What is U.S. Multiple Sclerosis Drugs Market Size?

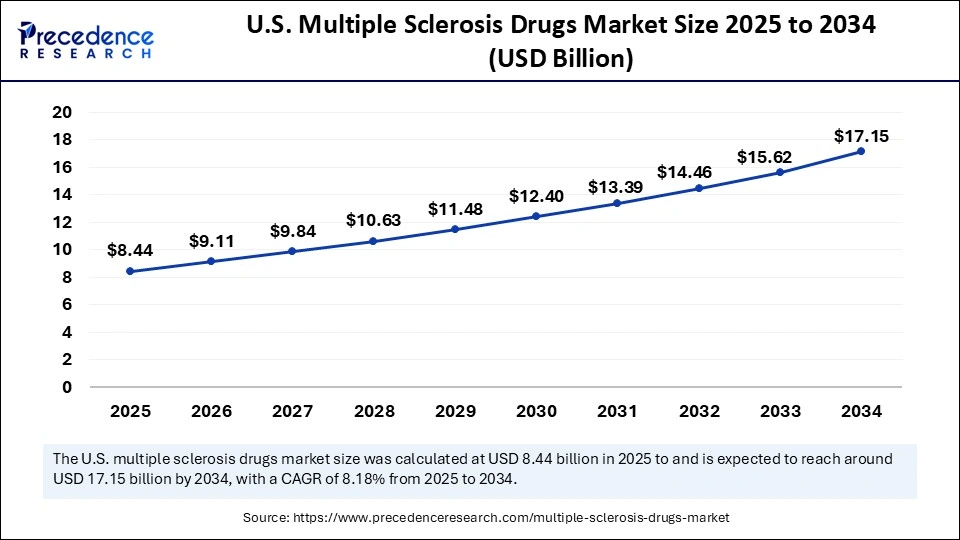

The U.S. multiple sclerosis drugs market size accounted for USD 8.44 billion in 2025 and is predicted to increase from USD 9.11 billion in 2026 to approximately USD 17.15 billion by 2034, expanding at a CAGR of 8.18% from 2025 to 2034. The growth of the U.S. multiple sclerosis drugs market is driven by the increased prevalence and awareness of multiple sclerosis, the availability of better diagnostic tools, and the rising regulatory approvals for innovative therapies.

Market Highlights

- By drug class, the immunomodulators segment captured the largest share of the market in 2024.

- By drug class, the immunosuppressants segment is anticipated to grow at the fastest rate during the forecast period.

- By route of administration, the injection segment held the largest market share in 2024.

- By route of administration, the oral segment is projected to witness the fastest growth over the forecast period.

- By distribution channel, the hospital pharmacies segment dominated the market with the largest share in 2024.

- By distribution channel, the online pharmacies segment is anticipated to expand at the fastest rate between 2025 and 2034.

Impact of Artificial Intelligence on the U.S. Multiple Sclerosis Drugs Market

Pharmaceutical companies in the U.S. are actively adopting AI-based tools to accelerate drug development processes and enhance the efficacy and safety of drugs. Artificial Intelligence AI algorithms can be applied to accelerate the MS drug discovery and development process in several ways, such as the identification of novel drug targets by analyzing large amounts of biological and genetic data. It is able to predict treatment response and optimize clinical trials by leveraging AI tools like Muse for patient recruitment. Researchers are utilizing concepts like digital twins and developing AI-assisted care platforms, which integrate data regarding patients and biomarkers, enabling proactive and personalized treatment approaches for multiple sclerosis.

Strategic Overview of the U.S. Multiple Sclerosis Drugs Industry

Multiple sclerosis (MS) is referred to as a chronic, autoimmune, demyelinating disorder characterized by inflammatory and neurodegenerative damage, generally affecting the brain, spinal cord, and optic nerves. This condition mostly affects individuals aged from 20 to 40, with a higher incidence in women. In the U.S., about 200 new cases of multiple sclerosis are diagnosed every week. Advancements in multiple sclerosis treatment, such as disease-modifying therapies (DMTs), targeting remyelination, autologous hematopoietic stem cell transplantation (AHSCT), immunomodulatory therapies, and nasal spray treatments have increased the success rate.

The increasing diagnosis rates of multiple sclerosis with access to advanced diagnostic tools, ongoing advancements in research & development activities, and rise in regulatory approvals with demonstration of safety and efficacy in clinical trials are boosting the growth of the U.S. multiple sclerosis drugs market. There is a strong emphasis on developing targeted therapies, which further support market growth. Moreover, improvements in distribution networks and the presence of leading pharmaceutical companies that are investing in drug discovery are supporting the growth of the market.

U.S. Multiple Sclerosis Drugs Market Growth Factors

- Patient Advocacy Networks: The U.S. has several patient advocacy networks, such as the National Multiple Sclerosis Society (NMSS), Multiple Sclerosis Association of America (MSAA), Can Do MS, and Patient Access Network (PAN) Foundation. These organizations offer a wide range of resources and services, such as treatment information, financial aid for medications, education programs, and support for patients with multiple sclerosis.

- Government Support and Research Funding: The U.S. government and the U.S. FDA plays a major role in regulating and approving multiple sclerosis drugs and disease-modifying therapies by ensuring their safety and efficacy. Government agencies like the National Institutes of Health (NIH) and the Agency for Healthcare Research and Quality (AHRQ) provide research funding for the prevention and treatment of MS. Additionally, the Veterans Health Administration (VHA) provides comprehensive care for people affected with MS.

Market Outlook

- Market Growth Overview: The U.S. Multiple Sclerosis Drugs market is expected to grow significantly between 2025 and 2034, driven by the high and increasing disease prevalence, strong and innovative drug pipeline, and shift towards oral and convenient therapies. The U.S. advanced healthcare infrastructure and government initiatives, and patient support.

- Sustainability Trends: Sustainability trends involve decarbonization and energy efficiency, green chemistry and sustainable manufacturing, and sustainable packaging solutions. Improvement in drug accessibility and affordability and ethical clinical trials, and diversity.

- Major Investors: Major investors in the market include Biogen, Genentech (Roche), Novartis, Sanofi, and Teva Pharmaceutical.

- Startup Economy: The startup economy in cell and gene therapy, AI-powered drug discovery, and novel oral and small molecule drugs. Alternative delivery methods and biomarkers, and precision medicine.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 8.44 Billion |

| Market Size in 2026 | USD 9.11 Billion |

| Market Size by 2034 | USD 17.15 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.18% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Drug Class, Route of Administration,Distribution Channel |

Market Dynamics

Drivers

Increased Prevalence of Multiple Sclerosis

According to the National Multiple Sclerosis Society, approximately one million people in the U.S. were living with multiple sclerosis in 2024. The rising number of cases of MS creates the need for safe and effective drugs for effective treatment. People have become more aware of multiple sclerosis, boosting the demand for personalized therapies. Due to the increased MS prevalence, governments and health agencies are investing in research activities for developing disease-modifying therapies (DMTs). Ongoing clinical trials and growing emphasis on progressive multiple sclerosis further drive the growth of the U.S. multiple sclerosis drugs market.

Restraint

High Treatment Costs

Disease-modifying therapies are essential for managing multiple sclerosis and ensuring longer patient survival rates. However, these therapies are quite expensive, making them unaffordable for many patients. High costs of drugs for MS may cause decreased compliance to treatment regimens, leading to disease mismanagement. Moreover, limited insurance coverages lead to significant out-of-pocket costs for patients, which potentially limits the growth of the U.S. multiple sclerosis drugs market.

Opportunity

Continuous Progresses in Drug Development

The favorable research landscape in the U.S., backed by well-established healthcare infrastructure and advanced research facilities, fosters innovation in the development of drugs and disease-modifying therapies for multiple sclerosis. Ongoing clinical trials, increased investments by pharmaceutical companies for developing novel treatment approaches, growing emphasis of manufacturers on expanding product portfolios, and rising approvals from the U.S. Food and Drug Administration (FDA) are creating immense opportunities in the U.S. multiple sclerosis drugs market.

Segment Insights

Drug Class Insights

The immunomodulators segment dominated the market with the highest share in 2024. Immunomodulators are widely used in newly diagnosed individuals with relapsing-remitting multiple sclerosis (RRMS) due to their well-established safety profiles and availability in self-injectable formulations, offering autonomy and convenience of at-home treatment for patients. Glatiramer acetate and interferon beta products are commonly used immunomodulators in treating RRMS, which is the most common form of MS. Furthermore, increased access to cost-effective treatments for patients, expiring patents, advancements in diagnostic tools facilitating early detection, focus on developing combination therapies, and rising investments in research and development activities bolstered the growth of this segment.

The immunosuppressants segment is expected to grow at the fastest rate during the forecast period. The growth of this segment is attributed to the rising prevalence of multiple sclerosis. Pharmaceutical companies are investing heavily in developing novel immunosuppressant and formulations. The growing patient preference for effective therapies, the rising demand for personalized treatments, and a strong emphasis on long-term disease management strategies are likely to support segmental growth. Furthermore, enhanced comprehension of specific immune mechanisms in MS is boosting the development of targeted immunosuppressant therapies.

Route of Administration Insights

The injection segment held the largest share of the U.S. multiple sclerosis drugs market in 2024. Injectable drugs have proven to be highly effective in managing multiple sclerosis, owing to their high safety and efficacy. Continuous advancements in research have accelerated the development of long-acting injectable formulations with reduced administration frequency. The availability of auto-injectors and pre-filled syringes for self-administration ultimately enhanced patient compliance and convenience. Additionally, the increased approvals for injectable drugs bolstered this segment's growth.

The oral segment is projected to witness the fastest growth over the forecast period. Oral formulations offer significant advantages over injectable or infusion therapies, such as ease of administration, improved safety and tolerability profiles, and reduced side effects, which is a key factor boosting their demand. Pharmaceutical companies are investing in research and development of oral formulations with enhanced safety and efficacy. There is a strong focus on addressing progressive forms of multiple sclerosis, creating a need for oral MS drugs due to their minimal side effects. Furthermore, the emergence of generic oral drugs, increased focus on timely interventions in the initial stages of multiple sclerosis, and continuous development of branded oral drugs are driving the growth of this segment.

Distribution Channel Insights

The hospital pharmacies segment dominated the U.S. multiple sclerosis drugs market with the largest share in 2024. Hospital pharmacies play a crucial role in managing the treatment of multiple sclerosis (MS), as many MS disease-modifying therapies are administered intravenously (IV) in hospital settings. They offer specialized services such as preauthorization assistance, medication counseling, and patient assistance programs. Interdisciplinary teams in hospitals ensure optimal management of MS, while maintaining a patient-centric approach and helping patients as well as healthcare professionals to make informed decisions by interacting with hospital pharmacists. Furthermore, the easy accessibility to these pharmacies improves access to MS drugs.

The online pharmacies segment is anticipated to expand at the fastest rate in the coming years. The growth of this segment can be attributed to the rise of healthcare e-commerce. Online pharmacies offer a convenient way for patients to obtain MS drugs. The growing awareness and digital literacy among the public, the availability of low-price medications on online platforms, and the rising integration of online pharmacies with telehealth services further support segmental growth. Online pharmacies allow patients to buy MS drugs from the comfort of their homes. They provide access to a wide range of MS drugs and doorstep delivery service, which is beneficial for patients in remote areas or with mobility restrictions. The expansion of the e-commerce sector has increased the proliferation of online pharmacies, contributing to segmental growth.

U.S. Multiple Sclerosis Drugs Market Value Chain Analysis

- Research & Development (R&D) and Clinical Trials

This critical initial stage involves the discovery of new drug candidates and rigorous testing through preclinical and clinical trials (Phases I-IV) to ensure safety and efficacy.

Key Players: Biogen, F. Hoffmann-La Roche Ltd. (Genentech), Novartis AG, Sanofi SA, Merck KGaA, Bristol-Myers Squibb Company, Teva Pharmaceutical Industries Ltd. - Manufacturing & Production

Once a drug receives FDA approval, it moves to commercial-scale manufacturing, including active pharmaceutical ingredient (API) production, formulation, and sterile packaging to ensure quality and integrity.

Key Players: Biogen, Teva Pharmaceutical Industries Ltd. (a major generic producer), Novartis AG, Sanofi SA, Merck KGaA, Pfizer Inc., Viatris Inc. (Mylan NV) - Distribution & Logistics

Approved drugs are transported through complex supply chains from manufacturing plants to various points of care, including hospitals, retail pharmacies, and specialized distribution centers.

Key Players: Major pharmaceutical companies often work with large wholesale distributors (e.g., Cardinal Health, McKesson, AmerisourceBergen) and pharmacies to reach end-users efficiently.

Key Players in U.S. Multiple Sclerosis Drugs Market and Their Offering

- AbbVie Inc. has previously collaborated with Biogen on the development of MS drugs, such as the once-monthly injection Zinbryta, which was later voluntarily withdrawn from the market due to safety concerns.

- Pfizer has contributed to the U.S. MS market through a collaboration with EMD Serono for the distribution of Rebif, a disease-modifying drug administered via injection for relapsing forms of MS.

- Biogen is a dominant force in the U.S. MS drugs market and held a significant market share with products like Tecfidera, Vumerity, and Tysabri. The company heavily invests in R&D and has a robust pipeline, focusing on both oral and injectable immunomodulator and antibody therapies to treat various forms of MS.

- TG Therapeutics contributes to the market through its development of innovative therapies, including ublituximab, a monoclonal antibody for the treatment of relapsing forms of MS. The FDA approval of this product, known as Briumvi, further expands the range of available treatment options for patients in the U.S.

- Genentech (Roche) is a major player and captured a considerable market share with its blockbuster drug Ocrevus (ocrelizumab), which is used for both relapsing and primary progressive forms of MS. This monoclonal antibody drug is highly effective and has significantly impacted the treatment landscape in the U.S.

- Kyverna Therapeutics, Inc. is a clinical-stage biopharmaceutical company focused on developing novel cell therapies for autoimmune diseases, including MS. Their approach using engineered T-cell therapies (like their anti-CD19 CAR-T candidate, KYV-101) represents a potentially transformative contribution to managing autoimmune conditions.

- Immunic Therapeutics is a clinical-stage biopharmaceutical company developing novel oral immunomodulatory drugs for the treatment of chronic inflammatory and autoimmune diseases, including MS. Their lead asset, vidofludimus calcium (IMU-838), is in clinical trials for relapsing MS and other conditions, aiming to provide a new oral therapeutic option.

- Zenas BioPharma, Inc. is a biopharmaceutical company focusing on the development and commercialization of innovative immunology-based therapies, which may include treatments for autoimmune disorders like MS. While specific MS products are not detailed, their focus on immune-mediated diseases contributes to the broader research and development pipeline for potential future treatments.

Industry Leader's Announcement

- In March 2025, AdventHealth Neuroscience Institute started recruiting patients for IDP023-2-101, which is a new Phase Ib clinical trial of investigational drug IDP-023 for people suffering from primary progressive or non-active secondary progressive multiple sclerosis. AdventHealth is among first in the U.S. to offer IDP023-2-101 clinical trial for patients with progressive multiple sclerosis. Dr, Anita Fletcher, MD, neurologist and Medical Director of Neuroscience Research, said, “There have been significant advancements in treating relapsing multiple sclerosis. However, most of the standard-of-care disease-modifying therapies available to us are not fully effective in slowing progression for PPMS or non-active SPMS. This is because the disease-modifying medications we currently have aim to reduce inflammation in the central nervous system, and with the progressive forms of multiple sclerosis, the primary challenge is nerve degeneration rather than inflammation. The aim of IDP023 is to realign the patient's immune system to slow or halt progression of the MS.”

Recent Developments

- In February 2025, TG Therapeutics Inc., presented data from the ULTIMATE I & II Phase 3 trials and the ENHANCE Phase 3b trial evaluating BRIUMVI (ublituximab-xiiy) for patients with relapsing forms of multiple sclerosis (RMS). The data was presented at the Americas Committee for Treatment and Research in Multiple Sclerosis (ACTRIMS) annual forum, demonstrating a compatible safety and tolerability profile in about 80 patients receiving the maintenance BRIUMVI dose in 30 minutes.

- In August 2024, Bristol Myers Squibb, an American multinational pharmaceutical company, invested in Abata Therapeutics for advancing the development of Abata's experimental regulatory T-cell (Treg) therapies applied for severe autoimmune and inflammatory diseases such as progressive multiple sclerosis.

Segments Covered in the Report

By Drug Class

- Immunomodulators

- Immunosuppressants

- Interferons

- Others

By Route of Administration

- Oral

- Injection

- Intramuscular

- Intravenous

- Subcutaneous

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting