What is the Veterinary Orthopedic Implants Market Size?

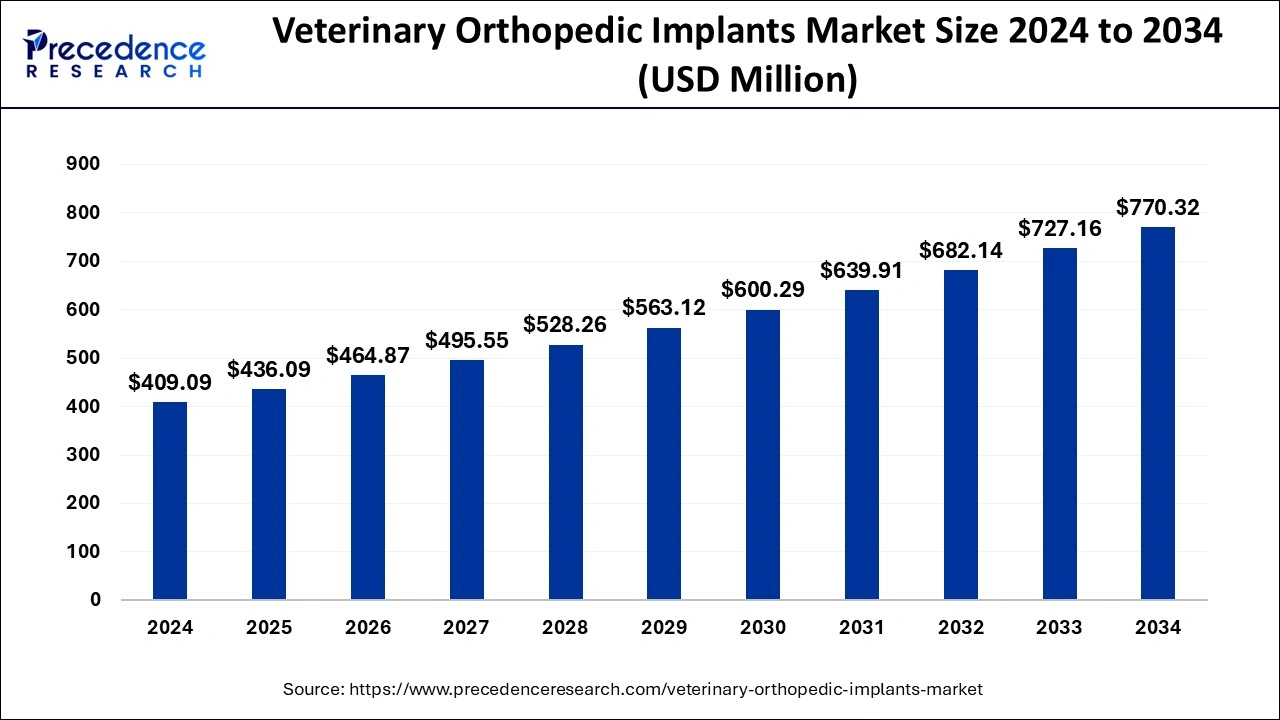

The global veterinary orthopedic implants market size is calculated at USD 436.09 million in 2025 and is predicted to increase from USD 464.87 million in 2026 to approximately USD 814.72 million by 2035, expanding at a CAGR of 6.45% from 2026 to 2035.

Veterinary Orthopedic Implants Market Key Takeaways

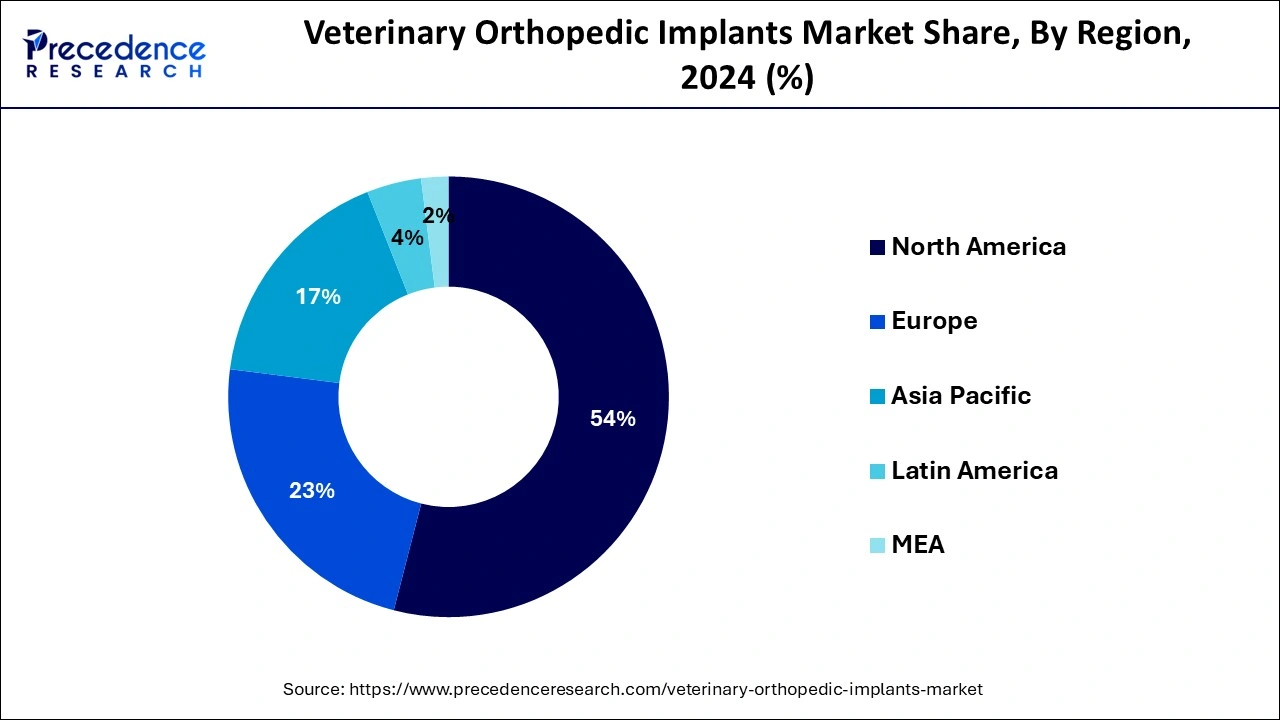

- North America dominated the veterinary orthopedic implants marketwith revenue share of 54% in 2025.

- Asia-Pacific is projected to host the fastest-growing veterinary orthopedic implants market in the coming years.

- By product, the plate segment recorded a major stake in the global market in 2025.

- By product, the screw segment is anticipated to grow with the highest CAGR in the market during the studied years.

- By end-user, the veterinary hospitals segment held a dominant presence in the market in 2025.

- By end-user, the veterinary clinics segment is projected to expand rapidly in the market in the coming years.

AI in the Market

Artificial intelligence is revolutionizing the veterinary orthopedic implant market by improving precision, customization, and productivity. AI analyzes imaging scans, detects fractures and abnormalities at an early period, and aids accurate preoperative planning. Furthermore, the system helps in the choice of materials that guarantee durability and compatibility with the unique physiology of the species. Data-driven robotic and navigation systems direct the surgeon in real-time, thus limiting errors and increasing recovery outcomes. The AI-enabled smart implants and wearables monitor postoperative healing progress, while analytic prediction identifies potential complications at an early stage. AI-assisted rehabilitation programs allow for optimal recovery timing.

Veterinary Orthopedic Implants Market Growth Factors

- Rising adoption of companion animals: The rising adoption of pets by humans necessitates proper veterinary care of the pets.

- Increasing Pet Expenditure: The rising adoption of pets leads to increased pet expenditure for healthcare and other purposes.

- Growing Research and Development: Ongoing efforts are made to design novel orthopedic implants based on animal requirements.

- Increasing Investments: Several government and private organizations provide funds for veterinary orthopedic implants.

- Rising Incidences of Veterinary Osteoarthritis: The rising veterinary osteoarthritis cases increase the demand for orthopedic implants, propelling the market growth.

- Increasing Number of Veterinary Clinics: The growing awareness and the rising adoption of pets lead to the increasing number of veterinary clinics and hospitals.

- Technological Advancements: Advanced technologies such as AI and 3D printing revolutionize the design and manufacturing of orthopedic implants.

Crucial Factors Accountable for Market Growth

- Increased number of companion animals

- Rising expenditure on pet healthcare

- Increasing number of veterinary surgeries

- Constant approvals for novel products

- Increasing cases of osteoarthritis in pets

- Growing research and development expenditure

- Increasing popularity of animal sports

- Technological innovations

Market Scope

| Report Highlights | Details |

| Market Size in 2025 | USD 409.09 Million |

| Market Size in 2026 | USD 464.87 Million |

| Market Size by 2035 | USD 814.72 Million |

| Growth Rate from 2026 to 2035 | CAGR of 6.45% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, End User, and Region |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, Middle East & Africa (MEA) |

Market Dynamics

Driver

Increasing Pet Ownership

The growing adoption of pets is driven by demographic changes, rising income levels, and the COVID-19 pandemic. It is estimated that more than half of the global population owns a pet. People in the regions like the US, Brazil, Europe, and China have the highest number of pets globally. The rising disposable income and healthcare expenditure drive the market. According to the American Pet Product Association, people spent $147 billion on their pets in 2025. The increasing pet ownership shows a positive influence on the veterinary orthopedic implants market growth. This results in more people becoming aware of pet health.

Restraint

Risk of Infections and Lack of Trained Professionals

The major challenge of the veterinary orthopedic implants market is the risk of infection. Surgery for implanting veterinary orthopedic implants possess high risk of infection, causing implant failure and further health issues for the animal. This decreases the demand for orthopedic implants, restricting market growth.

Another major challenge is the lack of trained professionals. Several veterinary offices in the underdeveloped and developing countries do not have sufficient trained professionals to perform surgery, hindering market growth.

Opportunity

Emphasis over 3D Printing

3D printing or additive manufacturing is a technique of manufacturing a three-dimensional object from a digital file. 3D printing is an emerging technique used for designing and manufacturing veterinary orthopedic implants. It can manufacture customized implants for different animals, eliminating the need for bulk manufacturing. It minimizes waste to a huge level as only the materials required for the implants are used. It is also environmentally friendly due to its capability to generate less waste. Additionally, 3D printing significantly reduces the overall cost of the product and results in faster production. Hence, 3D printing presents numerous opportunities for the veterinary orthopedic implants market in the future owing to its superior benefits compared to conventional manufacturing techniques.

Segment Insights

Product Insight

The Orthopedic Plates Accounted for Highest Market Stake in 2025

Plates recorded the major market stake in the worldwide veterinary orthopedic implants market in 2025. Ease of availability and new product launches are the major reason for high market share of NSAIDs. Other factors such as technological improvements and use of new materials will boost the demand for Orthopedic Implant Plates. Screw Implants are anticipated to advance at the maximum CAGR through the forecast period due to high demand in the treatment of companion animals as well as cattle.

End UserInsight

Veterinary Hospitals Are Expected to Dominate the End User Segment of Veterinary Orthopedic Implants Market

Veterinary hospitals are equipped with all the latest equipment's and skilled veterinarians which encourages the animal owners to visit these healthcare facilities for better and effective care of their pets. Moreover, the larger veterinary hospitals have sufficient funds to acquire latest technologies which can reduce the procedure duration and make the procedure pain free for small animals. These factors contribute to the high popularity of veterinary hospitals. Veterinary clinics are expected to advance at a high CAGR due to launch of new chains especially in developed regions.

Key Market Insights

The use of implants in animals is increasing at a rapid pace. The use is even more prevalent in cats and dogs. These domesticated animals frequently get hurt from fractures owing to multiple factors such as old age, fights, accidents, vehicular trauma, and sport related injuries. Although animal injuries heal rapidly, orthopedic surgeries are needed for healing in the event of cracked bones. The veterinarians decide the type of treatment and implant to be used based on the type of fracture. Plates and screws are the most common types of orthopedic implants.

The orthopedic screws are used to tighten injured bones or reestablish stability in a weak part. Orthopedic plates are used to treat fractures and provide stability and reconstruction. Other implants such as joint replacement implants, knee replacement implants, and hip replacement implants are also widely used to treat animals with serious injuries. Organized animal sports have also developed as a business in many parts of the world. In all such sports, trained animals can be quite lucrative for the people who control, train, and supervise them. These sports lead to serious injuries which require surgeries and use of implants.

The demand for veterinary orthopedic implants is growing rapidly due to increasing trend of owing companion animals. People are keen to spend more on the well being of their pets which is consolidating the demand for veterinary healthcare products. Moreover, increasing approvals for veterinary orthopedic implants is expected to present attractive opportunities over the forecast period.

Future of Veterinary Orthopedic Implants

Implants have been used in both humans and animals since a long time to effectively treat a huge array orthopedic ailment. After years of research, the use of new type of implants is on the rise. These bioabsorbable implants can be used in multiple orthopedic procedures. Bioabsorbable polymer implants are expected to make significant inroads into various orthopedic applications. Physicians who have been familiar with the features and handling attributes of the metal implants, could find it beneficial to familiarize themselves with the exclusive characteristics and benefits of these latest types of biomaterials.

Regional Insights

What is the U.S. Veterinary Orthopedic Implants Market Size?

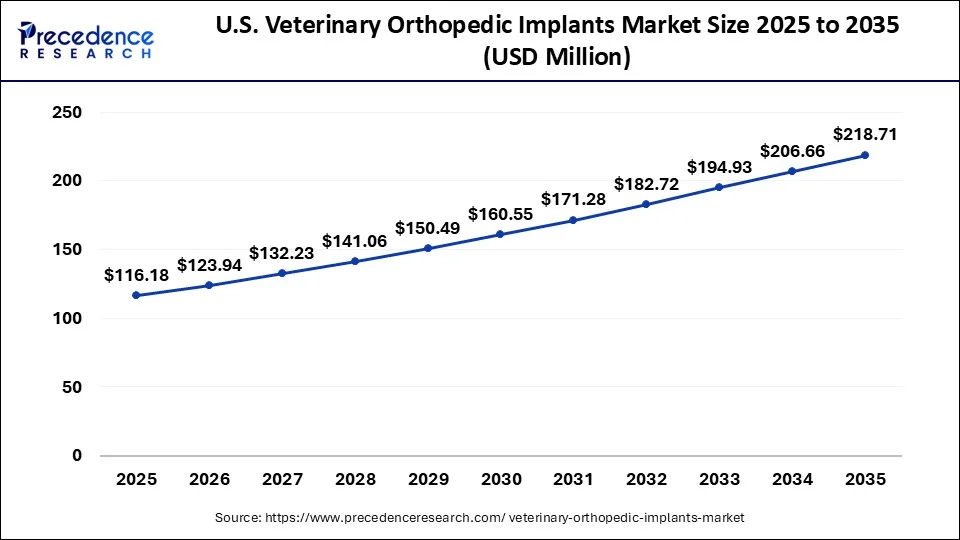

The U.S. veterinary orthopedic implants market size was estimated at USD 116.18 million in 2025 and is predicted to be worth around USD 218.71 million by 2035, at a CAGR of 6.53% from 2026 to 2035.

North America Is Projected To Lead the Veterinary Orthopedic Implants Market By Region

North America dominated the veterinary orthopedic implants market with revenue share of 54% in 2025. The rising adoption of companion animals and the increasing incidences of orthopedic disorders in animals drive the market. The rising disposable income and the increasing expenditure on pet health also contribute to market growth. The North American Veterinary Community (NAVC) increases awareness about veterinary care through veterinary publications, online continuing education, conferences, certifications, and webinars. The increasing number of veterinary clinics and hospitals also propels market growth in North America.

United States: Technological advancements and advanced healthcare infrastructure drive the market growth in the US. The US National Institute of Food and Agriculture announced an investment of $3.8 million for veterinary services. The US government also provides funding to provide education and extension activities for current and future veterinarians and veterinary students.

Europe accounted for the second-highest share of the veterinary orthopedic implants market in 2025. The rising pet ownership, increasing number of veterinary clinics, and the presence of trained professionals are the major growth factors driving the Europe market. The total number of enterprises in veterinary services in Europe is more than 70,000. While there are more than 214,000 people employed in veterinary services in Europe.

The UK Veterinary Orthopedic Implants Market Trends

The UK market is growing due to rising pet ownership, increasing awareness of animal health, and higher spending on veterinary care. Expansion of veterinary clinics, availability of trained professionals, and adoption of advanced orthopedic implant technologies further drive market growth, supported by ongoing R&D and innovations in surgical procedures for pets.

Asia-Pacific is projected to host the fastest-growing veterinary orthopedic implants market in the coming years. The increasing demand for pets and growing awareness of veterinary care boost the market. The increasing pet expenditure and rising middle-class population also augment market growth. The presence of key players and rising disposable income presents opportunities for market growth in Asia-Pacific. The growing research and development activities for expanding veterinary care also drive the market.

India Veterinary Orthopedic Implants Market Trends

The Indian market is growing due to increasing pet ownership, rising awareness of animal healthcare, and higher expenditure on pets. Expansion of veterinary clinics, growing middle-class income, and adoption of advanced implant technologies, along with government initiatives supporting animal welfare, are further driving the demand for veterinary orthopedic implants in the country.

Middle East & Africa Veterinary Orthopedic Implants Market: Rising Pet Care Awareness

The Middle East and Africa market is expanding due to growing pet ownership, increasing focus on animal health, and rising veterinary care expenditure. Expansion of veterinary clinics, adoption of advanced implant technologies, and awareness campaigns for pet welfare are further driving market growth across the region.

UAE Veterinary Orthopedic Implants Market Trends

The UAE market is increasing due to rising pet ownership, growing awareness of animal healthcare, and higher spending on veterinary services. Expansion of veterinary clinics, adoption of advanced implant technologies, and government initiatives promoting animal welfare are further driving demand for veterinary orthopedic implants in the country.

Latin America Veterinary Orthopedic Implants Market Growing with Rising Pet Healthcare Demand

The Latin American market is expanding due to increasing pet ownership, rising awareness of animal healthcare, and higher spending on veterinary services. Growth of veterinary clinics, adoption of advanced orthopedic implant technologies, and supportive government initiatives for animal welfare are further driving the market across the region.

Brazil Veterinary Orthopedic Implants Market Trends

The Brazilian market is increasing due to growing pet ownership, rising awareness of animal health, and higher expenditure on veterinary care. Expansion of veterinary clinics, adoption of advanced orthopedic implant technologies, and supportive government initiatives for animal welfare are further driving market growth across the country.

Value Chain Analysis

- R&D: The series of steps carried out in the invention, design, and testing of an orthopedic veterinary implant, be it new or improved, to meet the needs of the animal patients and the surgeons.

Key Players: Movora, B. Braun - Clinical Trials and Regulatory Approvals: A systematic procedure carried out wherein the implant is tested for safety and efficacy in animal subjects, and which eventually concludes with the ruling body's formal approval to sell and market the device.

Key Players: Movora, BioMedtrix, and Fusion Implants - Formulation and Final Dosage Preparation: For veterinary orthopedic implants, this description corresponds more to the precise manufacturing, sterilization, and assembly of an implant as opposed to dosage preparation.

Key Players: Integra LifeSciences, Johnson & Johnson - Packaging and Serialization: The processes leading to a secure packaging of the final sterile implant and each device receive a unique serial number, which can be traced for safety and quality-control purposes.

Key Players: CVM monitor - Distribution to Hospitals, Pharmacies: Logistics involved in moving the finished, serialized implants from manufacturing sites and into veterinary hospitals and veterinary clinics.

Key Players: Movora - Patient Support and Services: Support and services that include the training of veterinary doctors and pet owners, engineering support, and troubleshooting to ensure the correct and successful use of the orthopedic implant.

Key Players: BioMedtrix and KYON

Veterinary Orthopedic Implants Market Companies

- Everost, Inc. – Supplies veterinary orthopedic implants and surgical instruments, including trauma fixation plates, joint systems, and fracture repair solutions designed specifically for animal orthopedic applications.

- IMEX Veterinary, Inc. – Offers a broad range of veterinary orthopedic products, including external fixation systems and the world's smallest clinically tested locking plate system for fracture and joint stabilization.

- BioMedtrix, LLC – Designs and manufactures advanced veterinary orthopedic implants, such as total joint replacement systems and trauma implants for hips, knees, elbows, and other musculoskeletal needs.

- Securos Surgical – Provides orthopedic implants, including trauma and joint management plating systems, interlocking nail systems, and cannulated bone screw systems, plus surgical instruments and power equipment.

Other Major Key Players

- DePuy Synthes Vet

- KYON Pharma, Inc.

- MWI Veterinary Supply Co.

- Vet Implants

- Braun Melsungen AG

- Vet Implants

Latest Announcement by Industry Leaders

- Mark Stetter, Dean of the School of Veterinary Medicine, commented that they have a bold vision to create a state-of-the-art facility dedicated to providing life-changing surgical treatment for dogs, cats, and other beloved companion animals. He also said that their surgical specialists provide innovative treatments, such as total hip replacements and the ability to create 3D-printed titanium implants. He envisioned to grow their capacity to lead a rapidly evolving field to greater heights.

Recent Developments

- In March 2025, Medline UNITE's Synthetic Ligament Augmentation implant, designed for next-generation tendon and ligament repair, will be showcased at the American College of Foot and Ankle Surgeons Annual Meeting in Phoenix.

(Source:prnewswire.com ) - In February 2025, Atreon Orthopedics received FDA clearance for its BioCharge Autobiologic Matrix, a bioresorbable synthetic implant designed to improve rotator cuff repair integrity and patient outcomes.

(Source: biospace.com )

Major Market Segments Covered

By Product

- Screws

- Pins & Wires

- Plates

- Jigs

- Others

By End User

- Veterinary Clinics

- Veterinary Hospitals

- Others

By Geography

North America

- U.S.

- Canada

Europe

- Germany

- France

- United Kingdom

- Rest of Europe

Asia Pacific

- China

- Japan

- India

- Southeast Asia

- Rest of Asia Pacific

Latin America

- Brazil

- Rest of Latin America

Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting