Citrus Fibers Market Size and Forecast 2025 to 2034

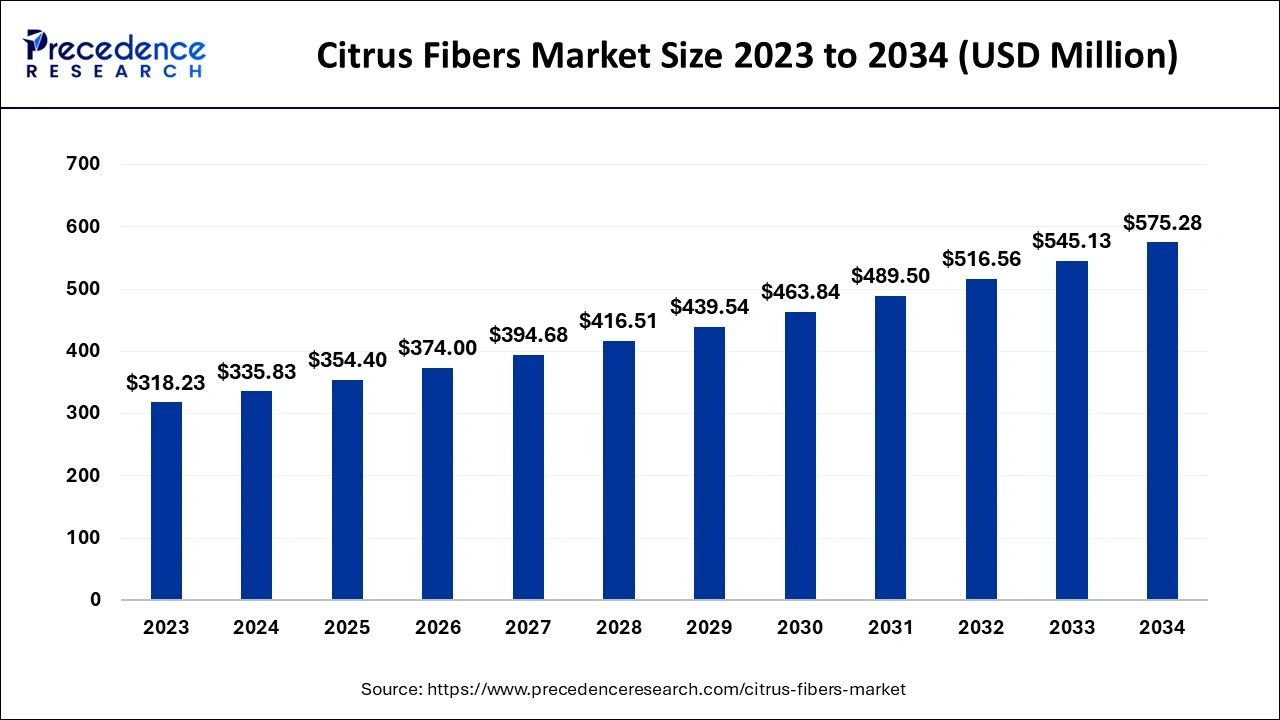

The global citrus fibers market size was valued at USD 335.83 million in 2024 and is anticipated to reach around USD 575.28 million by 2034, growing at a CAGR of 5.53% from 2025 to 2034. The citrus fibers market is driven by the food and beverage industry's increasing need for natural and clean-label ingredients.

Citrus Fibers Market Key Takeaways

- In terms of revenue, the citrus fibers market is valued at $354.40 million in 2025.

- It is projected to reach $575.28 million by 2034.

- The citrus fibers market is expected to grow at a CAGR of 5.53% from 2025 to 2034.

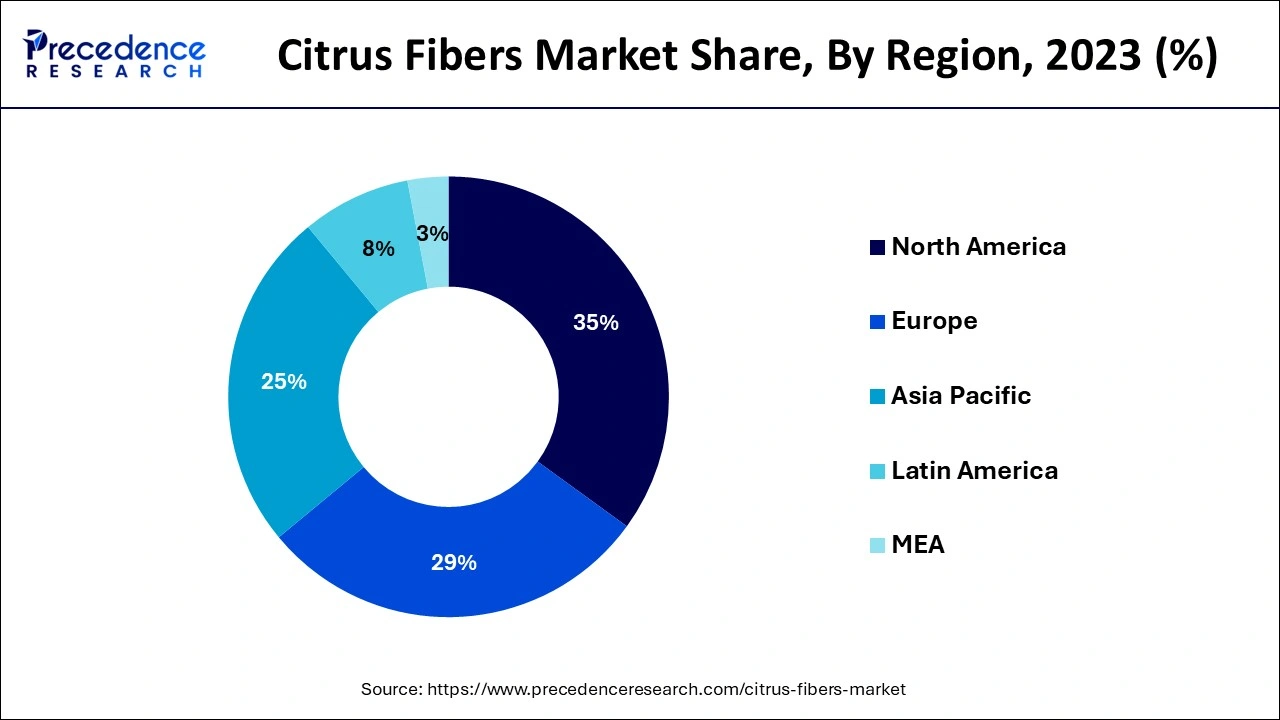

- North America dominated the global market with the largest market share of 35% in 2024.

- Asia Pacific is anticipated to grow at a significant CAGR during the projected period.

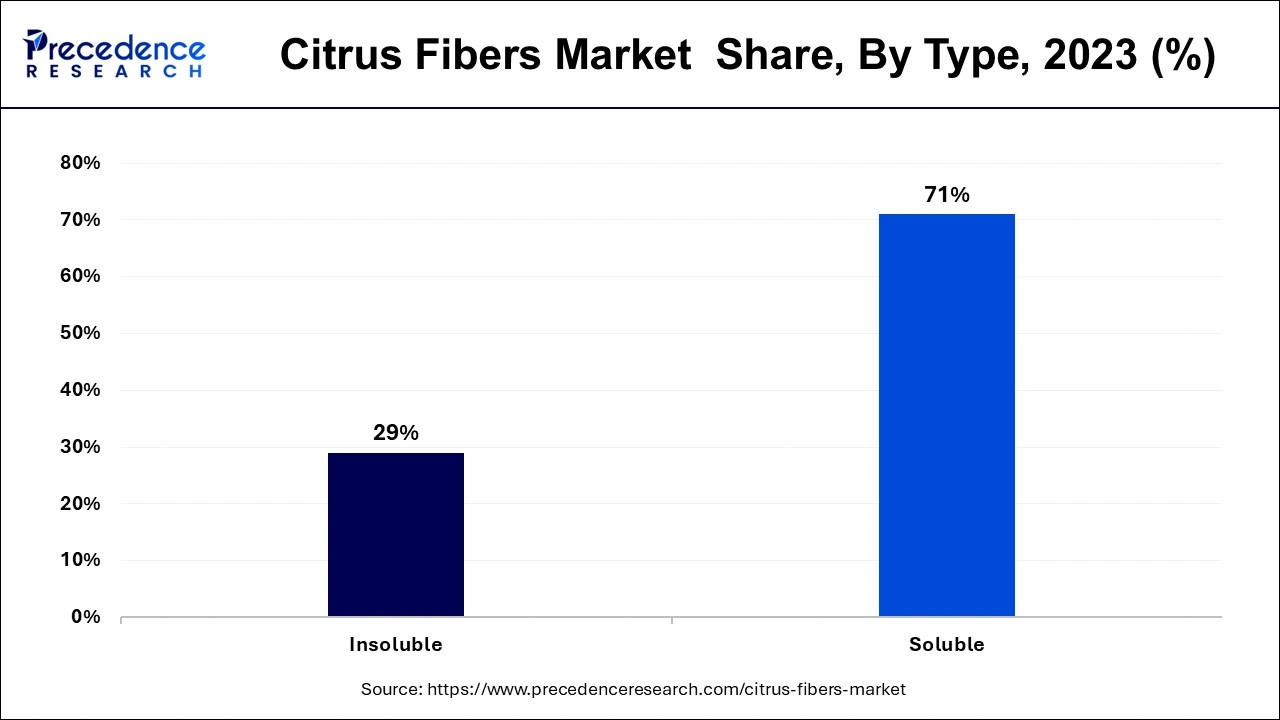

- By type, the soluble segment contributed the highest market share of 71% in 2024.

- By type, the insoluble segment shows a notable growth during the forecast period.

- By form, the orange segment captured the biggest market share of 51% in 2024.

- By form, the lemon and lime segment is expected to grow at the fastest CAGR during the forecast period.

- By function, the thickening agent segment generated the major market share of 31% in 2024.

- By application, the food and beverage industry segment captured the biggest market share of 71% in 2024.

- By application, the pharmaceutical industry segment is anticipated to expand at a CAGR from 2025 to 2034.

- By distribution channel, the supermarkets/hypermarkets segment captured the largest market share of 36% in 2024.

How is AI enhancing the citrus fibers industry?

To forecast the best periods for harvesting citrus crops and guarantee the highest possible yield of premium citrus fibers, AI-driven algorithms examine data from citrus farms, including weather, soil quality, and plant health. AI aids in the creation of novel citrus fiber formulations for a range of markets, including food, cosmetics, and pharmaceuticals. For example, it can recommend combinations to improve food products' texture, emulsification, or water retention. AI effectively finds ways to employ residual citrus peel trash to manufacture fiber, facilitating circular economy practices.

U.S. Citrus Fibers Market Size and Growth 2025 to 2034

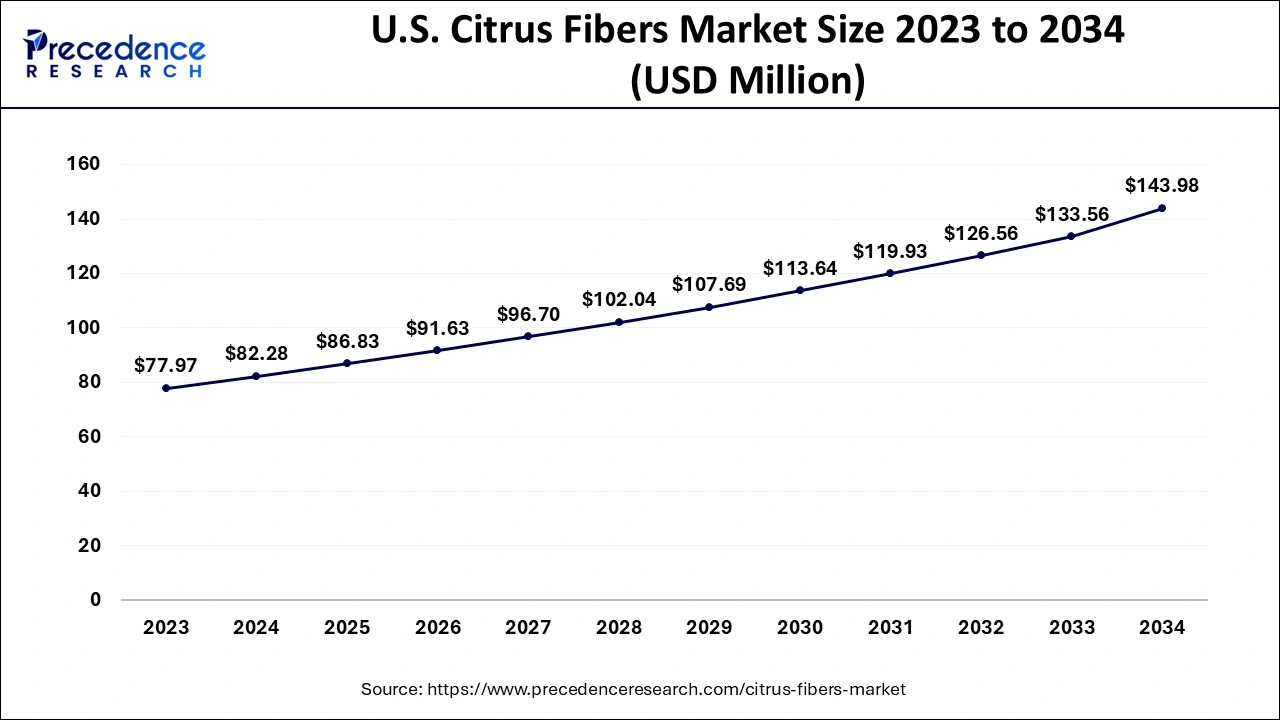

The U.S. citrus fibers market size was exhibited at USD 82.28 million in 2024 and is expected to exceed around USD 143.98 million by 2034, growing at a CAGR of 5.76% from 2025 to 2034.

North America carrieid the largest share in the citrus fibers market in 2024. North American consumers who are concerned about their health are looking for tasty, nutritious foods. Rich in dietary fiber, citrus fibers have practical advantages such as promoting weight management, digestion, and gut health. Citrus fibers are employed in baked goods, beverages, dairy products, and snacks as consumers become increasingly conscious of the health advantages of fiber. This is in line with the region's expanding functional food trend.

North America remains the frontrunner in the global citrus fiber market, with the United States and Canada taking the lead. The region's dominance stems from a mature and innovation-driven food industry, coupled with growing public awareness around clean eating and natural product alternatives. In the U.S., regulatory support and health-focused food policies—especially those encouraging the reduction of synthetic additives—have prompted widespread adoption of citrus-based fibers in food formulations. Canada, too, is seeing a significant uptick in demand for eco-friendly and nutritional ingredients, aided by consumer advocacy for transparent food labelling and ethical sourcing practices.

Top Contributing Countries in North America

United States: Strong health regulations, advanced food innovation labs, and consumer preference for clean-label ingredients.

Canada: Increasing demand for organic and allergen-free products; supportive governmental health initiatives.

Asia-Pacific is observed to be the fastest growing in the citrus fibers market during the forecast period.Plant-based and clean-label products are becoming increasingly popular as people choose natural, sustainable, and minimally processed ingredients. Because they come from a natural source, citrus fibers suit these customer expectations and are becoming increasingly well-liked in the area. There is a particularly strong demand for plant-based foods in nations where traditional plant-based diets are common, such as China and India. Customers are becoming more conscious of dietary fiber's role in reducing long-term conditions, including diabetes, heart disease, and obesity.

Asia Pacific records the fastest expansion in citrus fiber consumption, with nations like India, China, and Indonesia leading the surge. This growth is largely attributed to increasing health consciousness, improving living standards, and rapid urbanization. Consumers in these markets are moving away from traditional food habits and embracing modern food products enriched with functional ingredients. The region also benefits from an abundant supply of citrus fruits, especially in India and China, enabling cost-effective fiber extraction. Government-led initiatives promoting better child nutrition, food fortification, and agro-processing have further enhanced the market's prospects in this region.

Market Overview

The indigestible portion of citrus fruit, which primarily travels through the human digestive system undigested, is the source of citrus fiber, a type of dietary fiber. In food products, citrus fibers are natural thickeners, stabilizers, emulsifiers, and water-binding agents, replacing artificial or allergic substitutes such as xanthan gum or gelatin. Citrus fibers, which are clean-label, sustainable, and devoid of artificial additives, are becoming more and more popular as consumers' preferences for natural ingredients grow.

The global citrus fiber market is undergoing a significant transformation, primarily fueled by the growing consumer shift toward healthier and more natural food choices. Extracted from the peel and pulp of citrus fruits, citrus fiber is now widely used across the food industry for its ability to improve product texture, enhance water retention, and increase dietary fiber content. The trend toward plant-based, gluten-free, and clean-label food items is further accelerating the use of citrus fiber in everything from baked goods to dairy alternatives and processed meats. In addition to its functional value, citrus fiber also aligns with sustainability goals by repurposing agricultural waste, making it especially appealing to environmentally conscious consumers and manufacturers.

Citrus Fibers Market Growth Factors

- The increased knowledge of the advantages of dietary fiber, including better digestion and cardiovascular health, drives the need for citrus fibers in functional foods and dietary supplements.

- Citrus fibers are found in various products, including food and drink, cosmetics, medications, and personal hygiene items. Their function as stabilizers, texturizers, and emulsifiers fuel demands in these industries.

- Advancements in extraction and processing technologies are improving the quality and usefulness of citrus fibers, which increases their market acceptability and suitability for a wider range of applications.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 575.28 Million |

| Market Size in 2024 | USD 335.83 Million |

| Market Size in 2025 | USD 354.40 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.53% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Form, Function, Application, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, and Africa |

Market Dynamics

Drivers

Growing consumer preference for natural and clean-label ingredients

The demand for vegan and gluten-free products in the food and beverage industry is a major factor in the increased sales of citrus fibers. There is a noticeable movement toward plant elements as people grow more conscious of the negative health impacts linked to processed meals. Consumers seek items that provide additional health benefits beyond straightforward nutrition as part of the larger trend toward functional foods. Because of their fiber concentration, citrus fibers are a useful element that can help with weight management, gut microbiota support, and digestive health. They are increasingly used in functional food products such as snacks, fortified foods, and dietary supplements.

Increasing focus on health and wellness

Citrus fibers provide low-calorie, low-sugar substitutes for conventional components, supporting the global movement toward healthy diets and weight control. Citrus fibers can replace fat and sugar in some applications without sacrificing flavor or quality because of their capacity to improve texture, mouthfeel, and bulk. This makes them useful in creating calorie-conscious, health-conscious products, particularly for the snack, beverage, and dessert industries.

Restraints

Limited availability of raw materials

Usually, citrus fibers are taken from the leftovers of citrus fruits such as oranges. The peel, pulp, and membranes that remain after juicing and other processing operations are examples of these by-products. The number of citrus fruits cultivated and collected determines the availability of citrus fibers. Because citrus fruits are seasonal, there may be variations in the supply of citrus by-products, which restricts the year-round availability of raw materials. For firms that depend on these by-products for fiber extraction, this leads to uncertainties in the supply chain.

Regulatory challenges

Citrus fibers are frequently sold as natural, dietary, or functional additives, and scientific proof is required to support their health advantages (such as being high in fiber and facilitating digestion). All health claims on food labels must adhere to stringent regulations set by regulatory agencies. Many marketplaces have strict laws regarding the listing of ingredients in products. Citrus fibers may be subject to fines or product recalls if they are not appropriately declared or classified, particularly if customers have citrus allergies.

Opportunity

Innovations in product formulations and packaging

Food recipes contain citrus fibers, especially pectin, to enhance mouthfeel and texture. They are perfect for dairy, confections, and plant-based food items since they can function as gelling agents, stabilizers, or emulsifiers. The creative use of citrus fibers to create functional formulations can produce better quality and texture goods. Innovations in citrus fiber formulations that enhance its functionality (such as emulsification or gelling properties) can lead to the creation of value-added products like functional beverages, sauces, dressings, and plant-based products.

Type Insights

The soluble segment dominated the citrus fibers market in 2024. Due to their exceptional ability to retain water, soluble citrus fibers are perfect for preserving moisture in food items. This is very useful for dressings, sauces, and baked items. Encouraging a healthy gut flora and enhancing bowel regularity supports digestive health. They are frequently found in functional foods meant to improve general health. The global movement to decline waste and promote circular economies is in line with the sustainable production of citrus fibers, frequently by-products of the citrus juice business.

The insoluble segment shows a notable growth in the citrus fibers market during the forecast period. Insoluble fibers improve bowel movements and help avoid constipation by increasing stool volume. Insoluble fibers contribute to appetite management by promoting feelings of fullness. Since insoluble citrus fibers are made from citrus byproducts, they support the circular economy and encourage waste reduction, which aligns with global sustainability trends. Citrus peels, a byproduct of the juicing business, are being used by manufacturers more and more to make these fibers, which lessens their impact on the environment while producing goods with added value.

Form Insights

The orange segment dominated the citrus fibers market in 2024. Oranges make up a sizable portion of citrus production and are one of the most extensively grown citrus fruits worldwide. Due to the fruit's extensive use in juice manufacturing, many by-products are produced, including pulp and peels, which can be efficiently turned into fibers to cut down on waste. These fibers have superior emulsification and water-holding qualities, which improve the texture and stability of food products like sauces, drinks, and baked goods.

The lemon and lime segment is observed to be the fastest growing in the citrus fibers market during the forecast period. The market for citrus fibers, especially those from lemon and lime, has increased due to growing customer awareness of the advantages of natural and clean-label ingredients. These fibers are considered safer, chemical-free substitutes for artificial stabilizers, thickeners, and emulsifiers. Because of their anti-aging, brightening, and exfoliating qualities, lemon and lime fibers, strong in antioxidants and vitamin C, are highly sought-after in skincare products. The expanding trend for natural and organic cosmetics further supports their demand.

Function Insights

The thickening agent segment dominated the citrus fibers market in 2024. Citrus fibers are excellent thickening agents because of their remarkable capacity to hold onto water. This quality is especially prized for improving texture and retaining moisture without changing flavor characteristics in the food business. Citrus fibers improve viscosity and stabilize emulsions in processed meals, giving consumers a better sensory experience. Citrus peels, a by-product of the juice business, are used to produce citrus fibers, which is in line with international sustainability objectives. This cyclical method produces an environmentally friendly thickening solution while reducing waste.

Application Insights

The food and beverage industry segment dominated the citrus fibers market in 2024. Citrus fibers improve the consistency and texture of meals and drinks. They can enhance the mouthfeel and sensory experience of fruit juices, smoothies, sauces, dressings, and baked goods by acting as thickeners, stabilizers, and emulsifiers. Due to this functional adaptability, food producers can better satisfy consumer demands for higher-quality products. In the food and beverage business, where product freshness is critical, citrus fibers can contribute to extending the shelf life of products by inhibiting oxidation and microbiological growth. The global citrus fiber market is expanding exponentially due to the growing use of citrus fibers in various industries, including bakeries, sauces & seasonings, sweets, ice creams, drinks, flavorings, and coatings.

The pharmaceutical industry segment shows a significant growth in the citrus fibers market during the forecast period. Citrus fibers' ability to prevent disease opens the door for more health-conscious customers to include them in their regular diets. People are being influenced to embrace a healthier lifestyle that incorporates the usage of organic, natural, and healthful products by diseases like diabetes, allergies, and cardiovascular illnesses. Citrus fiber is becoming increasingly popular because of its health benefits, which include lowering body weight, controlling blood sugar, cleansing the skin, and enhancing immunity.

The personal care and cosmetics industry segment shows a notable growth in the citrus fibers market during the forecast period. Citrus fibers are becoming increasingly common in personal care products because of their brightening and antioxidant qualities. Pectin is a common ingredient in personal care products. Citrus fiber is the source of pectin, which propels the market for citrus fiber. The citrus fiber market players are seeing opportunities due to Asia-Pacific's growing demand for personal care products. Clean-label products emphasizing natural and environmentally friendly components are becoming increasingly popular with consumers. Because they are sustainable, biodegradable, and provide a clean production method, citrus fibers- made from the peels of citrus fruits- a byproduct of the juice industry, fit in well with this trend.

- In November 2022, Deardot, a Korean skincare company, aimed to expand internationally by offering goods that contained a "forgotten fruit." A fermented extract of Dangyuja, an endangered citrus species that can only be found on South Korea's Jeju Island, is a main component of Deardot's goods.

Distribution Channel Insights

The supermarkets/hypermarkets segment dominated the citrus fibers market in 2024. Due to modern consumers' hectic lifestyles, ready-to-eat and processed foods are becoming increasingly popular. These frequently include extra functional components, such as citrus fibers, which have health advantages like enhancing texture and supporting digestive health. By providing natural products with citrus fiber, fostering customer trust, and meeting the growing need for food production transparency, supermarkets and hypermarkets can profit from this trend.

Citrus Fibers Market Companies

- Carolina Ingredients

- Cifal Herbal Pvt. Ltd

- CP Kelco

- CEAMSA

- Cargill

- Lemont

- Nans Products

- Ingredion Incorporated

- Herbafood Ingredients Gmbh

- Edge Ingredients

- Fiberstar

- Golden Health

Recent updates on citrus fibers-2025

Clean label trends boost citrus fiber adoption

- In March 2025, the market for citrus fibers is growing quickly because consumers are demanding cleaner, plant-based, and allergy-free ingredients. Citrus fibers are extracted from the peels of oranges and lemons and are used extensively as natural fat substitutes, stabilizers, and thickeners. Citrus fibers are being used in product reformulation by food and beverage companies to satisfy clean-label and low-calorie requirements. As a result of the move away from artificial additives and emulsifiers, citrus fiber is becoming a popular multipurpose ingredient for meat, dairy, and bakery alternatives.

Functional benefits attract food and pharma sectors

- In April 2025, Citrus fibers' use in vegan gluten-free and ready-to-eat products has increased due to their moisture retention, emulsification, and gelling qualities. It appeals to health-conscious consumers and product developers who focus on gut health because it also provides prebiotic benefits. Citrus fibers' biocompatibility and sustainability have prompted the pharmaceutical and nutraceutical industries to investigate using them as carriers in drug delivery and tablet formulations.

Recent Developments

- On 12 January 2025, the citrus fiber market experienced notable growth fueled by rising demand for natural, plant-based ingredients. The functional benefits of citrus fibers, such as moisture retention and texture improvement, are attracting food manufacturers aiming to meet consumer preferences for clean label and health-focused products.

- On 18 February 2025, industry experts pointed out that citrus fibers are increasingly being used beyond food applications. Their incorporation into personal care and pharmaceutical products is expanding due to their natural origin and beneficial properties, opening new market avenues.

- On 10 March 2025, regulatory agencies emphasized sustainable sourcing and processing practices for citrus fibers. Efforts are underway to ensure production aligns with environmental standards, especially by utilizing products from citrus juice manufacturing to reduce waste and improve sustainability.

- In July 2024, FIBERTEX CF 500 and FIBERTEX CF 100 are two new clean-label citrus fiber compounds introduced by Ingredion. These minimally processed substances offer textural stability, emulsion, gelling, and viscosity.

- In April 2024, The Nutrava and Kelcosens citrus fibers are now produced at CP Kelco's $60 million expansion in Matao, Brazil. The enlargement gave options to increase the capacity further and raised the overall capacity to roughly 5,000 tons.

- In January 2023, Fiberstar, Inc., the industry leader in creative citrus fibers, introduced the Citri-Fi 400 family of novel organic citrus fibers. These novel citrus fibers meet the growing demand for organic, ecological, and natural food ingredients. Growing consumer health and wellness activities, supply chain issues that limit hydrocolloid availability, and growing awareness of sustainable business practices are some of the market factors driving the demand increase.

Segments covered in the report

By Type

- Insoluble

- Soluble

By Form

- Lemon And Lime

- Orange

- Mandarians

- Grapefruits

By Function

- Thickening Agent

- Stabilizer

- Gelling Agent

- Fat Replacement

- Others

By Application

- Food and Beverage Industry

- Pharmaceutical and Nutraceutical Industry

- Personal Care and Cosmetics Industry

- Animal Feed Industry

- Others

By Distribution Channel

- Online Retail

- Convenience Stores

- Supermarkets/Hypermarkets

- Specialty Health Stores

- Foodservice And Hospitality

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting