Fertility Market Size and Forecast 2025 to 2034

The global fertility market size was calculated at USD 36.53 billion in 2024 and is predicted to increase from USD 39.27 billion in 2025 to approximately USD 85.53 billion by 2034, expanding at a CAGR of 9.03% from 2025 to 2034.

Fertility Market Key Takeaways

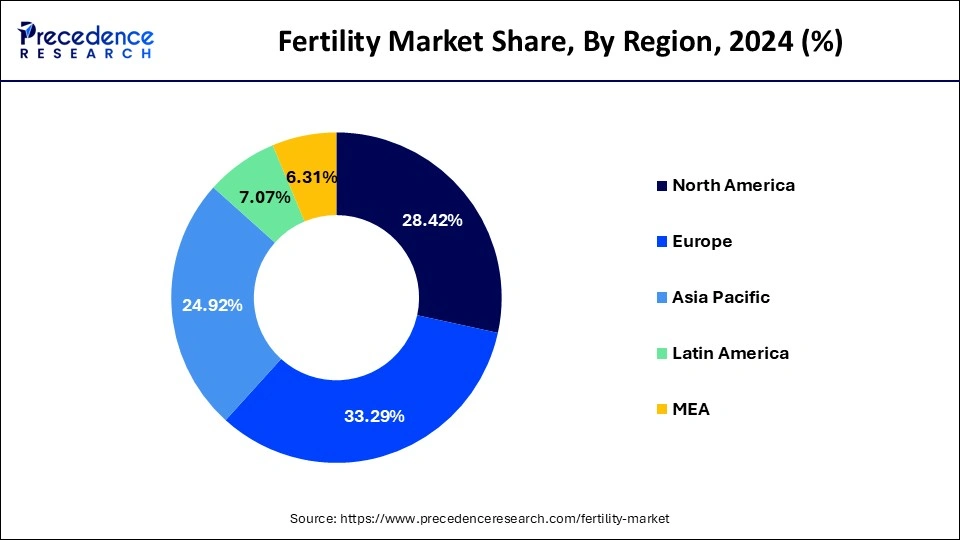

- Europe led the global market with the highest market share of 33.29% in 2024.

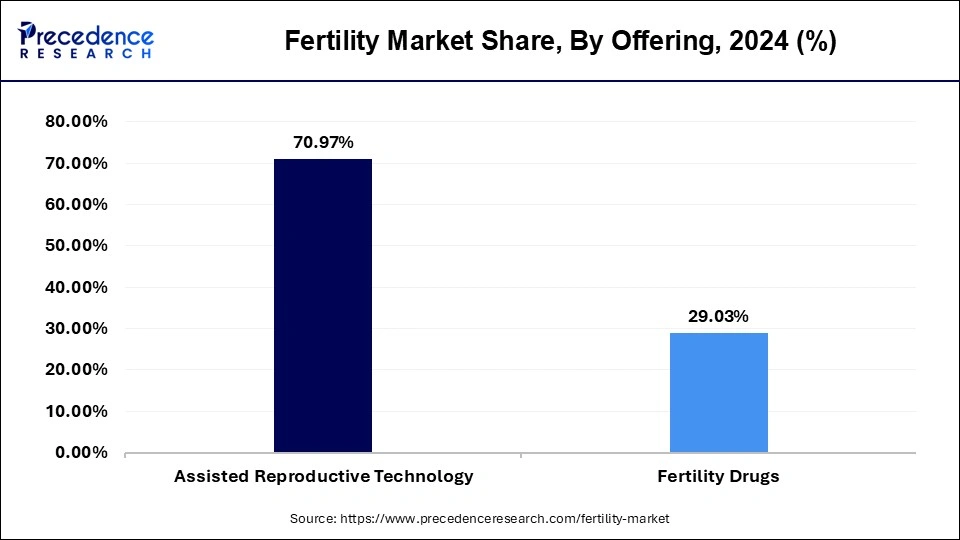

- By offering, the assisted reproductive technology segment registered a maximum market share of 70.97% in 2024.

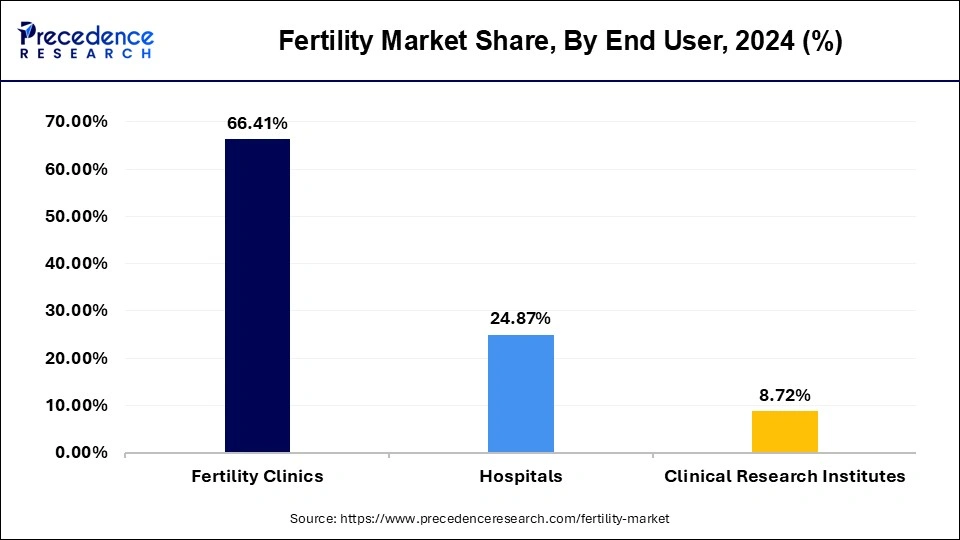

- By end user, the fertility clinics segment captured the biggest revenue share of 65.62% in 2024.

How Can AI Influence the Fertility Market?

Artificial intelligence (AI) was integrated into the fertility market to increase recovery accuracy and success rates in clinics, so that they were able to process embryo images to decide which embryos were most likely to lead to pregnancy. These types of tools allow clinics to monitor and assess embryo development over a period of time, providing doctors with better insights for their consultations. AI was able to reduce human errors and create based-sourced results versus experience-based results. This allowed clinics to customize each individual patient's treatment, by analyzing health history, hormone levels, and other factors with some systems even providing the ideal timing of egg retrieval or sperm retrieval. Fertility centers were able to have better success rates using AI and save time on procedures and this reduced the client's emotional and financial burden.

As the fertility market goes more towards AI, it became a trusted part of standardized care. AI transforms how doctors treat patients and gives patients a better chance of starting or growing their families. AI was increasingly being used in the fertility sector to help doctors select the best embryos for IVF. In one major study, an AI algorithm called STORK-A was used to analyze microscope images and maternal age data to predict embryo chromosome status. The system was able to predict normal chromosome embryos with nearly 69% accuracy genealogical testing being the gold standard of accuracy because it is invasive, but much more invasive the algorithm assisted in making embryo selections in a more objective, data-driven way.

- For instance, researchers at Columbia University observed an AI system called the STAR system, that scans millions of sperm images and within under an hour provided 44 viable sperm for a male patient suffering with very severe infertility when that would normally take days and be often unsuccessful.

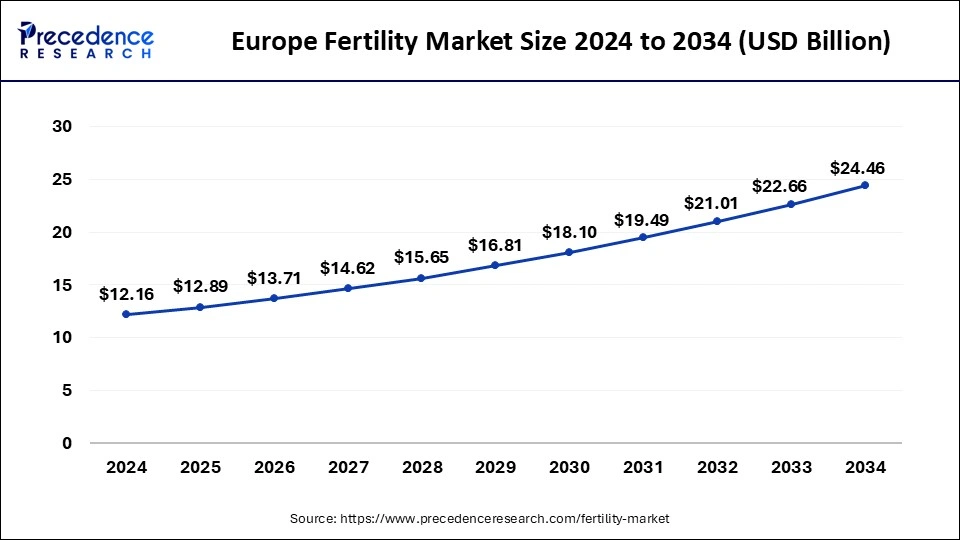

EuropeFertility Market Size and Growth 2025 to 2034

The Europe fertility market size was evaluated at USD 12.16 billion in 2024 and is projected to be worth around USD 24.46 billion by 2034, growing at a CAGR of 7.38%.

Europe held the largest share of 33.29% in the fertility market. In recent years, there has been an increase in demand for fertility treatments in Europe. This trend is influenced by elements like changing lifestyles, postponing childbearing, and an increase in infertility rates. Regulations pertaining to fertility treatments varies throughout European nations. While some nations have more lax laws that permit a variety of reproductive services, others have more stringent laws. Numerous fertility clinics providing a range of services, from sophisticated reproductive therapies to simple fertility assessments, can be found throughout Europe. These clinics frequently offer individuals and couples undergoing reproductive treatments individualized care and assistance. Certain individuals may choose to receive reproductive care beyond borders, which involves traveling to another country for fertility treatment, due to differences in rules and pricing among European nations.

The market for fertility in Germany is mainly propelled by the increasing rates of infertility, impacted by lifestyle choices and later childbirth among women. Enhanced government incentives, including subsidies for fertility treatments, paired with advancements in healthcare infrastructure, are offering substantial assistance. Regulatory structures are adapting to include innovative therapies, thereby promoting market expansion. Moreover, the rising affordability and availability of fertility drugs are driving demand, especially among city dwellers with greater purchasing ability. Current trends in the market emphasize technological advancements designed to enhance fertility results.

Asia Pacific also expected to grow at the fastest CAGR of 11.10% during the forecast period. Delays in childbirth, changes in lifestyle, and an increase in the prevalence of infertility problems have all contributed to an increase in the need for fertility treatments. The accessibility and efficacy of fertility treatments have increased due to advancements in assisted reproductive technologies (ART), such as intracytoplasmic sperm injection (ICSI), preimplantation genetic testing (PGT), and in vitro fertilization (IVF). Fertility treatments are becoming more affordable for couples thanks to financial assistance or subsidies from several governments in the Asia Pacific area. A greater number of couples are seeking assistance as a result of de-stigmatizing infertility and raising awareness of reproductive problems and accessible therapies. A number of nations are updating their ART laws to make them more accessible and inclusive to a larger range of people.

The fertility market in India is currently experiencing substantial growth due to several crucial factors. The need for fertility treatments has risen due to heightened awareness of infertility issues and a surge in couples seeking assisted reproductive technologies. Couples pursue fertility treatments due to postponed marriage and childbirth caused by urbanization and changing lifestyle preferences. Government initiatives that promote access to healthcare are additionally benefiting the sector. The Indian market for fertility services presents numerous opportunities. Artificial insemination and in-vitro fertilization (IVF) represent two advanced technologies that are rapidly becoming more popular and enabling service providers to enhance their offerings.

North America represented a significant segment of the fertility market, being the prominent region by market size. The region supplies essential contributors for major stakeholders, driven by factors such as a large population, greater awareness of fertility treatments, the growing popularity of IVF, rising infertility rates, and the trend of delayed childbirth. Additionally, North America has seen substantial investments and technological advancements in fertility services, which have contributed to the growth of the market.

An increasing number of infertility cases are linked to health issues, postponed childbirth, and environmental factors, driving the expansion of the U.S. fertility industry. Individuals are attracted to fertility therapies that offer better success rates and innovative methods, including egg freezing. Awareness initiatives boost public understanding of infertility and the treatments that are accessible. The market is supported by same-sex couples seeking options for family creation.

Key Market Insights

Research & developments are continually increasing in the healthcare industry for the infertility treatment which is expected to boost target industry growth in the near future. In the developed countries such as U.S and Canada the healthcare treatment, service costs are relatively high owing to availability of advanced healthcare infrastructure. Due to the ongoing healthcare technology advancements highly sophisticated tools and apps are used every day, around the globe. However, the emerging economies across the globe such as India, China are offering huge opportunities to the key operating players in the target market. Further, advancements in the healthcare infrastructure, coupled with growing medical tourism because of less costs of treatments are major factors boosting growth opportunities in the emerging economies, worldwide. Growth in the number of same-sex parents as well as solitary women selecting to have children has been exponential. All these factors are expected to boost growth and demand patterns for the global fertility industry in future.

Fertility Market Growth Factors

- Declining fertility rates across the globe

- Rising number of fertility clinics worldwide, coupled with technological advancements

- Changing life style among the individuals across the globe

Market Scope

| Report Highlights | Details |

| Growth Rate from 2025 to 2034 | CAGR of 9.03% |

| Market Size in 2025 | USD 39.27 Billion |

| Market Size by 2034 | USD 85.53 Billion |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Offering, End-user, and Region |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa (MEA) |

Future of the Global Fertility Market

Major companies of the global industry including Cooper Surgical and Cook Group are pointing towards commercial growth by adopting strategies like mergers and acquisitions, heavy investments in the manufacturing facilities that are predictable to flourish the global market growth in next few years. This trend is probable to continue and will augment growth of the target industry in the near future. For instance, in 2018, Cooper Surgical a leading player in the global industry acquired fertility business of Life Global Group. This has increased chances of a healthy pregnancies.

Market Dynamics

Driver

Delayed parenthood and lifestyle changes drove fertility market demand

The fertility market has been driven by an increasing number of people who are delaying having children for career aspirations, education and financial planning. As women and couples delayed family creation the natural decline in fertility associated with age became more pronounced, especially for women in their mid-30s and older. The increased demand for assisted reproductive technologies such as IVF, IUI, and egg freezing has increased due to delays in starting families. In addition to age, lifestyle factors associated with declining reproductive health, such as diet, stress, and environmental pollutants, have compounded the use of fertility treatments.

Information about fertility, and therefore the increasing demand for early diagnosis and subsequent assistance from fertility clinics, improved awareness of options and heightened demand for fertility services. With advances in medical technology and an increase in overall access and availability of fertility services in almost all areas, people were better able to access and understand their options. The changing trend and subsequent changes in behavior and awareness has certainly helped with the previously unmet demand for fertility care.

- As per Extended Fertility, as a woman ages, her chances of getting natural pregnant drops from around 25% at age 25 to less than 5% at age 40.

- According to the U.S. Centers for Disease Control, the average age of mothers at first birth increased from 26.6 years in 2016 to 27.5 years in 2023 indicating a widespread delay in childbearing and growing need for fertility services.

Restraint

Limited Success Rates

Numerous reasons, including hormonal, physiological, and genetic problems, can lead to infertility. Determining the precise cause and implementing a successful solution might be challenging. Individual differences in success rates can be attributed to a variety of factors, including lifestyle choices, general health, and the underlying causes of infertility. The cost of fertility treatments can prevent many people from accessing them. Some patients might only be able to afford one or two treatment cycles, which would lower their likelihood of recovery. Stress itself has been shown to impact fertility, and infertility treatments can be emotionally exhausting. The success rates of treatments may be further impacted by his emotional load. Certain reproductive treatments are prohibited by law or ethical principles in some areas, which restricts the options available to people in need of help.

Opportunity

With a strong promise on the horizon of the fertility market, and the potential for even greater opportunities with advances in new technologies and an ever-expanding culture of awareness, there is an array of opportunities worth noting. With the development in science, techniques such as time-lapse embryo imaging, genetic screening, and non-invasive testing helped make treatments more specific for people and less stressful for patients. With the introduction of personalized medicine, clinics could treat patients in consideration of their unique health conditions.

Then, with fertility preservation options like egg and sperm freezing and embryo storage made widely available to people wanting to postpone parenthood, things began to change. Add telehealth to the equation to assist patients in remote or isolated areas, as well as changing social impacts and attitudes about fertility treatments, all of which disrupted stigmas and expanded awareness of fertility treatment, and you can begin to see why there was significant opportunity for clinics, researchers and companies to flourish, improve outcomes and support people on their paths to parenthood.

Offering Insights

The assisted reproductive technology (ART) segment held the largest share of 70.97% in the fertility market. A wider spectrum of individuals now have greater access to fertility treatment thanks to ART treatments like intrauterine insemination (IUI), intracytoplasmic sperm injection (ICSI), and in vitro fertilization (IVF). The market for fertility clinics and related services is expanding as a result. The hazards connected with reproductive treatments have decreased and success rates have increased because to advancements in ART techniques. Better results for patients have been made possible by innovations like time-lapse embryo imaging, vitrification of eggs and embryos, and preimplantation genetic testing (PGT). The need for ART services has increased due to the rising occurrence of conditions such as same-sex parenthood, delayed childbearing, and medically-induced infertility.

Global Fertility Market Revenue, By Offering, 2022-2024 (USD Billion)

| By Offering | 2022 | 2023 | 2024 |

| Assisted Reproductive Technology | 22.05 | 23.88 | 25.92 |

| Fertility Drugs | 9.78 | 10.18 | 10.60 |

Fertility tourism has increased as a result of differences in national laws and availability to fertility treatments. People might fly to nations with more affordable ART procedures or more benevolent policies, which would contribute to the globalization of the fertility market. For many singles and couples, the high expense of ART procedures can be a major barrier to access. Because of this, some fertility clinics provide financing choices or package discounts to lower the cost of treatment. The accessibility of ART services is further impacted by the large variations in insurance coverage for reproductive treatments. The increasing use of ART has brought up moral concerns about the discarding of embryos, genetic trait-based selection, and the commercialization of human reproduction.

End user Insights

In 2024, the fertility clinics segment held the largest share of 65.62% in the fertility market. Fertility clinics are essential to the reproductive industry because they provide a variety of services to people and couples who need help conceiving. These clinics offer a range of services to aid with infertility problems, such as sperm donation, egg freezing, fertility testing, intrauterine insemination (IUI), and in vitro fertilization (IVF). Due to reasons such postponing childbearing, raising awareness of fertility treatments, and improvements in reproductive technologies, the fertility market has experienced tremendous development in recent years. Due to this, fertility clinics have proliferated all over the world, varying in size from huge, specialized institutions to tiny, independent practitioners.

The hospitals segment is also expected to remain the second largest during forecast period. Specialized fertility clinics can be found on the grounds of many hospitals or as separate establishments. In vitro fertilization (IVF), intrauterine insemination (IUI), fertility testing, and other reproductive treatments are among the services provided by these clinics. For patients receiving medical treatments like chemotherapy or radiation therapy that may have an impact on their fertility, hospitals may offer fertility preservation services. This can involve freezing sperm or eggs for later use. To provide cutting-edge fertility treatments and procedures, hospitals usually work in conjunction with reproductive experts, such as reproductive endocrinologists, embryologists, and fertility doctors. For individuals and couples dealing with infertility concerns, hospitals frequently provide counseling, support groups, and instructional materials.

Global Fertility Market Revenue, By End User, 2022-2024 (USD Billion)

| By End User | 2022 | 2023 | 2024 |

| Fertility Clinics |

20.39 | 22.08 | 23.97 |

| Hospitals |

8.39 | 8.81 | 9.27 |

| Clinical Research Institutes | 3.05 | 3.17 | 3.29 |

Recent Developments

- In July 2025, IVI RMA Global acquired ART Fertility Clinics in the United Arab Emirates and Saudi Arabia, including three clinics with state-of-the-art facilities, from Gulf Capital. The acquisition strengthened IVI RMA's global footprint, including high-IVF-success, research-based protocols within its expansive network. This acquisition was subject to regulatory clearance and aligned with the company's global expansion priorities.

(Source: https://www.businesswire.com)

- In August 2025, Jamaican women were projected to average just 1.3 births per lifetime in 2025, according to a report from the United Nations Population Fund, marking one of the lowest fertility rates in the world. The average number of births fell well below the 2.1 births needed to keep a population stable, making Jamaica one of a very small number of countries to have lowest-low fertility rates.

(Source: https://www.caribbeannationalweekly.com)

- In June 2025, Guardian Life Insurance collaborated with Carrot to incorporate fertility health and family-building services into its hospital indemnity insurance product. The association made Guardian the first insurance company in this type of insurance to offer Carrot's fertility, prenatal, menopause, urology, and parenting support. Employees also had access to Carrot's Provider Finder, Carrot Academy, expertise, 24/7 care navigation, and more than 20 wellness benefits.

(Source: https://www.prnewswire.com)

Fertility Market Companies

- Boston IVF Fertility Clinic

- INVO Bioscience

- San Diego Fertility Center

- Celmatix

- FUJIFILM IRVINE SCIENTIFIC

- Carolinas Fertility Institute

- Progyny Inc.

- Cook Medical

- LifeGlobal Group (Cooper Surgical)

Segments Covered in the Report

By Offering

- Assisted Reproductive Technology

- IVF

- Artificial Insemination

- Surrogacy

- Others

- Fertility Drugs

- Gonadotropin

- Anti-estrogen

- Others

By End user

- Fertility Clinics

- Hospitals

- Clinical Research Institutes

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa (MEA)

Get a Sample

Get a Sample

Table Of Content

Table Of Content