What is the U.S. Compounding Pharmacies Market Size?

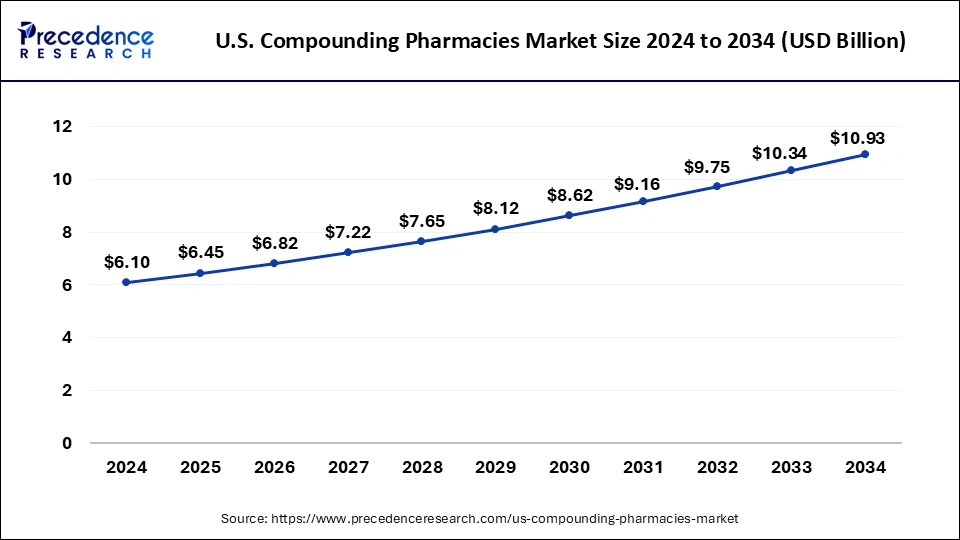

The U.S. compounding pharmacies market size is calculated at USD 6.45 billion in 2025 and is predicted to increase from USD 6.82 billion in 2026 to approximately USD 11.52 billion by 2035, expanding at a CAGR of 5.97% from 2026 to 2035

Market Highlights

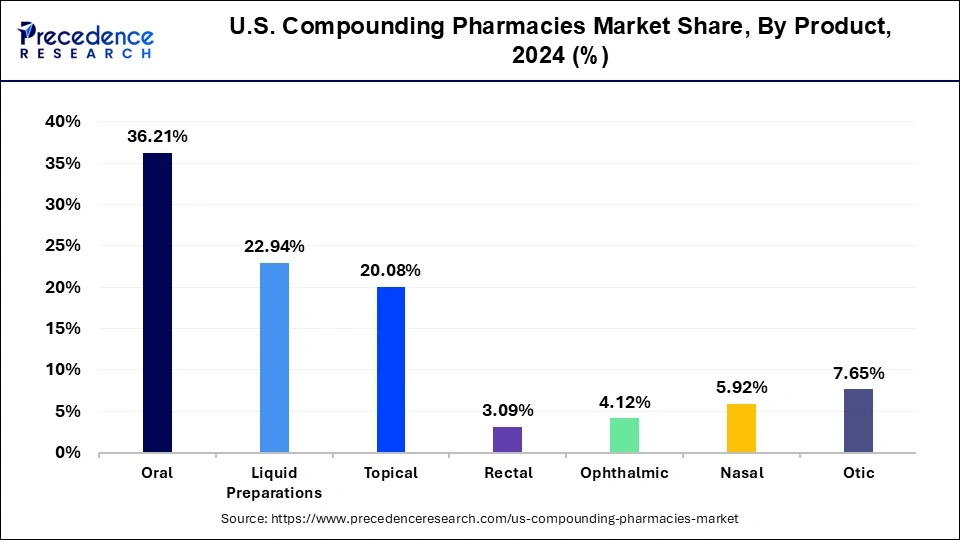

- By Product, the oral medications segment dominated the market with the largest market share of 36.21% in 2025.

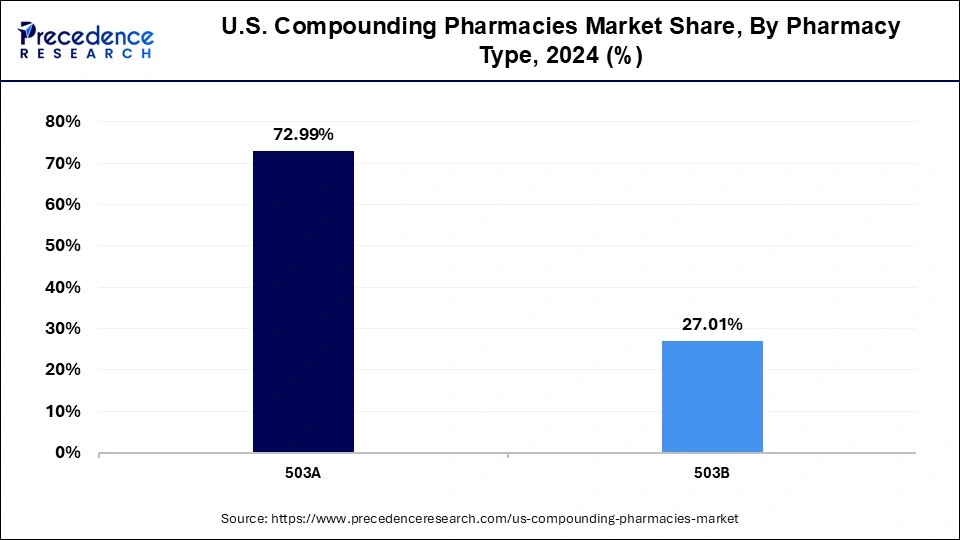

- By Pharmacy Type, 503A segment accounted for more than 72.99% of revenue share in 2025.

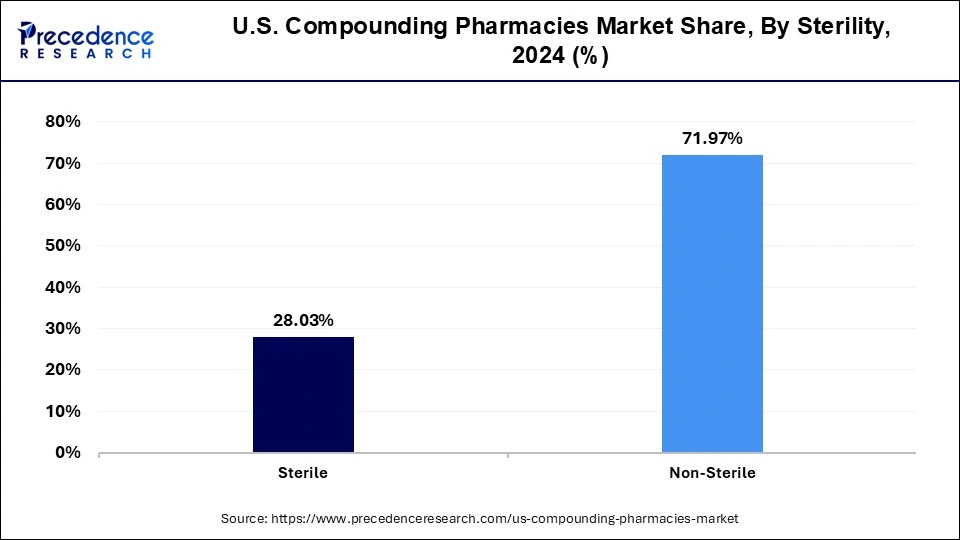

- By Sterility, the non-sterile segment dominated the market with the highest revenue of 71.97% in 2025.

- By Application, the adult segment is expected to significantly boost during the anticipated timeframe.

What are U.S. Compounding Pharmacies?

The U.S. compounding pharmacies market is slowly but steadily increasing with an impressive rate of growth and is showing no signs of slowing down. Much of this growth is propelled by the increasing demand for personalized medications, meaning that each medication is individually tailored for each patient. Compounded medications are, by definition, not pre-manufactured drug products. Compounded medications are products prepared by pharmacists to meet an individual's specific needs, changing strength of dosing, altering route of administration, omitting allergens or unnecessary excipients, or combining active ingredients into one product.

Personalized approaches to health care are necessary in specialty areas such as pain syndromes, dermatology, hormone replacement therapy (HRT), pediatrics, and oncology where standard medications do not provide the best opportunity for success. Compounded solutions fill an essential gap that commercial drugs leave behind as the burden of chronic disease and polypharmacy issues continue to rise.

What are the Upcoming Trends in Compounding Pharmacies Market?

The increasing demand for integrative and functional medicine that embraces personalized, holistic care creates sustained demand for compounded medications in hospital and specialty clinics and wellness-focused pharmacies. Healthcare practitioners and patients are more aware of the clinical flexibility and therapeutic indications of compounded medications, which provides market entrenchment and increased acceptance. Coupled with ongoing trust and technological advances involving pharmacy automation and reducing the regulatory fog, compounding medication will continue to support and advance the fabric of healthcare delivery in the U.S.

How is AI-driven Technology Revolutionizing U.S. Compounding Pharmacies?

The U.S. compounding pharmacies market is evolving rapidly, and artificial intelligence is making an impact on precision, efficiency and safety in compounding processes. AI-enhanced pharmacy technology is allowing pharmacists to generated highly customized medications to patients, given an analysis of a patient's data, history and potential drug interactions. This improves personalized medication accuracy and overall therapeutic outcomes.

At the same time, robots and AI-enabled automation technologies found within sterile compounding labs can supplement fast and efficient workflows, resulting in greater degrees of precision, while also reducing human errors, contamination potential, and even turn-around times. Predictive analytics also help with managing stocks, projecting medication needs, and eliminating drug waste in navigating challenges between distribution chains and drug shortages. AI can allow the management to remain in compliance by automating and analysing patient documentation, and quality assurance processes as part of ongoing declarations that need to be submitted.

U.S. Compounding Pharmacies Market Growth Factors

The surging investments by the key market players in the research and development to innovate and customize the formulations to effectively treat various diseases are expected to boost the growth of the US compounding pharmacies market. The growing prevalence of cancer among the US population is significantly augmenting the market growth.

According to the National Cancer Institute, in 2020, approximately 1,806,590 new cancer cases were estimated to be diagnosed and about 606,520 cancer deaths were estimated in US. The most diagnosed type of cancer included breast cancer, lungs cancer, prostate cancer, and colon and rectum cancer. The lungs, prostate, and colorectal cancer collectively accounted for 43% of the total new cancer cases diagnosed in men, while in women, the breast, lungs, and colorectal cancer accounted for 50% in 2020. The cancer incidence or rate of new cancer cases in men is 442.4 per 100,000. The cancer death rate is 158.3 per 100,000 per year. It was estimated that around 16,850 adolescents and children aged 0 to 19 years would be diagnosed with cancer and around 1,730 would die out of it in 2020. US$150.8 billion was estimated to be the national cancer care expenditure in US in 2018.

Therefore, the surging cases of cancer in US are expected to significantly boost the growth of the US compounding pharmacies market in the forthcoming years. There has been a shortage of drugs owing to the longer lead times, lack of adequate raw materials, increased drug failure, and delayed production, which is a prominent factor behind the growth of the US compounding market. Furthermore, growing geriatric population base in US along with the better longevity is accelerating the market growth significantly. According to the Population Reference Bureau, by 2060, the geriatric population in US will constitute around 24% of the total US population.

The increasing acceptance of compounding pharmacies and the presence of favorable government policies pertaining to reimbursements is driving the growth of the US compounding pharmacies market. Further, the rising technological advancements is leading to the growth of the effective compounding pharmacies. The presence of leading market players coupled with the presence of strong healthcare infrastructure in US is augmenting the growth of the US compounding pharmacies market.

- Demand for Personalized Medicine: The trend for custom-made drugs is on the rise, fueling demand for custom-prepared products.

- Absence of Commercial Drugs: In recent times, supply chain interruptions and delays in production or manufacturing stages have given compounds newfound favor as patient care alternatives.

- Growing Geriatric Population: The aging population with multiple chronic conditions is driving up the demand for special dosage forms and combination therapies.

- Technological Advancements: Machines that accept automation, sterile compounding technology, and digital quality control systems increase accuracy, safety, and efficiency.

- Friendly Regulatory Treatise: Governmental initiatives and reimbursement, considered favorable recognition to 503A and 503B compounding facilities, have driven the pace of market development.

Major Trends of the U.S. Compounding Pharmacies Market

• Automation-Driven Precision in Compounding Operations: The adoption of automated and semi-automated equipment in compounding pharmacies is becoming more widespread as they strive for greater formulation accuracy, to minimize contamination risks, and to comply with stricter regulations, particularly in sterile settings.

• Growth of Veterinary/ Specialty Care Compounding: As more pet owners become active in their pet's health care decisions and create a need for customized veterinary medications, compounding pharmacies will continue to expand into the animal therapeutic market as well as the human therapeutic market.

• Integration with Provider-Centric Care Models: To create seamless continuity of care for patients who require non-commercial or alternative dosage forms, hospitals, clinics, and outpatient facilities are increasing their partnership efforts with compounding pharmacies.

• Shift Toward Using Digital Workflow and Compliance Platforms: Pharmacies are turning to tools such as digital intake for prescriptions, batch tracking, quality audit, and patient documentation systems, which allow the pharmacy to maintain traceability and transparency related to regulatory compliance.

• Supply Chain Resilience/API Sourcing Strategy: To protect against supply chain disruption while still obtaining high-qualityactive pharmaceutical ingredients (APIs) at a reasonable price, compounding pharmacies are diversifying their sources for APIs.

U.S. Compounding Pharmacies Market-Trade Analysis

• Orienting Toward Domestic Markets: Because of rigorous legal and regulatory oversight, alongside patient-specific manufacturing capabilities, the U.S. compounded pharmacy industry predominantly focuses on domestic production rather than exporting finished goods.

• Exports of Finished Compounded Medicines do not Come from the United States: The U.S. compounded pharmacy industry does not export finished compounded medicines (finished medications); however, it does import the component parts (active pharmaceutical ingredients), making it vulnerable to changes in regulations and quality standards for the ingredients used to formulate compounded pharmacy preparations.

• Distribution is Affected by the Federal and State Legal and Regulatory Environment: Several federal and state legal and regulatory restrictions limit the interstate distribution of certain compounded pharmacy products. This limitation promotes localized manufacturing and has a major impact in defining how procurement and logistics strategies are developed across different geographical areas.

Market Outlook

- Industry Growth Overview: The U.S. compounding pharmacies market is growing, as increasing demand for targeted medicine, the requirement to address drug limitations, and the prevalence of chronic diseases. The demand for modified medications to meet particular patient needs involves dosage, form, and allergen-free options.

- Global Expansion: The U.S. compounding pharmacies market is experiencing global expansion, as the growing presence of pharmacies that create customized medications beyond what is commercially available, driven by factors such as targeted medicine trends. North America is dominated by a mature medical infrastructure and highly targeted medicine.

- Major investors: Major investors in compounding pharmacies are often private equity organizations and other massive institutional investors attracted to the sector's growth and profitability. Particular organizations that are major players in the compounding pharmacy market include Fagron, PharMEDium, and TruMont Compounding Pharmacy.

MarketScope

| Report Coverage | Details |

| Market Size in 2025 | USD 6.45 Billion |

| Market Size in 2026 | USD 6.82 Billion |

| Market Size by 2035 | USD 11.52 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 5.97% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Pharmacy Type, Product, Sterility, Compounding Type, Therapeutic Area, and End-User |

Market Dynamics

Drivers

Rising Emphasis over Personalized Therapeutics

The growing demand for personalized therapeutics represents a significant opportunity in the compounding pharmacy marketplace across several niche areas including pediatric dosing, veterinary compounding, hormone optimization, and dermatological applications. Patients and providers (prescribers) are recognizing and requesting customized formulations that meet their unique needs, allergies, and dosing where appropriate, leading to a shift away from traditional one-size-fits-all pharmaceuticals to adopting precision-based care.

Advanced Technologies

With automation, automated compounding systems driven by AI, and robotics, pharmacies can provide scalable, sterile medications of high-quality, and with more accurate and consistent outcomes now more than ever. Collaborations with telehealth partners, concierge medicine organizations, and specialty clinics are allowing access to patients and channeling new ways for compounding pharmacy organizations to acquire new patients outside their geography.

These collaborations are especially relevant when utilizing telehealth services to get medications or customized formulations that do not exist during the ongoing national shortage of pharmaceuticals, which can keep compounding pharmacies relevant to current patient care provision. Digital transformations (e-commerce websites, online consultations, and apps) that provide a more convenient, compliant, and accessible way in providing customized formulations is catering to patients' needs.

Restraint

Stringent Regulatory Framework and High Cost:

Increased compliance costs and burdensome regulatory frameworks related to evolving FDA and USP guidance will continue to constrain U.S. compounding pharmacies operationally and financially. Compliance with these stringent standards, especially the sterile compounding requirements, constantly require investment in improvements to the facility and ongoing staff training and documentation, and adds overhead for smaller pharmacies and limits their scaling ability.

Quality control challenges only bring a higher risk of liability in a market with products that have to meet absolute sterility and exacting specifications, like injectables or ophthalmic products. And with inflexible reimbursement and ambiguous insurance coverage limiting profitability, it is challenging for providers to justify offering a compounded alternative to a mass-produced pharmaceutical. Providers often shift the financial risk of a compounded medication back to the patient because of the lack of consistent reimbursement, which is a primary impediment to wide-scale utilization. With emerging competition from large pharmaceutical manufacturers releasing pre-formulated drugs aimed at previously compounded only indications, the market pressure is only adding constraints.

Opportunity

Automation & Business Activities

There are opportunities for automation, and AI-based precision to drive scalable opportunities with fewer errors and improved quality. Through strategic partnerships with telehealth provider and specialty clinics we can access new patients. Supporting gaps in therapeutic options may be another growth path as we're back into drug shortages. The future is digital, and through e-commerce we can create digital options and access that improves patient access, as well as further streamline the prescription workload across the U.S.

Segment insights

Product Insights

The oral medications segment dominated the US compounding pharmacies market, accounting for around 36.21% of the market share in 2025. The rising prevalence of various chronic diseases and increased preference for oral medications owing to their ease of use and easy storage have boosted the growth of this segment. The availability of various oral medications in the form of tablets, capsules, powder, and granules are some of the major and most preferred traditional forms of oral medications. The increasing demand for personalized medications among the various age groups is expected to foster the growth of the market in the upcoming years.

Liquid Preparations segment accounted for around 22.94% of the US compounding pharmacies market share in 2025 and is expected to be the fastest-growing segment during the forecast period. For doctors looking for a substitution for the more popular oral solid dose type, oral liquid solutions offer a versatile option. Compounding pharmacies may be required to manufacture oral liquids if an oral solid dose form is incorrect for a particular patient or if providing the patient's desired dosage is difficult. Tablets and prescriptions are typically difficult to swallow for children and the elderly. Due to liquid pharmaceuticals offering a more pleasant formulation & an easier delivery mechanism, these patient populations are able to consume their medications more readily. Patients occasionally require prescriptions that are not available over the counter, as well as certain drug combinations. Compounding chemists may develop these unique mixtures in liquid form to meet the needs of the patient.

- The oral medications segment was valued at USD 2.21 billion in 2024 and the growth rate of this segment is projected to be 6.13% during the forecast period.

- The topical medications segment reached USD 1.22 billion in 2024 and the growth rate of this segment is projected to be 6.20% from 2026 to 2035.

Pharmacy Type Insights

The 503A segment dominated the US compounding market in 2025. This segment is estimated to grow at a CAGR of 6.08% during the forecast period. The government restrictions on drug production and requirements of medicine prescriptions have led to the growth of the 503A segment in the market. It is highly used for domestic consumption and hence dominates the US market. The strict regulations for biannual monitoring and audit ensure the safety and quality of this product.

U.S. Compounding Pharmacies Market Revenue, ByPharmacy Type, 2022-2024 (USD Billion)

| By Pharmacy Type | 2022 | 2023 | 2024 |

| 503A |

3.99 | 4.21 | 4.45 |

| 503B |

1.49 | 1.57 | 1.65 |

Sterility Insights

Depending on the sterility, the US compounding pharmacies market was dominated by the non-sterile segment that accounted for a market share of around 5.85% in 2025.

The sterile segment is expected to witness the highest growth rate during the forecast period. The rising incidences of chronic ailments like cancer and cardiovascular diseases are expected to significantly drive the growth of the sterile segment in the upcoming future. The growing demand for the sterile compounding pharmacies owing to the increasing adoption of ophthalmic and parenteral medications is further fueling the growth of the segment during the forecast period

U.S. Compounding Pharmacies Market Revenue, By Sterility, 2022-2024 (USD Billion)

| By Sterility | 2022 | 2023 | 2024 |

| Sterile | 1.53 | 1.62 | 1.71 |

| Non-Sterile |

3.95 | 4.16 | 4.39 |

Therapeutic Area Insights

Others include,oncology, haematology, dental, and others. According to the International Diabetes Federation (IDF), there will be 537 million adult diabetics globally in 2021, rising to 643 million by 2030. Cancer patients are harder to live with than the disease itself. The adverse effects of chemotherapy can make patients weak and compromise their overall health, making other medications a complicated issue. Thus, oncology compounding is used by the doctor and prescribes a particular combination of drugs and treatments to meet patients' needs, minimizing the amount of time and effort a patient has to take medications. Innovative formulations such as mouthwash or topical creams are used to produce drugs who suffer from nausea, cannot swallow pills, or have other conditions that make traditional dosage difficult.

Moreover, using topical medications decreases the effectiveness lost through absorption during the digestive process and the potential for adverse interaction with cancer treatment. Similarly, with dental compounding unpleasant experiences and anxiety from patients can be removed, when the dentist and pharmacist work together. Dental compounding has grown more popular in recent years because many variables go into a dental procedure. Dental compounding is the practice of developing customized medications for your dental needs. These customized medications are prescribed for procedural anxiety, pain relief, gum disease, mouth ulcers, and many others. Thus, the growing applications of others in compound pharmacies are likely to enhance market growth during the forecast period.

The pain management segment reached at USD 0.54 billion in 2024 and is projected to grow at a CAGR of 6.10% from 2026 to 2035. Pain is the most obvious symptom for which patients explore medical help. Acute pain can easily grow into chronic pain, which later becomes difficult to treat. Commercially convenient pain relief medications can treat chronic conditions such as arthritis, fibromyalgia, migraine, and other nerve and muscle pain; however, these medication can grow undesired side effects such as dizziness, drowsiness, or stomach irritation. Therefore, many patients seek a more suitable solution through pharmacy compounding.

U.S. Compounding Pharmacies Market Revenue, By Therapeutic Area, 2022-2024 (USD Billion)

| By Therapeutic Area | 2022 | 2023 | 2024 |

| Hormone Replacement | 1.05 | 1.17 | 1.17 |

| Pain Management | 0.48 | 0.51 | 0.54 |

| Dermatology | 0.25 | 0.26 | 0.28 |

| Pediatrics | 0.19 | 0.20 | 0.21 |

| Urology | 0.15 | 0.16 | 0.17 |

| Others | 0.54 | 0.56 | 0.58 |

End-user Insights

In the U.S. compounding pharmacies market, hospitals continue to dominate the end-user market segment and are followed by home healthcare due to their continual need for sterile and personalized medication in times of critical care and monitoring chronic conditions. Hospitals utilize compounding pharmacies for on-demand medications, high-quality injectables, IV injectable therapies, and specialized medications and treatments, as they are often unavailable in commercial forms.

Home care is also beginning to rely more on compounded medications, as home healthcare services strive to ensure patient adherence, improve patient health outcomes, and aid in the comfort of those individuals receiving long-term care, which applied to elderly individuals and immunocompromised patients, to help alleviate pain levels and dependency on injected medications.

Country Analysis

With an infrastructure that supports advanced healthcare, high demand for personalized medicine, and patient-centred care, the U.S. is the global leader in the compounding pharmacies market. The growing aging population and the increase in chronic disease conditions in the United States had increased the need for customized medications that mass-produced medications traditionally do not accommodate. Compounding pharmacies in the United States are increasingly providing compounded medications associated with specific patient needs through not reuse allergen medications, delivering medications in a manageable dosing while providing patient-specific medications that are not commercially manufactured.

It is estimated that states like Texas, California, and Florida will continue to be critical operations bases for advancing compounding pharmacies due to the volume of specialty clinics, their aging population and supportive regulators. Advances associated with artificial intelligence and automation in the compounding pharmacy industry are also a benefit to improve accuracy, sterility, and efficiency in operations. Furthermore, the growing use of and awareness associated with functional medicine, hormone replacement therapies, and alternative treatment options also reverberant the increased use of compounding pharmacy services.

Increasing digital technology

The U.S. is the fastest-growing market region because of its focus on personalized medicine, a complex yet supportive regulatory environment, ongoing drug shortages in the commercial sector, and a robust healthcare infrastructure. The increasing and aging population, which has a high rate of chronic conditions such as pain management needs and hormonal imbalances, fuels the demand for customized, long-term treatments that mass-produced drugs often cannot fully meet.

Value Chain Analysis – U.S. Compounding Pharmacies

R&D:

Major R&D process focuses on preparation, formulation, and quality control under particular government guidelines, rather than the extensive clinical trials for new drugs.

- Key Players: Fagron, B., and Braun Melsungen AG

Clinical Trials:

Major clinical trials include Phase 1 (safety), Phase 2 (effectiveness), Phase 3 (efficacy), and Phase 4 (long-term effects) trials.

- Key Players: Fresenius Kabi and Baxter International

Patient Services:

Major patient services at a compounding pharmacy include personalized medication creation, creating alternate dosage forms such as liquids or creams, adjusting strengths, and eliminating allergens from medications.

- Key Players: Empower Pharmacy and Dougherty's Holdings, Inc.

Top Vendors in the U.S. Compounding Pharmacies Market & Their Offerings

| Company | Headquarters | Key Strengths | Latest Info (2025) |

| Triangle compounding pharmacy | North Carolina | High-quality medication | Triangle Compounding Pharmacy creates personalised compounded medications to meet medical needs. |

| Fagron | Belgium | Strong brand reputation and expertise | In November 2025, Fagron, the global leader in pharmaceutical compounding, reinforced its EMEA position with the acquisitions of a book of business from Amara (Poland) and Magilab (Hungary). |

| B. Braun melsungen ag | Germany | Innovation and R&D spending | In 2025, B. Braun Melsungen AG continues its focus on providing products and solutions that support safe and efficient pharmacy operations, including automated compounding systems and related supplies. |

| Fresenius Kabi AG | Germany | Specialized Product Portfolio | Fresenius Kabi AG is a significant provider of sterile compounded medications and related services. |

| Pencol Compounding Pharmacy | Denver, Colorado | Technology and innovation | Pencol Compounding Pharmacy significantly provides customized, patient-specific compounded medications across various specialties. |

Other Major Key Players

- US Compounding Inc.

- Avella specialty pharmacy

- Institutional pharmacy solutions, llc

- Pharmedium services llc

- Vertisis custom pharmacy

Recent Developments

- In February 2025, Fagron launched an advanced software platform designed to streamline 503A workflows and track patient outcomes.(Source- https://fagron.com)

- In March 2025, Empower Pharmacy commenced operations at its second high-capacity 503B outsourcing facility in Houston, enhancing sterile compounding through automated and robotic systems.(Source- https://www.empowerpharmacy.com)

- In April 2025, the FDA clarified enforcement timelines for compounded GLP 1 drugs like semaglutide and tirzepatide, mandating phase-outs by April 22 and May 22 to align with finished product availability. (Source- https://www.fda.gov)

Segments Covered in the Report

By Pharmacy Type

- 503A

- 503B

By Product

- Oral

- Capsules

- Granules

- Tablets

- Powder

- Others

- Liquid Preparations

- Emulsion

- Syrup

- Solutions

- Suspension

- Others

- Topical

- Gels

- Ointments

- Creams

- Pastes

- Others

- Rectal

- Enema

- Suppositories

- Others

- Ophthalmic

- Nasal

- Otic

By Sterility

- Sterile

- Non-Sterile

By Compounding Type

- Pharmaceutical Ingredient Alteration (PIA)

- Currently Unavailable Pharmaceutical Manufacturing (CUPM)

- Pharmaceutical Dosage Alteration (PDA)

- Others

By Therapeutic Area

- Hormone Replacement

- Pain Management

- Dermatology

- Pediatrics

- Urology

- Others

By End-User

- Hospitals and Clinics

- Specialty Clinics

- Others

Get a Sample

Get a Sample

Table Of Content

Table Of Content