What is Oleochemicals Market Size?

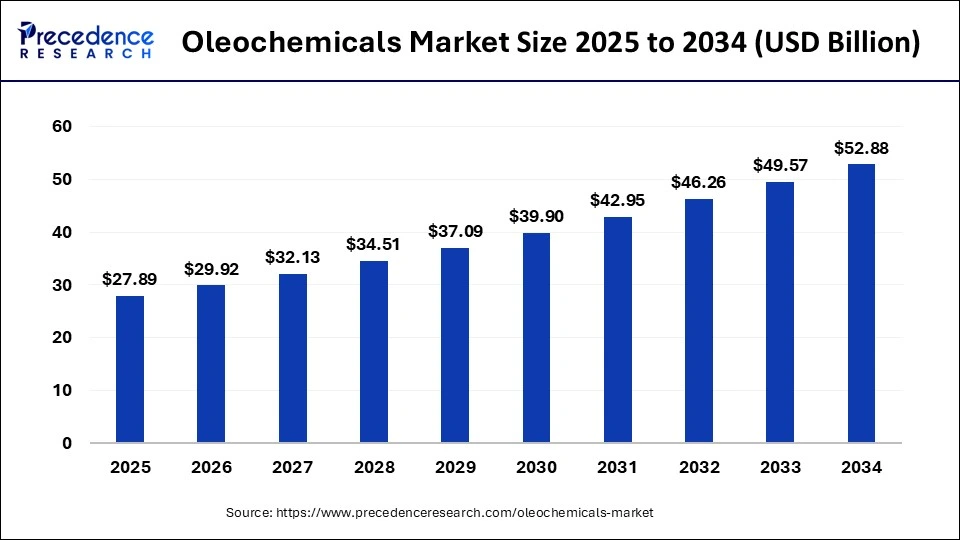

The global oleochemicals market size is estimated at USD 27.89 billion in 2025 and is predicted to increase from USD 29.92 billion in 2026 to approximately USD 56.19 billion by 2035, expanding at a CAGR of 7.26% from 2026 to 2035

What is the Oleochemicals Market?

Oleochemicals are mainly produced from plant oils, and they are used in cosmetics in other chemical products and lubricants. In order to provide high biodegradability, the oleochemical industry is now focusing on renewable feedstocks. There shall be an increase in oilseed production due to the increased demand for oleochemicals. Oils and fats are very important materials which are used in the production of oleochemicals. Due to a demand for renewableandsustainable biobased chemicals for the food and beverages or the personal care and cosmetics or the pharmaceutical industriesthe market foroleochemicals is expected to grow.

For the production of surfactants, detergents, soaps, and lubricantsoleochemicals are consumed in the form of fatty acids. It is also used in the production of varnishes and pharmaceuticals. During the pandemicthe demand for oleochemicals had dropped. The pandemic had shattered this sectors demand and supply chains. Rules and regulations by the governmenthad triggered the impact to this industry. All the manufacturing activities had come to a halt. There was a temporary halt in the production of various chemicals.Dueto the virus outbreak in Wuhan, the production of the chemicals was highly affected in China. China is the leading consumer and producer of the chemicals.

Delays and disruptions in the logistics services increase restrictions, limited staffand shortage ofttechnicalpersonalshad impacted the manufacturing process of theoleochemicals. Due to depletion of fossil fuels and increased global pollutionthere was a serious threat to environment. Increased use of biofuels, like that of biodieselwill help in resolving these problems. Biodiesel is manufactured from the natural feedstockwhich is obtained from oil and fat. And the adoption of these fuels is expected toprovide a growth opportunity for this market.

How is AI contributing to the Oleochemicals Market?

In the oleochemical industry, Artificial Intelligencehas been largely revolutionizing the operational efficiency, innovation, and sustainability aspects. On the production front, the techniques can maintain the facility and optimize it, rendering the facility reliable while making better use of the available resources. Computer vision with automation is put in place and used for quality-control purposes, free from human inspection limitations, while digital twins provide an additional layer for simulation in a virtual environment.

The supply chain has also been enhanced by AI through effective forecasting of demand, controlling inventories, and planning logistics, thus reducing costs and at the same time making it responsive to the needs of customers. R&D-wise, it speeds up the designing and formulation of molecules that can work efficiently and in a greener manner. AI analytics look for green chemical alternatives that forecast market trends and use blockchain for traceability and environmental compliance to develop consumer trust.

Market Outlook

- Industry Growth Overview: The oleochemical industry is still radiant and flourishing with the use of sustainable and bio-based alternatives.

- Sustainability Trends: Firms are spending large amounts of money on biodegradable, renewable, and circular solutions in order to be in line with the global climate and green chemistry goals.

- Global Expansion: On the one hand, the growing markets are making much effort to increase their production, and on the other hand, the mature markets are investing in the latest refining and automation technologies.

- Major Investors:The big players are pushing the limits of innovation through the use of green chemical technologies, mergers, and the development of sustainable materials.

- Startup Ecosystem: New ventures are investing in research of microbial fermentation and the use of AI to make palm-free and environment-friendly oleochemical production.

Oleochemicals Market Growth Factors

It is anticipated that theoverall product demand in the US shall risewith the use of all chemicals in the end user industries such as the personal care industries and the pharmaceutical industries. The demand for theolechemicalsis also expected to grow as there is an increasein the demand for cleaning products industry which includes self acting soaps, etc. Procter and Gamble, which is a leading manufacturer in the cleaning products line, it is based in Europe and imports many oleochemicals from Malaysia and Indonesia.

Theoleochemical segment is expected to grow in the forecast period as there is a demand for the use of natural organicskin care and hair care cosmetic products. As the environmental regulations are becoming stringent constantly andtherenewable resources are getting depleted. There is an opportunity for the growth of theoleochemicals and they shall substitute the conventional petroleum based products. The market for green chemicals is rising and there's an increase in the demandfor such productsinthe consumer markets.

- Rising Demand in End-Use Industries: The increasing use of oleochemicals in personal care, pharmaceutical, and cleaning products is fueling market growth.

- Lean Towards Natural Ingredients: With the rise in customer inclination toward organic and plant-based products, the demand for bio-based oleochemicals is getting stronger.

- Strict Environmental Regulations: Worldwide environmental regulations are getting stringent are pushing the movement from petrochemical-based oleochemicals to renewable oleochemical alternatives.

- Green Chemicals Applications Promote Market Growth: Increased interest in using eco-friendly and biodegradable ingredients in various application fields is the key factor in market expansion.

- Production Technology Advances: In production, processing, and refining technologies, continuous innovation can bring improvement in yield, efficiency, product quality, and overall growth of the industry.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 27.89Billion |

| Market Size in 2026 | USD 29.92 Billion |

| Market Size by 2035 | USD 56.19 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 7.26% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Products, Application, Form, Feedstock, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Opportunity

Technological Advancements:

Future expansion depends on technological advancements that enable the affordable production of high-quality oleochemicals. Cutting-edge technologies, including methods and microreactor innovations, are being advanced to improve the efficiency and sustainability of oleochemical manufacturing. These will enhance the competitiveness of oleochemicals against petrochemicals and promote their greater application in different sectors. Technology enables the main players in the oleochemical industry to attain operational efficiency via complete manufacturing integration. In addition, businesses are increasingly investing in manufacturing technologies, which signifies a recent opportunity in the oleochemicals market.

Market Challenge

Supply Chain Disruptions

Restrictions in the supply chain and changes in the costs of raw materials like palm oil, soy, and various vegetable oils can affect production expenses. These elements may result in price fluctuations and diminished profit margins for producers. Additionally, the market is contending with regulatory challenges and the necessity for substantial investments in research and development to enhance production efficiency. The market encounters difficulties in scalability, as moving to large-scale manufacturing of renewable chemicals presents a notable obstacle. Consequently, businesses in this field need to identify solutions to tackle these obstacles for achieving sustainable growth.

Regional Insights

Products Insights

Variousoleochemical products arefatty acids, methyl Ester and glycerol esters.Specialty esters accounted largest revenue share of around 32.83% in 2022. As it is used in the production ofcosmetics, rubberand as a lubricant in the pharmaceutical applications.There is a greater demand for fatty acidsin various cleaning agents like the surfactants, detergents, etc. The pharmaceutical and the cosmetic industries are also using fatty acids in the manufacturing of their products.

The fatty acids segment shall have the largest market share. Cetyl alcohol, which is a very commonly used product in the cosmeticsisused widely in lipsticks, hair lotions and shaving creams. They are also used in antihistamine creams as there is an increased use of glycerinby various companies. There is research and development in order to find alternative methods in order to purify the crude glycerin. The purity of glycerin drives the market and makes it more appealing for potential buyers. The manufacturing of glycerin in a more refined manner is expected tohelp in the growth of the market.

Application Insights

The industrial application segment dominated the market with a revenue share of around 22.06% in 2022. However, the personal care & cosmetics segment is estimated to account for the highest revenue share by 2032 growing at the fastest CAGR over the forecast years.

The personal care and the cosmetic segment is expected to grow during the forecast period with the fastestCAGR until 2030, the Industrial application segment had the largest share. The growth of the personal Care and cosmetic segmentis credited to the shift in the consumers demand for natural products and eco friendly products. The manufacturers have upgradedtheirtechnologies and have brought in more innovative technologies to meet the regulatory frameworks of the government. In the cosmetics industry there should be an increase in the overall product demandforthe United States, as there is a growing need for this product in pharmaceuticals and personal care.

The pharmaceuticals and the food and beverages industryshall have a greater demand for glycerol derivatives. Due to an increase in the cleaning products industrythe demand for oleochemicals will increase during the forecast. The use of bio based raw materials in the manufacturing of organic personal care products will lead to an increase in the oleochemicalsmarket.With the increased use of stabilizers, biobased thickeners and food additivesitis expected that the segment shall grow.

Form Insights

Liquid form held the dominating share of the market in 2024. This can be linked to the adaptability and broad usage of liquid oleochemicals such as fatty acids, glycerol, surfactants, etc. Liquid oleochemicals are utilized across different sectors due to their convenient handling, blending, and applicability characteristics compared to alternative types. They are present in personal hygiene items, industrial oils, and as intermediates in chemical production.

Liquid fatty acids are commonly used in producing soaps and detergents due to their ability to blend effectively with other components, improving both performance and stability. Similarly, liquid glycerol is utilized in numerous pharmaceutical and cosmetic uses due to its moisturizing properties and ease of blending with other components. Existing in this liquid state simplifies its application in biodiesel production, as it serves as an essential raw material for the transesterification process.

Feedstock Insights

Palm segment held the largest share of the market in 2024. The palm segment plays a leading role in the oleochemicals market, with palm oil and palm kernel oil acting as key feedstocks because of their adaptability and affordability. These oils, obtained from the oil palm tree, are high in fatty acids, making them excellent for creating a variety of oleochemicals such as fatty acids, fatty alcohols, and glycerol, which are essential for numerous uses. Although palm oil prevails, the sector is under examination due to the environmental and social effects of palm oil farming, resulting in increasing emphasis on sustainable sourcing and the investigation of alternative raw materials.

- Based on Volza's Global Export data, the world exported 57,942 shipments of Palm Oil between Nov 2023 and Oct 2024. These exports were conducted by 3,106 Exporters to 6,826 Buyers, representing a 9% increase relative to the previous twelve months. Worldwide, the leading three exporters of Palm Oil are Indonesia, Malaysia, and Vietnam. Indonesia tops global Palm Oil exports with 59,351 shipments, while Malaysia follows with 32,732 shipments, and Vietnam ranks third with 6,529 shipments.

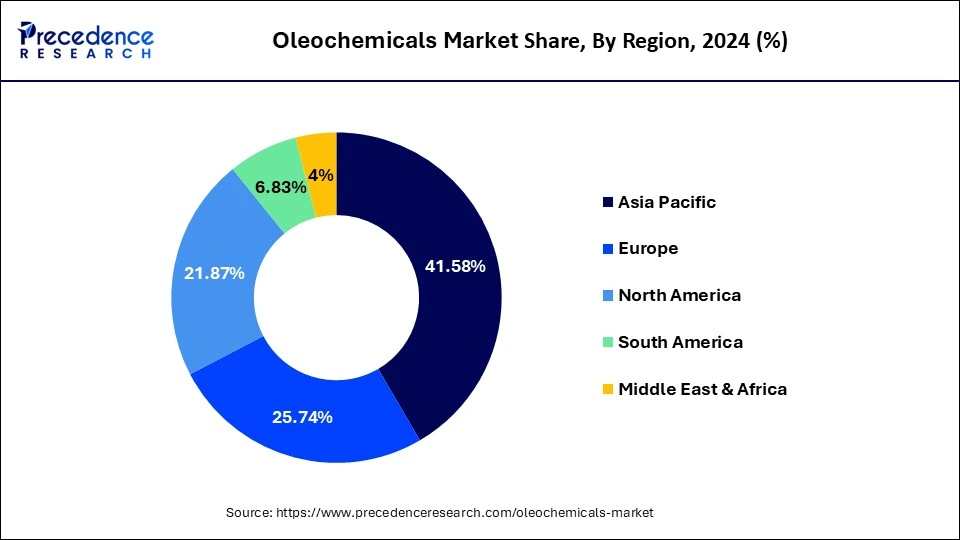

Regional Insights

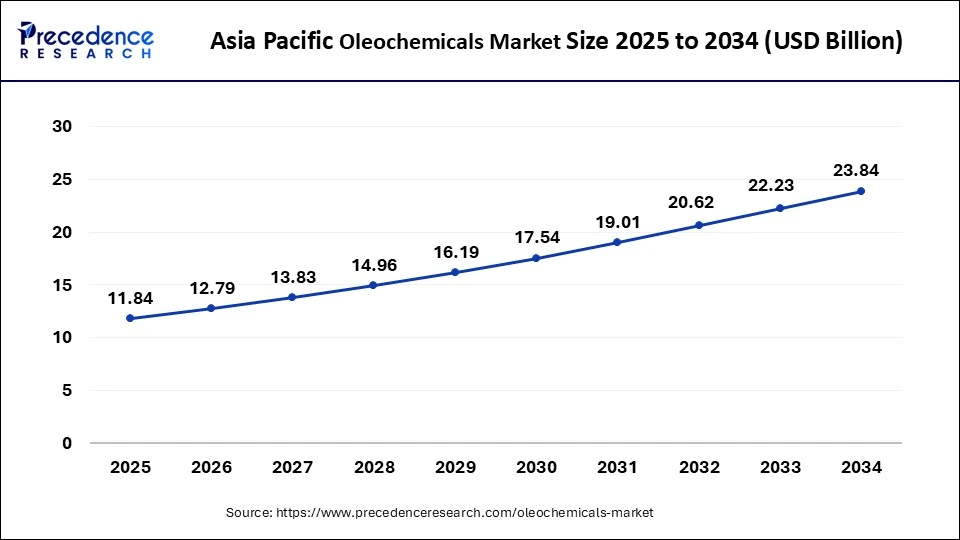

Asia Pacific Oleochemicals Market Size and Growth 2026 to 2035

The Asia Pacific oleochemicals market size is exhibited at USD 11.84 billion in 2025 and is projected to be worth around USD 25.45 billion by 2035, growing at a CAGR of 7.95% from 2026 to 2035.

How is Asia-Pacific Leading the Oleochemicals Market?

The oleochemical market is fundamentally dominated by the Asia-Pacific region owing to the prevention of underlying industrial activities, the upgrade of technology, and the availability of natural feedstock resources in large quantities. The wide variety of the region's applications in the cosmetics, food, and surfactants industries generates a constant demand. The governments' regulations highlight the sustainable sourcing and production, which also help the corporations in their transition from petrochemical to bio-based alternatives. The increasing investments in refining technologies are also improving the quality of the products and the competition in the global market.

China Oleochemicals Market Trends

The robust industrial infrastructure of China is the main reason why the country's oleochemicals market benefits from the increasing domestic demand for bio-based solutions. AI, along with the company of strong technology acceptance and the market, is now being applied in the areas of manufacturing automation and process optimization. The collaboration between academic and non-academic institutions and manufacturers in the production of eco-friendly surfactants and emulsifiers is one of the major encouraging innovation drives.

India:

The Indian oleochemicals market is seeing substantial investment to enhance production capability, responding to rising demand from personal care, pharmaceuticals, and food sectors. Firms are increasing their activities in major industrial centers such as Gujarat, securing a reliable domestic supply and minimizing dependence on imports. This transition promotes job creation, anticipating hundreds of new positions in advanced manufacturing plants.

Eco-friendly and bio-based chemical solutions are increasingly popular, matching worldwide movements towards sustainable alternatives. Investments are fueling innovation, enhancing process efficiency, and broadening product offerings. As consumer demand for natural ingredients increases, the industry is set for ongoing expansion, strengthening India's role as a significant player in oleochemical production.

How is North America Performing in the Oleochemicals Market?

North America is making its way to becoming a rapidly growing market with strong environmental governance and sustainable manufacturing initiatives. The rising demand for eco-friendly products stimulates the market for bio-lubricants, detergents, and additives, as well as the innovation associated with it. The implementation of AI-powered production has led to process precision and waste reduction in the respective facilities. The chemical companies' partnerships with the renewable feedstock suppliers are among the main reasons for the accelerating transition of the region towards low-carbon oleochemical solutions.

The North American market is expected to grow well during the forecast period due to various industries in North America, like pharmaceutical, personal care and cosmetics that are expected to support the growth of the regional market.

United States Oleochemicals Market Trends:

The American chemical market is making progress through the combination of smart chemical production systems with bio-based innovation. Research investments are directed towards the next-generation oleochemicals that come from renewable oils. AI is being utilized by the manufacturers to better the formulations for personal care, coatings, and green energy sectors. Improved logistics and digital supply networks ensure that there is continuous product availability across industries.

Europe Oleochemicals Market Analysis:

By means of the introduction of new and better chemicals and the regulation compliance in chemical production, Europe is the leader in these two areas. The reliance on the region's oil will go down, which will, in turn, renew the oleochemical area. The application of circular economy principles will lead to more waste and a lowering of the new bio-based materials.

Germany Oleochemicals Market Trends:

Germany is the continent's center of innovation when it comes to the oleochemicals market, with its focus on high productivity, environmental friendliness, and superiority in technology. The advanced research and development of biodiesel, lubricants, and surfactants of high quality receive the full support of the country's labs. AI-assisted process control gives the output quality of one hundred percent with no emissions at all.

Middle East and Africa Oleochemicals Market Trends

The oleochemical sector in the Middle East and Africa boasts a deep-rooted history and is presently undergoing notable growth, fueled by multiple influences such as the increasing need for sustainable products and the growth of sectors like cosmetics and personal care. The Middle East and Africa rely on petrochemicals due to the region's abundance of crude oil. With stricter laws and a shift in focus by the governments of the UAE and Saudi Arabia towards natural and eco-friendly products, manufacturers have been motivated to utilize oleochemicals in various applications due to their biodegradable characteristics. Oleochemicals, sourced from natural fats and oils, have been used for ages, yet their industrial production accelerated in the late 20th century. The Middle East and Africa region, rich in natural resources, especially palm oil and other vegetable oils, has emerged as an important participant in the oleochemical sector. Countries such as Malaysia and Indonesia have traditionally led in palm oil production, which acts as a key raw material for oleochemicals.

Recent Developments

- In June 2025, Perstorp, a prominent international innovator in specialty chemicals and a fully owned subsidiary of PETRONAS Chemicals Group Berhad , revealed the introduction of its new range of saturated synthetic polyol esters. The lineup features three effective synthetic esters - Perstorp Synthetic-EF 5, Synthetic-EF 15, and Synthetic-EF 22 - created to satisfy the changing technical, ecological, and performance requirements of the lubricant sector.

- In December 2024, the worldwide chemical firm OQ Chemicals divested its esters facility in Amsterdam to Perstorp Group as part of a strategic shift aimed at enhancing operational efficiency and fostering growth in key business sectors. OQ Chemicals is dedicated to consistently meeting customer needs while broadening its reach in rapidly growing markets and applications.

- In January 2025, Ecoscience International Bhd, a provider of integrated palm oil milling services, introduced an advanced effluent water treatment solution, Eco-Plasma•HO, to tackle the issues posed by palm oil mill effluent, the wastewater produced during the palm oil milling process that needs efficient treatment prior to being released into water bodies because of its severe pollution potential.

Value Chain Analysis

- Feedstock Procurement: Procurement of renewable raw materials such as vegetable oils and animal fats for oleochemical production.

Key Players: Wilmar International, Kuala Lumpur Kepong Berhad, IOI Group - Quality Testing and Certification: The assurance of safety, quality, and regulatory compliance of the finished products.

Key players: IOI Oleochemical, Intertek - Packaging and Labelling: Preparing and labeling products for safe handling and storage, to be distributed to customers.

Key Players: Ecogreen Oleochemicals or Godrej Industries Group - Distribution to Industrial Users: The transport of processed oleochemicals to industrial manufacturers in the respective sector.

Key Players: Cargill Inc., BASF SE, and Wilmar International - Waste Management and Recycling: Reusing waste materials and by-products, or disposing of them in an environmentally friendly way, to complete the circle of production.

Key Players: Techeco Waste Management LLP and Nashik Waste Management Private Limited - Regulatory Compliance and Safety Monitoring: Compliance with the safety regulations, quality control, as well as environmental guidelines, recording, and monitoring throughout production and distribution.

Key Players: Intertek and GPC Regulatory

Oleochemicals Market Companies

- BASF

- Evonik Industries AG.

- SABIC

- Godrej Industries Limited

- Emery Oleochemicals LLC.

- Oleon NV.

- KLK Oleo

- Kao Corporation

Segments Covered in the Report

ByProducts

- Specialty Esters

- Glycerol Esters

- lkoxylates

- Fatty Acid Methyl Ester

- Fatty Amines

- Others

By Application

- Personal Care & Cosmetics

- Consumer Goods

- Food & Beverages

- Textiles

- Paints & Inks

- Industrial

- Healthcare & Pharmaceuticals

- Polymer & Plastic Additives

- Others

By Form

- Liquid

- Solid

- Flakes

- Pellets

- Beads

- Others

By Feedstock

- Palm

- Soy

- Rapeseed

- Sunflower

- Tallow

- Palm Kernel

- Coconut

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting