What is the Probiotics Market Size?

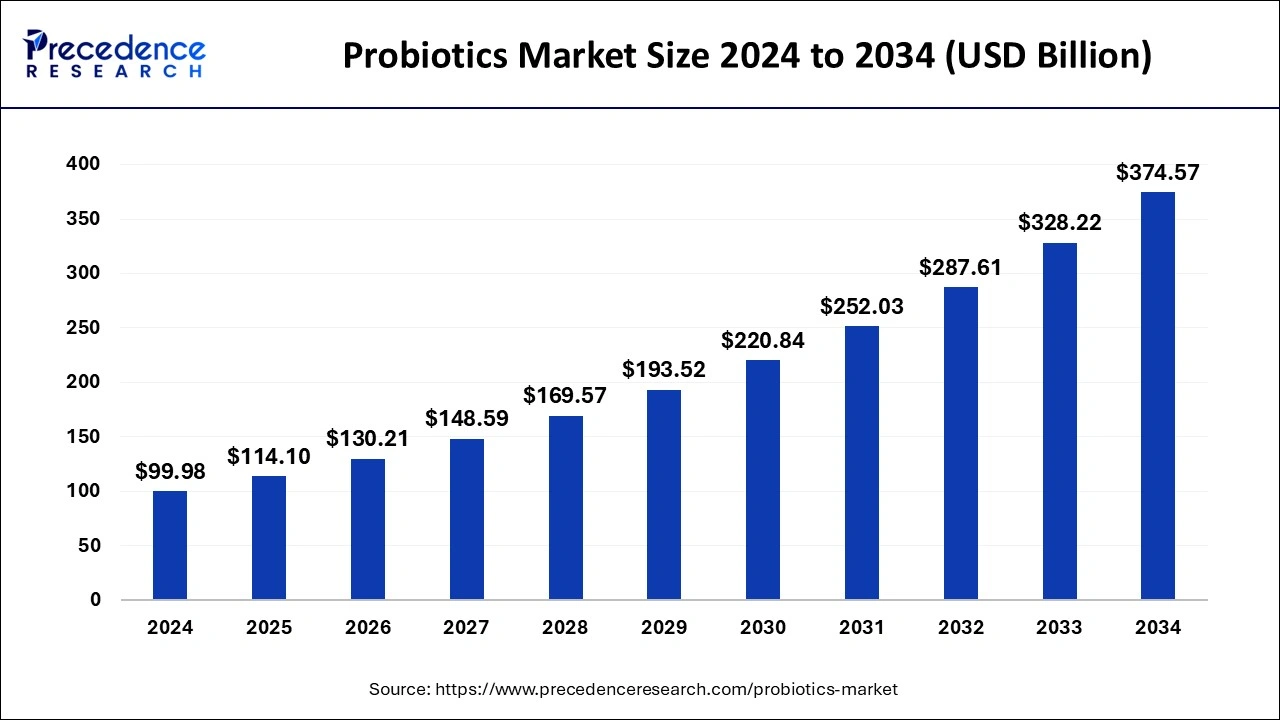

The global probiotics market size is estimated at USD 114.10 billion in 2025 and is anticipated to reach around USD 417.09 billion by 2035, expanding at a CAGR of 13.84% from 2026 to 2035

Market Highlights

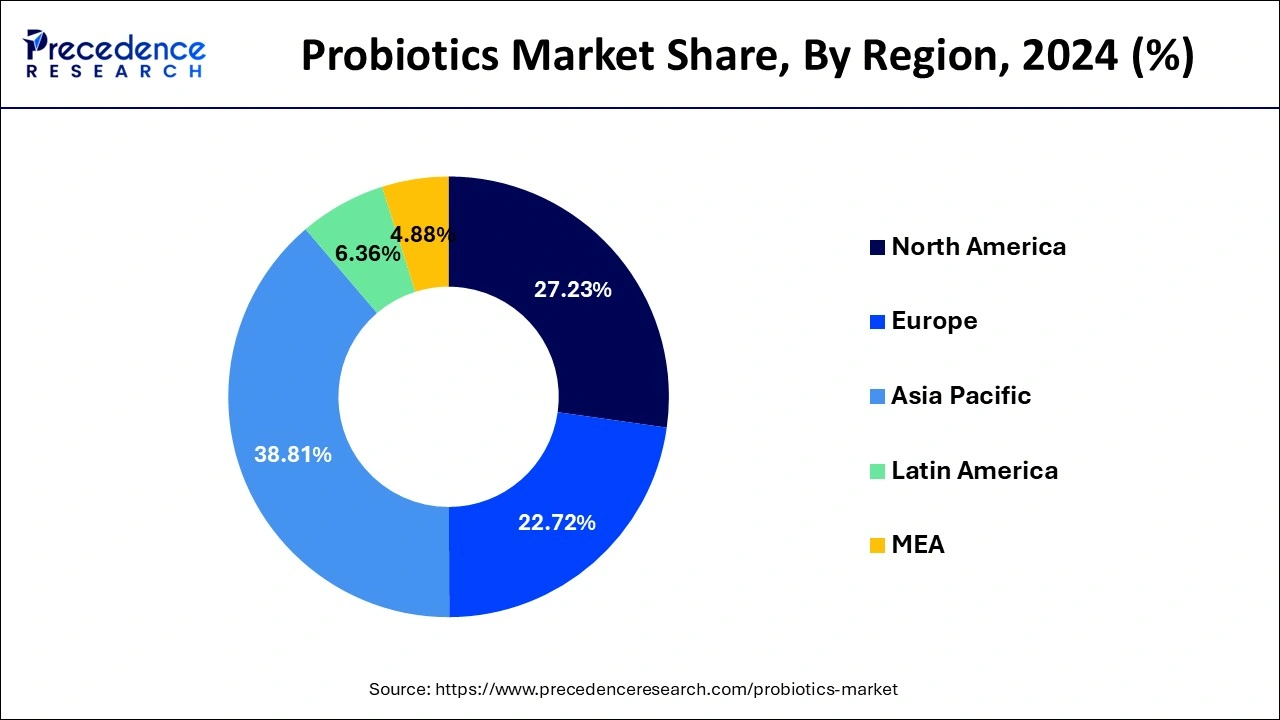

- Asia pacific dominated the global market with the largest market share of 38.81% in 2025.

- North America is projected to expand at the fastest CAGR during the forecast period.

- By application, the food and beverage segment contributed the highest market share of 62% in 2025.

- By ingredient, the bacteria-based ingredient segment captured the biggest market share in 2025.

Market Overview

The probiotics market deals with yeast and bacteria that help maintain a healthy microbial balance in the intestines of animals and humans. Probiotics promote the body's digestive enzymes and juices and guarantee appropriate digestion. Probiotics are being utilized to treat neurological, digestive diseases and mental problems. They also remove infections in the body, protect lipids and proteins from oxidative damage, and enhance the immune system. In addition, the probiotic market is driven by various factors such as rising technological advancements in probiotics and increasing adoption of probiotics in food and beverages. As scientific research increases to highlight the gut microbiome's crucial role in maintaining well-being, immune function, and digestive health, more people are identifying the value of incorporating probiotics into their daily routines.

Probiotics Market Trends

- The increasing consumption of supplements, beverages, and probiotic-rich foods as consumers search for effective and natural ways to enhance their health proactively contributed to propelling the market growth.

- The increasing approval of health claims and favorable regulatory frameworks in various regions for probiotics are expected to enhance the market growth.

- The growing consumer inclination towards preventative healthcare in confluence with the development of effective probiotic strains is further expected to drive the growth of the probiotics market.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 114.10 Billion |

| Market Size in 2026 | USD 130.21 Billion |

| Market Size by 2035 | USD 417.09 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 13.84% |

| Base Year | 2025 |

| Largest Market | Asia Pacific |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Application, End Use, Distribution Channel, Function, Form, Ingredient, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

The market is augmented by the growing consumer inclination towards preventative healthcare in confluence with the development of effective probiotic strains. Probiotics, when consumed in acceptable quantities, provide various benefits to the body, such as improved gut health and reduced intestinal inflammation. Probiotics play an essential part in preventative healthcare as they help the occurrence of diseases by strengthening the immune system. Therefore, rising consumer awareness regarding preventative healthcare is anticipated to boost the probiotics market growth over the forecast period.

Restraint

High cost of probiotics

The rising cost of research and development for new probiotic strains will challenge the growth of the market. The high spending on-recruiting research equipment, huge investments in laboratories, sustained spending in research and innovation activities, and skilled individuals hinder market growth. Therefore, these factors restrain the growth of the probiotics market.

Opportunity

Replace pharmaceutical agents with probiotics

The increasing demand for probiotics encompasses customers shift for products with developed health advantages. Consumer expectations related to these products have grown, as evidence of probiotics' positive impact on health continues to accumulate. This trend toward searching for cost-effective, natural, and safe alternatives to pharmaceuticals has improved the exploration of probiotics. To treat various human diseases, especially those affecting the gastrointestinal tract, clinical trials have demonstrated that probiotics have the potential. Incorporating probiotic-rich fermented dairy products into diets has shown assurance in meeting specific clinical diseases, such as lactose intolerance, Helicobacter pylori infection, cancer, allergic diseases, irritable bowel syndrome, inflammatory bowel disease, rotavirus-associated diarrhea, and antibiotic-associated diarrhea. These factors are expected to enhance the growth of the probiotics market.

Segment Insights

Ingredient Insights

Based on ingredient, the bacteria segment garnered the highest probiotics market share in 2025 due to surge in demand for bacteria derived probiotics food products. This is attributed to the growth in health issues that have encouraged market players to invest in R&D and launch new & innovative probiotics products.

Application Insights

Based on application, the food & beverages segment accounted largest revenue share of over 75% in 2025 due to the rising popularity of probiotic functional foods & potables among consumers. Growth in consumer awareness, faith in its efficacy, and safety are some of the factors driving the market of probiotics. The food & beverages segment is the largest market segment across the regions. Consumers are now taking a visionary approach towards preventing chronic conditions. China and Japan are the two dominant markets in the Asia Pacific, and the Japanese market is projected to reach its maturity level during the forecast period.

On the other hand, the animal feed segment is projected to record the fastest growth during the cast. The ban on synthetic antimicrobial growth promoters (AGP's) in Europe is a factor driving the market. The motive behind the ban was to check the practice of using antibiotics, antimicrobials, and other medicines for promoting the growth of livestock in order to rise the production of meat, milk, and other products.

Regional Insights

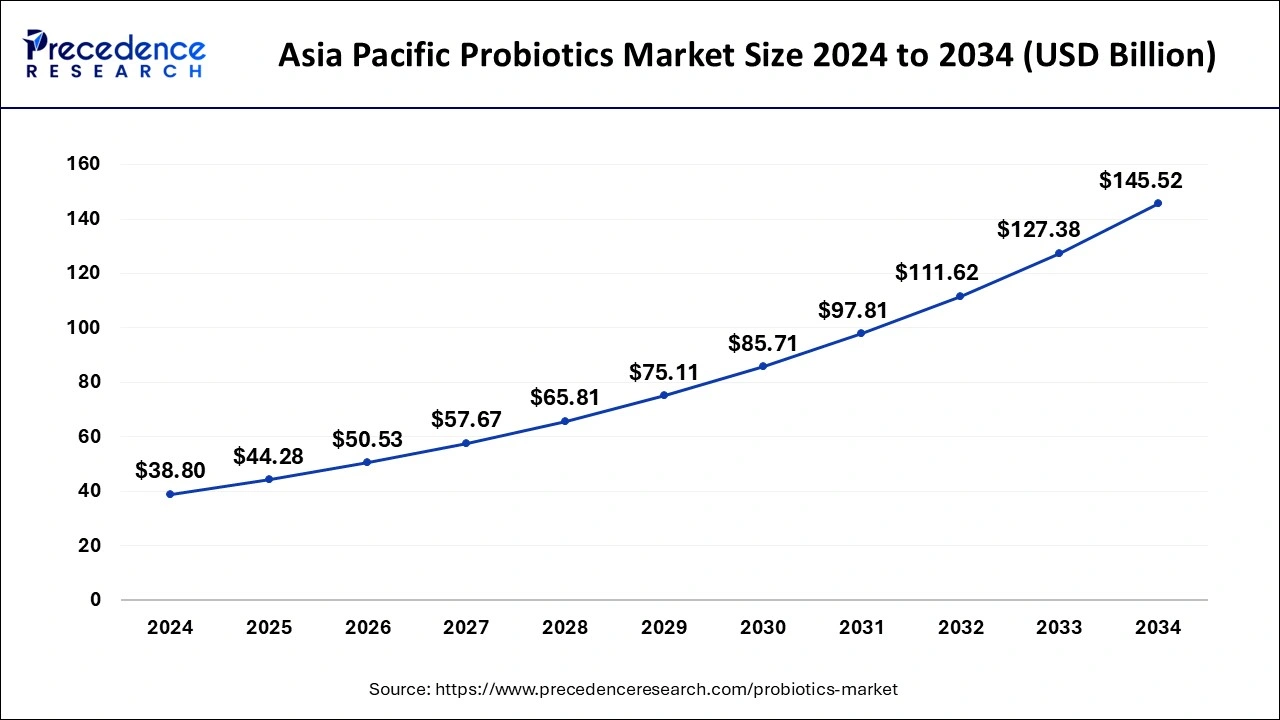

Asia Pacific Probiotics Market Size and Growth 2026 to 2035

The Asia Pacific probiotics market size is evaluated at USD 44.28 billion in 2025 and is predicted to be worth around USD 162.07 billion by 2035, rising at a CAGR of 44.28% from 2026 to 2035

Asia pacific dominated the global market with the largest market share of 38.81% in 2025. The region is witnessing a substantial rise in consumer awareness due to competitive strategies opted by the global players. Strong demand from countries, similar to India, China, and Australia, is contributing to the overall market growth. The rising population, coupled with the rising disposable income and improvised standard of living, is a factor anticipated to cater to the regional market growth. During the previous years, owing to a deficiency of technology, the market was swamped with these products which lacked room temperature stability. Therefore, this problem of quality was addressed as a major challenge, and various companies introduced technologies, such as microencapsulation, which enhance the stability and life of the probiotic bacteria in the region.

China Probiotics Market Trends

China is a major contributor to the probiotics market. The growing awareness about gut health and well-being increases demand for probiotics. The government support for the consumption of functional foods and healthy lifestyles helps in the market growth. The growing age-related health issues increase the consumption of probiotics. The growing production of dietary supplements and dairy-based probiotics helps in the market growth. The growing innovation in the development of probiotics-rich foods & beverages drives the market growth. The growing disposable incomes increase spending on probiotics. The growing demand for animal feed probiotics, especially for poultry, leads to market growth. The growing strategic partnerships of companies like ADM and Qingdao Biotech Group propel the overall growth of the market.

India Probiotics Market Trends

India held a significant share of the probiotics market. The growing health consciousness and the growing demand for probiotics-rich supplements and foods help in the market growth. The growing awareness about the importance of gut health increases demand for probiotics. The rise in gastrointestinal issues and lifestyle-related disorders increases demand for probiotics. The growing expansion of e-commerce platforms helps in the market growth. The growing disposable incomes and increasing middle class fuel demand for probiotics. The government encourages the use of probiotics in food and nutrition helps the market growth. The presence of key pharmaceutical companies like Dr. Reddy's, Sun Pharma, and Zydus helps in the production of probiotics supplements. Additionally, expansion of distribution channels like e-commerce & retail channels supports the overall growth of the market.

- According to Volza's India Export data, India exported 4069 shipments of probiotics.

North America region is likely to foresee considerable market growth during the forecast period. Also, continued manufacturer's investments in the food & beverage and pharmaceutical industries are likely to contribute to the market growth of the region. In addition, the key players of the region are investing in R&D to launch new products to provide products to consumers of various age groups and different genders. Therefore, all these types of factors are expected to propel the probiotics market growth over the forthcoming time period.

The United States is significantly growing in the probiotics market. The growing awareness about the benefits of immune support and digestive health helps in the market growth. The high disposable incomes increase spending on premium quality probiotics options. The growing research on the gut-brain axis increases demand for probiotics. The increasing awareness about the link between well-being and gut health increases demand for probiotic-rich options. The well-established distribution network, like e-commerce & retail platforms, helps the market growth. The growing prevalence of digestive disorders like GERD and IBD in the country increases demand for probiotics. The availability of various probiotic products, like supplements, foods, and beverages, drives the overall growth of the market.

- According to Volza's India Export data, the United States exported 9598 shipments of the probiotic.

Value Chain Analysis

- Procurement of Raw Materials: Sourcing and purchasing microorganisms and ingredients for the formulation of specific and quality high-grade probiotic strains.

Key Players: DuPont (IFF), Chr. Hansen Holding A/S (Novonesis), Lallemand Inc. - Processing and Preservation: This involves the culture and fermentation processes to keep the microorganisms alive until delivery while preserving the stability and potency of these probiotic microorganisms.

Key players: DuPont (IFF), Chr. Hansen Holding A/S (Novonesis), Lallemand Inc., ADM - Testing and Certifying Quality: Testing for strains' identities, purity, and potency is done with utmost scrutiny, and certification is granted to market the strain in terms of effectiveness and safety.

Key Players: Eurofins Scientific, Chemzin Biotox, Dextrose Technologies, BTH Laboratories - Packaging and Marketing: Packaging is targeted at providing extended shelf-life, with brand markings communicating benefits and quality of the product to the buyer.

Key Players: Amcor Plc, Sonoco Products Company, Arizona Nutritional Supplements, LLC, Alpla Inc. - Cold Chain Logistics and Storage are based on temperature requirements for handling, storage, and transport to maintain the viability of the live cultures.

Key Players: Lineage Logistics, Americold Logistics, Burris Logistics, NewCold - Distribution to Retail: For the efficient distribution of refurbished probiotic products to retail points, hotel operators, restaurants, and cafés.

Key Players: Nestlé S.A., Danone, Yakult Honsha Co., Ltd. - Retail Sales and Marketing: Marketing and sale of products to end users using retail channels.

Key Players: Yakult Honsha Co., Ltd., Procter & Gamble (includes Align), Lifeway Foods, Inc., Meiji Holdings Co., Ltd. - Waste Management and Recycling: Keeping to a minimum the disposal and recycling of the materials used in the production process.

Key Players: Amcor Plc, Sonoco Products Company, Alpla Inc.

Probiotics Market Companies

- Yakult Honsha Co., Ltd.

- BioGaia AB

- Danone

- E. I. du Pont de Nemours and Company

- Probi AB

- Ganeden, Inc.

- Protexin

- Nestle S.A.

- Chr. Hansen Holding A/S

- Lifeway Foods, Inc.

Recent Developments

- In July 2025, Pepsi Prebiotic Cola, launched in Original Cola and Cherry Vanilla flavors, offers a reinvention of the traditional cola experience, reinforcing the brand's commitment to providing choice across its portfolio. (Source: https://www.pepsico.com)

- In January 2025, Hebrew SeniorLife is conducting a clinical food trial to test the effectiveness of a probiotic and prebiotic combination, BondiaÒ, in managing bone health in women over 60.(Source: https://www.news-medical.net)

Segments Covered in the Report

By Application

- Food & Beverages

- Dairy products

- Non-dairy beverages

- Infant formula

- Cereals

- Others (snacks, meat, bakery, and nutrition bars)

- Dietary Supplements

- Food Supplements

- Nutritional Supplements

- Specialty Supplements

- Infant Formula

- Animal Feed

By End Use

- Human

- Animal

By Distribution Channel

- Hypermarkets/Supermarkets

- Pharmacies/Drugstores

- Specialty Stores

- Online Stores

- Others

By Ingredient

- Bacteria

- Synthetic

By Function

- Regular

- Preventative Healthcare

- Therapeutic

By Form

- Dry

- Liquid

By Geography

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting