What is the Animal Feed Market Size?

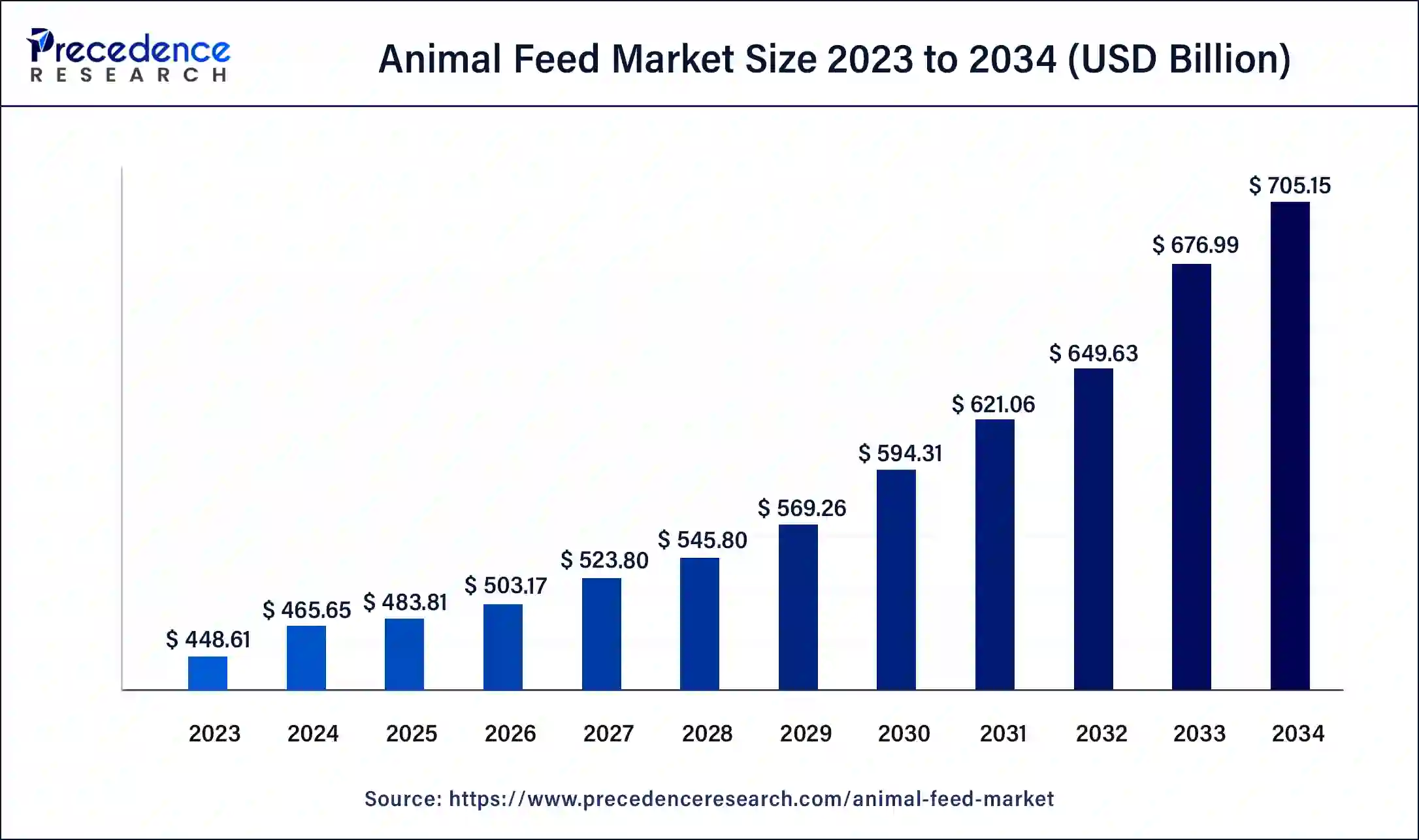

The global animal feed market size is accounted at USD 483.81 billion in 2025 and predicted to increase from USD 503.17 billion in 2026 to approximately USD 705.15 billion by 2034, expanding at a CAGR of 4% from 2025 to 2034.

Animal Feed Market Key Takeaways

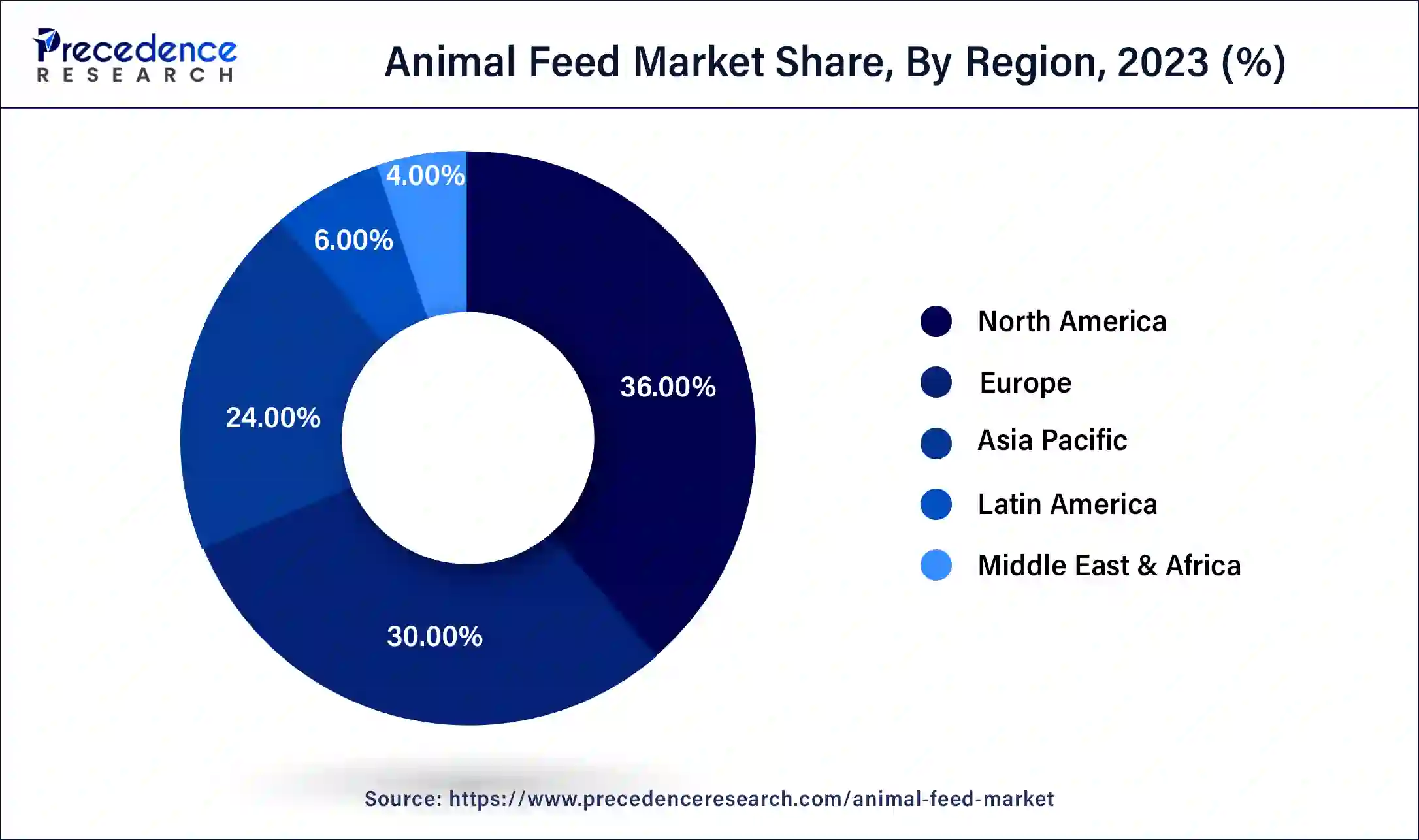

- North America contributed more than 36% of revenue share in 2024.

- Asia-Pacific region is estimated to expand the fastest CAGR between 2025 and 2034.

- By Additives, the amino acid segment has held the largest market share of 59% in 2024.

- By Additives, the antibiotics segment is anticipated to grow at a remarkable CAGR of 7.1% between 2025 and 2034.

- By Animal Type, the poultry segment generated over 42% of revenue share in 2024.

- By Animal Type, the pet segment is expected to expand at the fastest CAGR over the projected period.

- By Mode of Delivery, the premixes segment had the largest market share of 53.2% in 2024.

- By Mode of Delivery, the oral powder segment is expected to expand at the fastest CAGR over the projected period.

- By End User, the feed manufacturers segment generated over 35.8% of revenue share in 2024.

- By End User, the contract manufacturers is expected to expand at the fastest CAGR over the projected period.

Animal Feed Market Overview: Unlocking the Animal Nutrition

The animal feed market is a global industry responsible for producing and supplying feed and nutritional products for livestock, poultry, and aquaculture. It plays a crucial role in ensuring animal health and optimizing their growth and productivity. Key components in animal feed formulations include grains, protein sources, vitamins, and minerals. Additionally, the animal feed market is evolving with a focus on improving feed efficiency, reducing environmental impact, and ensuring food safety.

Research into ingredients and additives, like probiotics and enzymes, aims to enhance animal nutrition and overall agricultural sustainability. This industry is characterized by constant innovation to meet the challenges of feeding a growing world population. Sustainability and the development of alternative protein sources are emerging trends as the industry seeks more environmentally responsible and efficient feed solutions to meet the growing demands of animal agriculture.

Animal Feed Market Growth Factors

- Population growth: The rising global population drives an increasing demand for animal-based protein, stimulating the need for efficient and sustainable animal feed solutions.

- Changing diets: Shifting dietary preferences towards protein-rich diets, particularly in emerging markets, are boosting the demand for animal feed and related products.

- Environmental concerns: A growing focus on sustainable and eco-friendly practices in animal agriculture encourages innovation in feed formulations and production methods.

- Alternative proteins: The exploration of alternative protein sources, such as insect meal and plant-based feeds, is gaining momentum as the industry seeks more sustainable and efficient solutions.

- Nutritional enhancement: Research into novel feed additives, including probiotics and enzymes, aims to optimize animal nutrition and improve feed efficiency, resulting in healthier animals and lower environmental impact.

- Safety and traceability: Stringent regulations and the demand for food safety are driving advancements in feed quality control and traceability throughout the supply chain.

- Technology adoption: Embracing technology, such as precision feeding and data analytics, can improve feed efficiency and reduce waste, offering growth opportunities.

- Sustainable practices: Developing and marketing sustainable feed options aligns with consumer and regulatory expectations, opening new markets.

- Quality assurance: The need for stringent quality control and traceability in the feed production process presents business opportunities for innovative solutions in this space.

- Export market expansion: With increasing global demand for animal products, opportunities exist for businesses to expand into international markets by providing high-quality animal feed solutions.

- Customized feeds: Tailoring feeds to meet specific nutritional requirements for various animals, including specialty feeds for pets and exotic animals, presents a niche market with room for growth and innovation.

- Cargill's 23% revenue increase to $165 billion in fiscal 2022 reflects robust growth. This financial strength positions the company to invest in research, innovation, and sustainable practices, benefiting the animal feed market.

Animal Feed Market Outlook: Emerging Trends

- Industry Growth Overview: Increasing demand for animal proteins, livestock health awareness, and technological innovations are driving the industry growth.

- Major Investors: Multinational corporations, specialized venture capital, and private equity firms are the major investors.

- Startup Ecosystem: The startup ecosystem is focusing on accelerating innovations, which are backed by various investors and entrepreneurs.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 705.15 Billion |

| Market Size in 2025 | USD 483.81 Billion |

| Market Size in 2026 | USD 503.17 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 4% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Additives, Animal Type, Mode of Delivery, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Changing diets and population growth

Changing dietary patterns and rapid population growth are two primary drivers of surging market demand in the animal feed industry. As global populations expand, so does the need for food, particularly protein sources. People in emerging markets are increasingly adopting diets rich in animal-based proteins, contributing to a significant uptick in the demand for meat, dairy, and fish products. This surge, driven by increased income and urbanization, has profound implications for the animal feed market.

Changing diets plays a critical role in this transformation. As more consumers opt for protein-rich diets, the need for efficient and sustainable animal feed solutions becomes paramount. These dietary shifts necessitate innovative feed formulations that optimize animal nutrition and growth, aligning with the broader sustainability goals of the industry. To meet this demand, the animal feed market is evolving, introducing alternative protein sources and exploring eco-friendly feed additives while ensuring the production of high-quality and safe feed for livestock and aquaculture.

Restraints

Rising ingredient costs and competition for resources

Rising Ingredient Costs is one of the significant restraints on the animal feed market is the volatility in ingredient costs, particularly key components like grains and soy. These ingredients serve as the foundational elements in many feed formulations. These cost fluctuations are influenced by various factors, including weather patterns, global supply and demand, and commodity market conditions. The animal feed industry must navigate these uncertainties, often requiring strategic planning and risk management to maintain profitability.

Moreover, another challenging restraint on the animal feed market is the intensifying competition for vital resources. As the global population grows and dietary preferences evolve, there is increased pressure on resources like arable land and freshwater, which are essential for cultivating feed crops. The competing demands for these resources from other sectors, such as food and biofuel production, can constrain the availability of feed ingredients. This, in turn, can limit the production capacity of animal feed and lead to supply shortages, further elevating ingredient costs. Balancing the resource requirements for both food production and animal agriculture is a complex challenge that the animal feed industry must address to sustainably meet the growing demand for animal-based protein products.

Opportunities

Technology adoption and quality assurance solutions

The integration of advanced technologies such as precision feeding, data analytics, and automation has revolutionized feed production and animal nutrition. Precision feeding ensures that animals receive the right nutrients, improving their health and overall growth while minimizing feed wastage. Data analytics allow for real-time monitoring and adjustment of feeding programs, optimizing efficiency. Automation streamlines production processes, reducing labor costs, and enhancing consistency in feed formulation. These technologies not only boost efficiency but also promote sustainability by reducing resource use.

Moreover, with increasing concerns about food safety and transparency, quality assurance solutions have gained prominence. Consumers and regulatory bodies are demanding stringent quality control and traceability throughout the animal feed supply chain. This has led to the development of advanced testing methods and quality management systems, ensuring the safety and nutritional value of animal feed. Businesses that invest in these solutions gain a competitive edge by meeting and exceeding these expectations, boosting consumer confidence and demand for their products. Quality assurance also contributes to the prevention and mitigation of disease outbreaks, further driving market demand by ensuring animal health and productivity.

Additives Insights

According to the Additives, Amino acids held 38% revenue share in 2024. Amino acids, the building blocks of proteins, are vital additives in animal feed. They provide essential nutrients to support animal growth, reproduction, and overall health. In the animal feed market, the trend is shifting towards precision nutrition, where amino acids are used in formulations to meet specific dietary requirements. This not only enhances animal performance but also reduces excess protein in feeds, minimizing environmental impact.

The antibiotics segment is anticipated to expand at a significant CAGR of 7.1% during the projected period. Traditionally, antibiotics have been a common inclusion in animal feed to stimulate growth and prevent diseases. However, a recent industry trend is to reduce antibiotic use due to concerns about antibiotic resistance and consumer preferences for antibiotic-free meat products. This shift has prompted the development of alternative solutions, including probiotics and phytogenics, to support animal health and enhance feed efficiency while minimizing reliance on antibiotics.

Animal Type Insights

Based on the Animal Type, poultry feed is anticipated to hold the largest market share of 42% in 2024. Poultry feed is designed to meet the nutritional needs of chickens, turkeys, ducks, and other poultry species. The poultry feed market is increasing demand for high-protein, antibiotic-free, and genetically modified organism (GMO)-free feeds. Sustainability practices are also gaining importance, leading to innovations in eco-friendly feed production. Additionally, precision feeding techniques and probiotics are being used to optimize poultry health and productivity, aligning with consumers' preferences for healthier and more sustainably produced poultry products.

The pet segment is projected to grow at the fastest rate over the projected period. The pet feed market caters to dogs, cats, and other companion animals. The trend in this market is the premiumization of pet diets, with consumers showing a strong preference for high-quality, specialized, and natural ingredient-based pet feeds. There's a rising demand for grain-free, organic, and functional pet foods, along with a shift toward alternative protein sources such as insect-based or plant-based pet food. This trend underscores the emphasis on health and wellness, as pet owners increasingly consider their pets as integral members of their families and seek nutrition that aligns with human food standards.

Mode of Delivery Insights

The premixes segment had the highest market share of 53.2% in 2024 on the basis of the mode of delivery. In the animal feed market, premixes are blend formulations of vitamins, minerals, amino acids, and other essential nutrients. They are typically incorporated into compound feeds or complete diets. A trend in premixes is the growing demand for customized formulations to meet specific animal health and production goals. This includes precision premixes designed to optimize animal performance while minimizing nutrient waste.

Oral powders are anticipated to expand at the fastest rate over the projected period. Oral powders are a mode of delivery for supplements and medications in animal nutrition. A trend in this sector is the development of oral powder products designed for ease of administration and enhanced bioavailability, ensuring animals receive the necessary nutrients or medications efficiently while maintaining their health and productivity.

End User Insights

Based on the End User, Feed manufacturers is anticipated to hold the largest market share of 35.8% in 2024. Feed manufacturers are entities that produce animal feed products for various livestock and poultry. These manufacturers play a pivotal role in the animal feed market by formulating and producing feeds that meet the nutritional requirements of different animals. In recent trends, feed manufacturers are increasingly focused on the development of sustainable and eco-friendly feeds, including alternative protein sources and precision nutrition, to cater to changing consumer demands and environmental concerns.

On the other hand, the Contract manufacturers segment is projected to grow at the fastest rate over the projected period. Contract manufacturers, in the context of the animal feed market, are companies that produce feed products on behalf of other businesses, such as feed producers or livestock farms. These manufacturers provide a cost-effective solution for companies looking to outsource feed production. An emerging trend in contract manufacturing is the use of advanced technology to enhance production efficiency and meet the demand for custom and specialty feeds, addressing the diverse needs of various end users in the industry.

Regional Insights

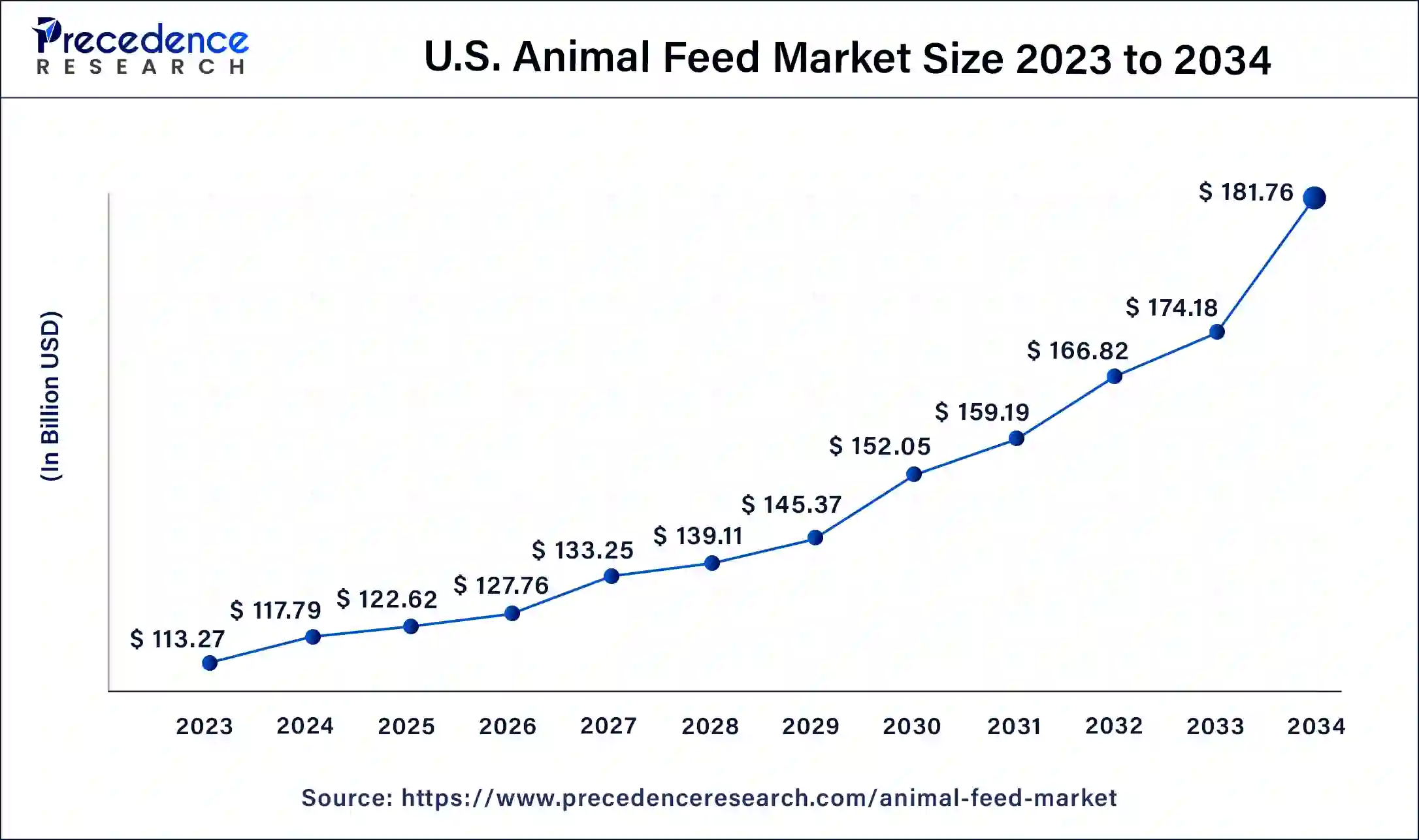

U.S. Animal Feed Market Size and Growth 2025 to 2034

The U.S. animal feed market size is valued at USD 122.62 billion in 2025 and is predicted to be worth around USD 181.76 billion by 2034, registering a CAGR of 4.40% between 2025 and 2034.

Robust Livestock Industry Drives North America

North America has held the largest revenue share of 36% in 2024. In North America, the animal feed market is well-established, driven by the region's large and advanced livestock industry. Key trends include a growing focus on sustainable and eco-friendly feed options, as well as precision feeding technologies to enhance animal nutrition and efficiency. The demand for high-quality animal feed, coupled with stringent food safety regulations, has led to investments in advanced quality control and traceability systems to meet consumer expectations.

U.S. Driven by Large Industries

The U.S. plays an evolving role in the global market as a major producer, consumer, and exporter, driven by its large livestock and poultry industry and a commitment to technological innovation and feed safety. Furthermore, the country's production capacity, combined with advancements in feed technology and a strong domestic market, positions it as a significant exporter and innovator in the field. Major companies like Cargill and ADM are leading the way in developing advanced feed technologies and additives to improve efficiency and sustainability.

The market is experiencing industrialization of livestock production due to increased demand for high quality animal protein. Technology integration in the animal feed market leading to feed formulation and delivery. The market is showing a strong demand for organic feeds and sustainability practices. The feed safety is ensured on a significant level in the market leading to the growth of the market which is driven by various strategic initiative and collaborative partnership for enhancing efficiency on operational level.

Growing Population Boosts Asia Pacific

Asia-Pacific is estimated to observe the fastest expansion. The animal feed market in the Asia-Pacific region is undergoing remarkable growth, primarily due to a surging demand for meat and dairy products resulting from a growing population and urbanization. A noteworthy trend involves the incorporation of innovative feed ingredients like insect meal and plant-based feeds to align with sustainability objectives. Furthermore, the region places a strong emphasis on disease prevention and management in animal agriculture, driving advancements in feed formulations and quality assurance measures.

Expanding the Livestock Sector Stimulates China

China also plays a distinctive role in the global market. This substantial role is driven by China's continuously expanding livestock sector, fueled by increasing urbanization, rising incomes, and changing dietary preferences among its massive population. The growing demand for meat, dairy, eggs, and aquaculture products necessitates the use of animal feed to support livestock nutrition, health, and productivity. The country's feed industry also offers substantial export opportunities for feed ingredients and compound feeds globally, highlighting China's multifaceted role as a key player in the market.

The market is showing a substantial growth in China due to increased demand for meat products. The market is experiencing demand and a shift towards high-quality mixed feeds and increasing focus on sustainability. The livestock and poultry sectors are showing a massive growth in China due to increased meat consumption linked with the availability of disposable income and increased awareness regarding the nutrition and protein intake.

Rising Demand for Dairy Products Fuels India

The growing demand in the market for meat, eggs, and dairy products is driving the need for quality animal feed. The livestock sector is continuously expanding due to increased population and growing demand for food. Such as cattle, buffaloes, goats, and poultry sector in growing rapidly. The growth is supported by government support, increased focus on various animal safety, and high-quality feed production and supply, and various new technological innovations and adoptions.

Europe Embraces Advanced Regulations

The Europe market is characterized by advanced regulations and a strong commitment to sustainability. With a well-established livestock industry, the region focuses on producing high-quality and environmentally responsible feed solutions. Emerging trends include the adoption of alternative protein sources and the use of precision feeding technologies. Europe places a significant emphasis on quality control, traceability, and disease prevention to ensure safe and nutritious animal feeds.

Robust Livestock Industries Propel the UK

The presence of robust livestock industries is increasing the demand for animal feed in the U.S. This is increasing the development of high-quality and nutritious feed, where the growing advanced farming practices are also increasing their demand. Moreover, due to the stringent regulations, the development of safe and certified products is increasing, which is promoting their use.

Growing Exportations Drive South America

South America is expected to grow significantly in the animal feed market during the forecast period, due to growing exportations. The presence of high-quality and nutritionally optimized animal feeds is increasing their exports, where the presence of a large livestock industry is also increasing their use. The growing technological advancement and abundant raw materials are also increasing their development, promoting market growth.

High Livestock Production Facilitates Brazil

Due to high livestock production, the demand for animal feed is increasing in Brazil. Moreover, the development of premium feed formulation is increasing its use. Additionally, the increasing industrial farming practices and product consumption volume are also increasing their use, where they are also focusing on enhancing their production and formulations.

Animal Protein Demand Advances MEA

MEA is expected to grow significantly in the animal feed market during the forecast period, due to growing demand for animal protein. The expanding poultry sector and aquaculture are also driving their demand. Moreover, the investments are increasing the development of high-quality wheat-based feed, enhancing the market growth.

Animal Feed Market Growth in GCC

The GCC animal feed market is expanding steadily due to growing livestock farming, rising meat and dairy consumption, and government initiatives to enhance food security. Demand for high-quality, specialty feeds is increasing, with key players investing in production capacity across the region.

Animal Feed Market Value Chain Analysis: The Strategic Insights

- Raw Material Procurement

Raw material procurements for animal feed involve the sourcing of bulk agricultural commodities and essential micronutrients to develop balanced feed.

Key players: Cargill, Inc., Godrej Agrovet. - Processing and Preservation

The processing of animal feed involves grinding, mixing, pelleting, and conditioning, while preservation involves controlling moisture and the use of additives.

Key players: Cargill, Inc., Godrej Agrovet. - Waste Management and Recycling

The transformation of various organic byproducts and surplus food items is involved in the waste management and recycling of animal feed.

Key players: Cargill, Inc., Wastelink, Protix.

Key Players' Offering

- Cargill, Inc.: The company provides products like Purina, Provimi, Nutrena, EWOS, etc.

- Archer Daniels Midland Company (ADM): Formula feed and health products are provided by the company.

- Charoen Pokphand Group (CP Group): The company provides extensive lines of livestock and aquafeeds.

- Nutreco N.V.: Trouw Nutrition, Skretting, Shur-Gain, and Nanta are provided by the company.

- ForFarmers N.V.: The company supplies organic and conventional feeds.

Animal Feed Market Companies

- Cargill, Inc.

- Archer Daniels Midland Company (ADM)

- Charoen Pokphand Group (CP Group)

- Nutreco N.V.

- New Hope Group

- Land O'Lakes, Inc.

- ForFarmers N.V.

- Alltech, Inc.

- Wen's Food Group

- J.D. Heiskell & Co.

- Dabaco Group

- De Heus Animal Nutrition

- Ridley Corporation Limited

- Kemin Industries, Inc.

- Biomin Holding GmbH

Recent Developments

- In July 2025, a new innovation by China in agriculture is revolutionizing the sector in Rwanda and helping many farmers to produce mushroom and livestock feed while being sustainable and increasing the food security. The technology known as Juncao technology. This method utilizes grass instead of wood to cultivate feeds and mushrooms, which makes it a very low-cost and eco-friendly solution compared to the traditional methods. Because of this, it is growing very rapidly in Rwanda. Chinese scientist Professor Lin Zhanxi developed the technology. (Source: https://farmersreviewafrica.com)

- In July 2025, Farmers in Africa or harvesting insects and using them for animal feed. Farmers in Africa or harvesting insects and using them for animal feed. Locusts are normally considered as a distructive thing for the crops but the new startup is using them and turning it into animal feed. The startup named Bug Picture, outsources the gathering of insects to local villagers. After collection, workers crush, dry and mill them into a fine powder. This insect meal is rich in protein and micronutrients, making it a viable resource for animal feed, fertiliser or even human consumption. (Source: https://farmersreviewafrica.com)

- In June 2023, Evonik launches updated Biolys product for animal feeds. The new Biolys provides a higher concentration of L-lysine (an 80 percent ratio to Lysine HCl) compared to the current version's 60 percent L-lysine and Lysine source with the lowest carbon footprint available on the feed additives market. The product also contains valuable components resulting from its fermentation process, additional nutrients, and energy that further benefit livestock such as swine or poultry.

- In September 2024, Growel Group announced a strategic expansion into the growing pet food sector with the launch of its new pet food brand, Carniwel. Carniwel aims to meet the rising demand for premium pet nutrition at affordable prices, providing a range of products tailored to the specific needs of both small and large breed dogs. This pet food is available in various pack sizes and is suitable for different life stages.

- In 2023, De Heus Animal Nutrition has inaugurated a greenfield animal feed factory in Ivory Coast, with an initial capacity of 120,000 metric tons of feed production for various animals, including cattle. This expansion caters to the region's growing demand for animal nutrition.

- In 2021, De Heus Vietnam has inked a strategic agreement with Masan, gaining full control of MNS Feed's feed-related business. This deal encompasses 13 animal feed mills with a combined production capacity of nearly 4 million metric tons, reinforcing De Heus' presence in Southeast Asia's prominent animal feed market.

- In 2022, Archer Daniels Midland Co. (ADM) has acquired a feed mill in Southern Mindanao, Philippines, further expanding its presence in the country's Animal Nutrition sector. This strategic move enhances ADM's capacity to meet the region's animal feed demands.

Segments Covered in the Report

By Additives

- Antibiotics

- Vitamins

- Antioxidants

- Amino Acid

- Feed Enzymes

- Feed Acidifiers

- Others

By Animal Type

- Poultry

- Cattle

- Swine

- Pet

- Others

By Mode of Delivery

- Premixes

- Oral Powder

- Oral Solutions

By End User

- Feed Manufacturers

- Contract Manufacturers

- Livestock Producers

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting