Generic Sterile Injectable Market Size and Forecast 2026 to 2035

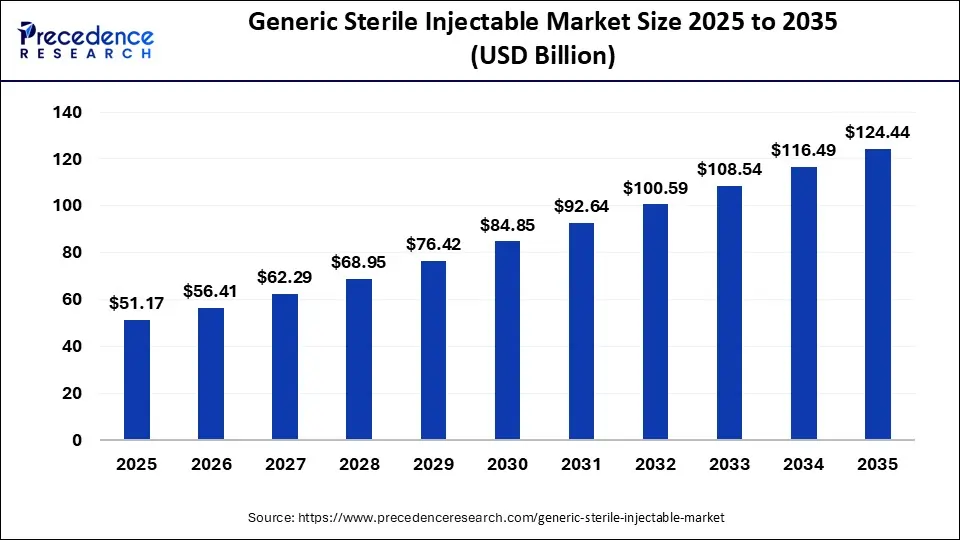

The global generic sterile injectable market size was estimated at USD 51.17 billion in 2025 and it is expected to hit around USD 124.44 billion by 2035, growing at a CAGR of 9.29% during the forecast period 2026 to 2035.

Generic Sterile Injectable MarketKey Takeaways

- Asia Pacific is expected to grow at the fastest rate during the forecast period.

- By Drug type, the vaccines segment is expected to grow at the fastest rate in the market during the forecast period of 2026 to 2035.

- By therapeutic application, the diabetes segment is projected to experience the highest growth rate in the market between 2026 and 2035.

- By distribution channel, the retail pharmacies segment is set to experience the fastest rate of market growth from 2026 to 2035.

The role of AI in the generic sterile injectable market:

Artificial intelligence (AI) is increasingly playing a transformative role in the generic sterile injectable market by enhancing precision, efficiency, and compliance across the manufacturing and distribution lifecycle. In production, AI systems are used to monitor sterile environments in real time, analysing vast sensor data to detect anomalies, predict equipment failures, and assure batch consistency, minimizing human error and reducing downtime. In formulation development, machine learning models accelerate optimization of drug stability and delivery systems, cutting development timelines significantly. AI is also revolutionizing supply chain logistics, especially for cold chain-dependent injectables like vaccines and biologics, by predicting demand, managing inventory, and assuring temperature integrity throughout transit.

Furthermore, generative AI tools are assisting operators by generating reports, summarizing deviations, and streamlining documentation. As regulatory bodies begin to embrace AI-based quality systems, the technology is enabling manufacturers to produce high-quality, affordable injectables faster and at scale, ultimately expanding access to critical therapies worldwide.

Market Trends

- Increasing cases of cancer, diabetes, and autoimmune disorders are driving demand for cost-effective injectable treatments.

- The market is witnessing rapid growth in biosimilar sterile injectables, especially as patents for blockbuster biologics expire.

- Prefilled syringes, auto-injectors, and pen devices are boosting retail pharmacy sales and enabling at-home care.

- More pharma companies are outsourcing sterile injectable production to CDMOs to meet regulatory standards and reduce costs.

- Asia Pacific, Latin America, and parts of Africa are becoming hotspots for generic injectable expansion due to growing healthcare access.

- Smart manufacturing using AI and robotics is improving batch consistency, real-time monitoring, and operational efficiency.

- Key players are engaging in partnerships and acquisitions to expand injectable portfolios and enter new markets.

Future of Global Generic Sterile Injectable Market

There have been a large many strategic acquisitions in the generic injectable market during the historic period of time. The acquisitions were motivated by the necessity to acquire a product portfolio, production capabilities from current injectable companies in order to consolidate share of the market or accelerate entrance into the lucrative sterile injectable market. Further, growing need for the target product is encouraging new industry players to enter in this competitive industry.

Market Scope

| Report Highlights | Details |

| Market Size by 2035 | USD 124.44 Billion |

| Market Size in 2026 | USD 56.41 Billion |

| Market Size in 2025 | USD 51.17 Billion |

| Growth Rate | CAGR of 9.29% From 2026 to 2035 |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Therapeutic Application, Distribution Channel, Region |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, Middle East & Africa (MEA) |

Market Dynamics

Drivers

A key force behind market growth is the worldwide surge in chronic diseases such as diabetes, cancer, cardiovascular disorders, and autoimmune conditions. These conditions require long-term, often injectable treatment, and their increasing incidence, driven by aging populations, sedentary lifestyles, and unhealthy diets, is steadily boosting demand. As more patients require injectable therapies like insulin or oncology drugs, genetic sterile injectables emerge as affordable alternatives to branded versions, supporting broader access and long-term treatment continuity.

The expiration of patents on high-value biologic injectables has opened the door for biosimilar and generic sterile injectable versions. When blockbusters like monoclonal antibodies also have exclusivity, multiple manufacturers can enter with lower-cost versions. This trend is already reshaping the market broader uptake of biosimilar (e.g., trastuzumab, rituximab) and is enabling wider vaccine and immune therapy availability through cost-effective sterile injectable formats.

Restraints

Complex Manufacturing Processes

Generic sterile injectables are made using intricate and strictly regulated manufacturing procedures that guarantee product efficacy, safety, and quality. Microbiological contamination must not be present in sterile injectable goods. To ensure sterility, techniques like autoclaving, filtration, and aseptic processing are employed. In order to prevent product contamination, aseptic processing entails keeping a sterile.

atmosphere throughout the production process. The sterile drug product is filled into vials, syringes, or other containers in this process, and they are sealed under sterile circumstances. Throughout the manufacturing process, quality control is included to guarantee that the finished product satisfies the necessary quality standards. This entails checking the purity, potency, sterility, and other quality features of raw materials, in-process samples, and completed goods.

Opportunity

With key patents on blockbuster GLP-1 injectable therapies like semaglutide (used in diabetes and weight loss treatments) expiring in major markets, there is a significant opportunity for generic sterile injectable manufacturers. Companies in India and Brazil are preparing to launch semaglutide generics as early as 2026, which could lead to dramatic price reduction of up to 80% compared to branded options, broadening patient access globally. For example, Hypera in Brazil and Eris Lifesciences in India aim to capitalize on this wave and build robust branded portfolios around these high-demand therapeutics. The expanding generic access to semaglutide and similar molecules presents a high growth opportunity within the sterile injectable space.

Emerging markets, especially in Asia Pacific, Latin America, the Middle East, and Africa, are rapidly expanding in healthcare infrastructure, driven by rising chronic disease prevalence and increasing public health spending. Indian pharmaceutical leadership in generic and vaccine manufacturing (accounting for more than 60% of global vaccine volume) offers an opportunity to scale distribution and penetration globally. Furthermore, the development of biosimilars such as trastuzumab and rituximab created a major growth avenue, especially in regions where branded biologics remain unaffordable. Indian and global manufacturers are actively investing in research and development to bring these biosimilars to market, signalling a widening opportunity in complex sterile injectable over the next few years.

Drug Type Insights

In terms of drug type, the vaccines segment is projected to grow at the fastest rate in the generic sterile injectable market between 2026 and 2035. This rapid growth is primarily attributed to the rising global demand for immunization, especially in developing and underdeveloped nations where affordable vaccine options are crucial. The increasing burden of infectious diseases, coupled with government initiatives and global health programs, is fuelling the expansion of cost-effective generic vaccines. Additionally, the COVID-19 pandemic has significantly accelerated both awareness and infrastructure for vaccine development and distribution, which is expected to have a lasting impact on the growth of this segment.

Generic Sterile Injectable Market By Drug Type, 2023-2025 (USD Million)

| Drug Type | 2023 | 2024 | 2025 |

| Monoclonal Antibodies | 14,396.2 | 15,921.4 |

17,643.8 ​

|

| Cytokines | 1,882.0 | 2,077.3 |

2,297.2 ​

|

| Insulin | 6,951.4 | 7,624.4 |

8,377.7 ​

|

| Peptide Hormones | 2,022.3 | 2,202.5 |

2,402.8 ​

|

| Vaccines | 5,173.8 | 5,653.7 |

6,188.9 ​

|

| Immunoglobulin | 1,069.6 | 1,157.4 |

1,254.3 ​

|

| Blood Factors | 1,395.5 | 1,511.9 |

1,640.7 ​

|

| Peptide Antibiotics | 553.1 | 599.9 |

651.8 ​

|

| Others | 8,948.1 | 9,786.5 | 10,722.60 |

Therapeutic Application Insights

The diabetes segment is anticipated to experience the highest growth rate during the forecast period. The global surge in diabetes cases, with over 500 million people currently affected and healthcare costs for the condition surpassing $1 trillion annually, is driving demand for generic sterile injectable therapies. Affordable access to insulin, GLP-1 receptor agonists, and other injectable diabetes treatments is becoming increasingly important, particularly in emerging markets where branded therapies are often cost-prohibitive. The introduction of biosimilar and generic options is making long-term diabetes management more accessible, thereby contributing to this segment's growth.

Generic Sterile Injectable Market By Therapeutic Application, 2023-2025 (USD Million)

| Therapeutic Application | 2023 | 2024 | 2025 |

| Cancer | 10,872.4 | 12,059.6 |

13,404.0 ​

|

| Diabetes | 7,428.8 | 8,173.0 |

9,008.4 ​

|

| Cardiovascular Disease | 5,885.0 | 6,413.5 ? |

7,001.5 ​

|

| Central Nervous System | 3,445.0 | 3,740.7 ? |

4,068.5 ​

|

| Infectious Disorders | 3,739.5 | 4,074.2 ? |

4,446.3 ​

|

| Musculoskeletal System | 3,283.9 | 3,604.2 |

3,962.9 ​

|

| Others | 7,737.5 | 8,470.0 ? |

9,288.3 ​

|

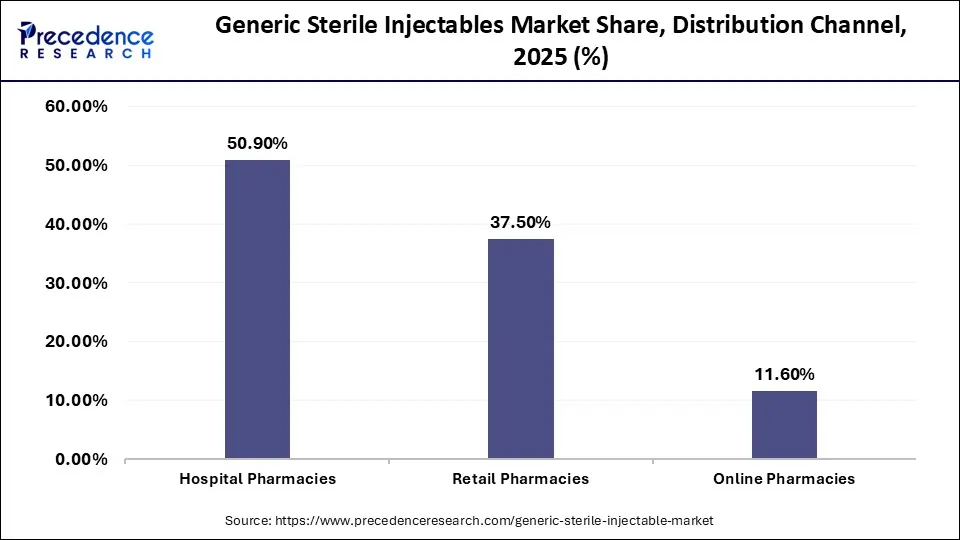

Distribution Channel Insights

In terms of distribution channel, retail pharmacies are set to witness the fastest market growth from 2026 to 2035. This surge is driven by the increasing shift of injectable treatments from hospital to home settings, supported by greater availability of self-administered injectable devices such as insulin pens. Retail pharmacies offer convenience, cost savings, and personalized services such as home delivery and patient counselling, which are increasingly favoured by patients managing chronic diseases. While hospital pharmacies currently dominate in market share, the expansion of retail healthcare infrastructure, especially in urban areas, is propelling retail pharmacies into a key growth position in the distribution landscape.

Generic Sterile Injectable Market By Distribution Channel, 2023-2025 (USD Million)

| Distribution Channel | 2023 | 2024 | 2025 |

| Hospital Pharmacies | 21,620.7 | 23,703.1 ? |

26,034.3 ​

|

| Retail Pharmacies | 15,771.4 | 17,370.9 ? |

19,169.0 ​

|

| Online Pharmacies | 5,000.0 | 5,461.0 |

5,976.7 ​

|

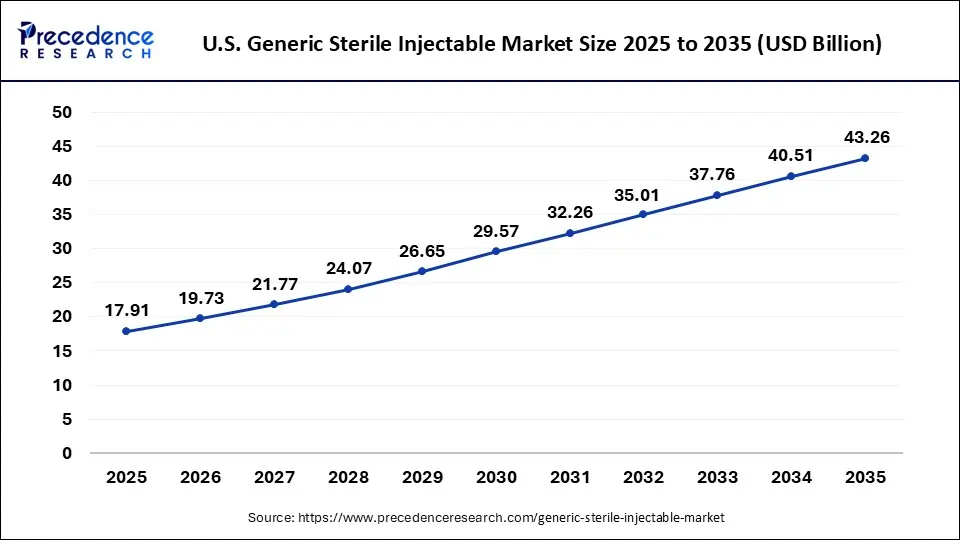

U.S. Generic Sterile Injectable Market Size and Growth 2026 to 2035

The U.S. generic sterile injectables market size was evaluated at USD 17.91 billion in 2024 and is projected to be worth around USD 43.26 billion by 2035, growing at a CAGR of 9.22% from 2026 to 2035.

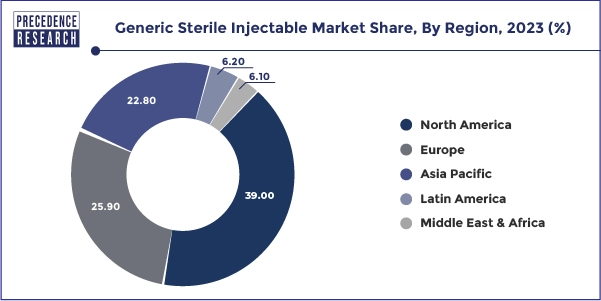

Why North America is dominating the Generic Sterile Injectable Market?

The generics market for sterile injectable products is dominated by North America, owing to the hospitals' high volume of purchases for sterile products; the prevalence of chronic diseases in North America; and the use of injectables as the route of administration for many cancers, as well as critical care and emergency medicine. Benefited from having an advanced manufacturing infrastructure, plus the high quality standards and emphasis on providing cost-effective alternatives to brand-name products, all assist in maintaining North America's stronghold in this segment of the pharmaceutical industry. In addition, drug shortages have also prompted an increase in local manufacturing and contract manufacturing in North America, thus supporting North America's continued dominance and providing health care providers with stable product availability.

U.S.

The U.S. has emerged as a leader in the sterile injectable market as a result of having a very broad hospital infrastructure; the large volume of injectables consumed by hospitals; the focus by health care providers on using generics as a method to reduce costs; and manufacturers' continual capacity expansions, the government helping to support domestic manufacturing, and the increasing use of injectable generics in the acute and specialty care sector.

Does the injectable growth in Asia Pacific continue to accelerate?

Asia Pacific is currently the highest-growing region with greater access to healthcare, more hospitals, and larger numbers of people suffering from chronic and infectious diseases. The ability for healthcare systems to access generic injectable medicines, the increasing cost consciousness of healthcare systems, and the improvements to regulatory processes will only feed this rapid growth trend. Additionally, investments are also increasing for sterile manufacturing and export-oriented facilities within this region which further add to the growth momentum.

India

The growth of injectables in India is primarily due to their strong generic pharma industry, large sterile manufacturing sector, and related cost efficiency. India is a significant supplier of injectable generic medicines both within India and abroad. This is accomplished by having highly skilled labor, growing demand from hospitals, and more compliance with international quality manufacturing standards.

What Makes Europe Notably Growing Region in Generic Sterile Injectable Market?

Europe has a growing market for injectable drugs, which is taking off thanks to health care reform in many countries, increased use of generics in public healthcare systems and a strong government focus on making medicine more affordable. As the population ages and the incidence of cancer continues to rise, the need for new medications administered in hospitals will continue to increase. Additionally, regulators in Europe are placing increased pressure on product quality and supply chain security, which is leading to increased domestic manufacturing as well as longer-term procurement contracts.

Germany

Germany has been at the forefront of this growth, due to its advanced hospital infrastructure, strong pharmaceutical manufacturing capabilities and high adoption rate of generic injectables. The combination of reliable supply chain, strict adherence to quality standards and high demand for inpatient care puts Germany in a position to continue to grow as a producer of sterile injectables.

Why Latin America is Emerging Quickly in Hospital Services Market?

The factors driving Latin America injection market development are increasing access to medical care in the region, an expanding capacity of hospitals to treat patients, and an increase in demand for low-cost injections will cause governments to promote the use of generic drugs to control increased medical costs. Continued investment from pharmaceutical companies in local manufacturing plants and continued governmental support for purchasing through the government procurement system will continue to strengthen the injection market throughout Latin America.

Brazil

Brazil is currently the largest market based on its large population, expansion of the public healthcare system, and demand for injectable drug therapies within hospitals. The Government-sponsored generic drug program, along with the continued growth in Brazil's ability to manufacture generic injectable drugs and the acceptance of generic injectable drugs across all areas of healthcare will allow for stable adoption of generic injectable drugs in Latin America markets.

Why Latin America Is Seen To Grow At A Notable Rate In Generic Sterile Injectable Market?

The Middle East and Africa are growing due to enhanced infrastructure of hospital care, an increase in hospital admissions, and a renewed emphasis on access to essential injectable medicines. Various governments are promoting local pharmaceutical manufacturers as a means of becoming self-reliant instead of importing. As more generic sterile injections become available for both acute illnesses as well as infectious diseases, the demand for these products has increased.

Saudi Arabia

Saudi Arabia has emerged as the top leader of this injectable market due to their investment in healthcare, the expansion of their number of hospitals, and the country's action to have more pharmaceutical plants build products in the Kingdom. As more drug manufacturers develop and market more cost effective injectable generics and as the regulatory frameworks are improved to assist the public and private sectors in more companies gaining access to the injectable market, many expect the injectable market in the Middle East and Africa will continue to grow in the next few years.

Key market Insights:

An alternative to the oral delivery mechanism is injectable drug delivery, which easily transports a drug dose through the bloodstream, thereby bypassing first-pass metabolism. There are some medications that would be entirely useless if delivered as capsules, as they would be killed by enzymes that digest food in the stomach. The insulin injection used in diabetes care is an example. Insulin is a protein. Therefore, if given as a tablet, the same enzymes that ferment food in the stomach would be digested. Therefore, as of today, there is no such term as an insulin tablet. Injectable allow the transport, directly into the bloodstream, of drugs manufactured in liquid form. The goal of the delivery of injectable drugs is to optimize patient compliance and reduce the frequency of dose administration without reducing medication efficacy. Due to deep vomiting, unconsciousness or having a cancer lining in the upper part of their dietary canal, it may be impossible to take tablets for certain patients. Therefore, injection options are available for most oral medications. The increasing prevalence of such metabolic disease aids in the overall growth in the sterile injectable market.

Generic Sterile Injectable Market Companies

- Fresenius Kabi

- Baxter

- Civica

- Pfizer

- Mylan

- Hikma

- Sandoz

- Teva

- Nichi-Iko

- 3M

- Merck & Co., Inc.

- Others

Recent Developments

- In July 2025, Cronus Pharma launches Butorphic (butorphanol tartrate) sterile injectable solution for equine pain relief, expanding its animal health portfolio to 25 products and enhancing sedative and anesthesia offerings in the U.S. market.

- In November 2025, Par Health completes its spin-off from Mallinckrodt, becoming an independent generic pharmaceuticals and sterile injectables leader with extensive manufacturing capabilities and a broad portfolio to address essential medicine demand.

- In August 2024, Fresenius Kabi launches generic Cetrorelix Acetate for Injection kit, providing a cost-effective fertility medication alternative that blocks premature ovulation during ovarian stimulation.

For the better understanding the recent situation of the global generic sterile injectable market and for most policies of the country, Precedence Research forecast the future evolution of the generic sterile injectable industry. This research study offers qualitative and measureable insights on generic sterile injectable market and valuation of market size and development trends for global market segments.

Segments Covered in the Report

By Drug Type

- Monoclonal Antibodies

- Cytokines

- Insulin

- Peptide Hormones

- Vaccines

- Immunoglobulin

- Blood Factors

- Antibiotics

- Others

By Therapeutic Application

- Cancer

- Diabetes

- Cardiovascular Disease

- Central Nervous System

- Infectious Disorders

- Musculoskeletal System

- Others

By Distribution Channel

- Hospitals Pharmacies

- Online Pharmacies

- Retail Pharmacies

- Others

By Geography

- North America

-

- U.S.

- Canada

-

- Europe

-

- Germany

- France

- United Kingdom

- Rest of Europe

-

- Asia Pacific

-

- China

- Japan

- India

- Southeast Asia

- Rest of Asia Pacific

-

- Latin America

-

- Brazil

- Rest of Latin America

-

- Middle East & Africa (MEA)

-

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

-

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting