U.S. Fertility Market Size and Forecast 2025 to 2034

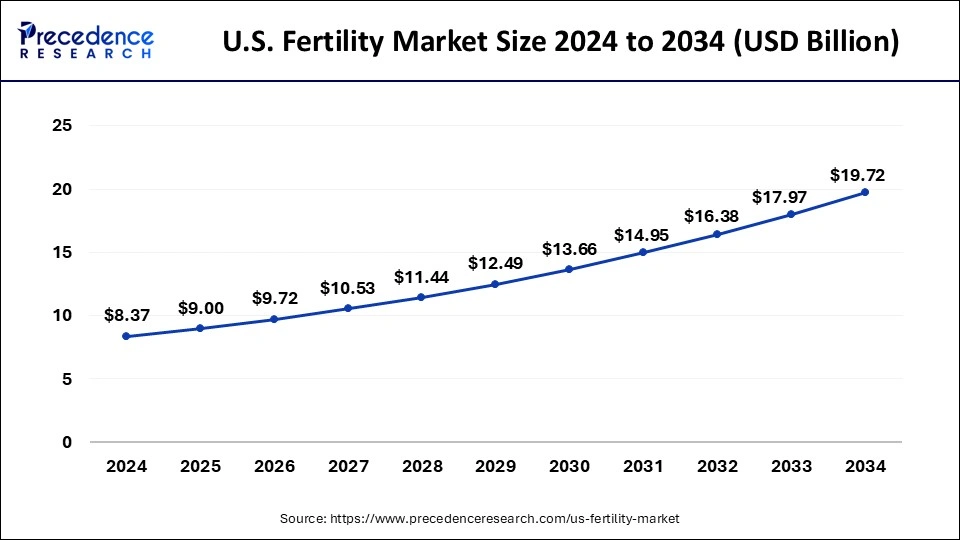

The U.S. fertility market size was calculated at USD 8.37 billion in 2024 and is predicted to increase from USD 9.00 billion in 2025 to approximately USD 19.72 billion by 2034, expanding at a CAGR of 9.10% from 2025 to 2034. The U.S. fertility market is driven by the increasing mean age of new mothers.

U.S. Fertility MarketKey Takeaways

- In terms of revenue, the U.S. fertility market was valued at USD 8.37 billion in 2024.

- It is projected to reach USD 19.72 billion by 2034.

- The market is expected to grow at a CAGR of 9.10% from 2025 to 2034.

- By offering, the assisted reproductive technology segment dominated the market in 2024.

- By end-user, the fertility clinics segment dominated the U.S. fertility market in 2024 and the segment is observed to sustain the dominance throughout the forecast period.

U.S. Fertility Market Overview

The fertility market includes a broad range of goods and services that help single people and couples become pregnant. Comprehending the market's applications and current developments is critical because it's a dynamic and complex arena driven by many variables.

By evaluating sperm quality, ovarian reserve, and any genetic problems, diagnostic testing helps determine the best course of action and increases treatment outcomes. By freezing eggs, sperm, or embryos, people can postpone having children while still maintaining their capacity for reproduction. In gestational surrogacy, the pregnancy is carried by a different woman; in situations when the intended parents do not have viable gametes, donor eggs, sperm, or embryos may be utilized.

- In November 2023, Fresenius, a healthcare firm, and IVI RMA inked a definitive deal for IVI RMA to purchase the North American Operations of Eugin firm, which includes the Toronto-based TRIO and the Boston IVF fertility network. The calculated additions will position IVI RMA as a top fertility group in North America and reaffirm the organization's mission to offer the most significant number of patients evidence-based fertility solutions with the best likelihood of success.

U.S. Fertility Market Data and Statistics

- About four out of ten Americans (42%) claim they have gone through fertility treatments or directly know someone who has, even though the average age at which American women give birth is still rising. A new survey from the Pew Research Center in 2023 states that this is an increase from 33% five years before.

- Based on data from hundreds of fertility clinics around the country provided by The Centers for Disease Control (CDC), 2.3% of all babies born in the US each year are conceived via the use of artificial reproductive technology.

- The FDA permitted INVO Bioscience to use its INVOcell technology more widely in July 2023, opening the door for better patient outcomes during infertility treatments. Like traditional in vitro fertilization (IVF) procedures, the gadget, which is well-known for its affordability and effectiveness, can be used for a 5-day incubation period.

U.S. Fertility MarketGrowth Factors

- Growing numbers of cases of infertility are attributed to medical disorders, delayed childbearing, and environmental causes, promoting the growth of the U.S. fertility market.

- Patients are drawn to infertility treatments with higher success rates and novel approaches, such as egg freezing.

- Education campaigns increase public knowledge of infertility and available treatments.

- The market is boosted by same-sex couples looking for family-building choices.

- The growth of reproductive clinics may result in cheaper costs since it improves access and competition.

U.S. Fertility Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 9.00 Billion |

| Market Size by 2034 | USD 19.72 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 9.10% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Offering and End User |

Market Dynamics

Drivers

Availability of improved diagnostic tools

Personalized and focused treatment programs are made possible by the more accurate detection of reproductive problems, which is made possible by integrating state-of-the-art diagnostic technology. The success rates of assisted reproductive technologies, including in vitro fertilization (IVF), have increased dramatically.

Due to improved diagnostic tools, medical professionals may now pinpoint specific factors that impact fertility, like hormonal imbalances, genetic disorders, or structural problems. This in-depth knowledge makes it possible to implement customized therapies that maximize the likelihood of a successful conception while cutting down on the duration and expense of fertility treatments. Thereby, the availability of improved diagnostic tools is observed to drive the growth of U.S. fertility market.

Rising acceptance of fertility treatments

The success rates of fertility treatments have increased dramatically due to developments in medical interventions and reproductive technologies, which have given people and couples seeking help conceiving greater confidence.

In addition, there has been a discernible change in the way society views non-traditional family structures, which has increased acceptability and openness toward assisted reproductive technology. More people are open to considering fertility treatments as a potential solution to their infertility problems as knowledge and comprehension of these concerns grow.

Restraints

High cost of fertility treatment

Advanced medical techniques and technology, including IVF, egg freezing, and genetic testing, are frequently used in fertility treatments. These treatments can come with high related expenses, which limits their accessibility to a larger audience. Fertility therapy success rates can differ, and it might take several treatment cycles to get pregnant. Additional expenses are incurred with each cycle, adding to the total financial load. Although some insurance plans may cover a portion of reproductive treatments, many must fully cover these procedures.

Couples or individuals with limited insurance coverage must pay significant out-of-pocket costs. Fertility drugs are essential for controlling the reproductive process and promoting egg formation.

Potential government regulation

Regulations can affect surrogacy agreements, donor gametes, and assisted reproductive technologies, among other elements of the sector. These rules include licensing, reporting, and following moral and medical guidelines.

Tight rules may put more of an administrative and operational strain on fertility clinics, raising the possibility of increased compliance expenses. Prospective parents may have fewer options if there are limitations on the use of specific reproductive technologies, donor sources, or surrogacy agreements.

Opportunities

AI-powered personalized treatment plans

AI can find patterns and correlations in this data by analyzing patient data, medical history, genetic data, and lifestyle factors—factors that conventional approaches could miss. This increases the likelihood of a successful conception by allowing medical experts to customize fertility treatment strategies to everyone or couple's specific needs.

AI can also expedite decision-making by offering insights into the best treatments depending on an individual's situation. By taking a customized strategy, fertility treatments may be more effective overall and require less time and money.

Advancements in egg and sperm freezing

By preserving their reproductive cells at an earlier age through egg and sperm freezing, people can increase their time for family planning. Women significantly benefit from this because fertility decreases with age. Many people have put off having children due to shifting societal attitudes, personal preferences, and professional goals. People can delay having children while still having the opportunity to use their preserved reproductive cells later by freezing their eggs and sperm.

The rising demand for fertility preservation services has created a new market niche in the healthcare sector and opened a wealth of job opportunities and economic possibilities. This trend contributes to the economy, making it a relevant topic for those considering fertility preservation and everyone interested in societal trends and economic development.

Competitive landscape

INVO Bioscience

One business that focuses on the fertility sector is INVO Bioscience. They gained notoriety for creating the cutting-edge INVOcell assisted reproductive technology (ART) device, which is utilized in fertility procedures. Compared to conventional in vitro fertilization (IVF) techniques, the INVOcell device offers a more cost-effective and natural method of vitro incubation of eggs and sperm inside the woman's body.

- In August 2023, the acquisition of Wisconsin Fertility Institute, which was previously disclosed, has been closed, according to INVO Bioscience, Inc. The acquisition supports the business's new-build INVO Center strategy and offers operational scalability and positive cash flow.

Offering Insights

The assisted reproductive technology segment held the largest share of the U.S. fertility market in 2024. The success rates of ART techniques, especially IVF, have improved. Because of this, ART is now the recommended option for individuals and couples seeking fertility treatments. A sizable percentage of foreign patients seeking fertility treatments travel to the United States. The availability of sophisticated ART methods and expertise in the nation further cements this segment's dominance in the global fertility market. More treatment options and excellent success rates have resulted from ongoing developments in reproductive technologies, including enhanced laboratory methods and embryo screening.

- For instance, Data from the Society for Assisted Reproductive Technology (SART) indicates that the success rate of surrogacy embryo transfers for women under 35 is approximately 50% in the US. The success rate falls to about 42% for women in the 35–37 age range and 27% for women in the 38–40 age range.

End-User Insights

The fertility clinics segment led the U.S. fertility market in 2024, the segment is observed to sustain the dominance throughout the forecast period. When it comes to offering assisted reproductive technologies (ART) like in vitro fertilization (IVF), intrauterine insemination (IUI), and fertility preservation, fertility clinics are essential. With its cutting-edge technologies and specialist knowledge, it draws singles and couples dealing with infertility problems. Reproductive clinic domination has been further bolstered by the rising demand for reproductive services resulting from the increasing prevalence of infertility caused by factors such as delayed childbirth and lifestyle changes.

In addition, medical research and technology advancements have significantly increased the success rates of the reproductive therapies that clinics provide. Clients now have great faith in them, and their reputation has improved. The U.S. fertility market's competitive environment has encouraged clinics to innovate continuously.

- For instance, after the Florida-based reproductive company INVO Bioscience announced that it would reverse merge with the private oncology and regenerative medicine company NAYA Biosciences in October 2023, the stock shot up and tripled in early trade. Based on statistics from Investing Pro, the remarkable increase has caused INVO's share price to drop by more than 90% from its 52-week high of $25.40.

Recent Developments

- In January 2024, the creative co-branding venture between Ivy Reproductive, an international center for family-building services, and SMP Pharmacy Solutions, a reproductive specialist pharmacy, aims to improve the patient experience at all 13 of Ivy's fertility centers.

- In June 2023, Prominent ovarian biology-focused biotechnology company Celmatix Inc. has discovered encouraging early leads in its most recent therapeutic development, which aims to create the first oral FSH receptor (FSHR) agonist medication ever. The cutting-edge experimental product has the power to change infertility therapies completely.

U.S. Fertility Market Companies

- Boston IVF Fertility Clinic

- INVO Bioscience

- San Diego Fertility Center

- Celmatix

- FUJIFILM IRVINE SCIENTIFIC

- Carolinas Fertility Institute

- Progyny Inc.

- Cook Medical

Segments Covered in the Report

By Offering

- Assisted Reproductive Technology

- IVF

- Artificial Insemination

- Surrogacy

- Others

- Fertility Drugs

- Gonadotropin

- Anti-estrogen

- Others

- Others

By End User

- Fertility Clinics

- Hospitals

- Clinical Research Institutes

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting