What is the Fuel and Lube Trucks Market Size?

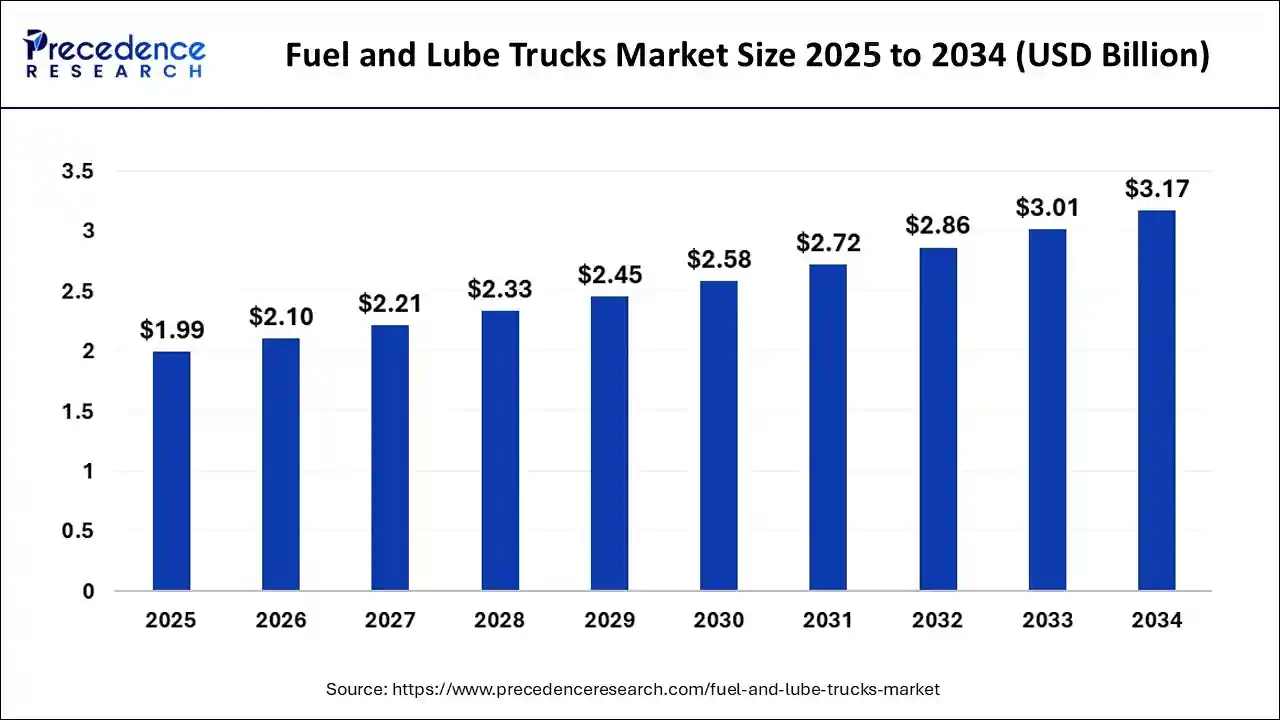

The global fuel and lube trucks market size is accounted at USD 1.99 billion in 2025 and predicted to increase from USD 2.10 billion in 2026 to approximately USD 3.17 billion by 2034, expanding at a CAGR of 5.32% from 2025 to 2034. The rising demand for fuel and lube trucks from the different end-use industries is the key factor driving market growth. Also, the ongoing expansion of construction and mining industries coupled with the technological advancements in truck design can fuel market growth further.

Fuel and Lube Trucks Market Key Takeaways

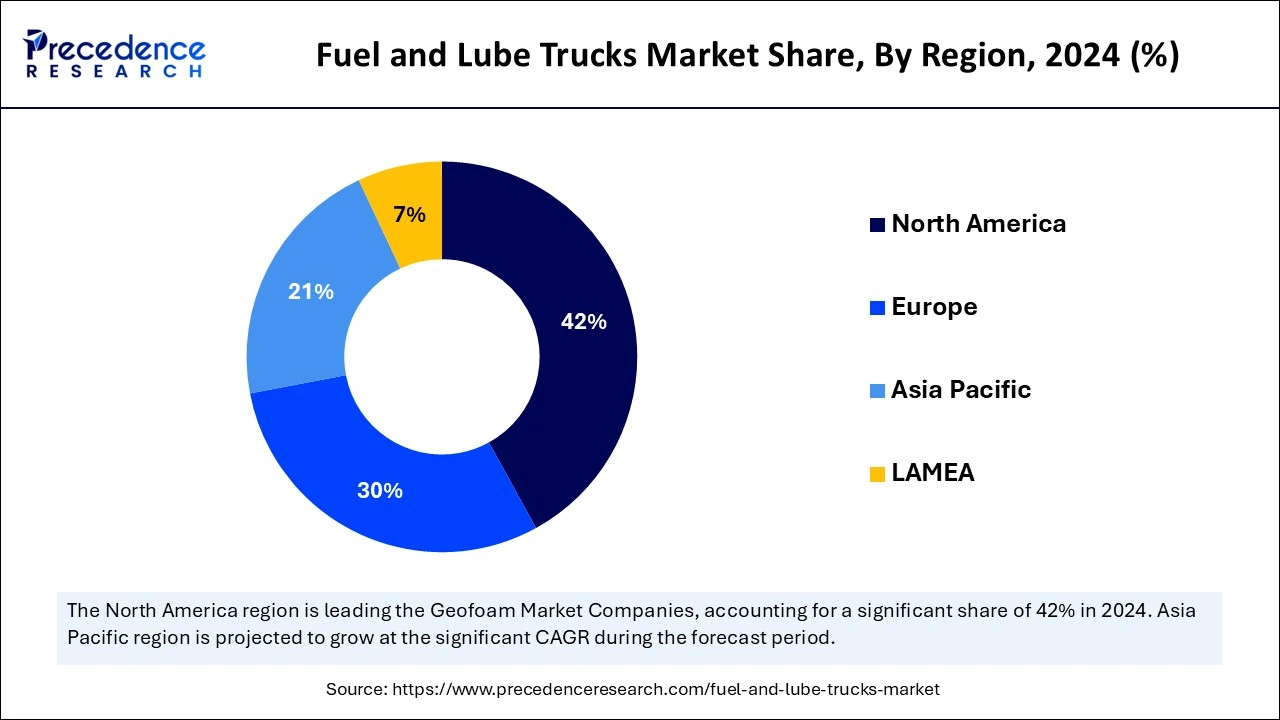

- North America dominated the global fuel and lube trucks market with the largest market share of 42% in 2024.

- Asia Pacific is expected to show the fastest growth in the market over the studied period.

- By truck type, the fuel tank trucks segment contributed the biggest market share of 56% in 2024.

- By truck type, the combination trucks segment is expected to show the fastest growth over the forecast period.

- By capacity, the 15,000 to 25,000 kg segment led the global market in 2024.

- By capacity, the above 25,000 kg segment is expected to grow at the fastest rate over the forecast period.

- By application, the construction and infrastructure development segment held the largest market share in 2024.

- By application, the mining and natural resources extraction segment is estimated to witness the fastest growth during the projected period.

Role of Artificial Intelligence (AI) in the Lubrication Industry

Artificial Intelligence algorithms can predict when the machine may require maintenance or new lubricants. Hence, AI can decrease downtime, lengthen equipment life, and optimize lubricant usage in the fuel and lube trucks market. Furthermore, AI can streamline the whole supply chain for lubricants, forecasting fluctuations in demand and optimizing delivery routes. This can help to ensure the availability of the right lubricant at the right time.

- In January 2023, a Swedish tech company launched a wireless condition-based lubrication system monitored via an App with AI-based decision support. This system represents a significant technological breakthrough in proactive maintenance, and international interest has been high. Agreements with distributors in several European countries have already been signed.

What are Fuel and Lube Trucks?

Fuel and lube trucks are mobile units created to offer fuelling services and on-site lubrication for heavy equipment and machinery. The applications of the fuel and lube trucks market are important in industries like mining, construction, and agriculture. Where equipment requires proper maintenance and fuelling to perform effectively, this truck helps to reduce downtime, lessen transportation costs, and improve operational efficiency by providing key services to the job site directly.

Fuel and Lube Trucks Market Growth Factors

- Increasing awareness regarding climate change is expected to boost fuel and lube trucks market growth soon.

- Stringent environmental regulations prompt key players to innovate their products, which can further propel market growth.

- Increasing investments in research and development to produce advanced solutions will likely contribute to the market expansion over the forecast period.

Fuel and Lube Trucks Market Outlook

- Industry Growth Overview: The market for fuel and lube trucks is poised for rapid growth between 2025 and 2034 due to increasing demand in industries such as construction, mining, and transportation, where on-site fueling and lubrication services are crucial for operational efficiency. Growth is further driven by advancements in truck technology, regulatory support for fleet management, and the rising need for uninterrupted operations in remote or off-road locations.

- Integration of Smart Technologies: The market is seeing a trend toward integrating smart technologies, such as telematics and digital monitoring systems, to enhance operational efficiency and safety. Additionally, there is a growing focus on durability and customization to meet the specific demands of industries such as construction and mining, where trucks must withstand harsh environments and provide reliable on-site fueling and lubrication services.

- Global Expansion: The market is growing worldwide as industries like construction, mining, and transportation increasingly rely on mobile fueling and lubrication solutions to enhance efficiency and reduce downtime in remote operations. Emerging regions, particularly in Asia-Pacific, Africa, and Latin America, offer significant opportunities due to expanding infrastructure development, growing industrial activity, and the need for more cost-effective and flexible on-site fueling services.

- Major Investors: Major investors in the market include large manufacturers such as Velcon Filters, Daimler AG, and Altec Industries, which design and produce advanced, high-quality trucks tailored for fueling and lubrication applications in demanding industries. These companies drive market growth through innovations in fuel delivery systems, mobile fueling technologies, and custom-built truck solutions that meet the evolving needs of industries like construction, mining, and transportation.

Market Scope

| Report Coverage | Details |

| Market Size by 2026 | USD 2.10 Billion |

| Market Size in 2025 | USD 1.99 Billion |

| Market Size in 2034 | USD 3.17 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.32% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Truck Type Insights, Capacity Insights, Application Insights, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. |

Market Dynamics

Drivers

Increasing demand for sophisticated delivery systems

The fuel and lube trucks market is witnessing an increase in demand for sophisticated delivery systems due to the increasing need for lubricants in different sectors like industrial machinery, automotive, and construction. Because vehicles and equipment require proper lubrication to ensure their longevity and optimal operation. In addition, this need is further fuelled by increasing emphasis on preventive maintenance strategies, where timely lubrication is needed.

- In April 2024, Premier Truck Rental (PTR), a leading provider of custom work truck and trailer rentals, announced the addition of cutting-edge Fuel Lube and mini-Lube trucks to its fleet. This strategic investment further emphasizes the company's commitment to adapting to customers' needs, delivering superior service, and prioritizing efficiency for rental customers.

Restraint

Complexity with regulatory compliance

The complexity between market and regulatory complaints is the major factor hampering the fuel and lube truck market. Laws governing vehicle safety, like those associated with braking systems, driver training, and stability control, require manufacturers to invest heavily in innovative safety features. Moreover, all this can lead to increased overall manufacturing costs, which can carry on to the consumers in the form of elevated prices.

Opportunity

Surge in the automotive and industrial sector

The rapid growth in the automotive and industrial sectors is a significant factor creating opportunities for the fuel and lube trucks market. There is a constant rise in the demand for lubricants from the automotive industry to ensure their proper maintenance and functioning. Furthermore, the ongoing expansion of the vehicle industry is escalating due to urbanization, increasing consumer demand, and launches of innovative vehicles to create scenarios for lube truck application as a practical option.

- In November 2024, Stellar Industries announced the acquisition of Elliott Machine Works, Inc., a well-respected, family-owned manufacturing company based in Galion, Ohio. This strategic investment is aimed at enhancing Stellar's growth, expanding its product offerings, and providing greater opportunities for Stellar distributors, customers, and employee-owners.

Truck Type Insights

The fuel tank trucks segment led the global fuel and lube trucks market in 2024. The dominance of the segment can be attributed to the increasing use of fuel tanks in a diverse range of industries such as mining, construction, agriculture, transportation, and oil and gas. Additionally, these end-use industries need on-site refueling solutions for vehicles, heavy machinery, and equipment that work in remote locations where conventional fuel stations are unavailable.

The combination trucks segment is expected to show the fastest growth over the forecast period. The growth of the segment can be credited to the operational flexibility and cost-efficiency provided by these trucks to businesses that require both maintenance and fuelling services. Also, the dual functionality of these trucks enables operators to decrease operational costs and fleet size and enhance service delivery.

- In October 2024, China's BYD launched its first pickup truck in Brazil, the Shark, to challenge the top-selling Toyota Hilux and the Ford Ranger. The Shark will play a significant role in BYD's ambitions to become a top-selling automaker over the next few years. BYD sees Brazil as a critical piece to its overseas expansion as it looks to continue climbing the global sales charts.

Capacity Insights

The 15,000 to 25,000 kg segment led the global fuel and lube trucks market in 2024. The dominance of the segment can be linked to the provision of sufficient weight capacity by this segment to carry enough fuel and lubricants for big operations. Trucks between this weight range give a balance between maneuverability and capacity to make them convenient for an extensive range of industries. These capacity trucks are widely used in logistics, agriculture, and construction.

The above 25,000 kg segment is expected to grow at the fastest rate over the forecast period. The growth of the segment can be driven by increasing utilization of this capacity truck for mining and oil extraction purposes, which are mostly situated in outer areas. Moreover, these trucks provide the capacity to deliver huge volumes of fuel and lubricants without needing frequent refueling.

Application Insights

In 2024, the construction and infrastructure development segment held the largest fuel and lube trucks market share. The dominance of the segment is due to the ongoing surge of megaprojects like airports, highways, and industrial facilities. This sector requires an extensive range of heavy machinery, including bulldozers, excavators, cranes, and earth movers. Furthermore, fuel and lube trucks are important for on-site maintenance and fuelling to ensure the infrastructure and construction projects are functioning properly.

The mining and natural resources extraction segment is estimated to witness the fastest growth during the projected period. The growth of the segment is because of the increasing global need for natural resources such as minerals, metals, and fossil fuels. Moreover, technological developments in mining operations, which require more fuel-sufficient equipment with larger capacity, can impact segment growth positively.

- In April 2024, Sany India, a construction and mining equipment manufacturer, introduced the SKT105E Electric Dump Truck, the first fully electric open-cast mining truck. Designed to meet the rigorous demands of open-cast mining operations, this indigenous off-highway dump truck features a new edition of innovation in construction and mining equipment manufacturing.

Regional Insights

U.S. Fuel and Lube Trucks Market Size and Growth 2025 to 2034

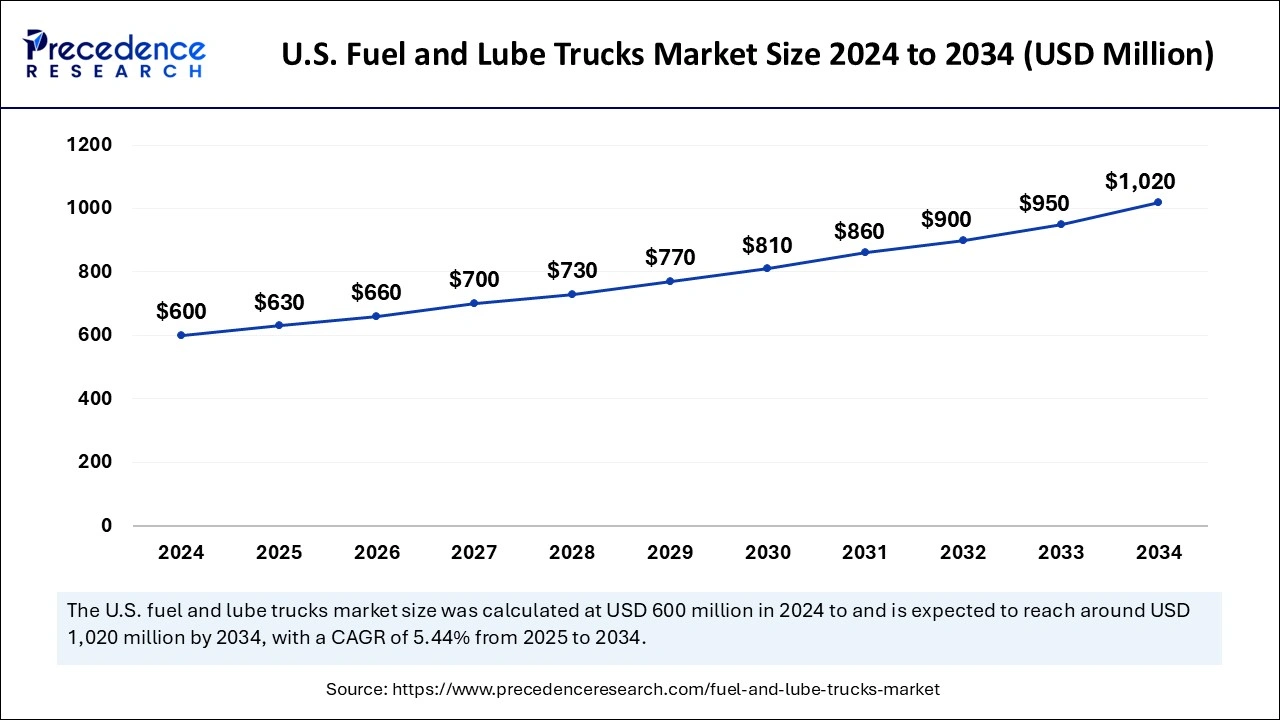

The U.S. fuel and lube trucks market size is exhibited at USD 630 million in 2025 and is projected to be worth around USD 1,020 billion by 2034, growing at a CAGR of 5.44% from 2025 to 2034.

North America dominated the global fuel and lube trucks market in 2024. The dominance of the region can be attributed to the ongoing infrastructure development and increase in demand from logistics companies and industries like mining, transportation, construction, and energy, which need constant fuel and lubrication support. In North America, the U.S. led the market owing to the growing adoption of innovative technologies such as real-time monitoring, automated dispensing systems, etc.

U.S. Fuel and Lube Trucks Market Trends

The U.S. is a leading player in the North American fuel and lube trucks market, with a strong industrial foundation and leadership in technological innovations such as automated dispensing systems and real-time IoT monitoring. The market features major domestic manufacturers known for durability and innovation and is increasingly emphasizing sustainability due to strict environmental regulations. Additionally, there is an increasing emphasis on environmental sustainability, with trucks being designed for fuel efficiency, lower emissions, and the use of alternative fuels. Customization options are also on the rise to meet the specific needs of industries like construction, mining, and oil & gas, while mobility and on-site service capabilities continue to drive demand for more flexible, durable, and cost-effective fueling and lubrication solutions.

What Makes Asia Pacific the Fastest-Growing Region in the Market?

Asia Pacific is expected to show the fastest growth in the fuel and lube trucks market over the studied period. The growth of the region can be linked to the rapid urbanization and industrialization in developing economies such as China and India. Moreover, the region's strong manufacturing base and heavy investments in building projects can influence market growth positively. In Asia Pacific, Japan is anticipated to grow at a moderate rate due to technological innovations in automation and equipment management.

India Fuel and Lube Trucks Market Trends

India is a major player in the Asia-Pacific market, with demand for fuel and lube trucks driven by rapid industrial growth, large government infrastructure projects, and the need for on-site fueling solutions for heavy equipment. The market is also witnessing an increasing focus on fuel efficiency and environmental regulations, with more companies opting for trucks designed to minimize emissions and reduce operational costs in line with sustainability goals.

Why is Europe Considered a Prominent Region in the Fuel and Lube Trucks Market?

Europe is a prominent region focused on sustainability, operational efficiency, and advanced technology. Strict environmental regulations and emission reduction targets at both EU and national levels are accelerating the adoption of eco-friendly solutions. The market is driven by the need for on-site maintenance across construction, agriculture, and logistics, with major manufacturers such as Mercedes-Benz, MAN, and Volvo investing in R&D to develop more efficient, biodegradable lubricants.

Germany Fuel and Lube Trucks Market Trends

Germany is a major player in the European market. The country is home to leading global manufacturers and a large industrial base. The market benefits from strong investments in industrial modernization and a well-developed infrastructure. Demand is high for efficient, high-quality fuel and lube trucks to support its manufacturing, construction, and transportation sectors.

What Potentiates the Latin American Fuel and Lube Trucks Market?

The market in Latin America is driven by the rapid expansion of the mining, construction, and agricultural sectors. These industries, often operating in remote areas, rely heavily on mobile, on-site fueling and maintenance solutions to minimize equipment downtime and boost productivity with combination trucks offering both fuel and lubrication services in a single unit due to their operational efficiency. The increasing adoption of advanced technologies such as telematics and the focus on high-performance, synthetic lubricants in modern machinery are key trends shaping the market, with countries like Brazil and Chile leading regional demand.

Brazil Fuel and Lube Trucks Market Trends

Brazil is leading the charge in the Latin American market, propelled by a robust automotive manufacturing base, large-scale infrastructure projects, and extensive agricultural operations. The market is seeing increased focus on efficiency, with fleet operators adopting advanced lubricants and condition-monitoring systems to extend equipment life and reduce maintenance costs. There is a gradual shift toward integrating alternative fuels and electric vehicles into the broader transport sector over the long term.

What Opportunities Exist in the Middle East and Africa for the Fuel and Lube Trucks Market?

The Middle East and Africa region offers significant market opportunities, driven by the expansion of oil and gas operations, large-scale infrastructure development, and growing mining activities. There is high demand for durable, high-capacity vehicles capable of operating in the region's often harsh environmental conditions. Countries across the GCC and South Africa are investing heavily in projects and modernizing their commercial vehicle fleets, driving demand for both fuel and lube delivery solutions.

Saudi Arabia Fuel and Lube Trucks Market Trends

Saudi Arabia is a key player in the MEA market, with significant demand driven by its ambitious economic diversification plan, which includes large infrastructure and industrial projects like NEOM. The market features strong demand for heavy-duty trucks and high-performance, low-SAPS lubricants to meet changing emission standards and improve fuel efficiency. The country is leveraging its strategic geographic location as a logistics hub and investing in digital fleet management systems.

Value Chain Analysis

- Component & Raw Material Sourcing

This stage involves procuring raw materials (metals, plastics) and components like pumps, hoses, and monitoring systems.

Key Players: McLellan Industries, Niece Equipment, Curry Supply Company, IDEX, and Tata Steel Ltd. - Manufacturing and Assembly

Producing the fuel and lube trucks by mounting equipment onto commercial vehicle chassis, involving design, welding, and integration.

Key Players: McLellan, Niece, Ground Force Mercedes-Benz, Volvo Trucks, and Tata Motors. - Distribution and Sales

Selling or leasing finished trucks to end customers in industries like construction and mining, managing dealer networks, and logistics.

Key Players: Field Mining Services Group, McLellan Industries, Inc., and Niece Equipment, LP. - Operations and Service Delivery

Using trucks for on-site fueling and maintenance to reduce downtime in remote locations.

Key Players: Larsen & Toubro (L&T), Caterpillar Inc., Rio Tinto and ExxonMobil & Shell.

Top Companies in the Fuel and Lube Trucks Market and Their Offerings

- McLellan Industries: Offers mobile preventative maintenance vehicles with hydraulically driven systems; tank capacities up to 5,300 gallons for construction/mining.

- Niece Equipment: Provides Heavy-duty fuel and lube trucks, customizable on/off-road models; large tank sizes up to 10,000 gallons for mining operations.

- Ground Force Worldwide:Offers custom-engineered heavy equipment solutions, articulated and rigid-frame options; specialized for extreme climates, often with heated bodies.

- Thunder Creek Equipment: Facilitates fuel and maintenance trailers/skids with durable multi-tank oil skids and trailers for mobile fueling in agriculture/construction.

- Stellar: Specialized service vehicles, including trailers with open or enclosed fuel and lube trailers with standard tanks, reels, and customization options.

Other Key Players

- Panda Mechanical Equipment Co., Ltd.

- Engineered Transportation International

- Tankmart International Inc.

- Platinum Tank Group

- Tremcar

Fuel and Lube Trucks Market Companies

- McLellan Industries, Inc.

- Niece Equipment, LP

- Panda Mechanical Equipment Co., Ltd.

- Engineered Transportation International

- Ground Force Worldwide

- Thunder Creek Equipment (LDJ Manufacturing Inc.)

- Tankmart International Inc.

- Platinum Tank Group

- Tremcar

- Stellar

Recent updates on fuel and lube trucks

Technological advancements drive fleet efficiency

- On 15 March 2025, significant improvements in automation and telematics integration marked a new era for fuel and lube trucks. These technologies are now widely implemented to streamline maintenance operations, reduce downtime, and optimize fuel delivery. Enhanced GPS tracking, remote diagnostics, and real-time data reporting have improved fleet productivity and safety compliance.

Sustainable models gain traction in heavy-duty applications

- By April 2025, manufacturers introduced hybrid and alternative fuel-powered lube trucks to support the global push for decarbonization. Noteworthy launches include electric and hydrogen-powered variants suitable for mining and construction sectors, offering high torque with zero emissions. These advancements are aligned with stricter emission norms and increased demand for environmentally friendly service vehicles.

Advanced mobility solutions enhance field service efficiency

- On 12 March, with the launch of trucks with GPS tracking, onboard diagnostics, and intelligent fluid management systems, the market for fuel and lube trucks entered a new stage of modernization. Field fueling and maintenance have become more dependable and efficient as a result of these improvements, especially in sectors like mining, construction, and agriculture. Manufacturers are concentrating on creating more durable, adaptable, and technologically advanced fuel and lube trucks in response to the growing demand for on-site service capabilities.

Growing industrial operations fuel global demand

- In April 2025, with the release of trucks with GPS tracking, onboard diagnostics, and intelligent fluid management systems, the market for fuel and lube trucks entered a new stage of modernization. These improvements have increased field fueling and maintenance dependability and effectiveness, especially in sectors like mining, building, and agriculture. Manufacturers are concentrating on creating more durable, adaptable, and technologically advanced fuel and lube trucks in response to the growing demand for on-site service capabilities.

Latest Announcement by Market Leaders

- In June 2024, Castrol, a global leader in lubricants and part of the oil giant BP, announced an investment of up to USD 50 million in Gogoro, a global technology leader in battery-swapping ecosystems. The first tranche of the investment will see Castrol invest USD 25 million to receive 5.72% of Gogoro's outstanding ordinary shares, followed by an anticipated second USD 25 million investment in the form of a convertible note.

- In November 2024, ExxonMobil announced expansion plans and joint venture investments in Texas, while PureCycle's new sorting facility aims to help with ongoing financial woes. Alterra will license its technology.ExxonMobil says it is "continuing to develop additional advanced recycling projects" at other manufacturing sites in North America.

Recent Developments

- On 10 February 2025, Maintainer Corporation of Iowa, Inc. unveiled its next-generation lube truck series with modular tank designs and digital fluid management systems. These trucks offer configurable compartments, allowing operators to service multiple equipment types with higher efficiency.

- In March 2025, Stellar Industries announced strategic collaborations with software firms to provide integrated service tracking dashboards in their fuel and lube units. This innovation is aimed at improving preventative maintenance schedules and fluid usage analytics for large fleet owners.

- In March 2025, Southwest Products introduced a new line of multi-tank lube trucks equipped with eco-reclaim technology. These vehicles can recover, and store used fluids safely, minimizing environmental impact and complying with new EPA regulations for fluid disposal.

- On 21 February 2025, a major North American fleet services company launched a new line of multi-tank fuel and lube trucks designed for harsh terrains. These trucks feature compartmentalized tanks, digital fluid meters, and remote dispensing controls, tailored for operations in mining and oilfields.

- In March 2025, a European manufacturer introduced a hybrid-powered fuel and lube truck model aimed at reducing emissions during on-site maintenance. The vehicle incorporates regenerative braking and a battery-assisted pump system, signaling a shift toward more sustainable solutions in fleet service operations.

- Also in March 2025, industry data revealed a projected market growth rate of 5.6% annually through 2030, with global demand for fuel and lube trucks expected to surpass USD 2.4 billion by the end of the decade. This growth is supported by the rising need for efficient fluid delivery systems in remote and off-grid industrial sites.

- In January 2024, Hermann Paus Maschinenfabrik GmbH (PAUS) and ELQUIP signed a Memorandum of Understanding to mutually evaluate and prepare a dealership for the Australian market and serve customers with specialized PAUS mobile equipment for the mining and tunneling market as well as with services and parts.

- In August 2024, Thunder Creek Equipment launched a new model of its fuel and service trailer (FST) series, designed for high-capacity fuel and DEF storage. This latest addition features a 990-gallon diesel tank and a 330-gallon diesel exhaust fluid (DEF) tank, specifically tailored to meet the needs of large-acreage farming operations and custom harvesters.

Segments Covered in the Report

By Truck Type

- Fuel Tank Trucks

- Lube Service Trucks

- Combination Trucks

By Capacity

- Below 10,000 kg

- 10,000 to 15,000 kg

- 15,000 to 25,000 kg

- Above 25,000 kg

By Application

- Transportation and Logistics

- Construction and Infrastructure Development

- Mining and Natural Resources Extraction

- Agriculture and Farming Operations

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting