What is the Thermoplastic Composites Market Size?

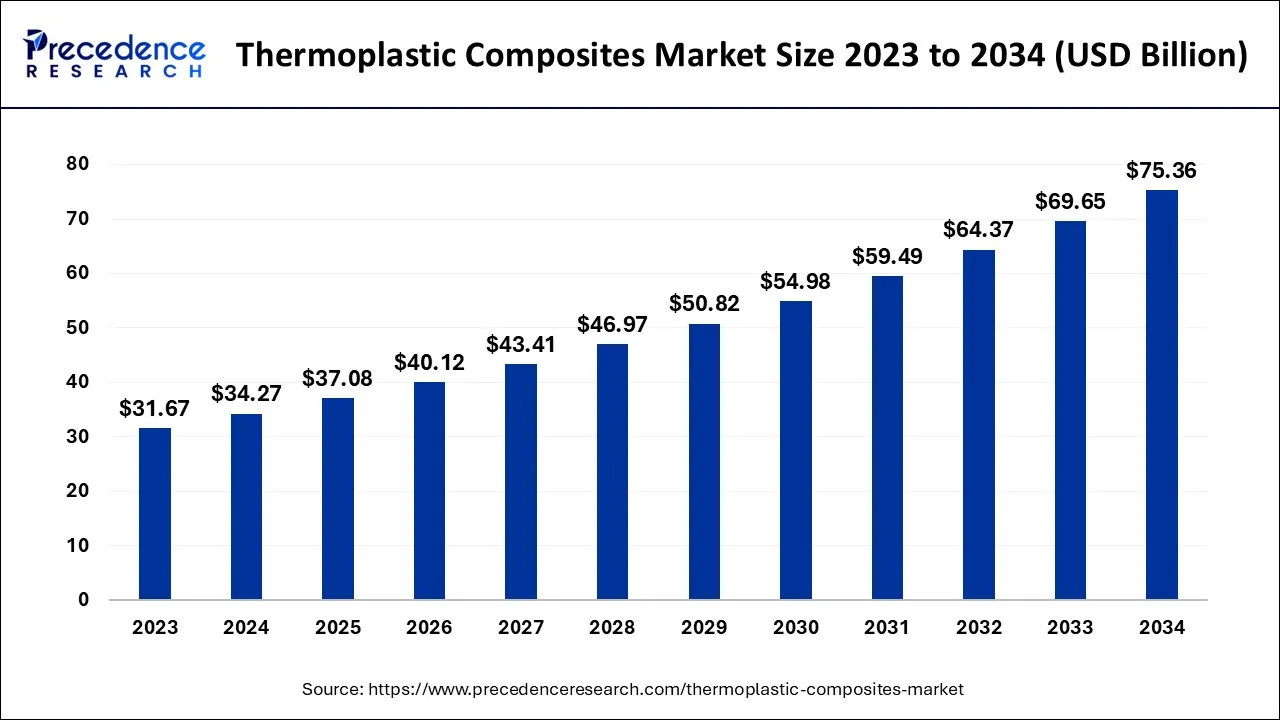

The global thermoplastic composites market size is calculated at USD 37.08 billion in 2025 and is predicted to increase from USD 40.12 billion in 2026 to approximately USD 80.78 billion by 2035, expanding at a CAGR of 8.10% from 2026 to 2035.

Market Highlights

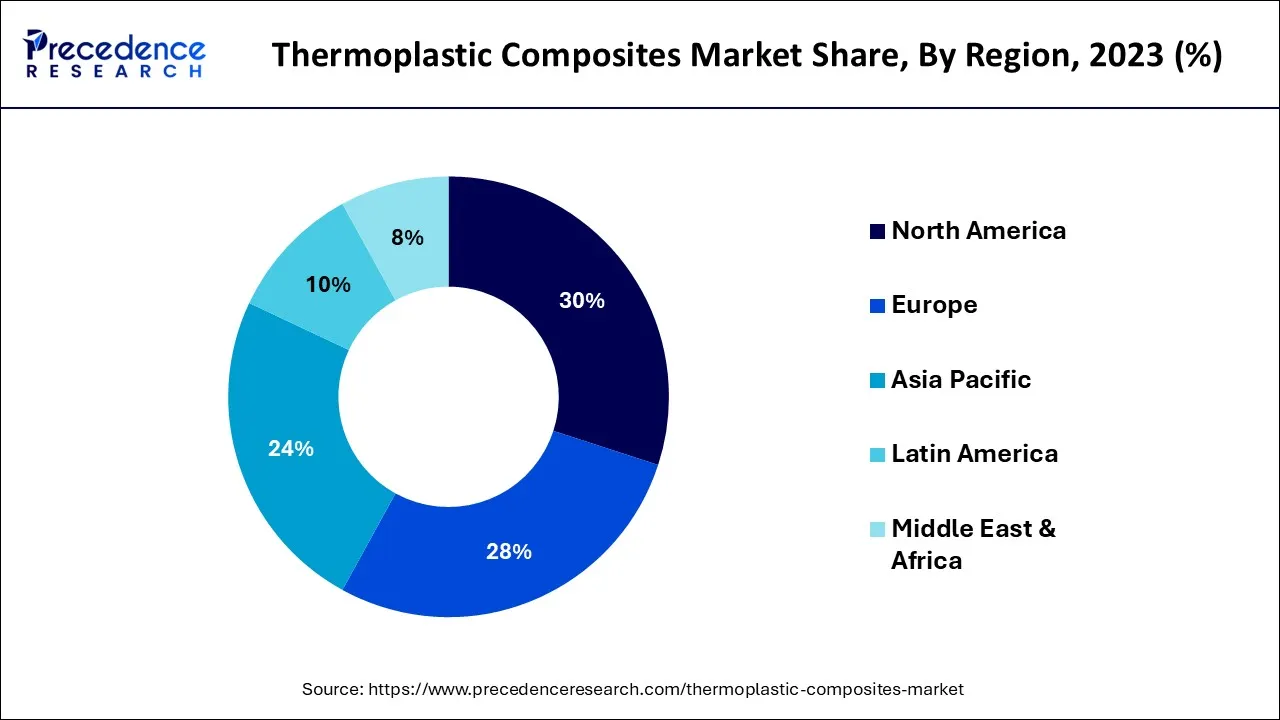

- North America generated more than 30% of revenue share in 2025.

- Asia Pacific region is expected to expand at the highest CAGR between 2026 and 2035.

- By Resin, the polyamide (PA) segment captured more than 57% of revenue share in 2025.

- By Resin, the polypropylene segment is expected to expand at the fastest CAGR between 2026 and 2035.

- By Fiber, the glass fibres segment recorded 69% of revenue share in 2025.

Market Overview

Combining a thermoplastic polymer with reinforcing fibers or other additives, thermoplastic composites are composite materials. Thermoplastics are a class of polymers which, when subjected to heat, become soft and flexible allowing them to be moulded or created in various shapes. These properties allow them to be used in a variety of materials, making them very flexible and desirable for use in composites. There is a wide variety of materials, such as carbon fiber, glass fiber, and aramid fibers, that are able to produce reinforced fibers for thermoplastic composites. These fibers are of superior strength and stiffness to the composite, which is able to withstand high pressures and deformations. To improve its properties, it is possible to introduce additional additives such as filler, reinforcement or flame retardants into the thermoset composite.

The use of thermoplastic composite materials in a variety of sectors such as aircraft, automobiles, construction, sports and consumer products is widespread. They're used for the production of components like structural parts, interiors, exteriors and vehicle panels in the car industry. Because of their large strength to weight ratio and ability to survive extreme temperatures, they are used in the aeronautics sector for structural parts, interior components as well as electrical components. In the construction industry, they are used for building facades, roofing, and flooring.

Thermoplastic Composites Market Growth Factors

The global thermoplastic composites market is presently experiencing significant growth, driven primarily by the automotive, construction, and aerospace industries. In the aerospace and defense industry, the adoption of thermoplastic composites is predominantly aimed at minimizing the overall weight and corrosion in the aircraft structure. Moreover, the maintenance costs associated with aircraft produced using composites have been substantially reduced compared to those produced using conventional materials. The desired characteristics associated with these thermoplastic composites are their light weight, excellent strength, resistant to the weather finish, and range of surface textures. As a result, it is projected that the need for thermoplastic composites in aerospace manufacturing would expand at a rapid annualised growth rate (CAGR).

To meet the carbon emissions limit of 95 grams per kilometer imposed by the European Union for new cars by 2020, automobile manufacturers are designing the lighter vehicles by replacing the metals with composites. This shift in demand in the automotive sector for the high-quality composite materials is also expected to direct investments in the development of new manufacturing of technologies. Proprietary composite manufacturing technologies are employed by leading companies such as Hexcel Corporation, Toray, Teijin Limited also SGL Group. The production and testing of thermoplastic composites are facilitated by SGL Group's collaborations with the various research centers and also the academic institutions.

The increase in fuel prices has prompted the need for fuel-efficient vehicles, and thermoplastic composites are increasingly being utilized to replace aluminum, wood, and steel due to their higher strength-to-weight ratio. The introduction of stringent environmental legislation in Europe has compelled automakers to use composites in the production of cars. As a result, OEMs worldwide, particularly in Europe, are being forced to significantly reduce the carbon dioxide (CO2) emissions from vehicles. To meet these proposed regulations, countries must increase their market demand for the products from this sector. The global thermoplastic composites market has been experiencing steady growth in recent years, driven by several growth factors.

key growth factors of the thermoplastic composites market

- The usage of thermoplastic composites in the aerospace and automotive industries is suitable since they are lightweight and have excellent strength-to-weight ratios. The market for thermoplastic composites is expected to increase significantly as a result of the increasing demand for lightweight materials in these sectors, which is being fueled by the desire to improve fuel economy and reduce emissions.

- The creation of thermoplastic composites has become simpler and more cost-effective because to the advancement of innovative production techniques and technologies including automated fiber insertion (AFP). This has boosted the use of these materials across a number of sectors.

- Due to its strength, resistance to corrosion, and capacity for complicated shaping, thermoplastic composites are also widely used in the construction sector. The market for thermoplastic composites in this industry is expanding as a result of the rising demand for environmentally friendly and sustainable building materials.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 37.08 Billion |

| Market Size in 2026 | USD 40.12 Billion |

| Market Size by 2035 | USD 80.78 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 8.10% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Resin, Fiber and Fiber, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Rising investment in research and the development

- Investments in the study and creation of novel and sophisticated thermoplastic composite substances are on the rise, which is creating new market prospects and applications.

Government policy

- To encourage the use of lightweight materials in many industries, governments all over the globe are putting standards and laws into place. For instance, laws like Corporate Average Fuel Economy (CAFE) requirements in the US and Euro 7 criteria in Europe are encouraging the use of lightweight materials like thermoplastic composites in the car sector.

Growing demands from the emerging economies

- Due to their increased industrialisation and rising disposable incomes, emerging nations like India, Brazil, and China are also experiencing an increase in demand for thermoplastic composites. The market in these areas has excellent development prospects as a result of this.

Key Market Challenges

High cost of the production

- The use of specialised tools and labor-intensive procedures is necessary for the manufacture of thermoplastic composites. It is challenging for companies to compete with alternative materials since this expense is passed on to the finished product.

Inadequate processing capability

- Compared to thermoset composites, thermoplastic composites are more challenging to produce and call for specialized machinery and procedures. This may reduce the market's capacity for output and flexibility.

Complexity in recycling

- Due to their intricate molecular structure, thermoplastic composites are more difficult to recycle than thermoset composites. This may raise concerns about the environment and reduce the likelihood of reuse.

Key Market Opportunities

In order to minimise fuel consumption and emissions, lightweight materials are becoming more and more in demand across a variety of industries, including automotive and aerospace. Manufacturers choose thermoplastic composites because they are lightweight and have good strength-to-weight ratios. Thermoplastic composites provide excellent durability and fatigue and impact resistance. This qualifies them for uses that call for great performance and dependability, such as in athletic apparel, medical technology, and building materials. Thermoplastic composites are an environmentally beneficial alternative to conventional composites, which can be challenging to recycle. Companies looking to increase sustainability and lower their carbon footprint will find this option very appealing.

Compared to conventional materials like metal and wood, thermoplastic composites provide more design freedom. They are perfect for use in the aerospace, automotive, and consumer goods sectors because they can be easily customized and moulded into intricate forms to fulfill certain design needs.

Segment Insights

Resin Insights

With a revenue share of over 57% in 2024, the polyamide resin segment has been the dominant contributor to the market and is anticipated to maintain a substantial compound annual growth rate (CAGR) over the forecast period. The growing use of polyamide in thermoplastic composite products can be attributed to its exceptional mechanical performance, resistance to corrosion, chemical inertness, abrasion performance, and thermal properties, which have bolstered its demand. Additionally, polyamide has proven to be an economical solution that delivers high performance at a reasonable cost, further driving its adoption.

Another promising segment that is expected to register a significant CAGR over the forecast period is polypropylene. Polypropylene is deemed an economic material that has diverse commercial and industrial applications, including the automotive, industrial, medical, textile, and consumer goods sectors. One of its unique advantages is its insensitivity to moisture, making it an ideal choice for applications where moisture is a significant concern.

Fiber Insights

The glass fibres category, which generated over 69% of the total revenue, continued to rule the international market in2024. Aerospace & military, windmill blades, sports goods, and automotive are just a few of the end-use industries where glass fiber-based thermoplastic composites have found widespread acceptance. Glass fiber thermoplastic composites are produced using plunger and screw-type injection molding procedures. Depending on the needs of the applications, those composites can be found in a variety of forms, including chopped fibers, woven mat fiber, and random mat fiber.

Glass fibers are renowned for their exceptional strength, strong thermal insulation, excellent heat resistance, lightweight, reduced stiffness, and fragility. They are also noted for their stability in dimensions, chemical resistance, and chemical resistance. These properties, coupled with their lower cost in comparison to carbon fiber, are driving their demand. Carbon-based fiber thermoplastic composites, on the other hand, have been receiving much attention due to their ease of processability and recyclability. They have also found applications in various end-use industries, like sporting goods, wind energy, automotive, marine, aerospace, infrastructure, building & construction.

Regional Insights

U.S. Thermoplastic Composites Market Size and Growth 2026 to 2035

The U.S. thermoplastic composites market size is exhibited at USD 7.79 billion in 2025 and is projected to be worth around USD 17.46 billion by 2035, growing at a CAGR of 8.41% from 2026 to 2035.

U.S. Market Analysis

The U.S. is a major contributor to the North American thermoplastic composites market. The U.S. boasts well-established aerospace, defense, and automobile industries, which are major end-users of high-performance thermoplastic composites. Additionally, growing demand for lightweight, recyclable materials further supports their widespread use.

With established economies like the U.S. and Canada supporting the expansion of the regional market, North America had the greatest revenue share of 30% of the worldwide revenue in 2025. High research and development efforts in the more sustainable and recyclable composite materials are also anticipated to propel this expansion throughout the projection period. Also, the region's transportation, aerospace & military, wind energy, and construction sectors have all witnessed an increase in demand for the commodity. The ongoing R&D initiatives by regional industry players to investigate the possible uses of the product in various end-use sectors are also anticipated to contribute to the region's growth.

What Drives the Market in Asia Pacific?

The Asia Pacific area is anticipated to have the strongest growth between 2024 and 2034due to the region's well-established sectors of the automotive, aerospace & military, and building trades. These sectors are particularly strong in China, India, and Japan. Likewise, the demand for electric vehicles (EVs) is rising in China, with the Chinese Association of Automobile Manufacturers (CAAM) forecasting that by 2025, sales of these new energy vehicles would account for 35% of all new vehicle sales in the nation. In the upcoming years, it is anticipated that the region's increased need for EVs would increase product demand.

China Market Analysis

The thermoplastic composites market in China is growing due to its robust aerospace, railroad, and electric vehicle industries, which drive demand for lightweight, high-performance materials. Government programs and subsidies further promote the use of these composites by expanding domestic manufacturing capabilities and advancing cost-effective production processes, enabling wider adoption across multiple sectors.

Europe: Moving Toward Thermoplastic Composite Adoption in Aerospace and Automotive

Europe is the second-largest market for thermoplastic composite materials worldwide, with high demand within the aerospace and automotive industries. The region is continuously moving towards lightweight, recyclable materials in line with EU sustainability regulations. Recently, Airbus significantly increased the amount of thermoplastics being used in their aircraft components, which improved fuel efficiency. Meanwhile, German makers used advanced composites to help reduce vehicle weight and vehicle emissions. The EU's Green Deal is also pushing for the use of environmentally friendly materials, which will help grow the market in Europe.

Germany Market Analysis

The thermoplastic composites market in Germany is growing due to its robust automotive and engineering sectors, which prioritize lightweighting and sustainability. Strict environmental regulations and the increasing use of composites in electric mobility and industrial machinery further drive the market.

How is the Opportunistic Rise of the Middle East & Africa in the Market?

The thermoplastic composites market in the Middle East & Africa is growing due to infrastructure expansion, energy projects, and industrial diversification. Demand from construction, oil and gas, and transportation sectors for durable, corrosion-resistant materials, along with increased manufacturing investments and technology transfer initiatives, is driving gradual adoption of these composites in the region.

UAE Market Analysis

The UAE's thermoplastic composites market is emerging as the country focuses on aerospace development, infrastructure enhancement, and industrial diversification. Strategic investments in advanced materials and partnerships with international manufacturers are strengthening the domestic manufacturing base and promoting wider use of high-performance composites.

What Potentiates the Market in Latin America?

The thermoplastic composites market in Latin America is gradually growing as industries adopt lightweight and corrosion-resistant materials. Growth in automotive assembly, infrastructure, and renewable energy projects, along with increased foreign investment, improved manufacturing capabilities, and rising awareness of material efficiency, is driving initial adoption of these composites in the region.

Brazil Market Analysis

Brazil leads the thermoplastic composites market in Latin America due to its strong automotive industry and rapidly expanding wind energy sector. Increasing use of lightweight materials in transportation and infrastructure, along with industrial diversification and improved processing capabilities, positions Brazil as the primary growth driver for the region.

Thermoplastic Composites MarketCompanies

- Toray Industries Inc.

- Owens Corning

- SGL Carbon

- Mitsubishi Chemical Holdings Corporation

- Solvay S.A.

- BASF SE

- Hexcel Corporation

- Teijin Limited

- Huntsman Corporation

- Koninklijke Ten Cate bv

- Cytec Solvay Group

- Gurit Holding AG

- Plasan Carbon Composites Inc.

- Cristex Composite Materials

- TPI Composites Inc.

Recent Developments

- In March 2025, Pinette PEI, a key player in industrial solutions for composite material stamp forming, launches the world's largest thermoplastic press for stamp forming. It is set to play a key role in the next-generation aerospace industry, where composite materials are essential for reducing weight, improving repairability, and enhancing recyclability.

- In November 2024, Swedish deep-tech startup Sinonus is launching an energy-storing composite material to produce efficient structural batteries, IoT devices, drones, computers, larger vehicles, and airplanes.

- In September 2024, Toray Advanced Composites announced the launch of Toray Cetex TC1130 PESU thermoplastic composite material. This high-performance thermoplastic composite material is specifically engineered to address the growing need for lightweight and environmentally sustainable materials in aircraft interior applications, offering significant benefits to the aerospace industry.

- In November 2024, Toray Advanced Composites announced the expansion of its continuous fiber-reinforced thermoplastic composite materials portfolio through the acquisition of Gordon Plastics. This investment by Toray Advanced Composites brings expanded development, testing, and production capacity for continuous fiber reinforced thermoplastic composite unidirectional tapes and enhances Toray's capability to process higher melting temperature polymer systems.

- A collaborative research laboratory focused on the advancement of innovative composite materials and manufacturing procedures crucial to the aviation sector's future was introduced by Solvay and Leonardo in February 2021.

Segments Covered in the Report

By Resin

- Polyamide (PA)

- Polypropylene (PP)

- Polyetheretherketone (PEEK)

- Others

By Fiber

- Glass Fiber

- Carbon Fiber

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting