Smoothies Market Size and Forecast 2025 to 2034

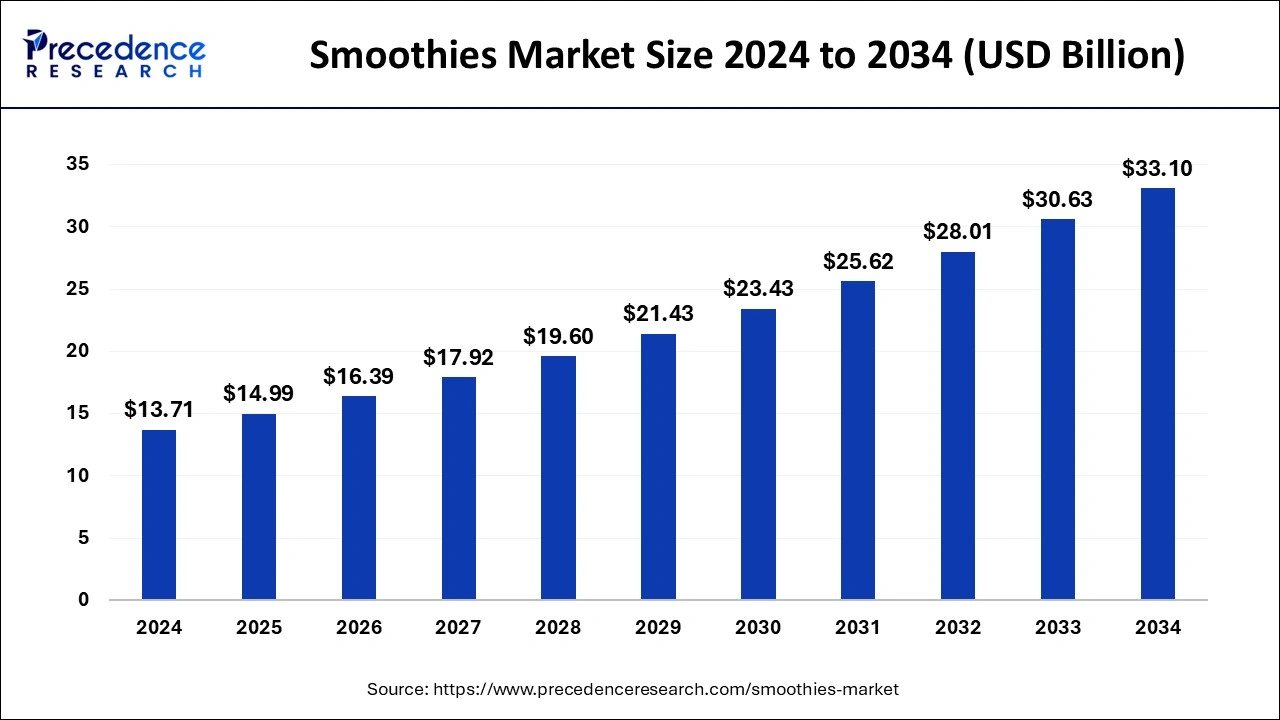

The global smoothies market size was estimated at USD 13.71 billion in 2024 and is predicted to increase from USD 14.99 billion in 2025 to approximately USD 33.10 billion by 2034, expanding at a CAGR of 9.21% from 2025 to 2034.

Smoothies MarketKey Takeaways

- In terms of revenue, the global smoothies market was valued at USD 13.71 billion in 2024.

- It is projected to reach USD 33.10 billion by 2034.

- The market is expected to grow at a CAGR of 9.21% from 2025 to 2034.

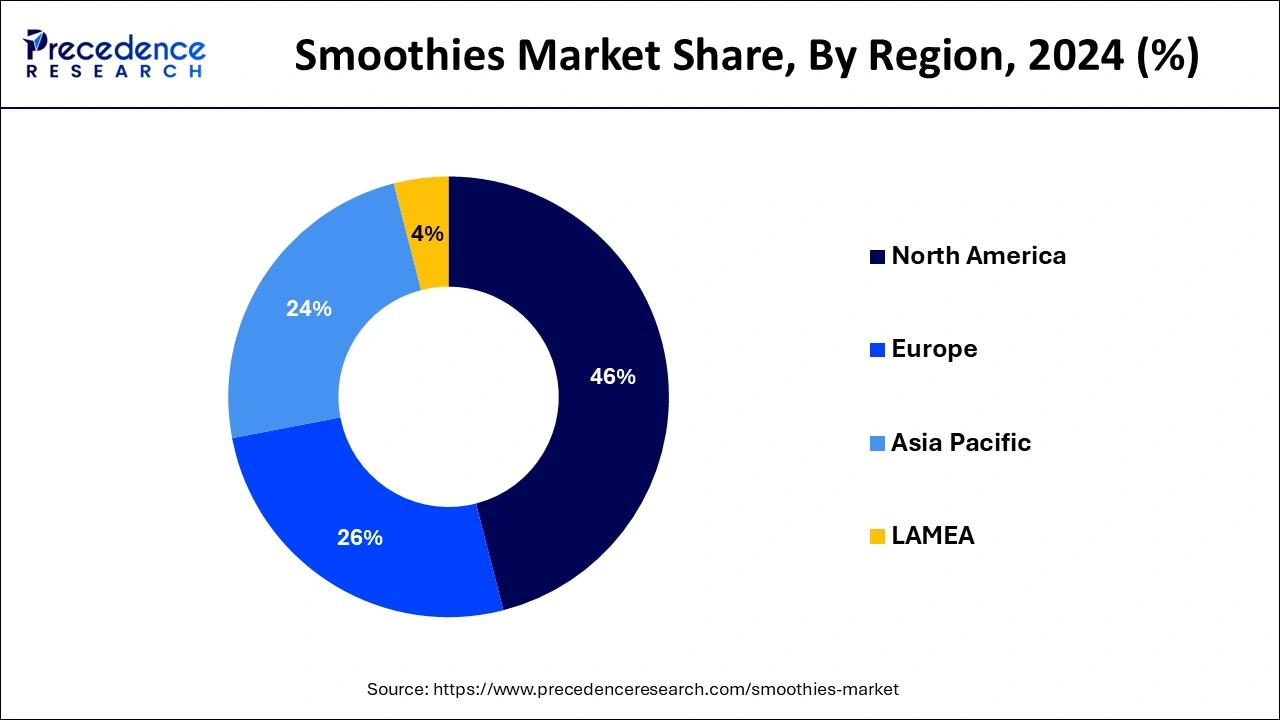

- North America dominated the market with the largest share of 46% in 2024.

- By product type, the fruit-based segment dominated the market share of 52% in 2024.

- By distribution channel, the smoothies bar segment held the largest share of 45% in 2024.

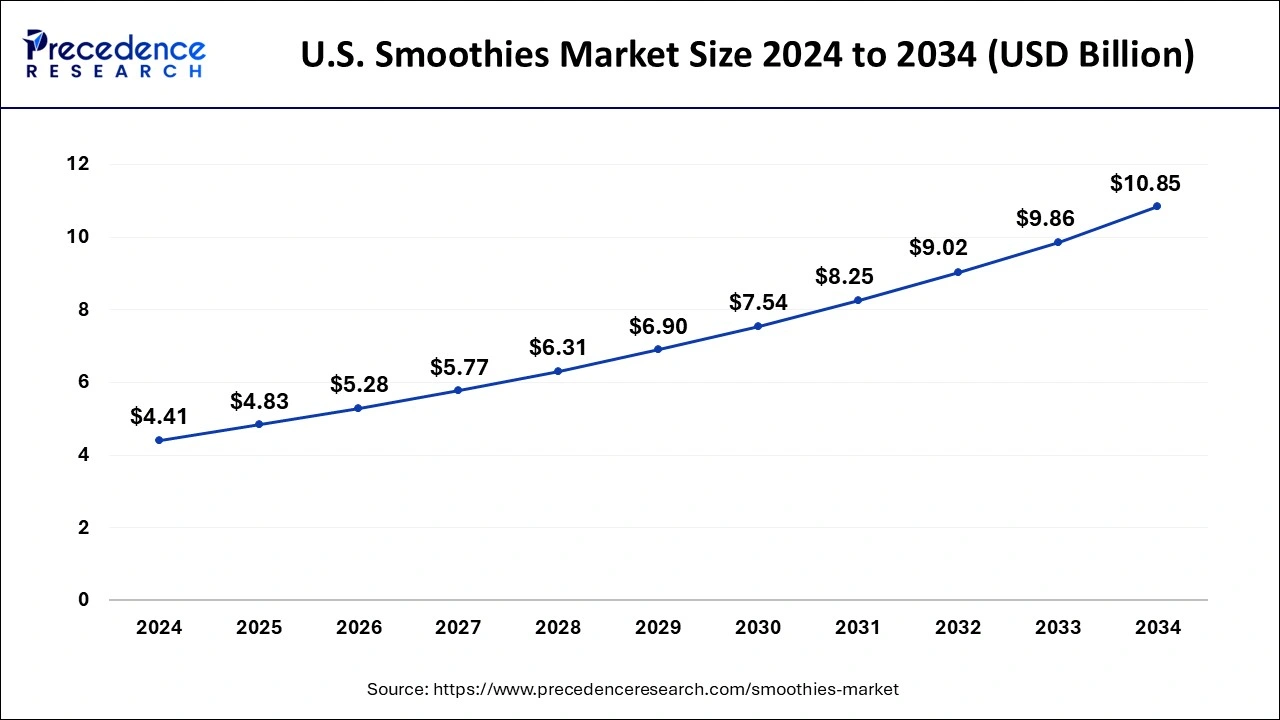

U.S.Smoothies Market Size and Growth 2025 to 2034

The U.S. smoothies market size was valued at USD 4.41 billion in 2024 and is anticipated to reach around USD 10.85 billion by 2034, poised to grow at a CAGR of 9.42% from 2025 to 2034.

North America led the market with the biggest market share of 46% in 2024, buoyed by a burgeoning population and substantial fruit consumption. This trend has spurred scientific and manufacturing endeavors towards a circular economy, facilitating the recycling and valorization of waste materials to reintegrate them into the foodsupply chain.

As such, businesses operating within the smoothies market in North America must innovate and diversify their offerings to capitalize on emerging consumer trends and maintain competitiveness in a dynamic marketplace. Notably, the U.S. functional beverage market is experiencing significant expansion, with heightened interest in energy, hydration, and protein-enhanced offerings.

- In August 2023, Smoothie King brought 15 additional units to Dallas-Fort Worth.

- In August 2022, Bolthouse Farms finalized the acquisition of Evolution Fresh.

Asia Pacific is the fastest-growing market for the smoothies market with a significant CAGR during the forecast period, fueled by a growing inclination towards healthier lifestyles and convenience. Nations such as India, China, and Australia are experiencing heightened interest in fruit-based and plant-based smoothies, particularly among younger demographics. The trend of adding functional ingredients, including protein, fiber, and probiotics, is also on the rise. Smoothie bars, cafes, and ready-to-drink products are becoming increasingly common, driven by the growth of online food delivery services and e-commerce platforms.

The smoothies market in India is rapidly growing due to the increasing awareness of health and wellness, particularly within urban areas. Young consumers, especially millennials, are propelling the demand for fruit-based, plant-based, and protein-rich smoothies. Furthermore, the expanding presence of smoothie bars, health cafes, and online platforms is enhancing consumer accessibility to these beverages. Local flavors and ingredients are also playing a significant role in the growth of smoothies in India.

Europe is observed to grow at a considerable growth rate in the upcoming period, driven by a rising health-conscious approach among consumers and an increased demand for functional food options. Plant-based smoothies are particularly favored, reflecting the expanding vegan and vegetarian demographics. Consumers are increasingly looking for smoothies featuring clean-label ingredients, reduced sugar content, and added health benefits such as probiotics and fiber. Innovations in ready-to-drink products and greater availability through supermarkets, retail chains, and online platforms are benefiting the market. The wellness-oriented product trend is further elevating the popularity of smoothies, notably in countries like the UK, Germany, and Spain.

Germany stands out as a vital participant in the European smoothies market, with a significant demand for nutritious and convenient food choices. Consumers are progressively opting for smoothies made from organic ingredients and those that provide functional advantages such as additional protein or fiber. The growth of smoothie bars and health-conscious cafes supports this market. Additionally, there is a growing demand for sustainably sourced products and eco-friendly packaging in Germany.

The Middle East and Africa are expected to grow significantly in the smoothies market during the forecast period. The increasing awareness about health is increasing the demand and the use of nutritional smoothies. Moreover, the development of new flavours along with natural ingredients is enhancing their use. Additionally, the busy lifestyle is increasing their adoption. Thus, this enhances the market growth.

Market Overview

The smoothies market offers beverages that represent a versatile and nutritious option for consumers seeking a convenient and flavorful means to enhance their dietary intake. These blended beverages offer a spectrum of flavors and nutritional profiles, catering to diverse preferences and dietary needs. With an average homemade smoothie containing 175 to 450 calories within an 8- to 12-ounce serving, they serve as a balanced meal replacement or supplement, providing a valuable source of essential nutrients.

During the COVID-19 pandemic, heightened awareness of health and immunity has spurred individuals to prioritize nutrient-rich foods. Smoothies emerge as a compelling solution, enabling individuals to effortlessly incorporate a variety of fruits, vegetables, and dairy or plant-based proteins into their diets. By utilizing whole fruits and vegetables rather than solely relying on juices, smoothies maximize nutrient absorption and support overall well-being.

The appeal of smoothies extends beyond their nutritional benefits to encompass factors such as convenience, taste, and affordability. This multifaceted appeal positions smoothie as a compelling choice for individuals seeking a balanced and satisfying dietary option. As such, integrating smoothies into school breakfast programs can notably augment fruit consumption among students, aligning with broader health and wellness initiatives. The adaptable nature of smoothies makes them an attractive solution for individuals striving to optimize their dietary habits amidst evolving health considerations.

- In March 2023, Main Squeeze Juice Co. acquired I Love Juice Bar.

- In September 2023, SAMBAZON partnered with KORA Organics and Erewhon and unveiled Miranda Kerr's KORA GLOW Smoothie.

Smoothies MarketGrowth Factors

- Increased consumer emphasis on healthy eating patterns to achieve and maintain healthy body weight and reduce the risk of chronic diseases is driving growth in the smoothies market.

- Smoothies offer a convenient way for consumers to meet their nutrient needs within calorie limits by providing a variety of nutrient-dense ingredients from different food groups.

- The versatility of smoothies as a quick and nutritious snack or meal replacement aligns with the modern lifestyle, contributing to their rising popularity.

- Incorporating protein-rich ingredients such as Greek yogurt or protein powder into smoothies supports post-workout recovery and muscle repair, appealing to fitness-conscious consumers.

- The fiber content in well-made smoothies promotes digestive health and aids in weight management, further enhancing their appeal to health-conscious individuals.

- Antioxidants and essential vitamins abundant in smoothie ingredients, particularly berries, citric fruits, and green vegetables, contribute to collagen production and promote healthy, radiant skin.

- The customizable nature of smoothies allows consumers to tailor recipes to suit their individual preferences and dietary requirements, expanding the market's appeal.

- With their combination of convenience, nutrition, and taste, smoothies have become a favored option for those seeking a balanced and satisfying dietary choice, driving sustained growth in the smoothies market.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 9.21% |

| Market Size in 2025 | USD 14.99 Billion |

| Market Size by 2034 | USD 33.10 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Convenience and nutritional value

The convenience and nutritional benefits of smoothies serve as key drivers in propelling the growth of the smoothies market. Smoothies cater to the demands of busy individuals and families seeking convenient dietary solutions by offering a quick and effortless means of obtaining a nourishing meal or snack. Their minimal preparation requirements and ability to be prepared in large batches enhance their appeal to time-constrained consumers. Equipped with a blender and basic ingredients, consumers can effortlessly craft satisfying and nutrient-rich smoothies suitable for consumption at home or while on the go.

The versatility of smoothies, which can incorporate a diverse array of fruits, vegetables, and other nutrient-rich components, positions them as a valuable source of essential vitamins, minerals, and antioxidants. The nutritional composition of smoothies can be tailored to meet specific dietary needs, providing consumers with options rich in fiber, protein, healthy fats, and other essential nutrients crucial for optimal bodily function. This adaptability underscores smoothies' appeal as a convenient and customizable dietary option, driving sustained growth of the smoothies market as consumers increasingly prioritize health-conscious food choices in their daily routines.

Enhanced energy and cognitive benefits

Smoothies emerge as a potent source of sustained energy, harnessing the power of nutrient-rich ingredients abundant in complex carbohydrates and energy-boosting nutrients. Laden with antioxidants found in berries, leafy greens, and nuts, they not only bolster brain function but also mitigate the risk of cognitive decline, amplifying their appeal to health-conscious consumers. Smoothies seamlessly integrate into healthy weight management plans, offering satiety and satisfaction as meal replacements.

By curbing food cravings and facilitating adherence to calorie-controlled diets, they serve as a strategic tool in promoting dietary discipline. The protein and fiber content in smoothies plays a pivotal role in promoting fullness and reducing the inclination toward unhealthy snacks and processed foods. Smoothies prolong satiety, curbing the urge for impulsive snacking and fortifying digestive health by leveraging high-fiber ingredients like leafy greens, fruits, and seeds.

Restraints

Limitations due to concerns related to sugar intake

The inclusion of free sugars, comprising added sugars like honey and maple syrup, presents a significant restraint on the expansion of the smoothies market. As consumers increasingly prioritize dental health and seek to manage energy intake for weight maintenance, the need to reduce free sugar consumption becomes paramount. Even with the addition of nutrient-rich vegetables such as spinach or kale, smoothies are susceptible to high sugar content, thus hindering widespread adoption among health-conscious consumers. This heightened awareness surrounding the adverse effects of free sugars acts as a deterrent, limiting the market's growth potential.

Obesity risks

The perception that smoothie consumption may exacerbate obesity presents a significant restraint on the expansion of the smoothies market. This concern stems from the notion that liquid or semi-liquid foods fail to adequately satiate hunger and appetite compared to solid foods, potentially leading to overconsumption of calories. Consuming calories in liquid form may not provide the same level of satiety as solid food, prompting individuals to seek additional calorie intake later to satisfy hunger. Furthermore, the common inclusion of sweeteners like ice cream, honey, or sweetened yogurt in smoothie recipes can elevate sugar content, exacerbating concerns regarding excessive calorie intake and weight management.

As health-conscious consumers prioritize dietary choices that promote satiety and weight control, addressing these concerns surrounding smoothie consumption becomes imperative for market growth. Industry stakeholders must innovate by offering lower-sugar options and emphasizing the nutritional benefits of smoothies without compromising taste or satisfaction. By proactively addressing obesity-related apprehensions, businesses can mitigate this restraint and foster greater consumer trust in the smoothies market.

Opportunities

Innovative packaging and advertisement strategies

The introduction of innovative packaging presents a promising opportunity for the smoothies market. Through rigorous in-vitro evaluation, this packaging has demonstrated antimicrobial efficacy against pathogens such as Listeria monocytogenens and Lactobacillus plantarum, ensuring the safety and freshness of smoothies.

Additionally, a preliminary assessment of lysozyme release kinetics under various conditions has been conducted, revealing its potential influence on key smoothie quality parameters. Leveraging bag-in-box and pouch packaging solutions, brands can offer eco-conscious packaging options that not only maintain product integrity from fill through end-use but also align with consumers' sustainability preferences with the integration of aseptic technology, smoothie products become shelf-stable and preservative-free, eliminating the need for refrigeration and enhancing convenience for consumers. This innovation opens doors for expanded distribution channels and extends market reach, catering to on-the-go consumers seeking convenient and nutritious beverage options.

Ultrasound technology for enhanced nutritional quality

The rising consumer demand for fresh, safe, and healthy food and beverage options has spurred innovation within the smoothies market. Traditional preservation methods often compromise nutritional quality, prompting food scientists to explore alternative solutions. Ultrasound technology emerges as a promising avenue for producing minimally processed fruits, vegetables, fruit juices, and smoothies that boast superior nutritional profiles and extended shelf life.

By harnessing ultrasound technology, manufacturers can maintain the nutritional integrity of ingredients while effectively preserving their freshness and safety. This innovative approach addresses consumer expectations for high-quality, health-conscious products, positioning ultrasound-processed smoothies as a preferred choice among discerning consumers.

The adoption of ultrasound technology aligns with broader industry trends centered around health and wellness, catering to modern consumers who prioritize nutrition and seek convenient yet wholesome dietary options. With enhanced nutritional value and prolonged shelf life, smoothies produced using ultrasound technology have the potential to capture a larger market share and capitalize on the growing demand for premium, health-enhancing beverages.

Product Type Insights

The fruit-based segment commanded a dominating share in 2024, owing to its inherent nutritional benefits and consumer appeal. Smoothies, laden with essential nutrients and wholesome ingredients, serve as natural energy boosters, leveraging the nutrient-rich profile of fruits such as bananas, green vegetables, and berries to provide a potent blend of vitamins, minerals, and carbohydrates. This nutrient-dense composition fuels the body, keeping consumers energized throughout the day. Regular consumption of fruit-based smoothies offers additional benefits beyond energy enhancement.

These beverages support collagen production, aiding in maintaining a youthful appearance. Rich in antioxidants sourced from berries, citric fruits, and green vegetables, smoothies combat free radicals that contribute to premature aging and skin damage, promoting healthy, radiant skin. The compelling combination of nutritional efficacy and skincare benefits propels the growth of the smoothies market, enticing consumers with the promise of holistic well-being. As health-conscious consumers increasingly prioritize nutritious and rejuvenating options, fruit-based smoothies emerge as a favored choice, driving sustained market expansion and innovation.

- In February 2022, OUTSHINE introduced Blended Fruit & Yogurt Smoothie Pouches, offering a nutritious on-the-go snack suitable for the entire family.

- In May 2023, Sunfeast debuted Smoothies crafted from milk and real fruits.

- In June 2023, Keventers launched Fruit Smoothies to combat the summer heat in India's retail market.

- In January 2024, a Thai fruit juice specialist tapped into the South Korean 'tango-pun' smoothie trend to release a new product centered around the wondrous watermelon.

- In February 2023, Parle Agro unveiled SMOODH Fruit Smoothies, featuring Dulquer Salmaan as the brand ambassador.

Distribution Channel Insights

In 2024, smoothie bars have emerged as a dominant distribution channel within the burgeoning smoothies market, fueled by increasing consumer demand for healthier food options. As consumers prioritize health-conscious choices, businesses in the juice and smoothie bar industry are poised for significant growth in the coming years. Successful smoothie bars excel by offering functional and convenient products made from fresh, natural ingredients that resonate with consumer preferences.

Smoothie bars can educate customers about their offerings and the health benefits they provide by leveraging social media platforms effectively. Regular distribution of business cards further enhances exposure and fosters brand recognition. The growing health consciousness among consumers is a driving force behind increased sales within the smoothie bar industry. With people increasingly vigilant about the nutritional content of their food, smoothie bars provide a convenient and accessible solution for incorporating fresh fruits, vegetables, and other nutritious ingredients into daily diets.

Smoothies Market Companies

- Barfresh Food Group, Inc.

- Bolthouse Farms

- Ella's Kitchen Ltd

- innocent ltd

- Jamba Juice LLC

- Maui Wowi Hawaiian Coffees & Smoothies

- Smoothie King

- Suja Juice

- Tropical Smoothie Caf�

- The Smoothie Company

Recent Developments

- In July 2025, to launch a green and pink blended concoction chock-full of probiotics smoothie named "Storm Storm," a collaboration between Travis Scott, who is a 34-year-old rapper, with Erewhon, which is a California-based grocery store, was announced. This Storm Storm consists of a mixture of Cocoyo Pi�a Colada Raw Coconut Yogurt and Agua de Kefir's fizzy Dragon Fruit Fresca, and is available at $22 tropical, non-dairy beverage. Moreover, the ingredients provide both gut-friendly and hydrating effects. Additionally, the Agua de Kefir is extracted from cactus-powered vegan kefir water made up of electrolytes, postbiotics, and leftover waste from prebiotics and probiotics. Furthermore, to aid digestion and absorb nutrients by maintaining a balanced gut microbiome and to decrease inflammation, this Kefir water is helpful. (Source: https://www.msn.com)

- In May 2025, keeping hydration as the main center, a line of three smoothies was launched by Smoothie King. Hydration Pineapple Mango, Hydration Berry, and Hydration Watermelon are the flavours of these smoothies. The coconut water, which is a natural source of electrolytes, as it contains calcium, sodium, potassium, and magnesium, is mixed in these smoothies as an electrolyte blend. Moreover, the fresh fruit, fruit juice, and stevia are added to it, making it free from added sugar. Thus, these smoothies quench the thirst and enhance the energy by minimizing the side effects of added sugar. (Source: https://www.aol.com)

- In October 2023, Smoothie King unveiled a new range of indulgent smoothie bowls, featuring flavors like A�ai Cocoa Haze� and Coco Pitaya-Yah�. These offerings target consumers in search of nutritious yet indulgent meals, reflecting the trend towards superfood-infused smoothies in the market.

- In April 2023, Smoothie King enhanced its status as the leading destination for Smoothie Bowls in the country by unveiling six appealing Smoothie Bowls at more than 1,100 locations across the U.S. These Smoothie Bowls feature a delightful mix of high-quality ingredients aimed at promoting an active and balanced lifestyle. The Acai bowls consist of PB Swizzle, Berry Gogi Getaway, and Go-Go Goji Crunch, whereas the Pitaya bowls include Be Berry Stings, High Five, and PB Delight.

- In February 2023, Parle Agro introduced SMOODH Fruit Smoothies through its dairy brand, SMOODH. Parle Agro appointed actor Dulquer Salmaan as the brand ambassador for �SMOODH' targeting southern markets in India.

- In February 2022, Smoothie King launched a pilot test of the Text-to-Order Platform.

- In June 2023, Veg of Lund launched DUG Mango Smoothie on the Swedish smoothies market.

- In October 2023, Emami ventured into the juice category with �AloFrut' through a stake acquisition in Axiom Ayurveda.

Segments Covered in the Report

By Product Type

- Fruit-based

- Dairy-based

- Others

By Distribution Channel

- Restaurants

- Smoothie Bars

- Supermarkets & Convenience Stores

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content