Fatty Acids Market Size and Forecast 2025 to 2034

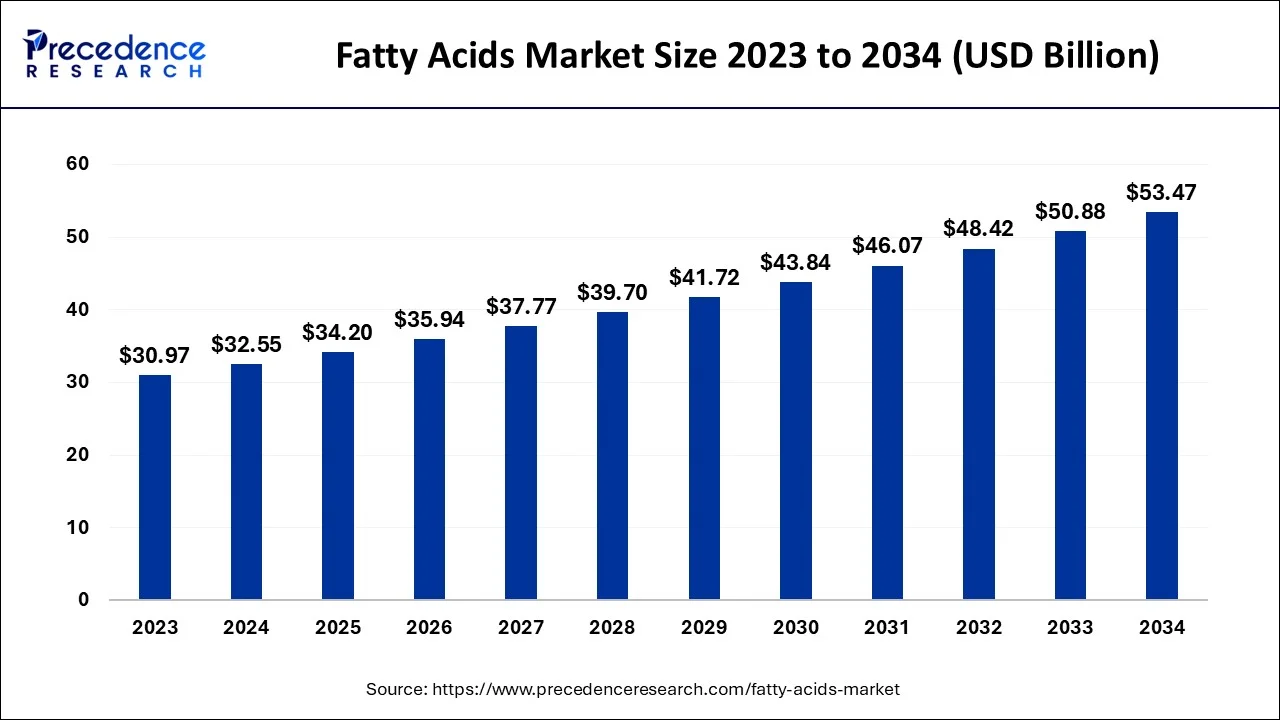

The global fatty acids market size was estimated at USD 32.55 billion in 2024 and is predicted to increase from USD 34.2 billion in 2025 to approximately USD 53.47 billion by 2034, expanding at a CAGR of 5.09% from 2025 to 2034.

Fatty Acids Market Key Takeaways

- In terms of revenue, the market is valued at 34.2 billion in 2025.

- It is projected to reach 53.47 billion by 2034.

- The market is expected to grow at a CAGR of 5.09% from 2025 to 2034.

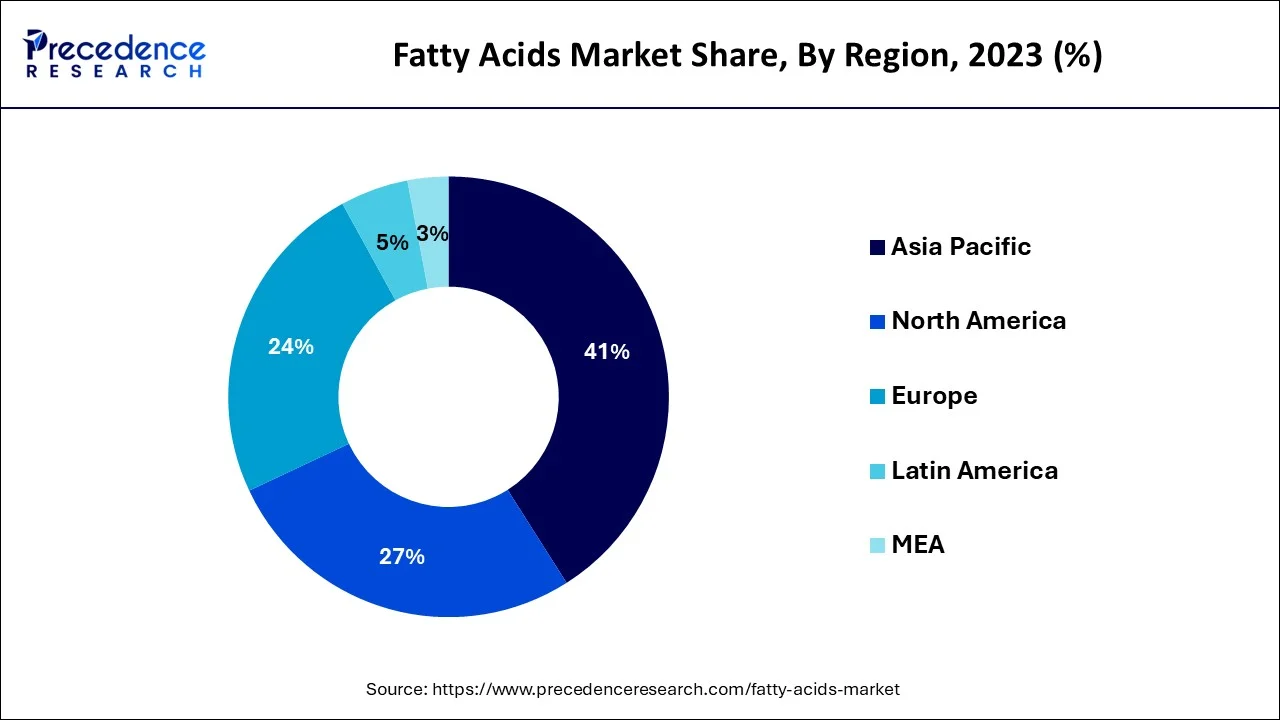

- Asia Pacific dominated the global market with the largest market share of 41% in 2024.

- By Type, the unsaturated segment had the highest revenue share in 2024.

- By Form, the oil segment had the highest revenue share in 2024.

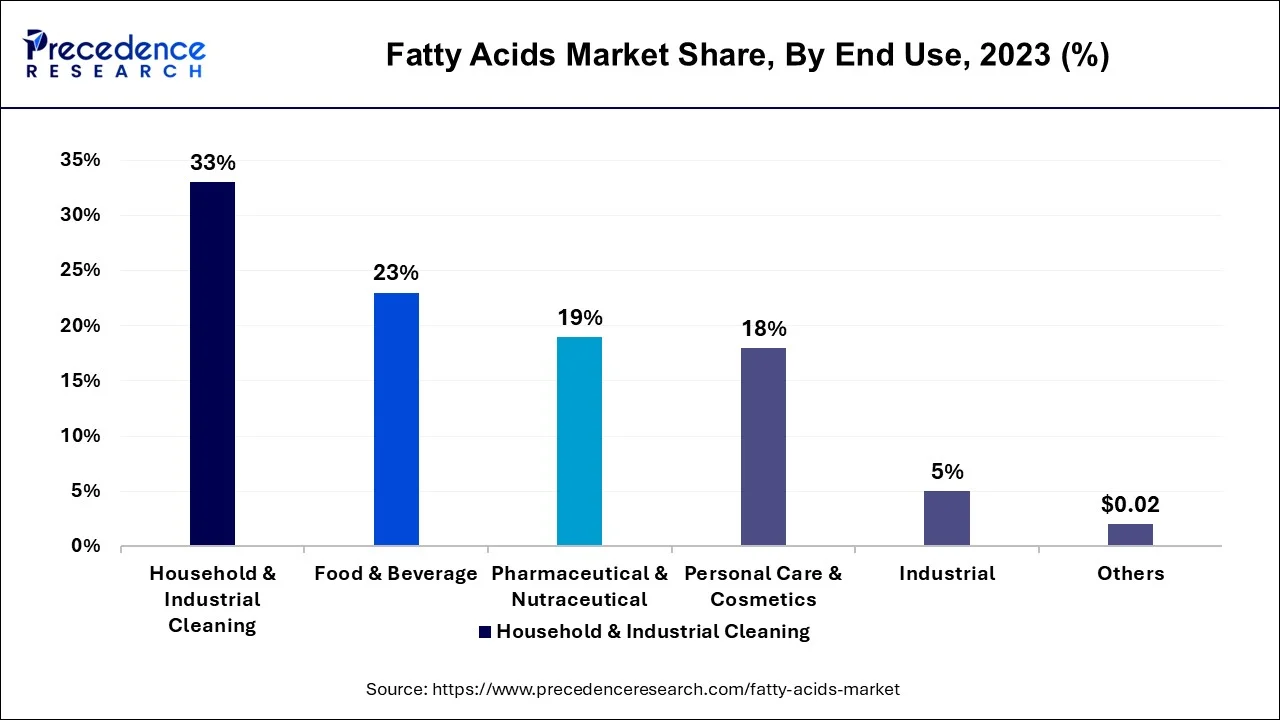

- By End-use, the household & industrial cleaning end-use segment has generated more than 33% of revenue share in 2024.

Asia Pacific Fatty Acids Market Size and Growth 2024 to 2034

The Asia Pacific fatty acids market size reached USD 13.35 billion in 2024 and is predicted to be worth around USD 22.19 billion by 2034, growing at a CAGR of 5.21% between 2025 and 2034.

The fatty acids market is spread across North America, Europe, Asia Pacific (APAC), the Middle East and Africa, and Latin America. In 2024, North America held the largest revenue share in the fatty acids market. North America is the most developed continent owing to the presence of nations with early adoption of fatty acids products and high gross domestic product (GDP). The revenue in the food market in the United States is estimated to account for around $996.40 billion in 2023. The food market in the U.S. is predicted to grow at a compounded annual growth rate (CAGR) of 3.40%. Thus, the growing food industry is enhancing the opportunity for fatty acids across the North American region.

The increasing preference of people towards enhanced appearance is accelerating the demand for cosmetic products in the European region. The rising use of cosmetics among millennials is anticipated to support the fatty acids market expansion in the European Union (EU) region.

The Asia Pacific (APAC) region is experiencing notable industrial growth since the last few years. Fatty acids have significant use across industrial applications such as cosmetics, lubricants, and plastics. Owing to the presence of crucial raw material suppliers across the region, Asia Pacific (APAC) is considered to be a prominent market for fatty acids. The easy availability of raw materials combined with enormous industrial consumption is encouraging fatty acid producers to raise their production capacities across Asia Pacific (APAC).

Due to uncertainty, low literacy, and civil war in African nations, the fatty acids market in Africa is estimated to expand at a comparatively slow rate. Owing to high disposable income and well-developed infrastructure, the fatty acids market is anticipated to grow remarkably in the Middle East region in the coming years.

Market Overview

Fatty acids are the building blocks of fats in the human body and in the food that is consumed. In the process of digestion, fats are broken down into fatty acids, which are then absorbed in the blood. The rising utility of fatty acids across industrial & household cleaning, and nutraceutical & pharmaceutical products is anticipated to drive the fatty acids market growth substantially. Also, the development of new products for floor care, dish care, surface care, and fabric care is creating remarkable scope for the market over the study period.

The usage of fatty acids is rising across numerous cosmetics & personal care products including detergents, soap, moisturizers, and many others. Additionally, evolving people's lifestyles, rising urbanization, and increasing disposable incomes have led to the growing use of personal care & cosmetics products. Thus, the demand for fatty acids is expected to rise exponentially in the rapidly expanding cosmetics domain over the forecast period.

Health consciousness among people across geographies such as China, India, and the Middle East countries is increasing, which, in turn, is accelerating the need for nutrient-rich beverages and food.

Growing awareness regarding the benefits of a healthy diet dominantly triggers the requirement for omega-3 and omega-6 fatty acids across the food & beverage sector. However, fluctuating supply and prices of raw materials can impact the market to some extent during uncertain situations such as the pandemic of COVID-19. During the COVID-19 pandemic, consumer expenditure on groceries, particularly food rose dramatically.

Fish is considered to be a notable source of omega-3 fatty acids as well as lean protein. As per CSIRO analysis, it is estimated that the domestic consumption of frozen and prepared packaged meals will rise from $2.7 billion in 2018 to $3.7 billion by 2030. This analysis also suggests that the export opportunity for frozen and prepared packaged meals will increase from $1.0 billion to $1.6 billion from 2018 to 2030. Thus, such high anticipated growth in the food industry is expected to support the fatty acids market growth consequently.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 32.55 Billion |

| Market Size in 2025 | USD 34.2 Billion |

| Market Size by 2034 | USD 53.47 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 5.09% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Form, End-use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Producers of fatty acids are extensively involved in enhancing their product offerings. Joint ventures, collaborations, and mergers & acquisitions among prominent market players can create drastic opportunities for the global fatty acids market. Inclination towards new product launches is supporting the market from the supply side. For strengthening the market position, various market players can enhance their collaboration with suppliers & distributors. Fatty acids are generally utilized in cosmetics as an emulsifier or an emollient. As an emollient, fatty acids are helpful in enhancing skin hydration by sealing in the skin's moisture.

Additionally, compliance with national as well as international regulations is proving to be a key concern for fatty acid producers. Competition among emerging market players tends to pose a price competition for acquiring a dominant market share. In order to gain a competitive edge over other players, market players in the fatty acids market are aiming to develop cost-effective products.

Investment in research and development (R&D) activities is expected to enhance the product quality. For gaining further access to the regional markets, companies can undertake various strategic initiatives including the expansion of existing product portfolio. These initiatives may result in more intensive rivalry over the study period. Additionally, rapidly evolving fatty acid offerings make the existing offering obsolete very soon. This further intensifies the market competition among the prominent players.

Since the count of fatty acid providers (manufacturers) is less in comparison to the count of buyers, the bargaining power of suppliers is relatively higher as compared to the bargaining power of buyers. Owing to considerable profit margins, the threat of new entrants in the fatty acids market is moderate as of now. In the global fatty acids market, BASF SE; Akzo Nobel; Croda International Plc; and Ashland Inc are some of the prominent market players with respect to product offerings across the globe.

The report covers numerous factors such as key players, competitive landscape, ongoing trends, and regional analysis. The analytical research on the impact of the COVID-19 situation helps in determining the effects on the supply and demand side of the market. The segmental analysis provides a clear view of various fatty acid variants and respective distribution channels.

Type Insights

The global fatty acids market is segmented into saturated and unsaturated. The unsaturated segment had the largest share of the global fatty acids market in 2024. The high share of the unsaturated segment type is attributed to its growing penetration across the pharmaceutical industry. The unsaturated fatty acids help in stabilizing heart rhythms, enhancing blood cholesterol levels, and can ease inflammation. The unsaturated fats are usually derived from avocados, nuts, olive oil, canola, and soybean.

Soybean fat contains a high content of polyunsaturated fatty acids. The production of soybeans in Europe accounted for 9.5 million tons in 2021, which is almost 6.4% higher as compared to the production in 2020. The production of soybeans under the Europe Soya (ES) or Donau Soja (DS) label raised by almost 49% in 2021, after a temporary decline in 2020. Farmers across 11 European nations certified under ES & DS soy standards produced around 715,000 tons of soy in 2021. Thus, the growing production of soybean in Europe is supporting the market from the supply side.

Form Insights

The global fatty acids market is segmented into oil, powder, and capsule. The oil segment had the highest revenue share in 2024. The oil segment is expected to dominate the market during the study period. The oil form segment type had a high market share owing to rising utility across the pharmaceutical and food & beverage domains. The distinct kinds of fatty acids such as omegas are derived from animals mostly in the oil form and are utilized across various end-use applications.

The powder form of fatty acids is utilized for household cleaning and industrial end-use applications. Medicines consist of fatty acids mostly in the form of powder in tablets. the powdered form of fatty acids is useful in energy bars, sports drinks, and bakery products.

Fatty acids are utilized in the form of capsules, particularly in nutraceutical, pharmaceutical, and personal care applications. The use of capsules remains on the rise owing to better absorption, no taste, and faster effect as compared to tablets.

End-Use Insights

The global fatty acids market is segmented into household & industrial cleaning, food & beverage, pharmaceutical & nutraceutical, personal care & cosmetics, industrial, and other segments. The household & industrial cleaning end-use segment had the highest revenue share in 2024. The household & industrial cleaning end-use segment is predicted to dominate the global fatty acids market during the study period.

The high market share of the household & industrial cleaning end-use segment type can be attributed to exceptional properties such as antiviral, antifungal, and antibacterial. Fatty acids offer nutritional support for reducing body fat and enhancing lean muscle mass. Growing weight loss programs are anticipated to trigger the demand for fatty acids used in gym health products. Increasing awareness about a reduction in calorie intake among athletes and gym professionals in several nations including Italy, China, the U.S., and India is likely to propel the use of omega-3 in functional food products and sports supplements.

Fatty Acids Market Companies

- Akzo Nobel

- BASF SE

- Ashland Inc.

- Eastman Chemical Company

- DOW

- Croda International Plc

- Cargill Incorporated

- Oleon N.V.

- Vantage Specialty Chemicals

- Polaris

Recent Developments

- In August 2022, Seraphina Therapeutics study discovered a new fatty acid, eyeing C15:0 supplement formulation. C15:0 is utilized by human bodies for making the 2nd-ever discovered full-acting endocannabinoid, known as PDC.

- In November 2022, Epax launched a long-chain monounsaturated fatty acid ingredient: Cetoleic 10. This ingredient consists cetoleic acid, an omega-11 marine lipid, and gondoic acid (omega-9). The extract is extracted from North Atlantic fish, which is lower in docosahexaenoic acid (DHA) and eicosapentaenoic acid (EPA).

Segments Covered in the Report

By Type

- Saturated

- Unsaturated

By Form

- Oil

- Powder

- Capsule

By End-use

- Household & Industrial Cleaning

- Food & Beverage

- Pharmaceutical & Nutraceutical

- Personal Care & Cosmetics

- Industrial

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting