What is the Biofuels Market Size?

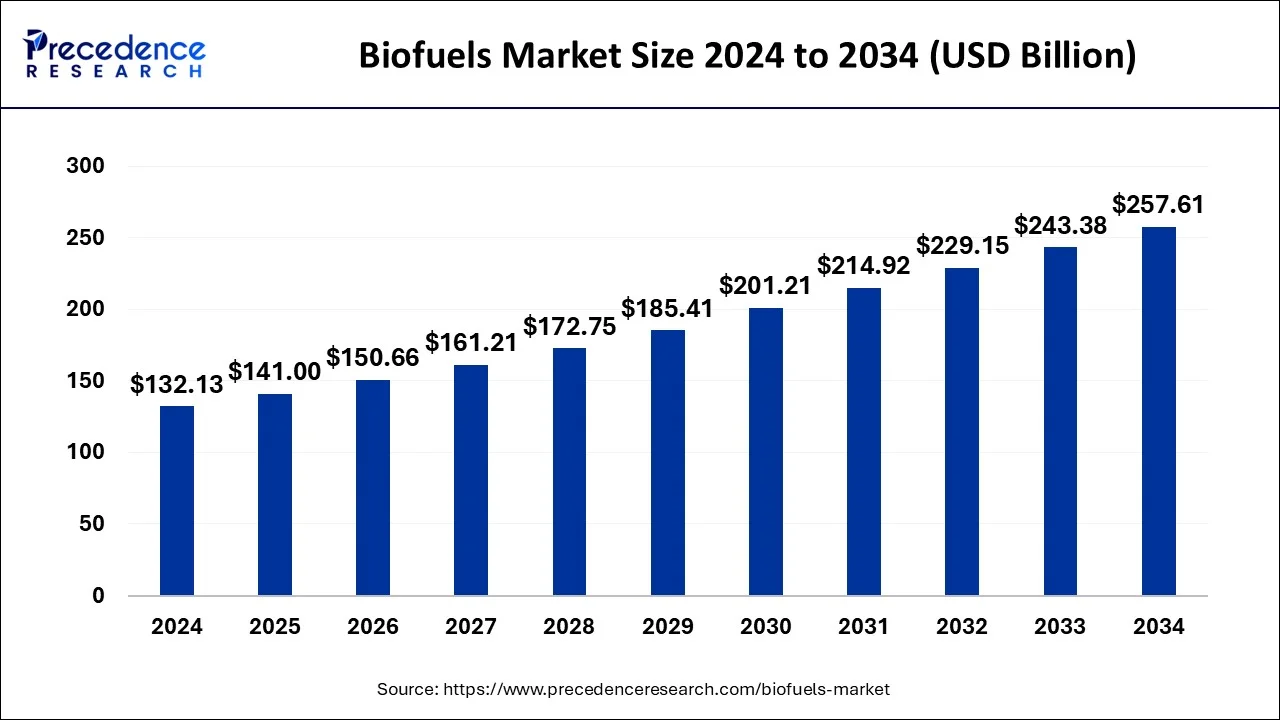

The global biofuels market size is calculated at USD 141 billion in 2025 and is anticipated to reach around USD 271.84 billion by 2035, expanding at a CAGR of 6.78% over the forecast period from 2026 to 2035. Growing demand as environment-friendly fuel in road transportation, Rising awareness about use of renewables and rising focus on lowering greenhouse gas emission are major growth driver of biofuels market.

Market Highlights

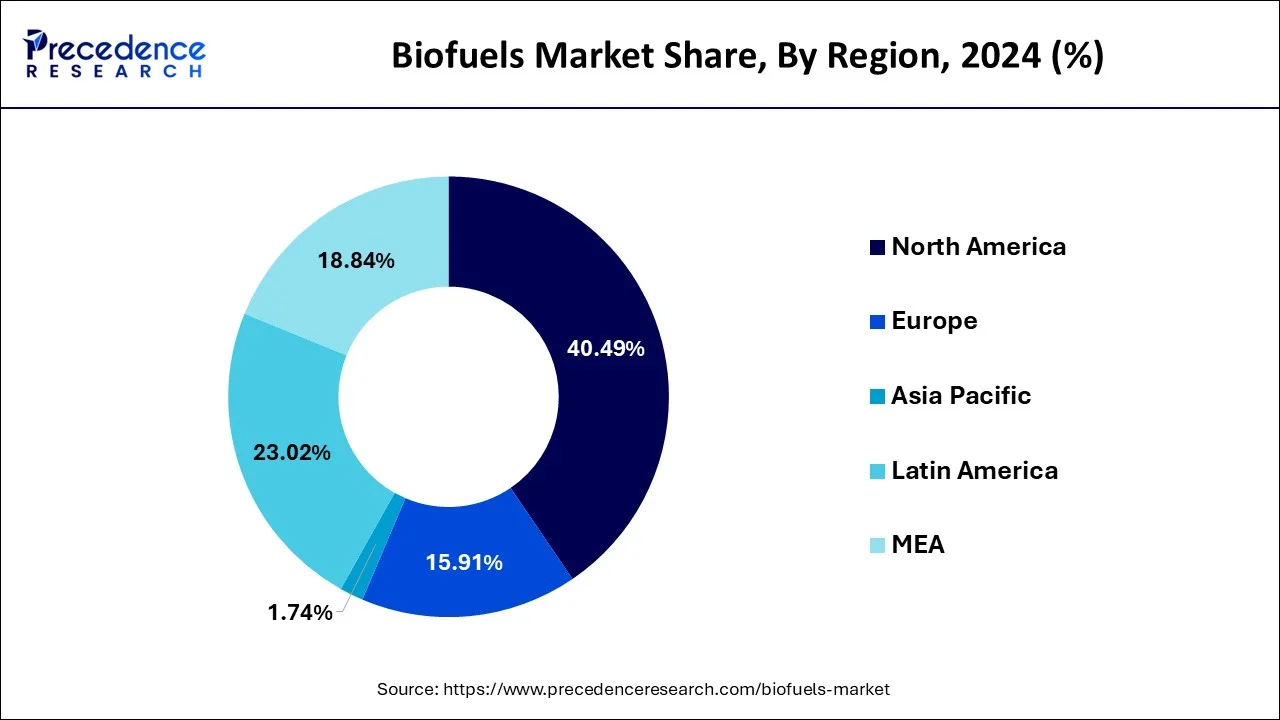

- North America led the global market with the highest market share of 40% in 2025.

Fuelling the Future: Biofuels Market Overview

Emerging applications of the biofuels are projected to generate lucrative growth opportunities for the major players operating in the global biofuel market. Biofuels are going to use as affordable and reliable jet fuels. The biofuels researchers and scientists have discovered production method which helps to produce jet fuel easily from the biomass. Further, technological advancements in the biofuel industry have reduced the cost of the biofuels which is among major factors used to replace the use of fossil fuels. In addition to this the introduction of newer feedstock for the production of the biofuels is another factor expected to support growth of the target industry in the near future. Also, emerging countries across the globe are focusing on increasing biofuel production in order to reduce GHG emission is creating opportunities in the target sector.

The global demand for biofuels is projected to surge by 41 billion litres, or 28%, over the period from 2021 to 2034. This substantial growth is driven by a variety of factors, including recovery from the Covid-19 pandemic and strong government policies. Let's delve into the specifics of this anticipated expansion and explore the regional dynamics shaping the biofuel market. In the United States and Europe, policies are particularly supportive of renewable diesel, also known as hydrogenated vegetable oil (HVO) in Europe. The demand for this fuel type is expected to nearly triple, driven by stringent environmental regulations and incentives for cleaner fuel alternatives. This growth underscores the critical role of policy frameworks in shaping fuel markets. China developed green technologies for methanol for maritime applications based on biomass gasification to produce 50,000 tons, by 2024.

How is AI Transforming the Biofuels Market?

Artificial Intelligence assists manufacturers in the generic medicines industry to accelerate development and guarantee quality. Together with machine learning technologies, AI and machine learning systems can predict how a drug acts in the body and suggest excipients to use, thereby avoiding lab trials and increasing precision and accuracy in formulation. AI also helps manufacturers to supply the drugs with less deviation from the design that is adopted routine, and automated production lines, and address quality assurance in the local area based in Ahmedabad, where select companies have been adopting AI worldwide to a good extent to expedite generics faster and provide a cheap alternative based on machine intelligence.

Biofuels Market Growth Factors

- Growing demand as environment-friendly fuel in road transportation

- Abundant availability of bioethanol blends and its extended use

- Rising focus on lowering greenhouse gas emission

- Increasing prices of crude oil

- Government support for research activities and favorable regulations

- Rising awareness about use of renewables

Biofuels Market Outlook: Growth Ahead

- Industry Growth Overview: The growth in the demand for cleaner fuels, energy security, and favourable government policies encouraging biofuel blending arecontributing to the industrial growth of the market.

- Major Investors:Global energy corporations, specialized technology firms, and agricultural processors are the major investors in the market.

- Startup Ecosystem: To develop advanced sustainable biofuels from non-food sources, the startup ecosystem is innovating technologies.

Top Countries to Consume Biofuel

| Region/Country | Consumption of Biofuel in 2022 | Policies and Projections |

| Europe | About 20 billion litres | The Renewable Energy Directive (RED II) mandates that 14% of the energy used in transport should come from renewable sources by 2030. |

| India | About 3 billion litres | The Indian government is pushing for a 20% ethanol blend (E20) by 2025, with current blending levels around 10%. |

| China | About 5 billion litres | The country has ambitious plans to expand ethanol use in gasoline, aiming for E10 (10% ethanol) nationwide. |

| United States | About 40 billion litres | The Renewable Fuel Standard (RFS) mandates significant biofuel blending in transportation fuels. |

Market Scope

| Report Highlights | Details |

| Market Size in 2025 | USD 141 Billion |

| Market Size in 2026 | USD 150.66 Billion |

| Market Size by 2035 | USD 271.84 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 6.78% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Fuel Type, Feedstock Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Government Support

Multiple government bodies across the globe, especially from the emerging economies are focused on the development of policies that can support the overall development and demand for biofuels. As advanced biofuels become more popular, multiple industries are seen to adapt government policies to seek fundings and overall support, overall promoting the growth of the biofuels market. For instance, the Indian government has set a target of 5% biodiesel blending in diesel by 2030. Whereas a target of 20% bioethanol blending in petrol by 2025 or 2026 has also been set by the Indian government.

Restraint

Decreased investments in the biofuels sector

In 2019, investments in liquid biofuels production capacity fell by roughly 30%, owing mostly to changes in China, where ethanol production facility investments were half compared to the previous year. To limit rivalry for maize production and ensure food security, China has put a stop to the extension of its 10% ethanol blending mandate across the country. Because 10% blending is still being implemented in some new provinces, investment in China could pick up in 2020, bolstered by new facilities already under construction.

In the United States and Brazil, policy-driven investment in ethanol-producing facilities has persisted. The Renewable Fuel Standard (RFS2) is the primary federal policy framework that encourages the use of biofuels in the United States. The new RenovaBio scheme in Brazil is driving growth. However, due to falling gasoline demand, shutdowns of biofuel production capacity in the United States and Brazil in 2020 are projected to restrict near-term interest for additional investments.

Opportunity

It is anticipated that the generic drugs market would continue to grow strongly over the coming years as many branded drug patents expire, allowing established generic drug manufacturers an opportunity to launch bioequivalent products and gain market share, while governments create and promote low-cost medicines by way of policy and/or bulk procurement, enhancing demand. Opportunities also exist in the area of digital pharmacy and with the automation of pharmacy supply chains for pharmaceutical companies, allowing them to forecast demand, avoid lapses in medications, and even reach new patient populations through online engagements. Furthermore, emerging and transition countries like India and China have an increasing chronic disease rate with an increasing number of middle-class patients that need low-cost health care. These trends enable manufacturers with the option of increasing their reach and decreasing the costs of production, while maintaining quality.

Biofuels MarketSegment Insights

Fuel Type Insights

The bioethanol segment recorded the prime market share in the global biofuels market by type in 2024. The rising use of bioethanol as an environment-friendly fuel in automotive applications in order to lessen global greenhouse gas emissions is a primary factor driving the growth of the bioethanol segment. Other factors such as increasing investment in research and development are projected to increase the usage ofethanol over the estimated period. Bioethanol's greater octane rating than ethanol-free gasoline raises the compression ratio of an engine, increasing thermal efficiency. Bioethanol fireplaces are also fueled with it. Because it is flueless and does not require a chimney, it is ideal for home use.

The biodiesel fuel type segment is predicted to rise at a noteworthy CAGR during the forecast time frame due to new product launches in the near future. Biodiesel is a biodegradable, renewable fuel made in the United States from vegetable oils, animal fats, or restaurant grease. Biodiesel satisfies the Renewable Fuel Standard's biomass-based diesel and total advanced biofuel requirements. Renewable diesel, commonly known as "green diesel," is not the same as biodiesel.

Biofuels Market Revenue, By Fuel Type, 2022-2024 (USD Billion)

| Fuel Type | 2022 | 2023 | 2024 |

| Biodiesel | 32.26 | 34.53 | 37.03 |

| Bioethanol | 84.20 | 89.45 | 95.10 |

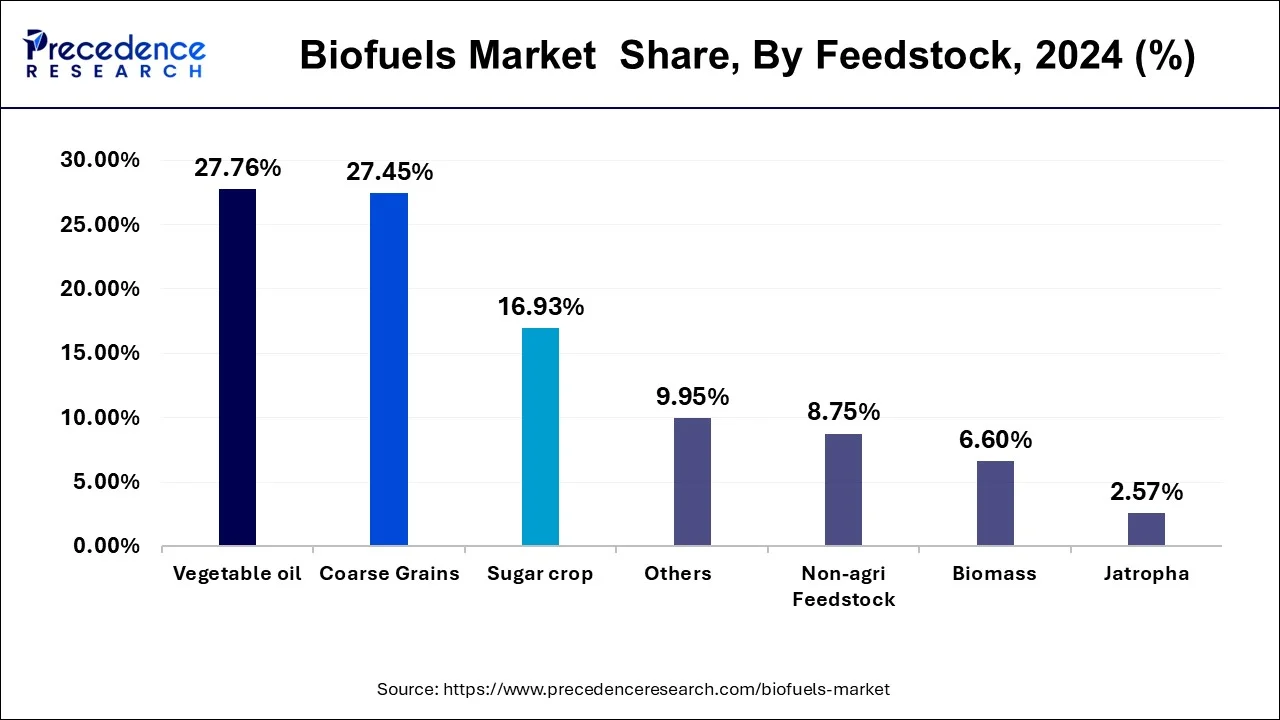

Feedstock Insights

The global market is segregated into coarse grain, sugar crop, vegetable oil, jatropha, and molasses. The vegetable oil feedstock segment is expected to dominate in terms of revenue over the forecast time frame. The growth is attributed to the benefits offered by vegetable oil such as low manufacturing costs and easy processing due to its low saturated fat contents. These factors are primarily responsible for the greater market share of vegetable oil in the feedstock segment of the biofuels market.

Although ethanol output is substantially larger, biodiesel production has increased at a faster rate since 2010, more than tripling between 2010 and 2015. Biodiesel now accounts for around 3% of all diesel fuel sold. In today's gasoline, 10% ethanol is incorporated into the majority of the blends.

The jatropha segment is observed to grow at the fastest CAGR of 13.1% during the forecast period. Jatropha seeds contain a relatively high oil content, typically ranging from 30% to 40%. This makes jatropha oil a potentially attractive feedstock for biodiesel production, as it can yield a significant amount of biofuel per hectare of cultivation. Jatropha is known for its ability to thrive in arid and semi-arid conditions, making it well-suited for cultivation in regions with limited water availability. Additionally, jatropha plants are relatively resistant to pests and diseases, reducing the need for chemical inputs and lowering cultivation costs.

Biofuels Market Revenue, By Feedstock, 2022-2024 (USD Billion)

| Feedstock | 2022 | 2023 | 2024 |

| Coarse Grains | 32.21 | 34.03 | 36.00 |

| Non-agri Feedstock | 10.03 | 10.84 | 11.73 |

| Biomass | 7.58 | 8.18 | 8.83 |

| Vegetable oil | 32.44 | 34.42 | 36.57 |

| Sugar crop | 19.77 | 20.98 | 22.30 |

| Jatropha | 2.74 | 3.19 | 3.69 |

| Others | 11.70 | 12.34 | 13.02 |

Biofuels Market Regional Insights

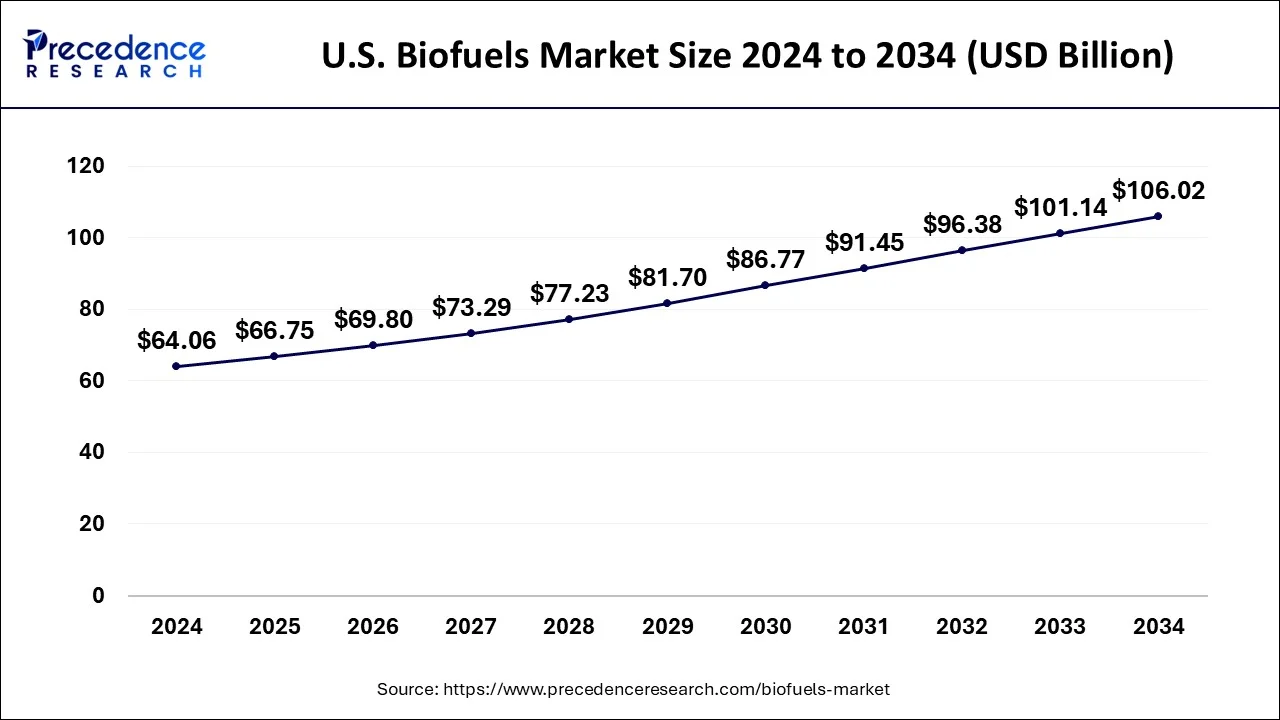

The U.S. biofuels market size accounted for USD 50.07 billion in 2025 and is projected to be worth around USD 96.51 billion by 2035, poised to grow at a CAGR of 6.78% from 2026 to 2035

The research report covers key trends and prospects of biofuels products across different geographical regions including North America, Europe, Asia-Pacific, Latin America, and Middle East and Africa. Geographically, biofuels market is conquered by North America owing to favorable government mandates for the biofuel production, coupled with the availability of abundant feedstock for the production of biofuels in the countries of this region, especially in the United States.

The North America region dominated the global biofuels market since it already has well-established, clear government regulations, strong climate policies, and established production regimes. The U.S., in particular, was supported by laws such as the Renewable Fuel Standard and state low carbon fuel rules that provided financial incentives for companies to build advanced biofuel plants utilizing non food biomass and feedstock supply chains, from agriculture residues to algae, which were systematically organized.

North American producers also invested a lot of research and technology in developing the capacity to take pilot plants to commercial-scale production. All of these present opportunities for greater volumes of sustainable aviation fuel, renewable diesel, and cellulosic ethanol to be produced. The North America region continues to attract significant investment in advanced biofuel projects and infrastructure because the policy environment continues to be open and stable.

The Asia-Pacific region is expected to grow at the fastest rate in the biofuels market because many countries in the region have very high energy needs tagged along with air pollution and climate issues that need solutions. Governments in countries such as China, India, and South Korea are launching biofuel programs and blending mandates, as well as renewable diesel and SAFF subsidies. The prevalence of agricultural residues and biomass feedstocks in the Asia-Pacific region directly points towards the possibility of effective, scalable production of biofuels.

Investment in new facilities and supply, and logistics systems is increasing, which further increases the speed and scale of the biofuel-based economy. The Asia-Pacific biofuel sector also generated a future export market for fuels such as SAF. The region's continued investment in transport infrastructure, coupled with a booming transport sector and relationships with established biofuel and SAF companies in other jurisdictions, all contributed to positive growth conditions in the market. The technological transfer and green financing obtained month by month also helped every country advance its production goals incredibly quickly.

China

China emerged as the leading country in the Asia Pacific biofuels market. The country has significant biomass resources, regulatory policies aimed at reducing fossil fuel consumption, and a national commitment to improving transport. China has been investing in biofuel production facilities, with an emphasis on sustainable aviation fuel and renewable diesel. Even though demand-side mandates are still in an earlier stage, Chinese companies and their foreign partners are already in the process of developing production capacity for domestic use and also for export.

The large extent of China was supported by domestic research and innovation, and the breadth of infrastructure deployment, which provided a competitive advantage for the country in the biofuel market. With this level of supported and willful commitment, China led the Asia-Pacific region and had still more production to grow, logistics chains to develop, and global energy markets to enter to develop their biofuels position.

Europe is expected to grow significantly in the biofuels market during the forecast period, due to growing environmental regulations, which are increasing its use. The growing shift towards net zero emissions is also increasing its use, which is being supported by government investments.

Expanding Industries Boost The UK

The expanding agricultural industry is providing biomass feedstock, which is driving the development of biofuels across the UK. At the same time, the strict regulations are encouraging the use of renewable fuels, where they are being used for transportation, shipping, and aviation as well.

MEA is expected to grow significantly in the biofuels market during the forecast period, due to its increasing use in transportation. At the same time, the growing industrialization, government policies are also growing their demand. Furthermore, the expanding use in aviation and marine is also increasing their use, where the abundance of feedstock is also contributing to the market growth.

Saudi Arabia Driven by Government Initiatives

The growing government initiatives in Saudi Arabia are driving the utilization of biofuels. This, in turn, is increasing the incentives for biofuels, which are being used for transportation. Additionally, the growing environmental awareness is also increasing their adoption rates.

Biofuels Market Value Chain Analysis

- Resource ExtractionThe resource extraction of biofuels involves the processing of agricultural crops, collecting, and refining waste materials.

Key players: Archer Daniels Midland Company, Wilmar International Ltd. - Power Generation Conversion of organic materials into electricity or heat by direct combustion or gasification processes is included in the power generation from biofuels.

Key players: Cargill, Drax Group, Green Plains Inc. - Regulatory Compliance and Energy Trading The regulatory compliance and energy trading involve certification for sustainability, use of renewable identification numbers (RINs), and low-carbon intensity credits.

Key players: Drax Group, Valero Energy Corporation, Neste Oyj.

Biofuels Market Key Players' Offering

- Abengoa Bioenergy S.A.: The company produces bioethanol, biodiesel, and other chemical bioproducts.

- Cargill: Developed biodiesels and provides agricultural feedstock used in biofuels production.

- DowDuPont, Inc.: Utilizes technologies and enzymes for biofuel production, and supplies feedstock for the same.

- Wilmar International Ltd: The company develops palm biodiesel, ethanol, as well as other oleochemicals.

- Archer Daniels Midland Company: Developed biodiesels and supplies industrial ethanol and biomanufacturing feedstock.

Biofuels Market Companies

- BTG International Ltd

- Renewable Energy Group, Inc.

- Abengoa Bioenergy S.A.

- Cargill

- DowDuPont, Inc.

- Wilmar International Ltd

- POET, LLC

- Archer Daniels Midland Company

- VERBIO Vereinigte BioEnergie AG

- My Eco Energy

- China Clean Energy Inc.

Recent Development

- In July 2025, KATZEN International was commissioned by Be8 S.A. to provide process technology and design services for the second phase of its flagship wheat based ethanol facility in Passo Fundo, Brazil. The facility was anticipated to process 525,000 metric tons of cereals annually and produce 210 million liters of ethanol, DDGS, and vital gluten. ( Source: https://biofuels-news.com)

- In August 2025, Vinci's subsidiaries Group Cobra and Masa won the €1.2 billion contract from Moeve and Apical to deliver the mechanical and piping work at Spain's largest second-generation biofuel facility in Huelva. Once complete, it was expected to produce 500,000 tonnes of sustainable aviation fuel and renewable diesel to significantly reduce CO emissions. ( Source: https://bioenergytimes.com)

- In August 2025, the ABFA report showed EPA's proposed 50% RVO cut would burden biomass-based diesel. The Advanced Biofuels Association wrote a report on the EPA's proposed cut to RIN values of imported feedstocks by 50% and expressed that this would burden the growth of the biomass-based diesel industry.

( Source: https://www.ofimagazine.com) - In July 2025, Platinum Crush joined NOPA to shape the US soy and biofuels future. Platinum Crush, LLC was accepted as a member of the National Oilseed Processors Association. The Iowa-based plant started up in May 2024 and will be making its first soy crush data report starting in August.

( Source: https://biofuels-news.com )

Biofuels MarketSegments Covered in the Report

By Fuel Type

- Biodiesel

- Bioethanol

By Feedstock

- Coarse Grain

- Non-agri Feedstock

- Biomass

- Vegetable Oil

- Sugar Crop

- Jatropha

- Others

By Region

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting