What is the U.S. Complex and Chronic Condition Management Market Size?

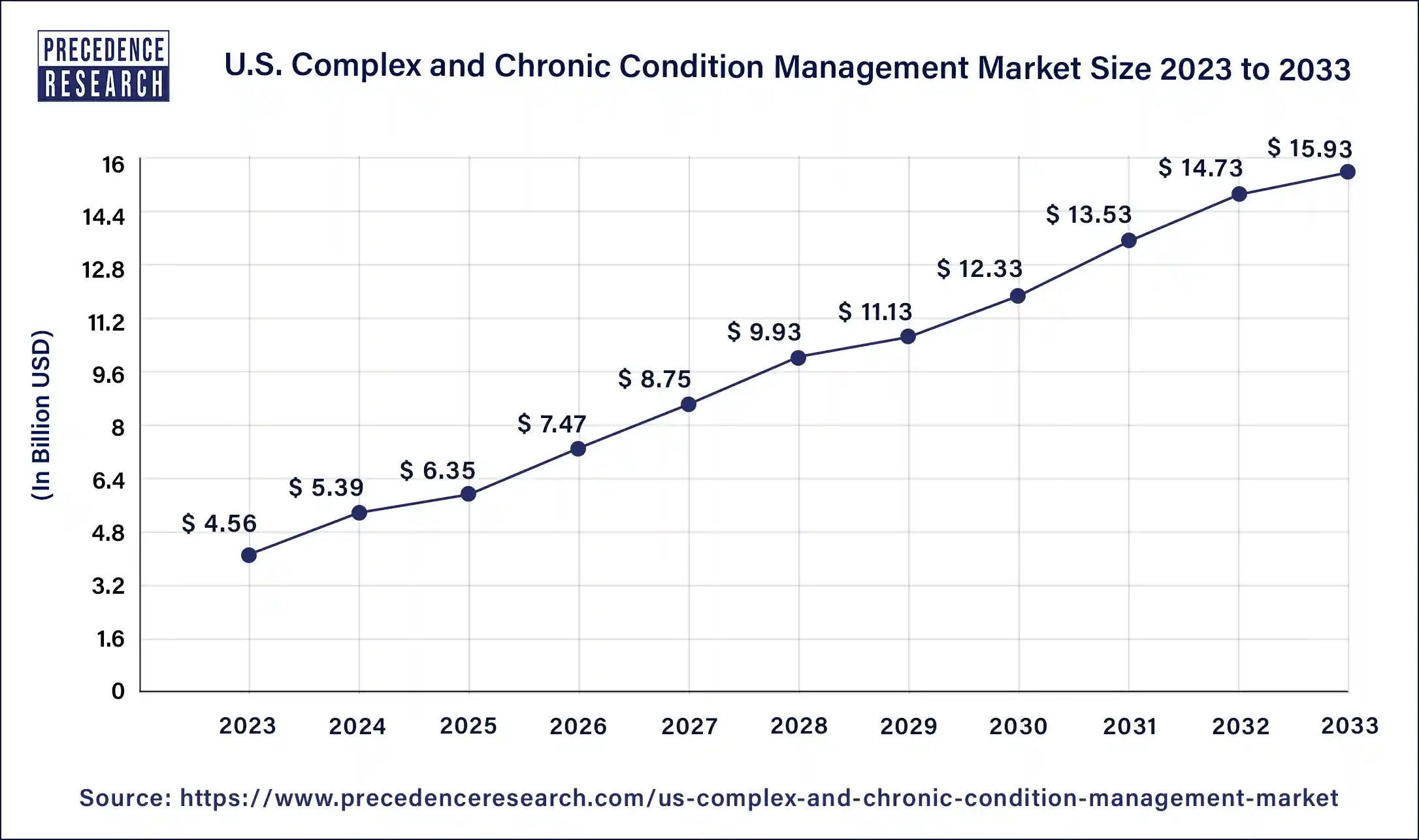

The U.S. complex & chronic condition management market size is calculated at USD 6.35 billion in 2025 and is predicted to increase from USD 7.47 billion in 2026 to approximately USD 18.33 billion by 2035, expanding at a CAGR of 11.18% from 2026 to 2035.

US witnessed a rapid surge in the adoption of telehealthand chronic condition management services during the pandemic owing to the lockdown restrictions. Moreover, the risks of getting infected with the COVID-19 diseases forced people to stay at their homes. This situation increased the adoption of the chronic condition management solutions among the patients who are suffering from one or more chronic diseases. The telehealth services helped the patients to take good care of their health and avoid any negative consequences due to the delayed care.

Moreover, the growth of the telehealth and chronic care management was fueled by the presence of strong telecommunications and IT infrastructure. The majority of the population had access to smartphones and internet that boosted growth of the complex & chronic condition management market in US. This trend is expected to continue during the forecast period and the US & chronic condition market is expected to witness a rapid surge throughout the forecast period.

Market Highlights

- By Services, the Implementation service segment has captured a revenue share of around 42.98% in 2025.

- By Services, the consulting services segment has accounted revenue share of around 34.63% in 2025.

- By Disease Type, the cardiovascular diseases segment has held a revenue share of 28.24% in 2025.

- By Disease Type, the oncology segment has generated a 25.10% revenue share in 2025.

U.S. Complex and Chronic Condition Management: Digital Revolution in Chronic Care

The U.S. complex and chronic condition management market offers a wide range of services and technologies aimed at helping patients with chronic health issues such as heart disease, diabetes, and cancer. This market includes solutions like remote patient monitoring, digital health platforms, data analytics, telehealth, and educational resources, all focused on improving health outcomes and enhancing care coordination. North America, especially the U.S., leads the global market thanks to its advanced healthcare system and widespread use of digital health technologies. The rising rates of chronic illnesses and the growing elderly population, who are more vulnerable to these conditions, drive strong demand for effective management solutions.

Market Outlook

- Industry Growth Overview: The market is set for strong growth from 2026 to 2035, fueled by the rise in chronic diseases, an aging population, and the increasing emphasis on value-based care models. High-growth sectors include technology-enabled solutions such as telehealth, remote patient monitoring (RPM), and AI-driven personalized treatment planning, which improve patient outcomes and lower healthcare costs.

- Strong Shift Toward Sustainable, Patient-Centered Digital Healthcare: This approach utilizes non-invasive monitoring and proactive digital interventions to enhance efficiency and significantly decrease hospital readmissions. Key elements include developing AI ethically with strong data privacy, and employing digital tools to support patient self-management and education, ultimately improving long-term health outcomes and creating a more efficient healthcare system.

- Major Investors: The market is drawing substantial investment from venture capital, private equity, and strategic corporate investors. Motivated by the potential for high returns and impactful solutions, major investors include firms like KKR in specialty additives, as well as leading tech companies and investment firms such as Google, IBM, Philips, and funds like Techstars and Y Combinator, who are actively supporting innovative solutions and startups.

- Startup Ecosystem: The startup ecosystem is thriving, with a strong focus on innovation in digital health technologies, real-time data analytics, and patient engagement platforms. New companies specialize in areas like AI-powered predictive modeling, personalized coaching, and integrated solutions with Electronic Health Records (EHRs). Startups are drawing significant VC funding to develop scalable, tech-driven solutions that change care delivery models.

U.S. Complex & Chronic Condition Management Market Growth Factors

- Increasing Prevalence of Chronic Diseases

About half of the U.S. population has at least one chronic disease. The most common conditions, such as cardiovascular diseases, cancer, chronic obstructive pulmonary disease (COPD), diabetes, and musculoskeletal disorders, are also leading causes of death in the country. This increasing burden of multiple and more severe diseases generates a significant and ongoing demand for management services, fueling market growth. - Growing Geriatric Population

The geriatric population in the U.S. is growing, and as people age, they become more vulnerable to chronic illnesses. Older adults generally incur higher healthcare costs, especially because of the complex, long-term care needed for chronic conditions. This demographic trend is a significant factor affecting the market. - Proliferation of Digital Health Technologies

The market is largely driven by the widespread adoption of digital technologies, including telehealth, remote patient monitoring (RPM), and mobile health apps. These innovations enable remote care delivery, boost patient engagement, and allow for continuous monitoring, which is especially helpful for managing chronic diseases. A strong telecommunications and IT infrastructure supports this growth, making it easier to manage chronic conditions. - Rising Healthcare Expenditure

The rising and substantial costs of managing chronic conditions are a major market driver. Chronic diseases make up a disproportionately large portion of national healthcare spending, and efforts focused on prevention and management can bring substantial health and financial advantages. This economic impact encourages stakeholders to invest in effective and innovative management services to control expenses and enhance outcomes. - Shift Toward Value-Based Care

The healthcare industry is increasingly adopting value-based care models that prioritize patient outcomes and cost-efficiency over service volume. This transition promotes investment in comprehensive management solutions for chronic conditions, enabling providers to deliver improved, more coordinated care, and positioning them for success under these new payment systems.

Government Initiatives Supporting the U.S. Complex and Chronic Condition Management Market

| Initiative/Act | Focus Area | Key Action/Goal |

| CCM & RPM Reimbursement | Reimbursement & Technology | Medicare compensation for virtual care coordination and remote monitoring. |

| Value-Based Care Models | Payment Models | Shifting provider incentives toward patient outcomes rather than service volume. |

| Inflation Reduction Act (IRA) | Drug Cost & Access | Enables Medicare to negotiate drug prices and caps patient out-of-pocket costs. |

| Health Equity/SDOH Programs | Health Equity | Addressing disparities and integrating Social Determinants of Health (SDOH) into care plans. |

| CDC & HHS Programs | Public Health/Prevention | Funding for chronic disease prevention, detection, and self-management support. |

Market Scope

| Report Coverage | Details |

| Market Size In 2025 | USD 6.35 Billion |

| Market Size In 2026 | USD 7.47 Billion |

| Market Size In 2035 | USD 18.33 Billion |

| Growth Rate From 2026 to 2035 | CAGR of 11.18% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Service, Disease Type |

Segment Insights

Disease Type Insights

Cardiovascular diseases accounted for the largest market share at 28.24% in 2024, and this trend is expected to continue over the projected period. The increased prevalence of cardiovascular diseases in US is the primary contributor to the growth of the complex and chronic condition management market. The proliferation of the digital technologies and development of advanced software systems has enabled a systematic care delivery in the US healthcare sector, which helps the patients to avoid any exacerbations and complications. The complex and chronic condition management solution connects the patients devices like smartphones and tablets with the electronic health records (EHR) through an app installed in the patients' device. This solutions analyses the cardiovascular health of the patient, processes the information, and provides alerts and notifications that helps in the timely diagnosis and treatment. The complex and chronic condition management solution and the mobile app serve as a crucial communication point between the caregiver and the patient.

Chronic Obstructive Pulmonary Disease (COPD) are expected to witness maximum gains over the forecast period due to rising patient preference for the complex and chronic condition management services for the COPD condition management. Moreover, the rising prevalence of the COPD among the US population is boosting the growth. It is estimated that around 14.8 million adults in US have been diagnosed with COPD in 2020.

The oncology segment held a significant share of the market in 2024 and is expected to register the highest CAGR in the upcoming period due to the rising prevalence of cancer and the increasing complexity of treatment protocols. Advances in personalized medicine, immunotherapy, and targeted therapies are driving demand for specialized care management solutions to optimize treatment outcomes. Additionally, higher healthcare costs and the need for coordinated, patient-centric care are encouraging providers and payers to adopt comprehensive oncology management programs. These factors collectively position oncology as a high-growth segment within the market.

Service Insights

The implementation services segment dominated the complex and chronic condition management market in US. The telehealth service providers play a crucial role in connecting the patients and the care providers. The arrangements are done by the service providers when a patient requires visiting a clinic or a hospital to acquire therapies and tests. The increased prevalence of various chronic diseases that frequently requires implementation services has fostered the growth of this segment. The patients suffering from the diseases such as cancer, reproductive disorder, and musculoskeletal disorders regularly needs the in-person care for receiving various therapies and conduct tests. Therefore, the implementation services have captured a huge market share owing to its higher revenue generation.

The education services are expected to be the fastest-growing segment. The education services are necessary for various patients who are suffering from COPD and different musculoskeletal conditions. The necessity for gaining information regarding the management of certain health conditions is driving the growth of the education services. The health education service providers are increasingly adopting the digital technologies to reach out to the consumers. The education services play a major role in the self-management of chronic conditions.

The consulting services segment held a significant share of the market in 2024 and is expected to grow at the fastest rate throughout the forecast period due to the increasing demand for expert guidance in managing multifaceted patient needs. Healthcare providers are seeking specialized support to optimize care coordination, implement digital health solutions, and improve patient outcomes for chronic and complex conditions. Additionally, rising regulatory requirements and the need for cost-efficient care delivery are driving organizations to leverage consulting expertise to design and execute effective disease management programs. This combination of clinical, operational, and technological guidance is positioning consulting services as a critical growth driver in the market.

Key Developments

- In 2020, Allscripts announced a definitive agreement to sell its CarePort Health business to WellSky Corp. CarePort solutions assist hundreds of hospitals and post-acute care providers to efficiently coordinate and transition patients through different settings of care.

- In 2020, ScienceSoft received licenses in the United Arab Emirates to offer IT services, IT solutions and IT consultancy and opened its first Middle East office in the UAE. The Middle East launch solidifies ScienceSoft's aspiration to tap into new markets and grow international presence.

- Siemens Healthineers and KlinikumLippe GmbH (KLG) had entered into a ten-year technology partnership for all the healthcare provider's locations. The contract covers delivery and maintenance of large imaging equipment and ultrasound units.

U.S. Complex & Chronic Condition Management Market Companies

- AllScripts

- Siemens Healthineers

- Koninklijke Philips N.V.

- Pegasystems, Inc.

- Cognizant TriZetto Software Group Inc.

- IBM Corporation

- ScienceSoft USA

- MINES & Associates, Inc.

- Healthcare at Home

- Mediware Information Systems

Recent Developments

- In August 2025, Noom introduced the Noom Microdose GLP-1Rx Program, offering personalized microdoses of GLP-1 medication combined with behavioral coaching. The program begins at $119, with ongoing monthly fees of $199, providing members with medication, continuous monitoring, clinician access, and refills as needed. CEO Geoff Cook emphasized its personal significance, noting that 70% of members on microdoses report no side effects. Noom also provides various GLP-1s like Wegovy and Ozempic, along with Metformin, by prescription. (Source: https://www.mobihealthnews.com)

- In November 2024, Teladoc Health announced new AI-enhanced capabilities for its Virtual Sitter solution to improve patient safety and support hospital teams. The AI enables a single staff member to monitor up to 25% more patients, helping address hospital falls, which cost around $50 billion annually. Teladoc's broader suite of connected care solutions aims to reduce administrative burdens and enhance clinician-patient interactions.(Source: https://ir.teladochealth.com)

- In May 2024, WELL Health Technologies and HEALWELL AI launched the second generation of WELL AI Decision Support (WAIDS), which now includes screening for chronic diseases like kidney disease, hypertension, and diabetes. This upgrade improves WAIDS's ability to identify over a hundred rare and chronic diseases, providing actionable insights for clinicians. Dr. Michael Frankel praised the tool for its support in detecting care gaps and assessing patient risk. (Source: https://finance.yahoo.com)

Exclusive Analysis on the U.S. Complex and Chronic Condition Management Market

The U.S. complex and chronic condition management market is poised for accelerated growth, underpinned by the rising prevalence of multimorbidity and chronic diseases, and by an aging population that necessitates longitudinal, patient-centric care. The increasing emphasis on value-based care and regulatory incentives for improved outcomes are driving healthcare providers and payers to adopt integrated management frameworks that encompass predictive analytics, care coordination, remote monitoring, and patient engagement platforms.

Technological enablers, including AI-driven analytics, telehealth, and remote patient monitoring, are creating opportunities for differentiation and efficiency, allowing stakeholders to optimize resource allocation, reduce hospital readmissions, and deliver personalized care pathways. The oncology and diabetes segments, in particular, are demonstrating strong growth potential due to the complexity of treatment regimens and heightened demand for specialized management programs.

Furthermore, the market is witnessing significant investment from both venture capital and corporate players, with a focus on digital health platforms, workflow automation, and consulting services that streamline chronic care delivery. The confluence of technological advancement, demographic trends, and regulatory support positions the U.S. CCCM market as a high-opportunity vertical, with substantial ROI potential for healthcare IT providers, consulting firms, and integrated care organizations.

Segments Covered in the Report

By Disease Type

- Cardiovascular Diseases

- Oncology

- Musculoskeletal

- Women's Health/Fertility/Maternity

- Chronic Obstructive Pulmonary Disease

- Others

By Service

- Consulting Service

- Implementation Service

- Education Service

- Others

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting