What is U.S. Over the Counter (OTC) Drugs Market Size?

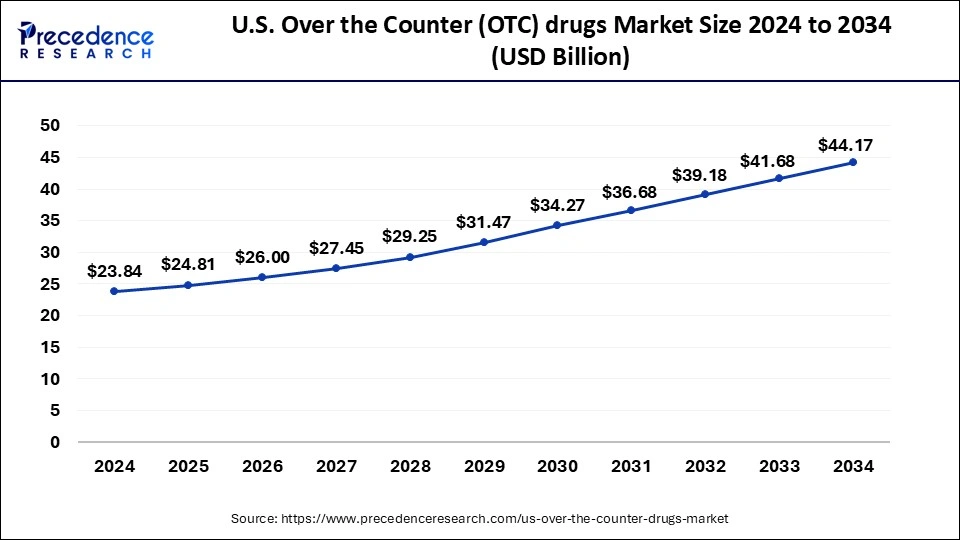

The U.S. over the counter (OTC) drugs market size is estimated at USD 24.81 billion in 2025 and is predicted to increase from USD 26.00 billion in 2026 to approximately USD 44.17 billion by 2034, expanding at a CAGR of 6.60% from 2025 to 2034.

Market Highlights

- By product type, the cough and cold products segment held the largest share of the market in 2024, the segment is observed to witness a notable growth during the forecast period.

- By dosage form, the tablets segment dominated the market with the largest share in 2024.

- By route of administration, the oral segment held the largest share of the market and is expected to sustain the position throughout the forecast period.

- By distribution channel, the drug stores & retail pharmacies segment dominated the U.S. over the counter (OTC) drugs market in 2024.

Over-The-Counter (OTC) Drugs Redefining the U.S. Wellness: The Market Overview

Over the counter drugs refer to medications that are available for purchase without a prescription from a healthcare professional. These drugs are also known as non-prescription drugs and are typically found on the shelves of pharmacies, supermarkets, and convenience stores. Unlike prescription drugs, which require a healthcare provider's authorization, OTC drugs can be bought directly by consumers for self-medication.

OTC drugs are generally considered safe when used as directed and for the intended purpose. They are commonly used to treat minor health conditions such as headaches, cold and flu symptoms, allergies, and mild pain. Common examples of OTC drugs include pain relievers like acetaminophen and ibuprofen, cough and cold medications, antacids, allergy medications, and topical creams for skin conditions.

U.S. Over the Counter (OTC) Drugs Market Growth Factors

- The growing number of people using over the counter drugs to treat minor illnesses is one of the main drivers of the U.S. over the counter (OTC) drugs market's expansion.

- Furthermore, major businesses are diversifying their product lines to reach a larger audience and establish a stronger presence across more regions. The market is being favorably impacted by this as well as the growing number of regulatory bodies' authorization allowing patients to transition from prescription to over the counter drugs.

- In addition, OTC medicines such as antacids, proton pump inhibitors (PPIs), and histamine-2 (H2) blockers are used to treat and prevent acid reflux disease (GERD). In addition, people are becoming more conscious of the value of self-care as a result of the coronavirus illness (COVID-19) outbreak. Consequently, this is driving up sales of dietary supplements and supporting the expansion of the U.S. over the counter (OTC) drugs market.

Major Key Trends in U.S. Over the Counter (OTC) Drugs Market

- Growth of Online and Retail Pharmacies: The swift rise of online and retail pharmacies improves consumer access to OTC medications, providing convenience, tailored services, and home delivery, which contributes to the market's expansion.

- Preference for Natural and Herbal Remedies: Consumers are increasingly leaning towards natural and herbal OTC options, looking for safer, holistic treatments with fewer adverse effects, prompting pharmaceutical companies to focus on herbal formulations.

- Regulatory Approvals Increasing Availability: Regulatory agencies are approving a larger number of OTC drugs, including transitioning some prescription medications to OTC status, thereby broadening consumer access to treatments without needing a doctor's prescription.

- Adoption of Digital Health Technologies: The integration of digital health technologies, like mobile apps and telehealth services, is revolutionizing the OTC market by improving accessibility, adherence, and consumer engagement.

Market Outlook: Steps Towards a Healthy Future

- Industry Growth Overview: Growing self-medication trends, expanding e-commerce channels, growing FDA approvals, and enhancing accessibility and affordability are contributing to the industrial growth of the market.

- Sustainability Trends: The sustainability trend focuses on the use of green chemistry manufacturing principles and eco-friendly and recyclable packaging solutions.

- Global Expansion: The growing preference for affordable and accessible self-medication and the shift from prescription drugs to OTC drugs are driving the global expansion of the market.

- Major Investors: Large multinational pharmaceutical and consumer health corporations, private equity firms, and venture capital firms are the major investors in the market.

- Startup Ecosystem: The startup ecosystem is focusing on the use of digital health and e-commerce platforms to provide specialized patient-centric products.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 24.81 Billion |

| Market Size in 2025 | USD 26.00 Billion |

| Market Size by 2034 | USD 44.17 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 6.60% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Dosage Form, Route of Administration, and Distribution Channel, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing prevalence of various diseases

Acute and chronic illnesses such as respiratory, neurological, orthopedic, and cardiovascular conditions are becoming more prevalent in the US. Every year in the US, heart failure is diagnosed in over 550,000 persons. The Centers for Disease Control and Prevention (CDC) estimate that every year, over 790,000 Americans suffer from a heart attack; of them, about 580,000 experience their first heart attack and 210,000 experience their second. Diabetes, hypertension, tobacco use, obesity, and other risk factors are making chronic cardiac, neurological, and orthopedic illnesses more common.

As the prevalence of chronic illnesses has increased, so has the usage of medications as people look for easy and efficient ways to manage their conditions. For instance, aspirin is frequently used in people with a history of heart disease or who are at high risk of developing heart disease to prevent heart attacks, strokes, and other cardiovascular disorders. In the same way, acetaminophen and ibuprofen are frequently used to lessen pain and inflammation brought on by ailments including headaches, chronic pain in the back, and arthritis. Thus, the increasing prevalence of various diseases drives the U.S. over the counter (OTC) drugs market.

Restraint

Safety concerns and regulatory challenge

OTC medications are typically regarded as safe when used as prescribed, however, abuse or overuse of them may raise safety issues. Making sure that products are safe for consumers is a continuous problem since certain components may have negative effects or interact with other treatments.

Furthermore, the market for over the counter drugs is governed by rules, and modifications to these regulations may affect the accessibility and promotion of certain OTC drugs. Regulatory obstacles may impact the status of already-approved OTC medications or delay the launch of new ones. Therefore, safety concerns and regulatory challenges might be a major impeding factor to the U.S. over the counter (OTC) drugs market's growth.

Opportunity

Growing approvals

The increasing approvals in the industry are expected to offer an attractive opportunity for market growth during the forecast period. For instance, in August 2023, the U.S. Food and Drug Administration (FDA) authorized ZURZUVAETM (zuranolone) 50 mg for people with postpartum depression (PPD), according to a statement from Biogen Inc. and Sage Therapeutics, Inc. For women with PPD, ZURZUVAE is the first and only oral, once-daily, 14-day medication that can significantly reduce depression symptoms.

Furthermore, a Complete Response Letter (CRL) was released by the FDA about the New Drug Application (NDA) for zuranolone, which is intended to treat the major depressive disorder (MDD) in adults. The CRL declared that further research or studies would be required since the application did not offer sufficient proof of efficacy to justify the approval of zuranolone for the treatment of MDD. Sage and Biogen are analyzing the comments and planning the next phase of action.

Regional Insights

Product Type Insights

The cough & cold products segment held the largest share of the U.S. over the counter (OTC) drugs market in 2024. A wide variety of viruses can cause the common cold. The illness is usually harmless, and symptoms go away in two weeks on average. The growth in over the counter (OTC) medicine use in this category can be attributed to the rise in the number of persons who are afflicted with cough, cold, and flu. As a last option, consumers rely on over-the-counter medications for cough, cold, or flu symptoms.

- For instance, the CDC reports that the common cold results in 22 million lost school days annually in the US. In addition, about 1 billion Americans have colds annually.

Dosage Form Insights

The tablets segment held the largest share of the U.S. over the counter (OTC) drugs market in 2024. Over the counter tablets are available in a wide range of therapeutic areas, such as digestive health, allergy relief, cold and flu treatment, pain management, and more. To treat various ailments, tablets may contain a single active ingredient or a mixture of active compounds. Additionally, customers frequently choose tablets for self-medication since they are a practical and simple dosing type. They may be taken without water in some situations due to their discreet and portable design, which makes them popular.

Route of Administration Insights

The oral segment held the dominating share of the market in 2024. The segment is observed to sustain the position in the upcoming period. Oral drugs provide a convenient method of medication delivery, allowing patients to take their medication at home or on the go without the need for medical supervision. This convenience promotes better adherence to treatment plans.

In addition, compared to some other routes of administration (such as injections or intravenous infusions), taking medications orally is generally less invasive and more comfortable for patients. Thus, these advantages drive the segment expansion.

Distribution Channel Insights

The drug stores & retail pharmacies segment held the largest share of the U.S. over the counter (OTC) drugs market in 2024. Drug stores and retail pharmacies provide a diverse range of OTC drugs that cater to different health needs. This includes pain relievers, cough and cold medications, allergy remedies, digestive aids, vitamins, and more. Thus, the availability of these products allows consumers to address common health concerns without visiting a healthcare provider for a prescription.

Growing Healthcare Costs Fuel the OTC Demand in the U.S.

The U.S. over-the-counter (OTC) drugs market is expected to grow significantly during the forecast period, due to increasing healthcare costs, which is increasing the self-medication, driving the demand for OTC drugs. Moreover, growing awareness and their accessibility are also increasing their use. Similarly, the growing FDA approval and innovations are also contributing to the market growth.

Value Chain Analysis

- R&D The R&D of U.S. over-the-counter (OTC) drugs focuses on the conversion of existing prescription medications to OTC status, the utilization of AI, and the development of new dosages.

Key players: Kenvuwe, Haleon, Bayer AG. - Clinical Trials and Regulatory ApprovalsThe clinical trials and regulatory approvals of the U.S. over-the-counter (OTC) drugs involve the safety and efficacy demonstration.

Key players: Haleon, Bayer AG, Sanofi S.A. - Patient Support and ServicesThe patient support and services of the U.S. over-the-counter (OTC) drugs focus on consumer education and engagement initiatives.

Key players: Kenvuwe, Haleon, Sanofi S.A.

Key Players in U.S. Over the Counter (OTC) Drugs Market and their Offerings

- Bayer AG: The company provides products like aspirin, Aleve, Claritin, Midol, and many more.

- Pfizer: Products such as Advil, Caltrate, ChapStick, Centrum, etc, are provided by the company.

- Johnson & Johnson Services Inc.: The company offers products like Zyrtec, Benadryl, Neosporin, Tylenol, etc.

- Sanofi S.A.: Products like Allegra, Rolaids, Gold Bond, Zantac 360, Dulcolax, etc, are provided by the company.

- Novartis AG: Voltaren Gel and Theraflu are the products provided by the company.

Recent Developments: The Emerging Innovations

- In August 2025, to support women's daily nutritional needs, three new products, namely, Vitanergy D3 Multivitamin Gummy, Rejuvenate and Glow 4-in-1 Capsule, and Vitanergy B Complex Gummy with Folate, were launched by Vitanergy Health U.S. Inc.

- In May 2025, AG1 Next Gen blend was launched by U.S.-based AG1, which consists of upgraded probiotics, minerals, and vitamins.

- In January 2025, Johnson & Johnson revealed a USD 14.6 billion acquisition of Intra-Cellular Therapies, which specializes in mental health treatment. This strategic acquisition seeks to strengthen J&J's portfolio with Caplyta, a medication for schizophrenia and bipolar disorder, potentially expanding its OTC mental health offerings.

- In February 2024, AbbVie finalized its acquisition of ImmunoGen, intending to accelerate its entry into the ovarian cancer treatment sector with ImmunoGen's drug Elahere. This acquisition fortifies AbbVie's oncology pipeline and may impact its OTC product development strategies.

- In March 2025,Sun Pharma announced the purchase of Checkpoint Therapeutics, which focuses on immunotherapy and targeted oncology treatments. This acquisition is anticipated to bolster Sun Pharma's position in the U.S. market and might lead to the creation of new OTC oncology-related products.

Segments Covered in the Report

By Product Type

- Vitamin and Dietary Supplements

- Cough & Cold Products

- Analgesics

- Gastrointestinal Products

- Sleep Aids

- Otic Products

- Wart Removers

- Mouth Care Products

- Ophthalmic Products

- Botanicals

- Antacids

- Smoking Cessation Products

- Feminine Care

- Others

By Dosage Form

- Tablets

- Hard Capsules

- Powders

- Ointments

- Soft Capsules

- Liquids

- Others

By Route of Administration

- Oral

- Parenteral

- Topical

- Others

By Distribution Channel

- Drug Stores & Retail Pharmacies

- Hospital Pharmacies

- Online Pharmacies

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting