What is the Lightweight Material Market Size?

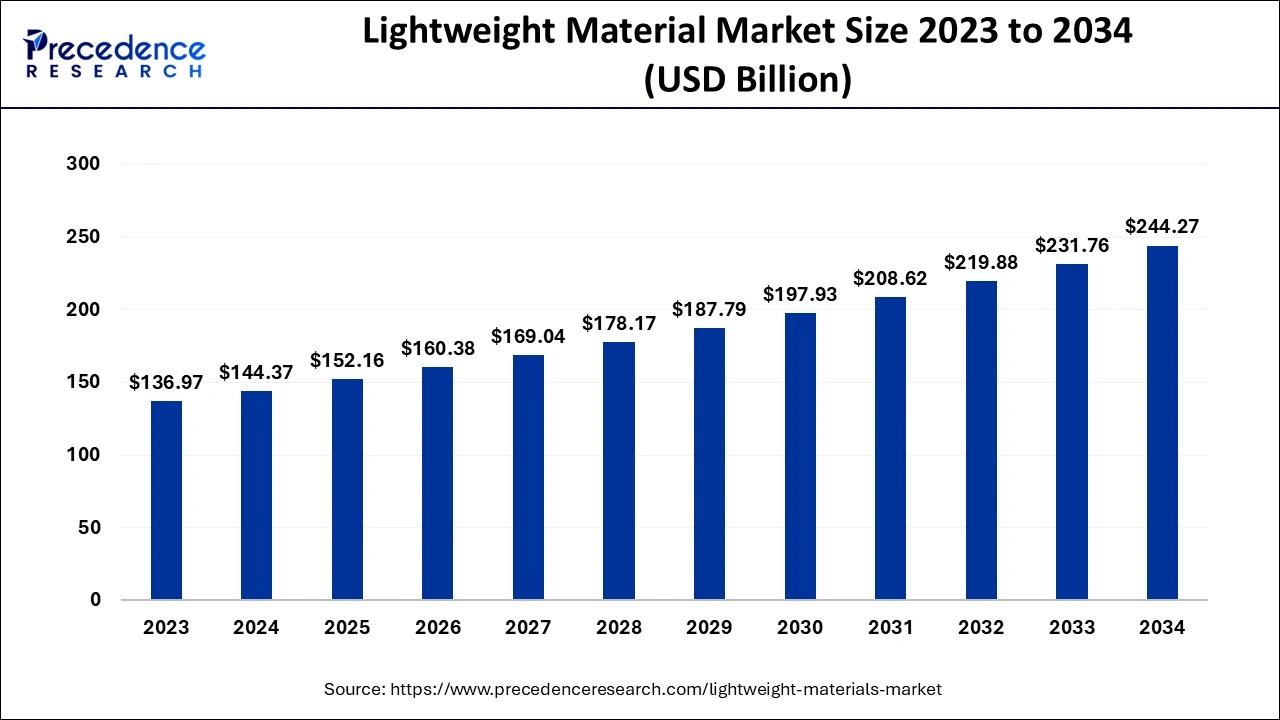

The global lightweight material market size is calculated at USD 152.16 billion in 2025 and is predicted to increase from USD 160.38 billion in 2026 to approximately USD 256.36 billion by 2035, expanding at a CAGR of 5.35% from 2026 to 2035.

Lightweight Material Market Key Takeaways

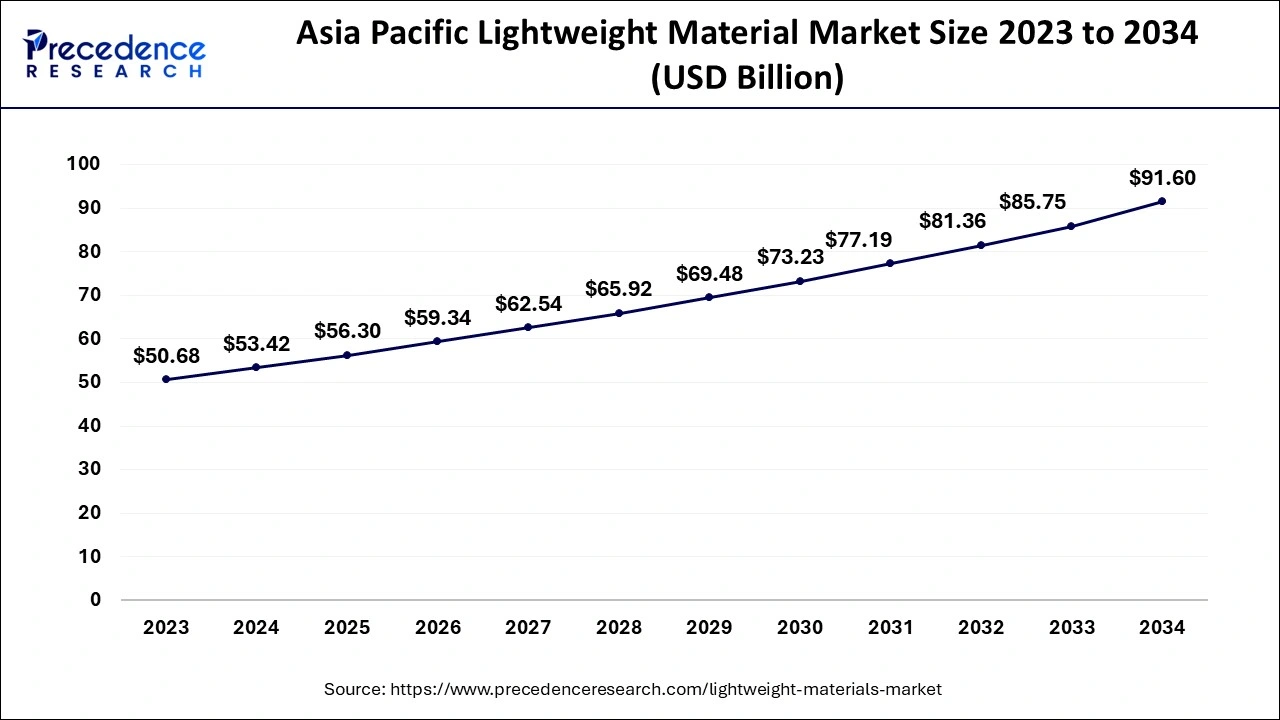

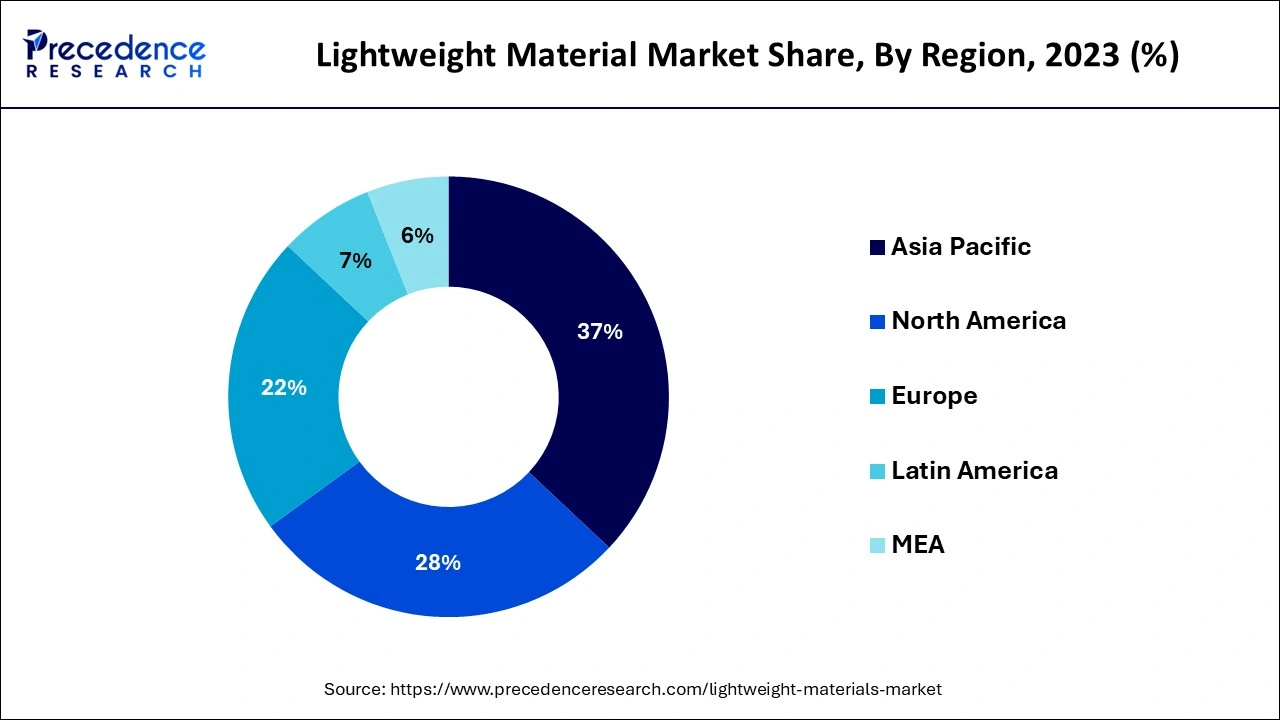

- Asia Pacific dominated lightweight material market in 2025.

- By product, the metal alloys segment will gain a significant market share over the forecast period.

Strategic Overview of the Global Lightweight Material Industry

In order to decrease the weightiness of automobiles, aircraft, and wind turbines while preserving the construction's durability and effectiveness, lightweight materials are often metal alloys and composites. Lightweight materials provide a high strength-to-weight ratio, higher corrosion resilience, and good design freedom. The combination of metals or composites that were utilized during manufacture determines how effective lightweight materials are. They come in a variety of forms and grades and are used to make lightweight vehicles, aeroplanes, packaging, and medical equipment. COVID - Due to the market's reliance on the maritime, automobile, aerospace, and windmill industries, the COVID 19 pandemic had a severe effect on lightweight materials. According to a report released by the National Center of Information (NCI) in April 2020, lockdowns and factory closures caused a 30% drop in sales for the automobile sector in March 2020 as compared to the same month in the previous year.

The car industry has experienced tremendous expansion as a result of factors like rising disposable income, technical advancements, an increase in new product innovations, and an increase in the total number of aftermarkets and OEMs. In the production of different vehicle parts, lightweight materials including alloys made from metal, composites as well as polymers are frequently employed. For instance, the Indian passenger car sector is predicted to grow between 22 and 25% in 2023, according to research released by the National Promotion and Facilitation Agency of India in March 2021. The expanding automobile industry may see a rise in demand for lightweight materials as a result. Additionally, both industrialised and emerging nations, such as the United States, China, and India, are working to modernise their fighter planes. Different aircraft parts are made from lightweight materials, such as aluminium alloys and hybrid materials. During the anticipated term, this may fuel the market for lightweight materials to increase.

Using lightweight materials is constrained in a number of end-use sectors, comprising automotive, manufacturing of aircraft, wind generators, and maritime, due to variables including the quick volatility in raw material costs and the high cost of carbon fibre. For instance, it was estimated that the cost of 1 kilogramme of carbon fibre reinforced polymers for automobiles (CFRP) could increase by 3900 percent compared to the cost of standard steel and by 400 percent compared to the cost of glass fibre reinforced plastics (GFRP). These elements can limit the market's expansion for lightweight materials.

Artificial Intelligence: The Next Growth Catalyst in Lightweight Materials

AI is profoundly impacting the lightweight material market by accelerating the discovery, design, and manufacturing of advanced materials. It revolutionizes R&D by allowing engineers to simulate complex material properties and performance virtually, drastically reducing the traditional trial-and-error process and physical prototyping time.

The use of generative design powered by AI allows for the creation of optimized, complex geometries (like lattice structures) that maximize strength while minimizing material waste and weight, which is particularly vital in the automotive and aerospace industries for improving fuel and energy efficiency. In manufacturing, AI enhances efficiency through predictive maintenance, real-time quality control using computer vision to detect micro-defects, and optimizing production processes to reduce energy use and waste.

Lightweight Material Market Growth Factors

- Due to their cost-effectiveness, fuel economy, and operational efficiency, electric vehicles are in greater demand globally. Electric cars are quite popular with consumers because of their great strength and lightweight components. In order to lighten the weight of the cars, parts of electric vehicles are generally built from lightweight materials including high strength steel, magnesium (Mg) alloys, aluminium (Al) alloys, and engineered plastics. Automobiles that are lightweight have the highest fuel economy when compared to conventional vehicles. Lightweight components are needed to drive an engine's pulling capability in low power engines utilised in electric cars.

- The outside trim, interior trim, and battery packs of electric cars may all be made of lighter materials. Compared to traditional cast iron and steel materials, lightweight materials are becoming more and more desirable. To have a longer range between recharges, consumers are more inclined to select electric vehicles made of lightweight materials. During the forecast period, all of these reasons are anticipated to grow the market for lightweight materials for electric cars.

Market Outlook

- Market Growth Overview: The lightweight material market is expected to grow significantly between 2025 and 2034, driven by automotive and aerospace demand, technological integration, material innovation and diversification, and sustainability and circular economy focus.

- Sustainability Trends: Sustainability trends involve circular economy and enhanced recyclability, adoption of bio-based and renewable materials, and energy-efficient manufacturing processes.

- Major Investors: Major investors in the market include BMW I Ventures, Airbus Ventures, Intel Capital, BASF Venture Capital, and Lockheed Martin Ventures.

- Startup Economy: The startup economy is focused on sustainable and bio-based materials, advanced composites and nanotechnology, and additive manufacturing solutions.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 152.16 Billion |

| Market Size by 2035 | USD 256.36 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 5.35% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Application, Geography |

Lightweight Material Market Segment Insights

Product Insights

Due to the product's ability to cut vehicle weight by 50% and increase fuel economy by about 35%, demand is anticipated to increase. The metal alloys segment is expected to reach a CAGR of 4.8% from 2024 to 2034.

Aluminum has been utilised in many applications since the Hall-Heroult method was developed to produce high-quality aluminium from alumina. Aluminum is increasingly used in automotive and aviation applications due to its age-hardening tendency and the strength it offers. The use of these unique features across a range of sectors is anticipated to stimulate market expansion.

For the most part, high strength steel is employed as a direct replacement for conventional steel in lightweight applications. It may decrease vehicle weight by around 25% and is highly favoured in the automobile industry. High strength steel's rising demand is expected to fuel the market's expansion during the upcoming years due to its recyclable nature.

Magnesium is mostly utilised in mobile and automotive electronics. Magnesium's rise throughout the anticipated period is due to its capacity to be recycled. Due to its widespread availability and ease of usage, titanium is utilised extensively in a wide range of applications. Although it is expensive, it is only utilised in specialised applications where greater strength and longevity are sought.

Application Insights

The market for lightweight materials is dominated by applications in the automotive, aviation, and energy sectors. With an almost 76% sales share in 2025, the automobile segment dominated the market as a whole. Aluminum, polymers and composites, and high-strength steel are among the main goods utilised in the automobile sector.

Growing applications in the automotive and aviation sectors are the main market drivers. Over the course of the projection period, it is anticipated that the aviation industry's growing innovation would increase market demand. Additionally, the rising use of lightweight materials in the energy application segment is anticipated to boost market growth. Utilizing lightweight materials has a direct effect on a number of variables, including driving dynamics, agility, and fuel economy. Over the projected period, demand for lightweight materials is anticipated to increase due to their use in the aviation industry. Additionally, the construction of windmills for one of the principal renewable energy sources, wind, requires lightweight materials.

Defense and transportation make up the other market application category. Titanium and magnesium are mostly used in these applications because of their unique ability to deflect electromagnetic energy. Due to increased research and development of novel materials for use in military applications, the market's demand is anticipated to rise.

Material Insights

In terms of material, the market for lightweight materials for electric cars was dominated by the metals and alloys category in 2025. This is mainly due to the rise in demand for metals and alloys in electric vehicle applications, such as battery packs, external trim, and interior trim.

Key metals for electric cars include aluminium, copper, and nickel. It is projected that demand for these metals would rise in tandem with the increase in sales of electric cars. An vast variety of a vehicle's body elements, such as brakes, wiring, wheels, and pipes, are made of aluminium, the metal that electric vehicle producers prize. Battery casings are made of aluminium, which is also a crucial component of the drive chain. Aluminum alloys are essential for the development of EVs because of their low density, which makes it easier to reduce total weight.

In the market for lightweight materials for electric cars in 2022, the engineering plastics material category also had a significant proportion. Electric car interior and exterior furnishings, power trains, electrical components, and under-the-hood components all use engineering plastics. The engineering polymers polycarbonate, polyamide, and polymethyl methacrylate are typical examples.

Lightweight Material Market Regional Insights

The Asia Pacific lightweight material market size is evaluated at USD 56.30 billion in 2025 and is predicted to be worth around USD 95.88 billion by 2035, rising at a CAGR of 5.47% from 2026 to 2035.

With a CAGR of more than 15% from 2026 to 2035, MEA is predicted to expand the quickest. Rapid industrialization and the establishment of manufacturing facilities by numerous conglomerates, including Cytec Solvay Group, are the main drivers of growth in this area. Natural resources are easily accessible, and a burgeoning application industry is anticipated to increase demand.

Due to the rising need for lightweight glass fibre reinforced concrete that is also fire resistant and has amazing features, Asia Pacific is growing quickly and might be a lucrative market in the years to come. The pace of urbanisation is rising, and this, along with rising disposable income and changing consumer habits in the area, has caused the building industry to grow significantly. The market for lightweight materials in the area has benefited greatly from this feature. The spike in government investment for renewable power projects, such hydro and wind energy, also has a significant positive impact on the APAC market. Additionally, the region's market position is strengthened by the increased demand for fuel-efficient cars. According to statistics, China produced close to 23.7 million vehicles in 2014, including trucks, vans, buses, and automobiles. Since then, this figure has been increasing steadily, which is a development that will undoubtedly benefit the market for lightweight materials in the next years.

Because there are more manufacturers of lightweight materials, there is a rise in demand for the product in Latin America. Additionally, the presence of aviation and wind energy equipment manufacturers in Europe is anticipated to boost market growth.

Because high strength steel has many qualities with conventional steel, it is widely utilised in North America. However, because to their widespread adoption in the automotive and energy industries, polymers and composites are predicted to increase quickly throughout the projected period. Growing uses in the automotive and aviation industries are driving up aluminium consumption in this region. The US and Canada have emerged as the top makers and exporters of aircraft in North America, dominating the worldwide market for lightweight materials. The aviation and aerospace industries' high consumption rates of these commodities have greatly benefited the local market. The market size will also be supported by the region's booming auto sales and the increasing emphasis on employing lightweight materials and components for improved fuel economy. The fact that the area is home to several well-known automakers and manufacturers of equipment for renewable energy sources is also anticipated to be a significant development driver.

The U.S.'s lightweight material market is experiencing significant growth, driven by the regulatory pressures for efficiency in the automotive and aerospace sectors, leading to diversification in materials like composites and aluminum, and the integration of AI for accelerated discovery and manufacturing. Additive manufacturing is also gaining traction for niche applications and waste reduction, reflecting a market shift towards innovative, high-performance, and sustainable material solutions. More information on this topic is available from the original source.

China's lightweight material market is the massive scale of its automotive and NEV sectors and strong government support for green construction and sustainable materials. The market is defined by advancements in composite technologies, increasing integration of additive manufacturing, and high AI adoption for accelerated R&D.

Europe's stringent environmental regulations necessitate improved efficiency and sustainability in vehicles and aircraft. This growth is reinforced by substantial EU investment in R&D and manufacturing innovations like additive manufacturing. A strong focus on circular economy principles has also led to a significant push for recyclable and reusable materials.

Germany's lightweight material market is experiencing a powerful automotive industry's need to meet stringent EU emission standards and enhance EV efficiency. The market is also heavily shaped by a strong national emphasis on circular economy principles, leading to innovation in recyclable and sustainable materials. Advanced manufacturing technologies like additive manufacturing and strong R&D infrastructure further accelerate the development of high-performance composites and alloys.

Value Chain Analysis of the Lightweight Material Market

- Raw Material Extraction & Processing:

This foundational stage involves sourcing and processing base materials such as bauxite (for aluminum), iron ore (for high-strength steel), carbon fiber precursors, and various polymers.

Key Players: Alcoa Corporation, Rio Tinto Alcan, ArcelorMittal, Toray Industries (carbon fiber), BASF SE (polymers). - Material Design & R&D:

This stage focuses on innovation, where material scientists use advanced modeling, simulation, and increasingly AI-driven generative design to engineer new alloys, composites, and polymers with optimal strength-to-weight ratios.

Key Players: DuPont de Nemours, Inc., Hexcel Corporation, SGL Carbon, Covestro AG, Altair Engineering, Inc. (simulation software). - Manufacturing & Component Fabrication:

This stage converts processed materials into final components using various methods, including traditional forging and casting, advanced composite layups, and additive manufacturing (3D printing).

Key Players: Magna International Inc. (automotive components), Airbus SE (aerospace fabrication), Stratasys Ltd. (3D printing solutions), Arconic Corporation (aluminum rolling and fabrication), Boeing Company (aerospace fabrication). - Integration & Assembly:

This stage involves the final assembly of the lightweight components into larger systems or end products, such as vehicles, aircraft, or wind turbines.

Key Players: Toyota Motor Corporation (automotive assembly), Lockheed Martin Corporation (aerospace/defense assembly), Vestas Wind Systems A/S (wind energy assembly), Tesla, Inc. (EV assembly). - Recycling & End-of-Life Management:

This final, increasingly important stage focuses on closed-loop systems for material recovery, especially for aluminum and high-performance polymers.

Key Players: Novelis Inc. (aluminum recycling), Veolia Environnement S.A. (waste management/recycling services), SGL Carbon (composite recycling solutions)

Top Companies in the Lightweight Material Market & Their Offerings:

- ThyssenKrupp AG: This German multinational conglomerate contributes to the lightweight material market by producing advanced high-strength steels and metal processing solutions that are vital for the automotive and construction industries.

- Henkel Corporation: Henkel plays a critical role through its Adhesives Technologies business, providing high-performance bonding solutions that replace heavier welding and mechanical fastening techniques in automotive and aerospace applications.

- Owens Corning Corporation: The company is a key supplier of glass fiber reinforcements and composite materials that are essential for the production of lightweight parts in the automotive, wind energy, and construction sectors.

- LyondellBasell Industries N.V.: LyondellBasell contributes by developing and supplying advanced polyolefins and specialty polymers that are used in a wide range of lightweight applications, from vehicle interiors to industrial components.

- Hexcel Corporation: Hexcel is a leader in advanced composites, providing carbon fiber and honeycomb structural materials primarily for the aerospace and defense industries.

- SGL Group: SGL Group (SGL Carbon) specializes in the production of carbon fiber and composite materials, catering to industries like automotive, aerospace, and wind energy, where lightweighting is a critical design factor. Their materials are used in high-performance applications, enabling lighter and more energy-efficient structures.

- Nippon Graphite Fiber Corporation: As a subsidiary of Nippon Paper Industries, this company is involved in the development and supply of high-performance carbon fiber materials for various industrial applications. Their products contribute to the creation of lightweight composites used in sporting goods and industrial machinery, where strength and weight reduction are paramount.

- Mitsubishi Rayon Co. Ltd.: Mitsubishi Rayon, now part of the Mitsubishi Chemical Holdings group, is a key producer of specialized carbon fiber and composite materials.

- Zoltek Companies Inc: Zoltek, a subsidiary of Toray Group, is a major producer of low-cost, high-performance commercial-grade carbon fiber that broadens the applicability of composites into price-sensitive, high-volume markets.

- UC Rusal: UC Rusal is a major global producer of aluminum, a highly recyclable and lightweight metal that is increasingly used in automotive body structures and other industrial applications.

- Aluminium Corporation of China (Chalco): Chalco is one of China's largest aluminum producers, playing a crucial role in providing raw materials and semi-fabricated products for the country's booming lightweighting industries, particularly in construction and automotive manufacturing. They help ensure the supply chain for this essential lightweight metal at scale.

- Rio Tinto Alcan Inc.: Rio Tinto Alcan is a significant global supplier of aluminum and related products, contributing to the lightweight material market with primary aluminum production and bauxite mining operations.

- China Hongqiao Group Ltd.: China Hongqiao is one of the world's largest aluminum producers, supporting the massive demand for lightweight materials in China's automotive and construction sectors.

- Kaiser Aluminium: Kaiser Aluminium is a leading producer of semi-fabricated specialty aluminum products, primarily for the aerospace and high-end automotive industries.

- US Magnesium LLC: As a major producer of magnesium, US Magnesium contributes a material known for being even lighter than aluminum and high-strength steel.

- A&S Magnesium Inc.: This company is a supplier of magnesium and magnesium alloy products, providing essential materials that enable the use of ultra-lightweight designs in various industrial applications.

Lightweight Material Market Companies

- ThyssenKrupp AG

- Henkel Corporation

- Owens Corning Corporation

- LyondellBasell Industries N.V.

- Hexcel Corporation

- SGL Group

- Nippon Graphite Fiber Corporation

- Mitsubishi Rayon Co. Ltd.

- Zoltek Companies Inc

- UC Rusal

- Aluminium Corporation of China

- Rio Tinto Alcan Inc.

- China Hongqiao Group Ltd.

- Kaiser Aluminium

- US Magnesium LLC

- A&S Magnesium Inc.

Key market developments

- In July 2020, Madison Dearborn Partners, LLC-controlled company Intelligent Packaging Limited Purchaser Inc. announced that it has signed a deal to acquire IPL Plastics Inc.

- February 2021: Boston Materials, a producer of high-tech lightweight materials, has started distributing its Z-axis carbon fibre to customers in Europe and North America. This fibre is made utilising a 60-inch-wide roll-to-roll process. Since there is a growing need for Z-axis lightweight carbon fibre in sectors like electronics, transportation, and industry, the business anticipates that the installation of its most recent industrial-scale manufacturing line will grow its clientele. SUPERCOMP, a high-performance lightweight 3D carbon fibre material that improves energy dissipation, manufactureability, and vibration damping of lightweight composite structures, will be the first product to ship.

Lightweight Material Market Segments Covered in the Report

By Raw Material

- Chemical compounds

- Metals

- Zeolites

- Others

By Product

- Heterogeneous Catalyst

- Chemical synthesis

- Chemical catalysts

- Adsorbents

- Syngas production

- Others

- Petroleum refining

- FCC

- Alkylation

- Hydrotreating

- Catalytic Reforming

- Purification

- Bed grading

- Others

- Polymers and petrochemicals

- Ziegler Natta

- Reaction Initiator

- Chromium

- Urethane

- Solid Phosphorous Acid catalyst

- Others

- Environmental

- Light-duty vehicles

- Motorcycles

- Heavy-duty vehicles

- Others

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia-Pacific

- China

- India

- Japan

- South Korea

- Malaysia

- Philippines

- Latin America

- Brazil

- Rest of Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting