What is the Over the Counter (OTC) Drugs Market Size?

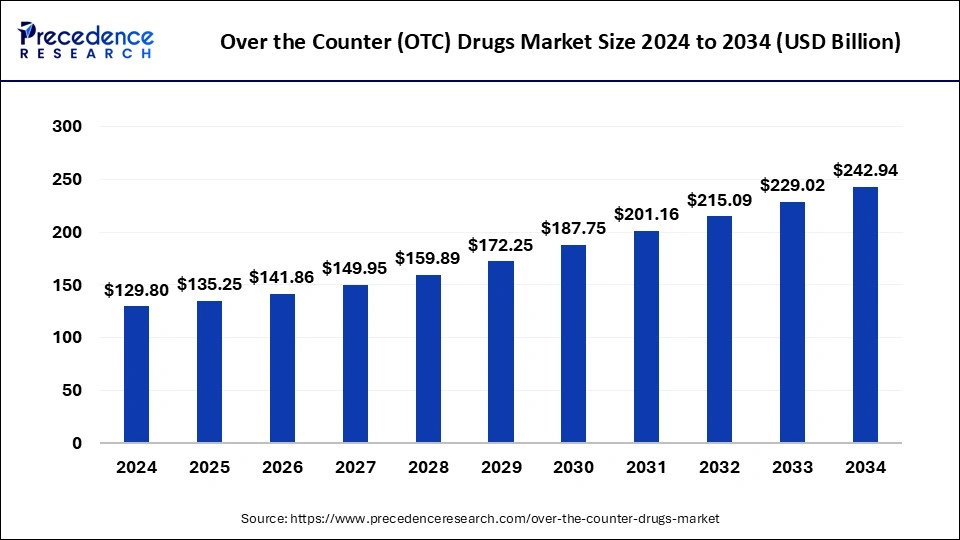

The global over the counter (OTC) drugs market size is accounted at USD 135.25 billion in 2025 and predicted to increase from USD 141.86 billion in 2026 to approximately USD 242.94 billion by 2034, expanding at a CAGR of 6.72% from 2025 to 2034.

Over the Counter (OTC) drugs MarketKey Takeaways

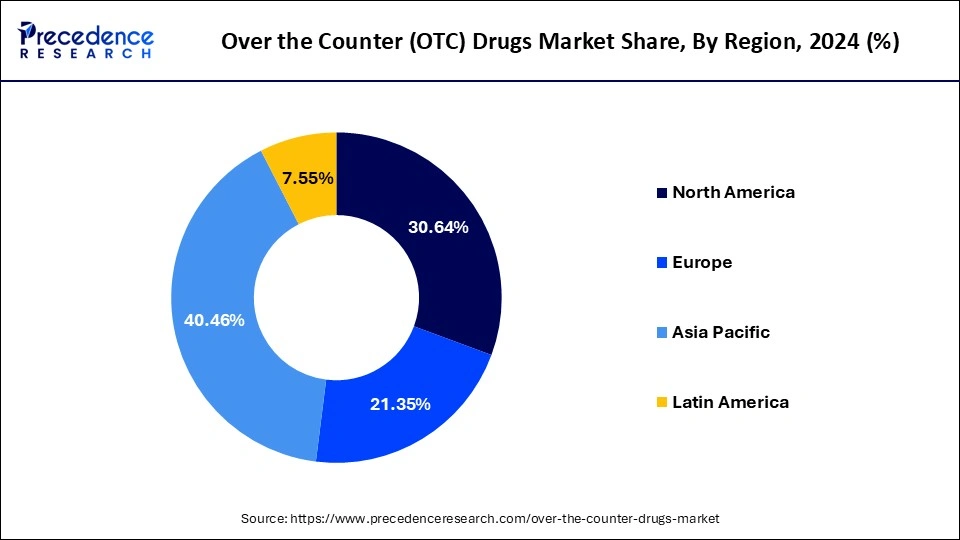

- The North America over the counter (OTC) drugs market size was valued at USD 39.77 billion in 2024.

- By route of administration, the oral segment has accounted for 56.66% revenue share in 2024.

- By route of administration, The parenteral segment has captured 20.24% market share in 2024.

AI in the Market

AI, or artificial intelligence, is indeed a game-changer in the field of Over-the-Counter (OTC) drugs, steering the market to new heights by deeply cross-cutting through product development, better pharmacy management, and higher customer satisfaction. The application of AI in this regard is quite widespread as the analytics AI-driven allows firms to always be on top of their competitors' moves by closely monitoring their pricing, position in the market, and marketing strategies, thus improving the basic decision-making process. On top of that, AI brings the customer closer to the company by personalizing the communication with the customer, predicting what is going to be in demand someday soon, and even handling the management of the campaigns all the time. The pharma industry indulges in AI-supported ingredient discovery and formulation, which helps in bringing the product faster to market and reducing the regulatory risks at the same time. Retail pharmacies have now become smart ones by using AI in the areas of demand forecasting, inventory management, and dispensing automation. The use of AI-powered chatbots and virtual assistants for the provision of medication information has increased customer satisfaction and adherence to treatments because customers are now receiving the right advice from the AI experts.

Over the Counter (OTC) Drugs Market Growth Factors

- The growth of global over the counter drugs market is being driven by growing demand for self-medications and drugs. As per the Pharmacoepidemiology and Drug Safety, roughly 20% of the Spanish population uses non prescribed medication, with females being more likely to do so.

- In addition, growing approvals for over the counter drugs is also boosting expansion of global over the counter drugs market. For example, Sanofi declared in February 2017 that the Food and Drug Administration has permitted Xyzal Allergy 24HR as an over the counter drugs for seasonal allergies.

- Another factor propelling the growth of global over the counter drugs market is due to cost effective in nature over the counter drugs. As per the survey published by the National Center for Biotechnology Information, over the counter drugs save the U.S. around $100 billion each year. The increase in the older population, as well as favorable regulatory measures, will boost the global over the counter drugs market's growth pace.

- In addition, increased patent expirations of many pharmaceuticals, resulting in their utilization as over the counter drugs, and the low cost of over the counter drugs are factors that will drive the expansion of global over the counter drugs market over the forecast period.

- The surge in demand for individualized drugs for minor disorders and the implementation of treatment procedures by healthcare payers are propelling the global over the counter drugs market.

- On the other hand, the global over the counter drugs market's growth is predicted to be limited by rigorous government rules and lack of knowledge among individuals. Furthermore, the global over the counter drugs market is likely to benefit from increased research and development spending.

- The global market for over the counter drugs is fiercely competitive, with a number of prominent players. Few of the large market players are currently controlling the market in terms of market share.

The prescription drugs, on the other hand, can only be sold to consumers who have a valid prescription. Over the counter (OTC) drugs are the medicines that is sold directly to a consumer without any kind of prescription from a healthcare providers or doctors. Over the counter (OTC) drugs are chosen by regulatory agencies in many countries to guarantee that they contain chemicals that are safe and effective when taken without the supervision of a physician. The active pharmaceutical ingredient (API) of over the counter (OTC) drugs is usually regulated rather than the end product. Governments can freely create chemicals, or combinations of ingredients, into proprietary mixes by controlling APIs rather than specific medication formulations.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 242.94 Billion |

| Market Size In 2026 | USD 141.86 Billion |

| Market Size In 2025 | USD 135.25 Billion |

| Growth Rate | CAGR of 6.72% from 2025 to 2034 |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Product Insights

Based on the product, the cold & cough remedies accounted revenue share of 25% in 2021. Due to seasonal variations, the sector is expected to dominate the market due to an increase in the occurrence of common colds and coughs among the population. Increased senior population, which is more susceptible to cough and colds, increased automobile pollution, more R&D activities, and increased awareness about advanced medications are all expected to help the cough remedies segment create larger revenue in the approaching years. An increase in the number of testing and research facilities, particularly in the pharmaceutical and biotechnology industries, would contribute to the growth of segment.

Cold and cough drugs can help to alleviate the symptoms of a regular cold. A runny nose, sore throat, coughing, and sneezing are all common cold symptoms. Cold and cough are the most prevalent illnesses in children under the age of ten and elderly population over 65, as per the Centers for Disease Control and Prevention, which is driving up demand for treatments.

- The vitamin and dietary supplements segment was valued at USD 63.23 billion in 2024 and it is expected to grow at a CAGR of 7.36% from 2025 to 2034.

- The cough and cold productssegment was estimated at USD 17.65 billion in 2024 and it is expected to grow at a CAGR of 7.15% from 2025 to 2034.

- The analgesics segment was accounted at USD 15.97 billion in 2024 and it is expected to grow at a CAGR of 6.83% from 2025 to 2034.

On the other hand, the analgesics is expected to grow at rapid pace during the forecast period. This is owing to the growing senior population, which is driving up demand for pain relievers, as well as the introduction of new over the counter (OTC) drugs pain relievers. Anti-inflammatory analgesics reduce inflammation, while opioid analgesics modify pain discernment in the mind. Few of the analgesics are accessible without a prescription, while others require one. The goal of better healthcare outcomes drives the global need for analgesics. This includes pain management, which necessitates a multidisciplinary approach in order to be effective. Apart from that, manufacturers' development of opioid analgesics with abuse-deterrent qualities has resulted in a significant demand for analgesics all over the world.

Over the Counter (OTC) Drugs Market Revenue, By Product, 2022-2024 (USD Million)

| Product | 2022 | 2023 | 2024 |

| Vitamin and Dietary Supplements | 58,668.36 | 61,042.45 | 63,623.01 |

| Cough and Cold Products | 16,345.25 | 16,972.87 | 17,655.23 |

| Analgesics | 14,882.98 | 15,408.28 | 15,979.84 |

| Gastrointestinal Products | 8,201.19 | 8,507.62 | 8,840.83 |

| Sleep Aids | 4,936.54 | 4,998.45 | 5,069.94 |

| Otic Products | 3,473.40 | 3,520.5 | 3,574.55 |

| Wart Removers | 3,385.12 | 3,420.5 | 3,462.40 |

| Mouth Care Products | 3,353.20 | 3,416.06 | 3,486.15 |

| Ophthalmic products | 2,534.92 | 2,524.77 | 2,519.02 |

| Botanicals | 2,271.15 | 2,269.10 | 2,270.99 |

| Smoking Cessation Products | 1,249.98 | 1,283.76 | 1,320.74 |

| Feminine Care | 1,017.06 | 1,032.97 | 1,050.95 |

| Others | 810.83 | 882.55 | 943.76 |

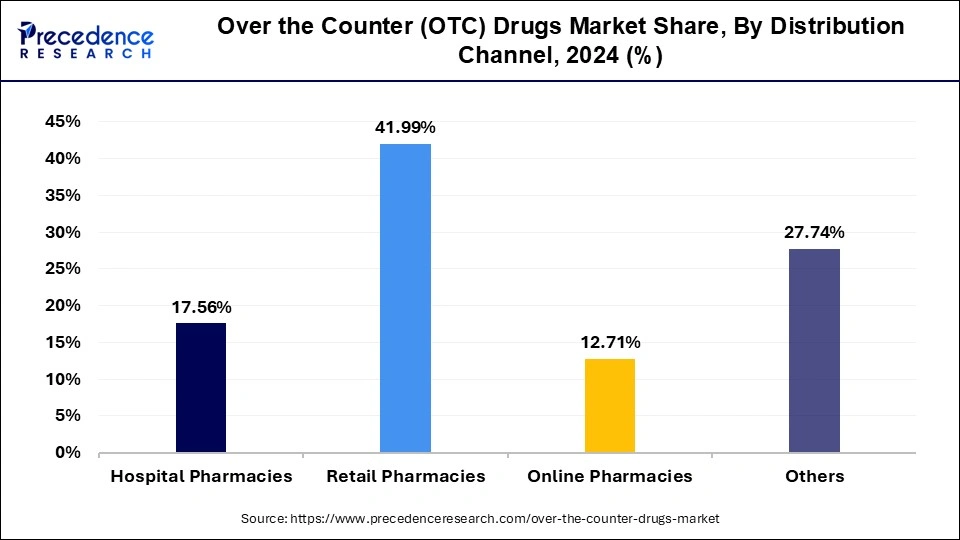

Distribution Channel Insights

Based on the distribution channel, the drug stores and retail pharmacies segment dominated the market with highest market share during 2021. This is attributed to the rising number of retail pharmacies providing over the counter (OTC) drugs. Due to the growing number of retail pharmacies offering over the counter medications and growing patient preference for these items, the drug stores and retail pharmacies category is expected to account for the greatest market share over the projection period.

- The hospital pharmacies segment was valued at USD 22.79 billion in 2024 and it is expected to grow at a CAGR of 5.9% from 2025 to 2034.

- The retail pharmaciessegment was valued at USD 54.50 billion in 2024 and it is expected to grow at a CAGR of 6.62% from 2025 to 2034.

- The online pharmaciessegment was valued at USD 16.50 billion in 2024 and it is expected to grow at a CAGR of 7.26% from 2025 to 2034.

On the other hand, the online pharmacies segment is fastest growing segment in the over the counter (OTC) drugs market. This is attributed to the increase in internet penetration in the developing and underdeveloped regions. An online pharmacy, often known as an internet pharmacy or a mail order pharmacy, is apharmacy that works online and provides orders to consumers by shipping firms, mail, or an online pharmacy web portal.

Over the Counter (OTC) Drugs Market Revenue, By Distribution Channel, 2022-2024 (USD Million)

| Distribution Channel | 2022 | 2023 | 2024 |

| Hospital Pharmacies | 21,144.66 | 21,934.69 | 22,793.80 |

| Retail Pharmacies | 50,963.66 | 52,657.00 | 54,501.18 |

| Online Pharmacies | 15,246.55 | 15,847.75 | 16,501.29 |

| Others | 33,775.13 | 34,840.55 | 36,001.13 |

Regional Insights

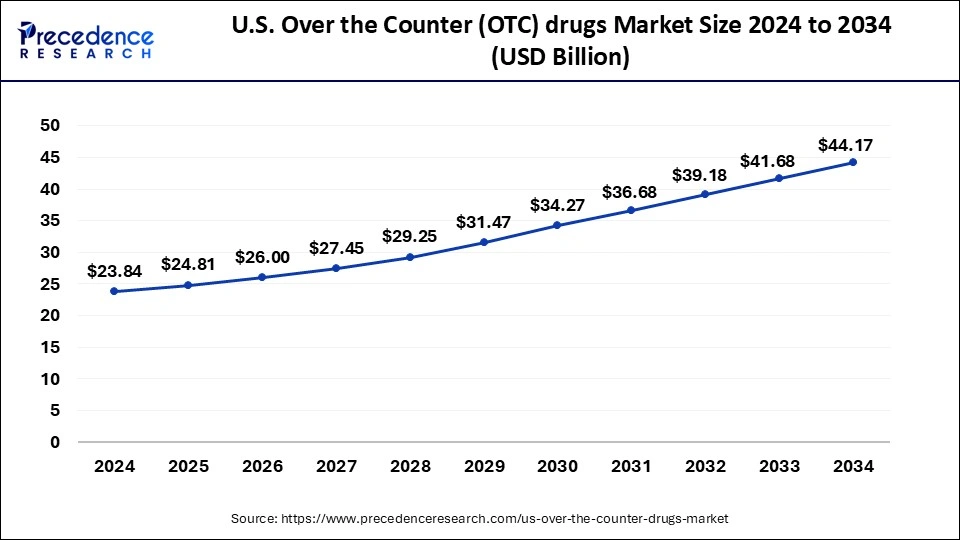

U.S. Over the Counter (OTC) drugs Market Size and Growth 2025 to 2034

The U.S. over the counter (OTC) drugs market size was exhibited at USD 39.77 billion in 2024 and is projected to be worth around USD 75.93 billion by 2034, growing at a CAGR of 6.94% from 2025 to 2034.

Based on the region, the North America segment dominated the global over the counter (OTC) drugs market in 2021, in terms of revenue and is estimated to sustain its dominance during the forecast period. The North America region's supremacy can be linked to consumer's growing preference for over the counter (OTC) drugs over prescription drugs. The growth of over the counter drugs market in North America region is being driven by the growing consumption of over the counter drugs. According to a National Institute of Health report, 93% of adults in the U.S. prefer to treat minor illnesses with over the counter drugs before seeking professional help, and 85% of parents prefer to treat minor illnesses in their children with over the counter drugs before seeking professional help. In addition, the growing preference for over the counter drugs over the prescription drugs is also driving the growth of North America over the counter drugs market.

On the other hand, the Europe is estimated to be the most opportunistic segment during the forecast period.Due to the widespread of self-medication and the presence of a big number of over the counter (OTC) drugs manufacturing companies in this region, Europe is predicted to be the fastest growing region during the forecast period. In addition, increased public awareness of over the counter (OTC) drugs is propelling the market expansion in this region.

One of the significant factors driving the growth of Europe over the counter drugs market is growing awareness about over the counter drugs among people. In addition, existence of major market players is also boosting the expansion of Europe over the counter drugs market. The Europe over the counter drugs market is expanding because to a growing senior population with a variety of illnesses caused by ageing impairments. With increased product penetration and availability, demand in the Europe region will continue to climb, boosting over the counter drugs market growth in the region.

- The North America over the counter (OTC) drugs market was valued at USD 39.76 billion in 2024 and is expected to grow at a CAGR of 6.94%.

- The Europe over the counter (OTC) drugs market was valued at USD 27.71 billion in 2024 and it is growing at a CAGR of 5.3%.

- The Asia Pacific over the counter (OTC) drugs market was valued at USD 52.51 billion in 20224 and it is exping at a CAGR of 7.15%.

How is North America leading in the Over the Counter (OTC) Drugs Market?

Due to the high expenses in healthcare, the sophisticated distribution systems, and the strong inclination of consumers towards self-care, North America takes the lead in the market of OTC drugs. The region's large pharmacy networks and the increase in online access to OTC medications are its advantages. Besides, people's awareness of prevention as a method of health care and the presence of many manufacturers in the area create conditions for continuous innovation in the fields of formulations, packaging, and delivery methods.

United States Over the Counter (OTC) Drugs Market Trends:

The U.S. takes the lead as the largest market for OTC drugs, which is supported by a strong pharmaceutical network and a very positive attitude of consumers towards OTC drugs. Moreover, the preventive care awareness is high and the products are very easily accessible through online and offline channels, which is the main reason for the growth. Continuous innovations in products, enlarging the digital retail space, and consumer education campaigns remain the active and continuous forces behind the U.S. as the largest market for OTC healthcare solutions.

What are the driving factors of the Over the Counter (OTC) Drugs Market in Europe?

Europe is estimated to be the most opportunistic segment during the forecast period. The very good healthcare system in Europe is one of the reasons for the sustained demand for OTC drugs. The wide acceptance of herbal and plant-based products and consumers' greater emphasis on health are market drivers. The differences in regulations from one country to another determine the degree of accessibility for new products and the speed of innovation. The constant focus on being eco-friendly and patient-oriented leads to the growth of the market; the large companies in the region are making use of digital tools and eco-friendly packaging to improve their effectiveness and to engage with consumers.

Germany Over the Counter (OTC) Drugs Market Trends:

Germany's location in Europe's OTC drugs market is very important as it is supported by a powerful pharmaceuticals industry and great consumer confidence in pharmacy-based healthcare. A very effective regulatory system guarantees the same quality and safety in every single OTC category. The consumers in Germany tend to use herbal and homeopathic remedies, which results in an increased demand for natural formulations. The presence of advanced R&D infrastructure, sustainable packaging initiatives, and digital pharmacy integration makes Germany the leader in the OTC healthcare sector in terms of innovation.

How is Asia-Pacific performing in the Over the Counter (OTC) Drugs Market?

The Asia-Pacific region is the one with the significant growth rate, thanks to the increased awareness of health and the access to affordable OTC medicines that are gradually becoming widespread. The right of self-medication preference and, at the same time, the popularity of herbal and traditional remedies act as factors that support growth in the region. The governments are making it easier for patients to have access to OTC drugs to share the burden of the healthcare system. Technological developments, increased retail presence, and online buying platforms are the factors that point in the same direction of the consumer being reached soon and easily, thus fostering strong momentum of the industry in the region.

India Over the Counter (OTC) Drugs Market Trends:

India is one of the fastest-growing markets for OTC drugs, with their healthcare awareness and the government encouragement for self-medication being the driving forces. Additionally, the country is a major player in herbal and ayurvedic product production, which in turn helps to build up the trust of consumers in the traditional wellness solutions. Gradually rolling out the pharmaceutical infrastructure, retail penetration, and digital outreach are all contributing to making the products more accessible. Increased incomes and changing lifestyles are also factors that foster continuous growth in the Indian OTC healthcare market.

China Over the Counter (OTC) Drugs Market Trends:

China ranks among the top OTC market contributors due to its enormous population and the increasing awareness of health. The natural and plant-based products drive up the demand, while the government support in healthcare modernization is the reason why the market is growing. Retail pharmacies and digital health platforms are expanding, ensuring that the products are available pretty much everywhere. On top of that, consumer education and innovation in formulations are two things that keep strengthening the Chinese role in global OTC drug development.

Key Companies & Market Share Insights

- In August 2019, Pfizer and GlaxoSmithKline Plc., two of the world's largest pharmaceutical corporations, announced a joint venture agreement. The goal of this agreement was to establish a leading consumer healthcare company and become the global over the counter (OTC) drugs market leader.

- The U.S. Food and Drug Administration approved Astepro Allergy as an over the countermedicine for the temporary alleviation of nasal congestion, itchy nose, runny nose, and other respiratory infections in June 2021, according to Bayer. It is only non-steroid antihistamine nasal spray available over the counter in the U.S. for adults and children aged 6 and up.

- Dr. Reddy's Laboratories Ltd. released Olopatadine Hydrochloride Ophthalmic Solution, an over the countereye allergy drop, in September 2020.

- Cipla Health teamed with Zomato, Swiggy, and Dunzo to deliver over the counter wellness goods to customer's homes in India in April 2020.

- GSK Consumer Healthcare declared in December 2020 that it will launch a new nasal decongestant portfolio in India under the Otrivin brand. Otrivin Breathe Clean Daily Nasal Wash was also introduced.

- Crown and Soma Pharmaceuticals declared a collaboration in December 2020 to bring Microcyn-based sprays and gels, as well as anti-itching over the counter drugs to the U.S. market.

Over the Counter (OTC) Drugs Market Companies

- Bayer AG

- Takeda Pharmaceutical Company Ltd.

- Pfizer

- Johnson & Johnson Services Inc.

- Sanofi S.A.

- Reckitt Benckiser Group PLC

- Novartis AG

- Boehringer Ingelheim International GmbH

- GlaxoSmithKline PLC

- Mylan

Recent Developments

- In June 2025, Eisai Co., Ltd. launched "Pariet S" to effectively relieve severe heartburn and stomach pain from gastric acid reflux, available at pharmacies across Japan.

https://www.eisai.com - In March 2025, Glenmark Pharmaceuticals launched polyethylene glycol 3350, a constipation treatment, in the US. The over-the-counter solution has a strength of 17 grams per capful, according to the company.

https://money.rediff.com

Value Chain Analysis

- Research & Development: Analyzes/reviews research methods to locate OTC drug candidates, streamline invention, and lessen costs and risks associated with innovation.

Key Players: Merck & Co., Roche, Johnson & Johnson, Novartis, AstraZeneca - Clinical Trials and Approval: Facilitates trial plans and clearance processes to give product launches that are faster, compliant, and economical.

Key Players: Labcorp, ICON plc, Parexel, Syneos Health, Medpace - Formulation and Dosage Preparation: Concentrates on production efficiency, quality assurance, and consistency of supply for drugs by scaling up.

Key Players: Pfizer, Johnson & Johnson, Novartis, Cipla, Sun Pharma - Packaging and Serialization: Guarantees product originality and compliance with regulations through secure methods of packing, labeling, and serialization.

Key Players: Amcor, Gerresheimer, Schott AG, West Pharmaceutical Services - Distribution to Hospitals and Pharmacies: Looks at the logistics and retail operations to make sure that the supply of products is reliable and the delivery networks are optimized.

Key players: McKesson Corporation, Cardinal Health, Cencora (formerly AmerisourceBergen) - Patient Assistance and Services: Provides enhanced customer education, marketing interaction, and post-sale experience to build up trust and loyalty toward the product.

Key players: Johnson & Johnson, Procter & Gamble, Reckitt Benckiser

Segments Covered in the Report

By Product

- Vitamin and Dietary Supplements

- Cough & Cold Products

- Analgesics

- Gastrointestinal Products

- Sleep Aids

- Otic Products

- Wart Removers

- Mouth Care Products

- Ophthalmic Products

- Botanicals

- Smoking Cessation Products

- Feminine Care

- Others

By Dosage Form

- Tablets

- Hard Capsules

- Powders

- Ointments

- Soft Capsules

- Liquids

- Others

By Route of Administration

- Oral

- Parenteral

- Topical

- Others

By Distribution Channel

- Drug Stores & Retail Pharmacies

- Hospital Pharmacies

- Online Pharmacies

- Others

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- MEA

- Rest of the World

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting