What is the Fuel Pumps Market Size?

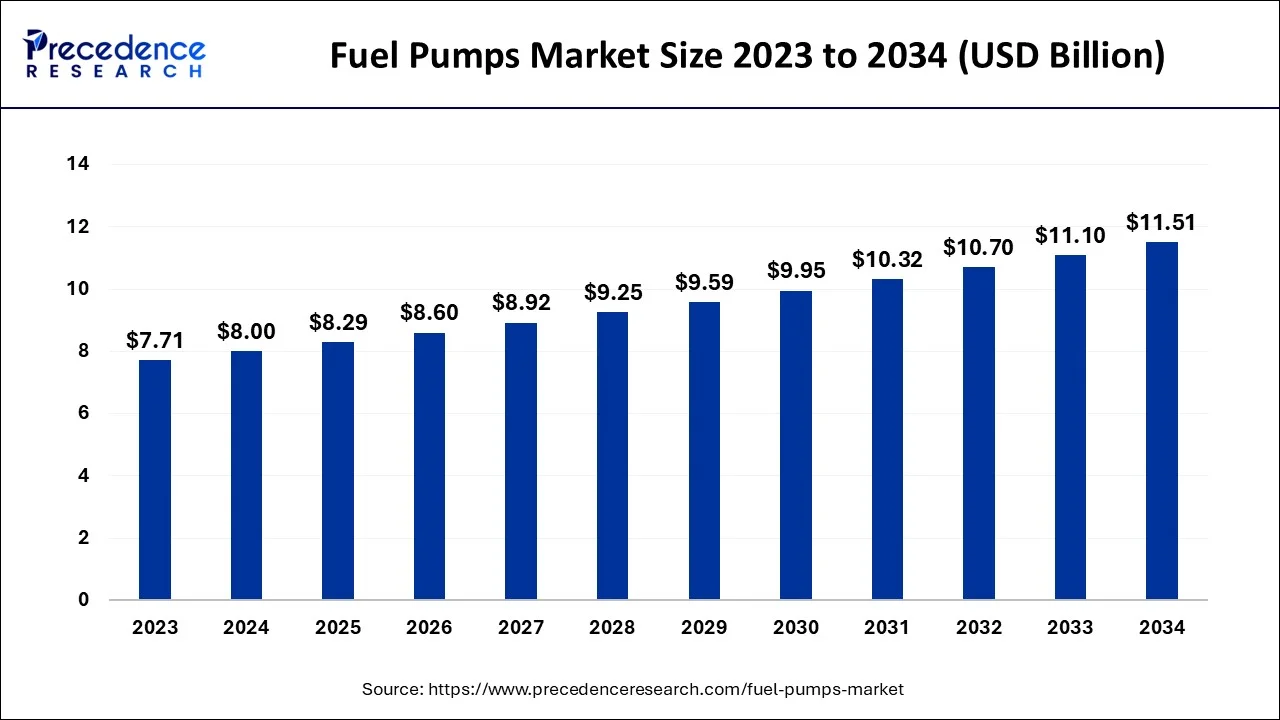

The global fuel pumps market size is calculated at USD 8.29 billion in 2025 and is predicted to increase from USD 8.60 billion in 2026 to approximately USD 11.91 billion by 2035, expanding at a CAGR of 3.69% from 2026 to 2035. The market is driven by stringent government regulations regarding vehicle emissions and the rising demand for efficient fuel delivery systems.

Fuel Pumps Market Key Takeaways

- North America captured the largest revenue share in 2025.

- Asia-Pacific is expected to expand at the fastest CAGR between 2026 and 2035.

- By Technology, the electric segment is predicted to grow at the quickest CAGR from 2026 to 2035.

- By Application, the passenger cars segment led the global market in 2025.

What is the Fuel Pump?

Fuel pumps are positioned at the fuel tank and are critical components in both gasoline and diesel engines, responsible for delivering fuel from the fuel tank to the engine. Fuel pumps are available in two main types: mechanical and electric. Mechanical fuel pumps have been used in automobiles for many years and are driven by the camshaft. These pumps use a diaphragm to draw fuel from the fuel tank and deliver it to the carburetor or fuel injectors. Mechanical fuel pumps are simple and reliable but are not as efficient as electric fuel pumps. Electric fuel pumps use an electric motor to deliver fuel from the fuel tank to the engine. These pumps are more efficient than mechanical pumps and can deliver fuel at higher pressures. Electric fuel pumps are commonly used in modern vehicles, and many new vehicles come equipped with electric fuel pumps as standard equipment.

The fuel pumps ensure that engines receive the fuel they need to operate efficiently and reliably. The factors that are likely to augment the growth of the fuel pump market include increasing demand for fuel-efficient vehicles, government regulations mandating fuel efficiency and emissions standards, and technological advancements in fuel pump design, among others.

How is AI contributing to the Fuel Pumps Industry?

Predictive analytics and real-time monitoring have made it possible for AI to optimize fuel pump operations. Its anomaly detection prevents theft and leaks. The use of computer vision increases the level of safety at dispensing points. Smart insights improve planning of maintenance, service efficiency, and customer experience in all fuel distribution ecosystems.

Fuel Pumps Market Growth Factors

The growing automotive production is anticipated to augment the growth of the fuel pump market during the forecast period. As the global automotive industry continues to grow, the demand for fuel pumps is expected to rise. The automotive industry is a major market for fuel pumps, as these components are critical to the operation of both gasoline and diesel engines. Furthermore, the increasing demand for fuel-efficient vehicles is also likely to support the growth of the market. With the continuous increase in fuel prices and rise in environmental concerns, there is a growing demand for fuel-efficient vehicles. Fuel pumps help in improving engine efficiency and performance, and fuel pump manufacturers are investing heavily in developing new technologies that can help automakers meet fuel efficiency standards and reduce emissions.

Additionally, advances in fuel pump technology, including the development of electric fuel pumps are also expected to drive the growth of the fuel pump market in the years to come. Electric fuel pumps are more efficient and reliable than traditional mechanical pumps, and software systems that optimize engine performance can help automakers meet fuel efficiency and emissions standards.

Market Outlook

- Market Growth Overview: The fuel pumps market is expanding at a significant rate from 2026 to 2035, driven by growing vehicle production, stringent emission norms, and the shift toward hybrid vehicles.

- Global Expansion:The market is growing worldwide as emerging regions witness rising vehicle ownership, industrial growth, and opportunities for advanced fuel pump solutions in both conventional and electric vehicles.

- Major Investors: Major investors include automotive manufacturers, industrial equipment companies, and venture capital firms, providing funding, technology development, and infrastructure support to drive market growth.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 8.29 Billion |

| Market Size in 2026 | USD 8.60 Billion |

| Market Size by 2035 | USD 11.91 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 3.69% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Technology and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Growing automotive industry

The growing automotive industry is expected to support the growth of the fuel pump market within the estimated timeframe. The automotive industry is one of the largest and most important industries in the world, and it plays an important role in the global economy. Fuel pumps are an essential part of any vehicle that uses an internal combustion engine, as they are responsible for delivering fuel from the fuel tank to the engine. Hence, with the growing automotive industry, the demand for fuel pumps is also likely to increase, as more vehicles are produced and sold each year.

Besides, the rising global population, increasing urbanization, and growing demand for personal mobility is likely to augment the demand for automobiles during the forecast period. As the population of the world continues to grow, the demand for personal mobility increases which is expected to drive the demand for vehicles. Furthermore, as more people move into urban areas, the need for personal transportation also increases, as public transportation may not be readily available or convenient. This trend is particularly evident in emerging economies, where the automotive industry is growing rapidly. Also, with the development of new technologies, vehicles become more efficient, reliable, and safe; this in turn is supporting the growth in the sales of the new vehicles. For instance, the development of hybrid vehicles has created new opportunities for the automotive industry, as consumers seek out more environmentally-friendly alternatives to traditional gasoline-powered vehicles. Thus, owing to the increasing automotive production and sales the demand for fuel pumps is also expected to rise during the forecast period.

Restraints

Dependence on fossil fuels

The dependence on fossil fuels is expected to restrain the growth of the fuel pump market in the long term. Fossil fuels are finite resources, and their production and use have significant environmental impacts, such as air pollution and greenhouse gas emissions. As society becomes more aware of these issues and governments implement policies to address them, there is likely to be a shift away from fossil fuels towards cleaner and more sustainable energy sources. This shift away from fossil fuels could have a significant impact on the growth of the fuel pump market, which is currently dominated by pumps designed to handle gasoline, diesel, and other fossil fuels.

As demand for these fuels decreases, the demand for the corresponding fuel pumps is also likely to decrease. This could lead to a reduction in investment in the development of new fuel pump technologies, as well as a decline in the overall size of the fuel pump market. Consequently, this is expected to restrain the growth of the fuel pump market within the estimated timeframe.

Opportunities

Technological advancements in the fuel pumps

The increasing technological advancements to meet the increasing demand for fuel-efficient and environmentally-friendly vehicles are expected to contribute to the growth of the market in the years to come. The modern electric fuel pumps are becoming increasingly popular as they are more efficient than traditional mechanical fuel pumps and helps lower the emission levels, lowers the fuel consumption and increase the fuel pump performance. They are also quieter and more reliable. In addition, high-pressure fuel pumps are used in gasoline direct injection (GDI) systems, which are also becoming more common in modern vehicles. GDI systems use high-pressure fuel pumps to inject fuel directly into the engine cylinder, improving fuel efficiency and reducing emissions.

Also, when dealing with high-performance and race engines, a dual-channel fuel pump may be a better option. These pumps have two rows of turbine blades that supply high-pressure fuel lines to the engine, which allows for improved hot fuel flow compared to pumps with a single impeller wheel. Additionally, dual-channel pumps are known for being quieter than single-channel pumps. Furthermore, the introduction of smart fuel pumps is also supporting the growth of the market. These fuel pumps are equipped with sensors and electronic control units that can monitor the engine's fuel requirements and adjust the fuel flow rate accordingly, improving fuel efficiency and reducing emissions. Thus, these new fuel pump technologies are anticipated to create immense opportunities for market growth in the near future.

Segment Insights

Technology Insights

Mechanical fuel pumps dominated the fuel pump market, and that is because their cost-effectiveness is appreciated in lots of applications. Users from the industry are attracted by their long life and uncomplicated nature. Less expensive production is a factor that keeps it competitive. The mixing of high-tech pumps and mechanical pumping systems creates a scenario where both the traditional and modern fuel delivery methods are equally benefited through the balanced opportunities created.

Application Insights

The heavy commercial vehicles segment is expected to grow at the fastest rate due to the increase in logistics activities necessitates the installation of higher-capacity systems. It is of great importance that the pumps are designed such that they can withstand the pressure and are durable at the same time.

The norms and expectations set by the regulators have a major influence on the design of the pumps. At the same time, they encourage investment in advanced and reliable fuel delivery solutions that are going to be used for a long time.

Regional Insights

What Made North America the Dominant Region in the Fuel Pumps Market?

North America held the largest revenue share in 2025. This is owing to the growing automotive industry along with the increasing implications of government regulations to reduce carbon emissions and improve fuel efficiency in the region. Additionally, the increasing fuel prices are also likely to increase the demand for fuel-efficient cars in the region. Furthermore, the increasing demand for advanced fuel pumps is likely to support the regional growth of the fuel pump market during the forecast period.

The fuel pumps market in the U.S. is expanding due to rising vehicle ownership, increasing demand for fuel-efficient and high-performance vehicles, and stringent emission regulations, driving the adoption of advanced pump technologies. Additionally, growing investments in smart fueling infrastructure, including automated systems and AI-driven solutions, are enhancing operational efficiency and customer experience, further boosting market growth.

What Makes Asia Pacific the Fastest-Growing Region in the Market?

Asia-Pacific is expected to grow at the fastest CAGR during the forecast period. This is attributable to the increasing demand for heavy commercial vehicles and passenger cars in the economies like India and China. Major automobile manufacturers including Hyundai, Toyota, Honda, and Suzuki have set up their manufacturing facilities in the Asia-Pacific (APAC) region. This strategic move has resulted in a decline in vehicle prices, thereby driving the demand for passenger vehicles in the region. As a result, the adoption of passenger vehicles has witnessed a significant increase across APAC. Furthermore, stringent government regulations and standards are also increasing the demand for advanced fuel pump technologies which is also likely to support the regional growth of the fuel pumps market during the forecast period.

China is the major contributor to the Asia Pacific fuel pumps market due to its rapidly growing automotive industry, rising vehicle ownership, and strong industrial and infrastructure development. Government initiatives supporting clean energy and modern fueling infrastructure, along with increasing demand for fuel-efficient and high-performance vehicles, further drive market growth. Additionally, investments in advanced technologies such as automated and smart fuel pumps strengthen China's leading position in the region.

What Are the Driving Factors of The Fuel Pumps Market in Europe?

Europe is expected to grow at a significant rate during the forecast period. Europe is the home of technology that is very much based on sustainability. The manufacturers are mainly looking for ways to reduce emissions, become energy efficient, and be compatible with cleaner fuels. The market is gradually moving towards advanced designs that not only meet the environmental goals of today but also those of the future regarding regulatory alignment.

Germany Fuel Pumps Market Trends

Germany more or less determines the demand for high-efficiency fuel pumps thanks to its precision engineering that is at the very top of the scale. Although the manufacturers are using different ways to make durable designs that comply with the strict emission levels, brushless DC pumps are becoming more and more popular just because of their efficiency and silence. Innovation is at the heart of synthetic fuels and low-lubricity hydrocarbons that provide decarbonization pathways.

Value Chain Analysis of the Fuel Pumps Market

- Raw Material & Component Suppliers: This stage involves sourcing essential materials such as metals, plastics, electronics, and precision components used in fuel pumps.

Key players: Bosch, Denso, and Delphi Technologies. - Manufacturing & Assembly:Fuel pumps are manufactured and assembled, combining raw materials and components into final products while ensuring adherence to quality and safety standards.

Key players: Bosch, Aisin Seiki, and Cummins. - Distribution & Logistics:This stage covers transporting fuel pumps from manufacturing facilities to wholesalers, retailers, and service centers.

Key players: Denso, Delphi Technologies, and Magneti Marelli.

Top Companies in the Fuel Pumps Market & Their Offerings

- Delphi Technologies PLC: Delphi Technologies provides a comprehensive portfolio of fuel pumps and even modules for both Original Equipment Manufacturers (OEMs) and the automotive aftermarket.

- Denso Corporation: Denso Corporation offers a broad range of electric fuel pumps and even complete fuel pump modules for OEMs and aftermarket applications. Their fuel pumps are known for their efficiency, reliability, and quiet operation, which is why they are usually selected as a standard instrument for premium vehicles.

- Aisan Industry: Aisan Industry provides an advanced fuel pump module aiming for high efficiency, fuel economy, and even multi-fuel compatibility for LPG, gasoline, CNG, and FCVs, aiding automakers in meeting strict emission guidelines with compact, lightweight designs for hybrid/EVs, guaranteeing reliable fuel delivery for performance and greener.

Other Major Companies

- Carter Fuel Systems LLC

- Daewha Fuel Pump Ind. Ltd.

- Aisin Seiki Co., Ltd.

- Bosch Automotive Service Solutions Inc.

- Continental AG

- General Motors Company

- Hitachi Automotive Systems, Ltd.

- Johnson Electric Holdings Limited

- Valeo SA

Recent Developments

- In December 2025, Dover Fueling Solutions launched 4Court Media, a retail media network connecting brands with consumers at fuel dispensers. This platform allows both endemic and non-endemic advertisers to access fueling retailers, including many independent operators, often difficult to reach through traditional national media buys. (Source: https://www.cspdailynews.com )

- In September 2025, Svanehøj introduced the world's first high-pressure centrifugal pump for ammonia fuel applications, the HP NH3 Fuel Pump, achieving up to 100 BAR fuel injection pressure. It features a compact size and is based on their successful low-pressure pump design, enhancing ammonia fuel systems. (Source: https://www.marinelink.com )

- In August 2025,Continental (DE) declared a strategic collaboration with a leading electric vehicle producer to develop integrated fuel pump solutions monitored for hybrid systems. This change is indicative of Continental's commitment to innovation and even its recognition of the expanding hybrid vehicle market.

- In January 2022,Aisan Industry successfully finalized the acquisition of DENSO CORPORATION's fuel pump module ("FPM") business, as previously announced in the disclosure titled "DENSO and Aisan Reach Agreement on Transfer of Fuel Pump Module Business" on January 17, 2022. As part of this acquisition, Aisan obtained full ownership of KYOSAN DENSO MANUFACTURING KENTUCKY, LLC.

- In December 2022,Delphi Technologies introduced an extra 21 parts in its specialty Sparta fuel pump line and 142 new parts to its primary product line. Delphi Technologies continues to enhance its fuel portfolio by introducing 35 new parts. Among these additions are module assemblies and fuel pump hanger, fuel pump strainer sets, and fuel transfer units. These components undergo rigorous OE-quality testing to ensure exceptional reliability and durability.

Segments Covered in the Report

By Technology

- Mechanical

- Electric

- Turbine Style

- Sliding Style

- Roller Vane

By Application

- Passenger Cars

- Light Commercial Vehicles

- Heavy Commercial Vehicles

- Off High-Way Vehicles

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting