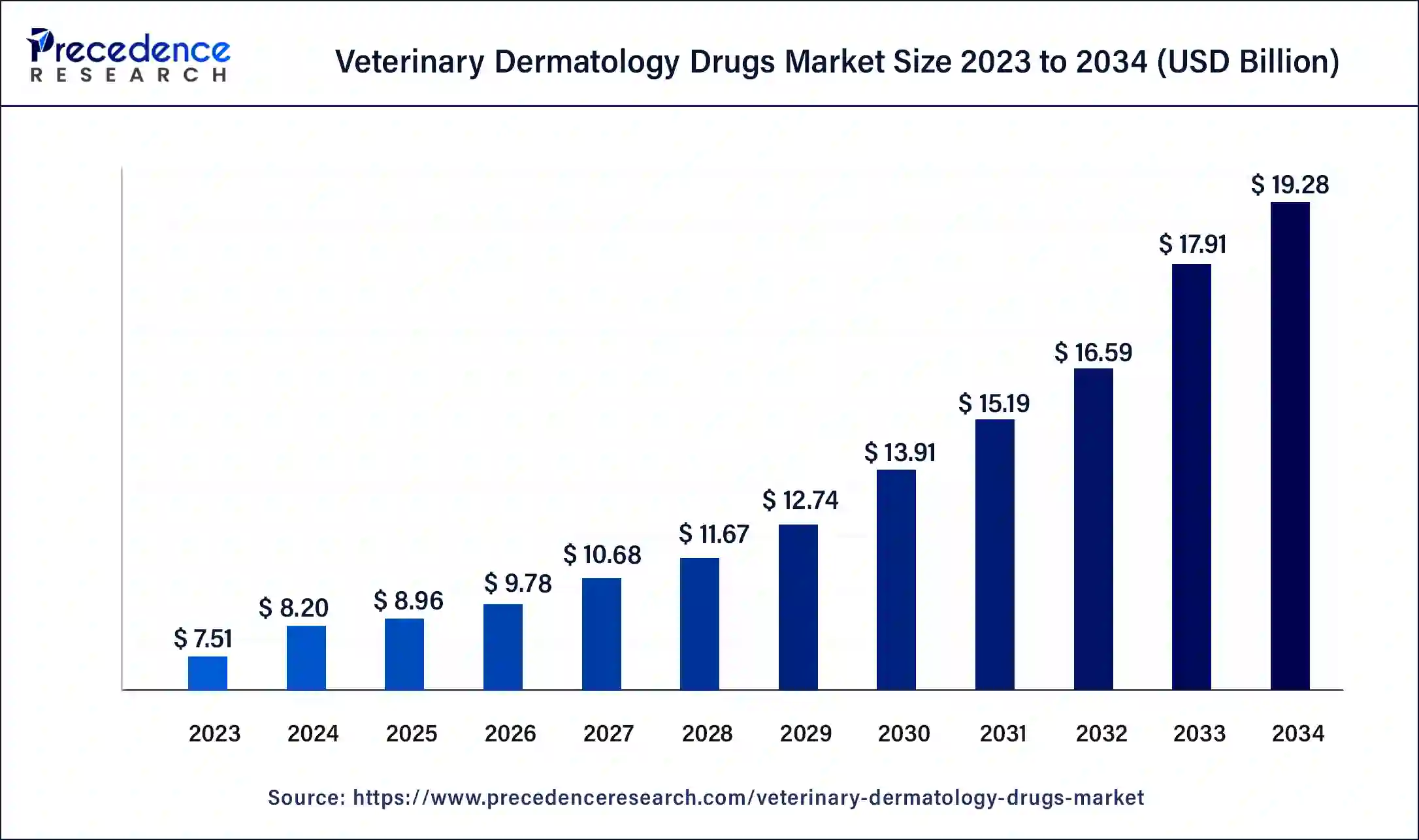

The global veterinary dermatology drugs market size is calculated at USD 8.96 billion in 2025 and is predicted to increase from USD 9.78 billion in 2026 to approximately USD 20.62 billion by 2035, expanding at a CAGR of 8.69% from 2026 to 2035.Drugs for veterinary dermatology are used to treat skin conditions or infections in animals, primarily pets and cattle.

Veterinary Dermatology Drugs Market Key Takeaways

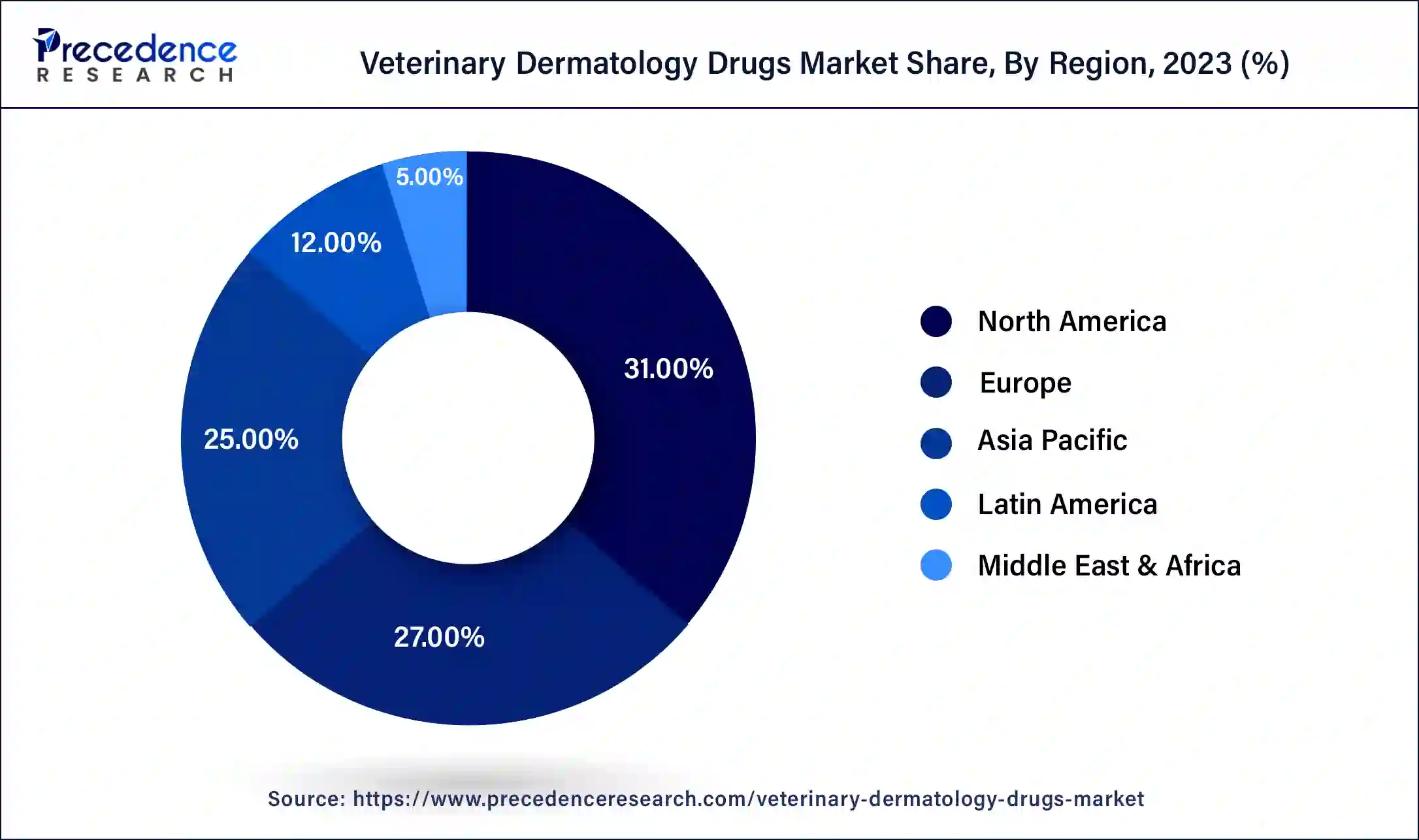

- The North America region contributed 31% of the revenue share in 2025.

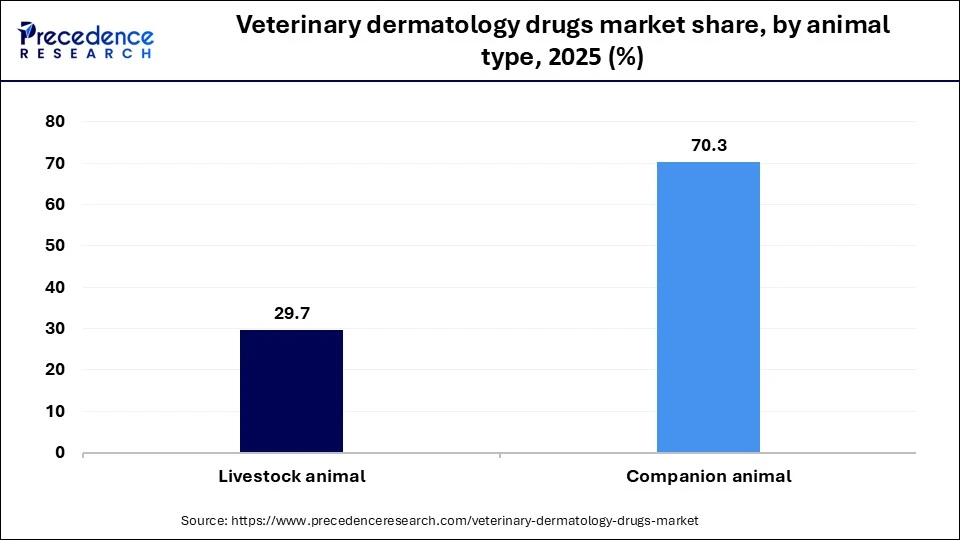

- By animal type, the companion animal market segment led and accounted for around 71% of total revenue, In 2025.

- By animal type, the livestock animal segment's revenue share recorded was the second-largest, In 2025.

- By route of administration, the oral segment led and contributed around 38% of total revenue, In 2025.

- By route of administration, the injectable category is anticipated to experience the fastest CAGR of around 10.70% throughout the projected period

- By indication, the parasitic infections segment has accounted market share of over 45.31% in 2025 and is anticipated to experience the fastest CAGR of around 10.5% from 2026 to 2035.

- By distribution channel, the hospital pharmacy led the industry and captured 45.50% of all sales in 2025.

- By distribution channel, the e-commerce segment is predicted to experience the fastest CAGR of about 10.5% from 2026 to 2035.

Veterinary Dermatology Drugs Market Growth Factors

The primary factors anticipated to propel market expansion include the increased prevalence of skin disorders in animals and significant expenditures made in this area by major industry competitors. The market is predicted to develop as a result of a trend in which pet owners are making more decisions about their pets' care. More than 20% of all animal veterinary consultations are now for dermatological issues. The four most prevalent chronic dermatological illnesses are allergies, otitis externa, seborrheic dermatitis, and surface pyoderma. In order to identify and treat major skin illnesses, the market is being supported by the introduction of cutting-edge medical equipment and technologies as well as an increase in the number of research papers on veterinary dermatology. As a consequence, it is anticipated that throughout the projected period, the rise in veterinary consultation visits would support the expansion of the global market for veterinary dermatology drugs.

Market growth is anticipated to be fueled by the rising prevalence of skin conditions in animals as well as rising industry investment by veterinary pharmaceutical firms. The adoption of new pet treatment options by pet owners is a growing trend in the pet care sector that is expected to fuel market expansion. The rising incidence of skin disorders and significant investments by market participants is the industry's development accelerators. Additionally, pet owners are increasingly making more decisions regarding their pets' care, which is anticipated to drive the market's expansion. Additionally, the global veterinary dermatology medications market is anticipated to see new growth opportunities due to an increase in incidences of dermatological conditions such as allergic dermatitis and flea-and-tick-related disorders. The market is also growing as a result of more clinical studies being conducted with medications for veterinary dermatology.

- The factors anticipated to propel market expansion include the increased prevalence of skin disorders in animals and significant investments made by industry participants in the segment.

- As there are more pet owners, there is a greater demand for improved companion animal treatment alternatives, which raises the cost of pet health care.

- The need for veterinary healthcare products is anticipated to rise as the number of companion animals increases.

- In the near future, it is anticipated that enhanced medical care and quick vaccination delivery would propel the growth rate of the global veterinary dermatology pharmaceuticals market.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 20.62 Billion |

| Market Size in 2026 | USD 9.78 Billion |

| Market Size in 2025 | USD 8.96 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 8.69% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Animal Type, Route of Administration, Indication, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Veterinary Dermatology Drugs MarketDynamics

Drivers

Rising prevalence of diseases among animals

- Comparatively to foot-and-mouth disease, lumpy skin disease can cause permanent weakening in afflicted livestock, making it an economically significant cow illness, according to the Food and Agriculture Organization. Lesions on the skin are the consequence of severe and irreversible damage to hides, and mortality rates of up to 40% or more have been documented. Mouth, throat, and respiratory tract lesions are frequent, leading to rapid decline and, occasionally, severe emaciation that can linger for months. For LSD infection in cattle, there is presently no particular antiviral therapy available. However, two vaccinations for the Neethling and Kenya sheep and goat pox viruses have been successfully marketed worldwide and have been widely utilized in Africa. The aforementioned elements have proven crucial for the growth of the market for veterinary dermatology medications worldwide.

Challenges

Adverse effects of the veterinary dermatology drugs

- Drugs for veterinary dermatology may have negative effects, which limit market expansion. Animals may experience minor to severe difficulties as a result of these negative impacts. Many animal patients are hesitant to use veterinary dermatological medications after seeing such negative consequences. These medications may also cause pets to eat less, which might result in dehydration and other problems.

Imposition of stringent regulations

- To be sold on the market, veterinary dermatology medications need to pass strict requirements. The drug-processing method aids in limiting skin cancer cells' aberrant skin growth. So, in order to be approved, veterinary dermatological medications must first pass a number of tests to demonstrate their safety for the intended purposes.

Opportunities

Development of cutting-edge medical therapies

- Veterinary dermatology medications for dogs have grown in both emerging and developed countries due to the rising prevalence of skin cancer and other chronic disorders. The government and commercial entities are making significant investments in the healthcare sector. For dermatological medications to produce reliable outcomes, further technology development is required. There were certain technological restrictions on earlier treatments and medications. Modern veterinary dermatological medications aid in the successful treatment of cancer cells.

An increase in the cost of veterinary treatment

- The industry is anticipated to experience considerable growth because to rising costs for veterinary health care. The pressure on the pocketbook is caused by an increase in pets, a rise in pet owners taking their animals to the doctor, and a rise in vet costs because of labor costs and more advanced therapies for animals that are adapted from human medicine. The price of new technology and medical supplies, as well as growing drug and medication costs, have all contributed to an increase in the price of veterinary care. In addition to greater expenses, other factors contributing to the increase in spending include an increase in the number of pets and longer pet lifespans, which call for more veterinary care.

Segment Insights

Animal Type Insights

The companion animal market segment led and accounted for more than 70.30% 2023 of total revenue. Growing pet ownership is anticipated to accelerate market expansion. Dogs, cats, horses, and other animals are further separated into several segments. Due to the wide availability of products for canine therapy, the dogs category is predicted to have the biggest market share.

In 2023, the livestock animal segment's revenue share was the second-largest. Cattle and other categories are added to it. The increased demand for animal protein and the frequency of parasitic infections in farm animals are anticipated to boost the market for veterinary dermatology medications. Additionally, the category for cattle is anticipated to experience the fastest CAGR of 9.1% throughout the projection period.

Route of Administration Insights

With a market share of 37.40% in 2023, the oral sector led the industry. It is anticipated that the market would rise due to the widespread availability of oral medications in the form of tablets, feed additives, and pills among others. Initiatives taken by market participants in this category are also anticipated to accelerate market expansion. For instance, Bioiberica expanded its offering of dermatological treatments in September 2021 when it introduced the oral and topical dermatology medication line Atopivet.

Since injectable medications allow for simple administration in a substantially lesser number of doses compared to oral medications, the injectable category is anticipated to experience the quickest CAGR of nearly 10.70% throughout the projected period. In contrast to 28 doses of tablets, Convenia from Zoetis cures the animal in just one treatment. Due to its widespread acceptance, the topical category is also anticipated to expand rapidly.

Indication Insights

With a market share of 45.31% in 2023, parasitic infections led the industry. It is anticipated that the market would rise due to the widespread availability of oral medications in the form of tablets, pills, and feed additives, among others. Initiatives taken by market participants in this category are also anticipated to accelerate market expansion. For instance, Bioiberica expanded its offering of dermatological treatments in September 2021 when it introduced the oral and topical dermatology medication line Atopivet.

Since injectable medications allow for simple administration in a substantially lesser number of doses compared to oral medications, the injectable category is anticipated to experience the quickest CAGR of nearly 10.5% throughout the projected period. In contrast to 28 doses of tablets, Convenia from Zoetis cures the animal in just one treatment. Due to its widespread acceptance, the topical category is also anticipated to expand rapidly.

Distribution Channel Insights

Hospital pharmacy led the industry and accounted for 45.50% of all sales in 2023. The expansion of the category is anticipated to be aided by the growing number of hospital pharmacies. Additionally, when it comes to treating their pets or farm animals, animal owners sometimes start by contacting veterinary institutions. As a result, hospital pharmacies are the go-to locations for purchasing prescription pharmaceuticals, accounting for their dominant market position.

During the projection period, the e-commerce segment is anticipated to experience the quickest CAGR of about 10.5%. This rise can be attributed to the increasing use of veterinary telemedicine platforms and e-commerce websites that are specifically dedicated to selling veterinary items. By 2028, the sector's market share is anticipated to surpass that of the retail sector.

Regional Insights

What is the U.S. Veterinary Dermatology Drugs Market Size?

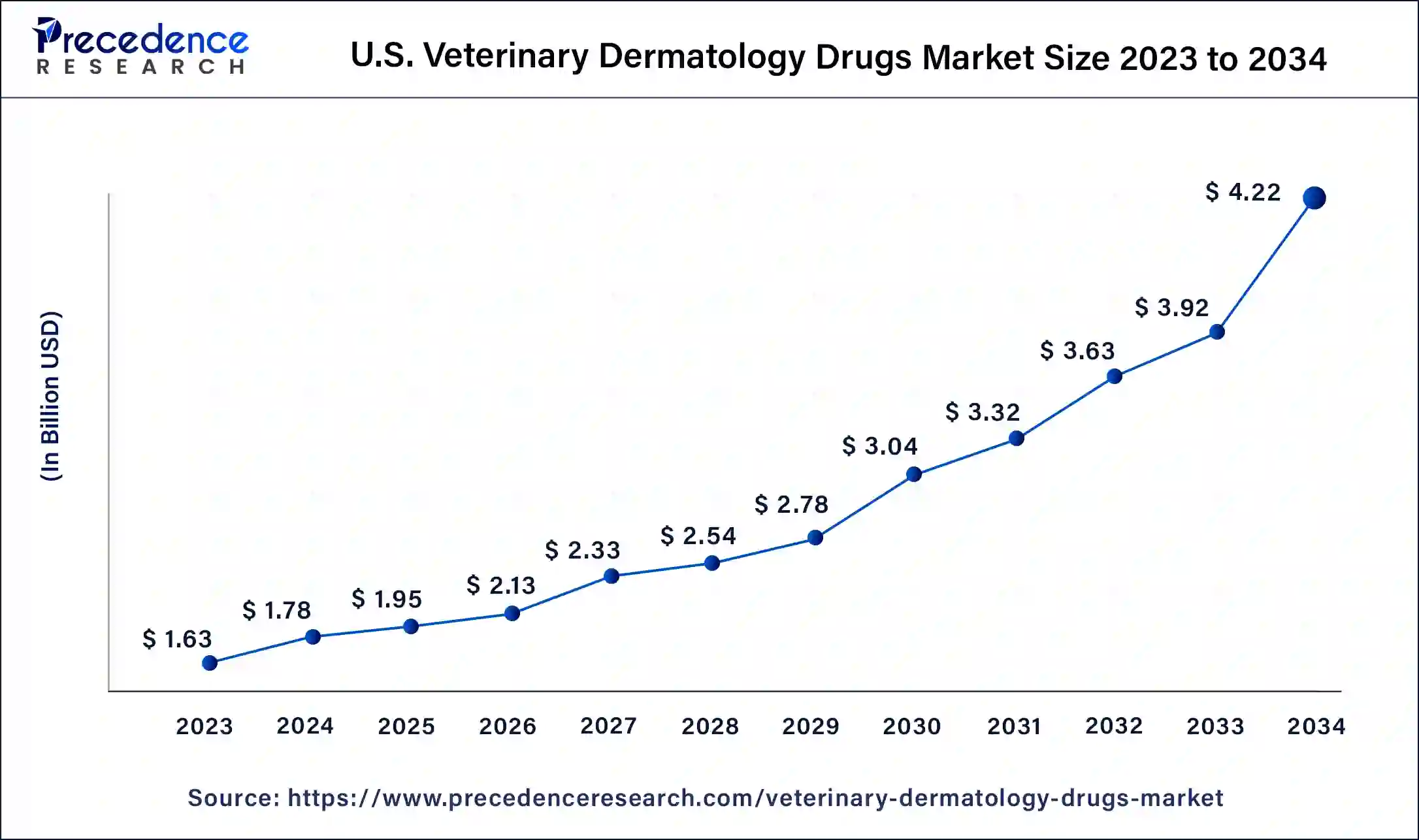

The U.S. verinary dermatology drugs market size is exhibited at USD 1.95 billion in 2025 and is projected to be worth around USD 4.51 billion by 2035, growing at a CAGR of 8.75% from 2026 to 2035.

North America led the market and accounted for over 30.50% in 2023 of total sales.Initiatives from the public and commercial sectors, growing pet care costs, and the existence of important players are the main drivers of this expansion. Additionally, the prevalence of zoonotic illnesses is anticipated to increase market growth.

U.S. Veterinary Dermatology Drugs Market

The market in the U.S. is expanding due to rising instances of allergies, infections, and skin conditions in pets, increased pet ownership, and higher expenditure on pet healthcare. Advances in dermatological products, greater availability of prescription treatments, and a strong veterinary infrastructure further drive growth, along with increasing awareness among pet owners about early skin disease management.

What Potentiates the Veterinary Dermatology Drugs Market in Asia Pacific?

Due to factors like the rising demand for veterinary dermatology drugs and the gradually spreading awareness of these products availability in emerging economies like India and China, the veterinary dermatology drugs market in the Asia Pacific is predicted to experience significant growth over the forecast period. Additionally, the fact that several significant market participants, like Elanco, have production facilities in Asia Pacific helps the region's growth.

India' Pet Health Boom: Dermatology Drugs Driving a New Care Revolution

India's veterinary dermatology drugs market is expanding due to increased pet ownership, greater awareness of animal skin health, and a higher incidence of parasitic infections, allergies, and fungal diseases. The growth of veterinary clinics, improved access to advanced treatments, and increased expenditure on companion animals are further driving demand. Additionally, ongoing livestock care initiatives and government-led animal health programs support market growth.

Europe: A Notably Growing Region

Europe is expected to grow at a notable rate during the forecast period due to an increase in chronic skin conditions among pets, higher adoption of premium dermatology treatments, and rising demand for specialized veterinary dermatologists. The use of innovative formulations like topical immunomodulators and long-acting antiparasitics, along with expanding pet insurance coverage and rapid digital veterinary consultations, is further driving market growth across the region.

UK Veterinary Dermatology Drugs Market Analysis

The UK veterinary dermatology drugs market is growing due to a sharp increase in pet allergies, eczema, and flea-related skin problems, especially in dogs and cats. High pet ownership, strong demand for premium dermatology treatments, and greater access to specialist vet dermatologists support market growth. Additionally, expanded pet insurance coverage and rising expenditures on companion animal health further boost market expansion.

How is the Opportunistic Rise of Latin America in the Veterinary Dermatology Drugs Market?

Latin America is experiencing an opportunistic rise in the market due to the increasing prevalence of skin disorders in companion and livestock animals, driving demand for effective treatments. Countries like Brazil and Mexico are expanding veterinary healthcare infrastructure and adopting advanced therapies, including biologics and topical treatments. Growing awareness among pet owners, along with government and private investments in animal health, is further boosting market growth across the region.

What Opportunities Exist in the Middle East & Africa for the Market?

The Middle East & Africa (MEA) presents immense opportunities for the veterinary dermatology drugs market. These opportunities arise from the rising pet ownership, increasing livestock production, and growing awareness of animal health and welfare. Investments in veterinary healthcare infrastructure, availability of advanced treatments, and government initiatives to improve animal health are supporting market growth. Additionally, expanding demand for preventive care and specialized dermatology therapies offers further potential for market adoption in the region.

Value Chain Analysis

- Clinical Trials

Clinical trials in veterinary dermatology, especially for atopic dermatitis, are exploring new treatments such as JAK inhibitors like Ilunocitinib and Numelvi for rapid itch relief. Research also emphasizes improving the effectiveness of existing drugs like Cyclosporine.

Key Players: Elanco, Zoetis, Bayer, Vetoquinol - Formulation and Final Dosage Preparation

Developing veterinary dermatology drugs involves choosing the appropriate dosage form, such as creams, ointments, or solutions, based on the drug's properties, the animal species, and treatment needs. Custom compounding by specialized pharmacies ensures medicines accommodate specific animal requirements.

Key Players: Elanco, Zoetis, Bayer, Vetoquinol - Packaging and Serialization

Packaging of veterinary dermatology drugs emphasizes product safety and integrity by using high-barrier materials like aluminum laminates. Serialization with unique 2D Data Matrix barcodes guarantees traceability, anti-counterfeiting, and compliance with regulations.

Key Players: Elanco, Zoetis, Bayer, Vetoquinol

Veterinary Dermatology Drugs MarketCompanies

- Virbac S.A.: Provides veterinary dermatology solutions, vaccines, antiparasitic treatments, and prescription therapies for pets and livestock, focusing on skin health and disease management.

- Elanco: Provides veterinary dermatology medications, antiparasitics, and specialty therapies for companion animals and livestock, focusing on skin conditions, allergies, and overall animal health.

- SAVAVET: Provides veterinary pharmaceuticals, including dermatology products, antibiotics, and antiparasitic drugs, serving both companion animals and livestock with a focus on effective skin care solutions.

- AB Science: Develops innovative veterinary dermatology treatments and specialty drugs, including JAK inhibitors and other therapies targeting chronic skin conditions in animals.

- Vetmedica: Vetmedica develops veterinary pharmaceuticals, vaccines, and nutritional supplements focused on companion animal health, disease prevention, and performance enhancement through science-backed veterinary solutions.

- IDEXX Laboratories: IDEXX Laboratories provide diagnostic instruments, reference laboratory services, rapid test kits, and software solutions for companion animals, livestock, and poultry health management.

- Vetoquinol S.A.: Vetoquinol specializes in animal health products, including pharmaceuticals, vaccines, and nutraceuticals for companion animals and livestock, focusing on pain management, anti-infectives, and chronic disease care.

- Bayer Animal Health: Bayer Animal Health offers parasiticides, vaccines, and therapeutic solutions for companion animals and farm animals, addressing flea, tick, parasite control, and disease prevention.

- Boehringer Ingelheim:Boehringer Ingelheim provides vaccines, biologics, and pharmaceutical treatments for livestock and companion animals, emphasizing disease prevention, herd health management, and veterinary innovation.

- Novartis Animal Health: Novartis Animal Health develops vaccines, antiparasitic treatments, and therapeutic medicines for companion and farm animals, supporting preventive healthcare and improved animal productivity.

- Toray Industries: Toray Industries supplies advanced biomaterials, membranes, and biotechnological solutions used in veterinary diagnostics, medical devices, and pharmaceutical manufacturing within the animal health sector.

Other Major Key Players

Recent Developments

- In September 2024, Elanco introduced Zenrelia (ilunocitinib), a once-daily oral JAK inhibitor for dogs over 12 months with allergic and atopic dermatitis, offering effective itch control at a more affordable price point.(Source: https://www.elanco.com/)

- In August 2024, Boehringer Ingelheim India partnered with Vvaan Lifesciences to strengthen the distribution of its pet parasiticide products. The alliance targets a wider reach in Tier 2 and underserved Indian cities, supporting improved access to quality pet healthcare.

(Source: https://www.boehringer-ingelheim.com/) - Elanco announced a deal to buy Kindred Biosciencesin June 2021 for USD 440 million. With this, Elanco has advanced the market for pet health, particularly in the quickly expanding dermatological sector. By 2025, three brand-new blockbuster dermatological medications from Kindred Biosciences are anticipated to be available.

- Ceva Animal Health introduced Douxo S3 Pyo skincare pads for cats and dogs in January 2021. These pads are expected to improve this range by providing an easy-to-administer antibacterial activity while hydrating and protecting the skin's environment.

- In September 2020, Bioiberica released the two newest products in its dermatological line, Atopivet Mousse and Atopivet oral suspension. The company's goal with this introduction was to treat atopic dermatitis in dogs and cats at all layers of the epidermis and dermis.

Segment Covered in the Report

By Animal Type

- Companion Animal

- Livestock Animal

By Route of Administration

- Oral

- Topical

- Injectable

By Indication

- Parasitic Infections

- Allergic Infections

- Others

By Distribution Channel

- Retail

- E-Commerce

- Hospital Pharmacies

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting