What is the U.S. Behavioral Health Market Size?

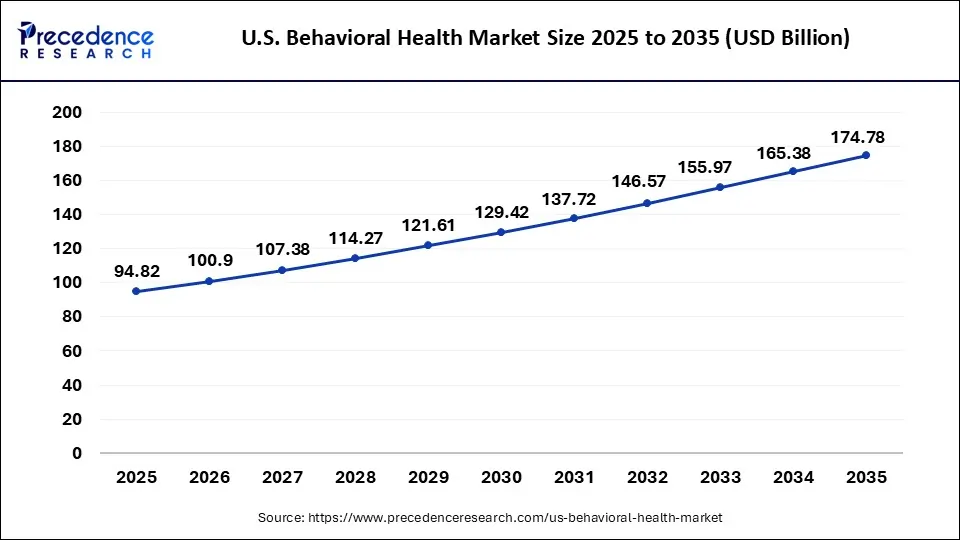

The U.S. behavioral health market size is valued at USD 94.82 billion in 2025 and is anticipated to reach around USD 174.78 billion by 2035 poised to grow at a noteworthy CAGR of 6.31% during the forecast period from 2026 to 2035. The declining mental health in citizens due to various factors such as pre-existing illnesses and the COVID-10 pandemic is expected to drive the US behavioral health industry during the forecast period.

Market Highlights

- By service, the outpatient counseling segment has held the maximum revenue share in 2025.

- By Disorder, the anxiety & depression segment has held the largest revenue share in 2025.

- By End User, the outpatient clinics segment has accounted revenue share in 2025.

Digital Shift and Rising Disorders Drive the Boom in U.S. Behavioral Health

Behavioral health is characterized by the wellbeing of mind, body and spirit. The behavioral symptoms include low mood, lack of positive emotion and other range of associated physical, emotional and cognitive issuessuch assubstance abuse disorders, personality disorders, depression, or other addictive behaviors. It is the most common health condition affecting 1 in every 5 individuals in the US as stated by National Institute of Mental Health in 2019. Additionally, it has been found that 1 in 4 Americansexperience mental disorder yearly as per Substance Abuse and Mental Health Services Administration (SAMHSA). Therefore, the uprising prevalence of mental disorders is anticipated to drive the US Behavioral Health Market.

The rise in adoption of digital behavioral health services during the COVID-19 has opened new avenues for the key participants of the market. Moreover, detrimental impact on many people's mental health during the COVID 19 pandemic hasleveraged the adoption of various technologies to combat the situation. Therefore, improved access to behavioral health care in the US with growing prevalence of mental disorders is fueling the market growth. In addition, remarkable funding for managing the behavioral health issues has fuelled the market for the US behavioral health having a positive impact during the pandemic period. However, dearth of Medicare coverage and inadequate reimbursement to mental care services is impeding the market growth.

Mental disease and drug abuse disorders are both examples of behavioral health illnesses. Mental illnesses are diagnosable conditions marked by persistent and severe changes in thought, emotion, and/or behavior. Substance use disorders are illnesses caused by the misuse of alcohol or other drugs, including prescriptions. People who require behavioral health care may have one or both of these illnesses, as well as physical co-morbidities.

Mental health is a crucial part of a person's total health. The public commonly thinks of a "healthy individual" as someone free of medical diseases, but a perfectly healthy person is someone who is in a state of complete bodily, mental, and social well-being. Furthermore, excellent mental health entails much more than the absence of mental illnesses or disabilities. A wide range of social, biological, and psychological elements all have a role in determining an individual's mental health. External variables, such as stress, socioeconomic situations, prejudice, and violence, are frequently a component of the equation. Individuals with good mental health are more likely to be able to work efficiently, cope with the regular demands of daily life, and contribute to their families and communities.

- In June 2025, legislation to expand Medicaid coverage for behavioral health treatment facilities was introduced by the U.S. House of Representatives. This bill aims to improve access to behavioral health care nationwide by removing long-standing Medicaid funding restrictions for behavioral health treatment in specific facilities, providing new flexibility for states and communities to meet growing behavioral health needs.

What is the role of AI in the U.S. Behavioral Health Market?

By providing users with insights into their emotional patterns over time, artificial intelligence (AI) empowers individuals to cultivate a deeper understanding of their emotions and triggers, equipping individuals with valuable skills for effectively managing emotions and fostering healthier responses to challenges. AI has the potential to improve early detection, provide personalized treatment options, and offer support through innovative platforms may transform how we approach mental wellness, making care more accessible and less stigmatized.

Ethical AI in mental health respects individual autonomy and empowers users to make informed decisions about their treatment options. Human oversight is important to ensure that AI interventions complement rather than replace human judgment and agency. AI can provide real-time interventions and accuracy of diagnosis, ultimately improving the treatment of depression and anxiety.

- In June 2025, the US launch of Wysa Gateway, an AI-powered chatbot designed to streamline how therapy providers and health plans facilitate patient access to care, was announced by Wysa, the global leader in AI-guided mental health support.

Market Trends

- Technological innovations in digital health technologies

- Increasing healthcare expenditure on behavioral health

- Rising prevalence of mental health disorders

- Changing demographics

- Growing demand for telehealth services

- Rising government funding for mental health programs

- Growing availability of effective treatments

Market Outlook

- Industry Growth Offerings- The market is growing through expanded tele-mental health services, digital therapeutics, integrated care models, and increased investment in addiction treatment. Rising demand for personalized therapy, employer-backed mental health programs, and technology-driven care solutions further supports market expansion.

- Global Expansion- The market is expanding globally through growing adoption of telehealth platforms, cross-border digital therapeutics, and partnerships with international providers. Increasing awareness of mental health, rising demand for evidence-based care, and technology-driven treatment models support global penetration.

- Startup ecosystem- The U.S. behavioral health startup ecosystem is expanding with digital therapy platforms, AI-driven diagnostics, virtual counseling services, and tech-enabled addiction treatment solutions. Strong investor interest, rising mental health awareness, and innovative care delivery models are accelerating startup growth.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 94.82 Billion |

| Market Size in 2026 | USD 100.90 Billion |

| Market Size by 2035 | USD 174.78 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 6.31% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Service, Disorder, and End User |

As per the National Alliance of Mental Illness (NAMI), where the evidences about the US mental illness conducted by the US Department of Justice, Centers for Disease Control and Prevention (CDC) and Substance Abuse and Mental Health Services Administration (SAMHSA) is highlighted below

Prevalence of Mental Illness in the US

- 1 in 5 US adults suffers from mental illness every year

- 1 in 20 US adults go through serious mental illness every year

- 1 in 6 US youth aged between 6-17 years experience some king of mental disorder yearly

- Approximately, 50% of lifetime mental illness arises start from age 17, and about 75% by age 24

- Suicide is the second leading cause of death amongst people aged 10-34

As per the Kaiser Family Foundation (KFF) Health Tracking Poll from July 2020, there are numerous adults that were reported with specific negative effects on their mental health and well-being, such as difficulty sleeping (36%) or eating (32%) due to worry and stress over the coronavirus, increases in alcohol consumption or substance use (12%), and worsening chronic conditions.

Market Dynamics

Restraint

Limited access to behavioral health services:

Limited access to behavioral health services includes social stigma of mental health treatment and conditions, limited availability of mental health education and awareness, lack of mental health care professionals and services, and financial barriers to mental health treatment. Untreated mental illness can cause severe emotional, behavioral, and physical health problems. We can experience positive well-being even if we are living with a mental health condition. Having access to effective treatment that helps to manage symptoms, along with the presence of safe, stable, and nurturing relationships and environments, can help. Some of the problems with behavioral health services include that it doesn't work for young people, it is unfair to people in deprived areas, community treatment orders don't work, shocking racial disparities in how it is used, and people detained under the Act don't have enough say in their treatment. 60% people with diagnosable mental health conditions don't get treatment.

Trends in digital behavioral health marketspace

1. Employer-focused startups

Employers are the focus of seven of the top 10 funded digital behavioral health firms. Some of the more well-known startups on this list include Lyra Health, Spring Health, Omada, and Ginger.io. Employer benefit programs are specifically geared to fulfill the demands of working professionals at these companies. These services include behavioral coaching and advice on how to maintain a healthy work-life balance. Individuals use these programs, but they also assist employers in providing mental health treatment options for their employees.

Behavioral health data and insights are provided by startups in this industry to their employers. They also contain a variety of activities and lifestyle change advice, as well as treatment. Ginger, for example, provides behavioral health coaching services in addition to a behavioral health analytics platform that translates mobile data into health insights.

2. Telehealth platforms lead the pack

Before the pandemic, telehealth adoption in psychiatry and therapy was at 80%, according to an Amwell survey. Following the start of the pandemic, this number jumped to 96 % in 2020. And, post-COVID-19, 100 % of those in psychiatry said they would be willing to employ telemedicinein 2020.

Telehealth platforms account for about 55 % of all digital behavioral health businesses that have received funding in 2020 as of December 10th. During the pandemic, platforms specializing in teletherapy and mental care, such as Mindstrong, MDLive, and SonderMind, acquired the most traction. These businesses aim to bridge the gap between patients and behavioral health professionals such as psychiatrists, psychologists, and counselors. Whether through chats, video conversations, or phone calls, they provide counseling electronically.

3. Meditation and sleep-tracking platforms take the spotlight

By the end of July 2020, Ginger.io had noticed a 20% rise in night-time talks with behavioral health counselors, indicating sleep disruption caused by stress and anxiety. According to a Teladoc survey, anxiety is becoming more prevalent among Gen Z and Millennials. In 2020, 58 % of patients with all mental health diagnoses covered in the survey were found to have anxiety and adjustment anxiety disorders, compared to 53 % in 2019. Platforms that allow for meditation and sleep tracking have been particularly popular. These apps aid in the treatment of stress, sadness, and insomnia, among other mental illnesses.

Calm, a meditation and anxiety management software that became a unicorn in February 2019, has just upped its valuation to USD 2 billion following the receipt of USD 75 million in investment. It reported that daily downloads have increased in 2020 compared to the previous year and that customers have listened to more than 1 billion minutes of their material this year, representing a 100 % increase over 2019.

4. The intersection of behavioral health and chronic disease management

According to data conducted by the North Country Health Consortium, 68 % of persons with mental illness had one or more chronic health issues. According to the Centers for Disease Control and Prevention (CDC), six out of every ten adults in the United States have a chronic illness. It is one of the top causes of mortality and disability, as well as a major contributor to the country's yearly healthcare costs of USD 3.5 trillion. An aging population and cultural changes are both contributing to a steady rise in these frequent long-term health issues.

Chronic disease patients have been unable to travel frequently to receive care and control their symptoms, both physical and mental, as a result of COVID-19. Digital behavioral health firms that specialize in treating chronic disease patients have grown in prominence as a result of this. In 2020, chronic disease-related behavior management systems received approximately USD 120 million in investment. Omada and Vida Health have been the market leaders in this space, with funding totaling USD 57 million and USD 25 million, respectively.

Opportunity

1. Payer-based strategy to provide opportunities for market growth

In the United States, the personal and societal costs of behavioral health disorders, such as mental health and substance abuse, are widely established, large, and growing. The epidemic of coronavirus is worsening the problem. Even before the pandemic, the consequences were dire: increased suicide rates, a sharp increase in drug overdose mortality, and a much shorter life expectancy among persons with serious mental illness. These sobering figures create a picture of a mental health care system in disarray, one that is woefully unprepared to satisfy the national demand that is only expected to rise in the aftermath of COVID-19.

Several system-level barriers hinder access to behavioral health care. There is a nationwide deficit of behavioral health providers, which is unlikely to improve in the next ten years. Because of the low compensation, many established providers do not join insurance networks, and patients typically refuse treatment when faced with high out-of-pocket costs. There are several evidence-based therapies available in behavioral health, but only a few practitioners consistently administer these interventions.

Despite a national need for measurement-based behavioral health care, the use of outcome measures is limited due to a lack of provider adoption and technology infrastructure to measure and report results on a large scale. As a result, only around half of Americans with mental illnesses receive treatment. Even when they do, quality isn't measured, and there's reason to believe it's low.

New solutions are needed to address these issues during and after the pandemic, and not simply from policymakers and healthcare providers. Payers, whose influence on behavioral health care access has been questioned or condemned, now have a chance to improve the future. Payers have always been primarily focused on cutting behavioral health costs, frequently in collaboration with carve-out corporations, contributing to the current inaccessible and fragmented system. However, there is a rising awareness of the harmful impact of behavioral health problems on overall health and costs, which is especially important for accountable care organizations (ACOs) and other risk-bearing entities now that COVID-19 has been implemented.

As a result, Blue Cross and Blue Shield of North Carolina (Blue Cross NC), a not-for-profit health insurer serving over four million people, is in the second year of a long-term plan to improve behavioral health access, quality, and efficiency. Eliminating the carve-out, integrating care, raising payment through value-based reimbursement, deploying point solutions at scale, and quantifying effect are the five actions outlined in this essay. While this plan was implemented before COVID-19, it offered a solid foundation for us to pivot rapidly and adapt to the pandemic's new behavioral health features. This model exemplifies how payment reform can spur the establishment of a flexible and responsive behavioral health system, particularly during times of high demand.

Segments Insights

Service Insights

In March 2025, a new Adolescent Mental Health Intensive Outpatient Program for youth in Livingston County, according to a new release, was opened by Trinity Health Livingston. HOWELL Trinity Health Livingston Hospital is offering a new mental health program for youth, helping them improve their well-being while living at home.

Disorder Insights

In March 2025, in the U.S. alone, it is estimated that one in five adults lives with a mental illness. According to the Kaiser Family Foundation, the COVID-19 pandemic exacerbated this issue, with about four in 10 U.S. adults reporting symptoms of anxiety or depressive disorder in 2021, showing a significant increase from before the pandemic. Eight mental health biotech companies are trying to make a difference to people's lives.

End User Insights

In July 2025, a breakthrough in the U.S. healthcare sector by surpassing half a million dollars in revenue within its first year was achieved by a significant achievement, CarePolicy.US, a technology and home health-consulting company established by Anton Fonseka.

Value Chain Analysis

- Clinical Trials

Clinical trials in U.S. behavioral health focus on evaluating new therapies, preventive approaches, and treatment methods for mental and behavioral disorders.

These studies help determine the safety, effectiveness, and real-world impact of drugs, devices, and therapeutic interventions.

They play a vital role in advancing care for conditions such as depression, anxiety, addiction, and personality disorders.

Key Players: National Institute of Mental Health (NIMH), NIH, FDA, Johnson & Johnson, Pfizer, AbbVie, Eli Lilly. - Formulation and Final Dosage Preparation

Formulation and dosage development for U.S. behavioral health drugs focuses on ensuring optimal effectiveness, safety, and stability while meeting strict FDA standards.

The industry is shifting toward personalized treatment options and innovative delivery systems to improve patient outcomes and adherence.

Modern approaches aim to address limitations of conventional formulations, such as slow onset or poor tolerability.

Key Players: Johnson & Johnson, Eli Lilly, Pfizer, AbbVie, Bristol Myers Squibb, FDA, NIH. - Regulatory Approvals

U.S. behavioral health regulatory approvals require navigating a layered framework of federal and state rules that differ by service type, provider category, and technology used.

Compliance areas include state licensing requirements, federal standards such as HIPAA and mental health parity laws, and FDA oversight for digital and clinical products.

These regulations ensure patient safety, data protection, and quality of care.

Key Players: FDA, SAMHSA, CMS, State Health Departments, ONC

Top Vendors and their Offerings

- Acadia Healthcare: Acadia Healthcare provides inpatient and outpatient behavioral health services, including treatment for mental illness, addiction, mood disorders, and trauma. It operates specialty hospitals, residential programs, and comprehensive care centers across the U.S.

- CuraLinc Healthcare: CuraLinc Healthcare offers employee-focused behavioral health solutions, including EAP programs, mental wellness support, substance-use management, and digital therapy tools. Their services emphasize early intervention, care coordination, and improved access to behavioral health resources.

- IBH Population Health Solutions: IBH delivers integrated population health and behavioral health services, including EAP programs, telehealth counseling, substance abuse support, and wellness management. They focus on personalized care, data-driven interventions, and improving mental health outcomes for organizations.

- Universal Health Services (UHS): UHS operates one of the largest behavioral health networks in the U.S., providing inpatient psychiatric care, outpatient therapy, addiction treatment, and specialty behavioral programs for children, adults, and seniors through hospitals and treatment centers.

- Behavioral Health Group, Inc.: BHG focuses on opioid addiction treatment through medication-assisted therapy, counseling, and recovery support. Its clinics provide methadone, buprenorphine programs, and integrated behavioral health services to support long-term recovery and patient stabilization.

Challenges to Implementation of Telehealth

| Level | Additional Challenges |

| Individual client and provider | Increasing access to and comfort using telehealth |

| Interpersonal client-provider relationships |

|

| Organizational |

|

| Regulatory and reimbursement environments | Complying with federal, state, and local regulations |

KEY BENEFITS FOR PATRONS

- The study provides an in-depth analysis along with the current trends and future estimations of the U.S. Behavioral Health market to elucidate the imminent investment pockets.

- A comprehensive analysis of the factors that drive and restrict the market growth is provided.

- The quantitative analysis of the industry from 2016 to 2027 is provided to enable the stakeholders to capitalize on the prevailing market opportunities.

- An extensive analysis of the key segments of the industry is provided to understand the profitability of the various types of products.

- The key players and their strategies are analyzed to understand the competitive outlook of the market.

Recent Developments

- In August 2025, the U.S. launch of ZILOY, a GenAI-powered integrative mental health platform developed by wholly owned subsidiary QuantumNexis, was launched by Healthcare Triangle, Inc., a leader in digital transformation solutions, including managed services, cloud enablement, and data analytics for the healthcare and life sciences industries.

- In December 2024, Youth Mental Health Tracker, backed by SHOWTIME/MTV, Melinda Gates, was launched by Surgo Health. The tracker highlights youth mental health across the U.S. through data, stories, and surveys. A related white paper offers recommendations for policymakers.

Segments Covered in the Report

By Service

- Home-Based Treatment Services

- Outpatient counseling

- Emergency mental health services

- Inpatient hospital treatment

- Intensive care management

By Disorder

- Bipolar Disorder

- Anxiety Disorder

- Depression

- Post-Traumatic Stress Disorder

- Eating Disorder

- Substance Abuse Disorder

- Others

By End User

- Outpatient Clinics

- Hospitals

- Rehabilitation Centers

- Homecare Setting

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting