What is the Functional Beverages Market Size?

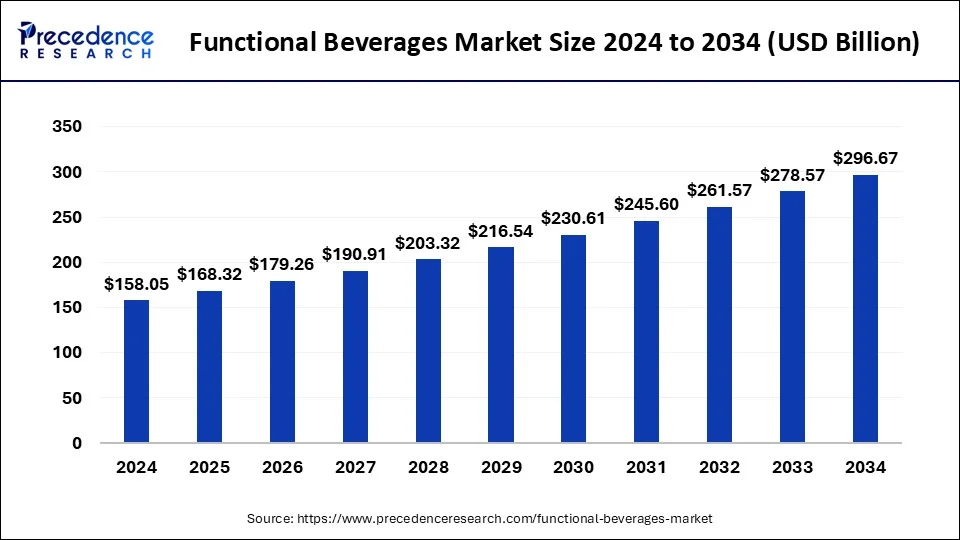

The global functional beverages market size is calculated at USD 168.32 billion in 2025 and is predicted to increase from USD 179.26 billion in 2026 to approximately USD 314.04 billion by 2035, expanding at a CAGR of 6.44% from 2026 to 2035.

Functional Beverages Market Key Takeaways

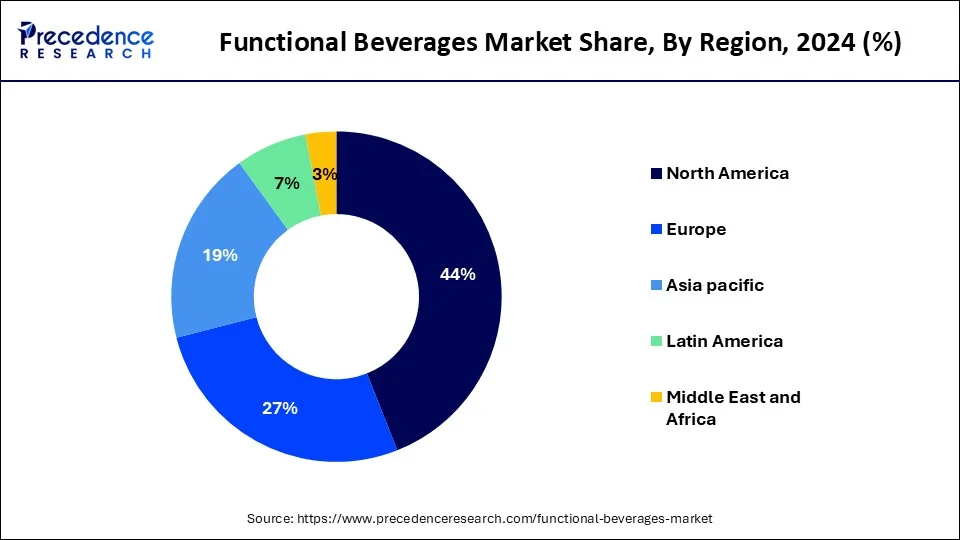

- North America dominated the global market with the largest market share of 44% in 2025.

- By type, the energy drink segment contributed the highest market share of 42% in 2025.

- By end use, fitness lifestyle users segment captured the biggest market share of 45.3% in 2025.

- By distribution type, the supermarket and hypermarket segment generated the major market share of 40% in 2025.

What are Functional Beverages?

The driving forces behind the high growth rates of the functional beverages market are driven by the need for more than just water-like hydration. The expansion of functional beverage lines is rapidly becoming popular amongst consumers who desire functional beverages that provide additional benefits to the general population, such as energy drinks, fortified waters, probiotics, and herbal teas. In addition, the need for increased immunity, improved digestive health, cognitive function, and wellness is encouraging consumers to be more proactive about their health by consuming functional beverages.

With increased awareness of health issues, a busy lifestyle, and growing trends toward preventative health care, it is no surprise that the functional beverage market is increasing in demand. In addition, clean ingredient labels, no added sugar, and naturally formulated products have contributed to changing the perception of functional beverages as a regular lifestyle choice rather than a niche market product.

AI in the Market

AI is leading the functional beverages market by driving innovation, personalization, and efficiency. It helps beverage companies to create health-oriented drinks by analyzing consumer preferences and trends. AI enriches the customer experience, increases customer satisfaction, and improves promotional campaigns through the targeting of messages aimed at specific audiences. It maximizes the productivity of the supply chains, forecasts the consumption of products, and contributes to the conservation of the environment by cutting down on the waste of raw materials and non-conforming products, thus enabling companies to survive the cut-throat competition.

Market Overview

Food and beverages have been progressively significant in disease avoidance and treatment lately. Because of their implied medical advantages, practical beverages have acquired favour among faithful purchasers. Non-alcoholic refreshments containing bioactive parts, for example, nutrients, minerals, cell reinforcements, omega-3 unsaturated fats, plant extricates fiber, prebiotics, and probiotics, as well as different supplements and bioactive mixtures. Utilization of these refreshments is connected to weight reduction, expanded energy, athletic perseverance, and hydration. These are related with an assortment of wellbeing benefits, including a solid cardiovascular (CV) framework, a sound stomach related framework, immunological protection, and cholesterol control, to give some examples. Utilitarian beverages have filled in prominence as of late because of various factors including simplicity of taking care of, stockpiling, and conveyance.

Functional Beverages Market Growth Factors

The COVID-19 has affected the practical drink area. Individuals' food buying and utilization propensities have been adjusted by the Coronavirus pestilence. To support their invulnerability, shoppers are continuously moving toward more wellbeing advancing food sources and drinks. This has brought about a flood popular for practical beverages. The quantity of wellness aficionados and the rising client inclination for solid options in contrast to sweet sodas are probably going to fuel market extension. Besides, expanded extra cash and wellbeing cognizance are fuelling interest for practical refreshments. This extension empowers industry organizations to foster low-calorie and fat-containing beavers, as well as foods grown from the ground seasoning increments like veggie lover, probiotic, and plant-based refreshments, thusly driving business sector development. Online business is basic to the market's improvement since it permits endeavours to get to a bigger client base all the more without any problem.

- The market is growing due to the increased use of beverages with health benefits, which are the consumers' preferred choice because of the rising health awareness.

- The trend is going towards preventive health care, with the generation of 'sweet sodas being replaced with functional drinks, powered by immunity and gut health being the major areas of health focus.

- Advancements in products have been witnessed, especially in the formulation of plant-based, probiotic, and low-sugar drinks, which are in line with the consumers' demand for natural and clean-label products.

- The demand for health and fitness products has been intensified by growing lifestyle trends, which, in turn, have increased the need for power, protein, and hydration drinks.

- The rise of e-commerce and the use of digital marketing by companies have helped to widen their customer base and, in the same vein, to improve product availability.

Market Outlook

- Industry Growth Overview: Increasing awareness of preventive health care by consumers. Growing demand for ready-made nutrition. Introduction of new flavors, formats, and health-enhancing properties will draw even more consumers worldwide.

- Sustainability Trends: Sustainability is increasingly becoming an integral part of each company's product strategy. Manufacturers are utilizing recyclable packaging, plant-based ingredients, and sustainable sourcing for their products.

- Global Expansion: Companies are also starting to expand into the emerging markets of the world by offering products with localized flavor profiles, competitive pricing and creating strategic partnerships. The emergence of digital distribution channels is helping accelerate Global Expansion and increase visibility of brands globally.

- Start-up Ecosystems: Start-ups are creating significant disruption in the functional beverage space by developing niche functional beverages focused on Immunity, Mental Wellness, and Gut Health. Start-ups are more agile, have more consumer-centric innovation than established companies, and are pushing established companies to quickly adapt.

Market Scope

| Report Coverage | Details |

| Market Size in 2026 | USD 179.26 Billion |

| Market Size in 2025 | USD 168.32Billion |

| Market Size by 2035 | USD 314.04 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 6.44% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Application, Ingredient, End User, Distribution Channel, Geography |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Type Insights

Energy Drink

Toward the finish of 2025, global energy drink deals are supposed to worth USD 168.32 billion with a CAGR of 6.44% and to reach valuation USD314.04 billion by 2035. This extension is connected to expanded prosperity, urbanization, and a more prominent familiarity with wellbeing and prosperity. Because of an ascent in execution, perseverance, and sharpness, both the grown-up and high school populaces are polishing off caffeinated beverages to help their occupied and dynamic lives. Because of the COVID-19 issue, "invulnerability helping" refreshment utilization is expanding as individuals look for wellsprings of nutrients and minerals.

Caffeinated Beverages

The worldwide caffeine refreshment market was surpassed at USD 314.04 billion by 2035. The global stimulated drink market is assessed to be worth USD 168.32 billion in 2025. The Caffeine-based Drinks market is rapidly arriving at it's before COVID levels and a solid development rate is normal over the estimate period, driven by the financial recovery in a large portion of the non-industrial countries. Notwithstanding, phenomenal circumstances because of expected third and further waves are making a melancholy viewpoint. This study attempts to assess various situations of COVID-19's effect on the fate of the Caffeine-based Drinks market from 2000 to 2027.

Probiotic Drinks

The overall pobiotic ingredients market was valued at USD 4,998.2 million in 2023 and is expected to reach at USD 15,432 million by 2034, with a CAGR of 5.1% from 2024 to 2034. Due to the effect of COVID-19, the market has seen rising revenue for immunological prosperity redesigning things. Covid-19, which is known to hurt individuals, while moreover affecting explicit sorts of minute organic entities in the human biome. Antibacterial prescriptions are used in all major COVID-19 treatment regimens. The antimicrobial development of the drugs used ensures that the settlement of BB animalis ssp. lactic are killed or smothered in the human host species, suggesting that they could be used as probiotics. This point should impact the premium for probiotic parts and drive the augmentation of the market all through the gauge period distinctly

Vegetable and Fruit Beverages

The soil juice market size was valued at US$ 176 billion in 2023 and expected to grow at a CAGR of 5.8% during the figure time frame 2024-2034. Products of the soil juice industry have seen huge development as this is considered being a normally obtained nutritious food with the capacity to help invulnerability. Juice is refreshment arranged by squeezing or separating the regular fluid tracked down in products of the soil. Carbonated juices and caffeinated beverages can be supplanted with foods grown from the ground juices. Purchasers are wellbeing cognizant, and they favour natural product juice to some other refreshment available. Vegetable mixes are effectively edible. Some squeezed vegetables are low in carbs and can be remembered for the keto diet. Products of the soil juice consumption have extended overall because of the on-going COVID pandemic, attributable to the medical advantages. A few provincial and global players have sent off items including invigorated nutrients and minerals to assist shoppers with expanding their invulnerability. Rising interest for natural product squeezes, the making of leafy foods mixes, seasoned soft drinks, cold-squeezed juices, and an ascent in extra cash are a portion of the causes driving the Fruit and Vegetable Juice Industry's extension.

Dairy-based beverages

Butter milk, yogurt, merged milk, and powdered milk, among other dairy things, are utilized to give acceptable enhancements and proteins, stimulating the general dairy-based drinks industry. Dairy-based drinks are truly perfect for people of all ages and a good wellspring of energy and food. The dairy reward industry is climbing a direct result of significant worth updates and the extension of added substances, which make it stronger. Dairy-based drinks show up in an extent of tastes, which is creating revenue in the general market. Purchasers by and by pick whey-based rewards and yoghurts since they are higher in sound advantage and contain less fat. Dairy-based drinks are valuable in the making of bread, frozen yogurt parlor, and dairy items, extending total usage.

Segment Insights

Application Insights

Health and Wellness

The global wellbeing drinks market was valued at USD 481 billion in 2023 and is growing at a CAGR of 6.5% during the time frame 2024 to 2034. Buyers these days approach wellbeing comprehensively, and they pick drinks that give extra wellbeing benefits. Numerous clients request utilitarian and fortifying refreshments, and this pattern is clearing over the drink business. Customers are turning out to be more wellbeing cognizant, and they are anxious to explore different avenues regarding better options in contrast to ordinary soda pops. Solid living patterns have helped the refreshment business, with better drinks overwhelming online entertainment stages and store promoting. Improved refreshments are expanding piece of the pie, especially among clients searching for sound products with high dietary benefit.

Weight Loss

The global weight loss drinks market should show up at USD 86 billion by 2034, creating at a CAGR of 6% in the forecast period 2024 and 2034. It furthermore gives a system of the huge components impacting this business and what they will mean for demand all through the projection period. The purchaser revolves around weight decrease and the extension in additional money is the huge components that will drive market advancement. Weight decrease rewards are open in an extent of flavours. They are a significant part of the time calorie-decreased, low-calorie rewards that can be used to substitute galas or as an element of a typical eating routine for weight decrease. Supper replacement shakes are the most notable sort, since they pass protein on to stay aware of muscle advancement and carbs to fuel rehearses while furthermore giving essential supplements and minerals.

Distribution Channel Insights

The grocery store/hypermarket class is supposed to rule the market over the conjecture period, inferable from expanded client dependence on them for food and drink buys. Due to the presence of an enormous choice of speciality things at wellbeing and health stores, as well as the extending prevalence of online channels, the dispersion of practical refreshments through wellbeing stores and online retailers is supposed to increment quick during the projection years.

Regional Insights

What is the U.S. Functional Beverages Market Size?

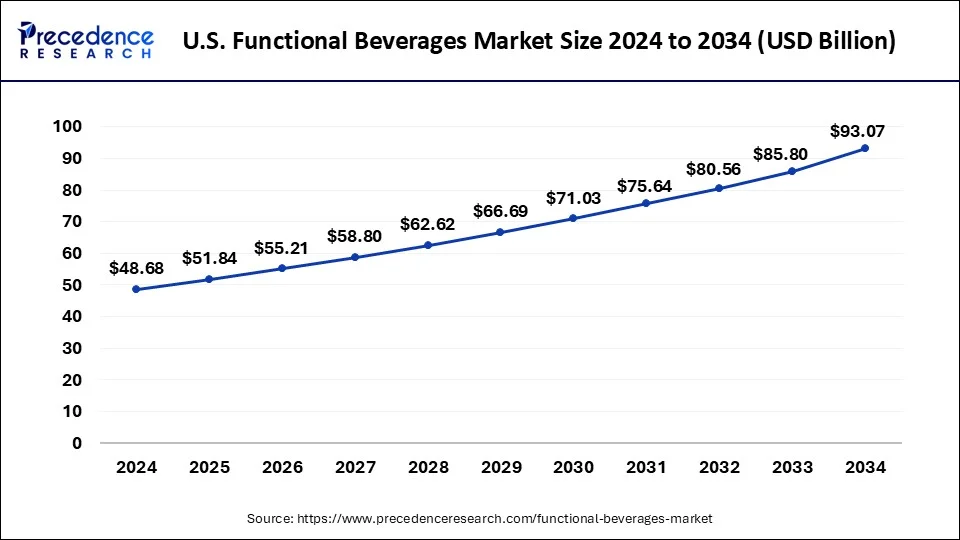

The U.S. functional beverages market size is evaluated at USD 51.84 billion in 2025 and is predicted to be worth around USD 98.99 billion by 2035, rising at a CAGR of 6.68% from 2026 to 2035.

In 2024, North America held a 44% portion of the overall market.Due to its deeply grounded economy and exclusive expectation of life, North America is the biggest market for utilitarian beverages, with a strong development rate. The area is seeing an expansion in the ubiquity of zero-calorie, zero-sugar, and low-carb delicate drinks. Drinks contribute essentially to the by and large dietary and calorie utilization of the US populace, as well as to meeting absolute water consumption necessities.

How is North America leading in the Functional Beverages Market?

North America is leading the functional beverages market due to the high level of product innovation, health consciousness of the consumers, and their strong financial capacity. The regional emphasis on fitness, cognitive health, and energy enhancement is the main driver for the consumption of functional and fortified drinks. Digital marketing and online retail channels are widely used, and their impact on the market has been to improve accessibility and support growth that is sustained across various consumer demographics.

United States Functional Beverages Market Trends:

Innovation and product diversity are the two areas where the United States stands out in the functional beverages segment. The drink categories that address energy, digestion, and cognitive wellness have slowly but surely gained consumer acceptance. The beverage and health sectors are constantly collaborating, and the R&D investments are never-ending; they are all responsible for new product launches. The country's well-established digital ecosystem and the consumers' preference for convenient health-promoting drinks keep the U.S. in the front row of the global market.

The presence of key worldwide market players, combined with developing number of utilitarian RTD drink producers in nations, for example, US is supposed to additional guide the development of the practical refreshment market of Europe, North America and the Asia Pacific are projected to enroll huge development during the predictable years, attributable to expanding interest for useful drinks in nations like Germany, UK, Japan and China. Rising wellbeing awareness among Asian shoppers, combined with expanding per capita pay of buyers situated in arising economies of Pacific Region is supposed to contribute fundamentally in the development of useful drink market of Pacific region.

Asia-Pacific is quickly emerging as the fastest growing region of functional beverages as a result of heightened health consciousness, urbanization, and changing lifestyles. The demand for beverages catered to energy, immunity, and hydration has grown with greater velocity than seen up until the pandemic, especially with the younger demographics. The increase in following western wellness trends to in corporate wellness drinks in tandem with plant-based and probiotic beverages is also having an impact.

Additionally, Agencies such as India's FSSAI are regulating and pushing product labelling and standards, instrumental in driving innovation in the sector. Japan and India are key drivers for growth within Asia-Pacific, as Japan has a rapidly aging population looking for functional health benefits, while India has a expanding younger set of consumers who are looking for fitness drinks and increasing market penetration for energy drinks.

Europe is the second high growth region, buoyed by a significant movement toward healthier living and natural ingredients. Functional beverage offerings across the Region are becoming more visible as consumers are looking for health benefits around gut health, immunity, and energy alongside not synthetics/non-natural additives. The growing movement towards alcohol alternatives has allowed for this transformation to move even more speedily.

In the UK, drinks like kombucha, kefir, and adaptogenic tea have developed a real wave of popularity for Gen Z and millennials respectively. Germany is similarly significant, however Germany is also noteworthy for their larger, comprehensive response to galvanising consumers into organic and fortified foods. EU regulatory support for clean labels, trade of goods with standards, and sustainable packaging also strengthens regional demand.

How is Asia-Pacific performing in the Functional Beverages Market?

Asian and the Pacific are expected to be the fastest growing region in the functional beverages market, with the health-conscious population, the culture valuing natural ingredients, and the speed. Preventive health routines include the consumption of fortified, plant-based, and probiotic drinks by consumers. Government support for nutrition-focused products on the one hand and the combination of traditional herbs with modern formulations on the other are the factors that drive the innovation and expansion of the market.

India Functional Beverages Market Trends:

Health, fitness, and natural nutrition are becoming an increasing focus of India's functional beverages market, which is thus evolving. The trend of consumption is shifting toward drinks fortified with vitamins, probiotics, and plant-based ingredients. The emergence of lifestyle-related disorders and the demand for sugar-free, low-calorie sweets open the way for technological advancements. Young population and growing retail channels are the factors driving the scale of growth and demand for a variety of functional sectors.

What are the driving factors of the Functional Beverages Market in Europe?

The European market is still expanding, and the natural, low-sugar, and sustainable packages of functional beverages are the main reason for it. Consumer knowledge about gut health, immunity, and the environment is responsible for the direction of product development. Besides, strict regulations on labeling and health claims effectively increase the level of transparency and quality. The region's commitment to sustainable production and eco-friendly packaging has long won over the consumers' trust and the market.

Germany Functional Beverages Market Trends:

Germany has a major role in turning the European functional beverages market into a million-dollar one due to its preference for natural, organic, and premium products. The consumers stand for transparency, sustainability, and health claims supported by science. The market is characterized by having a well-established retail network and knowledgeable consumers. The continuing focus on sustainable packaging and clean-label ingredients is still making Germany a stronger contender in the regional market.

Europe Sips Success: Notable Growth Energizes the Functional Beverages Market

Europe has a very well-developed and mature functional beverage market, which has been facilitated by its well-established regulatory framework and consumer education. The three largest markets for functional beverages in Europe are Germany, the United Kingdom, and France. These consumers are looking for an alternative to alcohol, and they place a greater emphasis on the use of probiotics, vitamin enhancement, and the growing range of plant-based functional beverages available.

Latin America's Wellness Wave: Emerging Growth Boosts the Functional Beverages Market

The fast-growing functional beverages industry in Latin America is being driven by rising levels of urbanization and increasing numbers of health-conscious consumers. The increasing interest in fortified and specially formulated juices, energy drinks, and herb teas, especially from younger people with higher disposable incomes, means that Brazil, Mexico, and Chile are the largest markets for this kind of drink.

Value Chain Analysis

- Raw Material Procurement: Acquisition of top-notch ingredients from reliable suppliers to maintain the same quality, nutrition, and safety standards all the time.

Key Players: Cargill, Archer Daniels Midland (ADM), Olam International, Ingredion - Processing and Preservation: Using various techniques such as blending, pasteurization, and preservation to turn raw materials into a finished product that is very tasty, fresh, and stable.

Key players: PepsiCo, The Coca-Cola Company, Nestlé, Danone, Unilever, Monster Beverage Corporation - Quality Testing and Certification: Running a thorough series of safety and nutritional tests to make sure that regulatory standards and consumer quality demands are met.

Key Players: SGS, Intertek, Bureau Veritas, TÜV SÜD, Mérieux NutriSciences, ALS Global, ITC Labs - Packaging and Branding: Packaging that is beautiful, informative, and protective has to be created, and it should communicate the brand's personality and keep the beverage quality up.

Key Players: Ball Corporation, International Paper, WestRock, Smurfit Kappa Group, Crown Holdings - Cold Chain Logistics and Storage: The entire chain of supply has controlled storage and transportation of the right temperature to keep the products fresh and nutritious.

Key Players: DHL, FedEx, Lineage Logistics, Americold - Distribution to Retail: Distributing functional drinks to retailers, restaurants, and cafes in a way that their quality is kept intact while being very quick and easy.

Key Players: Coca-Cola Europacific Partners, PepsiCo, Keurig Dr Pepper - Retail Sales and Marketing: Making people aware of the drinks and increasing their loyalty to the brand by promoting them through ads, digital campaigns, and placements in stores.

Key Players: Walmart, Amazon, Target, Whole Foods Market, Kroger - Waste Management and Recycling of Functional Beverages: All recycling and waste management activities are carried out in such a manner that they not only contribute to environmental sustainability but also conserve packaging.

Key Players:Waste Management, Republic Services, Veolia, Suez - Ingredient sourcing & formulation: Ingredient sourcing is the process of obtaining functional ingredients; examples include vitamins, minerals, and botanicals. An organization's formulation will have a direct effect on how it functions. The organization must also have a product that contains all of the claimed health benefits.

- Manufacturing & quality assurance: All functional beverages must meet safety standards and be manufactured according to guidelines from the FDA and/or equivalent international regulatory agencies. The organization must also ensure that its functional beverage maintains consistency in quality.

- Distribution & retail channels: The distribution and retail channel stage of the functional beverage value chain determines how and where an organization's functional beverage will be sold.

Functional Beverages Market Companies

- PepsiCo Inc.

- The Coca-Cola Company

- Kraft Heinz Company

- Nestle S.A

- Red Bull GmbH

- The Hain Celestial Group

- Universal Nutrition

- Suntory Holdings Ltd

- Fonterra Co-operative Group Limited

Recent Developments

- In January 2025, Celsius Holdings, Inc. introduced CELSIUS HYDRATION™, a new line of electrolyte-based powder sticks to support hydration with zero sugar, B vitamins, essential electrolytes and the refreshing, fruit-forward flavors of CELSIUS energy drinks. CELSIUS HYDRATION is the company's first caffeine-free, functional beverage product introduced in the U.S.

(Source: https://www.businesswire.com) - In March 2025, PepsiCo, Inc. has announced its definitive agreement to acquire poppi, a leading prebiotic soda brand, for $1.95 billion. PepsiCo continues to diversify its beverage portfolio with functional, health-conscious options to meet evolving consumer demand. This strategic move underscores PepsiCo's ongoing efforts to cater to growing consumer preferences for functional and wellness-focused beverages.

(Source: https://www.designrush.com) - In Oct 2021, Barry Callebaut presented another better-for-you drink blend made of 100 percent cacao natural product that will be accessible for makers overall to use in various kinds of refreshments. This send-off is the furthest down the line item to emerge from Barry Callebaut's emphasis on utilizing the entire cacao organic product in items.

- JoeFroyo, a conspicuous apportioned refreshment maker, reported the presentation of its very first prepared to-drink (RTD) utilitarian espresso that consolidates protein, caffeine, and probiotics in August 2017. The item professes to be without gluten and absent any trace of soy, refined sugars, and Trans fats.

- Restore Kombucha reported the arrival of Revive Sparkling Kombucha in March 2019, a generally matured, natural, and rack stable craftsman drink. Restore's imaginative way to deal with clump blending and regular aging cycles is fortified with the presentation of this new product offering, which is basically practically identical to their crude and chilled packaged Kombucha.

- The Coca-Cola Company announced the debut of 'Aquarius,' a low-calorie collection of delicious and functional drinks, in April 2019. The product promises to include essential minerals and is available in two flavours: lime with magnesium and lemon with zinc.

Segments Covered in this Report

By Type

- Energy Drink

- Caffeinated Beverages

- Probiotic Drinks

- Vegetable and fruit beverages

- Dairy-based beverages

- Nutraceutical drinks

- Juices

- Enhanced Water

- Others

By Application

- Health and Wellness

- Weight Loss

By Ingredient Type

- Antioxidants

- Minerals

- Amino acids

- Probiotics

- Prebiotics

- Vitamins

- Super-Fruit extracts

- Botanical Flavors

By End User

- Athletes

- Fitness Lifestyle Users

- Others

By Distribution Channel

- Supermarket and Hypermarket

- Specialty Stores

- E Commerce

- Others

By Geography

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting