What is the Pet Biotics Market Size?

The global pet biotics market is expanding rapidly as pet owners seek natural, science-backed probiotics to improve animal digestion and overall wellness.The market for pet biotics is experiencing steady growth driven by rising pet ownership, increasing demand for digestive health solutions, and expanding use of probiotic-based formulations in premium pet nutrition.

Market Highlights

- North America accounted for the largest market share in 2025.

- The Asia Pacific is set to expand the fastest CAGR between 2026 and 2035.

- By type, the probiotics segment contributed the highest market share in 2025.

- By type, the prebiotics segment is expanding at the fastest CAGR between 2026 and 2035.

- By application, the supplements segment generated the biggest market share in 2025.

- By application, the dry food segment is expected to grow at the fastest CAGR between 2025 and 2035.

- By pet, the dog segment captured the major market share in 2025.

- By pet, the cat segment is expected to expand with the fastest CAGR between 2026 and 2035.

- By function, the digestive/ gut health segment accounted for the biggest market share in 2025.

- By function, the oral & dental health segment is growing at the fastest CAGR between 2026 and 2035.

What Shapes the Future of the Pet Biotics Market?

Pet probiotics are supplements that may help pets maintain healthy digestive processes and immune systems by improving gut function and promoting overall health and wellness. These products support balanced microbiota, nutrient absorption, and digestive comfort, which is especially important for pets experiencing food sensitivities, antibiotic-related gut issues or age-related metabolic changes. As an increased emphasis on gut health and preventive care drives demand, pet supplement manufacturers are expanding their market share by making pet-friendly products available through e-commerce and subscription services, enabling pet owners to maintain consistent dosing schedules and convenient access to specialized formulations.

Manufacturers are increasingly introducing new strains of bacteria and customized blends or formulations that support specific conditions, allowing them to differentiate and maximize product value for pet owners. These targeted blends address issues such as immune resilience, skin and coat health, anxiety reduction and post-illness recovery, adding new functional benefits that strengthen consumer trust. Companies are also investing in research partnerships with veterinary clinics and universities to validate strain efficacy, improve stability and enhance palatability for pets across various breeds and life stages. This combination of scientific development, digital distribution channels and condition-specific formulations is shaping the rapid expansion of the pet probiotics market.

AI-Driven Probiotics Poised to Revolutionize Pet Care

The impact of AI on the pet biotics industry is very promising. This combination of microbiome research and advanced technology will help develop more effective products that improve pets overall health and well-being. With AI-enhanced evaluation of the gut microbiome, scientists can now create targeted probiotic products that will enhance digestive health, boost the immune system, and reduce stress levels in pets.

- In September 2025, Mars, Incorporated launched a global suite of artificial-intelligence-powered pet-health tools, beginning with GREENIES Canine Dental Check, which lets owners assess their dogs gum and teeth health via a smartphone photo.

AI tools can also be integrated into animal medicine, such as for early disease detection and the creation of customized treatment plans for veterinary patients. This integration will likely result in a higher standard of holistic pet health for pet owners who view their pets as part of their family and will likely lead to the widespread acceptance of AI/probiotic products as part of global preventive and wellness trends in pet care.

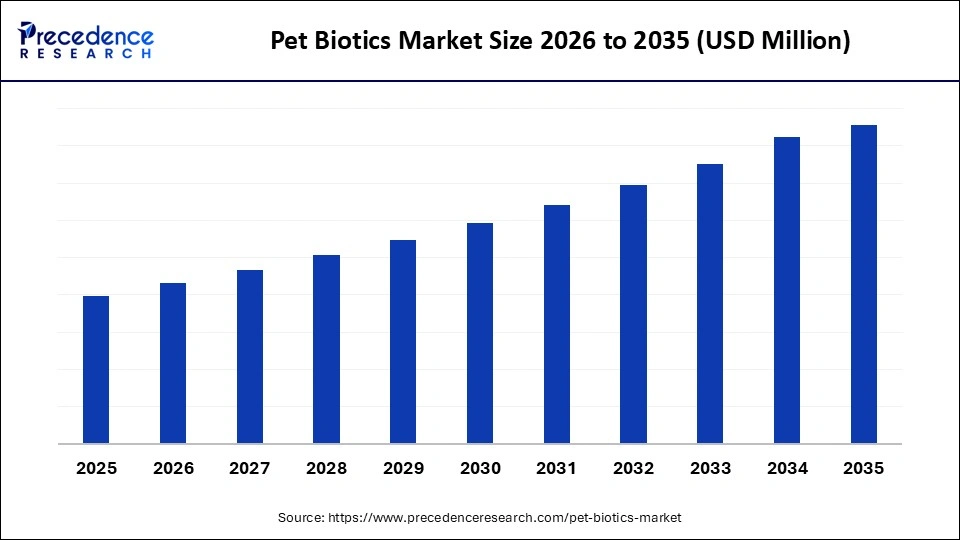

Pet Biotics Market Outlook

The pet biotics market is expanding as pet owners are looking for microbiome-friendly solutions to aid in digestion, immunity, and skin health. There is growing awareness of gut-based nutrition. The increase in the number of pet owners choosing high-quality, functional products is providing ongoing, long-term support and demand across all global regions.

Pet Food manufacturers are now using a probiotic/postbiotic mixture in their products as the regulations by organizations such as the U.S. FDA and EU EFSA support the use of microbial additives that the FDA and EFSA consider safe. This will provide Manufacturers with an opportunity to enter new markets across the globe through these regulations and speed up the time it takes to enter these markets with biotic supplements.

Veterinarians are beginning to recommend supplements that contain Microbiome supportive ingredients for use as preventative measures, as a result of Government/University initiatives that educate the public about the benefits of Microbiota support for their pet health. The increase in the use of preventive supplements will strengthen the long-term consistency of biotic supplement purchases, rather than making them seasonal.

The e-commerce regulations established by the Government have increased the level of trust in the pet supplement industry, and therefore have provided the opportunity for pet supplement manufacturers to use online sales as a source for access to niche markets to increase the speed of digital growth in both developing and Developed Countries.

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Pet Biotics Market Segment Insights

Type Insights

Probiotics: The segment is the leading type of biotics in the pet biotics market in 2024, as indicated by an increase in veterinary recommendations (the primary segment is for dogs). The presence of probiotics in both digestive and gut health products has also supported this growth. The primary methods for ensuring the stability of probiotic strains in supplemental and dry dog foods are centrifugation and filtration.

Prebiotics: This segment has demonstrated the fastest growth rate in the industry, driven by the rising prevalence of natural, fibrous-based products and their ability to support the performance of the canine and feline microbiomes. Both oral health and dental applications are drivers of prebiotic adoption, with many pet parents seeking daily preventive measures, particularly when in treat or snack form. The development of new protection and encapsulation technologies has enabled more users to access prebiotics through dry food formulations and emerging supplement formats.

Postbiotics: The segment is emerging as a viable solution because they are stable under high-heat conditions. Numerous formulations will begin to see increased use of postbiotics, particularly in the wet food category, due to their palatability benefits and their ability to modulate the immune system. There is also a growing body of support for the use of postbiotics in the care of small pets, such as rabbits and rodents, through the development of complementary blends for postbiotic management.

Application Insights

Supplements: The pet biotics market is dominated by supplements in 2024, as pet owners increasingly seek to support their dogs digestive and overall health with targeted, high-potency products. The flexibility of having supplements available in powders, capsules, chews, and liquids provides more options for consumers to use in the dog and cat segments. In addition, the fact that veterinary clinics frequently recommend supplement products to their clients, and that these products are readily available at retail and online, gives them an advantage over other forms of pet biotics.

Dry Food: The dry food market segment is expected to be the fastest-growing, as consumers seek a daily source of nutrition for their dogs that contains health-promoting ingredients (e.g., prebiotics and probiotics). Many companies are now combining prebiotics and probiotics with kibble to provide a daily source of gut support without requiring additional supplements. The use of prebiotics and probiotics in dry food formulations meets consumer demands for convenience, longer shelf life, and complete nutrition profiles; therefore, dry food will remain the primary application format for microbiome-enhancing products.

Wet Food: This segment is projected to grow steadily as manufacturers increasingly incorporate postbiotics and select probiotic strains into moisture-rich formulations that enhance pet palatability and digestive comfort. This type of product can benefit pets with chewing difficulties or upset stomachs. The presence of added moisture in a moisture-rich wet food enables better nutrient distribution throughout the food, allowing the formulation to deliver functional benefits, such as immune modulation and digestive support, in the premium segments of wet food.

Pet Insights

Dogs: The dogs segment is the dominant pet type in the pet biotic market, mainly due to the adoption of Pet Biotic products as part of their daily nutrition, supplements, and gut health formulations. The trend towards preventive health for pets is leading to an increase in owners using probiotics in their dog-specific dry food and in dog-specific supplement blends on the market. The larger overall dog population and increased consumer spending on pet health are also helping drive the dominance of the dog market, as many biotic-enriched formulas are being integrated into the regular pet wellness programs most owners currently use.

Cats: The fastest growing segment in Pet Biotics is the cat market, as cat owners have been increasingly switching to Microbiome-supportive diets for several reasons, including digestive sensitivity, hairball control, and Immune Balance. The growing availability of specialized prebiotic and multi-biotic treats is helping to drive support for the cat market growth. Improved technologies for palatability and the expanding availability of cat wet food formulations are likewise facilitating the significant growth of this category, as the cat market continues to grow in importance as the focus of the Pet Biotic industry for innovation.

Other Pets: For all other pets, the adoption of biotics is beginning to gain ground, as awareness of Gut Health for small animals continues to grow, and Post-biotic-infused blends are becoming more popular because they are easier to mix with a variety of food items and much more stable. The Postbiotic formats ability to maintain its nutritional integrity is helping drive adoption of this product for smaller pets, as specialty retailers promote it for immune support and overall vitality for small animals, and to expand the market beyond traditional companion animals.

Function Insights

Digestive/Gut Health: The dominant function segment for pet supplements is digestive/gut health, driven mainly by veterinarians focusing on optimizing the microbiome and by the growing number of dog owners seeking everyday digestive support for their dogs. Digestive (probiotic) products and related supplements, particularly for dogs, are the foundation for this segment, leveraging proven manufacturing processes, such as centrifugation and filtration, to retain the potency of the strains used to manufacture these products.

Oral & Dental Health: This segment is emerging as the fastest-growing, benefiting from increased focus on preventive oral care and newer, easy-to-use, convenient delivery methods for pet owners (e.g., treats, chews, and fortified supplements). Pet owners are seeking microbiome-friendly products that help reduce plaque and odors and promote healthy gums. Using encapsulation technology enhances the stability of these products, allowing manufacturers to develop products for daily use and advanced functional formulations targeting both dogs and cats.

Immune-Modulation: As the need to support pets resilience to environmental stressors and seasonal immune fluctuations increases, the category of immune-modulating supplements continues to grow in popularity. The area of metabolic and weight management is also expanding. As more pet owners become aware of the growing number of overweight pets, they are seeking ways to manage their pets weight. Drying and stabilizing technologies enable manufacturers to ensure consistent, effective use of weight management products, allowing for expanded use across various pet categories.

Pet Biotics Market Regional Insights

North America has a clear market share advantage in the pet biotics category due to very high pet ownership rates, a highly developed veterinary infrastructure and strong consumer demand for preventive care for their pets. The region has a mature ecosystem of veterinary clinics, pet hospitals, nutrition specialists and diagnostic labs that routinely recommend probiotic and microbiome-supporting products for digestive balance, skin health and immune resilience. Pet owners strongly desire products that support their pets digestive, skin and immune systems, and as a result, these products are in high demand. The trend toward holistic pet wellness and early intervention has further increased interest in daily probiotic supplements as part of long-term pet care routines.

The presence of many specialty retailers that sell pet biotics, rapid fulfillment of online orders and the availability of product recommendations from veterinarians increase consumer confidence in products and make it easier for them to find and purchase them. Large retail chains and subscription-based e-commerce platforms allow seamless access to premium blends tailored to breed size, life stage and condition-specific needs such as gastrointestinal recovery or immune support. Additionally, new product innovations, such as microbiome-specific chews and functional treats, keep consumers engaged with pet biotics. Companies continue to invest in scientifically validated strains, palatable delivery formats and veterinarian-backed product labels, strengthening overall adoption and supporting the markets strong regional growth.

The U.S. dominates North America, with one of the largest populations of cats and dogs, a mature pet-parenting culture, and extensive per capita probiotic spending. Most veterinary offices in the U.S. are recommending pet biotics to their clients to support digestive balance and immunity, thereby increasing their adoption in cities and suburbs. In April 2025, Premium pet supplement brand Fera Pets officially launched in over 175 Petco locations across the U.S., marking its first major expansion beyond e-commerce.

As a result of the significant number of pet owners who have access to the internet, it is time for most pet owners in the U.S. to be the first to adopt microbiome-focused products and also be the benchmark from which other companies in North America build their biotic brands.

Urbanization, rising disposable income and a generational shift toward pet humanization are driving rapid growth in pet care behaviors across major countries in the Asia Pacific, with a strong focus on e-commerce platforms and social media, which provide quick access to regional and global pet brands. Younger consumers in markets such as China, India, South Korea and Southeast Asia increasingly treat pets as family members, creating strong demand for supplements that improve digestion, immunity and overall wellness. As a result, probiotic treats, powders and condition-specific blends are becoming part of routine pet care.

Continued growth in the region is also supported by government initiatives that encourage domestic consumption, improved veterinary infrastructure and the growing availability of premium products in metropolitan pet stores and online marketplaces. National campaigns promoting animal health and vaccination programs further increase owner awareness of nutritional and microbiome-related issues. The rising penetration of modern veterinary clinics in urban centers enables pet owners to receive professional recommendations, thereby strengthening trust in scientifically formulated biotic products. These combined economic, cultural and policy factors make Asia Pacific one of the fastest advancing regions in the global pet biotics market.

China Pet Biotics Market Trends

With a rapidly growing urban pet population and increased disposable income among the middle and upper-middle class pet owners in China, the pet owners in China are looking for more effective functional products that support gut health, the immune system, and skin, the three big drivers of functional biotics supplementation. The powerful digital ecosystem of the Chinese market, including live streaming, pet-focused communities and large eCommerce platforms, enables new biotic formulations to gain significant traction and establish themselves very rapidly. Additionally, domestic brands are investing heavily in microbiome research to support their biotics and partnering with veterinary professionals to build consumer trust and establish China as a leader in biotic innovations in the Asia Pacific region.

Growth in Europe is characterized by stability, quality focus, and high levels of regulatory oversight of veterinary products. The region follows strict standards for pet supplements under frameworks such as those of the European Food Safety Authority (EFSA), which increase transparency and require evidence-based claims for microbiome-support products. There is also significant trust amongst European consumers in pet health products that are based on science, which creates strong demand for formulations that demonstrate measurable improvements in digestive stability and immune function.

Pet owners want the highest quality products, and they are gravitating towards clean label probiotic and postbiotic formulations that provide full ingredient transparency and are backed by clinical studies. These preferences drive manufacturers to invest in strain-specific research, palatability trials and controlled safety testing to secure consumer trust. Specialty retailers and veterinary clinics are the most significant influencers of buying behavior, and regional pet care trade associations provide information on responsible supplement use, proper dosing and quality verification.

Furthermore, there is a growing awareness amongst consumers in Western Europe of the role of the microbiome in nutrition, suggesting that there will be increasing opportunities for manufacturers to bring innovative, clinically substantiated solutions to the marketplace. Companies are beginning to introduce precision blends tailored to senior pets, sensitive-stomach breeds and immunity support, reinforcing Europe position as a mature and science-driven pet biotics market.

Germany Pet Biotics Market Trends

Germany leads the continent in responsible pet ownership, purchasing premium quality food, and meeting stringent quality standards. Pet owners in Germany are careful about the ingredients they give their pets, and are science-minded; therefore, they quickly adopt biotic products to support their pets digestive health (gut) and immune systems. Germanys well-developed infrastructure (veterinary practitioners and specialty retailers) facilitates the rapid growth of newly developed functional food categories for pets. As a result, Germany has become a leader in both demand for and innovation in biotic products via the microbiome in the European market.

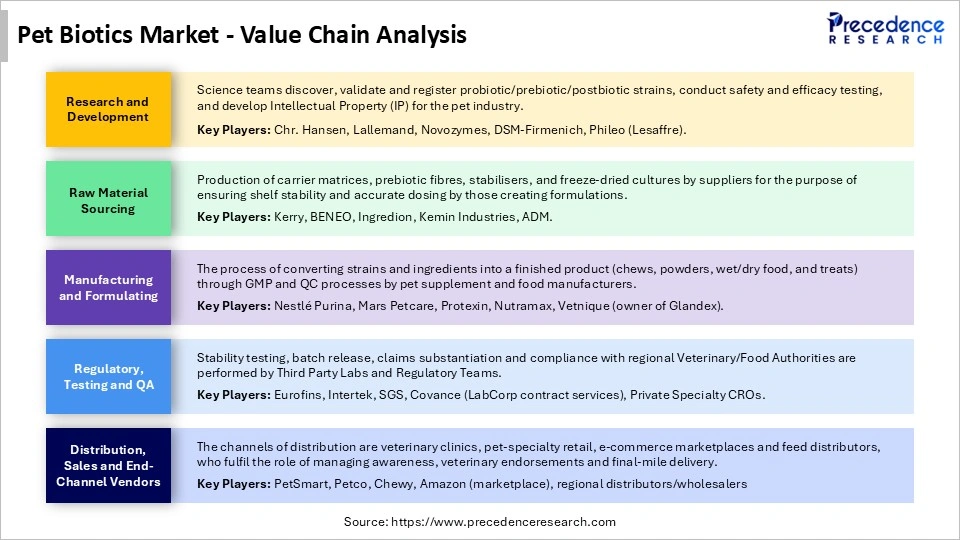

Pet Biotics Market Value Chain

Pet Biotics Market Companies

DE-CA probiotic, PRIOME GH postbiotic, Fibersol prebiotic and PreforPro phage.

Microbuild, a prebiotic fiber for gut health to support a healthy microbiome in pets.

Firmenich- Sustainable Omega-3s, algal-based, and provide a sustainable alternative to fish oil for cats and dogs.

Major supplier of functional ingredients to the pet food industry and is a key company in the pet biotics market.

salivarius BLIS K12 and BLIS M18 innovative, scientifically backed probiotic solutions for dogs and cats.

SUBACTIL, an ingredient sold and it also features in the chewable supplement RESOURCES Protegrity GI.

BENEOs ingredients Orafti Inulin and Oligofructose derived from chicory root, are both dietary fibers and plant-based prebiotics with proven efficacy.

Provides prebiotic fiber ingredients like FORTIFEED scFOS prebiotic soluble fiber is scientifically verified by Ingredion to support digestive and immune health in both dogs and cats.

Provides a range of pet probiotics and microbial solutions under its LALPROBIOME brand, designed for inclusion in pet food, treats, and supplements.

Sacco System provides expertise in probiotic product development and offers science-based proprietary strains and customised blends, supporting consumer needs.

Recent Developments

- In November 2025, Probi expanded its product portfolio across two new categories: Sports & Active Nutrition (for humans) and Pets by Probi, the latter offering probiotic supplements for dogs and cats aimed at digestive and oral health.(Source:https://www.nutritioninsight.com)

- In May 2025, Royal Canin unveiled a new line of biotics-powered pet supplements designed to complement its existing pet foods including probiotic powders for digestive and immune health, and soft chews targeting digestion, joints, skin & coat for dogs and cats.(Source: https://www.petfoodprocessing.net)

Pet Biotics marketSegments Covered in the Report

By Type

- Probiotics

- Prebiotics

- Postbiotics

By Application

- Dry Food

- Wet Foot

- Supplements

- Snacks and Treats

By Pet

- Dogs

- Cats

- Other Pets

By Function

- Digestive/ Gut Health

- Immune Modulation

- Metabolic & Weight Management

- Oral & Dental Health

- Other Function

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting