What is the Water As A Fuel Market Size?

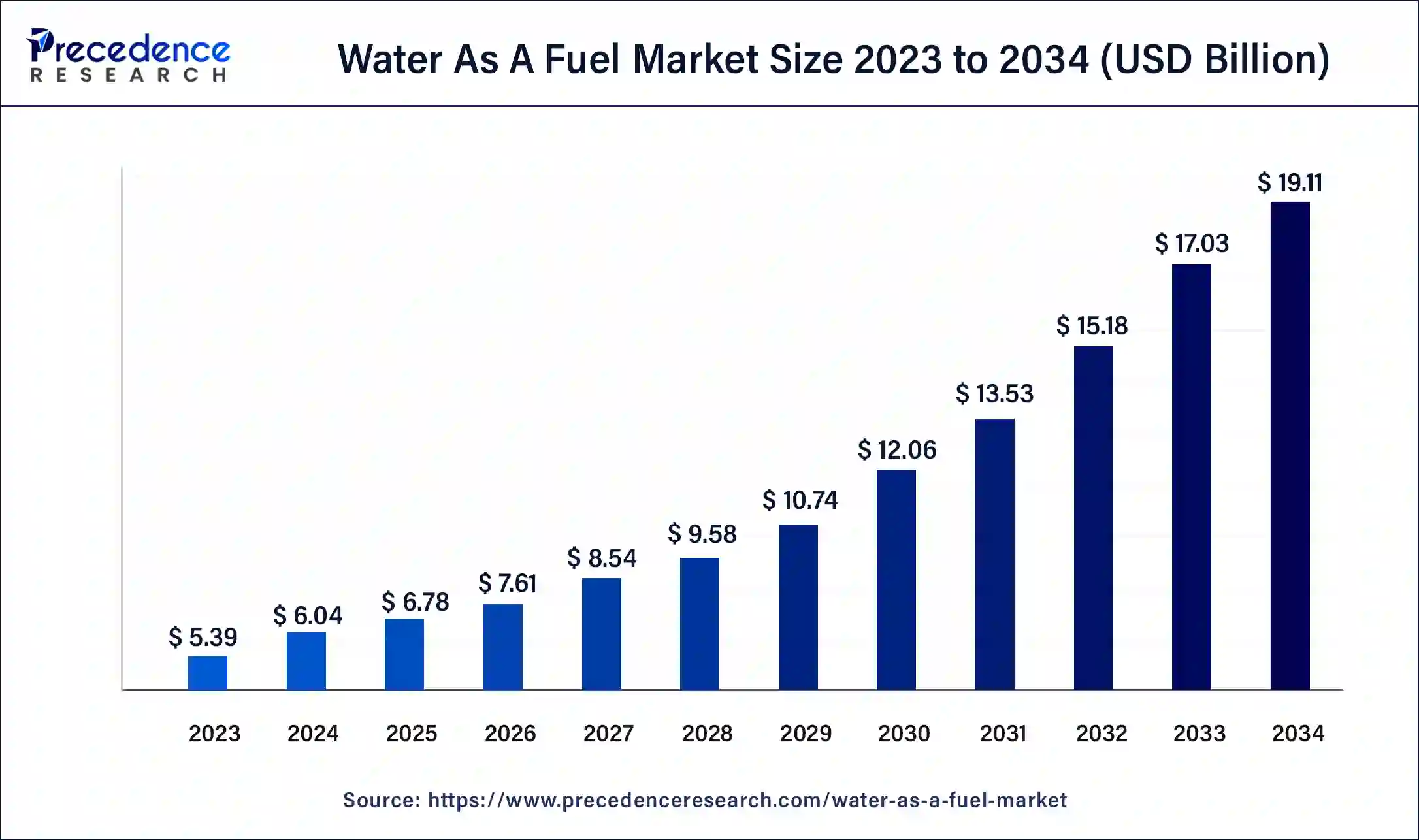

The global water as a fuel market size is valued at USD 6.78 billion in 2025 and is predicted to increase from USD 7.61 billion in 2026 to approximately USD 19.11 billion by 2034, growing at a CAGR of 12.2% over the forecast period 2025 to 2034.

Water As A Fuel Market Key Takeaways

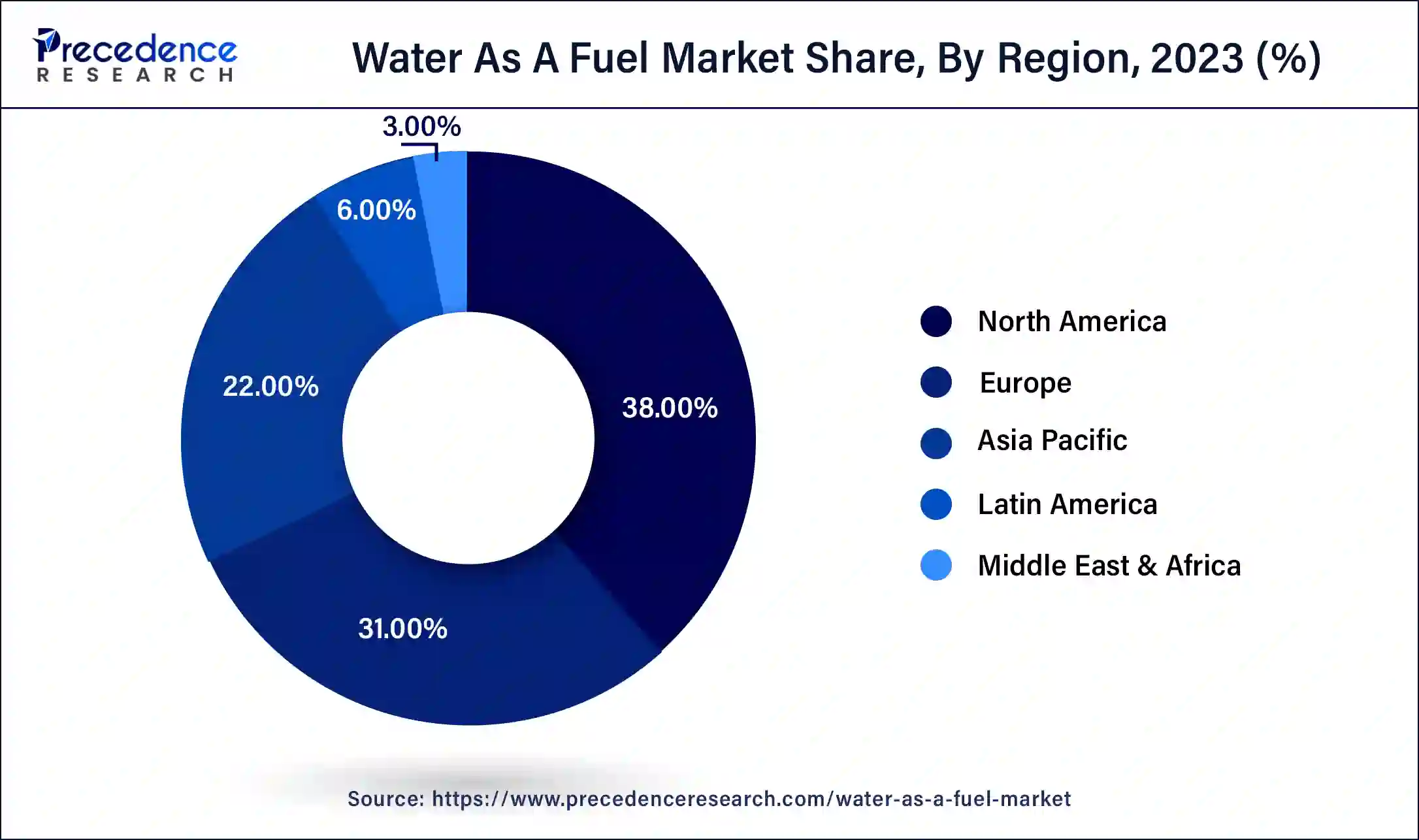

- North America contributed the highest market share of 38% in 2024.

- The Asia-Pacific region is estimated to expand the fastest CAGR between 2025 and 2034.

- By fuel type, the hydrogen segment has held the largest market share of 56% in 2024 and anticipated to grow at a remarkable CAGR of 13.1% between 2025 and 2034.

- By technology, the natural gas reforming segment generated highest market share of 59% in 2024.

- By technology, the electrolysis segment is expected to expand at the fastest CAGR of 12.8% over the projected period.

- By end-use industry, the automotive segment generated the highest share of 41% in 2024.

- By end-use industry, the manufacturing segment is expected to expand at the fastest CAGR of 12.6% over the projected period.

How is water used as fuel?

Water itself is not a fuel, but it can be used as a source of hydrogen, which can then be used as a fuel. Hydrogen can be generated through an electrolysis process, which includes breaking water (H2O) into its constituent elements, hydrogen (H2) and oxygen (O2), using an electric current. The resulting hydrogen gas can be used as a fuel in various applications, such as powering fuel cell vehicles or generating electricity. The overall process can be clean and sustainable when the electricity used in electrolysis comes from renewable or low-carbon sources, making hydrogen a potentially green energy carrier.

The water as a fuel market encompasses the technologies, equipment, and infrastructure associated with the production, distribution, and utilization of hydrogen as a fuel source, where water serves as the starting material for hydrogen production. The market has gained attention due to the prospective for hydrogen to play a substantial role in clean energy and transportation, decreasing greenhouse gas emissions and dependency on fossil fuels.

Water As A Fuel Market Growth Factors

- Clean energy transition: The global shift towards cleaner and more sustainable energy sources to combat climate change is a major driver. Hydrogen produced from water using renewable energy sources, such as wind and solar, is seen as a green and low-carbon alternative to traditional fossil fuels.

- Decarbonization efforts: Many countries and regions have set ambitious decarbonization targets and are investing in hydrogen as a clean energy carrier. Government policies and regulations to reduce greenhouse gas emissions are expected to drive the growth of the hydrogen market.

- Increasing hydrogen demand: Hydrogen is being explored for various applications, including fuel cell vehicles, industrial processes, and energy storage. This diversification of demand contributes to market growth.

- Technological advancements: Ongoing advancements in electrolysis technologies are making the production of hydrogen from water more efficient and cost-effective. Improved electrolyzers and materials are increasing the competitiveness of water electrolysis.

- Investments and funding: Governments, energy companies, and research institutions are making significant investments in research, development, and infrastructure for hydrogen production and distribution.

- Energy storage solutions: Hydrogen is considered a viable option for large-scale energy storage, especially when integrating variable renewable energy sources into the grid. This role in energy storage can drive market growth.

- International cooperation: Collaboration between countries and international organizations on hydrogen research, trade, and infrastructure development is contributing to the global growth of the water-as-a-fuel market.

- Increasing awareness: A growing awareness of the potential of hydrogen as a clean energy carrier and its benefits in reducing emissions is stimulating interest and investment in this market.

- Potential for green hydrogen: Green hydrogen, produced from water using renewable energy, is gaining prominence due to its environmental benefits. The development of green hydrogen projects is a significant driver of market growth.

- Hydrogen infrastructure development: Expanding hydrogen refueling stations for fuel cell vehicles and establishing hydrogen pipelines for industrial use is critical for the growth of the market.

Water as a Fuel Market Outlook

- Industry Growth Overview: The water-as-fuel market is expected to witness steady growth over the period from 2025 to 2030, driven by innovations in hydrogen extraction processes, electrolysis efficiency, and renewable energy integration. Demand for hydrogen as a fuel, primarily in both the transportation and energy sectors, increased dramatically, especially in Asia-Pacific and North America, as a growing number of industries began to pivot toward carbon-neutral fuel sources and reduce their reliance on fossil fuels.

- Global Expansion: Many of the world's largest energy companies, both private and state-owned, shifted their focus and investment into regions with abundant renewable resources and supportive policies, like Australia, the UAE, and the US West Coast. The companies worked in collaboration with local governments to develop new hydrogen production facilities on a scale to meet export demand while servicing local domestic use.

- Key Investors: Venture capital and institutional investing were on the rise for startups developing cost-effective electrolysis and scalable hydrogen storage technology. Investors such as Breakthrough Energy Ventures and SoftBank Vision Fund were supporting firms that could demonstrate a commercially viable, greener alternative to fossil fuel energy.

- Startup Ecosystem: The startup space was flourishing due to innovations using green hydrogen or fuel cell technology. Startups, such as H2Pro (Israel) and Ohmium (India), were in the spotlight for announcing low-cost and high-efficiency water-splitting systems that had garnered funding from investors focused on sustainability.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 12.2% |

| Market Size in 2025 | USD 6.78 Billion |

| Market Size in 2026 | USD 7.61 Billion |

| Market Size by 2034 | USD 19.11 Billion |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Fuel Type, By Technology, and By End-Use Industry |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Market Dynamics

Driver

Environmental sustainability

As the world struggles with the pressing necessity to decrease greenhouse gas emissions and battle climate change, the implementation of water as a source for clean hydrogen production has expanded substantial momentum. Hydrogen generated from water using renewable energy sources, such as wind and solar power, is considered a green and low-carbon alternative to traditional fossil fuels. It offers the promise of decarbonizing various sectors, including transportation, industry, and energy production.

The World Bank reported that the demand for hydrogen amounted to an approximate 87 million metric tons (MT) in 2020 and is projected to increase to a range of 500–680 million MT by 2050. During the period from 2020 to 2021, the market for hydrogen production had a valuation of $130 billion and is anticipated to experience a yearly growth rate of 9.2% through 2030.

The use of water as a fuel source aligns with global efforts to transition to sustainable and environmentally friendly energy solutions. It significantly reduces carbon emissions and air pollutants, as the only byproduct of hydrogen combustion is water vapor. As nations and industries set ambitious decarbonization goals, the role of hydrogen produced from water as a clean energy carrier becomes increasingly essential.

This demand is further reinforced by the recognition of hydrogen's potential to reshape the energy landscape and contribute to a more environmentally sustainable future. The environmental imperative to reduce carbon emissions is a driving force behind the expansion of the water-as-a-fuel market, as it offers a pathway to a cleaner and more sustainable energy future.

Restraint

High production cost

The high production cost of hydrogen, which is generated from water through methods like electrolysis, presents a significant obstacle to the widespread adoption of hydrogen as a fuel source. This cost challenge arises due to various factors. Hydrogen production processes, especially electrolysis, are energy-intensive, demanding substantial electricity inputs. This becomes economically burdensome, particularly when relying on non-renewable energy sources. Moreover, efficiency losses during hydrogen generation contribute to high production costs. Hence, the need for high-quality materials and specialized equipment further escalates expenses.

In addition, scaling up hydrogen production facilities, which is crucial for cost reduction, requires significant capital investment. Additionally, the development and maintenance of infrastructure for hydrogen production and distribution contribute to overall expenses. To overcome these cost barriers and stimulate the adoption of hydrogen as a fuel, research and development efforts, the utilization of renewable energy sources, government support, private sector innovation, and supply chain optimization are vital strategies.

As technology advances and economies of scale are achieved, the cost of hydrogen production may decrease, making it a more competitive and sustainable option for various applications, including as a fuel source. Keeping a close watch on the evolving hydrogen industry is essential to assess its current status and potential advancements.

Opportunity

Government support and incentives

Government support and incentives play a pivotal role in fostering opportunities for the water-as-fuel market. As the world seeks sustainable and clean energy solutions, water-based fuels have gained significant attention. Several governments have recognized the potential of water as a fuel source, especially in the form of hydrogen. Incentives, such as tax credits, grants, and subsidies, encourage research, development, and adoption of water-based fuel technologies. These financial benefits lower the barriers for businesses and consumers to invest in and adopt water-based fuel systems. Additionally, regulatory policies aimed at reducing carbon emissions are driving the demand for cleaner energy sources, and water-based fuels align with these goals.

Furthermore, governments are investing in infrastructure for hydrogen production, storage, and distribution, which is essential for a thriving water-as-fuel market. These investments create a more robust ecosystem for the adoption of water-based fuels in various sectors, including transportation and industry. Thus, government support and incentives not only promote innovation and sustainability but also provide an opportunity for the growth of the water-as-fuel market, contributing to a greener and more sustainable energy landscape.

Fuel Type Insights

In 2024, the hydrogen segment had the highest market share of 56% based on the fuel type and is anticipated to expand at the fastest CAGR of 13.1% over the projected period. Hydrogen is a clean and versatile energy carrier that can be produced by splitting water into hydrogen and oxygen through processes like electrolysis. It is widely recognized for its potential in fuel cells, which can power vehicles and provide electricity with zero emissions.

Hydrogen has gained prominence in the pursuit of renewable energy solutions and is supported by government initiatives worldwide, making it a key component of the water-as-fuel market.

Technology Insights

In2024, the natural gas segment had the highest market share of 59% on the basis of technology. Natural gas reforming, specifically steam methane reforming (SMR), is another method used to produce hydrogen from a hydrocarbon source, primarily natural gas. In this process, natural gas is combined with steam and subjected to high-temperature reactions, resulting in the production of hydrogen and carbon dioxide (CO2). While this method is widely used and is cost-effective, it generates carbon emissions and is often referred to as grey hydrogen.

Efforts are underway to implement carbon capture and storage (CCS) technologies to reduce emissions from natural gas reforming and produce blue hydrogen. Thus, natural gas reforming continues to be a dominant source of hydrogen with potential emissions mitigation strategies and further drive demand for the market across the segment.

The electrolysis segment is anticipated to expand fastest CAGR of 12.8% over the projected period. Electrolysis is a technology that involves the use of electricity to split water (H2O) into its constituent elements, hydrogen (H2) and oxygen (O2). This process is considered environmentally friendly when the electricity used for electrolysis is generated from renewable sources, as it results in "green hydrogen." Electrolysis technology is highly regarded for its potential to produce hydrogen with minimal carbon emissions and is integral to the development of a sustainable and clean hydrogen economy. It has applications in various sectors, including transportation, industry, and energy storage.

End-Use Industry Insights

In2024, the automotive segment had the highest market share of 41% on the basis of the end-use industry. In the automotive sector, hydrogen is utilized as a fuel source for fuel cell vehicles, offering a clean alternative to internal combustion engines. Water-based fuels are also used in some combustion engines to reduce emissions.

The manufacturing segment is anticipated to expand at a CAGR of 12.6% fastest over the projected period. The manufacturing sector incorporates water-based fuels in operations like metalworking, glass production, and heat treatment processes. Water-as-fuel technologies help enhance energy efficiency and reduce environmental impact in manufacturing facilities.

Regional Insights

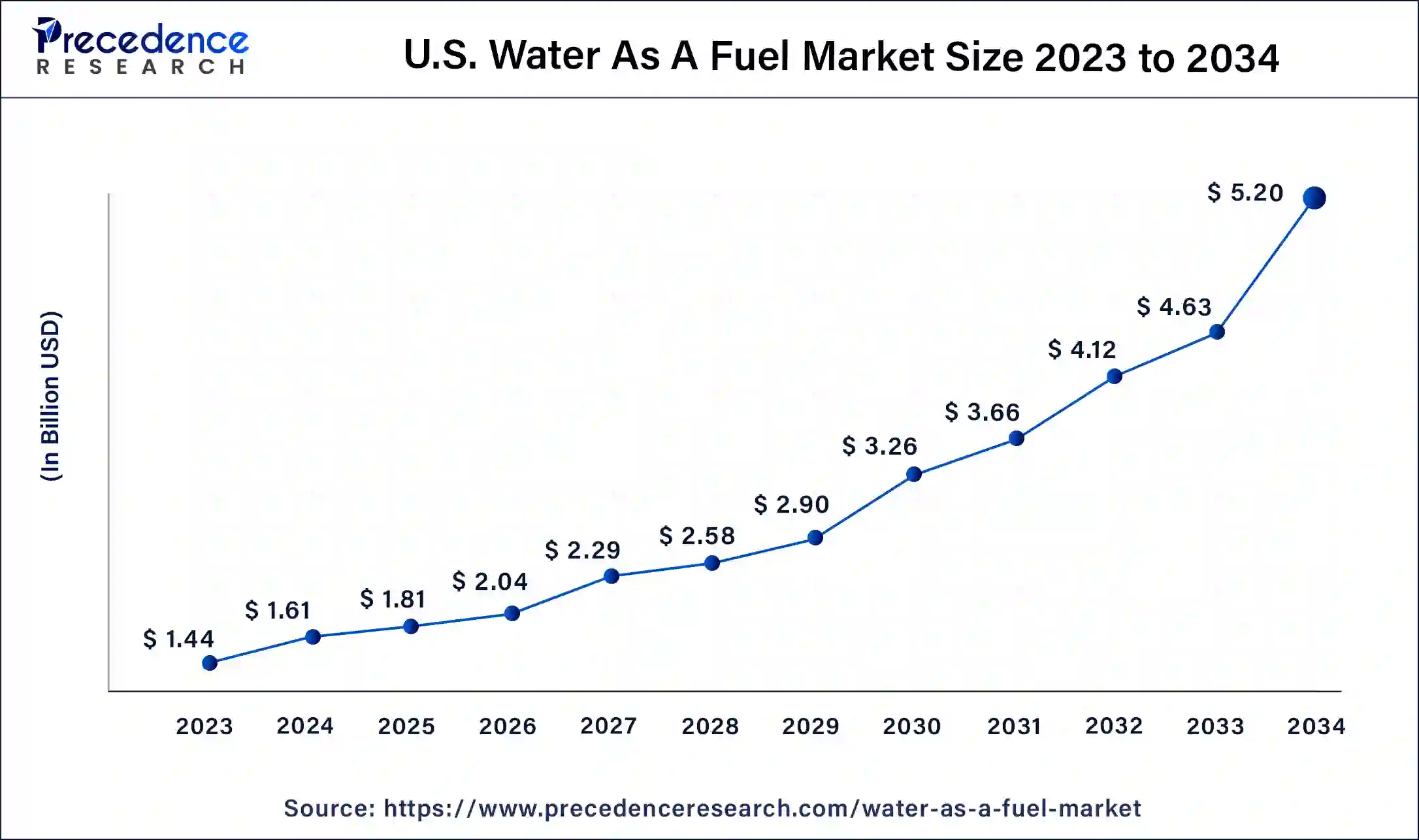

U.S. Water As A Fuel Market Size and Growth 2025 to 2034

The U.S. water as a fuel market size is estimated at USD 1.81 billion in 2025 and is predicted to be worth around USD 5.20 billion by 2034, at a CAGR of 12.4% from 2025 to 2034.

North America has held the largest market share of 38% in 2024. North America was making significant strides in developing a hydrogen economy. Governments, particularly in the United States and Canada, were announcing strategies and funding for hydrogen production, infrastructure development, and research initiatives. Hydrogen was seen as a versatile and low-emission energy carrier with applications in transportation, industry, and energy storage.

Asia-Pacific is estimated to observe the fastest expansion. The market is driven by various factors such as increasing awareness of clean energy, government initiatives, and industrial demand. The region, including countries such as China, Japan, South Korea, and India, was actively involved in developing the water-as-fuel market. Countries like Japan and South Korea were investing in hydrogen production and storage infrastructure. Japan, in particular, had ambitious plans to become a hydrogen society with the use of hydrogen in various applications, including transportation and industry.

Europe water as a fuel market is driven by a strong commitment to sustainability, renewable energy, and a transition to cleaner fuel sources. Europe had placed a strong emphasis on hydrogen as a clean energy carrier. The European Union's Green Deal and the European hydrogen strategy outlined ambitious goals to develop a hydrogen economy. Hydrogen, produced through water electrolysis, was seen as a key component of achieving carbon neutrality.

Water as a Fuel Market Companies

- ExxonMobil

- Air Liquide

- Orsted A/S

- FuelCell Energy Inc

- Panasonic

- China Petroleum & Chemical Corporation

- Iberdrola S.A.

- Plug Power Inc.

- Linde plc

- Enel Green Power Spa

Recent Developments

- September 2023: Indian Oil Corporation launched the nation's first green hydrogen-powered bus that releases just water as it takes the lead in bringing out unrivaled tools to substitute fossil fuels. It will produce close to 75 kg of hydrogen by splitting water using electricity from renewable sources.

Segments Covered in the Report

By Fuel Type

- Oxyhydrogen

- Hydrogen

By Technology

- Natural Gas Reforming

- Electrolysis

By End-Use Industry

- Refineries

- Manufacturing

- Petrochemicals

- Utilities

- Automotive

- Aerospace

- Electronics

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting