in food, beverages, and nutraceuticals.

- Emphasis is placed on cost-effective, sustainable, and high-quality sourcing.

Key Players: Cargill, Archer Daniels Midland (ADM), Ingredion Incorporated, Roquette Frères, Tate & Lyle.

Processing and Preservation

- Dietary fibers are modified using physical, chemical, and biological techniques to improve functionality and structure. Common methods include extrusion, acid/alkali treatments, and enzymatic

- To maintain quality and prevent spoilage, fibers are preserved through drying, canning, and low-temperature storage.

Key Players: Cargill, Archer Daniels Midland (ADM), Roquette Frères, Ingredion Incorporated, Tate & Lyle.

Quality Testing and Certification

- Dietary fibers are tested using standardized laboratory techniques to check content, purity, and functional properties.

- Certification follows international standards to ensure accurate nutrition labeling and quality control.

- The process guarantees product safety, effectiveness, and acceptance in the market.

Key players: SGS Group, Intertek Group, Bureau Veritas, and TUV SÜD.

Top Vendors and their Offerings

- ADM: Supplies plant-based and functional fibers for food, beverages, and nutraceutical applications, focusing on health benefits and product innovation.

- Lonza: Provides dietary fiber ingredients for functional foods and supplements, emphasizing gut health and clean-label solutions.

- Puris: Produces high-quality plant-based fibers for food and beverage fortification, supporting digestive health and formulation flexibility.

- Nexira: Offers natural, soluble, and insoluble fibers for functional foods, beverages, and dietary supplements.

- DuPont: Develops fiber ingredients to enhance nutrition, texture, and stability in food, beverage, and health products.

Other Major Componies

- Roquette Frères

- Emsland Group

- Cargill, Incorporated

- Kerry Inc.

- The Green Labs LLC

- Ingredion Incorporated

- Tate & Lyle

- Farbest Brands

- Taiyo International

- AGT Food and Ingredients

- Batory Foods

Recent Developments

- In May 2025, Healthy Extracts Inc., a platform for acquisition, development, patenting, marketing, and distribution of plant-based nutraceuticals and delivery systems, expanded its tech portfolio of nutritional supplement delivery systems thorugh an alliance with Whitney Jones, fitness influencer and health advocate for launching the new WHITNEY JOHNS Gut Health Straw. The new product is the world's first prebiotic fiber and probiotic supplement which is administered with a novel drinking straw technology, delivering up to 4 grams of prebiotic fiber and 60 billion CFU of Bacillus coagulans MB BCM9.

- In March 2025, Yukiguni Maitake, a leading Japanese mushroom manufacturer, introduced a new product range, Mushroom Meat which is made with maitake mushrooms and contains about 3.7g of dietary fiber in each 50g packet.

- In July 2024, Ingredion, a global ingredient solutions provider, launched two new clean-label citrus fibre ingredients made from upcycled citrus peels, FIBERTEX CF 100 and FIBERTEX CF 500, in Europe, the Middle East, and Africa (EMEA) region. The new citrus fiber products are a source of dietary fiber, offering various benefits.

- The Nurica enzyme was introduced by DuPont in China. Manufacturers can now naturally synthesize dietary fibers in the form of galactooligosaccharides thanks to this novel and unique enzyme.

Segments Covered in the Report

By Raw Material

- Fruits & vegetables

- Apple

- Banana

- Pear

- Grapefruit

- Raspberry

- Garlic

- Okra

- Carrot

- Potato

- Beet

- Cereals & grains

- Soy

- Oats

- Wheat

- Rice

- Barley

- Legumes

- Beans

- Corn

- Peas

- Nuts & seeds

- Almonds

- Flaxseeds

- Peanuts

- Psyllium

- Sunflowers

By Product

- Soluble Dietary Fibers

- Inulin

- Pectin

- Beta-Glucan

- Corn Fibers

- Others

- Insoluble Dietary Fibers

- Cellulose

- Hemicellulose

- Chitin & Chitosan

- Lignin

- Oat Bran

- Wheat Fiber

- Others

By Application

- Food & Beverages

- Dairy products

- Bakery & confectionery products

- Breakfast cereals

- Meat products

- Snacks

- Beverages

- Pharmaceuticals

- Animal Feed

- Others

By Processing Treatment

- Extrusion cooking

- Canning

- Grinding

- Boiling

- Frying

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting