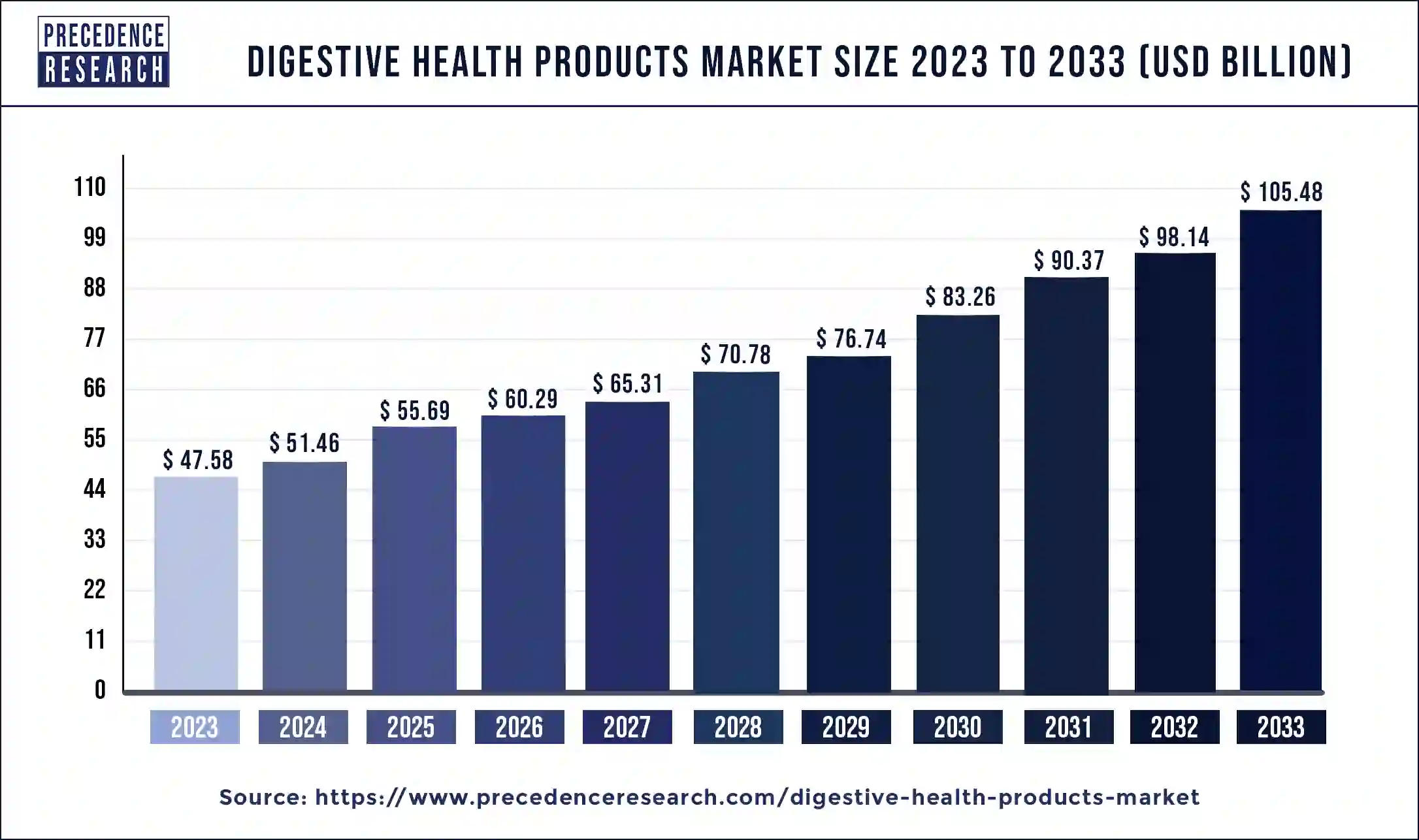

What is Digestive Health Products Market Size?

The global digestive health products market size is valued at USD 126.51 billion in 2025 and it is expected to hit around USD 290.31 billion by 2035 with a registered CAGR of 8.66% from 2026 to 2035

Market Highlights

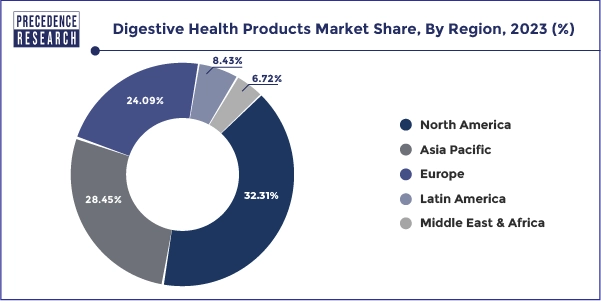

- North America has dominated the market with revenue share of 32.31% in 2025.

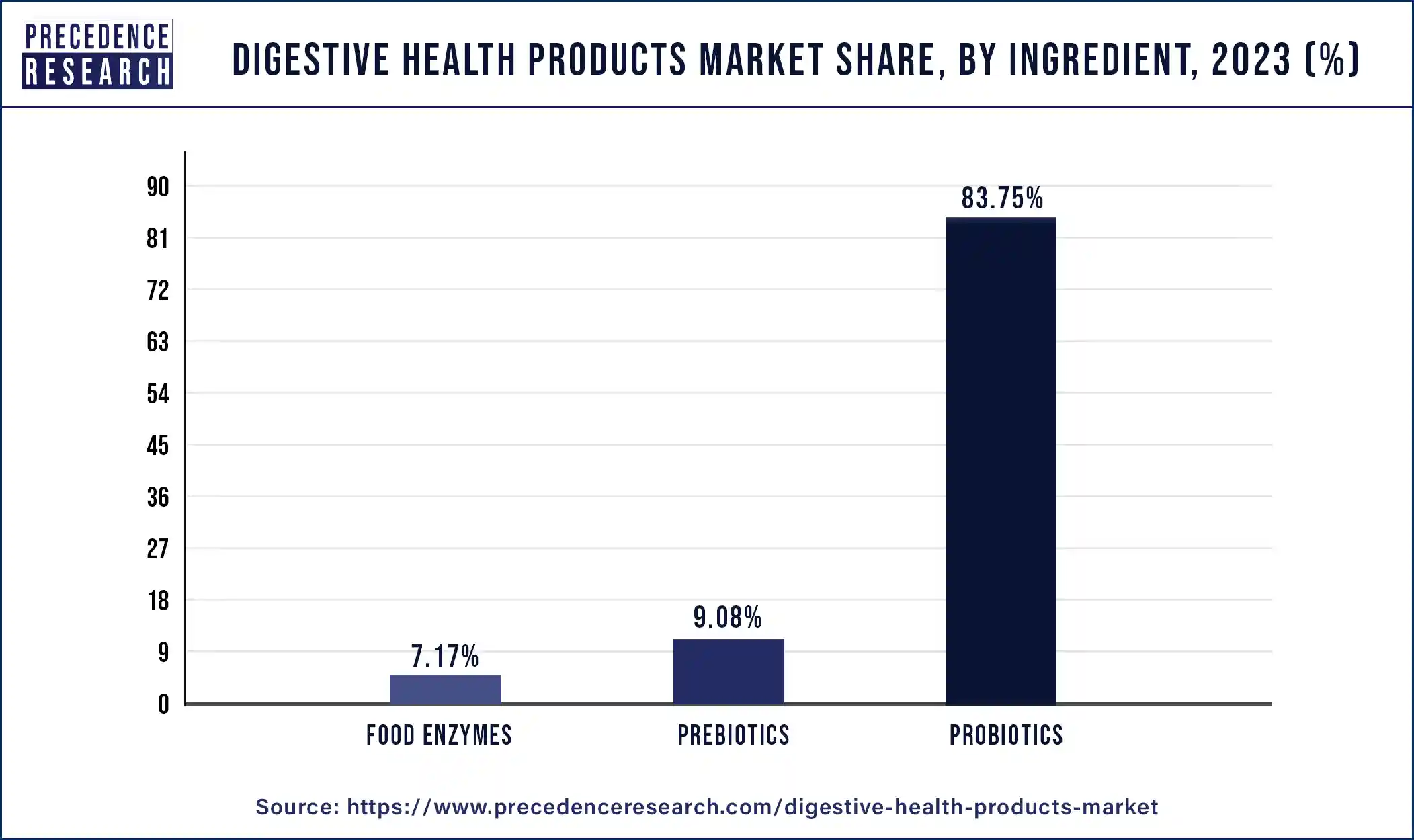

- By ingredient, probiotics segment has accounted highest market share of 83.75% in 2025.

- By product, dairy products segment has held revenue share of 65.21% in 2025.

- By distribution channel, supermarkets & hypermarkets segment has captured 46.92% revenue share in 2025.

Digestive Health Products Market Growth Factors

The growing prevalence of malabsorption, obesity, and reduction of food intake due to changing lifestyle of the consumers is augmenting the growth of the digestive health products market. Digestive health products are intended to boost the human immunity system by improving the functions of the digestive system. The presence of various enzymes such as lipase, amylases, and lactase in the digestive health products helps to maintain the stomach acid levels and improves digestion of nutrients. Rising demand for nutritional supplements and nutritional food additives is one of the key factors propelling the growth of the digestive health products market.

Changing lifestyle of the consumer, rising number of working population, busy and hectic schedule of consumers, growing geriatric population, rising disposable income, and increased consumer expenditure on healthcare products is significantly contributing to the growth of the digestive health products market. Furthermore, growing consumer awareness regarding probiotics and associated benefits coupled with rising healthcare costs is driving the demand for the digestive health products among the population.

Market Scope

| Report Highlights | Details |

| Market Size in 2025 | USD 126.51 Billion |

| Market Size by 2026 | USD 137.13 Billion |

| Market Size by 2035 | USD 290.31 Billion |

| Growth Rate From 2026 to 2035 | CAGR of 8.66% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Ingredients, Product, Distribution Channel, and region |

| Regional Scope | North America, APAC, Europe, Latin America, MEAN, Rest of the World |

Segment Insights

Ingredients Insights

Prebiotics segment expects the significant growth during the forecast period. The increasing prevalence of gastrointestinal disorders, including constipation, irritable bowel syndrome (IBS), Gastroesophageal Reflux Disease (GERD), and inflammatory bowel disease, has heightened concerns about gut health, thus expected to drive market growth during the forecast period. Moreover, the increasing growth and gathering of natural prebiotic herbs are also anticipated to boost the market. Furthermore, key prebiotic components like inulin and Fructo-Oligosaccharide (FOS) are sought after in products needing low-calorie sweetness, which in turn drives growth in the overall prebiotic market throughout the projected period.

Product Insights

Dairy products segment dominated the market in 2024. The expansion is influenced by multiple elements, including the increasing global population, rising disposable incomes, and evolving dietary patterns. As customers grow more health-conscious, the demand for dairy products such as milk, cheese, yogurt, and butter has increased and is now recognized for its rich nutritional value. Urbanization is a significant trend driving the dairy sector, as busy consumers choose convenient, ready-to-eat, and shelf-stable dairy products such as flavored milk and probiotic yogurts. Improvements in technology related to milk production and packaging are enhancing the product's shelf life and quality, appealing to a wide range of consumers.

Cereals segment is observed to grow at the fastest rate during the forecast period. A notable trend in the segment is the increasing popularity of plant-based cereals. Veganism and vegetarianism are gaining popularity, with consumers seeking cereals that contain no animal products. This has resulted in the rise of plant-based cereals created from components like oats, quinoa, and almond milk. Furthermore, the rising prevalence of single-person households is also aiding market expansion, as these households tend to buy cereals that are convenient and simple to make. Additionally, the increasing occurrence of celiac disease and various food intolerances has driven demand for gluten-free and specialty cereals. Furthermore rising demand for the organic products rising the demand for the organically produced cereals.

Distribution Channel Insights

The supermarkets and hypermarkets segment dominated the digestive health products market in 2023. Supermarkets and hypermarkets utilize in-store promotions, displays, and end-of-aisle placements to highlight digestive health products and stimulate impulse purchases. Eye-catching displays and promotional signage attract consumer attention and encourage shoppers to explore and purchase digestive health products while browsing the aisles. Supermarkets are trusted retail outlets that consumers frequent regularly for their grocery needs. This trust and familiarity extend to the purchase of digestive health products, as consumers perceive supermarkets as reliable sources of high-quality products and trusted brands.

Digestive Health Products Market, By Distribution Channel, 2022-2024 (USD Million)

| Distribution Channel | 2022 | 2023 | 2024 |

| Supermarkets & Hypermarkets | 46,939.75 | 50,777.95 | 55,020.93 |

| Pharmacy Stores | 22,786.72 | 24,527.08 | 26,444.07 |

| E-commerce | 18,388.26 | 20,010.84 | 21,812.65 |

| Others | 12,228.00 | 12,907.08 | 13,637.63 |

The e-commerce segment is expected to grow at a notable rate during the forecast period. E-commerce platforms provide unparalleled convenience and accessibility, allowing consumers to browse, purchase, and receive digestive health products from the comfort of their homes. This eliminates the need to visit physical stores, saving time and effort for busy individuals. Many e-commerce platforms offer subscription and auto-replenishment services for digestive health products, allowing consumers to schedule regular deliveries based on their usage frequency. This ensures continuity of product supply and encourages long-term customer loyalty.

Regional Insights

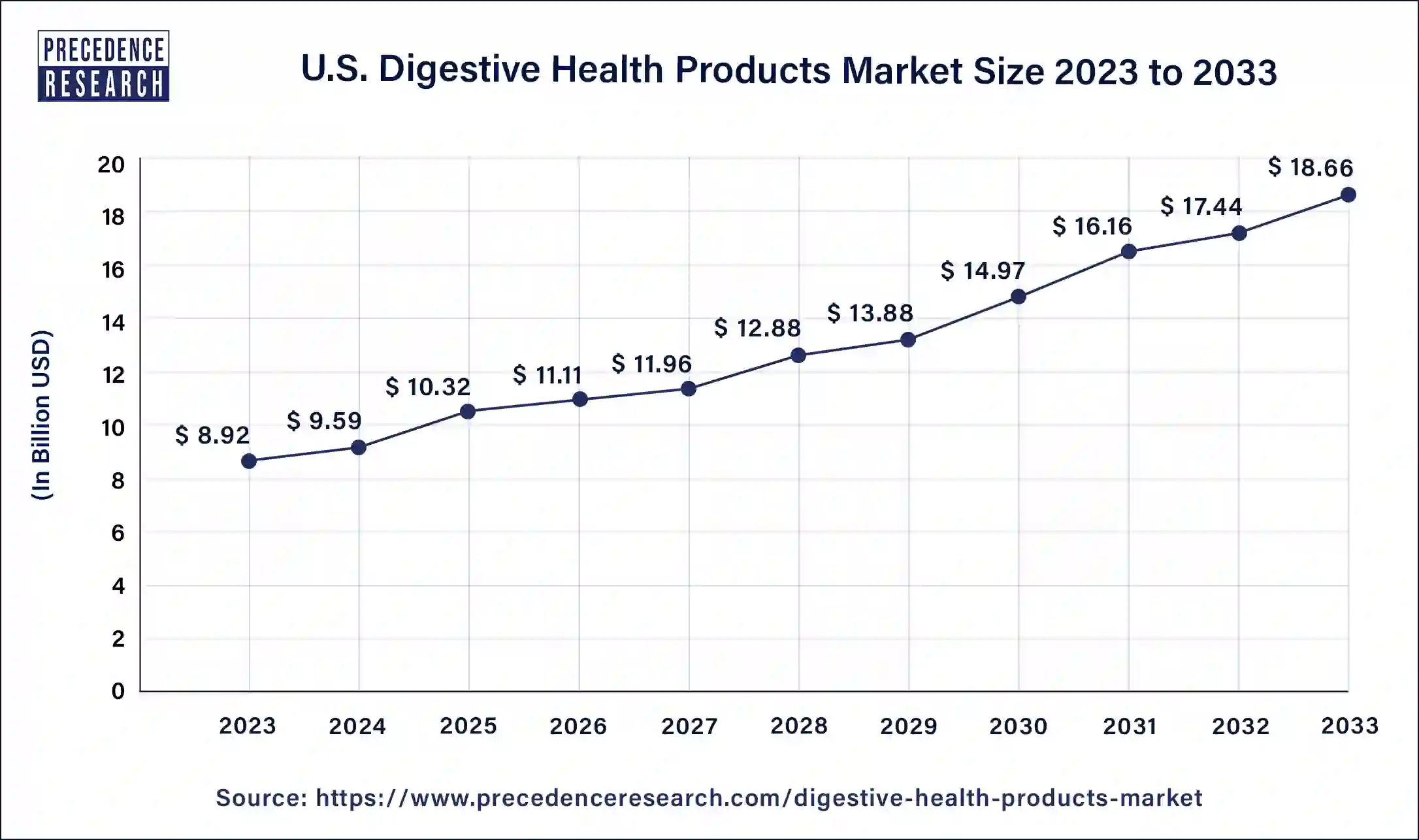

U.S. Digestive Health Products Market Size and Growth 2026 to 2035

The U.S. digestive health products market size is valued at USD 23.07 billion in 2025 and is expected to reach USD 53.88 billion by 2035, growing at a CAGR of 8.85% from 2026 to 2035.

North America dominated the digestive health products market and accounted for the largest revenue share of 32.21% in 2025. The presence of a substantial number of digestive health product producers and increased consumer awareness regarding the availability of various digestive health products has significantly contributed in the growth of the North America market. Moreover, technological advancements, product innovations, and quick door step delivery of products have fueled the growth of the North America digestive health products market in the recent years.

Asia Pacific is anticipated to be the fastest growing market for the digestive health products in the upcoming years. The growing penetration of different health products by the producers in the large economies such as China, Japan, and India is fueling the market growth across the Asia Pacific region. Moreover, the huge consumer base, rising disposable income, rapid urbanization, and growing number of working population is perfectly augmenting the market growth in the region.

Europe

Digestive health products market in the Europe growing notably. The increase in market growth is motivated by heightened consumer awareness regarding the connection between gut health and overall wellness. Another significant factor contributing to the expansion of the European market is the elevated incidence of pancreatitis observed in nations like Finland, Poland, Scotland, and Spain. This is partly because the aging European population is more vulnerable to gastrointestinal diseases and disorders. Consequently, European consumers are progressively searching for natural and effective methods to enhance their digestive wellness. This has resulted in a higher demand for dietary supplements, functional foods, and various products that include natural ingredients like probiotics, fiber, prebiotics, and enzymes.

Middle East and Africa

The market for digestive health products in the Middle East and Africa is expanding due to the prevalence of gastrointestinal diseases, including gastric cancer, affecting the area. This shows a growing need for efficient digestive health options. Other fairly typical conditions linked include irritable bowel syndrome, gastroesophageal reflux disease, and chronic liver disease. These are also very common in the area. As healthcare systems develop in nations like Saudi Arabia and South Africa, the demand for digestive health products is also increasing due to numerous intersecting factors that promote awareness, lifestyle modifications, and an aging demographic.

Recent Developments

- In March 2025, Nature Made, the top national vitamin and supplement broadline brand with over 50 years of providing high-quality products supported by science, announces the introduction of clinically researched innovations and new formulations in its Digestive portfolio, offering a variety of probiotic, prebiotic, and fiber supplements aimed at daily gut health support and tailored benefits according to specific wellness requirements.

- In May 2025, Bon Natural Life Limited, a prominent bio-ingredient solution provider in the natural, health, and personal care sectors, announced a non-exclusive sales partnership with Shanghai Risesun International Trade Co., Ltd., a top functional ingredient distributor in China. The duration of the Agreement is 24 months, with an overall contract value of US$ 24 million.

- In May 2025, created with the proprietary AI of the bioactive leader, Forager — Bio Gut Core became part of the company's expanding collection of nature-based health ingredients and platform solutions. Bio Gut Core consists of a unique combination of two bioactive compounds, N-trans caffeoyltyramine and N-trans feruloyltyramine, which demonstrated significant digestive health benefits and enhanced gut barrier function in a randomized, double-blind, placebo-controlled study.

Digestive Health Products Market Companies

- Cargill, Inc.

- Arla Foods, Inc.

- Danone A.S.

- PepsiCo, Inc.

- Yakult Honsha Co.

- Nestle SA

- AST Enzymes

- Beroni Group

- Danisco AS

- Chr. Hansen Holding

Segments Covered in the Report

By Ingredients

- Food Enzymes

- Probiotics

- Prebiotics

By Product

- Dairy Products

- Cereals

- Non-Alcoholic Beverages

- Others

By Distribution Channel

- Supermarkets & Hypermarkets

- Pharmacy Stores

- E-commerce

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Rest of the World

Get a Sample

Get a Sample

Table Of Content

Table Of Content