What is the Poultry Feed Market Size?

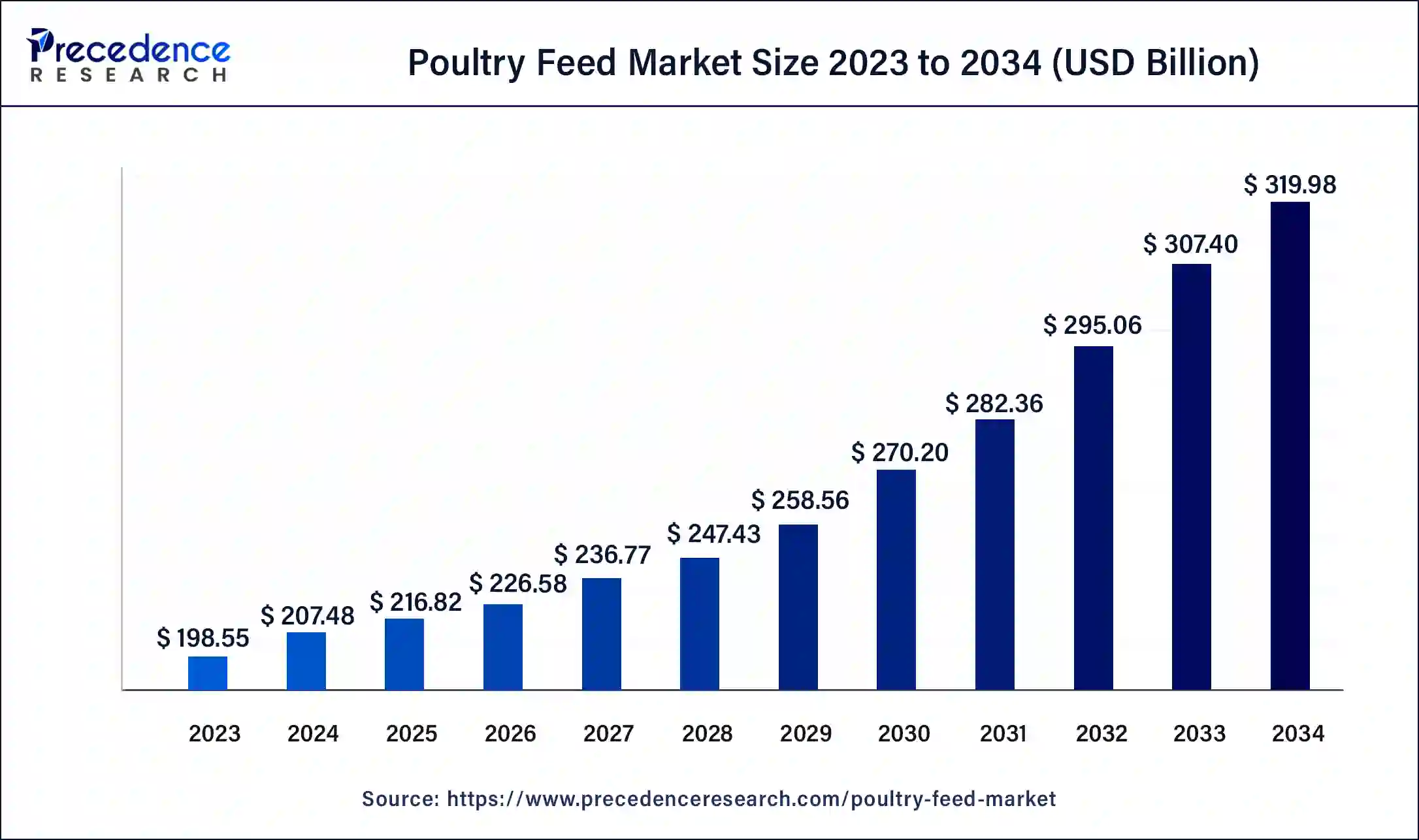

The global poultry feed market size is calculated at USD 216.82 billion in 2025 and is predicted to increase from USD 226.58 billion in 2026 to approximately USD 332.40 billion by 2035, expanding at a CAGR of 4.37% from 2026 to 2035.

Market Highlights

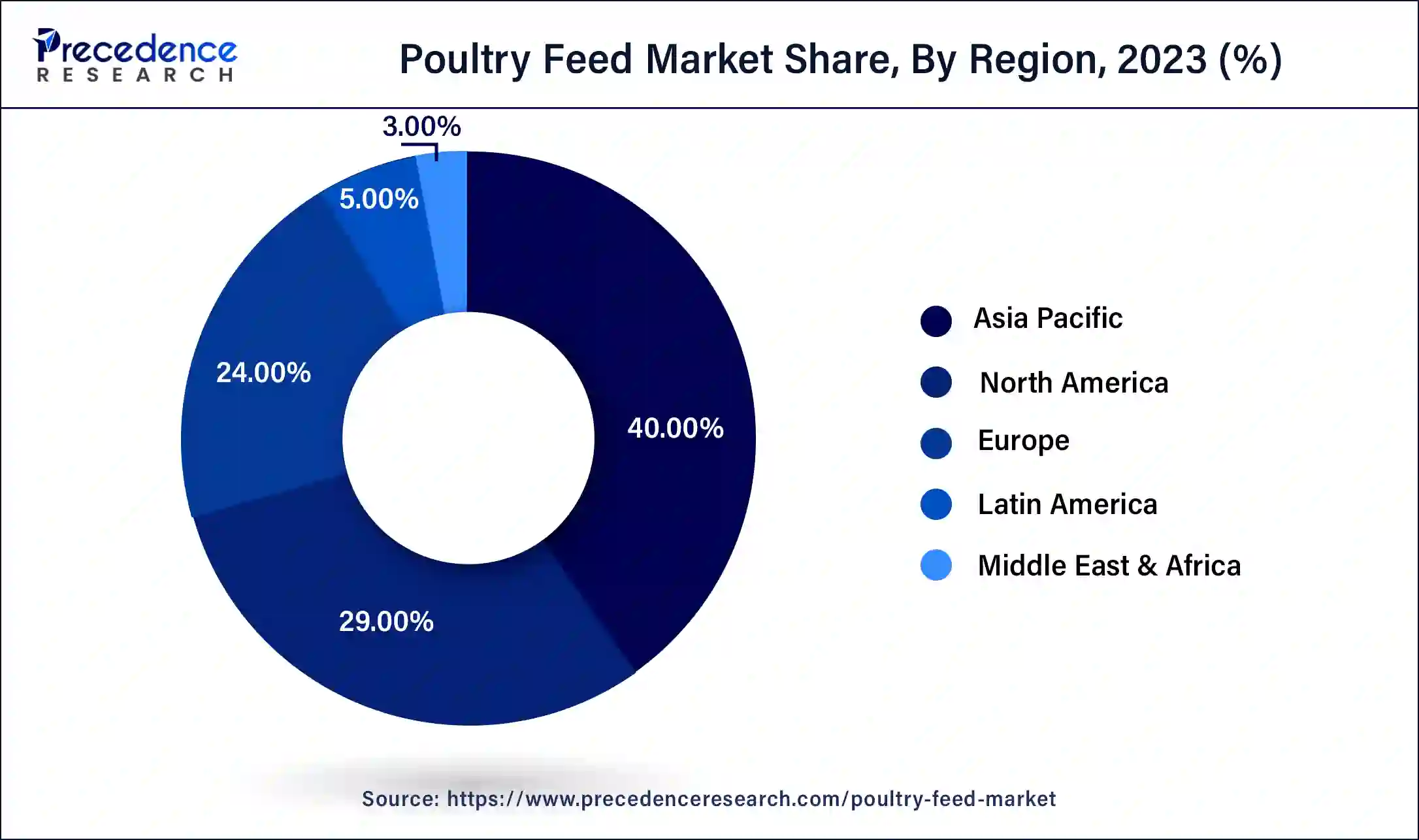

- Asia-Pacific dominated the high-speed camera market with the largest market share of 43% in 2025.

- By livestock, the broilers segment has held revenue share of 55% in 2025.

- By livestock, the layers segment is projected to grow rapidly in the market in the coming years.

- By additive, the amino acid segment held the largest share of the market in 2025.

- By additive, the vitamins segment is projected to grow rapidly in the market in the upcoming years.

Market Overview

The worldwide expansion of the poultry feed industry continues at an accelerated pace as a result of the continued advancement of poultry meat production and poultry egg consumption, the increase in population; and the increase in demand for affordable sources of animal protein. Poultry feed is composed of a combination of feed grains (cereal), oilseeds, vitamins and minerals to promote bird health and performance, as well as support an efficient feed-to-meat (or bird) conversion rate. Advances in poultry nutrition, increased emphasis on reducing poultry disease, and increased interest by poultry producers to maximize the nutritional quality of their poultry feed have all contributed to the increasing popularity of bird-based and commercially prepared poultry feeds globally.

Poultry Feed Market Growth Factors

The factors such as the surge in demand for organic feed and growing production of livestock production are driving the growth of global poultry feed market. As per the Organization for Economic Co-operation and Development, poultry requires 13% fat, 60% protein, and 3% calcium. Therefore, poultry by products and fish food are used to meet the nutrient requirements. The by-product accounts for about 50% and the live market weight of ruminants and 30% of the live market weight of poultry. These by products are processed, pulverized, and used as chicken feed. Poultry meat is becoming more popular around the world, with consumption rising from 45,033 metric tons in 2018 to 45,938 metric tons in 2020.

Poultry chicken is regarded as one of the most cost-effective sources of protein and as a result, the demand for poultry goods such as eggs and meat is continually increasing. As per the United States Department of Agriculture, worldwide chicken meat production will likely to exceed 97.8 million tons in 2019, up 2% from 2018. The market for poultry feed is also growing due to favorable government regulations. By 2019, the integration of insect protein in poultry feed will have high requirement for poultry feed, thus projecting the growth of global poultry feed market. In February 2018, the European Commission's Health and Food Safety Commissioner allowed the incorporation of insect protein in poultry feed.

The product releases, acquisitions, business expansions, joint ventures, and considerable investments in research and development are all strategies used by poultry feed makers to obtain optimal business expansion and building a positive market position. The evolving global businesses or new competitors are expected to have more chance to expand the poultry feed market, particularly in emerging nations. During the projected period, the growing government activities and growing foreign investments in the emerging agricultural sector, particularly in India and China of Asia-Pacific region, are likely to promote the growth of global poultry feed market.

Due to growing number of diseases and infections, the animals are more vulnerable to the such ailments. Thus, this factor is driving demand for poultry feed in the global market. The factors such as raw material price volatility as well as environmental concerns are expected to stymie the global poultry feed market's expansion throughout the projection period.

Market Outlook

- Industry Growth Overview: The Poultry Feed segment will see Positive growth due to the increase in production of poultry, increase in urbanization, and the demand for a protein-based diet. Improvements in feeding efficiency and the management of nutrition for poultry are increasing Global productivity and profitability of Poultry Products due to the use of Technology.

- Global Expansion: Global feed manufacturers are expanding their businesses into Emerging Markets (Asia, Africa & Latin America) using Strategic Acquisitions, Local Partnerships & Capacity Expansions to meet Local Demand.

- Innovation and Startups: There are new startups entering the Poultry Feed segment with new Enzyme Based Additives, Insect Protein Products and Digital Feed Optimization Tools into the Poultry Feed Industry.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 216.82 Billion |

| Market Size in 2026 | USD 226.58 Billion |

| Market Size by 2035 | USD 332.40 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 4.37% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Livestock, Additives, Form, Nature, Distribution Channel, Ingredients, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Poultry Feed Market Segment Insights

Livestock Insights

The broilers segment dominated the poultry feed market in 2025 with a revenue share of 71%. The broilers are chickens or birds raised purely for the purpose of producing meat. They have genes that allow them to grow more quickly than native chickens and layers. Broilers can gain a lot of weight in a short amount of time, which might cause their vents to expand or make them paralyzed and unable to walk as a result of their extreme weight increase. Broiler meals are designed to provide extra energy to help them gain weight.

The layers segment is expected to witness strong growth over the forecast period. The primary purpose of layer farming is to produce eggs. As the world's population grows, so does the demand for food and energy, resulting in an increase in layer production around the world. The key factors driving the demand for the layers segment are rising per capita egg consumption and worldwide population increase.

Additive Insights

The amino acid segment dominated the poultry feed market in 2025. The amino acids are the building blocks of proteins. The amino acids are left over after proteins are broken down or digested properly. The amino acid segment is growing due to benefits provided by it. It is one of the good sources of proteins and nutrition. In addition, the amino acids help in digestion of animal bodies. That's the fact, amino acids are added to the poultry feed.

The vitamins segment is projected to grow at a strong growth during the forecast period. Vitamins are a collection of chemical molecules that must be consumed in modest amounts. Vitamins are vital additives because they govern regular bodily processes, reproduction, and growth. Water soluble vitamins and fat-soluble vitamins are two types of vitamins that can be found in the body.

Poultry Feed Market Regional Insights

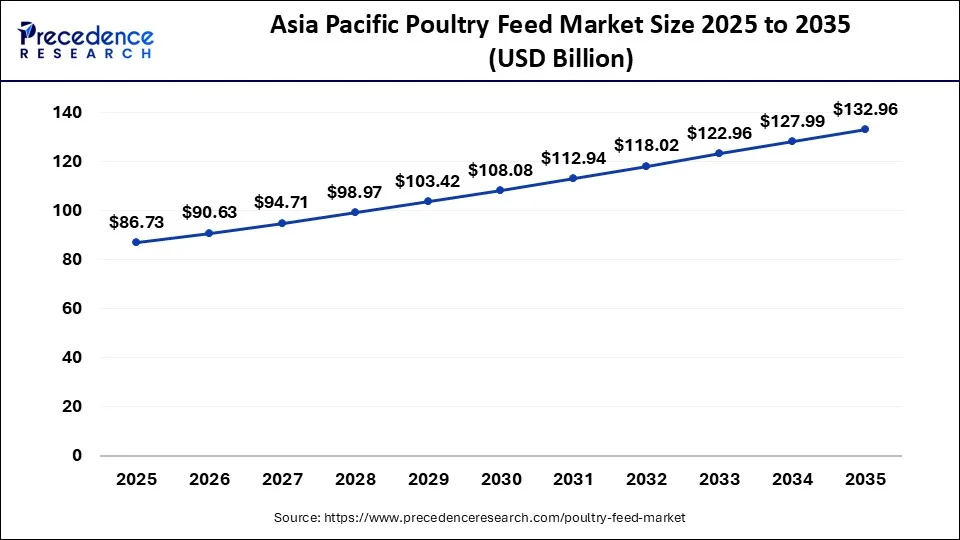

The global asia pacific poultry feed market is valued at USD 86.73 billion in 2025, and it is expected to be worth around USD 132.96 billion by 2035, with a CAGR of 4.50% from 2026 to 2035.

Asia-Pacific region accounted revenue share of around 40% in 2025. India and China dominate the poultry feed market in Asia-Pacific region. The growing production of feed in emerging regions is driving the growth of Asia-Pacific poultry feed market. The poultry sector accounts for roughly 70% to 75% of the Indian commercial feed business in 2019. Nearly 39 million metric tons of commercial feed were produced in the country. Poultry feed accounts for roughly 24.9 million metric tons of the country's feed production in 2019.

The poultry feed market in China has a strong dependence on the development of Large Broiler and Layer populations, as well as on the modernization of farming methods due to the rapid increase in farm size as a result of increasing urbanization. The Government has also increased their attempts to stabilise the availability of feed ingredient supplies and has become increasingly encouraging of the use of low-antibiotic, high-efficiency feed additives, which are helping to drive growth in the poultry feed industry in China.

North America is expected to develop at the fastest rate during the forecast period. The North American companies are engaged in meat and chicken-based ingredients processing. The North America poultry feed market is being driven by factors such as growing government initiatives, stringent government regulations, and high investments by government bodies. The poultry feed market in North America region is expected to grow due to rising broiler production in the region and customers' preference for poultry products due to their lower prices when compared to other alternatives.

Why Is the U.S. Leading the Poultry Feed Industry in Terms of Innovation and Production?

U.S. poultry feed industry in the is driven largely by a significant quantity of broiler production, a growing amount of advanced feed formulations, and a significant amount of consumer demand for protein-rich diets. Producers are increasingly using feeds that contain high levels of enzymes and have been formulated without the addition of antibiotics, following a recent shift in regulations. The presence of long-established poultry processing companies and a high level of biosecurity within the industry in conjunction with a highly developed produce manufacturing infrastructure support the growth of consistent innovation in addition to a continual adoption of high-quality commercial feeds.

The European poultry feed market is experiencing steady growth due to the increasing demand for premium-quality poultry meat and egg products, the introduction of stringent feed safety regulations in many European countries, and the increasing use of balanced nutrition formulas as an alternative to conventional feed formulations. In addition to these trends, the expanding number of commercial poultry farms in the European Region, the improved animal welfare legislation being enacted, and the continuing development of new feed enzymes and additives are all contributing to the growth of poultry feed production in the region and attracting more investment into advanced feed production technologies.

The European region has a mature, yet innovation focused, poultry feed marketplace, having strict animal welfare legislation in place to ensure that all poultry products sold meet the high quality and standards that consumers have become accustomed to expect. Specifically, Germany, France and the Netherlands are producing the highest levels of poultry feed, producing nutritionally optimized products (no antibiotic residues), and producing a growing quantity of organic and non-GMO poultry feeds. In addition to the use of nutritional science to optimise poultry feeding, advancements in feed technology, innovations in feed formulation and sustainability are furthermore helping European poultry feed producers to develop products made using alternative protein sources, as well as eco-friendly feed products.

The Middle Eastern and African region is rapidly emerging as a major poultry feed production region due to the rapid rise in poultry meat consumption in the two regions, the rapid population growth occurring in both regions, and the rapid increase in urbanization occurring within many African and Middle Eastern countries. In addition to these factors, many countries in the Middle East and Africa are investing in improving their feed mills in order to reduce their reliance upon imported feeds. The continuing improvement of commercial poultry farming methods used within the two regions, as well as the increased emphasis on using low-cost protein sources and the increasing number of Government-sponsored agricultural-development programmes have contributed to accelerating the progress being made in the area of feed production.

UAE Poultry Feed Market Is Growing Based on Domestic Poultry Farm Expansion, Food Security, and the Importation of Feed Ingredients. Producers in the UAE are producing nutrient-dense and climate-adaptable poultry feeds that optimise productivity in areas of high temperatures. Further investments being made by the UAE Government in modern poultry production facilities and bio-secure production systems are facilitating the adoption of premium-feed, performance-enhancing feed products.

With an increasing amount of poultry being produced in Brazil, Mexico, and Argentina, or areas with a burgeoning middle-class populace, it is clear to see that this region has become an emerging high-growth market within the poultry feed sector due to numerous factors including rising demand for meat exports, changes in consumer behaviours towards eating chicken instead of other meats (due to cost), modernization of farms, greater use of compound feeds, and large investments by both local companies and multinationals in Latin America.

Value Chain Analysis

- Raw Materials and Processing: The three major ingredients used to manufacture feeds include corn and soybean meal, along with additives that are required to produce quality, safe feeds with nutrient levels that are consistent.

- Feeding and Feeding Systems: Companies like Cargill and ADM use precision nutrition as well as R&D based approaches in their feed manufacturing processes that allow them to provide their customers with a feed that results in optimum feed conversion ratios.

- Logistics and Delivery: With established logistics and the presence of direct working relationships with commercial poultry farms, feed manufacturers can ensure that feed is delivered on schedule and that performance is monitored in real time.

Poultry Feed Market Companies

- Chicken Pokphand Foods PCL

- Cargill Inc.

- Archer Daniels Midland

- Alltech Inc.

- De Heus B.V.

- Land O'Lakes Inc.

- ForFarmers N.V.

- Nutreco N.V.

- NEOVIA Group

- BASF SE

Key Developments

- In 2020, ForFarmers declared the purchase of De Hoop Mengvoeders' poultry industry, establishing a dominant position in the broiler market.

- Cargill introduced a feeding intelligence platform in October 2019 to supply farmers with resources on the most up to date intelligent animal production practices, with the goal of assisting them in navigating and improving their operations across all species, including poultry.

- SYNCRA, a poultry feed supplement developed by DuPont de Nemours Inc., was introduced in March 2019 to improve nutrient digestibility in the poultry industry.

- In 2021, Associated British Foods PLC introduced AB Neo, an animal neonate specialist company that caters to the needs of young farm animals. It makes calves, chickens, and piglets' products.

- Charoen Pokphand Group announced a cooperation with Plug and Play, the world's largest global innovation platform for industry accelerators, in Silicon Valley in May 2021. C.P. Group and Plug and Play will collaborate closely to maximize innovation as the company expands its efforts to establish sustainable enterprises and foster beneficial impacts on global communities.

Segments Covered in the Report

By Livestock

- Layers

- Broilers

- Turkey

- Others

By Additives

- Antibiotics

- Vitamins

- Antioxidants

- Amino Acid

- Feed Enzymes

- Feed Acidifiers

- Others

By Form

- Mashed

- Pellets

- Crumbles

- Others

By Nature

- Conventional

- Organic

By Distribution Channel

- Offline

- Online

By Ingredient

- Cereal

- Oilseed Meal

- Molasses

- Fish Oil and Fish Meal

- Supplements

- Other Ingredients

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content