Functional Drinks Market Size and Forecast 2025 to 2034

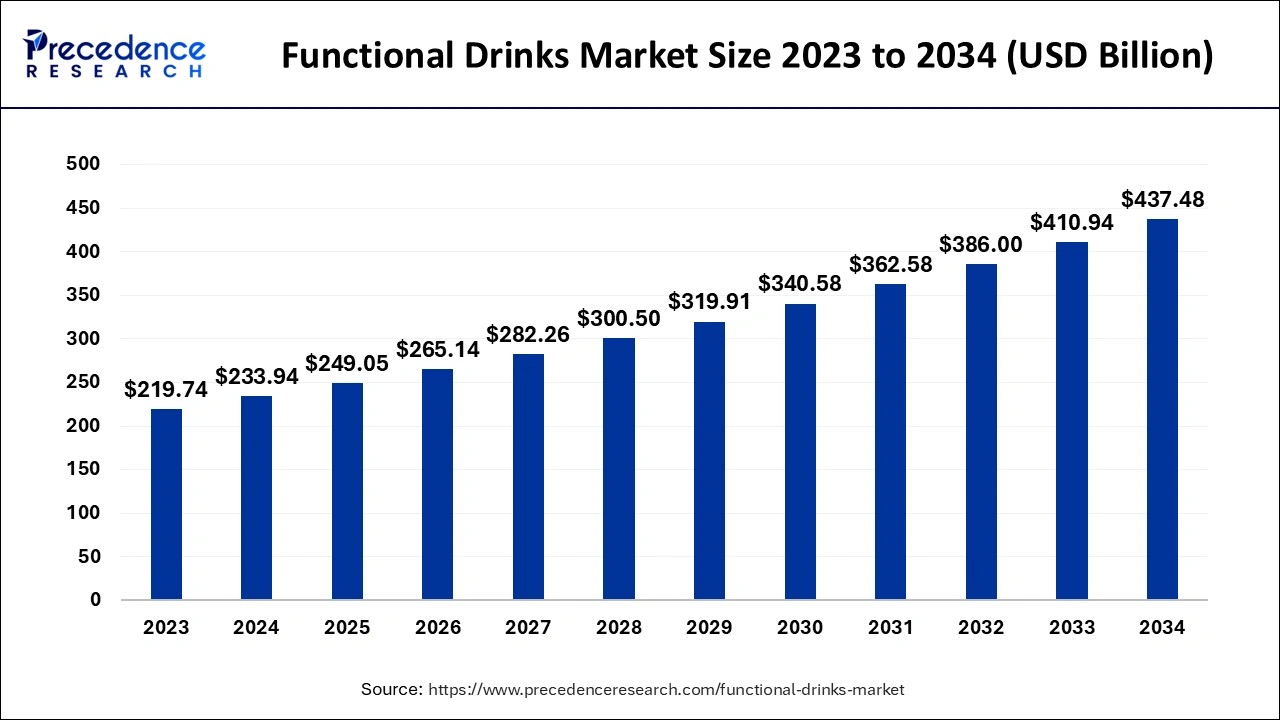

The global functional drinks market size was estimated at USD 233.94 billion in 2024 and is anticipated to reach around USD 437.48 billion by 2034, expanding at a CAGR of 6.46% between 2025 and 2034.

Functional Drinks Market Key Takeaways:

- In terms of revenue, the functional drinks market is valued at $249.05 billion in 2025.

- It is projected to reach $437.48 billion by 2034.

- The functional drinks market is expected to grow at a CAGR of 6.46% from 2025 to 2034.

- North American region is expected to expand at the biggest rate between 2025 and 2034.

- By type, the energy beverage segment is predicted to grow at the largest CAGR between 2025 and 2034.

- By type, the sports drink segment is expected to expand at a significant rate from 2025 to 2034.

- By distribution channels, the supermarket/hypermarket segment is expected to grow at the quickest CAGR from 2025 to 2034.

- By end-user, the fitness lifestyle user segment is expected to expand at the highest rate from 2025 to 2034.

Market Overview

Over the forecast period, rising health consciousness is expected to drive demand for functional drinks. Due to the presence of minerals, vitamins, amino acids, and herbs functional drinks help to improve a variety of body functions, including digestive health, heart rate management, immune system, as well as weight management. Customers are progressively turning to functional drinks that contain ingredients that involve these specific health concerns. As the journal Packaging Strategies reported, a significant shift in the beverage sector is towards functional beverages as customers are interested in enhancing their health.

Furthermore, the emergence of clean-label, organic, and non-GMO products influences consumer purchasing habits. And thus, customers demand functional drinks over carbonated beverages, and fruit juices are expected to fuel demand for functional drinks in the coming years.

Market Scope:

| Report Coverage | Details |

| Market Size in 2024 | USD 233.94 Billion |

| Market Size in 2025 | USD 249.05 Billion |

| Market Size by 2034 | USD 437.48 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 6.46% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Type, By Distribution Channels and By End-User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Growing interest in healthy hydration goods.

The growing consumer preference for health-oriented drinks has necessitated the inclusion of probiotic food on the list. Furthermore, sale-advertising tag lines like "ready to drink," as well as other convenience aspects include favorable packaging of all served beverages and increased consumption of probiotic drinks like kombucha. Consumers are increasingly preferring functional beverages rather than fruit juices as well as carbonated drinks.

Drinkers are commonly rejecting vilified categories, such as juices and carbonates, with 'healthier choices, such as probiotics, soymilk, and other functional beverages, as consumers become more aware of the health implications linked with soft drink groups. Consumer awareness has been a driving force behind the increased interest in nutritious hydration beverages. The increasing awareness of fermented beverages with organic ingredients, as well as the wide adoption of ingesting probiotics, has contributed to the popularity of the healthy hydration trend.

Rising awareness regarding health is expected to expand the need for functional drinks during the projected period. The functional drinks assist to enhance a variety of body functions such as heart rate management, management of the immune system as well as the digestive system, and weight management attributed to the existence of minerals, vitamins, amino acids, and herbs.

Restraints

Increase in weight.

The significant obstacles impeding the growth of the functional drinks market are rising obesity concerns. When it relates to well-being and health, weight management is a top priority for consumers. Customers demand foods and drinks with low calorie and sugar content to regulate weight. Fruit juices as well as energy drinks are the most common sources of artificial sweeteners in functional drinks.

A single can of energy beverage includes about 26.5 grams of added sugar on average, with large cans having double the amount. Energy drinks are also high in fats, artificial sweeteners, caffeine, and starch. As a result, numerous people avoid drinking functional beverages.

Opportunities

The functional beverages industry is anticipated to expand at a significant pace during the coming years due to increasing health concerns of customers as well as the launch of products that provide advantages rather than just hydration. Functional drinks offer a wide range of benefits like cognitive function, energy, immunity support, and gut health that attract health-concerned customers. The functional beverages market is ready for innovation, as firms seek to separate their foods and attract consumer demands.

Technological Advancement

Technological advancements in the functional drinks market feature automation, robotics, blockchain, and filtration techniques. Blockchain technology supports supply chain management, helping with the transparency and tracking of the data. This alerts fraudaulent. The filtration technique consists of methods such as reverse osmosis, microfiltration, and ultrafiltration. The methods are used to eliminate particles, contaminants, and microorganisms. The filtration gives clarity by filtering out sediment and particles, giving beverages a hazy and cloudy look. This interest satisfies consumers with its visual appeal. It also discards spoilage organisms. Few filtration methods can remove certain nutrients with the help of advanced techniques such as nano-filtration and ultrafiltration. The reverse osmosis filtration techniques use small pores that enable only water to pass through. It eliminates dissolved solids and viruses. These technologies attract and measure the health and safety of consumers.

Type Insights:

On the basis of type, the energy beverage sector is anticipated to grow at the highest CAGR from 2025 to 2034. The growth is due to a rise in energy, increasing attention and concentration, and decreased fatigue which expands industry growth. Energy beverages are majorly consumed by young customers between the age group of 18-34 years. They are also used as a mixer for cocktails and lower the side effects of alcohol, raise drinking capacity, and decrease dizziness. The aforementioned factors increase the necessity for energy drinks in the functional drinks market.

Based on the type, the sports drink sector is projected to grow at a remarkable pace from 2025 to 2034. The segment is growing due to the rising involvement of individuals in games as well as sports in developed nations. The sector is also anticipated to grow due to the increasing athlete community as well as an expanding number of sportspersons in emerging countries. The rising customer preference towards fitness along with the expanding number of health clubs and fitness centers.

Distribution Channel Insights

The supermarket/hypermarket sector is anticipated to grow at the fastest CAGR from 2025 to 2034. The expansion of the segment is due to the rising popularity owing to various factors like the availability of various functional drinks under the same roof with huge discounts. These factors are anticipated to generate numerous opportunities for the sector throughout the projected period.

The supply of functional drinks through e-commerce is estimated to expand rapidly over the projected period due to the existence of a wide range of specialty products at wellness stores as well as the growing popularity of online channels. Emerging nations such as India and China are witnessing an increasing number of online grocery shops in main cities to provide functional drinks as well as other grocery products.

End-User Insights:

The fitness lifestyle user sector is projected to grow at the highest rate in the global functional drink market with a CAGR from 2025 to 2034. The expansion of the segment is due to the emerging sector of health-conscious as well as fitness-concerned people. Furthermore, the growing trends of daily exercise and yoga, in addition to fitness lifestyle users, are a few of the significant aspects that boost the industry expansion of functional drinks. The abovementioned factor assists in the production of profitable revenue for the market throughout the projected period.

Followed by the fitness lifestyle user, the athlete segment is anticipated to expand at the fastest rate from 2025 to 2034. Functional drinks enhance athletic performance as well as assist or prevent specific health conditions. As a result, professional athletes are subjected to higher and more challenging workouts, depending on a variety of variables like the type of physical training, the number and period of sessions, the environment setting, and so on. To maximize endurance performance, athletes must drink before they get thirsty; in fact, being hydrated prior to exercise is essential.

Regional Insights

Due to the rising demand for functional beverages, the North American region is anticipated to expand at the highest pace from 2025 to 2034. Nonetheless, it is growing at a high rate, raising awareness of health, active lifestyle, as well as working environment among customers of all ages. The rising popularity of energy beverages in North America has boosted availability via improved distribution channels and increasing accessibility, and this has increased the region's potential for growth.

- In March 2025, PepsiCo announced that it is acquiring prebiotic soda brand Poppi for USD 1.95 billion, marking a major move into the functional beverage market. The deal includes USD 300 million in tax benefits, bringing the net cost to USD 1.65 billion. Poppi, launched in 2018 by Allison and Stephen Ellsworth, has gained traction among health-conscious consumers, competing with Olipop.

Furthermore, Asia is the most rapidly developing region due to rising consumer demand for beverages in nations such as Japan, China, and India which drives functional drinks growth. The high prevalence of heart disease, arthritis, and osteoporosis, combined with rising sales for beverages as well as rapid urbanization among Asian customers, is the key cause of market growth for functional beverages.

Asia Pacific is dominating the functional drinks market. Within the region, China, Japan, and South Korea are contributing the largest amount of share to the market. The increased urbanization and demand for functional drinks are boosting the market sales. The health-conscious population approaches functional drinks such as probiotic drinks and energy drinks.

Moreover, due to the rising incidence of diabetes in nations like China and India, people are becoming conscious of the importance of an active lifestyle and healthy diet, prompting them to prefer organic sweeteners like stevia beverages. As reported by the International Diabetes Federation, India is 1 of the seven countries that comprise the Southeast Asia area in 2022. Diabetes affects 90 million individuals in Southeast Asia; by 2045, this figure is expected to rise to 151.5 million.

As a result, companies such as Coca-Cola and PepsiCo Inc. are pledging to eliminate synthetic ingredients and reduce the amount of sugar in products.

Market Concentration & Characteristics

The market is characterized by a surge in growth potential propelled by growing consumer demand for health-oriented products, especially in the Asia Pacific region. Furthermore, market concentration is considered low, with many players and product variations, especially in the sports drink, energy drink, and nutraceutical beverage categories. Many small players and brands provide a wide range of products.

Functional Drinks Market Companies:

- Monster Beverage Corporation

- The Coca-Cola Company

- Red Bull

- Coif Bar

- MaxiNutrition

- Meiji Co., Ltd

- Dupont Nutrition Biosciences ApS

- Pepsico, Inc.

- Nestlé S.A.

- National Beverage Corp.

Recent Developments

- In May 2025, Tata Consumers announced plans to expand its food and beverage business with new product launches and acquisitions. With a focus on functional drinks, premium foods, and selective market entry, the FMCG firm targets urban growth and evolving consumer needs to drive future revenue.

- In January 2025, Reliance Consumer Products Ltd (RCPL), a subsidiary of Reliance Industries, launched a new rehydration beverage, RasKik Gluco Energy, priced at an affordable Rs 10 for a single-serve drink. The beverage combines electrolytes, glucose, and real lemon juice, offering a refreshing solution for consumers seeking both hydration and energy.

- In March 2025, Entertainment icon Snoop Dogg invested in a partnership with Harmony Craft Beverages to release a range of cannabis and functional drinks named Iconic Tonics. As wellness and mindful drinking trends accelerate, the musical artist's move to release Iconic Tonics is well-timed for the sector.

- In September 2024, Adapt, a new functional beverage start-up founded by neuroscientist Michael Vicary, launched a line of drinks aimed at improving mental performance and promoting relaxation. This launch reflects a broader trend in the F&B industry towards health-oriented products as consumers increasingly seek alternatives to traditional caffeine and alcohol for stress management.

- In March 2025, PepsiCo acquired Poppi for USD 1.95 billion to expand into the fast-growing prebiotic soda and functional beverage market. The deal includes USD 300 million in anticipated tax benefits.

- In April 2025, Prime Drink Group moved to a ‘functional' drinks brand, relax downlow. The Canadian beverage holding company plans to execute the acquisition through a combination of share issuance and a cash payment.

- In April 2025, Muush launched a new line of lightly sparkling to-go cans, making it easier than ever to drink flavor-packed refreshment wherever you are. The drink is available in two new flavors: raspberry and lychee, and bloody orange and ginger.

- In August 2022, Coca-Cola India launched Limca Sportz as an innovative beverage in its n-fizz group. Limca Sportz aids in the rehydration of athletes, exercisers, as well as those engaged in high-intensity workouts.

- Koios introduced six new Fit Soda functional drink flavors in May 2022. Strawberry Snow Cones, Cherry Slushee, Mimosa, Sweet Tea Lemonade, Blueberry Lemonade, and Pumpkin Spice are available.

- National Beverage Corp. introduce Cherry Blossom Sparkling Water in March 2022.

- Nestlé S.A. purchased Essentia Water, LLC, in March 2021. Nestlé S.A. hopes to enhance its existence in the functional water segment and gain a market leader through this acquisition.

- In January 2020,a Coca-Cola sports drink brand introduced two sugar-free drinks, Powerade Power water, and Powerade Ultra.

- Barry Callebaut revealed an innovative better-for-you drink mix made from 100 inches of fruit in October 2021.

Segments Covered in the Report:

By Type

- Energy Drinks

- Dairy-based Beverages

- Sports Drinks

- Juices

- Others

By Distribution Channels

- Specialty Stores

- Supermarket/ Hypermarket

- E-Commerce

- Others

By End-User

- Fitness Lifestyle Users

- Athletes

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content