Fertility Supplements Market Size and Forecast 2025 to 2034

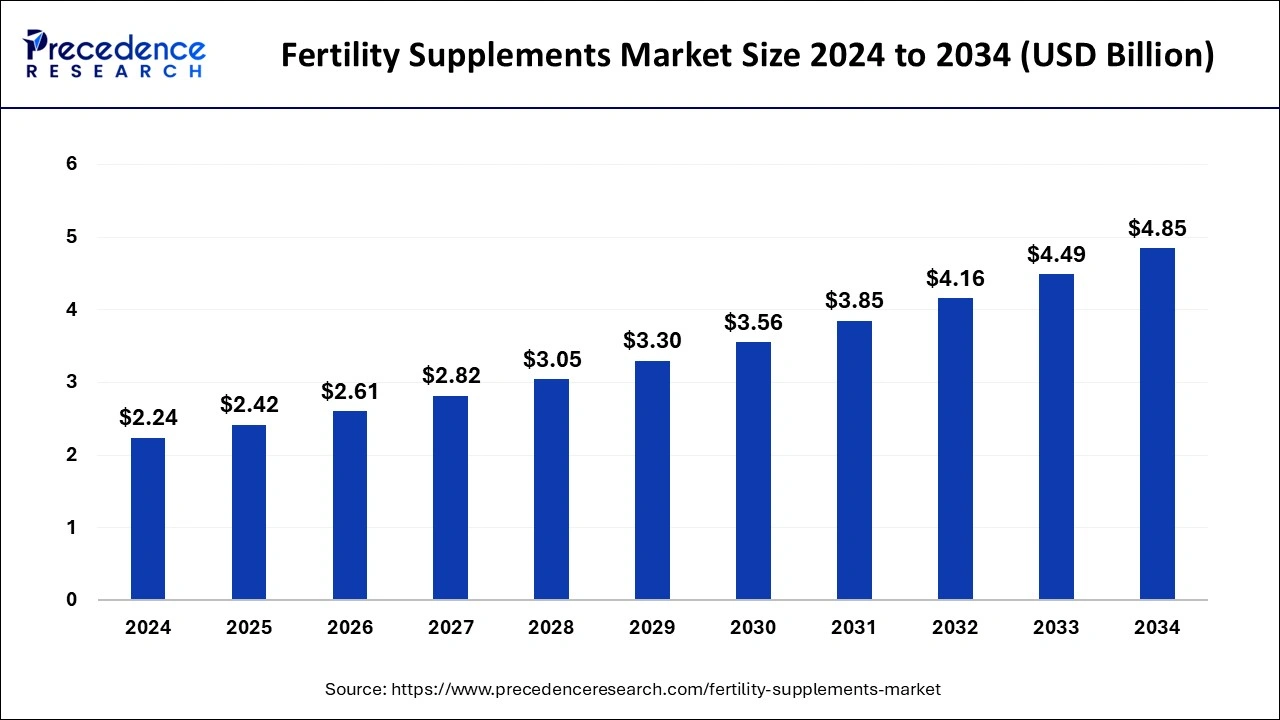

The global fertility supplements market size accounted for USD 2.24 billion in 2024 and is expected to exceed around USD 4.85 billion by 2034, growing at a CAGR of 8.04% from 2025 to 2034. The growing trend of women delaying pregnancies is the key factor driving the fertility supplements market growth. Also, increasing healthcare costs coupled with advancements in the medical industry can fuel market growth soon.

Fertility Supplements Market Key Takeaways

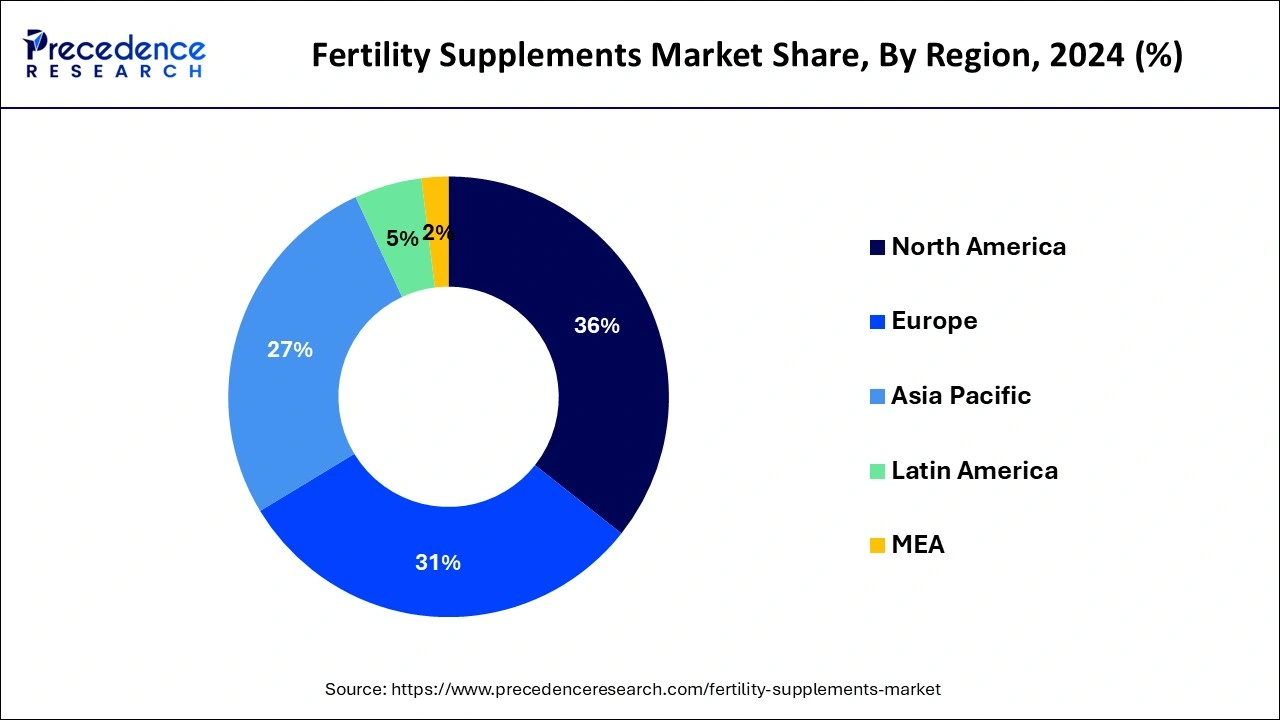

- North America dominated the fertility supplements market and contributed the largest market share of 36% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR of 11.13% over the studied period.

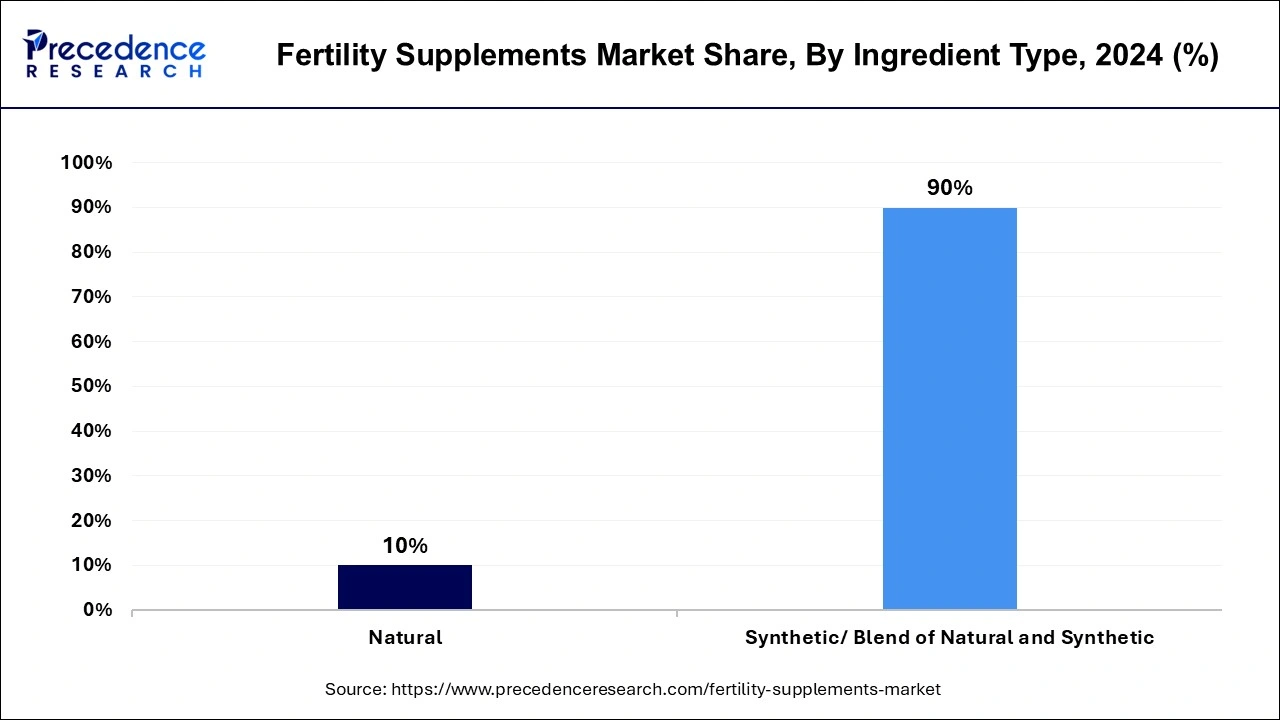

- By ingredient type, the synthetic/ blend of natural and synthetic segment has held the biggest market share of 90% in 2024.

- By ingredient type, the natural segment is expected to grow at the fastest rate over the forecast period.

- By product, the capsule segment generated the highest market share of 41% in 2024.

- By product, the liquid segment is anticipated to grow at the fastest rate over the forecast period.

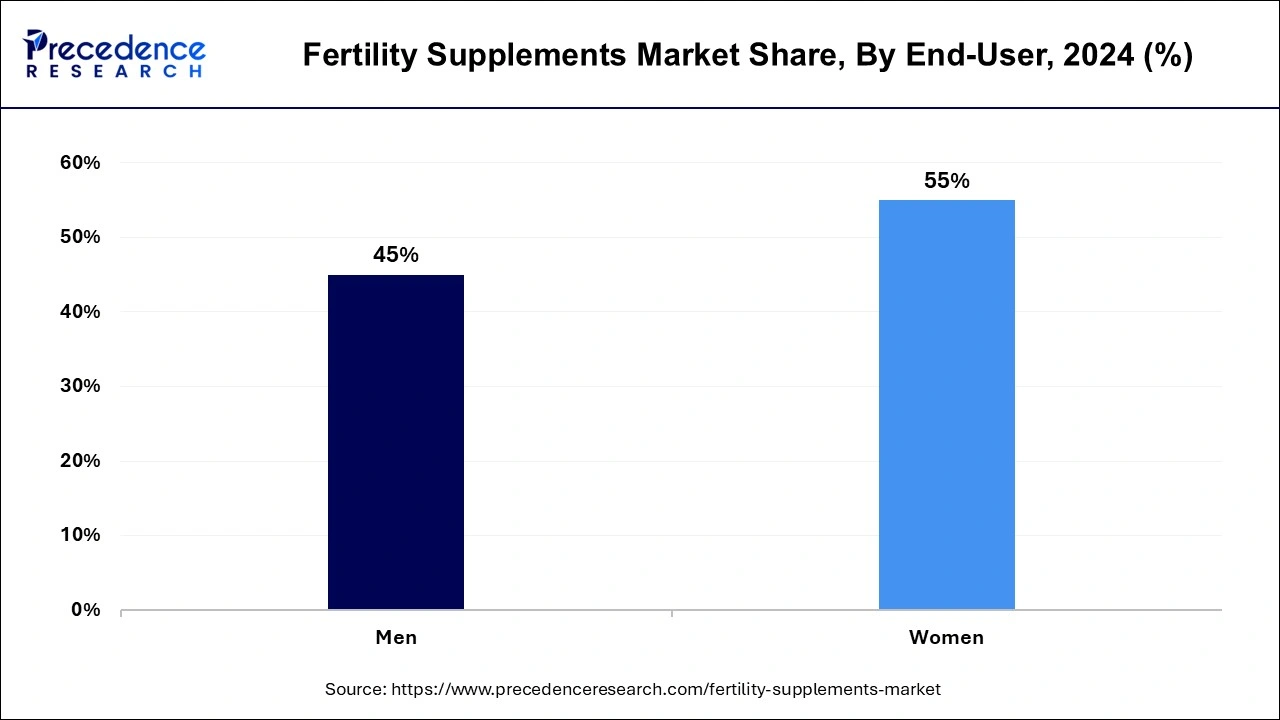

- By end-user, the women segment recorded a major market share of 55% in 2024.

- By end-user, the men's segment is expected to grow at the fastest during the projected period.

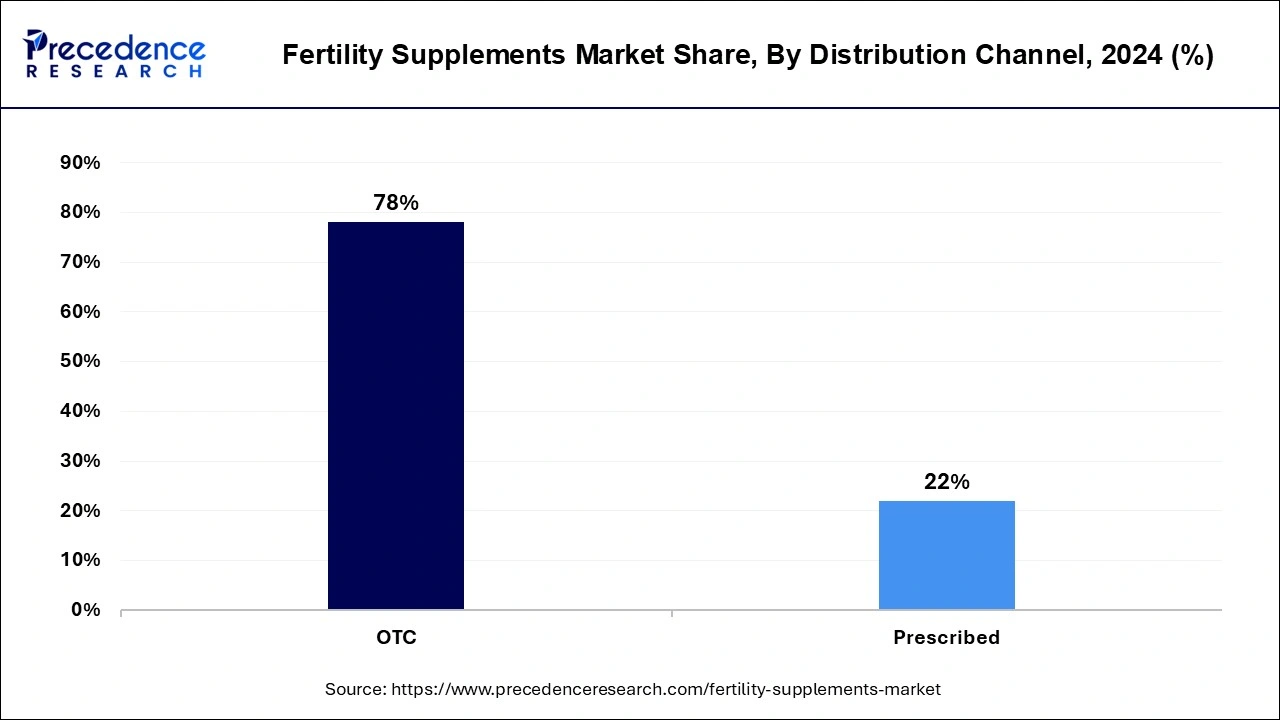

- By distribution channel, the OTC segment accounted for the highest market share of 78% in 2024.

- By distribution channel, the prescribed segment is projected to show the fastest growth during the forecast period.

Role of Artificial Intelligence (AI) in IVF Laboratories

In the fertility supplements market, Artificial Intelligence tools like deep learning and machine learning improve quality control, enhance precision, and increase efficiency in processes such as sperm and embryo selection. It also decreases variability and human error, hence supporting greater success rates for in-vitro fertilization treatments. Furthermore, AI has the ability to transform IVF by streamlining the outcomes, but it requires keen management to ensure moral standards that can fulfill patients' trust.

- In October 2024, Alife Health (Alife) announced a groundbreaking partnership with Inception Fertility™ (Inception), the largest provider of comprehensive fertility services across North America, to expand access to AI technology for in vitro fertilization (IVF).

U.S. Fertility Supplements Market Size and Growth 2025 to 2034

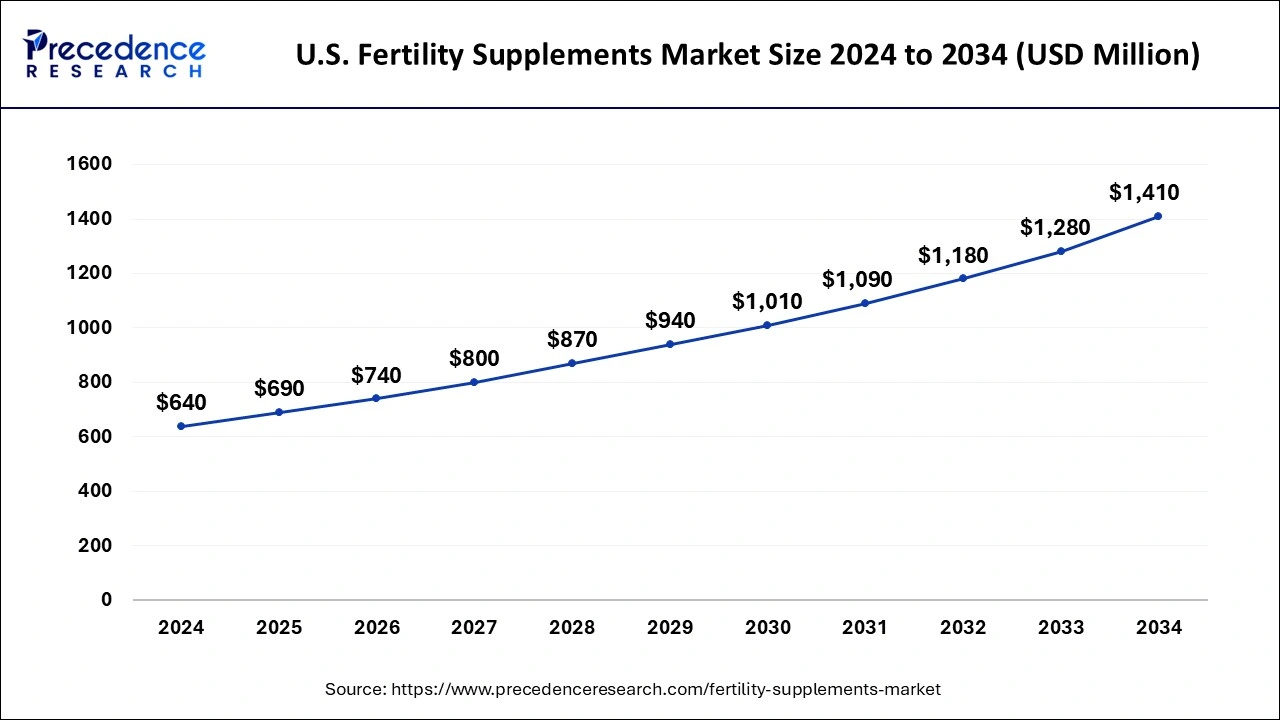

The U.S. fertility supplements market size was evaluated at USD 640 million in 2024 and is projected to be worth around USD 1,410 Million by 2034, growing at a CAGR of 8.21% from 2025 to 2034.

North America dominated the fertility supplements market in 2024. The dominance of the region can be attributed to the increasing infertility rate along with the growing public awareness regarding health in general. However, in North America, the U.S. led the market owing to the rising demand for organic and natural products, with the presence of a strong regulatory environment that promotes a healthy lifestyle.

Asia Pacific is expected to show the fastest growth in the fertility supplements market over the studied period. The growth of the region can be linked to the enhanced availability and accessibility of healthcare facilities coupled with the growing investments in research and healthcare infrastructure. Furthermore, governments in developing countries are taking various initiatives to increase awareness about infertility.

- In April 2023, Indian pharma company Mankind Pharma set up a dedicated factory in Udaipur, Rajasthan, for the comprehensive manufacturing of Duphaston (dydrogesterone), a synthetic hormone widely utilized for preventing miscarriage and treating infertility.

Market Overview

Fertility supplements help to enhance hormonal profiles and increase delivery and pregnancy rates for women and men. Male infertility is mainly associated with the decreased motility of sperm and low sperm count, which can occur due to hormonal imbalance. Growing infertility has occurred because of factors like a rise in the consumption of drugs and alcohol, frequent smoking, increased stress levels, and environmental factors. Many individuals are emphasizing enhancing sexual well-being.

Top five countries by total fertility rate 2024

| Country | Total fertility rate in 2024 (births/woman) |

| Niger | 6.6 |

| Chad | 6 |

| DR Congo | 6 |

| Somalia | 6 |

| Central African Republic | 5.7 |

Fertility Supplements Market Growth Factors

- The surge in fertility rates due to the rising consumption of alcoholic beverages is expected to fuel market growth soon.

- Growth in the number of fertility clinics can propel market growth shortly.

- The ongoing fertility rate decline among women will likely contribute to the fertility supplements market expansion over the forecast period.

Market Scope

| Report Coverage | Details |

| Market Size by 2024 | USD 2.24 Billion |

| Market Size in 2025 | USD 2.42 Billion |

| Market Size in 2034 | USD 4.85 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.04% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Ingredient, Product, End-User, Distribution Channel, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. |

Market Dynamics

Drivers

Increasing demand for natural fertility treatments

Many individuals who are trying for a baby are considering natural alternatives over traditional medical treatments like IVF. The fertility supplements market can be seen as a more secure way to increase the chances of conception naturally. In addition, fertility supplements are considered an essential segment of preconception care, because they offer the body with necessary nutrients that are required for good fertility.

- In October 2024, Premom announced the launch of its latest innovation: a premium, female doctor-formulated supplement line. Developed to meet the specific needs of women who are trying to conceive, pregnant, or postpartum, this new line underscores ongoing commitment to offering the highest quality products that support women's health at every stage.

Restraint

Low success rates

Effectivity concerns are a key constraint for the fertility supplements market. Patients may be in a state of dissonance regarding the efficiency of these products because of fluctuating results and less evidence supporting their effectiveness. Moreover, fertility supplements confront significant regulatory hurdles due to changing requirements and standards across different regions.

Opportunity

E-commerce development

Availability of online in recent years, fertility supplements have earned substantial attention in the men's and women's health markets because of their part in supporting reproductive health. Fertility supplements emphasize improving the functionality of the uterus, fallopian tubes, and ovaries in the female reproductive system. Furthermore, players in the fertility supplements market are strengthening their online presence to make this product accessible to all customers.

- In April 2024, Perelel built upon its bestselling Conception Support Pack with the launch of Fertility+ Support, an antioxidant boost for those in the early stages of their fertility journey. The new product was launched on the brand's e-commerce site.

Ingredient Type Insights

The synthetic/ blend of natural and synthetic segments dominated the fertility supplements market in 2024. The dominance of the segment can be attributed to the increasing demand for these supplements by consumers as they provide benefits of both natural and synthetic nutrients. These supplements possess a blend of natural ingredients and vitamins to assist in strengthening fertility. Additionally, vitamin C, vitamin B6, Selenium, zinc, and Myo-Inositol are the primary synthetic ingredients that are easily accessible.

The natural segment is expected to grow at the fastest rate in the fertility supplements market over the forecast period. The growth of the segment can be linked to the ongoing technological advancements and launches of innovative products in the wellness and health industry. Also, these supplements have minimum side effects because they are direct extracts of plant-based products.

Product Type Insights

The capsule segment led the global fertility supplements market in 2024. The dominance of the segment can be credited to the increasing importance of microencapsulation in the fitness industry to monitor the color properties and ensure the fixed release of products. However, the high cost that comes with the packaging method is preventing market players from utilizing capsule formulation during the projected period.

The liquid segment is anticipated to grow at the fastest rate in the fertility supplements market over the forecast period. The growth of the segment can be driven by the increasing use of this product-type supplement in the form of smoothies or water. These supplements have a shorter shelf life than other types and also need to be refrigerated. In addition, for patients suffering from oesophageal challenges or pill ingestion, liquid supplements can be the best choice.

In September 2024, Ritual will launch the Fertility Support drink mix in a new window. The company said, "When Katerina Schneider was pregnant for the first time, she could not find a prenatal vitamin that checked all the boxes: clean, science-backed and vegan-certified.

End-user Insights

In 2024, the women's segment dominated the global fertility supplements market. The dominance of the segment is due to the increasing infertility in women due to various external factors such as obesity, excessive drinking and smoking, etc. Hence, women who are looking to have a child can use these supplements to enhance egg quality and menstrual cycle, improving overall reproductive health.

- In April 2024, Fertility Family, a leading provider of fertility supplements in the UK, announced the launch of their new product, Inofolic AlphaPlus.This innovative new supplement is designed specifically to address the unique challenges faced by women with PCOS who have a Body Mass Index of over 25.

The men's segment is expected to grow at the fastest rate in the fertility supplements market during the projected period. The growth of the segment is due to the low or no sperm counts in males along with the abnormal motility and sperm shape. Moreover, the unhealthy lifestyle among much of the male population is increasing the risk associated with reproductive health.

Distribution Channel Insights

The OTC segment accounted for the majority of the fertility supplements market share in 2024. The segment's dominance can be attributed to increasing consumer awareness about the health benefits and nutritional value of these products. Also, sales of these supplements are expected to experience steady growth in developing countries such as India and China.

The prescribed segment is projected to show the fastest growth in the fertility supplements market during the forecast period. The growth of the segment can be driven by limited awareness among most people regarding fertility supplements. Furthermore, stringent government regulations imposed by governing authorities across the globe can impact segment growth positively.

Fertility Supplements Market Companies

- Fairhaven Health

- Coast Science

- Lenus Pharma GesmbH

- Active Bio Life Science GmbH

- Orthomol

- Exeltis USA, Inc.

- Bionova

- Fertility Nutraceuticals LLC

- Vitabiotics Ltd.

- extreme V, Inc.

- Xena Bio Herbals Pvt. Ltd.

- Gonadosan Distribution GmbH (Fertilovit)

- InnovaMed Ltd. (Amino Expert)

- Babystart Ltd

- Crown Nutraceuticals

- Sal Nature LLC

- Yadtech

- Prega News

- PlusPlus Lifesciences LLP

- Eu Natural

Latest Announcement by Market Leaders

- In June 2024. Bionova Scientific, an Asahi Kasei Group company and full-service biologics CDMO, announced plans to expand into plasmid DNA (pDNA) production. The centerpiece of the project is a new development and manufacturing facility in the Woodlands, Texas (near Houston).

- In November 2024, General Mills, Inc. announced it has entered into a definitive agreement to acquire Whitebridge Pet Brands' North American premium Cat feeding and Pet treating business from NXMH in a transaction valued at USD 1.45 billion. The business includes the Tiki Pets and Cloud Star portfolio of brands.

Recent Developments

- In August 2023, Sexual wellness brand HANX unveiled two new natural supplements – Menopause Support and Pregnancy Support. These offerings, developed in-house by HANX Co-Founder Dr. Sarah Welsh, a former NHS gynecology and obstetrics doctor, promise to provide much-needed assistance to women during crucial life stages.

- In November 2023, Los Angeles-based perinatal supplement startup Needed raised USD 14 million to study pregnant people's nutritional needs.

Segments Covered in the Report

By Ingredient Type

- Natural

- Synthetic/ Blend of Natural and Synthetic

By Product

- Capsules

- Tablets

- Soft Gels

- Powders

- Liquids

By End-User

- Men

- Women

By Distribution Channel

- OTC

- Prescribed

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting