Water and Wastewater Treatment Market Size and Forecast 2025 to 2034

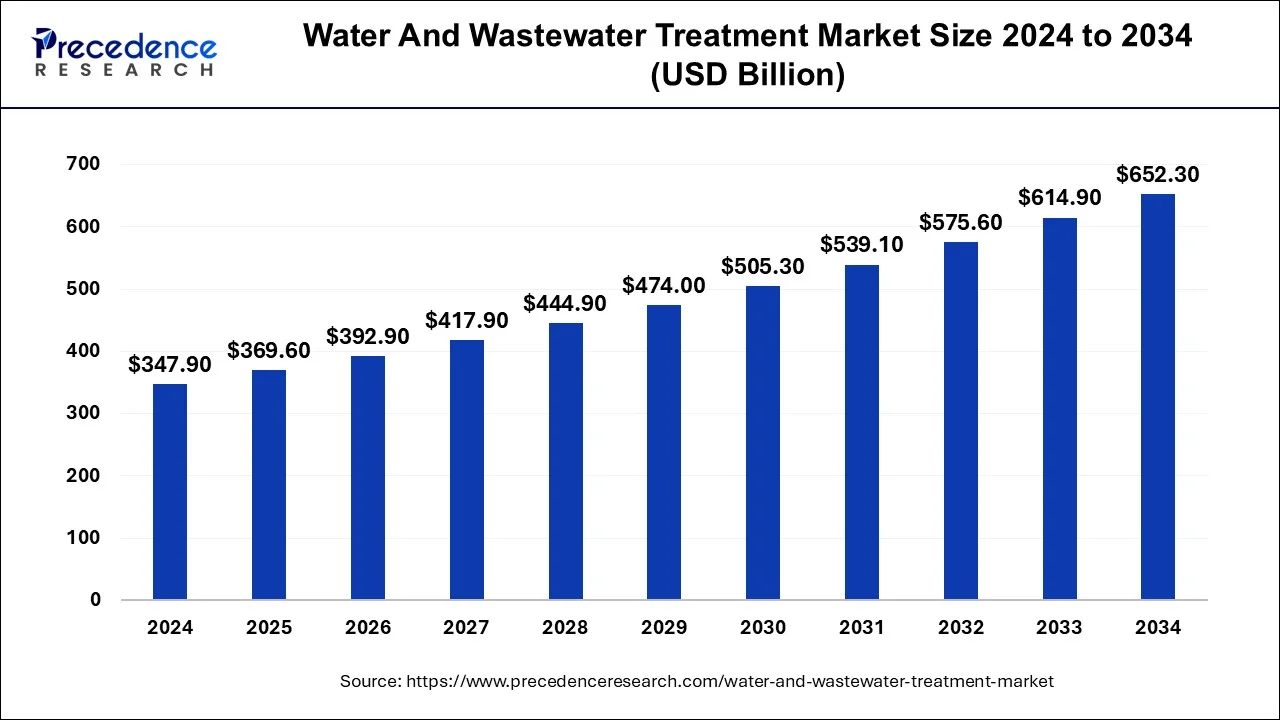

The global water and wastewater treatment market size was estimated at USD 347.90 billion in 2024 and is predicted to increase from USD 369.60 billion in 2025 to approximately USD 652.30 billion by 2034, expanding at a CAGR of 6.50% from 2025 to 2034. Wastewater and water treatment is the procedure of enhancing the quality of wastewater and transforming it into an effluent that can be either recycled or returned to nature with little impact on the environment.

Water and Wastewater Treatment Market Key Takeaways

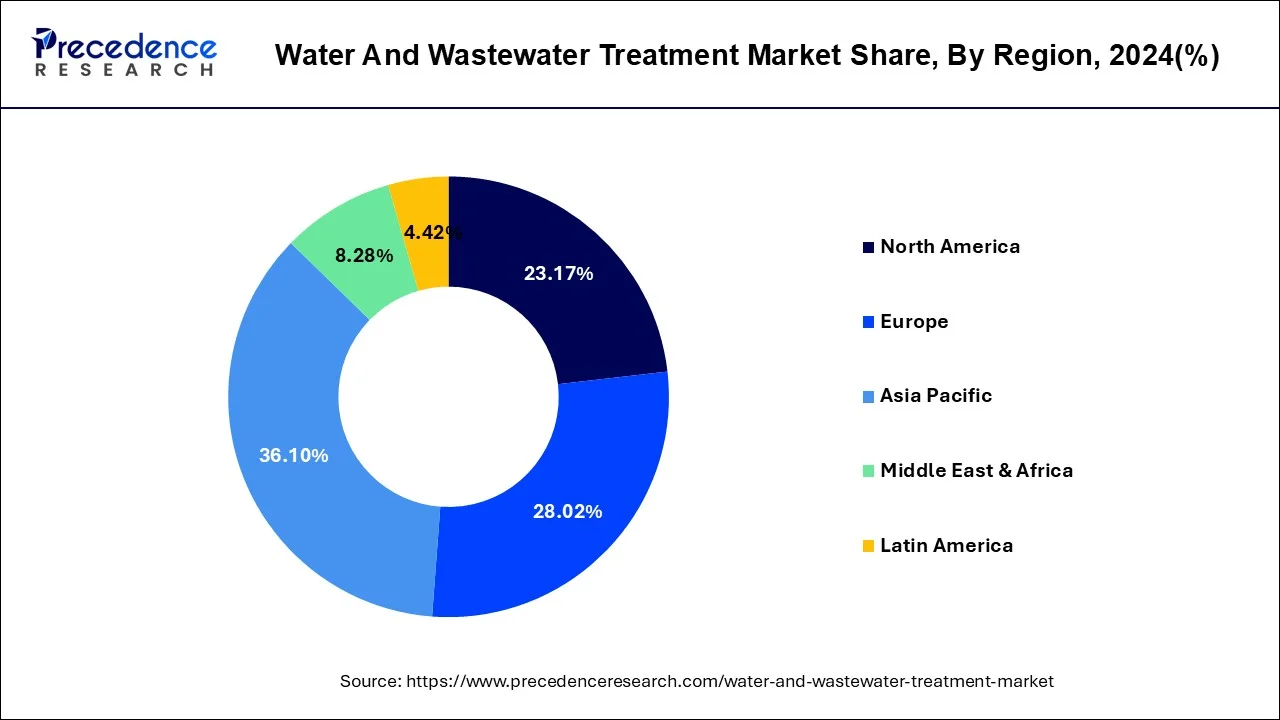

- Asia Pacific dominated the global market with the largest market share of 36.10% in 2024.

- By type of treatment, the secondary treatment led the market share of 41.20% in 2024.

- By type of treatment, the tertiary treatment segment is expected to grow at a significant CAGR of 7.90% over the projected period.

- By technology, the biological wastewater treatment segment held the biggest market share of 36.70% in 2024.

- By technology, the advanced treatment technologies (ATT) segment is expanding at a significant CAGR of 8.50% from 2025 to 2034.

- By application, the municipal sector segment dominated the market with the largest share of 49.30% in 2024.

- By application, the industrial sector segment is expected to grow at a significant CAGR of 7.60% from 2025 to 2034.

- By equipment type, the filtration equipment led the market with a major market share of 28.40% in 2024.

- By equipment type, the disinfection equipment is expected to grow at a significant CAGR of 7.80% over the projected period.

- By service type, the installation and maintenance services segment dominated the market with a major share of 33.50% in 2024.

- By service type, the upgrading and retrofitting services segment is expanding at a significant CAGR of 8.20% from 2025 to 2034.

- By end user, the government and municipal bodies segment held the largest market share of 44.90% in 2024.

- By end user, the private utility providers segment is anticipated to grow at a significant CAGR of 7.40% over the projected period.

Asia Pacific Water and Wastewater Treatment Market Size and Growth 2025 to 2034

The Asia Pacific water and wastewater treatment market size was estimated at USD 125.60 billion in 2024 and is predicted to be worth around USD 282.8 billion by 2034, at a CAGR of 8.5% from 2025 to 2034.

Asia Pacific dominated the water and wastewater market in 2024. The rising concerns over water scarcity and environmental pollution are observed to act as major supporting factors for the market to expand in Asian countries. Growing urbanization, insufficient infrastructure, and rising health risks are other factors to promote the market's growth in the upcoming years. Countries such as China and India have already started advanced wastewater treatments that clearly promote the integration of advanced technologies in such services. Additionally, countries with high populations in Asian areas are required to add additional water treatment capacity to upgrade the currently employed ones. On the other hand, the booming industrial segments in the Asian area create another potential for the market to grow.

Water And Wastewater Treatment Market Growth Factor

One major element driving the market expansion of wastewater treatment chemicals is the growing worry about the depletion of freshwater resources. In order to prevent and resolve such issues and improve the reusability of wastewater in the process, governments of many nations throughout the world are putting tight laws and regulations into place. A number of governments are also actively interested in enhancing municipal water infrastructure in both urban and rural locations. The demand for water & wastewater treatment chemicals is anticipated to increase during the forecast period as a result of such advancements in industrial and domestic/municipal water treatment. Rapid industrialization is also contributing to rising groundwater pollution, particularly in developing nations. Because of this, governments in many nations are launching programs to use wastewater effectively, which is predicted to increase demand for chemicals used in wastewater treatment. Globally, the COVID-19 pandemic has had a detrimental effect on a number of businesses and nations. Lockdown has been implemented all over the world, which has halted the manufacture of electronic components and limited the market's growth for chemicals used in water and wastewater treatment. The delivery of raw materials needed to manufacture electrical components has also been delayed. Regulations governing the import and export of chemicals and raw materials have an impact on the supply chain as a result of the COVID-19 pandemic. The paucity of raw materials, therefore, has an influence on the manufacture of chemicals for water treatment, which also has an effect on the market expansion.

Additionally, it was expected that until the second quarter of 2022, production halts brought on by staff illnesses and mandated firm closures would restrain the market's expansion for water treatment chemicals. Additionally, it was anticipated that as a result of the decline in production, manufacturing, oil & gas, and other activities, the market for water treatment chemicals would grow more slowly by 2020. With a market share of 33.05% in terms of revenue, Asia Pacific excluding Japan led all other regions in 2022 for water and wastewater treatment chemicals, followed by North America and Europe, respectively.

- Water and wastewater treatment system suppliers could have considerable growth prospects due to the increasing demand for energy-efficient and innovative water treatment systems.

- The growing need for a practical strategy for the appropriate disposal of industrial wastewater is the primary cause of the rising demand for wastewater treatment.

- The growing urban population, in particular, continues to be a key driver of industrial development.

- Growing industrialization, population growth, and urbanization have all raised the need for wastewater treatment.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 347.9 Billion |

| Market Size by 2034 | USD 652.3 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 6.5% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Equipment, By Process, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing pulp and paper industry

- To remove particles and particulate matter and reduce effluent toxicity, the pulp and paper industry uses water and wastewater treatment technologies such as reverse osmosis, ion exchange, UV disinfection, membrane filtering, biological treatment, and others. For instance, the Canadian government claims that the pulp and paper sector is expanding. In 2021, the Minister of Natural Resources announced an investment of around US$3.8 million through Sustainable Development Technology Canada (SDTC) in Red Leaf Pulp, a company located in Kelowna. Additionally, Invest India estimates that the paper and paperboard industry in India would develop at a rate of 6-7% annually. India uses 15 kilograms of paper per person annually. The expanding pulp and paper sector will need additional water and wastewater treatment technology to handle waste streams, which will spur industrial expansion over the course of the projected period.

Key Market Challenges

- Numerous end users, especially small-scale enterprises, are discouraged from employing water treatment chemicals due to the fluctuating price of raw materials. Only because of stringent government regulations that also apply to small sector participants are manufacturers embracing wastewater chemicals. The market growth for chemicals used in water and wastewater treatment is predicted to be adversely affected by this aspect. Over the course of the projected period, it is anticipated that adverse reactions to wastewater treatment chemicals, such as allergies, mouth sores, eczema, and rashes, would restrain market expansion. Additionally, not all pathogens and contaminants are eliminated from the water since certain pollutants are still present in the water and difficult to remove. This aspect is anticipated to limit the market expansion of chemicals used in wastewater treatment.

Key Market Opportunities

Increasing population and globalization

- More than two-thirds of the world's population is projected to reside in cities by 2050. Rapid urbanization fosters economic growth, but it also raises the demand for freshwater resources. More urban garbage will probably pollute water with a variety of contaminants, including plastics, chemicals from personal care items, and nutrients and pathogens from human excrement. The need for water and wastewater technology is anticipated to increase as a result in the upcoming years.

Service Type Insights

The installation and maintenance services segment dominated the market in 2024. This was driven by an increasing focus on upgrading and maintaining existing treatment plants, along with the demand for new plant construction. Many regions need to modernize their water and wastewater treatment facilities to comply with stricter environmental regulations. The installation and maintenance of complex treatment systems require specialized knowledge and expertise, making service providers essential in navigating environmental regulations and addressing increasing water demands. Their roles include modernizing equipment, improving treatment processes, and enhancing overall efficiency.

The upgrading and retrofitting services segment is experiencing the fastest growth in the market. This trend is driven by aging infrastructure, stricter regulations, and the demand for improved efficiency and sustainability. Upgrading allows for the modernization of existing systems to meet current standards and integrate new technologies without the high costs associated with full replacements. Stringent environmental regulations regarding water quality and discharge limits are pushing the need to upgrade existing systems. Retrofitting enables the incorporation of energy-efficient technologies, process optimization, and water reuse strategies, thus reducing operational costs and minimizing environmental impact

Type of Treatment Insights

The secondary treatment dominated the water and wastewater treatment market in 2024. This method effectively removes a significant amount of biodegradable organic matter and suspended solids, making it essential for protecting water bodies and ensuring water reuse. Secondary treatment utilizes biological processes, primarily involving microorganisms, to break down pollutants and achieve a higher level of purification than primary treatment alone. This process significantly reduces the biochemical oxygen demand (BOD), which measures the amount of oxygen consumed by microorganisms to decompose organic matter. Secondary treatment is applicable not only to municipal sewage but also to various agricultural and industrial wastewaters.

The tertiary treatment segment is expected to experience the fastest growth during the forecast period. This growth is mainly driven by increasingly stringent regulations, rising water scarcity, and the growing demand for water reuse, especially in industrial and municipal sectors. Tertiary treatment focuses on removing remaining contaminants after secondary treatment, ensuring that water is safe for various purposes, including irrigation, industrial processes, and even potable reuse. With regions facing significant water shortages, the need for water reuse has become critical. Tertiary treatment plays a vital role in enabling the safe and reliable reuse of wastewater for multiple applications.

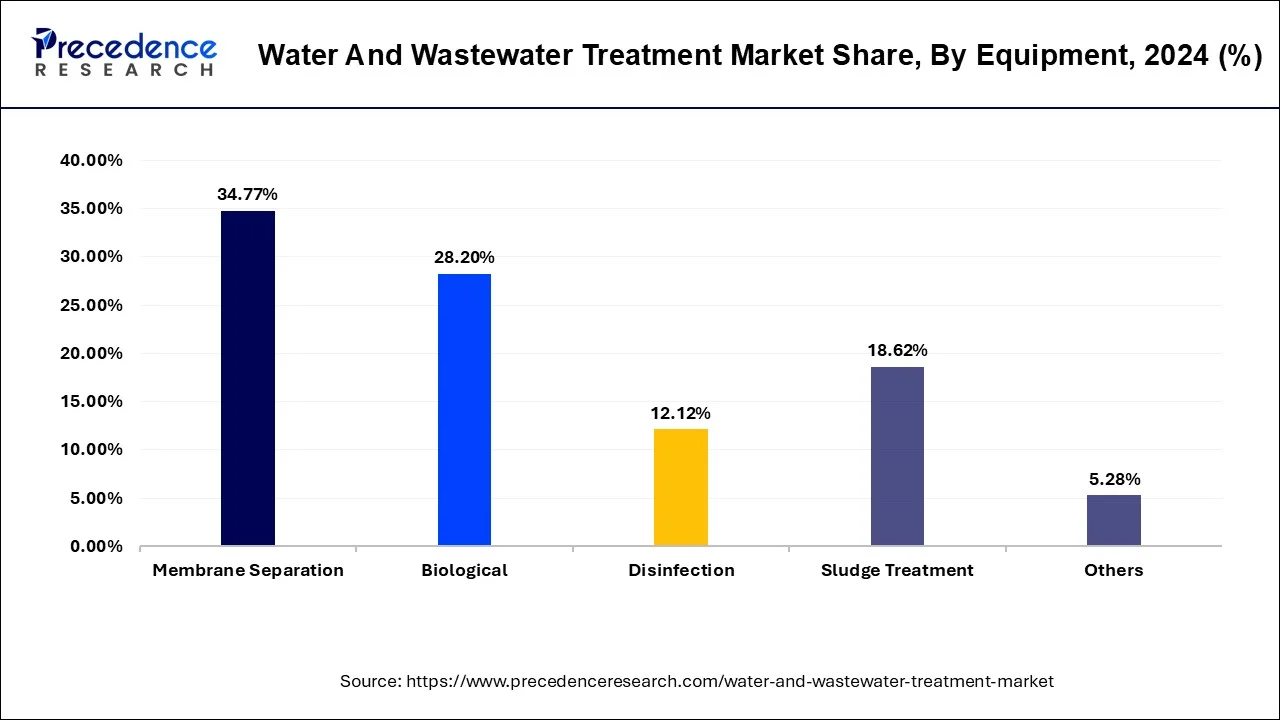

Equipment Insights

The filtration equipment was the market leader in 2024, primarily due to its essential role in removing impurities such as sediments, microorganisms, and chemicals. This ensures water quality for various applications. Advanced filtration technologies, including membrane filtration and ultrafiltration, further enhance efficiency and reliability, making them vital in municipal, industrial, and residential sectors. Filtration effectively removes suspended solids and contaminants, improving water quality for various uses. The demand for reliable filtration solutions has increased, heightened by growing awareness of waterborne diseases and stricter regulations regarding water quality, particularly in rapidly developing regions.

The disinfection equipment segment is experiencing rapid growth in the market. This is due to the increasing demand for safe drinking water and stringent regulations regarding water quality. This growth is further fostered by concerns about waterborne diseases, the rise in industrial discharge, and the necessity to meet stricter environmental standards for water reuse. The need to conserve water resources and reduce pollution is driving the adoption of wastewater treatment and reuse, where disinfection plays a crucial role in ensuring the water is safe for various applications. Growing awareness of the potential drawbacks of chemical disinfectants is driving the adoption of non-chemical methods like UV disinfection.

Global Biotechnology Market Revenue, By Equipment, 2022-2024 (USD Billion)

| By Equipment | 2022 | 2023 | 2024 |

| Membrane Separation | 107.2 | 113.9 | 121.0 |

| Biological | 89.5 | 95.4 | 101.6 |

| Disinfection | 37.5 | 39.8 | 42.2 |

| Sludge Treatment | 57.9 | 61.2 | 64.8 |

| Others | 16.8 | 17.6 | 18.4 |

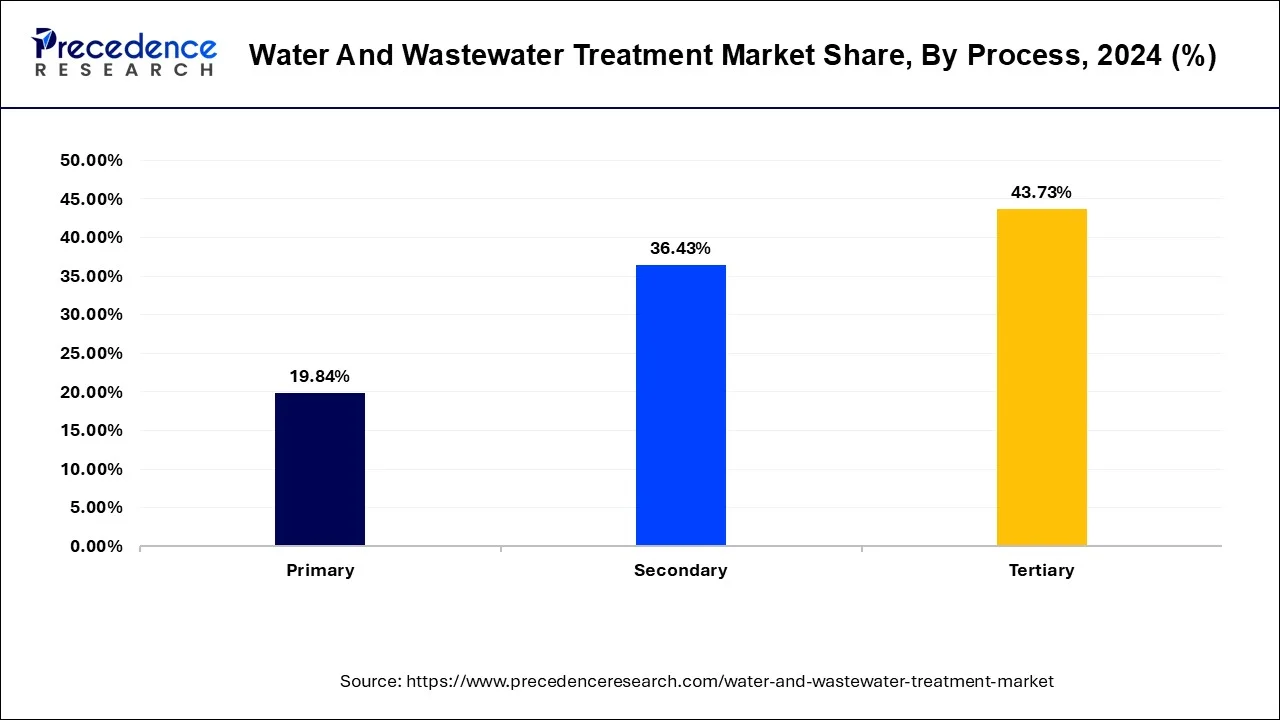

Process Insights

The market was dominated by the tertiary treatment process category in 2024, accounting for about 43.73% of global revenue, and is anticipated to grow at the quickest CAGR of 6.3% from 2025 to 2034. Prior to reuse or environmental release, effluent quality is improved by tertiary treatment. In order to make water suitable for reuse, this method eliminates the inorganic chemicals, viruses, germs, and parasites that remain after subsequent treatment procedures. For the purpose of removing heavy sediments and floating objects from effluent, the first treatment is utilized. Water and pollutants are separated from wastewater by passing it through a number of tanks and filters. During the projected period, it is anticipated that low operating costs and strong market visibility will be extremely important in expanding the main treatment's application area.

From 2025 to 2034, the secondary treatment process category is anticipated to grow at the second-fastest CAGR of 6.8%. Utilizing trickling filters, bio-towers, rotating biological contactors, and activated sludge systems, secondary treatment is primarily used to remove soluble organic waste and compounds, such as phosphorus and nitrogen. Aerobic or anaerobic biological processes can be employed in subsequent therapy. A membrane bioreactor is a cutting-edge treatment system that combines membrane filtration with traditional biological treatment methods like the activated sludge process to remove suspended and organic particles more effectively and efficiently. Using microfiltration or ultrafiltration membranes, solid-liquid filtration is accomplished.

Global Biotechnology Market Revenue, By Process, 2022-2024 (USD Billion)

| By Process | 2022 | 2023 | 2024 |

| Primary | 61.6 | 65.2 | 69.0 |

| Secondary | 111.9 | 119.1 | 126.8 |

| Tertiary | 135.6 | 143.6 | 152.1 |

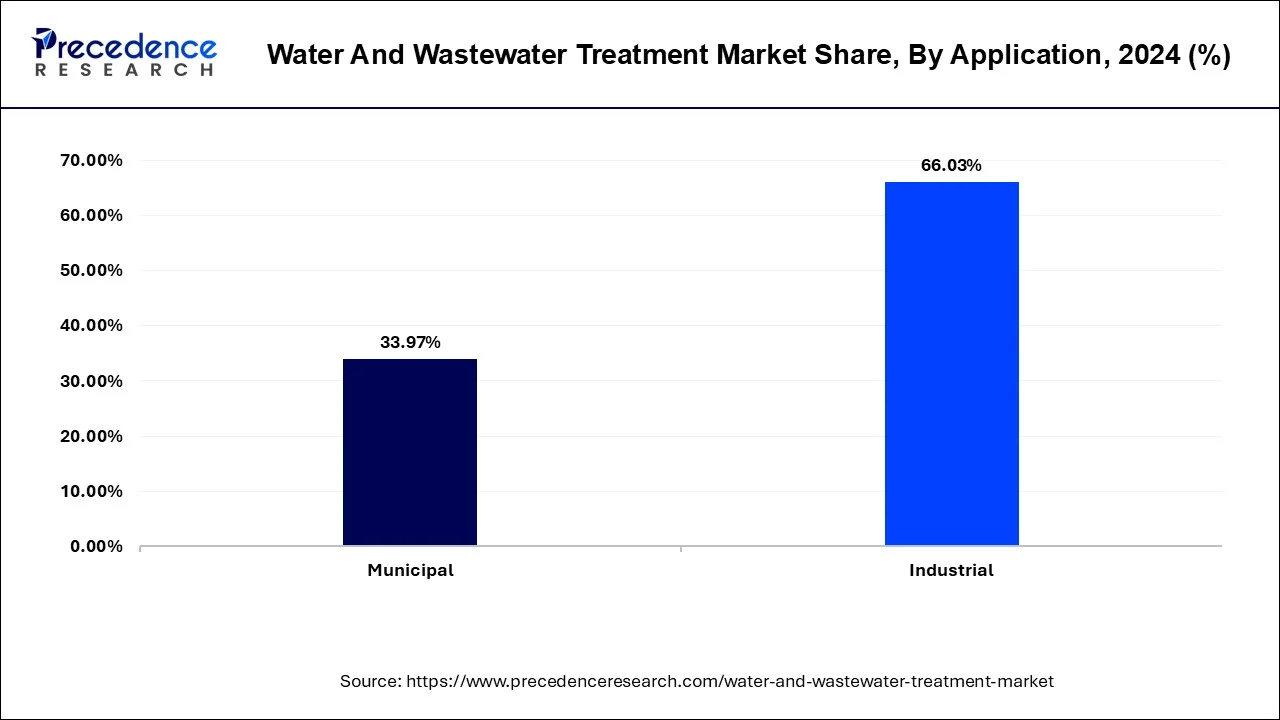

Application Insights

The municipal sector segment led the global market in 2024, primarily due to the higher demand for clean drinking water and effective wastewater management in urban areas, along with increasing population and urbanization. Municipalities are adopting advanced technologies like membrane filtration, UV disinfection, and biological treatment to meet regulatory standards, address water scarcity, and promote water reuse. Rapid urbanization and population growth in cities have heightened the demand for both water and wastewater treatment infrastructure. Ensuring proper wastewater treatment and discharge is crucial for public health and environmental protection, leading to significant investments in this area and creating opportunities for upgrades and modernization.

The industrial sector segment is anticipated to be the fastest-growing segment in the market. This growth is primarily driven by rapid industrialization, increasing water scarcity, and stringent environmental regulations, particularly in developing regions. Industries such as pharmaceuticals, food and beverage, and chemicals require large volumes of clean water and generate significant amounts of wastewater that need treatment. Innovations like membrane bioreactors, UV disinfection, and advanced oxidation processes are enhancing treatment efficiency and enabling industries to meet regulatory standards. Furthermore, the emphasis on sustainable practices and resource recovery is driving the adoption of advanced technologies.

End User Insights

The government and municipal bodies segment led the market in 2024. This dominance stems from their responsibility to provide clean water and sanitation services, especially in urban areas. This responsibility is intensified by rising populations, rapid urbanization, and stricter regulations on water quality. Municipalities are legally obligated to ensure access to safe drinking water and effective wastewater treatment to prevent the spread of waterborne diseases and protect public health. Managing water and wastewater treatment is a critical component of urban infrastructure development, necessitating significant investment and planning by local governments.

The private utility providers segment is experiencing rapid growth in the market. This growth is primarily driven by increasing demand for sustainable water management and the expertise offered by private operators. Private utility providers often bring specialized knowledge, advanced technologies, and operational efficiencies, resulting in more effective and cost-efficient management. These private companies are increasingly adopting sustainable practices and technologies in water and wastewater treatment, aligning with global sustainability goals. This trend is further supported by population growth, urbanization, and stricter environmental regulations, which are driving the need for advanced treatment technologies and effective infrastructure management.

Water and Wastewater Treatment Market Companies

- Suez Environnement S.A. (France)

- Veolia Environnement SA. (France)

- Xylem, Inc. (U.S.)

- DuPont de Nemours, Inc. (U.S.)

- 3M Company, Inc. (U.S.)

- Pentair plc (U.K.)

- United Utilities Group PLC (U.K.)

- Kingspan Group Plc (U.K.)

- The Dow Chemical Company (U.S.)

- BASF SE (Germany)

- Kurita Water Industries Ltd. (Japan)

- Bio-Microbics, Inc. (U.S.)

- Calgon Carbon Corporation (U.S.)

- Trojan Technologies Inc. (Canada)

- Kemira Oyj (Finland)

- Thermax Limited (India)

- Wog Technologies (India)

- Golder Associates, Inc. (Canada)

- SWA Water Technologies PTY LTD. (Australia)

- Burns & McDonnell (U.S.)

- Adroit Associates Private Limited (India)

- Sauber Environmental Solutions Pvt. Ltd. (India)

- SPEC Limited (India), Ecolab, Inc. (U.S.)

- GFL Environmental Inc. (U.S.)

- Clean TeQ Water Limited (Australia)

Recent Developments

- On 9th Dec 2024, around 800 sewage treatment plants enrolled for rating under the Jal Amrit scheme. The Ministry of Housing and Urban Affairs has initiated an incentive scheme to encourage states and UT authorities to provide clean, quality recycled water. Further, New Delhi, in a week after the launch of the scheme, enrolled in the ‘Jal hi Amrit‘ scheme. Later, around 2,500 participants joined the scheme with online training programmes.

- On 7th Nov 2024, Gujarat introduced a new wastewater recycling policy to combat freshwater scarcity. In Gandhinagar Gujarat government has developed this policy addressing the increased pressure on drinking water resources and health issues caused by water pollution. Improved water management in India has seen a rise in India's GDP rate, providing sustainable water.

- On 3rd Oct 2024, five stocks to watch as PM Modi launches Rs 10,000-crore water sanitation projects. On the 10th anniversary of Swachh Bharat Mission Prime Minister recalled the success and growth of water management projects.

Segments Covered in the Report

By Type of Treatment

- Primary Treatment

- Secondary Treatment

- Tertiary Treatment

- Sludge Treatment

By Technology

- Chemical Treatment Technologies

- Coagulation and flocculation

- Chemical precipitation

- Physical Treatment Technologies

- Sedimentation

- Flotation

- Screening

- Biological Treatment Technologies

- Aerobic treatment

- Anaerobic digestion

- Sequencing batch reactors (SBR)

- Advanced Treatment Technologies

- Membrane filtration

- Advanced oxidation processes (AOPs)

- Electrodialysis

By Application

- Municipal Sector

- Drinking water purification

- Sewage treatment and sanitation

- Industrial Sector

- Food and beverage processing

- Pulp and paper industry

- Chemical manufacturing

- Others (Textile industry, etc.)

- Agricultural Sector

- Irrigation water treatment

- Treatment of agricultural runoff

- Commercial & Institutional Sector

- Hospitals & Healthcare Facilities

- Educational Institutions

- Office Complexes & Commercial Buildings

By Equipment Type

- Filtration Equipment

- Disinfection Equipment

- Pumps and Valves

- Sludge Management Equipment

- Others (Membrane Systems, etc.)

By Service Type

- Design and Consulting Services

- Installation and Maintenance Services

- Operation and Outsourcing Services

- Upgrading and Retrofitting Services

By End User

- Government and Municipal Bodies

- Private Utility Providers

- Industrial Enterprises

- Commercial Establishments

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting