What is the Veterinary Services Market Size?

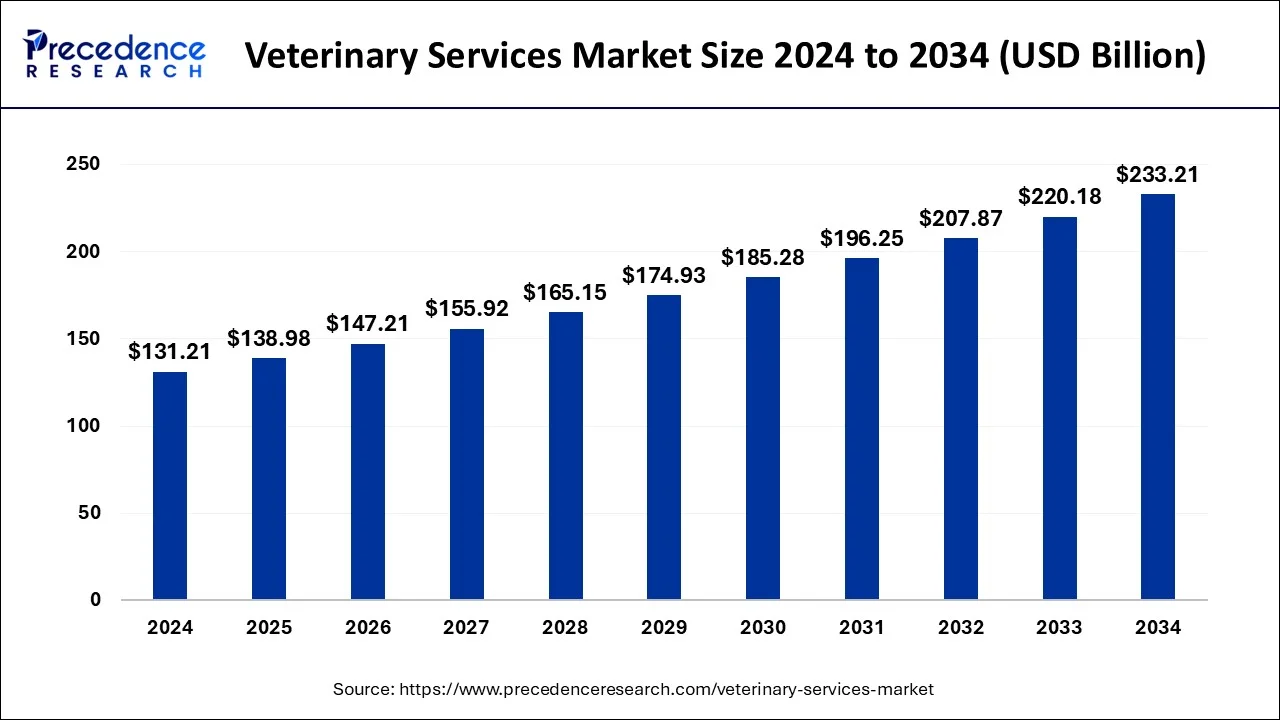

The global veterinary services market size is calculated at USD 138.98 billion in 2025 and is predicted to increase from USD 147.21 billion in 2026 to approximately USD 245.76 billion by 2035, expanding at a CAGR of 5.87% from 2026 to 2035.

Market Highlights

- North America dominated the market with the largest share in 2025.

- By region, Asia-Pacific is expected to grow at the fastest rate during the forecast period.

- By service insight, the diagnostic tests and imaging services segment dominated the market in 2025.

- By animal type insight, the companion animals segment led the market in 2025.

Market Size and Forecast

- Market Size in 2025: USD 138.98 Billion

- Market Size in 2026: USD 147.21 Billion

- Forecasted Market Size by 2035: USD 245.76Billion

- CAGR (2026-2035): 5.92%

- Largest Market in 2025: North America

- Fastest Growing Market: Asia Pacific

How is AI Transforming the Veterinary Services Market?

The future of veterinary services is taking new turns with the introduction of Artificial Intelligence (AI). It is improving diagnosis and treatment processes as well as improving general operational efficiency in the veterinary services market. AI makes the most intricate analysis of medical records, laboratory tests, and imaging studies and assists veterinarians in the highly accurate detection of diseases and conditions. This would create better treatment strategies and allow for more effective interventions while decreasing the guesswork. Also, it allows one to reach telemedicine and remote care. Today, it allows real-time monitoring and consultation through telemedicine and remote care. AI-driven chatbots mainly take care of appointment scheduling while fielding queries and optimizing inventories while automating billing. In such ways, AI is speeding up veterinary research. Collaborations between veterinary professionals, AI specialists, and tech developers are very important in making this full realization possible. The future of AI in veterinary services is currently very bright with lots of room for further development and innovations.

Veterinary Services Market Growth Factors

The huge global increase in zoonotic and food-borne illnesses is the primary factor driving the market. The protection of animal health and welfare as well as the upkeep of the hygienic safety of international trade are vital functions of veterinary services. Additionally, it helps protect the general public's health and guarantees food safety. The Organization for Animal Healthcare (OIE) said in an article that there is a rising worldwide demand for foods derived from animals, including meat, which is anticipated to reach 445 million tons by 2050. Customers' preferences for shopping have changed from traditional brick-and-mortar stores to online marketplaces as a result of the COVID-19 pandemic, which has accelerated industry growth.

It is expected that a growing number of government measures to guarantee food security and biosecurity would hasten the adoption of veterinary services in cattle across the world. For instance, the OIE, which is concerned with preserving food safety, has continuously issued guidelines to remove possible biological dangers and risks connected with inspections on-farm, before slaughter, prior to processing, and during processing. Because more workers are working from home due to the pandemic, pet adoption has skyrocketed. Pets are a big part of many people's life. Many people view their pet as a member of the family. There are always cats and dogs around, and people are spending more money on them. In order to meet the growing demand, veterinary businesses produced new goods, diagnostic equipment, and services. This is a brand-new platform for diagnosing intestinal parasites in canines. Additionally, the following rise in pet ownership around the globe has aided in the market's quick expansion. In order to ensure animal welfare, veterinarians and veterinary service providers consistently make efforts, which motivates pet owners to employ these services.

- The growing prevalence of zoonotic diseases is increasing the growth of the veterinary service market

- Rapidly increasing pet adoption will result in an increase in the demand for pet care services

- Raising awareness about animal health is also fueling market growth.

- The growing number of cattle and poultry farm

Veterinary Services Market Outlook

The veterinary services market is an important branch of the healthcare industry. This industry deals in delivering comprehensive healthcare services to animals globally. There are several types of services provided by this sector, comprising diagnostic tests and imaging, physical health monitoring, surgical procedures, and nutrition. These services are designed for various types of animals, including poultry, swine, cattle, sheep & goats, fish, dogs, cats, and horses. The increasing cases of zoonotic diseases in different regions of the world are driving the growth of the market for veterinary services.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 138.98 Billion |

| Market Size in 2026 | USD 147.21 Billion |

| Market Size by 2035 | USD 245.76Billion |

| Growth Rate from 2026 to 2035 | CAGR of 5.87% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Service Type, Animal Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Key Market Drivers

The willingness of pet parents to spend more on pets

- About 70% of American families would have at least one pet in 2021, according to the American Pet Products Association (APPA). Over the past few decades, pet care spending in the United States has climbed both nationally and per person. The North American Pet Health Insurance Association (NAPHIA) estimates that in 2020, the total written premiums for pet insurance in the United States will exceed $1.99 billion. With the help of pet insurance, pet owners may effectively spend money on high-quality services for their animals and provide them with the best possible care, lowering their out-of-pocket costs. Additionally, it has been noted that the adoption rate of pets has grown recently. In 2021, 14% of new and current pet owners adopted a new animal, according to the APPA. As a result, the market as a whole is anticipated to expand considerably over the course of the forecast period due to increased pet adoption and pet insurance programs.

Key Market Challenges

Rising costs of veterinary services may hamper the market growth

- Increasing demand for veterinarian services, an increase in the number of pets, and technical developments in clinical procedures all contribute to rising veterinary service prices. This is anticipated to limit market expansion somewhat. For instance, according to the American Veterinary Medical Association, over 38% of dogs and over 40% of cats made up the pet population in the United States in 2020. Furthermore, just 5% of cats and 10% of dogs have pet insurance, according to a poll by the American Pet Product Association. Even though it is growing, the pet insurance market in the United States is still very young. Additionally, the cost of veterinarian services has climbed 2015 by over 10% for clinical treatments and more than 5% for routine check-ups, according to the Nationwide/Purdue University Veterinary Price Index. Prices for both veterinary surgical procedures and pharmaceuticals are showing a similar rise. As pet insurance products become more widely used, it is projected that the aforementioned aspect will have a minor long-term influence on the industry.

Key Market Opportunities

Increase in pet adoption

- Because so many people were working from home during the coronavirus epidemic, the adoption of pets increased. Many people view their pet as a member of the family. To meet the demand, veterinarian businesses introduced several new goods, services, and diagnostic equipment. The development of the veterinary services sector is anticipated to be aided by rising consumer spending on veterinary care, a rise in pet ownership, and a rise in the number of poultry and cattle farms. Throughout the anticipated period, rising pet adoption in Southeast Asia and Central America will additionally fuel the market for veterinary services. In the case of an incident or infection, pet owners are more worried about the health of their animals and take better care of their livestock. As a result, the market value for veterinary services will rise significantly in the near future.

Government programs for animal care

- Government institutions work with veterinary associations to establish programs that guarantee the best inventory availability in sectors for treating domestic animals. The rising need for veterinary supplies is a reflection of veterinary services industry developments. Additionally, it is anticipated that throughout the forecast period, rising per capita spending on animal healthcare and an increase in animal health consciousness would fuel the market development.

Segments Insights

Service Type Insights

The market for diagnostic tests and imaging services generated over USD 34 billion in revenue in 2024, and it is expected to continue to dominate over the forecast period with a sizable market growth rate. Pets who get infectious illnesses run the risk of dying, and farm animals are frequently less productive as a result. The potential of disease invasion is exacerbated by the globalization of the animal and allied product trade. The detection, control, and eradication of such illnesses depend on accurate and timely diagnostic procedures. As a result, veterinary services including diagnostic testing and imaging have increased. The development of equipment and auxiliary instruments for the quick and simple identification of animal diseases has been prompted by the requirement for imaging and diagnostic tests. The creation of prototype diagnostic tests for a variety of zoonotic illnesses is made possible by revolutionary technological technologies for personalized human medicine. A veterinary clinic also uses cutting-edge imaging technologies in its radiology and imaging rooms to identify and treat illnesses in animals. Therefore, as a result of the aforementioned factors, the market for veterinary services is anticipated to continue to grow over the projected period.

Animal Type Insights

Over 60% of the market was predicted to be occupied by companion animals in 2024. The need for pet care services, including veterinary services among others, is significantly increased by the growing adoption rate of companion animals. For instance, The American Pet Products Association (APPA) estimates that in 2021, pet owners would spend USD 1,480 on average per year on the essential costs of a pet dog. Similar to this, there has been a marked rise in the prevalence of several illnesses in animals kept as pets. In 2018, it was projected that 2.5% of dogs in the UK have osteoarthritis, according to research that was published in the Nature Journal. Additionally, about 8% of cats and 10% of dogs received surgery, according to the APPA's 2017-2018 National Pet Owners Survey data. As a result, the market need for veterinary services will increase as more pets undergo surgical operations.

Regional Insights

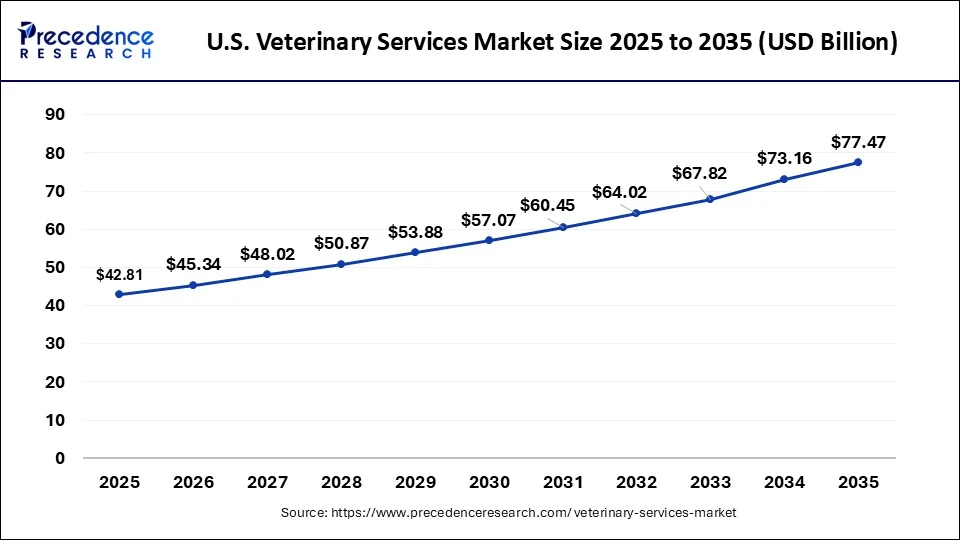

What is the U.S. Veterinary Services Market Size?

The U.S. veterinary services market size is anticipated to surpass USD 42.81 billion in 2025 and is expected to be worth around USD 77.47 billion by 2035, poised to grow at a CAGR of 6.11% from 2026 to 2035.

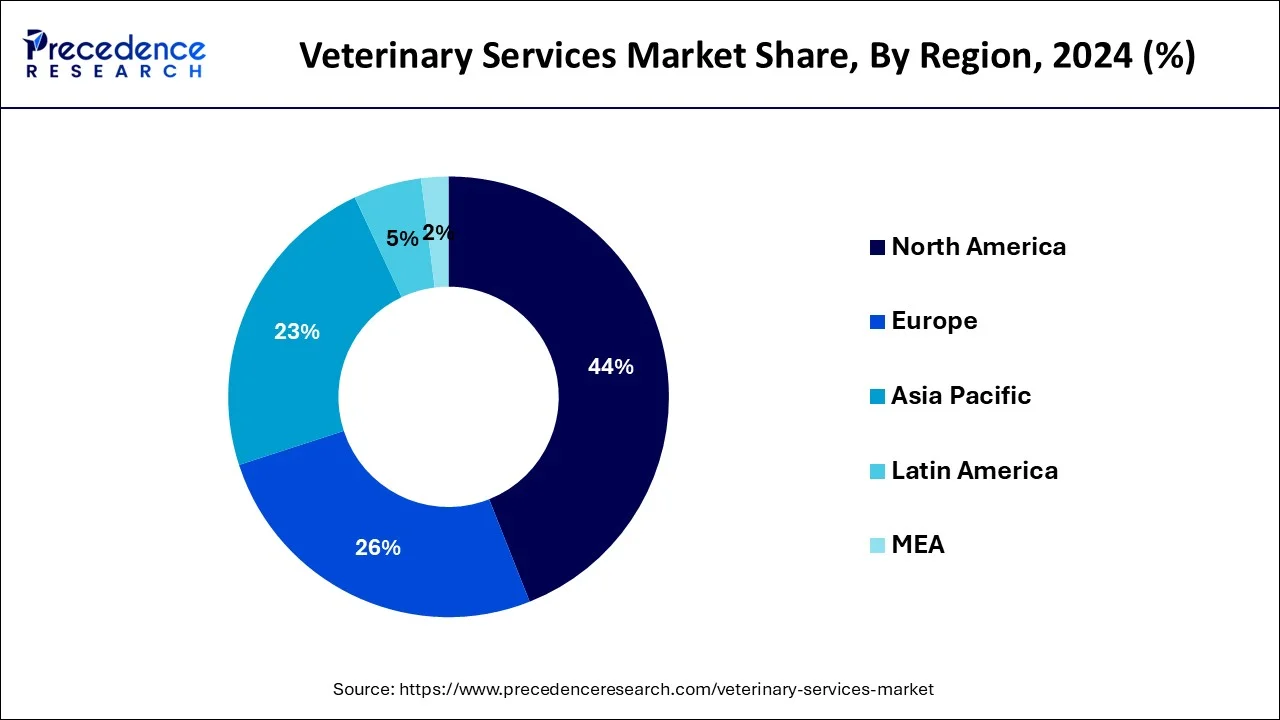

Why Did North America Hold the Largest Share of the Veterinary Services Market?

North America had the biggest revenue share of more than 43% in 2025.The main causes of this significant expansion are the determined actions conducted by various government animal welfare groups geared at the enhancement of veterinary services in the United States and Canada. It is projected that the proliferation of new animal education programs in the United States, including unconventional programs seeking accreditation, will increase access to these services and hence increase the potential for acceptance of veterinary services in the years to come.

What Makes Asia Pacific the Fastest-Growing Region in the Veterinary Services Market?

On the other hand, during the anticipated years, Asia Pacific is expected to see the quickest rate of growth. The regions developed and developing economies' expanding pet and livestock populations are the cause of the exponential rise. Additionally, because they aid in the maintenance of the priceless livestock herd, veterinary services also serve to lower poverty, particularly among rural communities in developing nations. The number of veterinarians in Japan who treat pets and other small animals is rising, which might present a development opportunity for the industry. The increased demand for goods like meat and milk as a result of the expanding population, which leads to animal husbandry, is predicted to enhance the need for veterinarians and their services in India.

What Drives the European Veterinary Services Market?

The European market is primarily driven by the rise in the number of veterinary clinics, as well as the rapid adoption of pets by citizens. Additionally, the increasing prevalence of bird flu in several nations, such as Germany, France, Italy, the UK, Sweden, and the Netherlands, has increased the demand for advanced medication, thereby driving the growth of the market in this region.

How is the Opportunistic Rise of Latin America in the Veterinary Services Market?

Latin America is expected to grow at a considerable CAGR during the forecast period. The increasing preference of cow owners to visit veterinary diagnostics centers in regular intervals is boosting the market expansion. Also, governments of numerous countries, such as Brazil, Argentina, and Peru, are investing significantly in providing high-quality veterinary services, thereby boosting the growth of the market in this region.

What Opportunities Exist in the Middle East & Africa for the Veterinary Services Market?

The Middle East & Africa (MEA) presents significant opportunities for the market. These opportunities arise from the growing adoption of companion animals by the elite-class consumers staying in Saudi Arabia, the UAE, Qatar, and South Africa, boosting the demand for preventive care solutions. Additionally, the rapid investment by market players for launching new pet care services is expected to accelerate the growth of the market in this region.

Veterinary Services Market Companies

- Merck Animal Health

- Ceva Sante Animale

- Vetoquinol S.A.

- Zoetis

- Boehringer Ingelheim GmbH

- Elanco

- Nutreco N.V.

- Virbac

- Kindred Biosciences, Inc.

- Biogenesis Bago

- Indian Immunologicals Ltd.

- Neogen Corp.

- Hester Biosciences

- Phibro Animal Health

- Dechra Pharmaceuticals PL

Latest announcements

- Brian Garish, president of Mars Veterinary Health International, applauded the mission of Crown Vet to improve pet health in India. Garish emphasized the alignment of Mars' Purpose with Crown Vet's mission, aiming to enhance pet care and training for local veterinary professionals.

Recent Developments

- In December 2025, Serenity Vet launched a subscription-based veterinary service. This new service enables veterinary clinics and hospitals to enhance staffing tasks with assistance from AI and automation.

(Source: https://www.dvm360.com ) - In October 2025, Lollypop Farm opened a new veterinary clinic in Rochester. This clinic was inaugurated to deliver high-quality treatment to the pets across this region.

(Source: https://www.nysenate.gov ) - In April 2025, Tractor Supply launched Tractor Supply Rx, a new service that helps in streamlining pet prescriptions.

(Source: https://www.retailtouchpoints.com ) - In July 2024: Pawan Kotwal an advisor to Lieutenant Governor LG, UT Ladakh, launched Mobile Veterinary Clinic Services for the rural areas and animal husbandry, which has been funded by Livestock Health and Disease Control Programme of the MoF, DAHD, Government of India, for inaccessible and remote areas of UT Ladakh.

- In March 2024, A'alda Group, the preeminent provider of quality veterinary services, launched its first Japanese pet care facility in Gurugram, India, making the achievement even more worth its global expansion strategy. It is a significant step in the international expansion plans of A'alda and its commitment for the provision of great pet healthcare worldwide. The facility forms part of the expansion plans in Delhi and Noida.

Segment Covered in the Report

By Service Type

- Diagnostic tests and imaging

- Physical health monitoring

- Surgery

- Others

By Animal Type

- Production

- Poultry

- Swine

- Cattle

- Sheep & Goats

- Fish

- Companion

- Dogs

- Cats

- Horses

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting