What is Bioethanol Market Size?

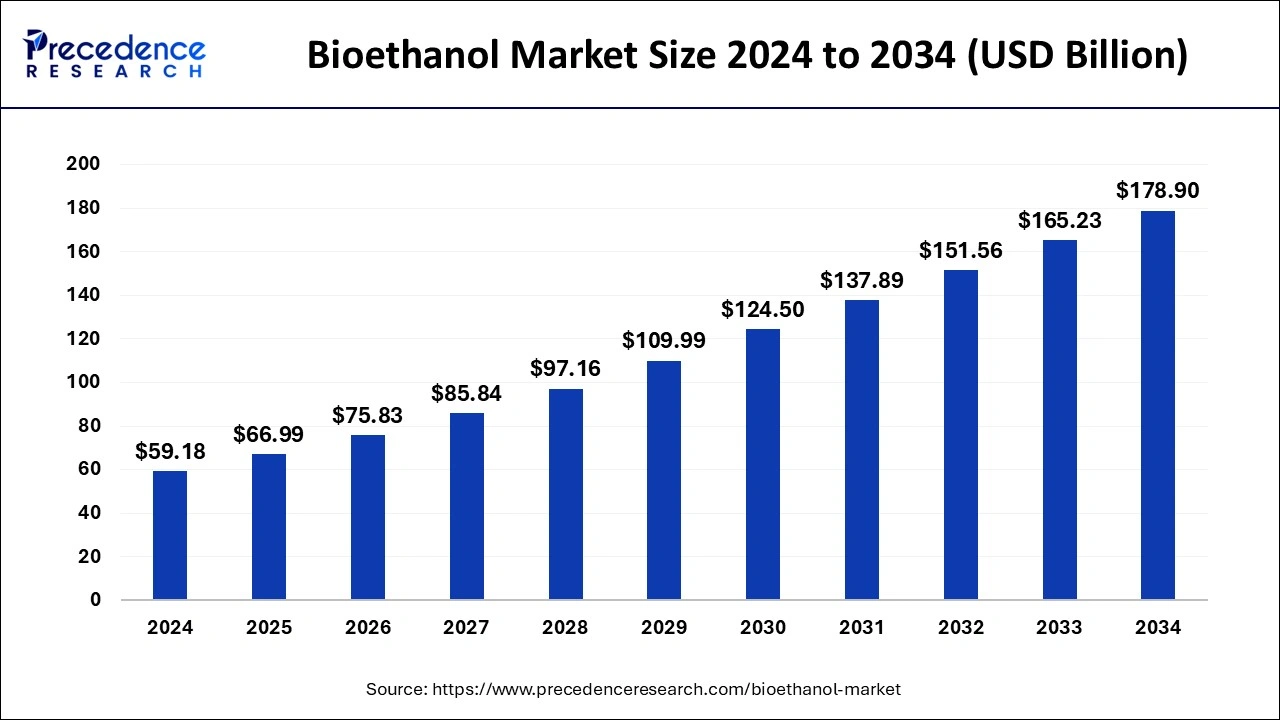

The global bioethanol market size is estimated at USD 66.99 billion in 2025 and is anticipated to reach around USD 192.57 billion by 2035, expanding at a CAGR of 11.14% from 2026 to 2035

Market Highlights

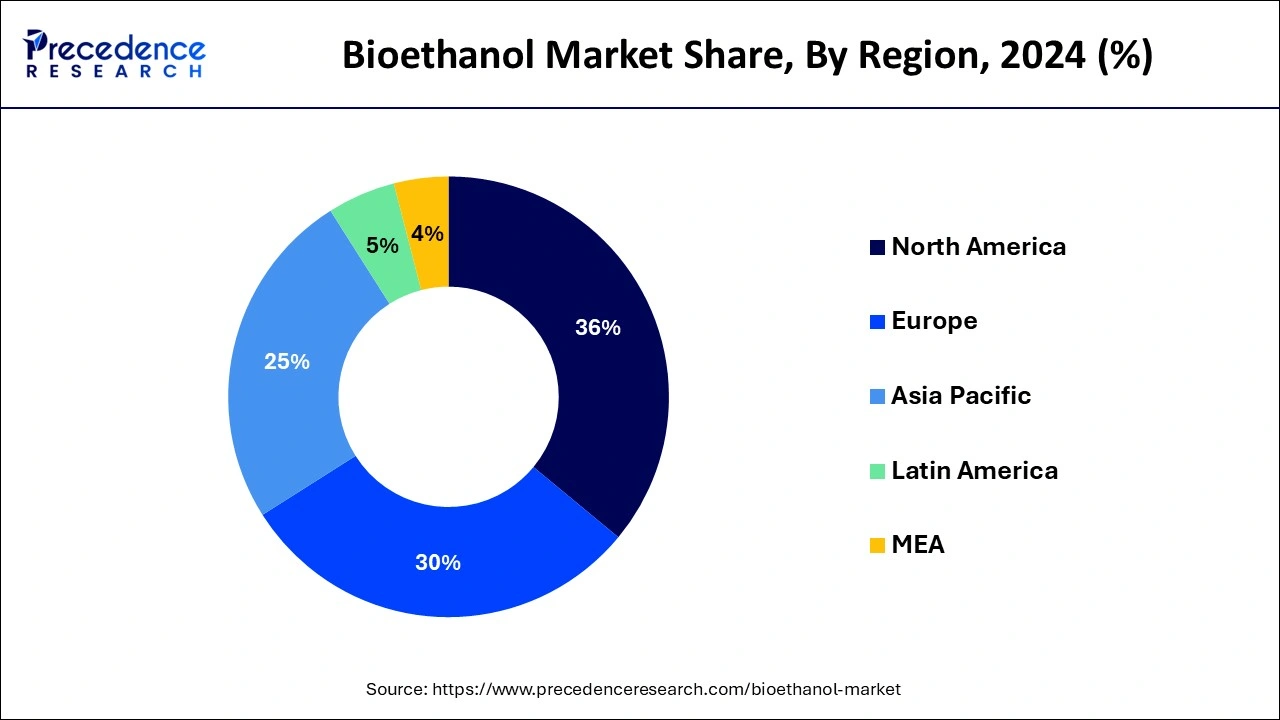

- North America had a 36% share of the global bioethanol market in 2025.

- By blend, The E-10 segment had the greatest market share in 2025.

Market Overview

Sugar cane molasses, starch crops, agricultural leftovers, and other discarded crops can all be used to make bioethanol. Manufacturers are focused on agricultural and forest leftovers, as well as energy crops such as miscanthus, switch grass, and sugarcane bagasse, for manufacturing. It may be used as a fuel both alone and in combination with other fossil energy. Bioethanol is a biodegradable, sustainable energy source produced from biomass by sugar fermentation and a chemical process. Because of its high-octane value as well as lower greenhouse gas emissions, bioethanol is an appealing alternative to traditional gasoline sources.

Fermentation, distillation, dehydration, and other industrial procedures are used in production. Bioethanol offers a variety of features, including physical stability, homogeneity, low viscosity, poor lubricity, anti-corrosiveness, and improved antiknock properties. Bioethanol's adaptability allows it to be utilised as a feedstock in the chemical industry, a fuel for generating power, a substitute for gasoline in road transport vehicles, and so on. Furthermore, one of the keys aims of the United Nations is to slow down and minimise global warming through the Sustainable Development Goals (SDG). Biofuels are critical in this regard. Furthermore, decreasing energy supplies and a greater emphasis on renewable energy sources are projected to drive market expansion. Due to its quick production rate and natural presence in the water, technological developments and increasing R&D to create ethanol from algae are predicted to enhance market demand, cutting production costs. Furthermore, because of the cheap prices relative to diesel and gasoline, usage will increase.

The COVID-19 epidemic has affected people's everyday life and changed the ethanol market needs for manufacturing usage in several nations. Despite these short-term repercussions, fuel ethanol requirements remain a viable option for future growth, and regional councils are working hard to promote market access in specific nations. As a result of the coronavirus pandemic, which is reducing gasoline usage and driving corn-based fuel off the market, some ethanol factories in the United States have reduced or reduced output. Governments have cut fuel needs as they encourage individuals to stay at home to prevent the COVID-19 outbreak.

Bioethanol Market Growth Factors

Advanced technologies and expanding R&D for the manufacture of ethanol from algae are expected to drive market demand due to its quicker rate of production as well as natural occurrence in the sea, which lowers production costs. Growing environmental concerns about bioethanol production drive manufacturers' propensity, while blending rules from regulatory organizations such as the EPA (Environmental Protection Agency) and ample raw material availability drive market expansion. It is not necessary to change car engines since mixing ethanol with conventional gasoline promotes market expansion.

Bioethanol is composed of natural components that enable it to perform better than fossil fuels. Furthermore, combustion outcomes are more environmentally friendly than fossil fuels due to the absence of harmful sulphur and nitrogen molecules, and increased support for ecological arrangements is propelling market expansion. Aside from that, easing prohibitions on the sale of gasoline containing a high proportion of ethanol is rising the global market. Growing government initiatives to produce and use greener fuels are driving market expansion.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 66.99 Billion |

| Market Size in 2026 | USD 75.83 Billion |

| Market Size by 2035 | USD 192.57 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 11.14% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Application, Feedstock, Fuel Generation, Blend, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Key Market Drivers

Benefits of bioethanol as compared to conventional fuel-

- When opposed to typical fuels, bioethanol has several advantages, including the fact that it is created from renewable resources such as cropers. As a result, bioethanol emits little or no net carbon dioxide into the environment, making it a green energy source. Mixing bioethanol and gasoline compensates for falling global oil supplies, increasing fuel security and eliminating nation-to-nation dependency on foreign fuel supply.

- The increased demand for police needed for bioethanol production would most likely benefit rural areas. It also contributes to improved air quality by lowering carbon monoxide emissions from ageing automotive engines.

Increasing research and development activities

- The solution is a key trend in the bioethanol sector. Bioethanol synthesis from plant waste that can be utilised to produce second-generation bioethanol (SGB) has been widely researched. Several initiatives have been launched with the goal of effectively replacing diesel and gasoline with bioethanol.

- The NILE (New Improvements for Lignocellulosic Ethanol) project brings up 21 industrial and scientific entities from 11 member countries to pursue bioethanol production research. As a result, such R&D initiatives are expected to boost market expansion in the approaching years.

Key Market Challenges

- Increasing electric vehicle market - The market is expected to be constricted in the nourish term as the usage of electric cars grows. Sales of electric vehicles have risen in recent years, and so this trend is predicted to continue over the forecast period. According to the International Energy Agency, the worldwide electric vehicle stock topped ten million units in 2020, a 43% increase from 2019. The global electric car industry is booming. As a result, demand of fossil as well as bioethanol fuels would fall. As a result, the bioethanol industry is expected to be suffocated in the near future as the usage of electric cars grows.

Key Market Opportunities

- Increasing sales of passenger vehicles: One of the primary factors positively affecting the market is the suburbanization trend and increased sales of passenger automobiles globally due to rising disposable incomes. Furthermore, consumers' rising environmental concerns are pushing desire for bioethanol like a substitute for fossil fuels. Aside from that, improved road transportation networks are increasing the usage of commercial cars. Because these cars contribute significantly to air pollution and traffic congestion, governments in many countries are enacting severe rules to reduce pollutant emissions to encourage the use of bioethanol. Furthermore, bioethanol is used in current engines to minimise carbon monoxide emissions, so helping to improve overall air quality.

- Usage in multiple industries - Bioethanol is also widely utilised as a carrier or solvent in personal care products and cosmetics across the world since it is skin-friendly and safe for the environment and health. It is also used as a main component in the pharmaceutical business to make medications, cough syrups, medical capsules, and disinfectants. Furthermore, it is gaining popularity as a flavour enhancer in the food and beverage (F&B) business.

Segments Insights

Application Insights

The transport end-use market sector of the bioethanol industry accounted for the biggest market share in terms of value and volume.

Bio-ethanol is used as a fuel and gasoline additive in the automobile and transportation industries. It is employed in combination with regular gasoline to power gasoline engines in cars. Bioethanol is less costly and less harmful to the environment than petroleum. To generate mixes that burn better efficiently and emit zero carbon dioxide, a little quantity of bioethanol is combined with pure gasoline. As a consequence, bioethanol fuel mixes are mandated in several nations throughout the world. As a result of the increasing usage of bioethanol with in transportation end-use industry, its market is growing.

Blend Insights

The E-10 category had the greatest proportion of the bioethanol industry in 2025 and is expected to increase at a CAGR of 14.2% between 2026 to 2035. Blending bio-ethanol with conventional fuels improves their renewability. E10 is a gasoline mix that combines 90% ordinary unleaded fuel and 10% ethanol. Bioethanol is indeed a low-carbon biofuel that can help with transportation decarbonization. This may be put in the majority of new automobiles and light-duty diesel engines without modifying the engine or fuel system. Bioethanol consumption in the E10 sector is predicted to climb due to greater use in the automobile industry. To reduce global greenhouse gas (GHG) emissions, several governments in Europe and other areas have enforced the use of E-10 fuel mixes in cars. As a consequence, market for E-10 gasoline blends is increasing in a variety of end-use sectors, fueling market development.

Regional Insights

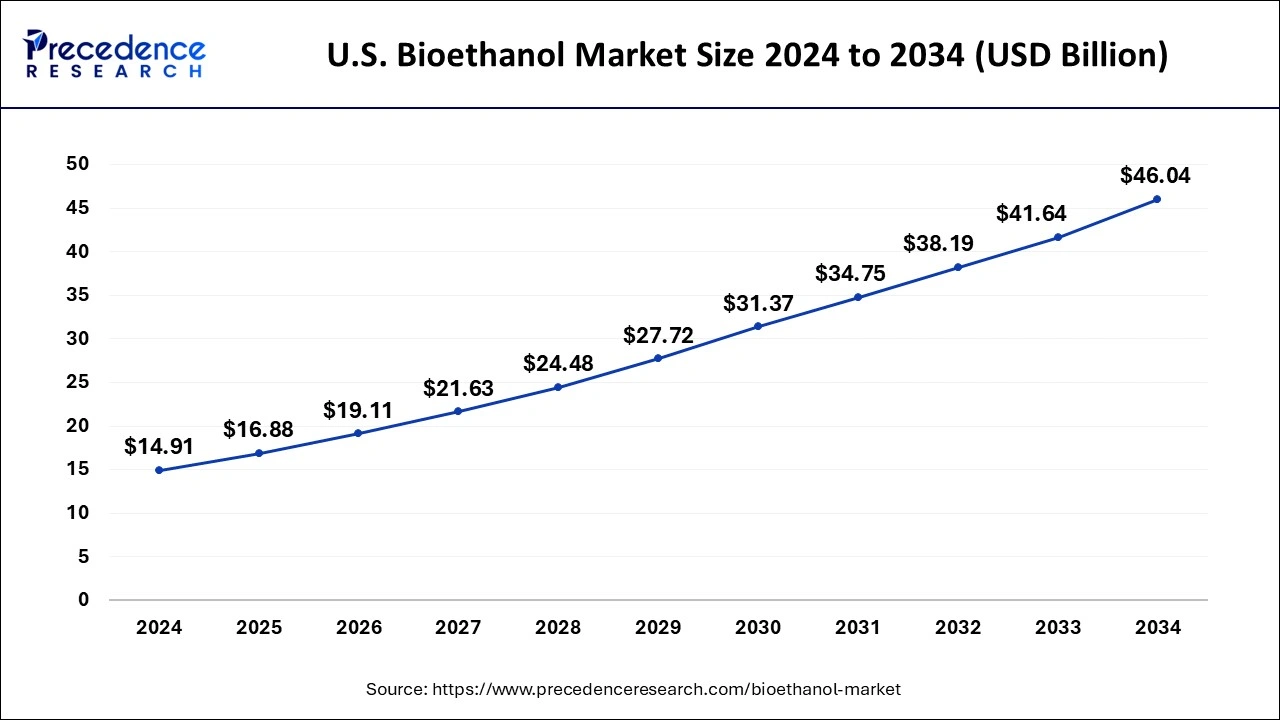

U.S. Bioethanol Market Size and Growth 2026 to 2035

The U.S. bioethanol market size is evaluated at USD 16.88 billion in 2025 and is predicted to be worth around USD 49.8 billion by 2035, rising at a CAGR of 11.43% from 2026 to 2035

In 2025, North America had a 36% share of the global bioethanol market. Bioethanol is used as a replacement for normal gasoline due to the government's severe environmental laws. Technical advancements and the rapidly expanding vehicle sector are likely to considerably contribute to boosting demand in this area over the next 7 years.

Canada has a high per capita consumption of transport fuels. The decarbonization of transportation is a crucial strategic focus, as transport contributes 22% of Canada's greenhouse gas emissions, with on-road vehicles responsible for 85% of this total. Biofuels currently make up about 5% of energy consumption for transportation in Canada. The demand for ethanol and bio-based diesel rose by 34% and 42%, respectively, from 2021 to 2023 as a result of supportive policies and is anticipated to keep rising.

Significant technological advancements in ethanol production techniques have aided in reducing expenses and enhancing efficiency. Methods of fermentation and the genetic alteration of feedstock crops have led to increased yields with greater energy efficiency. Canada has made substantial investments in establishing a domestic bioethanol sector, and it is anticipated that bioethanol derived from lignocellulosics will become more desirable to the industry as it expands.

Furthermore, the usage of bioethanol blends in automobiles is required in the USA and Canada. Aside from favourable biofuel regulations, the industry is being spurred forward by significant growth in corn-based production of bioethanol, increased crop yields, and a growing emphasis on energy efficiency.

- In 2023, the use of bioethanol and biomass-derived diesel (BBD) in Europe is projected to rise by 4.5% to 6.58 billion liters and by 0.6% to 17.98 billion liters, respectively. The growth in bioethanol is primarily attributed to the increase in the gasoline fuel pool. Recently, there has been an increase in awareness regarding the negative impact of fossil fuels on the environment. Consequently, the companies are also involved in discovering eco-friendly fuel options.

Bioethanol may serve an important role as it can be blended with fossil fuels to reduce the carbon footprint. In 2024, Germany dominated the European bioethanol consumption market, holding a share of 21.95 thousand metric tons. European biorefineries have a broad scope – they generate food, feed, renewable ethanol, and various essential products for different industries across Europe.

- Rayonier Advanced Materials Inc., a world leader in manufacturing high-purity cellulose specialty products, held a groundbreaking ceremony for its new second-generation bioethanol facility in Tartas, Les Landes, France, on June 15, 2023. The construction of the plant started in January 2023.

Europe: France Bioethanol Market Trends

France's market is driven by the increasing demand for sustainable alternative fuels, depletion of natural resources, growing energy consumption, and excessive greenhouse gas output are the main drivers of market expansion. Moreover, the vast amount of biomass accessible for production is propelling research in the field, resulting in market growth.

Bioethanol Market in the Asia Pacific

Asia Pacific's market shows significant growth during the forecast period. It is driven by strong mandates along with incentives in China, India, and Australia, which is an aim for blending biofuels to cut reliance on imported fossil fuels. Increasing economies and populations raise overall energy demands, driving the push for diverse energy sources.

China Bioethanol Market Trends

China's bioethanol market is undergoing steady growth, driven by government mandates for renewable fuels, growing energy needs, and goals for energy security and reduced pollution. With the growth of technology in advanced feedstocks such as cellulosic materials.

Bioethanol Industry Dynamics in Latin America

Latin America's market shows notable growth during the forecast period. It is driven by abundant agricultural resources, mainly sugarcane, with Brazil and Argentina leading, funded by strong government mandates such as Brazil's RenovaBio and the growing need for renewable fuels.

Argentina Bioethanol Market Trends

Argentina's market growth is largely attributed to government policies, which promote renewable energy sources and the increasing need for biofuels. Furthermore, the ethanol market benefits from Argentina's favorable climate and agricultural conditions, which support the cultivation of feedstocks necessary for ethanol production.

Bioethanol: Decarbonization Enabler in MEA

MEA's market shows a rapid growth rate during the forecast period. By leveraging agricultural residues and sugarcane, bioethanol offers a lower-carbon option to gasoline, supporting the transition towards Net Zero 2050 goals. Enhancements in production, like the usage of advanced distillation systems along with Second Generation (2G) technology, are rising yields and improving the sustainability of bioethanol.

UAE Bioethanol Market Trends

UAE's strong push for renewable energy, clean energy targets, along with supportive regulatory frameworks. Growing need for cleaner fuels to meet emission standards along with combat climate change. Increasing usage of ethanol in gasoline blends like E10, etc., to decarbonize transport, funded by new emission standards.

Value Chain Analysis for the Bioethanol Market

- Resource Extraction

It includes the cultivation, harvesting, and even initial processing of biomass to obtain fermentable sugars.

Key Players: Valero Energy Corporation, Green Plains Inc., Raízen S.A., Tereos - Power Generation

It operates by utilizing the byproducts of ethanol production, mainly lignin, agricultural residues, and the bioethanol itself, to produce electricity and heat via combustion, gasification, or advanced fuel cells.

Key Players: Archer-Daniels-Midland Company, Raízen S.A., Green Plains Inc. - Distribution Network Management

It works by improving the logistics of moving bulky agricultural feedstocks to biorefineries, along with distributing the finished ethanol to consumption centers.

Key Players: Valero Energy Corporation, Green Plains Inc., Raízen S.A., Tereos S.A.

Bioethanol Market Companies

- Archer Daniels Midland (US)

- POET LLC (US)

- Green Plains (US)

- Valero Energy Corporation (US)

- Tereos (France), Raizen (Brazil)

- Flint Hills Resources (US)

- Pacific Ethanol (US)

- The Andersons Inc. (US)

- Sekab Biofuels & Chemicals AB(Sweden)

Recent Developments

- Blue Biofuels Inc. stated in May 2022 that their fifth generation Cellulose-to-Sugar ("CTS") plant is on schedule and that testing and additional engineering for bigger quantities has begun. Furthermore, Blue Biofuels has worked out a plan for the future and has hired K.R. Komarek Inc. to create the successors to the fifth generation CTS machine through commercialization. Alto Ingredients, Inc.

- Announced in November 2021 that it would sell its fuel ethanol production plant in Stockton, California, to Pelican Acquisition LLC approximately $ 24.0 million in cash, including USD 16.2 million of the proceeds going toward the firm's remaining term debt.

- In October 2021, ADM agreed to sell its ethanol producing plant in Peoria, Illinois, to BioUrja Group. Their strategic examination of dry mill ethanol assets included the sale of their Peoria facility.

Segments Covered in the Report

By Application

- Transportation

- Alcoholic Beverages

- Cosmetics

- Pharmaceuticals

- Others (chemical, paint & coatings)

By Feedstock

- Starch based

- Sugar based

- Cellulose-based

By Fuel Generation

- First generation

- Second generation

- Third generation

By Blend

- E5

- E10

- E15 to E70

- E75 & E85

- Others (E85 to E100)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting