What is the Pet Food and Supplements Market Size?

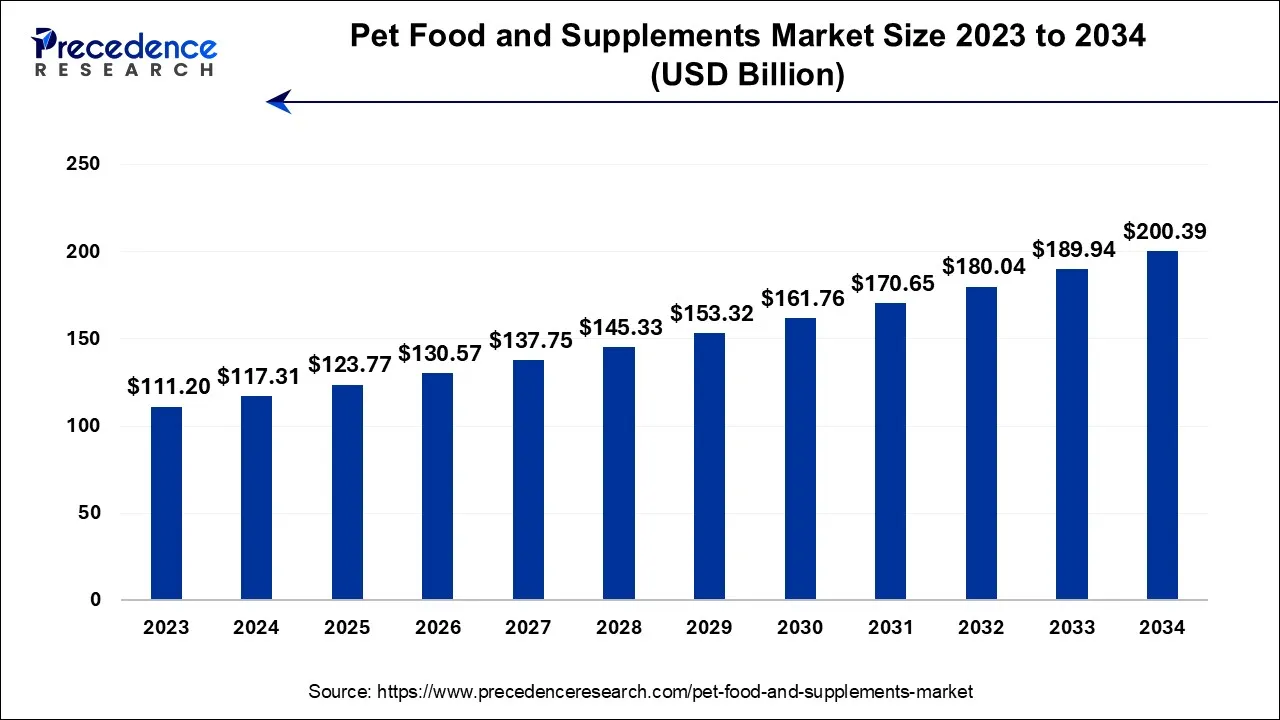

The global pet food and supplements market size is calculated at USD 123.77 billion in 2025 and is predicted to increase from USD 130.57 billion in 2026 to approximately USD 200.39 billion by 2034, growing at a CAGR of 5.5% during the forecast period 2025 to 2034.

Pet Food and Supplements Market Key Takeaways

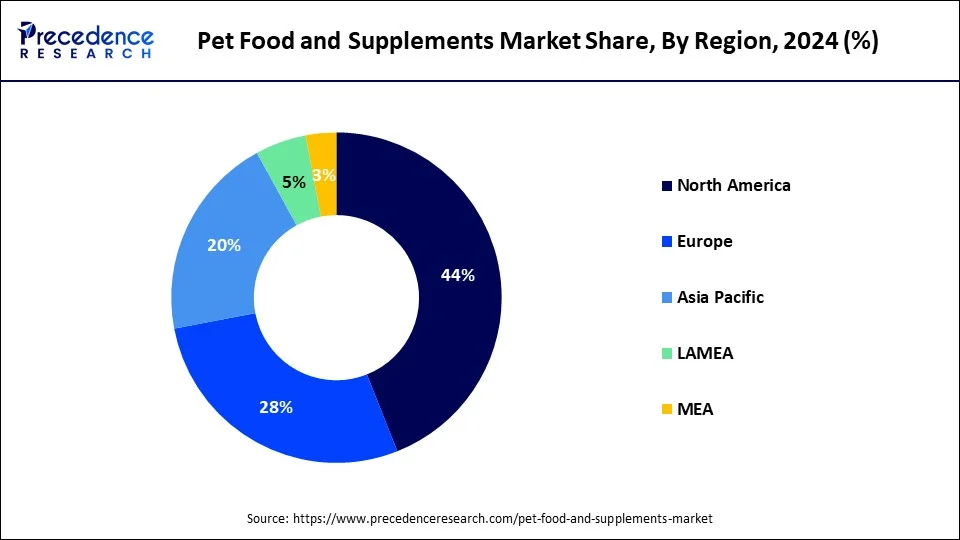

- North America contributed more than 44% of revenue share in 2024.

- Asia Pacific is estimated to expand the fastest CAGR between 2025 and 2034.

- By pet, the dog segment has held the largest market share of 35% in 2024.

- By pet, the others segment is anticipated to grow at a remarkable CAGR of 6.2% between 2025 and 2034.

- By application, the multivitamins segment generated over 35% of revenue share in 2024.

- By application, the others segment is expected to expand at the fastest CAGR over the projected period.

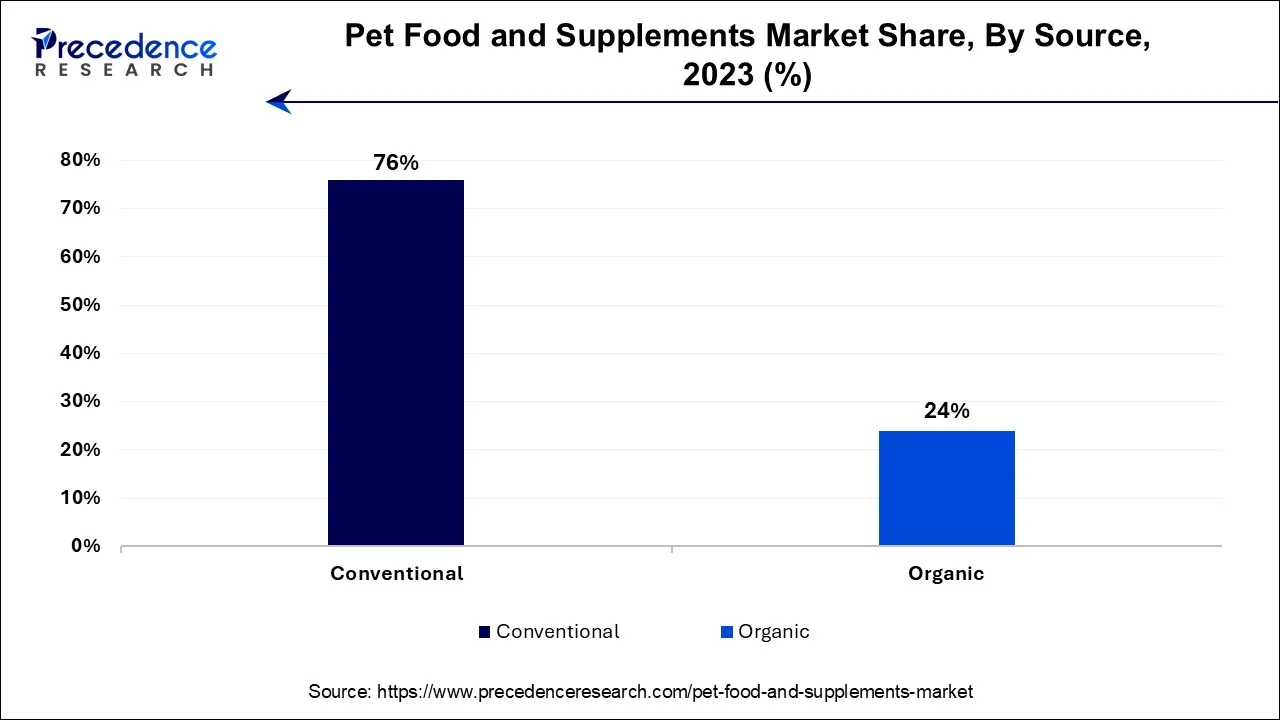

- By source, the conventional segment generated over 76% of revenue share in 2024.

- By source, the organic segment is expected to expand at the fastest CAGR over the projected period.

- By distribution channel, the offline segment generated over 86% of revenue share in 2024.

- By distribution channel, the online segment is expected to expand at the fastest CAGR over the projected period.

Market Overview

Pet food denotes nutrition tailored for household animals, such as dogs and cats. This nutrition is expertly formulated to meet their distinct dietary prerequisites, guaranteeing the provision of crucial nutrients necessary for their health and overall well-being. Pet food is available in assorted formats, including dry kibble, moist canned varieties, and even raw diets, with each variant meticulously balanced to offer the right combination of proteins, carbohydrates, fats, vitamins, and minerals, catering to the specific demands of diverse species and life stages.

Conversely, pet supplements serve as supplementary products that can be administered alongside a pet's regular dietary intake to address specific health issues or provide supplementary nutritional support. These supplements come in various forms, like tablets, powders, or liquid preparations, and may comprise elements like joint-supporting compounds, omega-3 fatty acids, vitamins, and minerals. Many pet caretakers turn to supplements to enhance their pets' coat quality, promote joint flexibility, or boost overall vitality. It is highly recommended for pet owners to seek professional guidance from a veterinarian before integrating supplements to ensure they align with their pet's individual requirements and do not disrupt their primary diet.

What is the Global Pet Food & Supplements Market on Track to Grow at a Rapid Rate By 2025?

One reason is that as more and more people consider their pets members of their families, they want their nutritional needs met with a higher-quality and more balanced product. This has created a significant increase in the demand for organic, grain-free foods, and products that have functional benefits such as supporting an animal's immune system, digestive system, healthy joints and healthy skin.

Pet owners' disposable income is rising, there are many more online shopping opportunities, and pet owners are increasingly influenced by veterinarians. Together, these three factors are helping create a strong level of adoption of these products.

Pet Food and Supplements Market Growth Factors

- The growing trend of pet ownership, driven by factors like companionship and mental health benefits, fuels the demand for high-quality pet food and supplements.

- Pet owners are becoming increasingly health-conscious, seeking premium nutrition and supplements to ensure their pets' well-being, driving the market growth.

- As pets live longer, there's a rising need for age-specific pet food and supplements that cater to senior pets' unique nutritional requirements.

- The shift towards premium and specialized pet food and supplements, including organic and grain-free options, continues to gain traction.

- More pet owners are heeding veterinary advice, leading to increased use of prescription-based pet food and supplements.

- The inclusion of functional ingredients like probiotics, antioxidants, and joint-support compounds drives the popularity of specialty pet products.

- Growing concerns about pet obesity drives the demand for weight management products, contributing to market growth.

- The emphasis on preventive healthcare encourages the use of supplements for specific health concerns, like dental care or skin and coat health.

- An increasing focus on sustainability leads to a surge in eco-friendly pet food and supplements.

- Stricter regulations and certification requirements ensure the safety and quality of pet food and supplements, building consumer trust.

- The influence of online reviews and recommendations from pet communities and forums impact purchase decisions.

- Advancements in personalized pet nutrition, such as DNA-based diets, offer growth opportunities in the market.

- Humanization of Pets: As pets become family members, we are more willing to purchase higher-quality, nutritious, and specialty food products, including supplements that will support the health and lifespan of our pets.

- Increased Pet Ownership: Urbanization, lifestyle changes, and awareness of the benefits of human-animal companionship are global drivers of pet ownership growth and subsequent increases in demand for pet food and wellness products.

- Health and Wellness Trends: Just as we see in the human food industry, there is a growing preference for organic, grain-free, functional, and customized nutrition in pet products, driving demand for premium or fortified products.

- Growth of E-Commerce: Accessing a variety of pet food and supplements is easier than ever through online-only retailers that engage consumers with compelling subscription offers, promotions, and personalization.

- Advances in Veterinary & Nutritional Research: Research into pet health is advancing, and with this are veterinary recommendations promoting the use of dietary supplements to help assist with issues such as joint health, digestion, immunity, and anxiety in our pets.

Market Outlook:

- Industry Growth Overview: Industry Sales are on a record growth path through pet owners being proactive on maintaining their pets' health and more specifically providing individualized nutrition plans to their pets and as more disposable income is available to pet owners, the growing trend of premiumization, the wide availability of products that focus on enhancing the digestive health and joint support of pets, have created greater global demand for these products.

- Sustainable Trends: Pet manufacturers are increasingly utilizing sustainable packaging and plant-based sources, and environmentally conscious sourcing methods to meet consumers' growing demand for sustainable products. Additionally, many of these manufacturers are producing recyclable materials and implementing eco-friendly manufacturing processes.

- Global Expansion: Manufacturers are continuing to expand their pet food and supplements production and distribution bases into Latin America, Asia/Pacific and the Middle East with the use of partnering and local production and cross-border e-commerce techniques.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 200.39 Billion |

| Market Size in 2025 | USD 123.77 Billion |

| Market Size in 2026 | USD 130.57 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.5% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Pet, Application, Source, Distribution Channel, Food Type, Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising pet ownership

The surge in pet ownership is a compelling catalyst propelling the growth of the pet food and supplements market. This escalation can be attributed to a myriad of factors. Foremost, the deepening emotional connection and companionship between humans and their pets have fostered an undeniable humanization of animals. As pets are increasingly considered cherished family members, pet owners exhibit a heightened inclination to invest in their pets' overall welfare. Consequently, this inclination drives a growing demand for premium and specialized pet food and supplements, tailored to the distinctive dietary and health prerequisites of these cherished companions.

Furthermore, the burgeoning trend of pet ownership has triggered an upswing in health consciousness among pet custodians. They are becoming progressively discerning about their pets' nutritional needs and overall well-being, thereby intensifying the quest for top-tier, nourishing pet food and supplements designed to fortify their pets' vitality and prolong their well-being. In essence, the burgeoning prevalence of pet ownership serves as a driving force for the market, expanding the consumer base and nurturing a more profound emphasis on pet health, consequently resulting in amplified sales of pet food and supplements.

Restraint

Consumer price sensitivity

Consumer price sensitivity is a notable restraint affecting the pet food and supplements market's growth. Pet owners, particularly in times of economic uncertainty, may become more cost-conscious when it comes to purchasing pet-related products. This sensitivity can limit the market's ability to introduce and sell premium and high-cost pet food and supplements. When consumers seek affordability, they may opt for less expensive alternatives, which can directly affect the sales of premium offerings. Manufacturers and suppliers may encounter challenges in maintaining profitability while accommodating price-sensitive consumers, potentially impeding their capacity to invest in research and development for innovative and superior-quality products.

The presence of cost-conscious consumers also deters the market from fully capitalizing on the potential for premiumization and specialized nutrition. To address this restraint, businesses in the pet food and supplements sector often need to strike a balance between offering value-focused options and premium products while providing transparent information about the quality and benefits of their offerings to justify higher price points.

Opportunity

Eco-friendly and sustainable devices

CBD and hemp-based products are creating exciting opportunities in the pet food and supplements market. These products, derived from cannabis plants, are gaining acceptance for their potential health benefits in pets. Firstly, they offer natural alternatives for managing issues like anxiety, pain, and inflammation in pets, which is particularly appealing to pet owners looking for holistic and non-pharmaceutical solutions. Secondly, the market for CBD and hemp-based pet products is relatively new and less saturated compared to traditional pet supplements. This allows for innovative product development and market entry.

Additionally, the increasing legalization and destigmatization of cannabis products in various regions is expanding the potential customer base. Pet owners are becoming more health-conscious and are actively seeking products that promote their pets' overall well-being. CBD and hemp-based products align with this trend, providing a unique niche within the market. As research continues to uncover the potential benefits of these products, the pet food and supplements market has a growing opportunity to cater to the demand for natural, alternative pet health solutions.

Pet Insights

According to the pet, the dog segment has held 35% revenue share in 2024. The dog segment dominates the pet food and supplements market due to several factors. Dogs are among the most popular and numerous pets globally, leading to a substantial consumer base. Their diverse dietary needs and life stages require a wide range of specialized food and supplements, driving product diversity and market growth. Additionally, the growing trend of humanization of dogs, where they are considered family members, leads to increased demand for premium and specialized products, further solidifying the dominance of the dog segment in the market.

The other segment is anticipated to expand at a significant CAGR of 6.2% during the projected period. The other segment holds significant growth in the pet food and supplements market because it encompasses a diverse range of non-dog and non-cat pets, such as birds, reptiles, small mammals, and fish. These pets have unique dietary and nutritional requirements, creating a demand for specialized food and supplements. Additionally, this segment caters to the growing popularity of small pets and exotic animals. As pet ownership diversifies beyond traditional cats and dogs, the "Others" category captures this expanding market, making it a major player in the industry.

Application Insights

The multivitamins segment had the highest market share of 35% on the basis of the application in 2024. The multivitamins segment commands a significant share in the pet food and supplements market due to its broad applicability across various pet types and life stages. multivitamins are essential for addressing overall health and nutritional gaps in pets, making them a staple in pet owners' routines. They offer a convenient and comprehensive way to ensure pets receive the essential vitamins and minerals required for their well-being. With a focus on preventive healthcare and the desire for simplified supplementation, the multivitamins segment enjoys a major share as a fundamental and versatile component in the pet food and supplements market.

The others segment is anticipated to expand fastest over the projected period. The others segment commands significant growth in the pet food and supplements market by application due to its inclusive nature, covering a wide array of non-dog and non-cat pets. This segment caters to the nutritional needs of various animals like birds, reptiles, fish, and small mammals, each with distinct dietary requirements.

Moreover, it accommodates the growing trend of pet owners embracing less conventional pets, including exotic species. As the diversity of pet ownership expands, the others category remains pivotal, ensuring the market effectively addresses the unique nutritional demands of this diverse range of animals.

Source Insights

The conventional segment had the highest market share of 76% on the basis of the source in 2024. The conventional segment holds a significant share in the pet food and supplements market because it caters to a wide and established customer base seeking traditional pet food and supplements. Conventional sources offer affordable and widely recognized options, appealing to price-sensitive consumers. Many pet owners trust and are familiar with these standard products, fostering brand loyalty.

Furthermore, conventional sources have a track record of safety and quality, making them a preferred choice for pet owners. While there is a growing demand for premium and specialized products, the conventional segment's affordability and reliability maintains its substantial market share.

The organic segment is anticipated to expand fastest over the projected period. The organic segment plays a prominent role in the pet food and supplements market because of the growing interest in natural and healthy options for pets. Pet owners increasingly favor products free from artificial chemicals, pesticides, hormones, and antibiotics. Organic pet food and supplements align with this trend, offering a healthier choice for their beloved animals. With a rising focus on pet health and wellness, the organic segment captures significant growth in the market, addressing the evolving preferences of pet owners who seek high-quality and chemical-free options for their pets.

Distribution Channel Insights

The offline segment had the highest market share of 86% on the basis of the distribution channelin 2024. The offline distribution channel commands a significant share in the pet food and supplements market for several reasons. Many consumers prefer hands-on shopping, particularly for items with direct implications on their pets' well-being. Physical stores like pet specialty shops and veterinary clinics also offer the advantage of seeking expert guidance from knowledgeable staff. Additionally, traditional shopping methods continue to appeal to a segment of consumers, thus upholding the prominence of the offline distribution channel in the realm of pet food and supplements.

The online segment is anticipated to expand fastest over the projected period. The dominance growth of the online distribution channel within the pet food and supplements market can be attributed to its remarkable blend of convenience and accessibility. Online platforms extend a vast spectrum of pet-related products, empowering pet owners with an extensive selection of brands and offerings for comparison and selection. What's more, the ability to shop from the comfort of one's home, bolstered by the wealth of customer reviews and endorsements, streamlines the purchasing experience.

The online segment's eminence is further propelled by the growing wave of e-commerce and the surging preference for contactless retail experiences, making it an influential cornerstone of the pet food and supplements market's success.

Regional Insights

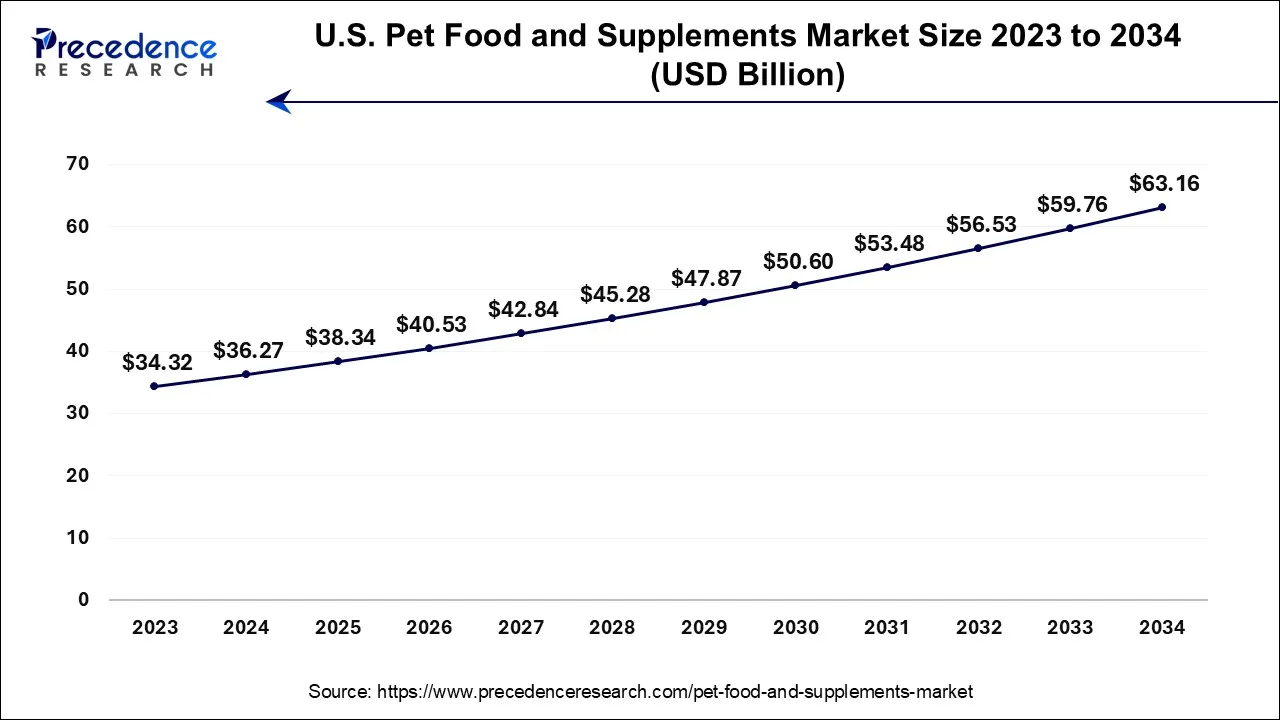

U.S. Pet Food and Supplements Market Growth 2025 to 2034

The U.S. pet food and supplements marketsize is evaluated at USD 38.34 billion in 2025 and is projected to be worth around USD 63.16 billion by 2034, growing at a CAGR of 5.7% from 2025 to 2034.

North America has held the largest revenue share of 44% in 2024. North America holds a substantial share in the pet food and supplements market due to several key factors. Firstly, the region has a high level of pet ownership, with a significant portion of households having dogs, cats, and other pets, driving consistent demand for pet-related products.

Secondly, North American consumers are increasingly health-conscious for their pets, seeking premium and specialized pet food and supplements. Additionally, the presence of well-established pet food companies and a robust e-commerce infrastructure provides consumers with a wide range of options and convenient access to pet products. These factors collectively contribute to North America's major share in the pet food and supplements market.

Asia Pacific is estimated to observe the fastest expansion. Asia Pacific commands a significant growth in the pet food and supplements market for several key reasons. The region's rapid urbanization and increasing disposable income have led to a growing pet ownership culture, particularly among the burgeoning middle class. This has propelled demand for high-quality pet food and supplements.

Additionally, changing consumer preferences towards premium and natural products has boosted market growth. The region's large and diverse pet population, including a variety of species beyond dogs and cats, offers a vast customer base. Furthermore, expanding e-commerce platforms and a focus on pet health and wellness contribute to Asia Pacific's substantial presence in the market.

Asia Pacific: China Pet Food and Supplements Market Trends

The U.S. market is growing strongly in 2025, driven by rising pet ownership and the increasing “humanization” of pets, with many owners treating pets like family and willing to spend on high-quality nutrition and wellness. Demand for premium, organic, and health-oriented pet foods, such as grain-free and functional diets, is increasing, especially for dogs and cats, boosting overall pet-food sales.

On the supplements side, growing awareness about pet health, including joint care, digestive health, and overall wellness, is fueling rising adoption of vitamins, chewable supplements, and functional treats.

Why Latin America Is Becoming a Rapidly Growing Area with Great Potential for Pet Food and Supplements?

Urbanization is driving this trend by the increasing urban pet ownership rate in Latin America. Urban pet owners in Brazil, Mexico and Argentina are creating demand for premium products such as premium pet food, functional treats and evidence-based supplement products. In addition, middle-class disposable income levels are rising, and the availability of premium manufacturers' products through e-commerce is increasing.

The pet specialty stores and veterinary clinics continue to shape the demand for high-quality pet food and supplements by influencing consumer behaviour to choose products that offer higher nutritional value.

Why Europe Is the Leader in Sustainable and Premium Pet Nutrition Products?

Europe continues to be the leader in high-quality pet nutrition because of strict regulations, high ethical and environmental standards of product quality, and consumers' preference for products manufactured to be clean and contain ingredients produced with sustainability practices.

Countries like Germany, France, Italy and the U.K. are leading the way in developing Organic, Hypo-Allergenic, and Functional Nutrition Products. Europe's emphasis on transparency of ingredients, being environmentally responsible, and developing pet-specific supplements (probiotics, joint-support formulations) is driving pet nutrition trends on a global basis.

Value Chain Analysis

What Does the Pet Food & Supplements Market Value Chain Do to Provide Quality and Efficiency to Pet Owners?

In the Pet Food & Supplemental Market value chain, the chains start with Raw Material Sourcing, Formulation, Manufacturing, Packaging, and Logistics & Retail. Top manufacturers such as Nestlé Purina, Mars Petcare, and Hill's Pet Nutrition emphasize a strong commitment to providing high-quality protein, producing clean-label ingredients, and maintaining a strict level of quality testing on each product prior to the finished package being put into the market.

- Ingredient Sourcing & Quality Control: The companies in the Pet Food and Supplement Market each have their own ingredient sourcing, quality-testing and inspection criteria to provide a high-quality and safe product to customers. These companies emphasize using certified proteins, having natural ingredients, and maintaining strict standards for quality control related to ingredient testing.

- Advanced Manufacturing: These companies utilize precision nutrition, functional supplements and nutrient-retaining technology to produce high-quality, consistent products.

- Distribution & Retail Optimization: As e-commerce, subscription service models and the emergence of omnichannel retailing create greater convenience for consumers, these methods improve customer retention.

Pet Food and Supplements Market Companies

- Mars Petcare

- Nestle Purina Petcare

- Hill's Pet Nutrition

- The J.M. Smucker Company

- Blue Buffalo

- Diamond Pet Foods

- Spectrum Brands

- Nutro Products

- Wellness Pet Food

- Merrick Pet Care

- Ainsworth Pet Nutrition

- Big Heart Pet Brands

- Champion Petfoods

- Zesty Paws

- Virbac

Recent Developments

- In February 2025, Elanco Animal Health Incorporated announced the launch of Pet Protect, a line of veterinarian-formulated supplements for dogs and cats. Pet Protect emerges as a modernized, science-backed supplement line specifically designed to cater to the diverse health needs of pets. Bobby Modi, Executive Vice President, U.S. Pet Health and Global Digital Transformation, stated, "This underscores our dedication to enhancing the health and well-being of pets while driving growth and expanding our footprint in this dynamic market." (Source: https://www.prnewswire.com)

- In March 2025, Vegan Minerals, a supplier of sustainable nutrient solutions for human, pet, and plant health, announced the launch of its 100% plant-based, sustainable calcium ingredient Calcea. By providing this clean-label, plant-derived alternative to calcium, Vegan Minerals aims to redefine mineral nutrition. It has a natural honeycomb structure that touts superior absorption, according to the company. The ingredient is sourced from Lithothamnion, a calcified microalgae, found off the coast of Brazil. (Source: https://www.petfoodprocessing.net)

- In August 2024, Pet Honesty, the multiple award-winning, vet-recommended natural pet wellness brand, launched its latest format innovation: liquid supplements. This advanced collection includes Hip + Joint Health, Skin + Coat Health, and 10-in-1 Multivitamin, all formulated to address common pet wellness needs in a convenient, easy-to-dispense format, making meal time even tastier. (Source: https://www.businesswire.com)

- March 2023will witness Mars Petcare's venture into the supplements category with the introduction of Pedigree Multivitamins. This new product line includes three varieties of soft chews meticulously crafted to address pets' essential needs, focusing on immunity support, digestive health, and joint care.

- In March 2022, Virbac introduced two fresh Veterinary HPM wet diets designed to aid in the prevention and management of feline lower urinary tract disease (FLUTD), a prevalent health concern in cats.

- In February 2022, Virbac unveiled its debut line of pet nutrition under the banner of Veterinary HPM Pet Nutrition, specially formulated for spayed and neutered animals. This product line encompasses two cat foods and four dog foods, available in six unique formulas tailored to pets' requirements based on their age and size.

Segments Covered in the Report

By Pet

- Dog

- Cat

- Freshwater Fish

- Others

By Application

- Multivitamins

- Skin & Coat

- Hip & Joint

- Prebiotics & Probiotics

- Calming

- Others

By Source

- Organic

- Conventional

By Distribution Channel

- Offline

- Online

By Food Type

- Wet Food

- Dry Food

- Snacks/Treats

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting