What is the Water Treatment Chemicals Market Size?

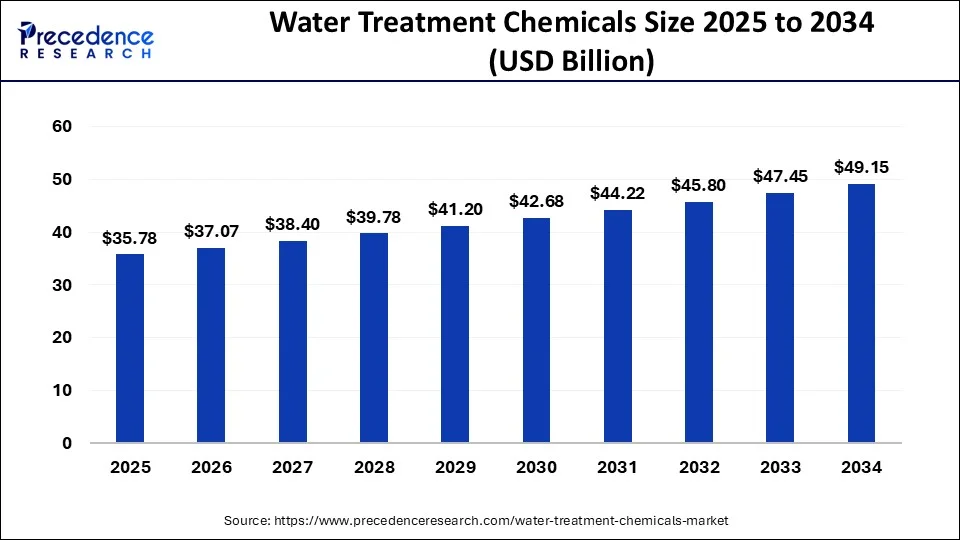

The global water treatment chemicals market size is valued at USD 35.78 billion in 2025 and is predicted to increase from USD 37.07 billion in 2026 to approximately USD 50.82 billion by 2035, growing at a CAGR of 3.57% over the forecast period from 2026 to 2035.

Water Treatment Chemicals Market Key Takeaways

- In terms of revenue, the water treatment chemicals market is valued at $35.78 billion in 2025.

- It is projected to reach $50.82billion by 2035.

- The water treatment chemicals market is expected to grow at a CAGR of 3.57% from 2026 to 2035.

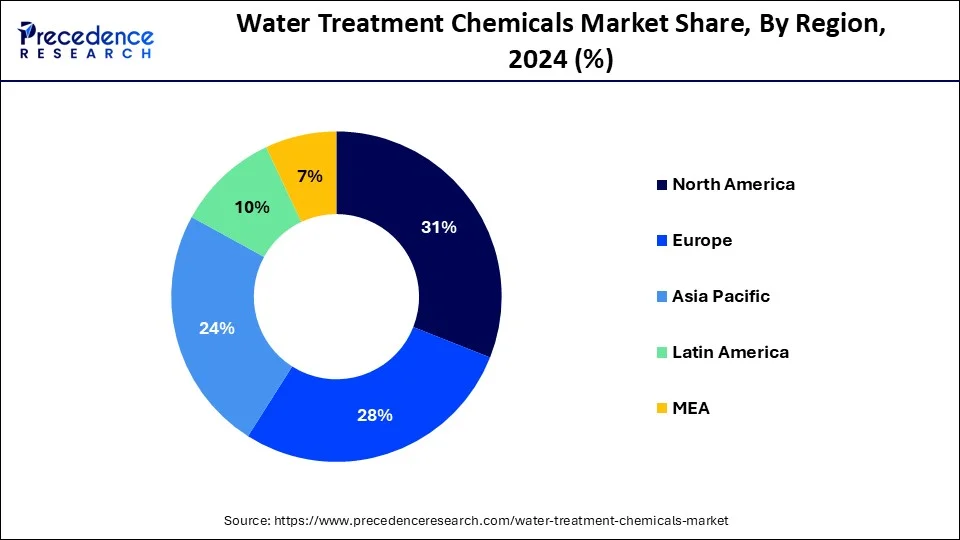

- North America led the global market with the highest market share of 31% in 2025.

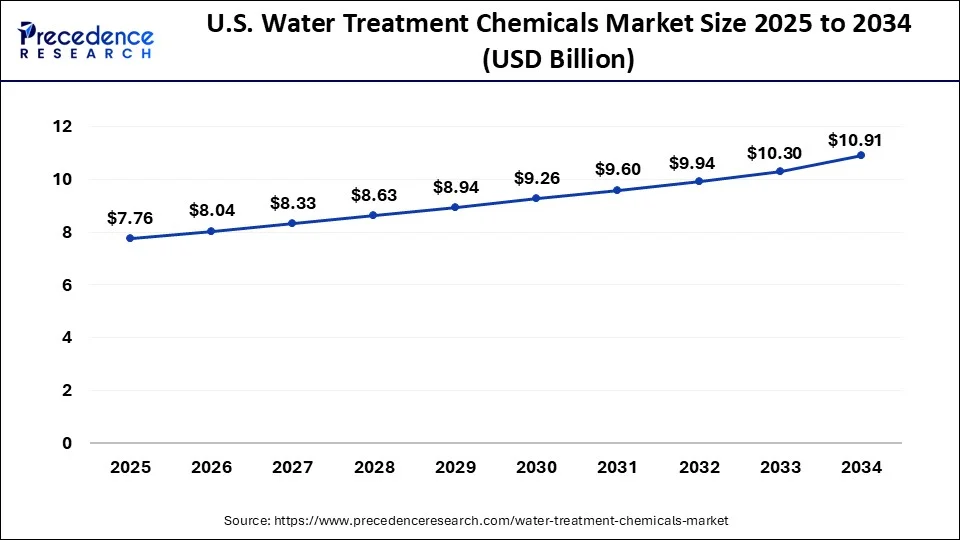

- The U.S. water treatment chemicals market size was accounted at USD 7.50 billion in 2025 and is projected to be worth around USD 10.91 billion by 2035, poised to grow at a CAGR of 3.82% from 2026 to 2035.

- By Product, the coagulants & flocculants segment generated more than 37% of revenue share in 2025.

- By End-use, the municipal segment captured more than 40% of revenue share in 2025.

Market Overview

In order to render water more acceptable for end use, e.g. in irrigation, cooking, drinking and industrial processes, the chemicals applied when treating water need to be improved. sodium meta bisulphite, ferric chloride, and Sodium hex metaphosphate (SHMP) are some of the water chemicals. Various water treatment techniques for removing substances such as bacteria, viruses, minerals, sand and others are used in the chemicals industry by way of both physical and chemical methods. Water availability to households and numerous uses in the end-use sector has led to a considerable demand for water treatment, so that it may be reused or recycled. The global water treatment chemicals market is estimated to be driven by rising demand for water as a result of population growth and economic development.

The expansion can be attributed to rising demand from the refining, manufacturing, petrochemical, geothermal power generation, fertiliser, and sugar and ethanol industries, particularly in emerging markets. Furthermore, the market is expected to grow rapidly in Africa and the Middle East as a result of the increasing use of saline water treatment to meet rising water demand. Desalination is the most widely used technology in the Middle East. Saudi Arabia is heavily reliant on desalination to meet their water needs. It is expected to be one of the major consumers for industrial chemicals owing to the high usage of water in sectors like oil and gas and petrochemical.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 35.78 Billion |

| Market Size in 2026 | USD 37.07 Billion |

| Market Size by 2035 | USD 50.82 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 3.57% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Product, By End-Use, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Key Market Drivers

Regulations for water and wastewater

Water and wastewater treatment regulatory and sustainability mandates have increased demand for wastewater treatment. These rules are especially stringent in developed countries like North America and Europe. For example, the US Environmental Protection Agency's (EPA) Clean Water Act regulation controls water pollution by regulating the sources that discharge pollutants into waters. Minimum standards for the quality of effluents that can be achieved by wastewater treatment are set out in the waste water Effluent Regulations, laid down pursuant to the Canada Fisheries Act. Other regions have regulations that help the water treatment industry grow. Government regulations governing water and wastewater treatment will boost the water treatment sector, driving the water treatment chemicals market even further.

Promoting the expansion of the power generation sector

Water treatment chemicals are widely used in the energy industry to generate energy via various methods such as hydro, thermal, nuclear, and others. The focus on increasing the production of renewable energy resources, coupled with an increase in funding and development for power generation, has resulted in a rapid expansion of this sector. According to the International Energy Agency, renewable generation capacity is expected to increase by more than 60% from 2020 levels and reach over 4 800 GW in 2026.

The Indian Ministry of Energy has set a target to produce electricity for thermal, hydropower, nuclear power and Bhutan's imports at 1356 billion units, an increase of 9.93% from the actual production achieved last year. In view of the significant potential for electricity production, water treatment chemicals are increasingly used in power plants which include hydro, steam and others. As a result, the market for water treatment chemicals is booming. The use of different water treatment chemicals such as chlorine dioxide coagulants, corrosion inhibitors, disinfectants and others is being used in the oil and gas industry to filter water from steam turbines, oil refineries or similar facilities.

The booming oil and gas sector, the growing number of exploration and production activities as well as urban development has led to a rapid growth in this sector. According to the India Brand Equity Foundation (IBEF), India's oil consumption will reach 11 million barrels per day by 2045. According to the US Energy Information Administration (EIA), crude oil output increased from 11473 barrels per day in September 2021 to 10809 barrels per day in October 2021.

As a result, the use of water treatment chemicals to treat the waters in oil refineries, as well as onshore and offshore drilling operations is being increasingly used due to the rapidly growing energy sector. This drives the demand for water treatment chemicals. As a result, such factors have recently boosted the market for water treatment chemicals. However, an increase in water use by end users in the electricity sector is another factor driving revenue growth in the water treatment chemicals market.

Key Market Challenges

Presence of alternatives

There are alternative water treatment solutions available, such as membrane filtration, UV treatment, and ozone treatment, which can compete with traditional water treatment chemicals. Companies in the industry must remain innovative and competitive to stay ahead of the competition. Advanced technologies reduce the use of water treatment chemicals. End users are looking for sustainable water treatment options due to rising environmental concerns and regulations. For example, Environmental Protection Agency (EPA) regulations favour UV disinfection over chlorine-based biocides.

need for environmentally friendly formulations, as well as the risk of patent infringement

The stringent environmental regulations implemented by governments and various agencies such as the EPA are the major factors impeding the growth of the water treatment chemicals market. Some water treatment chemicals can have negative impacts on the environment, such as the release of pollutants or chemicals that are harmful to aquatic life. This can lead to regulatory challenges and negative public perception of the industry. End users of water treatment chemicals are looking for environmentally friendly water treatment chemicals as well as long-term water treatment options. However, manufacturers face challenges in developing highly effective and economically viable environment-friendly water treatment chemicals due to cost and profit issues in green chemistries. Once a patented water treatment chemical is made public, it is susceptible to imitation. Some Asian manufacturers offer counterfeit products at lower prices, posing a significant challenge to water treatment chemical manufacturers.

Key Market Opportunities

Product Innovation

There is a growing demand for eco-friendly water treatment solutions, which presents an opportunity for companies to develop innovative products that are more sustainable and environmentally friendly. Some of the product innovation are bio-based water treatment chemicals, smart water treatment solutions, nanotechnology-based water treatment chemicals, modular water treatment systems, and low-temperature water treatment chemicals. The such product innovation being introduced by the market players is expected to create an opportunities for the growth of the water treatment chemicals market.

Limited availability of water

Water scarcity has also increased the use of wastewater recycling, which is a major factor driving the growth of the water treatment chemicals market. Additionally, the growing demand for water treatment chemicals in the energy sector, power plant, mining, pulp and paper and chemical processing industries is likely to bring about a growth of this market. The market for water treatment chemicals will however be hindered by the increasing process of water treatment chemicals as well as presence of alternative processes, whereas the need for environmentally friendly formulations and patent infringement risk pose a challenge to growth in this market.

Segment Insights

Product Insights

Flocculants and Coagulants emerged as the most important product segment in 2024, accounting for more than 37% of total revenue. The tanks of chemical products in the gas and oil industry commonly use coagulation and flocculation. Coagulation processes speed up sedimentation process. Coagulants, like aluminium hydroxide chloride or aluminium sulphate, are inorganic and organic substances. During the treatment processes, coagulants are used to remove 90% of trapped particles in wastewater. Disinfectants and biocides have emerged as the other most important product segment, ensuring the maintaining operational efficiency and the safety of manufacturing systems by preventing hazardous growth of microbial, reducing contamination and biofouling. Controlling microbiological activity safely is an important aspect of industrial and manufacturing processes. To ensure proper water conditions for waste, feed, and reusable treated water, biocides and disinfectants are used. They are being used in the ethanol and sugar industries to ensure that the proper wastewater conditions are met. Furthermore, biocides are widely used to control bacteria in the ethanol fermentation process.

End-Use Insights

The municipal come up as the biggest end-use segment having a revenue share of more than 40%. Rising water scarcity in Europe and North America's developed economies has compelled major players to prioritise water reuse and recycling. Municipalities' increasing charges for waste treatment have provided additional impetus for industrialists to improve or establish the reuse facilities and wastewater treatment. Fluid treatment uses strength chemicals for flocculation, sludge dewatering, and, emulsion breaking among other things. The huge consumption in oil refineries resulted in high wastewater generation, oil and gas emerged as a prominent end-use segment. Water and steam are used in a variety of processes in petroleum refineries and chemical plants, from desalination to fluid catalytic cracking units, steam generators, and cooling towers. In oil refineries and chemical plants, effective wastewater treatment processes are needed in order to operate safely and reliably on a sustainable basis due to water scarcity. In the long term, it is expected that this will lead to increased chemicals demand by end users of oil and gas.

Application Insights

Due to the growing use of raw water in industrial facilities for formulation, cooling, and rinsing human consumption where it is being properly purified, Raw Water Treatment represented the largest share on the market. For a specific application, it is used for the pre-treatment of drinking water sources to improve product efficiency and process performance. Its primary goal is to protect industrial equipment from scaling, corrosion, fouling, and other forms of damage. It is possible that the process differs from one another because they are intended to meet each patient's particular needs.

A typical step in this process is flocculation, coagulation, filtration, sedimentation, distribution and disinfection. Boiler is expected to emerged as a largest segment on the basis of application owing to their widespread use in the petrochemical industry. It is used to protect piping and boiler components from damage caused by contaminants in the feeds or boiler. Suspended solids, organic material like aluminium, copper, silica, iron magnesium, calcium, dissolved solids, and dissolved gases hardness are examples of contaminants that may be present. Without proper boiler treatment, boiler feed water can cause fouling, corrosion, and scaling of the boiler and downstream equipment, resulting in plant downtime, costly maintenance fees, increased fuel consumption, and boiler failure.

Regional Insights

What is the U.S. Water Treatment Chemicals Market Size?

The U.S. water treatment chemicals market size was accounted at USD 7.76 billion in 2025 and is projected to be worth around USD 11.35 billion by 2035, poised to grow at a CAGR of 3.88% from 2026 to 2035.

What Made North America the Dominant Region in the Wastewater Treatment Chemicals Market?

On the basis of geography, the water treatment chemicals market is segmented into North America, Europe, Asia-Pacific, Latin America and Middle East & Africa. North America has the largest market share. The advancement of hydraulic fracturing technology has resulted in increased result of unconventional sources such as tight oil and shale gas in West Texas and North Dakota. This led to greater adoption of water treatment facilities for the crude oil and natural gas sector, which is expected to deliver significant market benefits over the forecast period. This expansion can be attributed to stringent government regulations aimed at monitoring wastewater disposal and production. According to the International Trade Administration (ITA), the United States is a world leader in energy production, consumption, and supply (presence of thermoelectric power plants). The growing demand for treatment chemicals from the power industry in the United States to treat its wastewater is anticipated to boost market growth.

U.S. Wastewater Treatment Chemicals Market Analysis

The market in the U.S. is expanding due to stringent environmental regulations, increasing industrial wastewater generation, and ongoing modernization of aging water infrastructure. Rising urban population, growing focus on water reuse, and higher investments in advanced treatment technologies by municipalities and industries are further driving demand for effective wastewater treatment chemicals across the country.

What Makes Asia Pacific the Fastest-Growing Region in the Wastewater Treatment Chemicals Market?

The expansion of the industrial, power, and manufacturing sectors is expected to boost demand for boiler chemicals and systems in Asia Pacific's emerging economies in the near future. Because of the presence of suspended particles and heavy metals, China has increased its demand for pretreated water. China Water Risk (CWR) works for a number of government agencies both in China and around the world. CWR briefs on the risks and impacts of wastewater generated in China's mining, food and beverage, power, textiles, and agriculture sectors. The CWR reports have proven to be useful in addressing challenges and thus contributing to the country's water treatment activities.

India Wastewater Treatment Chemicals Market Analysis

India's market is growing due to rapid urbanization, rising industrial discharge, and stricter pollution control norms. Increasing investments in sewage treatment plants, government initiatives for river cleaning and water reuse, and growing awareness of water scarcity are driving demand for effective wastewater treatment solutions across municipal and industrial sectors, supporting market growth.

Europe is experiencing rapid expansion in the water treatment chemicals market as a result of tough environmental regulations, a rising amount of industrial wastewater produced, and emphasis on sustainable water management. Germany, France, and the UK are investing significant resources into modernizing water infrastructures, and the EU's Zero Pollution Action Plan is helping to further push the adoption of chemical solutions. Moreover, the increasing demand for clean water from the food & beverage, pharmaceutical, and power generation sectors is contributing to growth across the region.

Europe: A Notably Growing Region

Europe is expected to grow at a notable CAGR in the market due to stringent environmental regulations, rising focus on water reuse, and increasing investments in advanced treatment technologies. Upgrades to aging water infrastructure, industrial compliance requirements, and the adoption of sustainable, eco-friendly treatment chemicals across municipal and industrial facilities are further expected to drive market growth during the forecast period.

UK Wastewater Treatment Chemicals Market Analysis

The market in the UK is expected to grow as utilities focus on improving treatment efficiency and sludge management. Rising adoption of advanced biological and membrane-based treatment systems, increasing demand for nutrient removal, and innovation in specialty and low-impact chemicals are also driving market growth across the country.

What Opportunities Exist in the Middle East & Africa for the Water Treatment Chemicals Market?

The Middle East & Africa (MEA) presents immense opportunities for the market. These opportunities arise from the increasing water scarcity, rising reliance on desalination, and rapid industrialization. Expanding urban populations, government investments in water infrastructure, and the need for efficient wastewater management in power, oil, and manufacturing sectors are driving demand for advanced chemical solutions across the region.

UAE Water Treatment Chemicals Market Analysis

In the UAE, the market is growing due to limited freshwater resources and heavy reliance on desalination. Increasing industrial activities, strict environmental regulations, and investments in advanced water and wastewater treatment technologies drive demand. Additionally, the government's focus on sustainable water management and efficient chemical usage in power, oil, and manufacturing sectors further supports market growth.

How is the Opportunistic Rise of Latin America in the Water Treatment Chemicals Market?

Latin America is experiencing an opportunistic rise in the market due to rapid urbanization, industrial growth, and rising demand for clean and safe water. Government initiatives for wastewater treatment, investments in municipal and industrial infrastructure, and increasing awareness of water scarcity and pollution management are driving the adoption of advanced chemical solutions across the region.

Brazil Water Treatment Chemicals Market Analysis

The market in Brazil is expanding due to growing industrialization, rising urban populations, and increasing demand for safe and sustainable water. Government investments in sewage treatment, stricter environmental regulations, and the need for efficient wastewater management in industries such as power, oil, and manufacturing are driving the adoption of advanced chemical solutions.

Value Chain Analysis

- Feedstock Procurement: This stage includes sourcing of fossil-derived and bio-based raw materials for coagulants, flocculants, and disinfectants.

Key Players: BASF, Kemira, Solenis, Ecolab, Arkema - Compound Formulation and Blending: This stage focuses on developing custom formulations of coagulants, flocculants, pH regulators, and additives to optimize contaminant removal.

Key Players: SNF Group, Nouryon, Lanxess, Kurita Water Industries, Buckman - Distribution to Industrial Users: Chemicals reach industries via producers, distributors, and direct contracts, ensuring compliance and promoting water reuse initiatives.

Key Players: Univar Solutions, Brenntag, IMCD Group, Solvay, Veolia

Water Treatment Chemicals Market Companies

- Johnson Matthey – Supplies specialty and precious metal-based chemical products used in water treatment systems, supporting corrosion resistance, ballast water treatment, and protection of infrastructure through high-performance chemical coatings and additives.

- Green Water Treatment Solutions – Offers comprehensive water and wastewater chemical solutions, including biocides, antiscalants, corrosion inhibitors, coagulants, and polymers for boilers, cooling towers, RO systems, and industrial/desalination applications.

- Bosch Somicon ME FZC – Provides advanced water purification and treatment system technologies, including ultrapure and sustainable water solutions for industrial and hydrogen production projects, focusing on chemical-free or minimal chemical processes.

- Veolia – Delivers a wide range of water treatment chemicals and services, optimizing raw, utility, and wastewater treatment applications with formulations for cooling, boiler feed, drinking water, and effluent processing.

- Kurita Europe GmbH – Offers industrial and municipal water treatment chemicals such as corrosion inhibitors, scale control agents, and wastewater treatment formulations, alongside systems for boiler, cooling, and ultrapure water needs.

- Solvay S.A. – Provides specialty water treatment chemicals, including coagulants, flocculants, corrosion inhibitors, and dispersants, designed to enhance purification, contaminant removal, and compliance in industrial and municipal water applications.

- Ecolab:Provides comprehensive wastewater treatment chemicals and services, including coagulants, biocides, scale inhibitors, and customized solutions to improve water quality and regulatory compliance across industrial and municipal sectors.

- Solenis: Offers a wide range of treatment chemicals such as coagulants, flocculants, corrosion inhibitors, and biological care solutions that enhance wastewater processing efficiency and reduce environmental impact.

- Nouryon: Supplies advanced wastewater treatment chemicals, including coagulants, flocculants, and pH adjusters designed to optimize contaminant removal, sludge reduction, and overall plant performance.

- SUEZ: Delivers water and wastewater treatment solutions with specialized chemical products, process optimization services, and digital support to enhance treatment efficiency and sustainability for municipalities and industries.

- BASF SE: Provides wastewater treatment additives like flocculants, coagulants, and biocides, supporting industrial and municipal treatment processes with advanced chemical formulations for improved purification and compliance.

- Kemira Oyj: Offers a portfolio of wastewater chemicals, including polymers, coagulants, and process aids that help remove pollutants, improve filtration, and support efficient water recycling.

- Cortec Corporation: Supplies environmentally friendly and corrosion-inhibiting chemical solutions for wastewater systems, focusing on protecting infrastructure while maintaining treatment performance.

- Buckman: Provides wastewater treatment chemistries such as biological enhancers, coagulants, and antiscalants, tailored to improve treatment outcomes, reduce costs, and support sustainable operations.

Other Major Key Player

- Baker Hughes, a GE company LLC

Recent Developments

- In March 2025, DuPont Water Solutions today launched WAVE PRO, a powerful online modeling tool for a variety of ultrafiltration (UF) water treatment applications, including drinking water, industrial utility water, wastewater, and seawater desalination. This next generation of the Water Application Value Engine (WAVE), WAVE PRO for UF, guides water professionals through the water treatment design process for ultrafiltration.

- In March 2025, Whitewater Management, a market-leading fluid management company, announced its purchase of Orion Water Solutions, a pioneer in advanced wastewater treatment solutions. The acquisition strategically positions Whitewater and its production chemical company, Catalyst Production Services, for continued growth while enhancing their ability to provide sophisticated water treatment solutions across a range of industries.

- In November 2024, Solenis acquired BASF's flocculants business, strengthening its specialty chemical portfolio for the mining sector and expanding its capabilities in mineral extraction, enhancing competitiveness in the market.

(Source: www.chemanalyst.com) - In April 2024, Gradiant, a global solutions provider for advanced water and wastewater treatment, announced the launch of CURE Chemicals. Continuing Gradiant's track record of innovation and commercialization, CURE Chemicals will set new benchmarks in environmental sustainability and operational efficiency for the world's essential industries.

- In July 2024, Kurita America, part of the Kurita Group, a leading global provider of industrial water treatment solutions, announced a collaboration with Solugen, a bio-based chemical manufacturer, to develop a suite of new carbon-negative water treatment products.

- November 2021- Kemira announced the completion of its expansion of production capacity in the United Kingdom. The company plans to increase annual production of ferric-based water treatment chemicals in its UK facility by more than 100.000 tons.

- Juy 2020- Solenis acquired Poliquimicos, S.A. de C.V. (Poliqimicos), a Mexican company. Poliquimicos is a manufacturer and supplier of specialised chemical solutions for industries that use a lot of water.

- January 2019- With the aim of combining its process optimization expertise with Valmet's industrial water and sludge analysers and measurement technology, Kemira has entered into an agreement with Valmet to deal with customer applications for wastewater treatment.

Segments Covered in the Report

By Product

- Scale & Corrosion Inhibitor

- pH & Adjuster & Softener

- Defoamer & Defoaming Agent

- Biocide & Disinfectant

- Coagulants & Flocculants

- Others

By End-Use

- Pulp & Paper

- Food & Beverage

- Municipal

- Mining & Mineral Processing

- Chemical Manufacturing

- Oil & Gas

- Power

- Others

By Application

- Effluent Water Treatment

- Boiler

- Cooling

- Water Desalination

- Raw Water Treatment

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content