What is the Protein Ingredients Market Size?

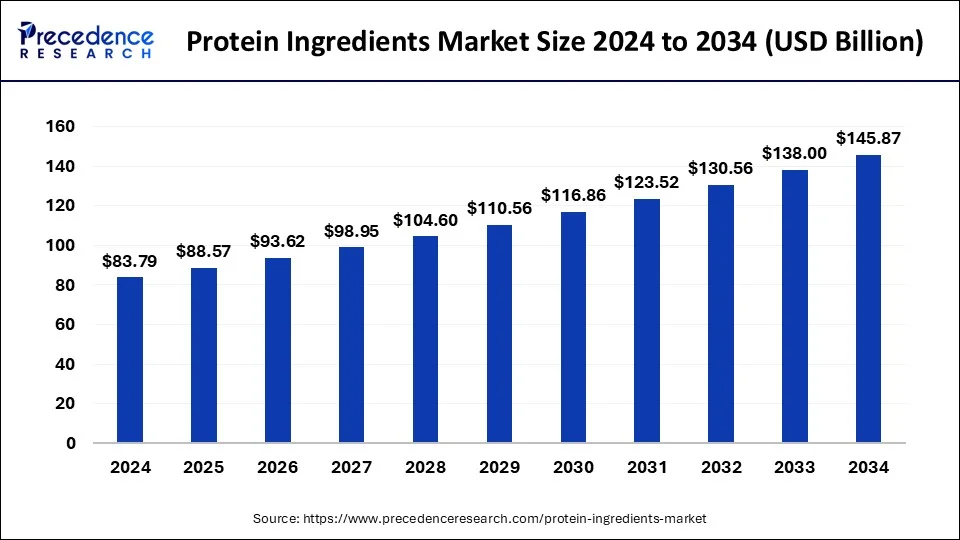

The global protein ingredients market size was USD 88.57 billion in 2025, estimated at USD 93.62 billion in 2026, and is anticipated to reach around USD 153.45 billion by 2035, expanding at a CAGR of 5.65% from 2026 to 2035.

Protein Ingredients Market Key Takeaways

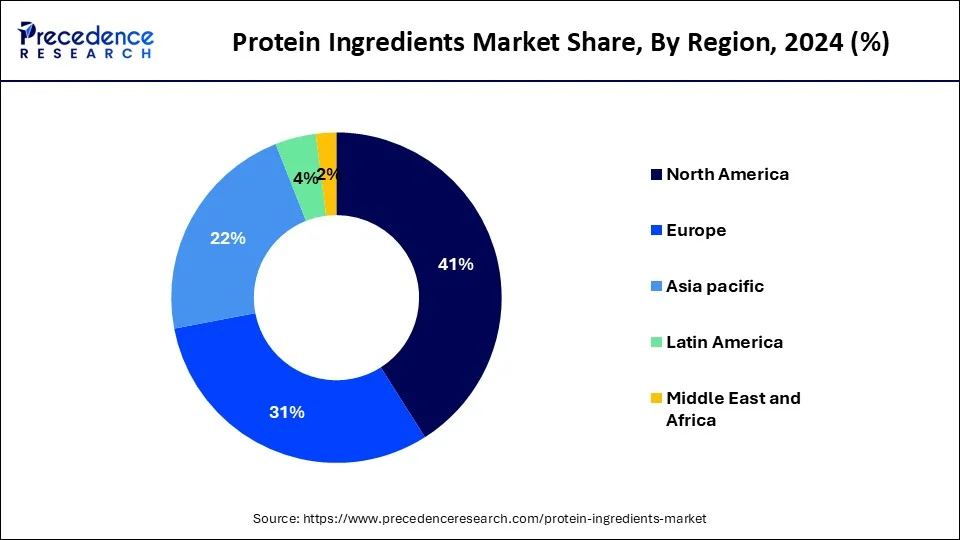

- North America led the global market with the highest market share of 41% in 2025.

- By product, the animal proteins segment has held the largest market share of 71% in 2025.

- By application, the food and beverages segment captured the biggest revenue share of 40% in 2025.

Growth Factors

One of the significant factors driving the growth of global protein ingredients market is rising consumer awareness regarding healthy and nutritious food products. In addition, the growing demand for plant-based proteins is also contributing towards the growth and development of global protein ingredients market. Moreover, dieticians and doctors are recommending people to consume proteins on a large scale. This is attributed to the growing prevalence of chronic disorders and infections. Furthermore, the surge in the number of geriatric people is also boosting the expansion of global protein ingredients market.

Due to the rapid rise of the global population and growing consumer awareness of health and nutritional meals, the global protein ingredients market is expanding dramatically. The consumer knowledge of the advantages of a protein rich diet has boosted the demand for protein components in the infant formulation, nutritional supplement, and food and beverage industries all over the world. In addition, the surge in demand for soy protein is also propelling the growth of protein ingredients market. The Food and Drug Administration approved a health benefit for lowering LDL cholesterol through nutritional recommendations that recommend four meals of soy per day to help lower LDL cholesterol levels by 10% in the body.

The government all around the world is taking constant efforts for the development of global protein ingredients market. The government is investing for the expansion of food and beverage industry. This is directly impacting the growth and expansion of global protein ingredients market. Moreover, the government of emerging nations is collaborating with market players for increasing market reach in the market. The government is also conducting awareness programs for the promotion of protein ingredients among people. Thus, all of these aforementioned factors are driving the growth of global market.

The key market participants are employing a variety of tactics in order to meet rising product demand while also lowering total costs by lowering raw material and labor prices. Due to the existence of organized and unorganized market structures in emerging and established nations, there is a great potential for public, small, and internationally famous firms in the global protein ingredients market. To grab growing markets and combat with domestic firms, major market players are pursuing acquisitions and mergers. The strategy has also aided corporations in expanding distribution networks in order to improve product supply across regions.

Market Scope

| Report Coverage | Details |

| Market Size in 2026 | USD 93.62 Billion |

| Market Size in 2025 | USD 88.57 Billion |

| Market Size by 2035 | USD 153.45Billion |

| Growth Rate from 2026 to 2035 | CAGR of 5.65% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Application, Form, and Region |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

Segment Insights

Product Insights

The animal proteins segment accounted for a revenue share of around 71% in 2024. The growth of the segment is attributed to a rise in health and fitness consciousness. Furthermore, animal protein is widely employed in a variety of applications, including pet food and cosmetics, whereas egg and milk proteins are often used in confectionary and baking items.

The plant proteins segment is fastest growing segment of the protein ingredients market in 2023. The expansion of the segment can be attributed to the low cost of plant proteins as compared to animal proteins. The consumers are gradually adopting plant protein sources since they are perceived to be healthier and more nutritious than their animal-based alternatives.

Application Insights

The food and beverages segment dominated the market in 2024 with a revenue share of 40%. The customers are increasingly focusing on healthy diets with low fat and high nutritive value foods, leading to an increase in the consumption of protein components. As a result, there is a growing need for functional and nutritional food.

The infant formulations segment is expected to hit strong growth from 2025 to 2034. The premixes for infants can contain either plant or animal proteins. The milk protein isolates and concentrates are commonly utilized in newborn formulae. The liquid ready to eat and powder or liquid versions of the products are available on large scale. The non-fat milk, partially hydrolyzed whey protein, and casein concentrates are all products made from cow milk.

Regional Insights

What is the U.S. Protein Ingredients Market Size?

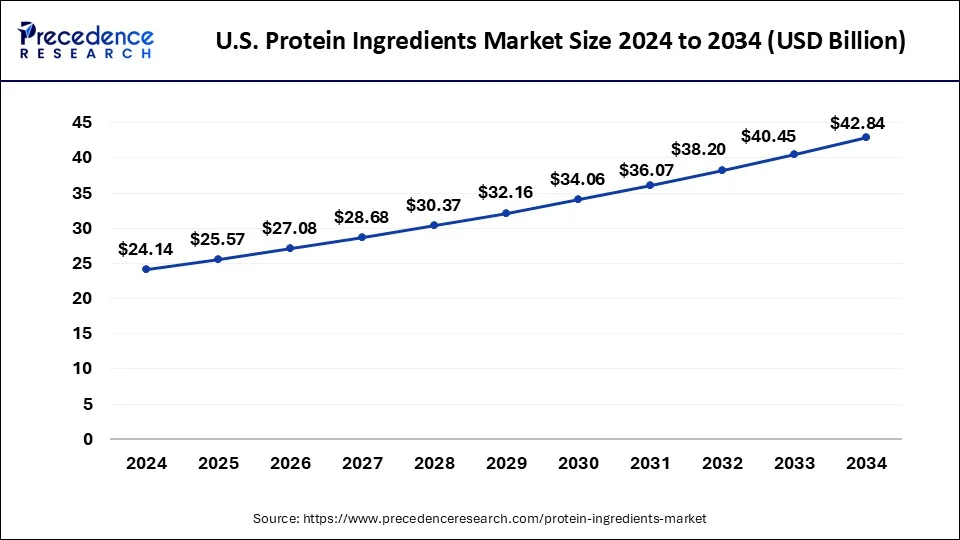

The U.S. protein ingredients market size was estimated at USD 25.57 billion in 2025 and is predicted to be worth around USD 45.14 billion by 2035, at a CAGR of 5.85% from 2026 to 2035.

North America Leads Protein Ingredients Market on Rising Health and Vegan Trends

North America region led the market in 2024 with revenue share of around 41%. The North American protein ingredients market size was valued 12,650 million in 2020. The growing trend of consuming healthy and nutritious food products is driving the growth of North America protein ingredients market. The other factors driving the growth of protein ingredients market in North America region are shift in consumer patterns and growing demand for vegan food products. The evidence by the United States Department of Agriculture that soy protein lowers the risk of heart disorders has propelled the protein ingredients market in the U.S. and surged the demand for other vegan proteins.

U.S. Protein Ingredients Market Trends

The U.S. market is expanding due to increasing consumer focus on healthy and nutritious diets, including high-protein and plant-based foods. Growing demand for vegan and functional protein products, along with evidence supporting health benefits like reduced heart disease risk, is driving adoption. Rising awareness, changing dietary patterns, and strong food and beverage innovation further boost market growth.

Surgical Demand in India and China Fuels Asia-Pacific Protein Ingredients Market Growth

Asia-Pacific is expected to develop at the fastest rate during the forecast period. India and China dominate the protein ingredients market in Asia-Pacific region. The growth of Asia-Pacific protein ingredients market is being driven by the surge in demand for animal and plant protein ingredients. The other factors contributing towards the growth of protein ingredients market in Asia-Pacific region are economic development and expansion of food and beverage and healthcare sectors.

India Protein Ingredients Market Trends

India's market is growing due to rising health awareness, increasing demand for both plant- and animal-based proteins, and a shift toward nutritious and functional foods. Rapid economic development, expanding food and beverage industry, and rising disposable incomes are driving consumption. Additionally, the growing popularity of vegan and protein-enriched products supports market expansion.

Europe Sees Notable Growth in Protein Ingredients Amid Health and Functional Food Trends

The European market is growing at a notable rate due to rising demand for high-protein and plant-based foods, increasing health consciousness, and expanding functional food and beverage products. Supportive government initiatives, growing adoption of vegan diets, and strong research and development in the food sector are further driving market growth across key countries like Germany, France, and the U.K.

The UK Protein Ingredients Market Trends

The UK market is growing at a notable rate due to increasing consumer preference for healthy, high-protein, and plant-based foods. Rising awareness of nutrition and wellness, expansion of functional food and beverage products, and growing demand for vegan and clean-label ingredients are driving market growth. Strong innovation and product launches further support the market's expansion.

Protein Ingredients Market Companies

- Fonterra: Provides dairy proteins, including whey, casein, and functional protein ingredients for beverages, bakery, nutrition bars, and infant nutrition, focusing on quality, functionality, and global distribution.

- Burcon NutraScience: Develops plant-based protein ingredients such as pea, canola, and soy proteins for food, beverages, and nutritional products, emphasizing clean-label, non-GMO, and sustainable solutions.

- Kewpie Corporation: Offers plant- and egg-based protein ingredients for sauces, dressings, and food applications, providing functional, high-quality protein solutions for consumer food products.

- Tessenderlo Group: Supplies soy, pea, and other plant proteins for food and beverage industries, focusing on functional, nutritional, and sustainable protein solutions globally.

- Roquette Freres: Provides plant-based proteins, including pea, wheat, and potato proteins, for bakery, dairy, beverages, and nutrition products, emphasizing health, functionality, and sustainability.

Other Major Key Players

- Archer Daniels Midland Company

- DuPont

- Rousselot

- The Scoular Company

- CHS Inc.

Recent Developments

- In December 2025, Arla Foods Ingredients launched Lacprodan CGMP 30, a low-phenylalanine protein for PKU patients. Lacprodan CGMP-30 is designed to support blood management and digestion, expanding Arla's medical-nutrition portfolio and innovation in specialized foods.

(Source: https://www.arlafoodsingredients.com ) - In July 2024, Ingredion introduced VITESSENCE Pea 100 HD, a high-protein pea ingredient with 84% protein. VITESSENCE Pea 100 HD is designed for cold-pressed bars and other fortified products, offering functionality similar to whey and soy proteins. (Source:https://www.ingredion.com)

- Lcprodan BLG-100, a pure BLG ingredient with a unique nutritional profile, was declared by Arla Foods Ingredients in October 2021. It includes 45% more leucine, the major muscle building amino acid, than currently available why protein isolates, due to a patented new separation method.

- Nutriance, a line of wheat protein concentrates with uses in sports and geriatric nutrition, was introduced to ADM's ingredient portfolioin November 2017.

- In May 2020, Marfrig and ADM announced Plantplus foods, a joint venture that will provide clients in North and South America with plant-based goods. ADM intends to contribute all of its technological expertise to the development of a system that combines ingredients, scents, and a plant basis from the protein complex, including its new pea protein facility in North Dakota.

- Cargill stated in October 2019 that it would invest $225 million in a facility in Ohio to better serve local farmers and meet the growing demand for protein and refined oils.

Segments Covered in the Report

By Product

- Plant Proteins

- Cereal-based

- Legumes-based

- Root-based

- Nuts & Seeds-based

- Ancient Grains

- Animal/Dairy Proteins

- Egg Protein

- Milk Protein Concentrates/Isolates

- Whey Protein Concentrates

- Whey Protein Hydrolysates

- Whey Protein Isolates

- Gelatin

- Casein/Caseinates

- Collagen Peptides

- Microbe Proteins

- Algae

- Bacteria

- Yeast

- Fungi

- Insect Proteins

- Coleoptera

- Lepidoptera

- Hymenoptera

- Orthoptera

- Hemiptera

- Diptera

- Others

By Application

- Food & Beverages

- Bakery & Confectionery

- Beverages

- Dairy Alternatives

- Breakfast Cereals

- Dietary Supplements/Weight Management

- Sports Nutrition

- Meat Alternatives & Extenders

- Snacks

- Others

- Infant Formulations

- Clinical Nutrition

- Animal Feed

- Others

By Form

- Isolates

- Concentrates

- Hydrolyzed

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

- GCC

- North Africa

- South Africa

- Rest of the Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting