What is the Pet Food Extrusion Market Size?

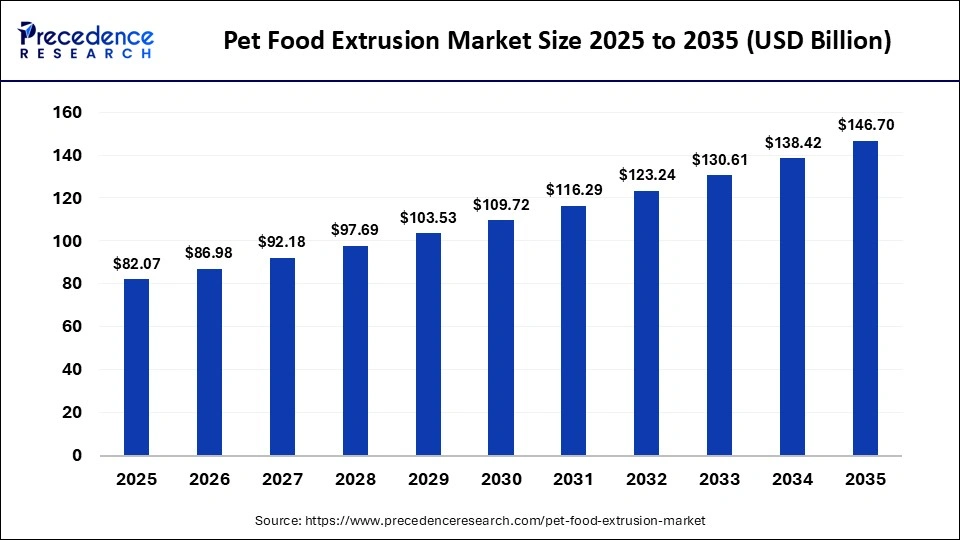

The global pet food extrusion market size accounted for USD 82.07 billion in 2025 and is predicted to increase from USD 86.98 billion in 2026 to approximately USD 146.70 billion by 2035, expanding at a CAGR of 5.98% from 2026 to 2035. The market is driven by the growing awareness of animal health and the rising trend of treating pets as family members.

Market Highlights

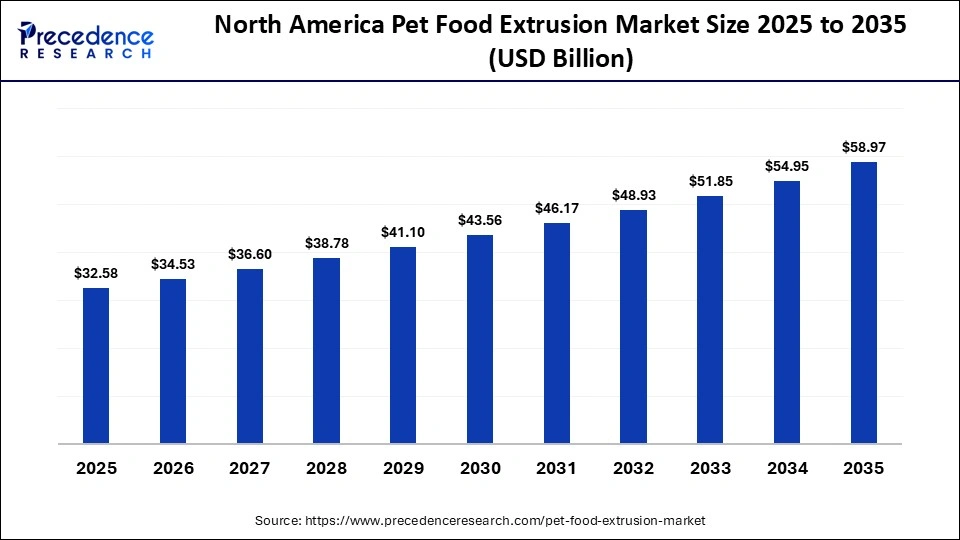

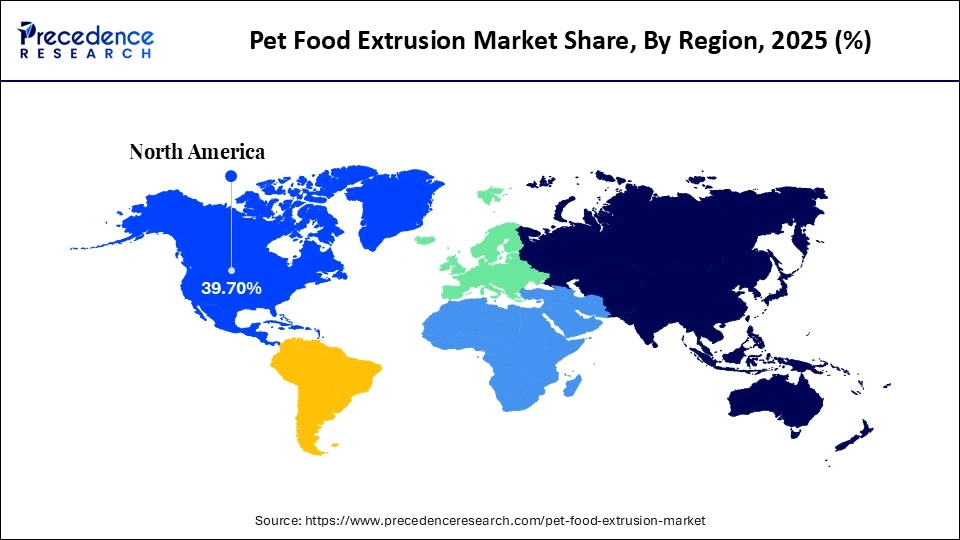

- By region, North America led the pet food extrusion market with approximately 39.7% share in 2025.

- By region, Asia Pacific is observed to be the fastest-growing region in the market.

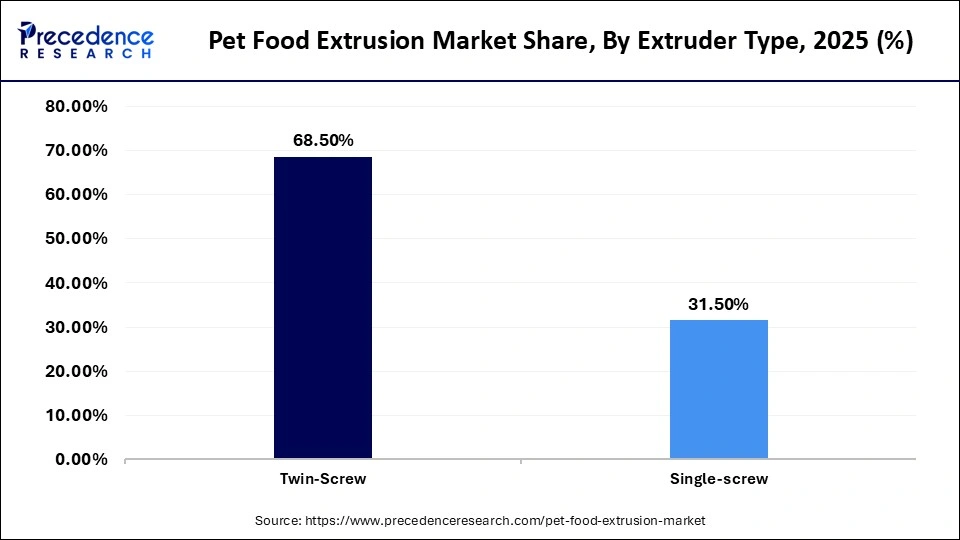

- By extruder type, the twin-screw extruder segment led the market with around 68.5% share in 2025.

- By extruder type, the single-screw extruder segment is observed to grow at a notable rate in the coming years.

- By animal type, the dog segment dominated the global market with 49.2% share in 2025.

- By animal type, the cat segment is observed to be the fastest-growing segment with about 6.1% CAGR in 2025.

- By product type, the dry pet food (kibble) segment dominated the market with approximately 62.3% share in 2025.

- By product type, the treats & snacks segment is expected to grow at a 6.5% CAGR in the foreseeable period.

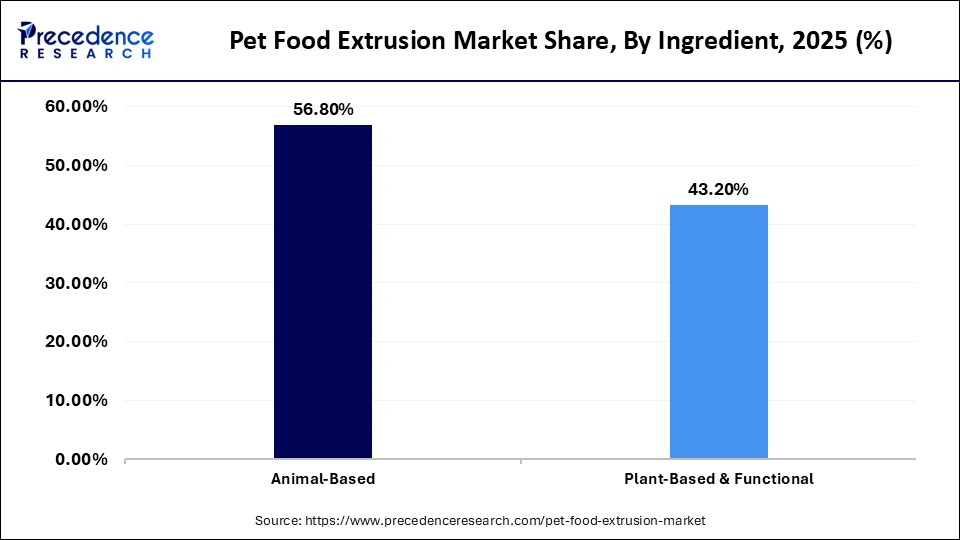

- By ingredient, the animal-based segment dominated the market with a 56.8% share in 2025.

- By technology, the plant-based & functional segment is observed to grow at the fastest rate in the upcoming period.

What is Pet Food Extrusion?

Pet food extrusion is a method used to improve the digestibility and quality of pet food by balancing nutrition, palatability, and safety. Extrusion is the manufacturing process in the pet food industry. It is the gold standard for creating shelf-stable, nutrient-dense kibble through a combination of high temperature, pressure, and mechanical shear. Moreover, this method delivers a wide variety of shapes, fair proportion, higher fat content, and longer service life. The market is growing due to rising pet ownership, increasing consumer demand for high-quality, nutritious, and specialized pet foods, and the popularity of premium, functional, and grain-free diets.

Impact of Artificial Intelligence on the Pet Food Extrusion Market

The implementation of Artificial Intelligence (AI) in pet food extrusion has shown noteworthy developments, including personalized diets based on pet data like health, breed, and age. Additionally, AI helps to estimate the nutritional value of diverse ingredients. Advanced thermal control systems leverage artificial intelligence to monitor production conditions in real time and automatically control heating and cooling. Artificial intelligence and computerized data collection help keep extruders running efficiently. It minimizes downtime and production disruptions, amplifies production efficiency, and reduces leftovers.

Pet Food Extrusion Market Trends

- Manufacturers are incorporating functional ingredients, such as probiotics, prebiotics, and superfoods.

- Technological innovations like automation, digitalization, and data analytics are revolutionizing operations in pet food manufacturing.

- Growing demand for tailored pet food products, such as breed-specific, age-based, and health-oriented diets, is pushing manufacturers to adopt advanced extrusion technologies capable of handling diverse formulations.

- There is a rising preference for clean label, natural, and high-quality ingredients, driving investments in extrusion systems that preserve nutrient integrity and sensory qualities.

- There is growing demand for extrusion equipment that supports small batch production, rapid changeovers, and multi product capabilities to meet diverse market needs and reduce time to market.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 82.07 Billion |

| Market Size in 2026 | USD 86.98 Billion |

| Market Size by 2035 | USD 146.70 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 5.98% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Extruder Type, Product Type, Animal Type, Ingredient, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Extruder Type Insights

Why Did the Twin-Screw Segment Dominate the Market in 2025?

The twin-screw segment dominated the pet food extrusion market, holding approximately 68.5% share in 2025, and is expected to continue its growth trajectory during the projection period. This is because of the twin-screw extruders' long service life, versatility, and ability to handle complex, protein- and fat-rich formulations. Twin-screw extruders require more water flow for most formulations and operate under lower pressure. Most pet formulas are more complex in nature as they primarily include meat, fat, and protein-rich bases, which increases the preference for twin-screw extruders. They generate less heat due to reduced friction and provide better mixing and temperature control. Their higher shear rate further supports efficient processing, which boosts their adoption.

The single-screw segment is expected to grow at a notable rate in the coming years due to its lower cost and suitability for small-scale production. Single-screw extruders operate at higher shaft speeds and are suitable for extrusion processing of simpler ingredient formulations. Although they offer lower shear control compared to the twin-screw system, they are widely used for simpler pet food formulas such as fish-based and vegetarian diets, as well as feed relying on less complex nutritional composition. Growing adoption among cost-sensitive manufacturers is driving the rapid growth of this segment.

Product Type Insights

Why Did the Dry Pet Food (Kibble) Segment Lead the Pet Food Extrusion Market?

The dry pet food (kibble) segment dominated the market by holding approximately 62.3% share in 2025. This is because of its cost-effectiveness and longer shelf life. Companies are enhancing dry kibble with probiotic coating to deliver functional benefits while keeping products within mainstream price ranges. Advancements in packaging, such as resealable pouches, help maintain freshness and encourage bulk purchasing, further supporting the growth of the segment.

The treat & snacks segment is expected to grow at the fastest CAGR of about 6.5% in the upcoming period, driven by the increasing trend of pet humanization. Pets are increasingly treated as family members, particularly among young consumers, who are more focused on their pets' health, happiness, and overall well-being. This shift is driving higher demand for premium and healthier treat and snack products, thereby contributing to the steady growth of the segment and creating opportunities for product innovation.

Animal Type Insights

What Made Dog the Dominant Segment in the Pet Food Extrusion Market?

The dog segment dominated the market by holding around 49.2% share in 2025. The dominance of the segment in the market is driven by increasing dog adoption for companionship and loyalty, along with rising urbanization, higher disposable income, and growing awareness about animal health and nutrition. As a result, pet owners are more inclined to spend on quality dog food, strengthening the segment's leading position.

The cat segment is expected to grow at the fastest CAGR of about 6.1% during the forecast period, driven by the rising cat ownership. Cat adoption is increasingly common, especially in urban households, as cats require less maintenance than dogs and do not need regular walking or outdoor litter routines. Moreover, growing demand for premium, healthy, and personalized nutrition for cats is creating strong growth opportunities and driving the segment.

Ingredient Insights

Why Did the Animal-Based Segment Dominate the Market?

The animal-based segment dominated the pet food extrusion market with around 56.8% share in 2025 because pet foods rich in meat, fish, and other animal proteins are highly preferred for their superior nutritional value and palatability. Animal-based ingredients provide essential amino acids and support growth, immunity, and overall health, making them a key choice for both dog and cat diets. The complexity of processing these protein-rich formulations also drives the adoption of advanced extrusion technologies, reinforcing the segment's market leadership.

The plant-based & functional segment is expected to grow at the fastest rate in the coming years due to rising consumer demand for healthier, sustainable, and specialty pet diets. Ingredients like grains, legumes, fibers, and added functional nutrients (probiotics, vitamins, and antioxidants) are increasingly used to support digestion, immunity, and overall wellness. Additionally, environmental awareness and the popularity of alternative protein sources are driving the adoption of plant-based and functional extruded pet foods.

Regional Insights

How Big is the North America Pet Food Extrusion Market Size?

The North America pet food extrusion market size is estimated at USD 32.58 billion in 2025 and is projected to reach approximately USD 58.97 billion by 2035, with a 6.11% CAGR from 2026 to 2035.

Why Did North America Dominate the Pet Food Extrusion Market?

North America dominated the market by capturing approximately 39.7% in 2025, primarily due to high companion animal ownership, well-established retail infrastructure, and a shift toward premium and ultra-premium grain-free diets. The region is also at the forefront of integrating advanced digital technologies within supply chains, which enhances operational resilience and efficiency. The adoption of innovative technologies, such as artificial intelligence, enables manufacturers to optimize production, switch rapidly between formulations, and enhance supply chain efficiency. Investments in energy-efficient machinery, waste reduction, and sustainable ingredient sourcing further strengthen the region's leadership in the global market.

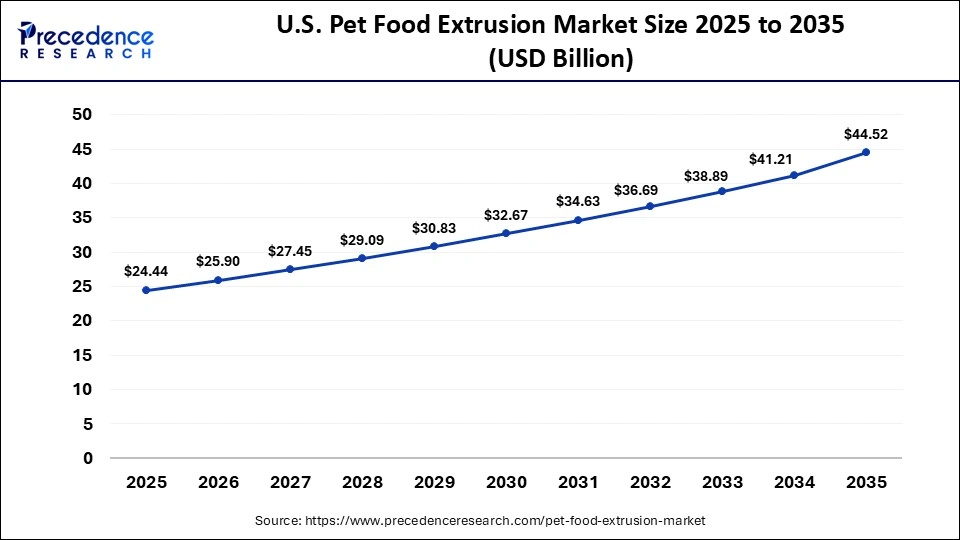

What is the Size of the U.S.Pet Food Extrusion Market?

The U.S. pet food extrusion market size is calculated at USD 24.44 billion in 2025 and is expected to reach nearly USD 44.52 billion in 2035, accelerating at a strong CAGR of 6.18% between 2026 and 2035.

U.S. Pet Food Extrusion Market Analysis

The U.S. is the major contributor to the North American market, owing to rising pet ownership and increasing consumer demand for high-quality, nutritious, and convenient pet food products. Manufacturers across the country are expanding their use of extrusion technology to produce a wide range of formats and functional formulations that meet the demand for grain-free, natural, and tailored dietary foods. Additionally, advancements in extrusion equipment and processing efficiency are enabling producers to improve product consistency while reducing costs, further driving market expansion.

What Makes Asia Pacific the Fastest-Growing Region in the Pet Food Extrusion Market?

Asia Pacific is expected to grow at the fastest rate in the market. This is mainly due to the increasing urbanization, nuclear families, and the pet adoption rate. This shift resulted in greater demand for innovative pet food. The growth of pet-focused retail outlets in urban areas has further amplified the need for efficient, high-capacity extrusion machines to meet volume demands. Moreover, technological advancement for a more resilient and flexible supply chain allows regional manufacturers to quickly adapt to market fluctuation and consumer demands.

Pet Food Extrusion Market Value Chain Analysis

- Raw Material Procurement

The raw material sourcing involves extrusion, drying, and coating, with a premium, high-protein formulation and advanced machinery.

Key Player: Bühler Group, Andritz Group, Clextral (Groupe Legris Industries)

- Processing and Preservation

Processing involves ingredient mixing, conditioning with high-temperature, short-time (HTST) extrusion.

Key Player: Bühler Group, Andritz Group, Clextral SAS, Wenger Manufacturing, and Baker Perkins

- Quality Testing and Certification

It includes ensuring the safety, nutritional adequacy, and regulatory compliance of kibble, treats, and semi-moist foods

Key Player: Eurofins Scientific, SGS, Intertek Group PLC

- Packaging and Branding

Packaging is done by high-barrier pouches, stand-up bags, and folding cartons that prevent oxygen/moisture ingress, ensuring freshness for extruded kibble.

Key Player: Mars Petcare Inc., Hill's Pet Nutrition (Colgate-Palmolive)

- Cold Chain Logistics and Storage

Col chain logistics is experiencing a transformation, driven by the shift from traditional dry kibble to premium, raw, and fresh pet foods

Key Player: Lineage, Inc., Americold Logistics LLC

- Distribution to Retail

It reveals a high-volume, logistics-intensive process focused on extending shelf life and ensuring consistent product quality from factory to store shelf.

Key Player: Mars Incorporated, Nestlé Purina PetCare

Who are the Major Players in the Global Pet Food Extrusion Market?

The major players in the pet food extrusion market include Major Food Brands, Mars Petcare (USA), Nestle Purina PetCare (Switzerland), Hill's Pet Nutrition (Colgate-Palmolive) (USA), The J.M. Smucker Company (USA), General Mills (Blue Buffalo) (USA), Diamond Pet Foods (USA), Charoen Pokphand Foods PCL (Thailand), Buhler Group (Switzerland), Andritz Group (Austria), Clextral (Groupe Legris Industries) (France), Coperion (Hillenbrand) (Germany/USA), Baker Perkins (UK), Wenger Manufacturing (acquired by Bühler) (USA), Geelen Counterflow (Netherlands), and Kemin Industries (USA).

Recent Developments

- In 2025, Extrusion processing technology suppliers Wenger and Extru-Tech launched their new advanced extrusion process optimization software: EXPRO AI. The software uses artificial intelligence (AI) to help transform extrusion operations by predicting outcomes, optimizing setpoints, and enhancing product quality and operational efficiency.(Source: https://www.petfoodindustry.com)

- In 2025, ExMax S1021, the latest extrusion innovation, is launched by ANDRITZ at the VICTAM LATAM event in Brazil. It will help producers create safer, more sustainable pet food and aqua feed by helping producers achieve consistently high-quality nutrition, improved food safety, and greater efficiency, while reducing operating costs and unplanned downtime.(Source: https://www.andritz.com)

Segment Covered in the Report

By Extruder Type

- Twin-Screw

- Single-screw

By Product Type

- Dry Pet Food (Kibble)

- Treat & Snacks

- Semi-moist & Other

By Animal Type

- Dog

- Cat

- Other (Fish, Birds)

By Ingredient

- Animal-Based

- Plant-Based & Functional

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting