What is the Yeast Protein Market Size?

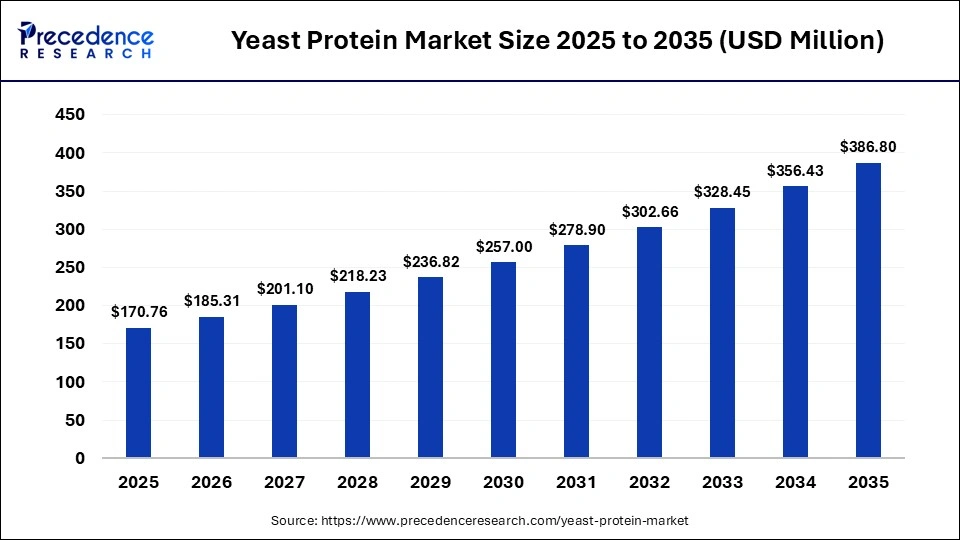

The global yeast protein market size accounted for USD 170.76 million in 2025 and is predicted to increase from USD 185.31 million in 2026 to approximately USD 386.80 million by 2035, expanding at a CAGR of 8.52% from 2026 to 2035. This yeast protein market is growing due to surging consumer demand for sustainable, nutrient-dense, and allergen-free alternatives. Another factor responsible for optimizing yeast protein is the growing trend of becoming vegan and the demand for non-dairy protein substitutes due to lactose intolerance.

Market Highlights

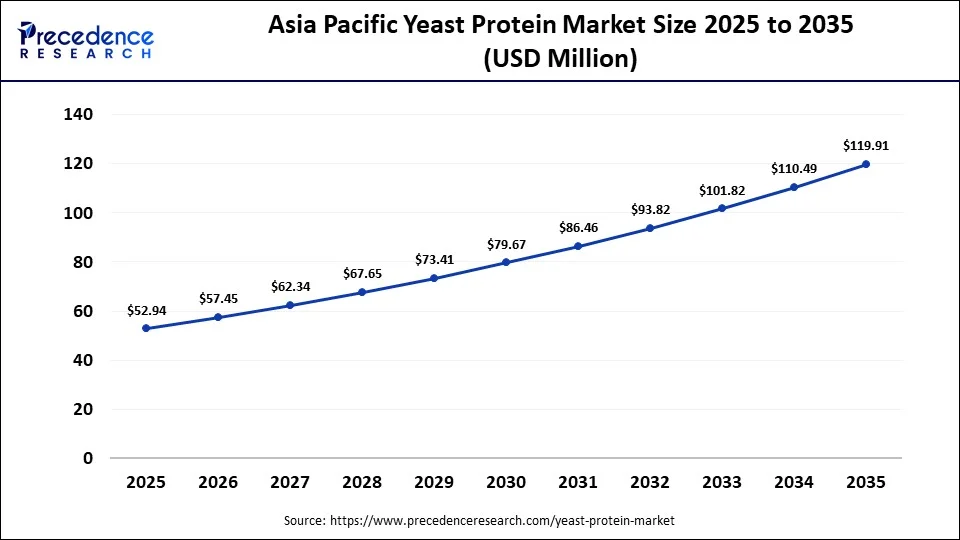

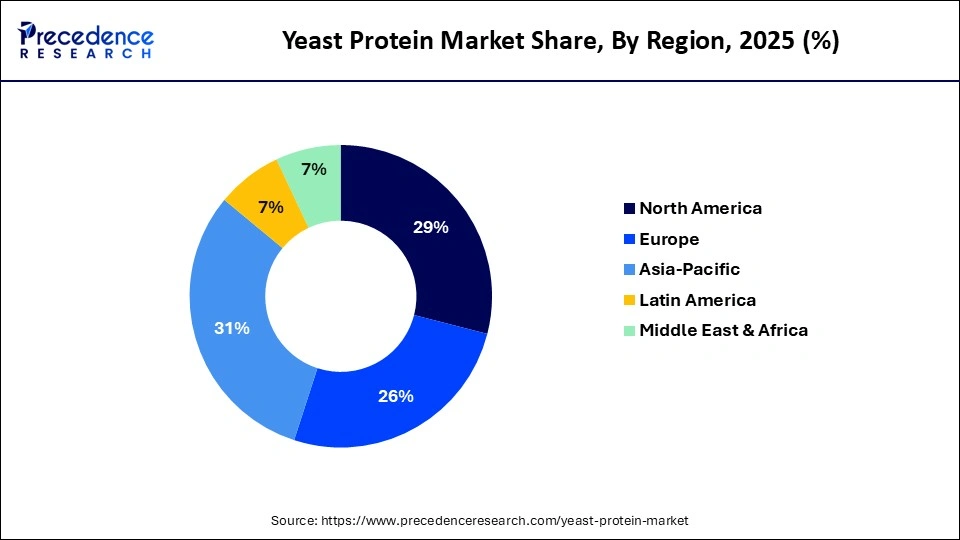

- Asia Pacific dominated the market with the largest market share of 31% in 2025

- North America is expected to grow at the fastest CAGR between 2026 and 2035

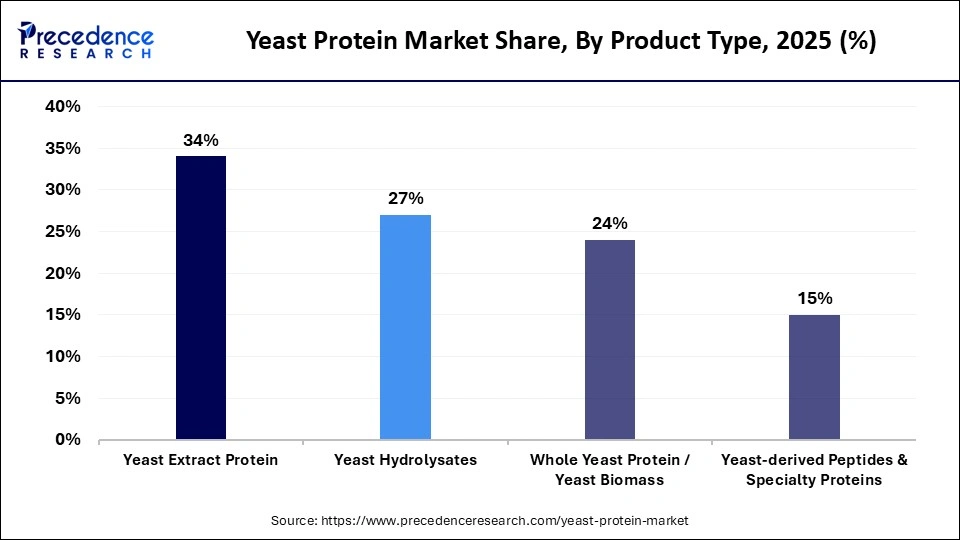

- By product type, the yeast extract protein segment generated the biggest market share of approximately 34% in 2025

- By product type, the yeast-derived peptides & specialty proteins segment is expanding at the fastest CAGR between 2026 and 2035

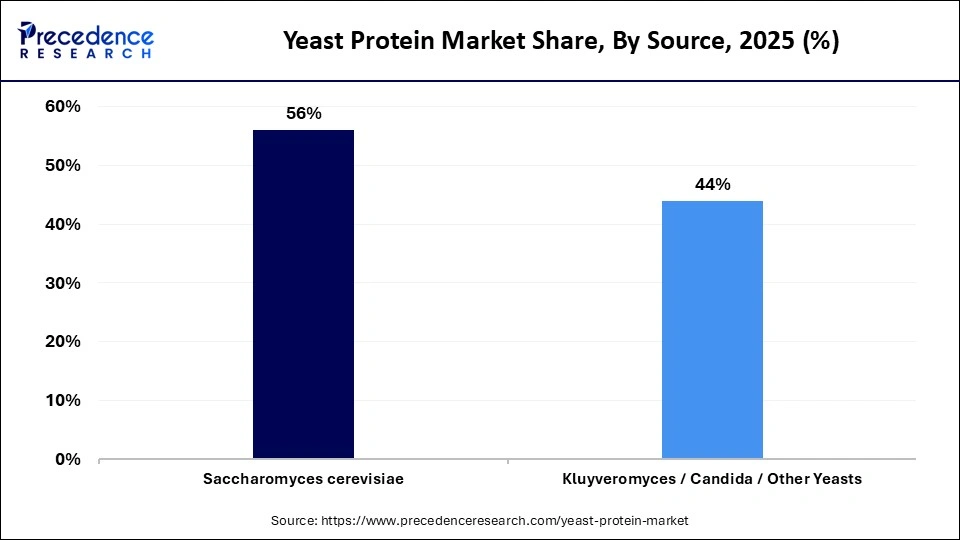

- By source, the Saccharomyces cerevisiae segment contributed the highest market share of approximately 56% in 2025

- By source, the Kluyveromyces/candida/other yeasts segment is growing at a strong CAGR of 44% between 2026 and 2035

- By application, the food & beverages segment held a major market share of approximately 38% in 2025

- By application, the aquaculture feed segment is expected to expand at the fastest CAGR from 2026 to 2035

Whatis Driving the Growth of the Yeast Protein Market?

The yeast protein market is growing as businesses move toward premium sustainable protein substitutes. It is appealing for plant-based food, animal feed, and nutrition products because of its robust nutritional profile, ease of digestion, and minimal environmental impact. Market adoption is being aided by a growing emphasis on clean label and environmentally friendly ingredients.

How is AI Shaping the Future Growth of the Yeast Protein Market?

Artificial intelligence is accelerating innovation in the yeast protein market by refining strain selection and streamlining fermentation procedures to increase yields. AI-driven analytics improve the quality and consistency of protein while lowering production costs. By forecasting consumer preferences and formulation performance, it also facilitates quicker product development. Consequently, AI is making yeast protein production more efficient, scalable, and sustainable.

Market Trends

- Rising use of yeast protein in plant-based and alternative meat products. Manufacturers are leveraging its neutral taste and high amino acid profile to improve texture and nutrition.

- Growing preference for clean-label and non-GMO protein ingredients. Consumers are increasingly seeking transparent sourcing and minimally processed protein options.

- Increased adoption of fermentation-based protein production for sustainability. This approach reduces land, water, and carbon footprint compared to conventional protein sources.

- Expanding applications in animal feed and aquaculture nutrition. Yeast protein supports gut health and improves feed efficiency in livestock and fish.

- Investments in biotechnology and precision fermentation to improve yield and taste. Advanced processing technologies enhance scalability and commercial viability.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 170.76 Million |

| Market Size in 2026 | USD 185.31 Million |

| Market Size by 2035 | USD 386.80 Million |

| Market Growth Rate from 2026 to 2035 | CAGR of 8.52% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product Type, Source, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Opportunities

- Growing demand for alternative and sustainable protein sources, Yeast protein offers a scalable solution with lower environmental impact than animal proteins.

- Expansion of plant-based and vegan food segments. Food brands are incorporating yeast protein to enhance nutritional texture and flavor profiles.

- Increasing use in sports nutrition and functional foods, high digestibility, and complete amino acid content support muscle recovery and wellness products.

- Rising adoption in animal feed and pet nutrition. Yeast protein improves feed performance while supporting immunity and gut health.

- Technological advancements in fermentation and strain development. Improved strains enable higher yields, cost efficiency, and consistent quality.

- Untapped potential in emerging markets. Growing health awareness and protein consumption are creating new commercial opportunities.

Segmental Insights

Product Type Insights

What made the yeast extract protein segment dominate the yeast protein market in 2025?

The yeast extract protein segment dominates the market with approximately 34% market share because food nutraceuticals and animal nutrition all use it extensively because of its rich amino acid profile high digestibility and potent flavor enhancing qualities food manufacturers greatly favored and potent flavor enhancing qualities food manufacturers greatly flavored it furthermore yeast extract protein is seen as a natural and clean label ingredient which fits in nicely with consumer demand for functional and healthier food products. Its dominant position was further reinforced by its established supply chains and cost-effectiveness.

The yeast-derived peptides & specialty proteins segment is growing rapidly in the yeast protein market, fueled by the growing desire for functional ingredients and targeted nutrition. These proteins provide improved bioavailability, particular health advantages, and versatile uses in dietary supplements, medical foods, and sports nutrition. Adoption is accelerated by growing research on bioactive peptides and their functions in immunity and muscle health. One of the main factors driving this segment's growth is innovation-driven product development.

Source Insights

Why did Saccharomyces cerevisiae segment dominate the yeast protein market in 2025?

The Saccharomyces cerevisiae segment dominates the market with approximately 56% market share because of its extensive use, established safety record, and high protein yield because its versatility in food, feed, and fermentation-based applications. This strain of yeast is widely used. It is the go-to source for commercial yeast protein production due to its scalability, ease of cultivation, and reliable quality. Its dominance was further reinforced by strong regulatory acceptance.

The Kluyveromyces/candida/other yeasts segment is growing rapidly in the yeast protein market, propelled by a variety of protein sources. For lactose-free vegan and specialty nutrition products, this yeast provides distinctive nutritional profiles and useful qualities. Adoption is accelerated by growing interest in sustainable protein production and alternative fermentation sources. Growth is also supported by increased investment in strain development and bioprocess optimization.

Application Insights

Why did the food & beverages segment dominate the yeast protein market in 2025?

The food & beverages segment dominated the market with approximately 38% market share, encouraged by the growing market for functional and plant-based foods. Yesat protein is frequently used to improve the texture, flavor, and protein content of processed foods. Its adoption in bakeries with clean label trends. Dominance is maintained by strong customer acceptance.

The aquaculture feed segment is growing rapidly, motivated by the demand for fishmeal substitutes that are sustainable. For aquatic animals, yeast protein provides increased feed efficiency, high digestibility, and immune support. Demand is being driven by rising seafood consumption worldwide and the growth of aquaculture farming. Concerns about sustainability and legal pressure to lessen reliance on marine resources hasten growth even more.

Regional Insights

What is the Asia Pacific Yeast Protein Market Size?

The Asia Pacific yeast protein market size is expected to be worth USD 119.91 million by 2035, increasing from USD 52.94 billion by 2025, growing at a CAGR of 8.52% from 2026 to 2035.

What made Asia Pacific dominate the Yeast Protein Market in 2025?

Asia Pacific dominates the yeast protein market with approximately 31% market share, bolstered by robust population growth, growing food processing sectors, and rising protein intake. This region gains increased use of alternative protein, widespread fermentation expertise, and cost-effective production. Growing demand from the food feed and nutraceutical industries keeps bolstering regional leadership. India is important because of its expanding vegetarian population and ecosystem for food innovations.

India Yeast Protein Market Trends

India is growing rapidly in the market, driven by the growing need for vegetarian, sustainable, and reasonably priced protein sources. The growing use of yeast protein and beverage applications, particularly in baked goods, fortified foods, and savory formulations, supports growth. India's robust fermentation industry, growing food processing industry, and rising consumer health consciousness are all promoting domestic adoption. Additionally, India is positioned as a major growth contributor within the Asia Pacific region due to the growing interest in cost-effective nutrition solutions and alternative proteins.

North America Yeast Protein Market Analysis

North America is growing rapidly, driven by the robust demand for sustainable, functional, and plant-based protein ingredients. The U.S. leads growth because of strong investment in fermentation-based proteins, high consumer awareness, and cutting-edge food technology. Market expansion is accelerated by the growth of alternative protein startups, dietary supplements, and sports nutrition. Regional momentum is further increased by supportive innovation ecosystems.

U.S. Yeast Protein Market Trends

The U.S. is leading in the market trends, driven by a robust market for clean-label plant-based and functional protein ingredients. Because of its high bioavailability and sustainable production profile, yeast protein is being utilized more in sports nutrition, dietary supplements, and alternative protein products. Market expansion is supported by sophisticated fermentation technologies and large investments in precision fermentation startups. Innovation-driven product launches and high consumer awareness keep the U. S. strong.

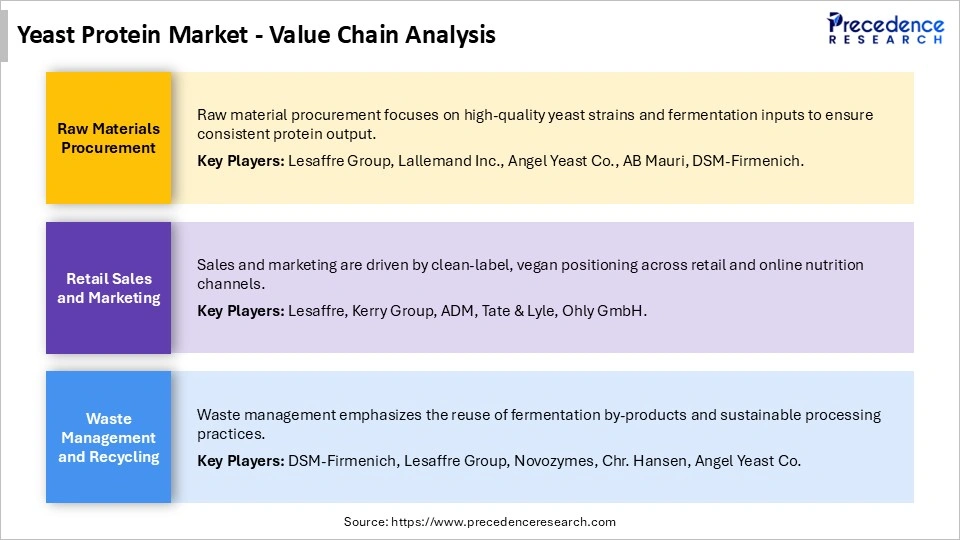

Yeast Protein Market Value Chain Analysis

Who are the Major Players in the Global Yeast Protein Market?

The major players in the yeast protein market include AB Mauri, ADM, Alltech, Inc., Angel Yeast Co., Ltd., Biospringer, Biorigin, Chr. Hansen, Kerry Group plc, Lallemand Inc., Leiber GmbH, Lesaffre, Novonesis, Ohly, Oriental Yeast Co., Ltd., SuperYou (SuperYou Pro), and Titan Biotech Limited.

Recent Developments

- In January 2026, Starbucks India launched a new yeast-protein-boosted cold foam in collaboration with the startup SuperYou. This partnership introduces a bio-fermented, non-dairy protein topping available across 500 Starbucks stores nationwide, addressing the demand for healthy beverage options. More information is available on the afaqs.com website.(Source: https://www.afaqs.com)

- In November 2025, Angel Yeast announced the launch of the world's first 11,000-ton automated yeast protein production line. Located at the Baiyang Biotechnology Park, the facility mass-produces the sustainable, high-purity protein AngeoPro. This expansion provides a scalable, eco-friendly alternative to traditional plant and animal proteins for the global food market.(Source: https://en.angelyeast.com)

- In August 2025, SuperYou announced the launch of "SuperYou Pro," India's first bio-fermented yeast protein powder co-founded by actor Ranveer Singh. The product targets the ₹4,000 crore health supplement market as a sustainable, vegan-friendly alternative to traditional whey protein. It offers a complete amino acid profile with a PDCAAS score of 1.0, ensuring high absorption and muscle recovery for consumers.

Segments Covered in the Report

By Product Type

- Yeast Extract Protein

- Autolyzed yeast extract

- Hydrolyzed yeast extract

- Yeast Hydrolysates

- Whole Yeast Protein / Yeast Biomass

- Yeast-derived Peptides & Specialty Proteins

By Source

- Saccharomyces cerevisiae

- Kluyveromyces / Candida / Other Yeasts

By Application

- Food & Beverages

- Animal Feed & Pet Food

- Dietary Supplements

- Aquaculture Feed

- Other Applications

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting