What is the Fuel Ethanol Market Size?

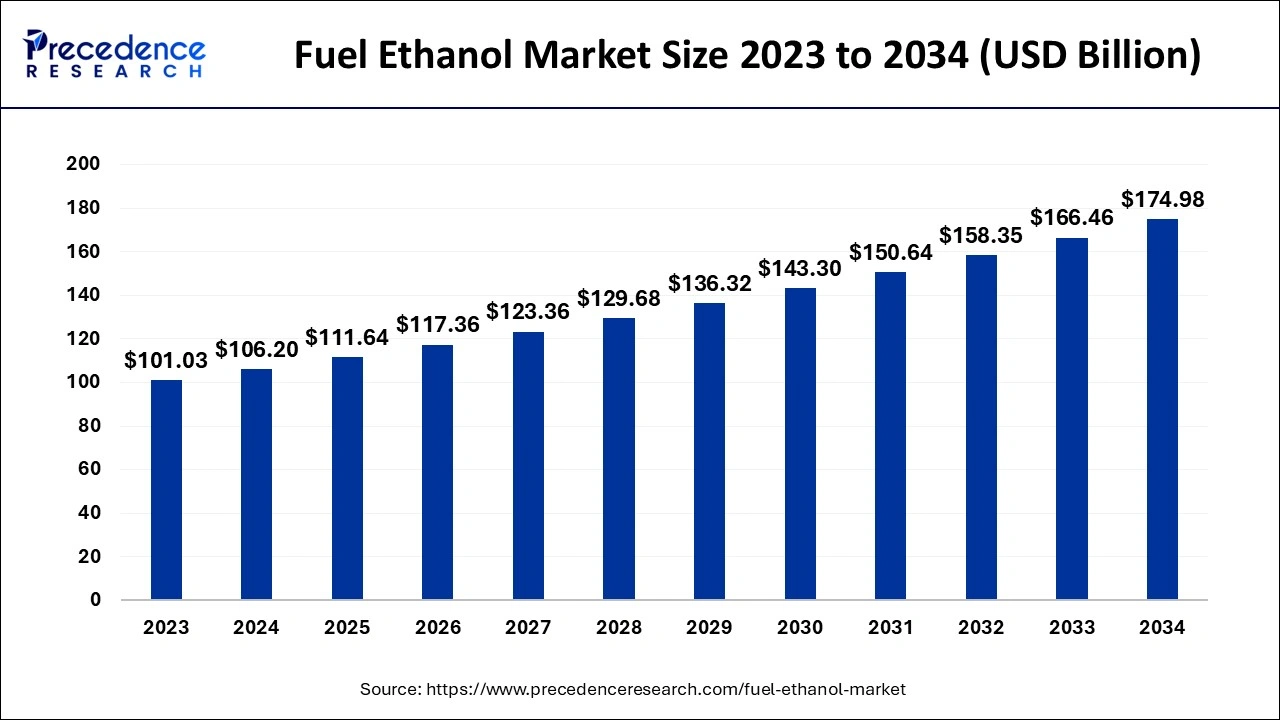

The global fuel ethanol market size is accounted at USD 111.64 billion in 2025 and predicted to increase from USD 117.36 billion in 2026 to approximately USD 183.23 billion by 2035, expanding at a CAGR of 5.08% from 2026 to 2035. The fuel ethanol market growth is attributed to increasing demand for sustainable energy solutions, government-driven renewable energy initiatives, and technological advancements in ethanol production.

Fuel Ethanol Market Key Takeaways

- In terms of revenue, the fuel ethanol market is valued at $111.64 billion in 2025.

- It is projected to reach $183.23 billion by 2035.

- The fuel ethanol market is expected to grow at a CAGR of 5.08% from 2026 to 2035.

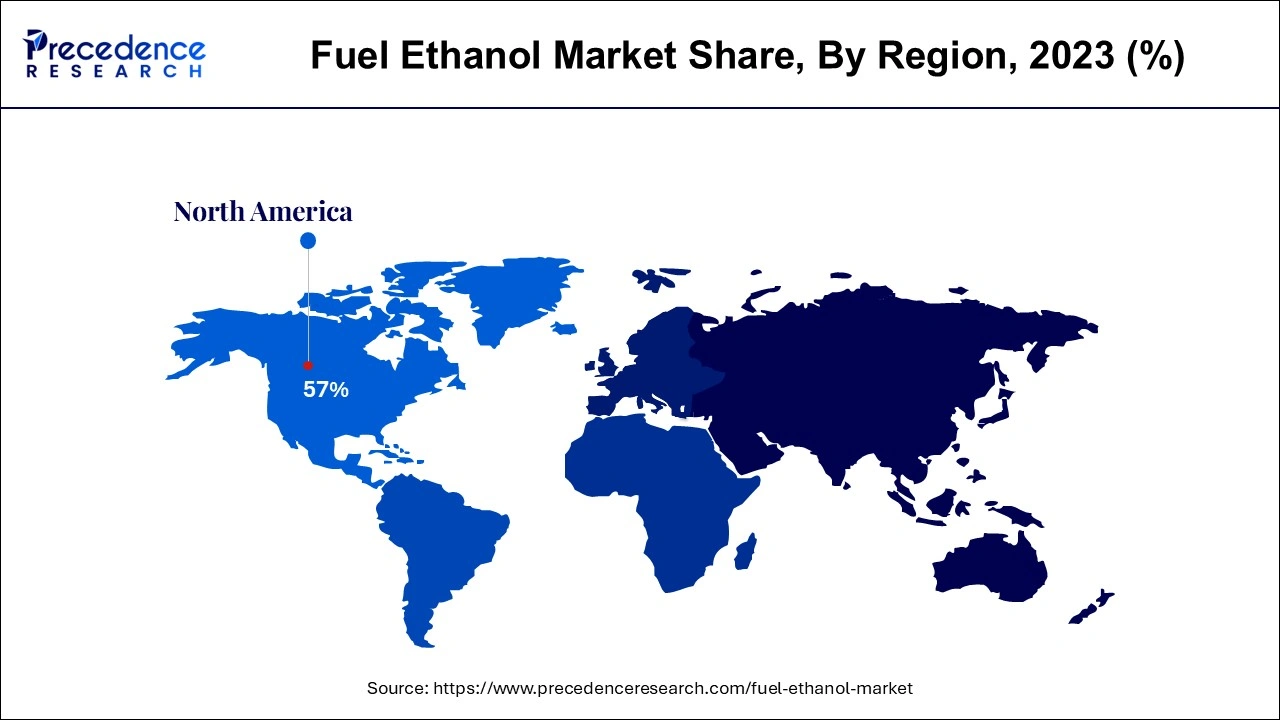

- North America dominated the global fuel ethanol market with the largest market share of 57% in 2025.

- Asia Pacific is projected to host the fastest-growing market in the coming years.

- By product, the starch-based segment contributed more than 76% of the market share in 2025.

- By product, the cellulose segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034.

- By technology, the wet mill segment accounted for the major market share of 91% market in 2025.

- By technology, the dry mill segment is anticipated to grow with the highest CAGR in the market during the studied years.

- By application, the conventional fuel vehicles segment recorded more than 83% of the market share in 2025.

- By application, the flexible fuel vehicles segment is projected to expand rapidly in the market in the coming years.

Impact of Artificial Intelligence on Fuel Ethanol Market

Artificial Intelligence (AI) systems in ethanol production have enhanced decision-making in a variety of aspects, including timing of numerous production processes, cost reduction, and improvement of efficiency in the fuel ethanol market. Current technology helps various algorithms that, in turn, may help producers adapt their production calendar. The use of automation through the adoption of AI in ethanol plants has cut down on many errors that would have been made by human personnel and, at the same time, increased production rates. Additionally, this technology is instrumental in enhancing the supply chain logistics by acting as a forecaster of the demand for various products.

Market Overview

There is increased concern for renewable sources of energy fuelling the growth of the fuel ethanol market. The governments of nations around the world are incorporating stiffer standards for renewable energy and comprehensive targets for cutting back on carbon output. There is the U.S. Renewable Fuel Standard (RFS) program, where biofuels, including ethanol, have to be mixed with gasoline, and volume is set in the coming years.

- The EU RED II demands that the share of biofuels, including ethanol, be at least 14% of energy utilized in the transport sector by 2030.

This is likely to force efficiency improvements in production technologies, particularly in cellulosic ethanol production, which is produced from animal waste and crop residues. Furthermore, the emergence of wet and dry milling is improving productivity and costs, hence positioning ethanol in the appropriate place in the market as a renewable source of energy.

The fuel ethanol market is witnessing a remarkable shift as sustainability, energy security, and innovation align to promote cleaner alternatives to fossil fuels. A prominent trend is the increasing blend mandates set by governments worldwide to reduce carbon emissions in the transportation sector. Blended fuels are gaining traction, particularly in passenger vehicles and commercial fleets. Another key trend is the technological enhancement in ethanol production, especially second-generation bioethanol derived from agricultural residues, which offers a sustainable solution without compromising food sources. The integration of digital tools and AI for process optimization, alongside the expansion of bio-refineries, is positioning fuel ethanol as a vital component in the future of low-emission mobility.

Fuel Ethanol Market Growth Factors

- Rising government mandates for renewable energy: Countries are increasingly enforcing renewable energy standards, driving demand for ethanol in transportation fuels.

- Technological advancements in biofuel production: Innovation in second and third-generation biofuels, such as cellulosic ethanol, is expanding ethanol's market potential.

- Growing consumer preference for eco-friendly fuels: A shift toward cleaner, renewable energy sources is encouraging greater ethanol consumption in the automotive sector.

- Expansion of ethanol blending requirements: Increasing ethanol blend limits in gasoline, such as the adoption of E15 and E85, is fuelling market growth.

- Investment in infrastructure for ethanol production and distribution: Enhanced infrastructure in both developed and emerging markets is enabling easier access to ethanol fuel.

- Government subsidies and incentives for ethanol producers: Financial support for the biofuel sector, especially in countries like the U.S. and Brazil, is stimulating production capacity.

- Increased adoption of ethanol in the chemical and industrial sectors: Ethanol is increasingly being used as a feedstock for producing bio-based chemicals, expanding its market beyond transportation.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 183.23 Billion |

| Market Size in 2026 | USD 117.36 Billion |

| Market Size in 2025 | USD 111.64 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 5.08% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Technology, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, & Africa |

Market Dynamics

Driver

Increasing demand for clean energy

Increasing demand for clean energy is expected to drive the growth of the fuel ethanol market. The fundamental factor affecting the development of ethanol production is the growing need for environmentally friendly energy sources as governments and industries of the world turn to unleashing pollutants in the atmosphere. This shift emphasizes biofuels, such as ethanol, which is considered a safer fuel than fossil fuels.

- The United States Environmental Protection Agency (EPA) has lately established new Renewable Fuel Standards RFS for 2023-25 that set biofuel volumes that will actionize a fresh U.S. energy security coverage able to decrease dependence on foreign crude by 130,000 to 140,000 barrels per day approximately.

Many nations have long-term targets for the use of renewable energy sources, which creates more demand for ethanol as a key player in the fuel ethanol market shift toward these targets. Furthermore, according to IEA, ethanol is on the rise, and many countries, including Brazil and India, are in the process of boosting the production of ethanol as an essential part of long-term renewable energy strategies.

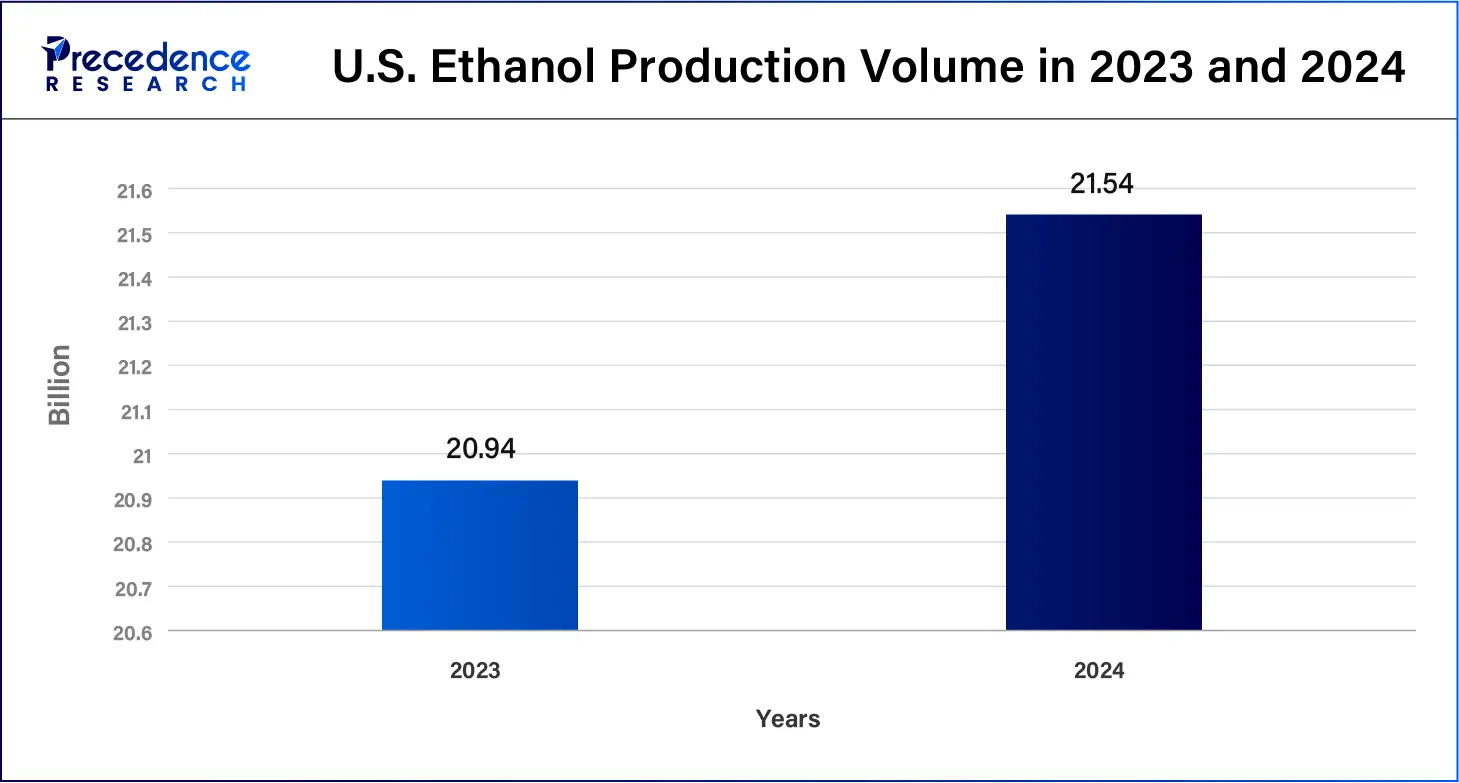

Ethanol Production and Global Renewable Energy Share (2023-2024)

| Year | Renewable Energy Volume (in billion gallons or percentage) | Focus on Renewable Energy |

| 2023 | 20.94 billion gallons of ethanol are projected to be used as a renewable fuel standard in the U.S | Increased volume in renewable fuel targets. |

| 2024 | 21.54 billion gallons of ethanol are projected to be used as a renewable fuel standard in the U.S. | Growth in biofuel adoption across the U.S. |

| 2023 | Over 15% of global energy is from renewable sources, primarily ethanol in transportation. | Global shift towards renewable energy sources. |

| 2024 | Aiming for 20% renewable energy share globally by 2024. | Increased government incentives for clean energy. |

| 2023-2025 | Steady growth in U.S. ethanol from 20.94 billion gallons to 22.33 billion gallons. | Regulatory targets driving renewable energy integration. |

| 2024 | India aims to blend 10% of its ethanol in fuel. | Focus on biofuel development as part of renewable targets. |

| 2023-2024 | Brazil's ethanol production growth is forecasted at 5% per year. | Continued investments in ethanol as part of the renewable energy transition. |

Restraint

Limited infrastructure for ethanol distribution

The lack of ethanol distribution and retailing infrastructure is hindering the fuel ethanol market. Ethanol needs specialized fuel pumps, storage tanks, and transport in a way that is sometimes unavailable in parts where traditional fossil fuel rules the market. Although RFA has reported major achievements in ethanol infrastructure in the United States, there is still limited achievement in rural and developing regions where there is a slow rate in the use of ethanol-blended fuel. The limitation in distribution structure is believed to inhibit the expansion of alcohol usage progressively worldwide, especially in regions where infrastructure is yet to be enhanced. This causes a slowing down of the change to cleaner biofuels, mostly in those countries that are in development.

Opportunity

High governmental support for ethanol blending

Supportive governmental policies and subsidies are expected to create immense opportunities for the players competing in the fuel ethanol market in the coming years. Governments around the world are providing strong policy support for ethanol blending into gasoline. Second-generation biofuels, notably cellulosic ethanol, are also being invested in assets as part of the shift from food crops-based feedstock. These fuels are derived from crop residues from agriculture or forestry and are far better options than first-generation bioethanol.

In the United States, bioenergy is being developed with the objective of replacing first-generation biofuels through investment in the Department of Energy, which supports several cellulosic ethanol projects. Additionally, through the Higher Blends Infrastructure Incentive Program (HBIIP), which is part of the Biden-Harris administration, the authorities are supporting the introduction of facilities for biofuel ethanol blending.

- The U.S. Department of Agriculture (USDA) has also been progressively financing efforts to ensure the development of the infrastructure of biofuels, including cellulosic ethanol. The USDA has committed over USD 180 million to more than 200 projects supporting biofuel production in the region.

Product Insights

The starch-based segment held a dominant presence in the fuel ethanol market in 2025, as it has inherited production facilities and feedstock ability. The U.S. DOE (Department of Energy) supports the growth of corn-based ethanol through a number of subsidies and tax credits. Moreover, the EPA has other policies regardingrenewable fuels, such as making ethanol to help achieve greenhouse gas reduction goals. The increased global focus on the need for biofuels, especially in the transport sector, further boosts the need for corn-based ethanol.

- In 2023, approximately 94% of the U.S. ethanol production was from corn due to programs, such as the Renewable Fuel Standard (RFS), that promote the use of these renewables.

The cellulose segment is expected to grow at the fastest rate in the fuel ethanol market during the forecast period of 2024 to 2034, owing to the enhancement in government support policies, increasing technology application, and raising awareness of environmental issues. Additionally, there is a growing focus on the commercialization of renewable fuels in the automotive sector.

- In 2023, the U.S. DOE continued to support several projects that aim to develop cellulosic ethanol production technologies with few biological and chemical conversion processes. The DOE's Bioenergy Technologies Office (BETO) is directing USD 11 million towards five new cellulosic ethanol initiatives.

Technology Insights

The wet mill segment accounted for a considerable share of the fuel ethanol market in 2025 due to its higher efficiency in starch extraction. This method results in higher production of ethanol per bushel of the feedstock than dry milling. This feature is relatively advantageous in regions such as the United States, where corn is the feedstock. Wet mill technology has been preferred for large centralized ethanol production plants for the production of other valuable byproducts, such as corn gluten feed and corn oil, appealing to the animal feeds and biodiesel segments, respectively.

As claimed by the U.S. Department of Energy, more than one-third of total ethanol production in 2023 is contributed by wet mill plants in the U.S., primarily due to government policies, such as the Renewable Fuel Standard (RFS).

The dry mill segment is anticipated to grow with the highest CAGR in the fuel ethanol market during the studied years, owing to the fact that lesser capital expenditure is needed in dry milling than in wet milling. Cry mills were established, mainly in the United States of America and Brazil, since they are cheaper to set up for small to medium-scale farmers. Furthermore, growing global consumption of bioenergy, such as ethanol, used in cars instead of gas due to the effects of climate change further fuels the segment.

- The U.S. Energy Information Administration observes that trends in dry milling show that by 2023, the general ethanol production in the United States will approach 70% of the total amount produced using this technique. This growth can especially be attributed to the lower energy requirements of dry milling and a generally lower cost of production.

Application Insights

The conventional fuel vehicles segment led the global fuel ethanol market, as standard ethanol blended with gasoline is E10 (having 10% ethanol and 90% gasoline) and E15, which do not cause compatibility issues with most conventional fuel vehicles. The mechanisms include mandates by governments, such as the renewable fuel standard that has greatly boosted ethanol utilization in regular cars since automakers meet the specified blending rates. The previously established infrastructure for fuelling stations that provide ethanol-blended gasoline, on the other hand, also contributes to market domination by conventional fuel vehicles.

The flexible fuel vehicles segment is projected to expand rapidly in the fuel ethanol market in the coming years, owing to the growing customer preference for cars that produce fewer emissions and OEMs' higher emission standards set by different governments. The positive outcome is shown in the countries that use this technology, such as Brazil, and similar trends have increased in countries, including the United States and India, where FFVs are beginning to become popular. Furthermore, the continuous advancement of higher ethanol blends strengthens the growth of the FFV segment, as this vehicle uses ethanol concentrations without affecting engine efficiency.

- The Office of Energy in the United States has observed that the number of FFVs in the United States reach more than USD 20,000,000,000 by 2023, and the use of E85 is predicted to increase with ethanol production and availability of FFVs.

Feedstock/ Type Insights

The starch-based segment held the largest share of 62.80% in the 2025 global fuel ethanol market. The segment is highly ruling over the fuel ethanol production as an essential feedstock in the market. The wheat, barley and corn are the significant source centre point in the fuel ethanol process. Though the process is excellently developed but the development is fuelled by the latest initiative towards enhancing efficiency volume, identifying challenges that escalate to food versus fuel competition. The segment is evolving into this market due to its rich existence as a critical carbohydrate, serving as the initial raw material for production.

The cellulose-based (lignocellulosic) segment is expected to grow at a CAGR of 12.60% during the forecast period. The development structure of this segment is called as the second generation (2G) biofuel. This is a huge shift in the advancement of the global fuel ethanol market. The energy crops (miscanthus, switchgrass), forestry and agricultural residues play a major role in the segment as it tries to identify food security conflicts and sustainability concerns arising from edible crops such as sugarcane and corn. With the fine extraction, the 2G ethanol provides various environmental benefits.

Production Technology Insights

The dry milling segment held the largest share of 78.40% in the 2025 global fuel ethanol market. The dry milling production technology accelerates with its peaked ethanol yields and its reduced capital cost in comparison to the optional wet milling process. The segment is held responsible for its massive grain-based fuel ethanol production. It's mainly equipped in the United States. The development is on scaling the value and enhancing the efficiency of its co-products like distillers' grains. The segment is a hassle-free one-shot method engineered for increasing ethanol output from the whole grains.

The wet milling segment is expected to grow at a CAGR of 7.10% during the forecast period. The segment plays a fundamental role in the global fuel ethanol sector with its separation and smart effectiveness of corn kernels into the double value-added co-products such as gluten meal, starch and oil prior to the fermentation of starch into ethanol. The wet milling is convenient for small-scale production. The major development involves the scalability of the relatable plants falling under this segment's operation.

End-use industry Insights

The automotive and transportation segment held the largest share of 64.90% in the 2025 global fuel ethanol market. The automotive and transportation industries have been leading ahead with the rising demand for travel spacious comfort. The segment is the main reason for the elevation of technological innovation, infrastructure extension as a development in the market. Promoting the renewable fuel the ethanol is highly blended with gasoline to mitigate dependence on fossil fuels and to meet rigorous emission standards. This has raised the demand for fuel ethanol in this segment.

The aerospace segment is expected to grow at a CAGR of 10.10% during the forecast period. The segment is mainly boosting the establishment of ethanol-related sustainable aviation fuels (SAF). The aerospace industry largely opts for SAF for decarbonising flight, accelerating its investment and technical potential to add these biofuels into its existing infrastructure setting. The fuel producers closely work with aerospace industries, along with engine manufacturers and aircraft, to qualify new SAF pathways to accelerate the global fuel ethanol sector.

Distribution Channel Insights

The direct sales segment held the largest share of 57.30% in the 2025 global fuel ethanol market. For direct sales of the fuel ethanol, need for expert-level knowledge and a team in biofuel production, the potential to map critical market regulations and comprehensive B2B sales skills. The segment is emerging with the accelerating demand for renewable fuels. This demand has unlocked new career opportunities and has largely moved the sales strategies brilliantly in the technological space. Alongside, the promotion of sustainability via messaging and global collaborations has been fruition for the direct sales distribution platform.

The in-direct sales segment is expected to grow at a CAGR of 8.20% during the forecast period. The indirect sales mainly focus on constructing collaboration with the oil marketing companies (OMCs), distributors, etc. The companies act as a middle person to reach to the end users. The career development under this segment has been making headlines, focusing on international trade, revolutionary supply chain technologies and government renewable energy mandate (specific products).

Regional Insights

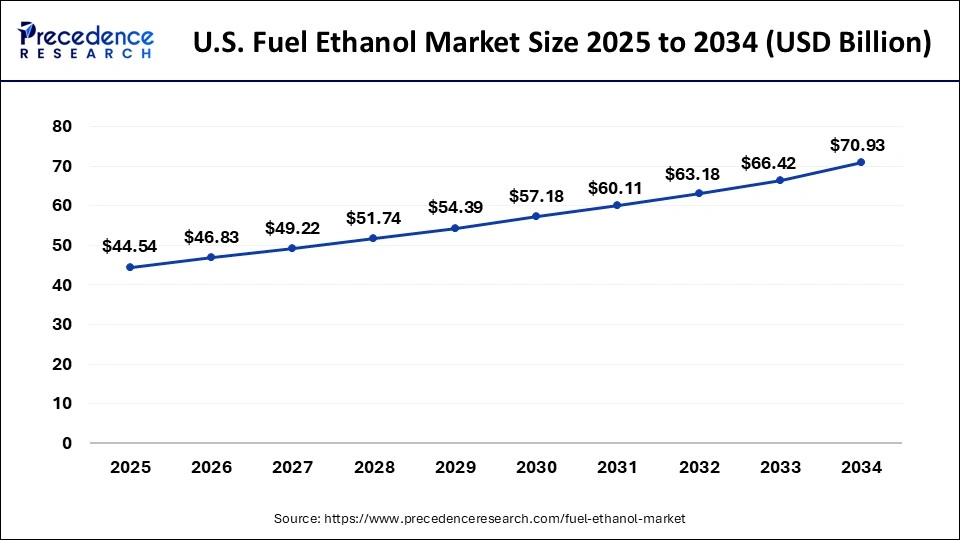

U.S. Fuel Ethanol Market Size and Growth 2026 to 2035

The U.S. fuel ethanol market size is exhibited at USD 44.54 billion in 2025 and is projected to be worth around USD 75.44 billion by 2035, growing at a CAGR of 5.41% from 2026 to 2035.

North America dominated the global fuel ethanol market in 2025, owing to government support, developed infrastructure, and a large agricultural sector. Production policies, such as the renewable fuel standards, require the inclusion of renewable fuel in gasoline, which supports ethanol production and distribution. The largest use of ethanol is blending with gasoline to act as an oxygenate to reduce emissions.

North America remains the dominant force in the global fuel ethanol market, driven by a robust policy environment and a mature biofuel infrastructure. The United States stands as the world's leading ethanol producer, thanks to its vast corn reserves and long-standing support through the Renewable Fuel Standard (RFS), which mandates biofuel blending into gasoline. The Environmental Protection Agency (EPA) regularly revises blending quotas, incentivizing production. Canada follows closely with initiatives such as the Clean Fuel Standard (CFS), aiming to reduce carbon intensity across transportation fuels.

The regional market contributes significantly due to supportive government policies, large-scale agricultural production, established refining infrastructure, and strong domestic demand from the automotive sector. The continued investment in research for cellulosic ethanol, favourable tax incentives, and public-private partnerships further enhance their leading status in the global ethanol market.

Asia Pacific is projected to host the fastest-growing fuel ethanol market in the coming years, owing to the rising urbanization and industrial development in countries such as China, India, and Thailand. National and local administrations promptly pursue biofuel strategies to control emissions and decrease external oil dependence, justified by an international commitment to ecological protection.

Asia Pacific is emerging as the fastest-growing market for fuel ethanol, driven by rising energy demands, environmental concerns, and policy reforms aimed at cleaner fuels. China, India, Thailand, Indonesia, and Australia are spearheading efforts to scale ethanol production, often using diverse feedstocks such as sugarcane, cassava, and broken rice. In this region, governments are rolling out ambitious ethanol blending targets. Recent developments include the expansion of ethanol distilleries, foreign investments, and state-supported pilot programs focused on second-generation ethanol. The region is also seeing a rise in ethanol-compatible vehicle production, supporting the transition from conventional to renewable fuels.

- The India government is pushing to achieve 20% ethanol blending (E20) by 2025.

- India's National Biofuel Policy has set a target to ensure 20% ethanol blended with gasoline by 2025, which is up from current levels. This growth is expected to strengthen the demand for ethanol as governments put in place enabling policies to enable renewable energy goals to be met.

What are the Advancements in the Fuel Ethanol Market in Europe?

Europe is expected to grow at a significant rate over the forecast years. This growth can be attributed to the rise of various technological innovations that are enhancing the quality and production process of ethanol, as well as improving the sustainability during the production processes. European governments are seen offering various support mechanisms and implementing policies to promote ethanol production and use, thus pushing the market forward.

Germany Fuel Ethanol Market Trends: Germany is growing at a steady rate due to good government support and their policies regarding rising greenhouse emissions. Consumption and production of bioethanol have both risen in recent years, supported by stronger sales of E10 at service stations and slight increases in domestic ethanol output.

What are the Key Trends in the Fuel Ethanol Market in Latin America?

Latin America is set to experience substantial growth throughout the forecast years. The region's abundant agricultural resources, particularly sugarcane and corn help to provide a strong foundation for ethanol production. Countries such as Brazil and Mexico are leading players in the region as they are leveraging advanced technologies and favorable policies. The increasing demand for cleaner fuels along with government incentives helps to boost the market even more.

Brazil Fuel Ethanol Market Trends: Brazil remains the largest market for ethanol, in the region due to its extensive sugarcane production. Technological advancements in production processes are also further enhancing efficiency. Key market drivers include increasing energy security and consumer preferences for renewable energy sources.

How is the Middle East and Africa Region Growing in the Fuel Ethanol Market?

The Middle East and Africa are expected to witness a steady growth rate in the upcoming years, due to growing environmental awareness among the public. Rising ethanol blending mandates, government incentives, increased sugarcane production, expanding biofuel infrastructure, demand for cleaner fuels, and investments in ethanol plants are more market drivers. Regions like South Africa also have an abundance of sugarcane, corn, and sorghum cultivation, providing high levels of feedstock for ethanol production.

South Africa Fuel Ethanol Market Trends: The temperate climate and diverse landscape across the region support market growth. Various government initiatives have also helped the region grow, thereby fueling the market growth positively.

Fuel Ethanol Market-Value Chain Analysis

- Raw Material Sourcing

Raw materials like corn, wheat, or sugarcane are sourced and prepared here. Yeast is added to the prepared feedstock to convert sugars into ethanol and carbon dioxide.

Key Players: ADM, Cargill, Bunge - Manufacturing Process

This stage involves processes such as milling, enzymatic hydrolysis, distillation, and dehydration to ensure the purity of ethanol.

Key Players: Green Plains, Raizen, Valero - Distribution Process

In this stage, the finished ethanol is distributed through various channels, such as direct sales, distributors, and wholesalers. This ensures that ethanol reaches the end-users, such as vehicles, in a timely and efficient manner.

Key Players: ExxonMobil, Chevron, Total Energies

Fuel Ethanol Market Companies

- Solvay SA

- Sasol Limited

- SABIC

- Mitsubishi Chemical Corporation

- LyondellBasell Industries Holdings BV

- INEOS Group Limited

- HPCL Biofuels Limited

- Cargill Incorporated

- Braskem S.A.

- BP Plc

Recent updates on fuel ethanol

Technological advancements transforming ethanol production

- On 15 March 2025, Significant technological developments are occurring in the fuel and bio-based ethanol. In line with the objectives of global sustainability, these innovations seek to improve production efficiency and lessen their negative effects on the environment. To address concerns about food security and advance the ideas of the circular economy, emerging technologies are concentrating on using non-food biomass and waste materials to produce ethanol.

Emerging trends emphasize sustainability and global trade dynamics

- On 5 April 2025, Global trade dynamics and a shift towards sustainable practices are being observed in the market. Trade agreements are affecting the imports and export trends of ethanol, and nations are putting policies into place to support the biofuel domestic ethanol industry. For example has been affected by recent trade agreements that have changed tariff structures increasing competition and requiring local producers to make strategic adjustments.

Latest Announcements by Industry Leaders

- June 11, 2024 – Indian Oil Corporation Ltd

- Union Minister for Petroleum & Natural Gas and Housing and Urban Affairs - Mr. Hardeep Singh Puri

- Announcement- Union Minister for Petroleum & Natural Gas and Housing and Urban Affairs launched ‘ETHANOL 100', a revolutionary automotive fuel, at the IndianOil retail outlet M/s. Irwin Road Service Station in New Delhi today. Customers can purchase ETHANOL 100 at 183 select retail outlets of IndianOil across five states: Maharashtra, Karnataka, Uttar Pradesh, New Delhi, and Tamil Nadu. He stated, “This initiative reflects the government's commitment to reducing import dependency, conserving foreign exchange, and boosting the agricultural sector. Since the Hon'ble Prime Minister's announcement on E20 (20% ethanol blended fuel) in 2023, the availability of E20 has increased to 12,000 outlets in less than a year.

Recent Developments

- On 10 January 2025: Karnataka's State Bio-Energy Development Board in India is actively implementing its 2025-26 biofuel policy, focusing on enhancing energy security and environmental sustainability. Initiatives include collaborations with German universities to promote global cooperation in biofuel production and the inauguration of biofuel-powered vehicles and biogas plants.

- On 21 February 2025: China and Brazil have signed a trade agreement allowing the export of Brazilian distillers' dried grains (DDGs), a by-product of ethanol production, to China. This move diversifies China's import sources and strengthens Brazil's position in the global ethanol market.

- On 25 March 2025: The UK and US have entered a trade agreement eliminating tariffs on American ethanol imports into the UK. While this benefits US exporters, UK bioethanol producers express concerns over increased competition and potential threats to domestic production.

- In July 2024, Stellantis, the global carmaker behind brands, including Fiat, Peugeot, and Jeep, announced a groundbreaking USD 6 billion investment in ethanol-based bio-hybrid engines. This move will enhance flexibility and sustainability in the automotive sector, using a combination of ethanol and electric power in new bio-hybrid models. The engines will be produced in Brazil, where ethanol is already a widely adopted fuel, marking a major step toward cleaner transportation technologies.

- In August 2024, Gevo, a company focused on renewable fuels, launched a strategic partnership with major biofuel producers to develop sustainable ethanol. The initiative aims to scale up the production of renewable ethanol to meet the growing demand for low-carbon alternatives in aviation and transportation. This partnership is expected to drive the commercial success of sustainable ethanol in various industries.

- In September 2024, POET, a leading biofuel producer, expanded its bioethanol production capabilities with a new facility designed to meet increasing market demand. The expansion focuses on producing higher volumes of ethanol from renewable resources like corn, helping reduce the carbon footprint of the fuel industry and further solidifying POET's position in the renewable energy sector.

Segments Covered in the Report

By Feedstock / Type

- Starch-Based

- Corn

- Wheat

- Barley

- Sugar-Based

- Sugarcane

- Sugar beet

- Molasses

- Cellulose-Based (Lignocellulosic)

- Agricultural residues

- Forestry residues

- Energy crops (e.g., switchgrass, miscanthus)

- Others

- Cassava

- Sorghum

- Potato

By Production Technology

- Dry Milling

- Wet Milling

By End-Use Industry:

- Automotive & Transportation

- Power & Energy

- Pharmaceuticals

- Food & Beverage

- Chemicals

- Personal Care & Cosmetics

- Aerospace

By Distribution Channel:

- Direct Sales

- In-Direct Sales

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting