What is the Yeast Ingredients Market Size?

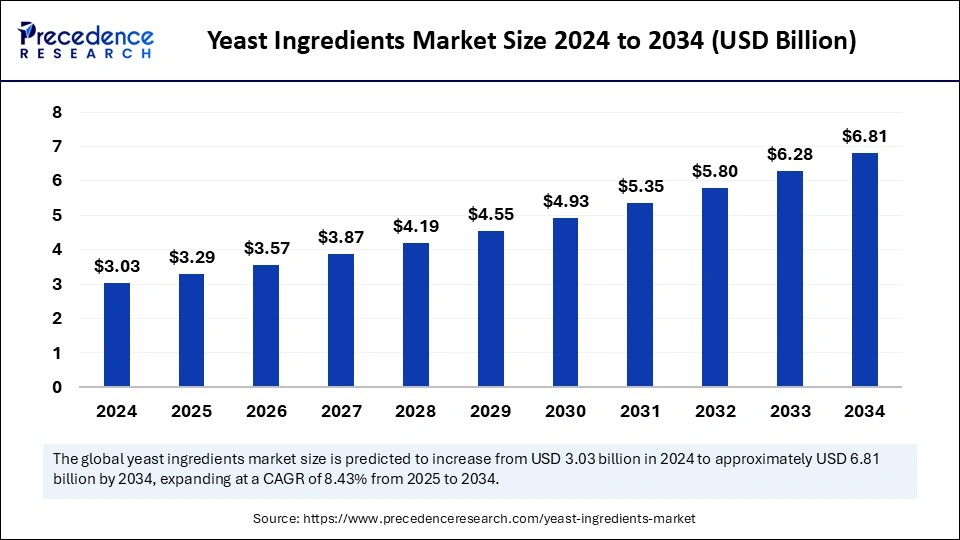

The global yeast ingredients market size is calculated at USD 3.29 billion in 2025 and is predicted to increase from USD 3.57 billion in 2026 to approximately USD 7.31 billion by 2035, expanding at a CAGR of 8.31% from 2026 to 2035.

Yeast Ingredients Market Key Takeaways

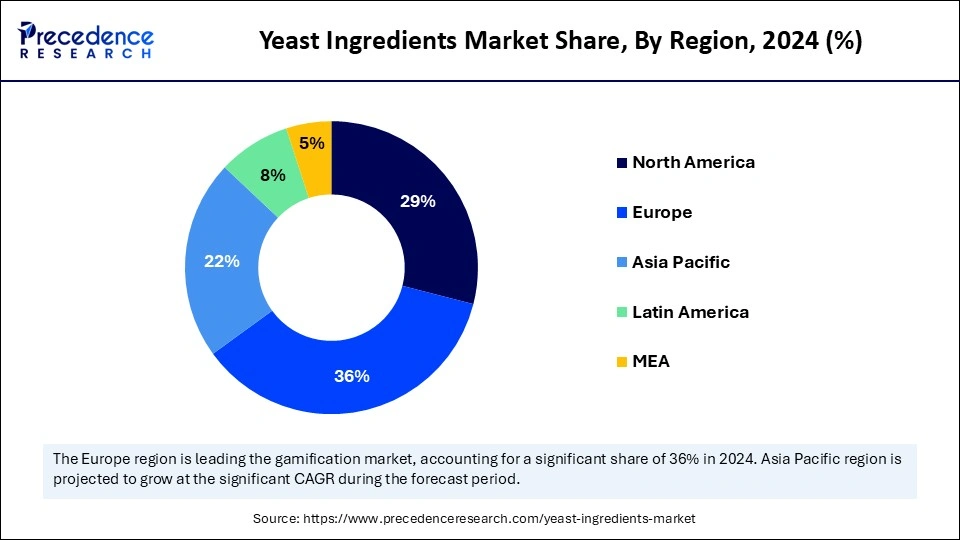

- Europe dominated the global market with the largest market share of 36% in 2025.

- Asia Pacific is expected to grow at the fastest CAGR over the studied period.

- By product, the yeast extracts segment contributed the highest market share of 38% in 2025.

- By product, the yeast autolysates segment is expected to grow at the fastest CAGR over the forecast period.

- By application, the food segment generated a major market share of 61% in 2025.

- By application, the feed segment is anticipated to grow at the fastest CAGR over the projected period.

Market Overview

Yeast is a type of fungus used mainly in brewing and baking because of its capability to ferment sugars, creating alcohol and carbon dioxide gas. The important component in this product is Saccharomyces cerevisiae. Other ingredients are flour, water, sugar, and salt. Yeast necessitates a moist, warm environment to grow and undergo fermentation. Also, its part in the baking process is important as it boosts the leavening process, which results in the distinguished flavor and texture of cakes, bread, and other baked items.

The Impact of Artificial Intelligence (AI) on the Bakery Industry

Artificial intelligence systems are helping bakeries to be more accurate in the overall baking processes and automate systems that can precisely measure ingredients, which makes each baked goods batch high-quality and consistent. Furthermore, AI is transforming the way bakeries are interacting with customers. By analyzing the data, AI systems can get an insight into customer preferences, enabling bakeries to provide customized promotions and recommendations.

- In September 2024, Mondelez International announced the launch of artificial intelligence (AI) technology to create and deploy marketing content via a collaboration with tech and professional services firm Accenture and global advertising and communications firm Publicis Groupe. This capability, in turn, will help the snack and confectionery product manufacturers whose brands include Oreo, Chips Ahoy, Cadbury, Clif, and Ritz.

Yeast Ingredients Market Growth Factors

- The growing demand for livestock products is expected to boost yeast ingredients market growth soon.

- Increasing demand for nutrient-rich foods and extensive acceptance of natural ingredients can propel market growth shortly.

- The rising consumer preferences for yeast derivatives will likely contribute to the market expansion over the forecast period.

Top import markets for active yeast in 2025

| Country | Imports |

| United States | USD 352.4 million |

| France | USD 74.8 million |

| Brazil | USD 60.4 million |

| United Kingdom | USD 59.2 million |

| Algeria | USD 47.3 million |

Yeast Ingredients Market Outlook

The yeast ingredients market is expanding at a significant rate between 2025 and 2034 due to the rising demand for natural food additives, increasing consumer preference for clean-label products, and the growing popularity of fermented food and beverages.

Sustainability is influencing the market by driving companies to adopt eco-friendly production methods, such as reducing energy consumption and using renewable resources. The trend toward sustainable sourcing of raw materials, coupled with yeast's ability to replace synthetic additives and preservatives, is pushing companies to innovate and meet consumer demand for more environmentally conscious products.

The market is expanding worldwide as the food and beverage sector increasingly turns to yeast-based ingredients for their functional benefits, such as flavor enhancement, fermentation, and nutritional fortification. Emerging regions, particularly in Asia-Pacific and Latin America, are witnessing accelerated growth due to changing dietary patterns, urbanization, and expanding food industries, offering ample opportunities for investment and innovation.

Key investors in the yeast ingredients market include global players like Lesaffre, Associated British Foods (ABF), and Chr. Hansen. They contribute to the market by advancing yeast production technology, expanding their product offerings, and enhancing their global distribution networks to meet the growing demand for yeast-based ingredients in food, beverages, and animal feed.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 7.31 Billion |

| Market Size in 2025 | USD 3.29 Billion |

| Market Size in 2026 | USD 3.57 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 8.31% |

| Dominated Region | Europe |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Application, Product, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising demand for ready-to-eat food products

Increasing preference for ethnic food such as Mexican and Thai food in restaurants has strengthened the demand for the yeast ingredients market. Constantly changing food consumption patterns and people's habits impact market growth positively. In addition, the increased need for convenience in food products facilitated the demand for ready-to-eat food like ready-to-consume noodles and soups, which possess high amounts of yeast.

- In June 2024, Lesaffre, an independent key global player in fermentation and microorganisms, announced the signing of a transaction with dsm-Firmenich, a leading innovator in nutrition, health, and beauty, regarding its yeast extract business. Lesaffre and DSM-Firmenich have reached an agreement for a multi-part collaboration in yeast derivatives serving the savory ingredients space.

Restraint

Strict food safety regulations

Strict regulatory laws implemented by governments and regulatory bodies in many countries are major factors hampering the yeast ingredients market. The unavailability of raw materials necessary in the manufacturing of a diverse range of yeast types can impact market growth negatively. Moreover, the lack of raw materials potentially will create demand-supply imbalances, and the increasing global focus on decreasing dependence on fossil fuels will hinder market growth further.

Opportunity

Increasing demand for organic yeast offering

The growing demand for organic yeast is the latest trend in the yeast ingredients market. Organic yeast is gaining traction due to customers' preferences for sustainable and healthier options. In the baking market, organic yeast is utilized in many baked items like cookies, crackers, cakes, biscuits, and buns. Furthermore, the production of this yeast requires milk, organic sugar, and flour as raw materials, sticking to stringent organic standards. However, producing organic yeast can sometimes pose some technical challenges.

- In October 2024, Novonesis, formerly Novozymes, proudly introduces Innova Eclipse as the latest, most advanced yeast innovation for the ethanol production industry. Designed to break through fermentation barriers and withstand fermentation stressors. Innova Eclipse promises to redefine the possibilities for ethanol producers and their plants.

Yeast Ingredients Market Segment Insights

Product Insights

The yeast extracts segment dominated the yeast ingredients market in 2025. The dominance of the segment can be attributed to the benefits offered by yeast extracts in food items. Yeast extracts contain vitamins, minerals, amino acids, nucleotides, and others. It is also an important component in the food & beverage industry. The crucial properties of extracts include sodium content reaction, high nutritional value, and flavor and taste enhancers. Additionally, it is extensively used in savory mixes, dairy products, soups, and processed foods.

In May 2025, Ohly, a global supplier of yeast extracts, yeast-based flavors, and culinary powders, developed its new Neiva range of health products supporting immune health and overall well-being. These scientifically validated products provide formulators with tailored solutions for functional food, sports nutrition, and dietary supplements.

The yeast autolysates segment is expected to grow at the fastest rate over the forecast period. The growth of the segment can be credited to the increasing use of yeast autolysis in pork and poultry applications. These products are rich in proteins, vitamins, fiber, and micronutrients and hence incorporated into food products. However, they are widely utilized as a nutrient for microorganisms and a pet food ingredient in fermentation processes.

Application Insights

In 2025, the food segment led the yeast ingredients market by holding the largest share. The dominance of the segment can be linked to the increasing awareness among key players about calorie deduction, including China, the U.S., and Italy. Consumers are rapidly inclining towards balanced diets, which will drive the demand for food applications in the segment. Furthermore, the surging importance of plenty of protein intake in developing economies such as China and India can propel segment growth further.

In March 2024, Swiss startup Cultivated Biosciences raised a USD 5 million seed round to scale up a yeast fermentation platform it claims can dramatically improve the mouthfeel and performance of alt dairy products and help firms achieve cleaner labels. The round was led by Navus Ventures and supported by Founderful, HackCapital, and Lukas Böni.

The feed segment is anticipated to grow at the fastest rate over the projected period. The growth of the segment can be driven by the increasing use of yeas feed as an animal feed for its nutritional value. The feed yeast used in animal meals enhances digestion and boosts the growth of animals. In addition, the dry yeast, after fermentation, generates products like nitrogen, oxygen, and CO2, which are then used to produce animal feed.

Yeast Ingredients Market Regional Insights

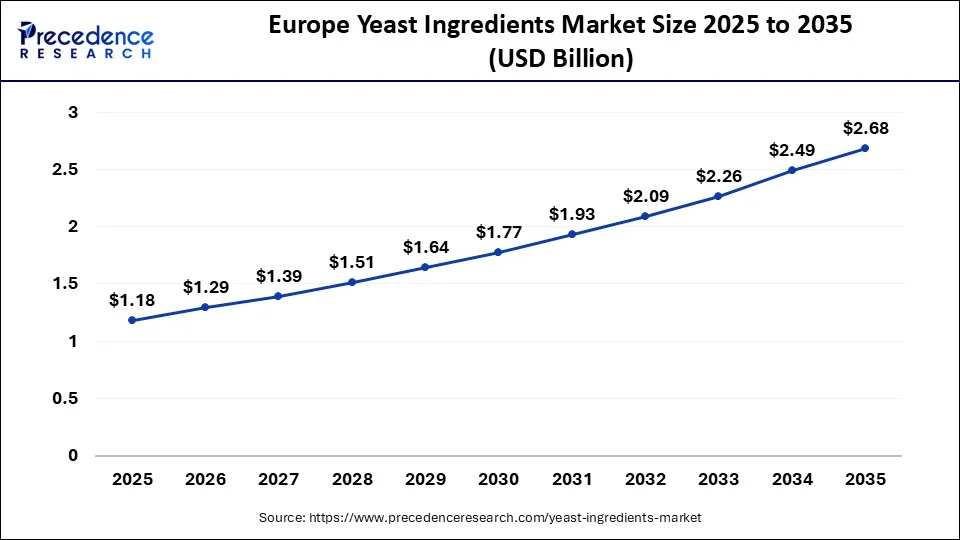

The Europe yeast ingredients market size is exhibited at USD 1.18 billion in 2025 and is projected to be worth around USD 2.68 billion by 2035, growing at a CAGR of 8.55% from 2026 to 2035.

Europe dominated the global yeast ingredients market in 2025. The dominance of the region can be attributed to the ongoing advancements in the bakery industry coupled with the growth of business in emerging markets such as the U.K., Italy, Germany, and France. Furthermore, the increasing demand for bakery products in other European countries will likely contribute to market expansion soon. Enhancements in yeast manufacturing technology and techniques to keep high-quality standards and innovations are further propelling regional market growth.

- In February 2023, Lallemand Inc. expanded the utilization of Lalmin Vitamin D Yeast within the European Union. Having acquired permission in May 2020 to employ Lalmin Vitamin D Yeast in baked products and food supplements, the company obtained approval to incorporate Lalmin Vitamin D Yeast in 22 new categories.

Germany is a major contributor to the market due to its strong food and beverage industry, particularly in baking, brewing, and processed food sectors. The country's advanced technology, efficient manufacturing capabilities, and a growing demand for clean-label products have bolstered the market. Additionally, Germany's emphasis on sustainability and innovation in food processing supports the continued growth and adoption of yeast-based ingredients in various applications.

Asia Pacific is expected to grow at the fastest rate in the yeast ingredients market over the studied period. The growth of the region can be credited to the rising awareness about the consumption of nutritional products and high animal feed production in the region. In Asia Pacific, emerging countries like. China, India, and Japan are major contributors to the market growth. China held the largest market share in Asia Pacific, owing to the highest growth in yeast production and consumption.

The market in Asia Pacific is also driven by rapid urbanization, changing dietary habits, and increasing demand for processed foods and beverages. The rise in disposable incomes and a growing middle class have led to greater consumption of convenience foods, baked goods, and fermented products, driving the demand for yeast-based ingredients. Additionally, the expansion of the animal feed industry, coupled with investments in food processing and a heightened focus on nutrition, is further boosting the adoption of yeast ingredients across various sectors in the region.

The growth of the market in North America is largely driven by rising demand for clean-label, natural, and functional food products, which is fueling the adoption of yeast-based ingredients in food and beverages. The region's robust food processing industry, particularly in baking, brewing, and dairy, alongside innovations in nutritional supplements and animal feed, further propels market expansion. Additionally, growing consumer interest in health and wellness, along with the rising popularity of plant-based foods and fermentation technologies, is driving demand for yeast ingredients as versatile functional additives.

The U.S. is a major contributor to the market due to its well-established food and beverage industry, which relies heavily on yeast for applications in baking, brewing, and processed foods. The country's high demand for clean-label, natural ingredients, coupled with its thriving health-conscious consumer base, has driven the adoption of yeast-based ingredients.

Yeast Ingredients Market Value Chain Analysis

Raw material suppliers are responsible for providing the essential ingredients required for yeast production, such as sugar, starch, and agricultural by-products.

Key Players: Archer Daniels Midland Company (ADM), Cargill, and Südzucker Group.

Yeast production involves cultivating and fermenting yeast strains using raw materials, often employing advanced biotechnology to optimize yields and ensure high-quality products.

Key Players: Lesaffre, AB Mauri, Angel Yeast, and Lallemand.

This stage includes the drying, grinding, and formulation of yeast into various products such as active dry yeast, baker’s yeast, and yeast extracts.

Key Players: Chr. Hansen, BASF, and Lesaffre.

The distribution and logistics stage is where yeast products are packaged and transported to different industries, including food and beverages, animal feed, and pharmaceuticals.

Key Players: Brenntag, Univar Solutions, and Merewen.

This is the stage where yeast ingredients are used in various applications, such as food (baking, beverages), animal feed, nutritional products, and pharmaceuticals.

Key Players: Nestlé, Anheuser-Busch InBev, General Mills, and PepsiCo.

Yeast Ingredients Market Companies

It is a leading producer of various yeast ingredients, including baker's yeast, yeast extract, and nutritional yeast, serving applications in the food, beverage, and animal feed industries.

It offers a wide range of yeast products, including specialty yeast extracts and fermentation-based ingredients used in the food and nutrition sectors.

It specializes in providing high-quality yeast-based ingredients and enzymes for animal feed, focusing on improving animal nutrition and feed efficiency.

Other Major Key Players

- Lallemand Inc.

- Alltech

- BD

- ECPlaza Network Inc.

- Chr. Hansen Holding A/S

- Cangzhou YaTai Commercial & Trade Co., Ltd

- Foodchem International Corporation

- Kerry Group plc

- Lallemand, Inc.

Latest Announcement by Market Leaders

- In November 2024, Kerry Group plc announced that it has entered into an agreement with Kerry Co-Operative Creameries Limited (the "Co-Op") to sell Kerry Dairy Holdings (Ireland) Limited to the Co-Op (the "Disposal") for a total expected consideration of 500 million [1]. Kerry Dairy Ireland is fully owned by Kerry. Kerry Dairy Ireland consists of Dairy Consumer Products, with its leading range of well-loved brands across cheese, cheese snacks, dairy snacks, and dairy spreads.

- In May 2024, Lallemand Specialty Cultures (LSC), a company specializing in the development of microbial solutions for the food industry, announced a series of advancements aimed at enhancing the quality and appeal of dairy products, particularly cheese. One of the developments is the introduction of Flav-Antage BLB1, a specially selected strain of Brevibacterium aurantiacum.

Recent Developments

- In January 2024, Lallemand Inc., a Canadian biotech company, completed the acquisition of Swiss biotech firm Evolva AG. Evolva specializes in yeast-derived natural ingredients for various industries. The strategic fit aligns Evolva's precision fermentation technology with Lallemand's yeast-based solutions, enhancing their global biotech portfolio.

- In February 2023, AngelYeast Co., Ltd. announced its brand development strategy by delivering innovative offerings to the market. This brand development strategy also comprises the development of strategic partnerships and investments to expand its research and development capabilities and global supply chain. These initiatives are expected to improve the company's market reach.

- In September 2025, Estonian startup Aio produced its first ton of yeast-based palm oil alternative and plans to launch its first cosmetic ingredient by the end of the year, moving toward the commercialization of sustainable options for tropical fats.

(Source: www.greenqueen.com)

Segments Covered in the Report

By Product

- Yeast Extracts

- Yeast Autolysates

- Yeast Beta-glucan

- Yeast Derivatives

- Others

By Application

- Food

- Feed

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting