What is the Ethanol MarketSize?

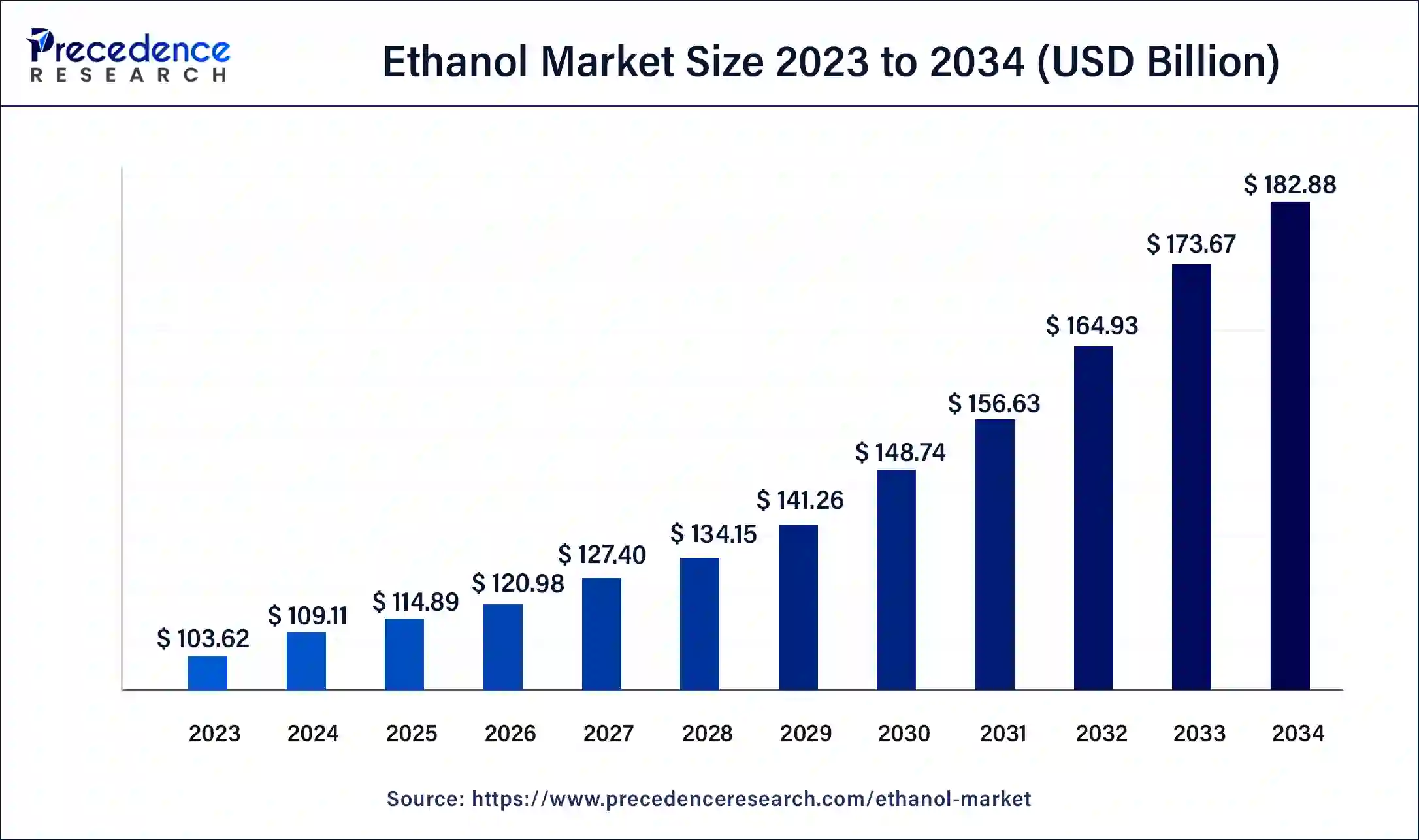

The global ethanol market size accounted for USD 109.11 billion in 2024 and is expected to reach around USD 182.88 billion by 2034, expanding at a CAGR of 5.3% from 2024 to 2034. The North America ethanol market size reached USD 48.70 billion in 2023. Growing consumption of alcoholic beverages and increasing adoption of alcohol-based hand sanitizers are major growth drivers of the ethanol market.

Ethanol Market Key Takeaways

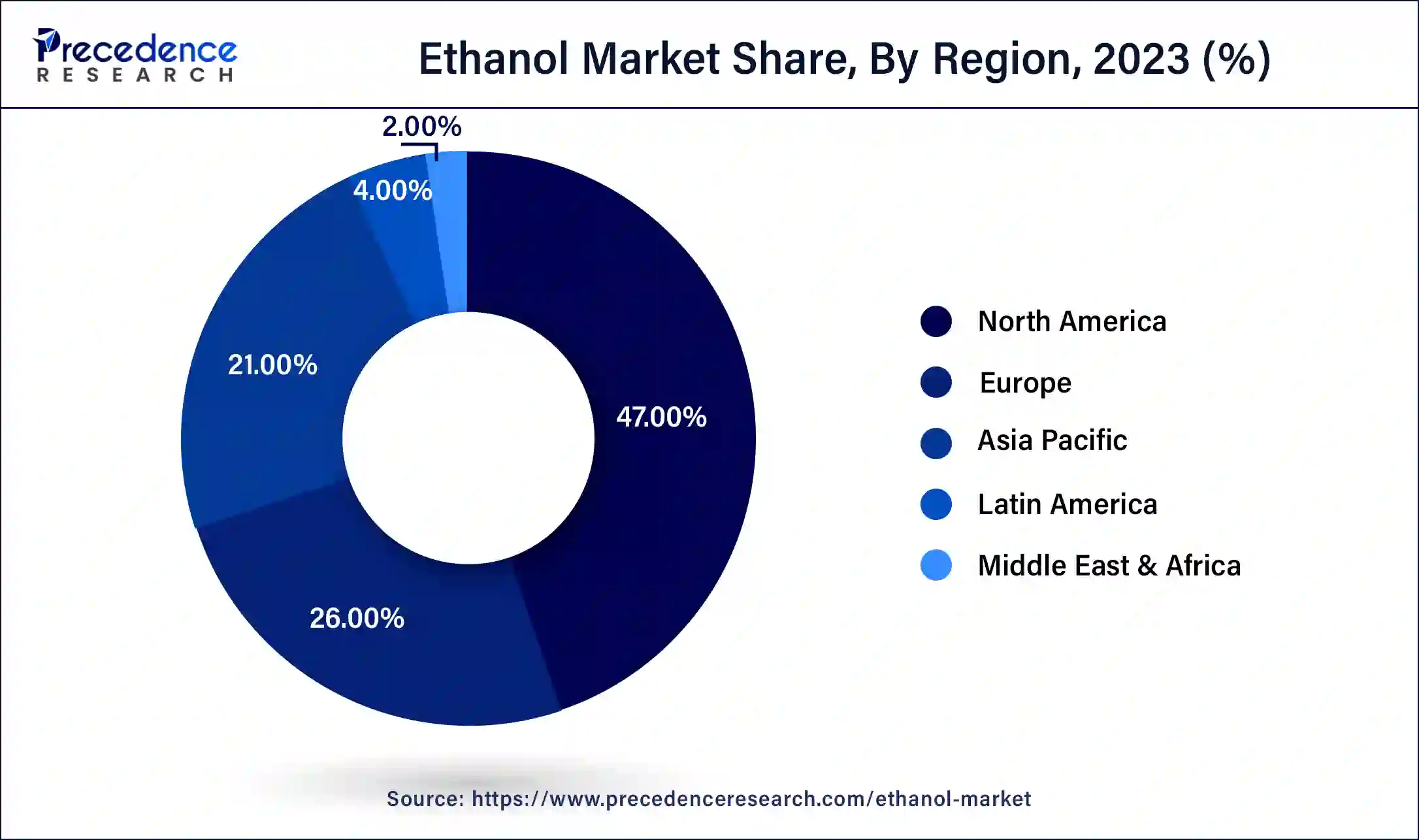

- North America has accounted revenue share of around 47% in 2024.

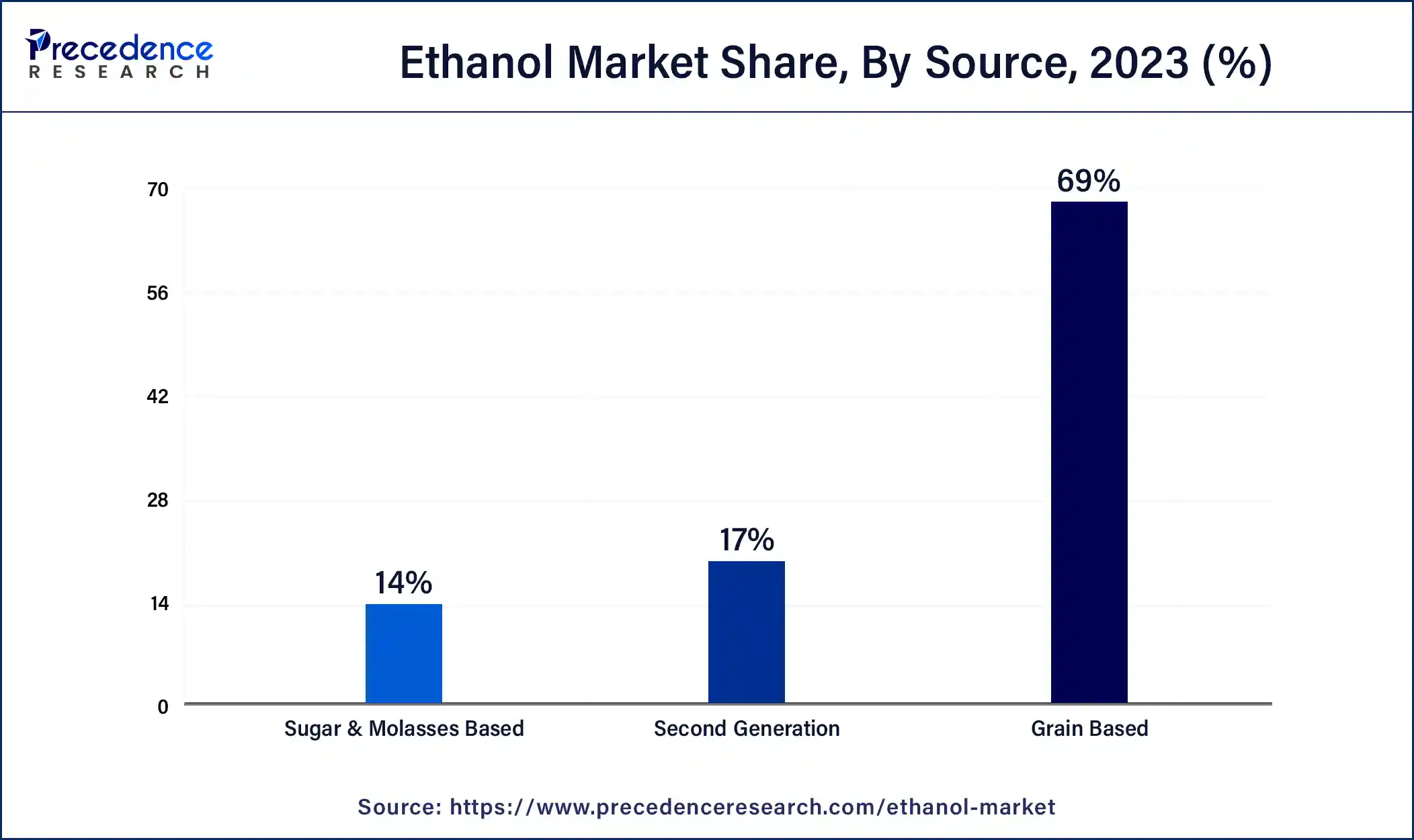

- By source, the grain-based segment captured more than 69% of revenue share in 2024.

- By purity, the denatured alcohol segment is expected to expand at the fastest CAGR from 2024 to 2034.

- The Fuel and fuel additives segment captured more than 45% of revenue share in 2024.

AI in the Market

The ethanol market is revolutionized by automation with livelihood-oriented approaches in the areas of production, feedstock management, and supply chain. It increases fermentation efficiency, saves energy consumption, and controls quality to maintain product standards. Generated by precision agriculture, it maximizes crop yield and promotes the development of better strains for ethanol production. In governance, it can assess internal demand, optimize routes of transportation, and assist in building a stronger supply chain. For sustainability, AI can bring down emissions, reduce waste, and aid in accurate environmental reporting. Automating processes with data analysis guarantees the perfect combination of lower costs, reliability, and great concern for the environment.

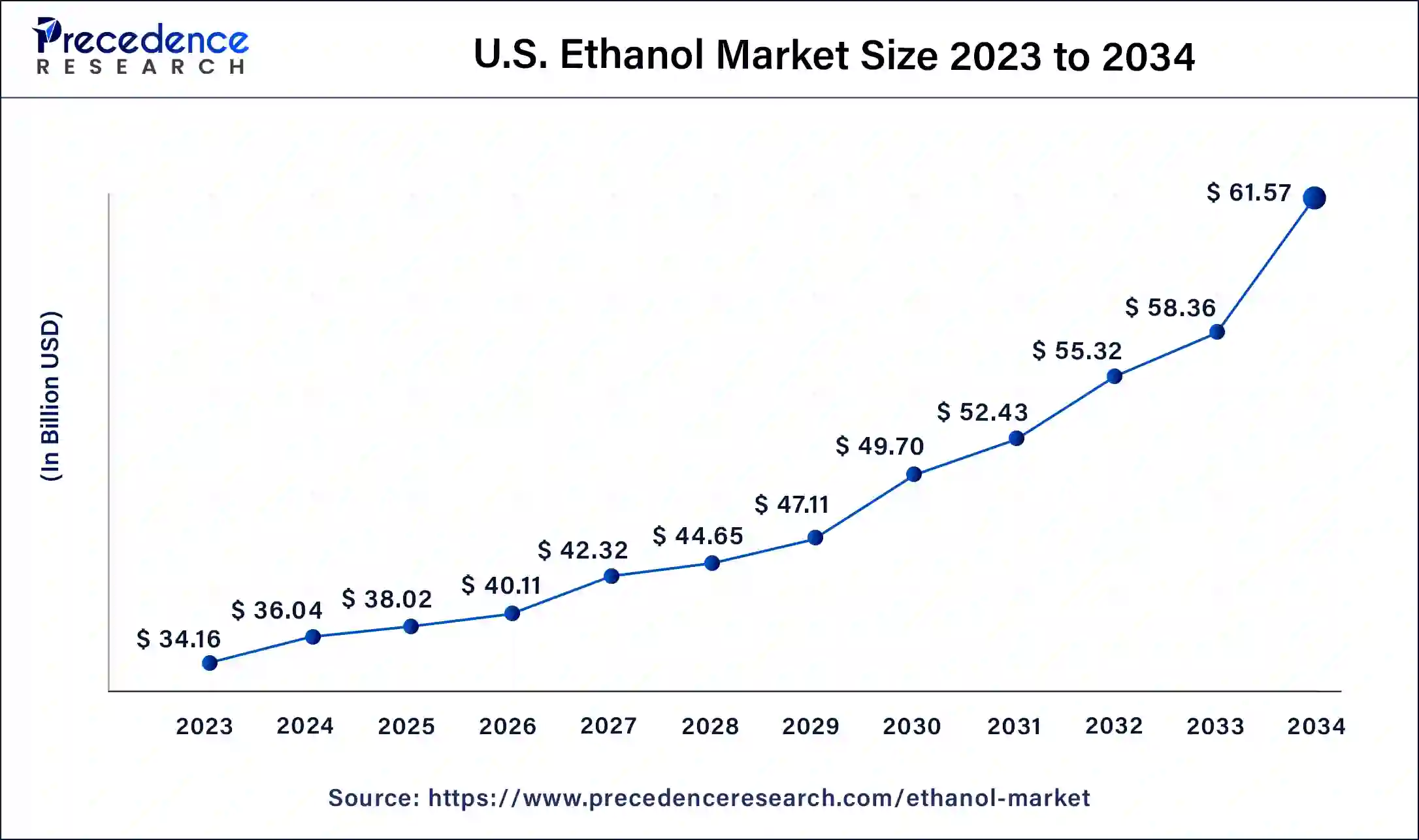

U.S. Ethanol Market Size and Growth 2025 to 2034

The U.S. ethanol market size was recorded at USD 34.16 billion in 2023 and is predicted to be worth around USD 61.57 billion by 2034, at a CAGR of 5.5% from 2024 to 2034.

North America Is Estimated to Be the Largest Market for Ethanol

The research report covers key trends and prospects of ethanol products across different geographical regions including North America, Europe, Asia-Pacific, Latin America, and Middle East and Africa. Geographically, ethanol market is conquered by North America owing to favorable government policies for the production and use of ethanol as biofuel, along with growing awareness regarding environmental pollution control caused due to use of conventional fuels in the countries of the region. Asia Pacific is expected to register the fast growth rate, on account of expanding ethanol manufacturing capacity, coupled with presence of leading companies in the countries of Asia Pacific. Further, availability of the abundant feedstock for ethanol production is major factor responsible for the growth of Latin America ethanol market. Brazil is expected to hold major share in terms of revenue in Latin America ethanol market in the near future owing to growing production and export of ethanol from Brazil.

Market Overview

Emerging applications of ethanol are anticipated to create potential opportunities for the key players operating in global market. Aviation industry is focusing on the research and development of ethanol blended fuels for the overall cost reduction and to reduce carbon emission. Recent applications of ethanol in ignition systems and emission control in transportation sector is expected to generate better opportunities over coming years. Further, outbreak of coronavirus disease has increased usage of ethanol-based hand sanitizers which is supporting global market growth. Centers for Disease Control and Prevention (CDC), recommended usage of ethanol as it is effective in killing microorganisms including bacteria, viruses, and fungi. Further, abundant availability of raw materials for the production of ethanol is developing countries is encouraging major companies to expand their production facility. Moreover, stringent environmental regulations for the use of biofuels are supporting ethanol production. Increasing end use applications in cosmetic industry as solvent and in many household applications are expected to boost target market growth in future.

Ethanol Market Trends

Increasing demand for clean-burning fuel

The major trend that the ethanol market holds is increasing demand for clean burning fuel which does not leave toxic residue while burning, like carbon dioxide. Ethanol is gaining popularity as a biofuel due to its clean burning properties. Growing demand for better fuel efficiency along with minimizing carbon emissions have created significant opportunities for the ethanol market. Ethanol is a more affordable and clean fuel option than any other synthetic fuel. The Brazilian government has taken an initiative to increase the tax on petroleum –based fuels to adopt biofuels like ethanol.

Ethanol offers a cost-effective solution

Ethanol is a cheaper solution than any other conventional petroleum-based fuel, making it stand out as a preferred option in many countries. Ethanol can be easily blendable, and it is produced on a large scale due to its renewable properties, unlike finite sources of oil and coal which are extiguishing and can not be generated manually. Furthermore, ethanol generated can create significant job opportunities for individuals ready to learn skills related to this sector and is propelling the ethanol market globally.

Ethanol MarketGrowth Factors

- Increasing usage of ethanol as biofuel

- Growing consumption of alcoholic beverages

- Increasing adoption of alcohol based hand sanitizers

- Government initiatives for environmental pollution control

- Growing adoption of ethanol as industrial solvent

Market Scope

| Report Highlights | Details |

| Market Size in 2023 | USD 103.62 Billion |

| Market Size in 2024 | USD 109.11 Billion |

| Market Size by 2034 | USD 182.88 Billion |

| Growth Rate from 2024 to 2034 | CAGR of 5.3% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Source Type, Application Type, Purity Type, and Regions |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

Future of Global Ethanol Market

Due to ongoing COVID-19 pandemic, usage of alcohol-based hand sanitizers has been increased. As per the Food and Drugs Administration's policy; ethanol can be used as an active ingredient in the hand sanitizers. So, the leading players operating in the target industry are focusing on increasing production of ethanol in order to get competitive edge in the global market. Further, according to the data published by National Institutes of Health (NIH) in September 2020, COVID-19 can be treated using ethanol vapor inhalation. Combination drug, ethanol with aspirin is intoits 3rd phase of clinical trials and have potential to treat viral diseases. That can have positive impact on the growth of the ethanol industry.

Value Cain Analysis

- Feedstock Procurement: This stage covers the sourcing and acquisition of raw materials for production processes.

Key Players: Cargill and Andersons Inc. - Chemical Synthesis and Processing: Here, the raw materials are converted into the desired chemical compounds through selected chemical reactions and subsequent processing steps.

Key Players: POET, Archer Daniels Midland (ADM) - Compound Formulation and Blending: This entails the mixing and blending of different chemical compounds in specific proportions to achieve a chemical product that possesses all of the desired properties.

Key Players: LyondellBasell and Ineos - Quality Testing and Certification: Here, the characteristics of the chemical product are tested to see if they meet quality standard requirements, and certification is obtained if applicable.

Key Players: SGS, Bureau Veritas, and AmSpec Group - Distribution to Industrial Users: This involves the transportation of the finished product to industrial customers for use in their operations.

Key Players: BPCL, IOCL, and HPCL

Source Insights

Grain based ethanol recorded the prime market share in the global ethanol market by source in 2024. Growing manufacturing of ethyl alcohol using grain-based feedstocks is major factor expected to augment growth of the segment. Sugar & molasses-based source segment is predictable to rise at a noteworthy CAGR during the forecast time-frame. Increased adoption of sugar & molasses-based ethanol as industrial solvent is major factor to raise the share of sugar &molasses-based ethanol in the near future.

Purity Insights

Denatured ethanol is anticipated to dominate the target market by purity during the forecast period 2024-2034. This is due to its growing demand from automotive and household applications worldwide. Denatured ethanol is manufactured mainly from feedstocks like grains, starch. However, undenatured segment is expected to raise at a significant CAGR during the forecast time-frame.

Application Insights

The global market is segregated into industrial solvents, beverages, personal care, fuel & fuel additives, disinfectant, others. The fuel & fuel additives application segment is expected to dominate in terms of revenue over the forecast time frame. Increasing demand form automotive sectors coupled with regulations related to environmental safety in developed as well as emerging economies is expected boost growth of the segment in the near future. Additionally, beverages application segment will expand at a significant CAGR during the forecast time-frame. The growth is attributed to increasing demand for ethanol-based beverages in developed countries across the globe which is in tern fulling growth of the segment.

Ethanol Market companies

- Flint Hill Resources LP

- Braskem

- Andersons Ethanol Group

- Archer Daniels Midland Company

- Cargill Corporation

- Aventine Renewable Energy

- HPCL Biofuels Limited

- Butamax Advanced Biofuels LLC

- Advanced Bioenergy LLC

- British Petroleum

Recent Developments

- In August 2025, Kirloskar Oil Engines Limited (KOEL) introduces new ethanol and isobutanol engine technology for generator applications, the first of its kind globally evaluated by ARAI.

https://manufacturing.economictimes.indiatimes.com - In August 2025, Mahindra unveils E30+ Ethanol fuel-compatible engines with advanced sensors and cold-start tech, enabling real-time monitoring and fuel rail/injector heaters for cold starts.

https://www.news18.com

Segments Covered in the Report

By Source

- Sugar & Molasses Based

- Grain Based

- Second Generation

By Purity

- Denatured

- Undenatured

By Application

- Industrial Solvents

- Fuel & Fuel Additives

- Beverages

- Disinfectant

- Personal Care

- Others

By Region

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting