What is Refractory Material Market Size?

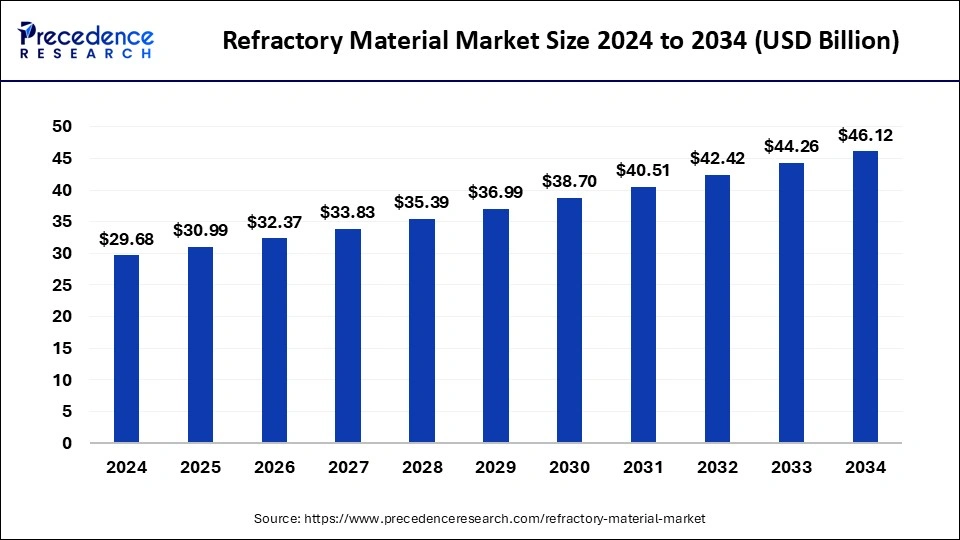

The global refractory material market size is estimated at USD 30.99 billion in 2025 and is predicted to increase from USD 32.37 billion in 2026 to approximately USD 46.12 billion by 2034, expanding at a CAGR of 4.52% from 2025 to 2034.

Market Highlights

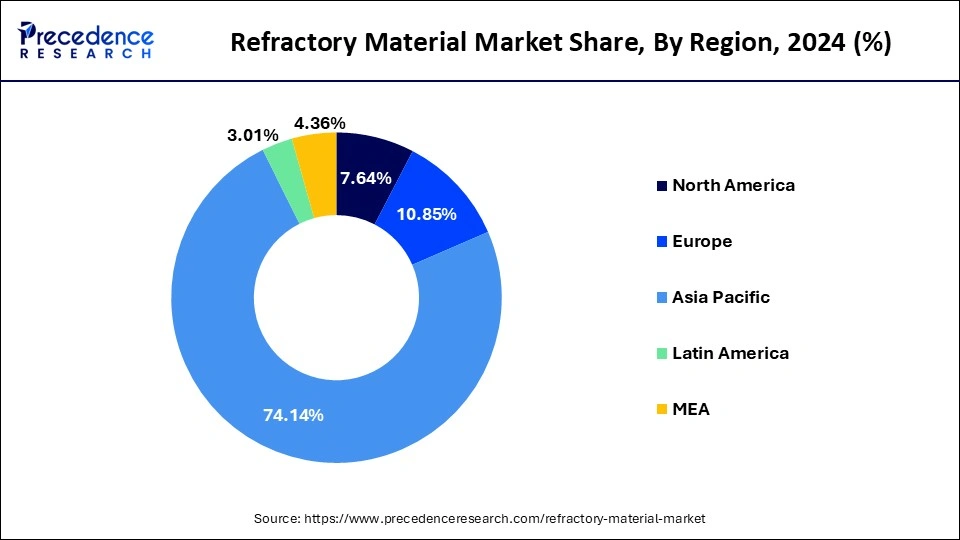

- Asia-Pacific is expected to dominate the market with revenue share of 74.40% in 2024.

- By Chemical composition, the magnesia segment is expected to grow at the fastest rate in the fastest rate in the market during the forecast period of 2025 to 2034.

- By form, the unshaped segment is projected to experience the highest growth rate in the market between 2025 and 2034.

- By end use, the cement segment is anticipated to grow with the highest CAGR in the market during the studied period of 2025 to 2034.

- By chemistry, the basic segment is projected to experience the fastest rate of market growth from 2025 to 2034.

Market Size and Forecast

- Market Size in 2025: USD 30.99 Billion

- Market Size in 2026: USD 32.37 Billion

- Forecasted Market Size by 2034: USD 46.12 Billion

- CAGR (2025-2034): 4.52%

- Largest Market in 2024: Asia Pacific

- Fastest Growing Market: North America

What is Refractory Materials Market?

The refractory materials market serves as the silent but indispensable infrastructure of heavy industry. These are the heat-resistant materials bricks, castables, ceramics, and advanced composites that enable furnaces, kilns, reactors, and boilers to function at extreme temperatures without degrading. As steel, cement, glass, petrochemicals, and non-ferrous industries expand and modernize, refractory materials remain the unseen pillars of global industrial resilience. In today's landscape, refractories are transitioning from commodity materials to precision-engineered solutions tailored to energy efficiency, durability, and environmental compliance.

What is the role of AI in the market?

In the refractory materials market, artificial intelligence (AI) is playing a pivotal role in transforming product design, manufacturing efficiency, and performance optimization. AI powered predictive modelling enables manufactures to simulate how different refractory compositions will behave under specific thermal, chemical, and mechanical stresses, reducing the need for costly trial and error experiments. Machine leaning algorithms are being applied to optimize raw material blends for maximum durability and cost efficiency, taking into account variables like grain size distribution, binder ratios and firing temperatures.

In production, AI driven process control systems monitor furnace conditions in real time, automatically adjusting parameters to ensure consistent quality and reduce energy consumption. AI is also improving maintenance strategies by analysing sensor data from industrial furnaces and kilns to predict wear patterns and schedule timely replacements, minimizing downtime. Furthermore, AI assisted supply chain analytics help manufacturers respond quickly to fluctuations in raw material availability and market demand, while computer vision systems support automated quality inspections, detecting micro crackers or structural defects that human eyes might miss. Collective, these AI industries to enhance product longevity, cut production costs, and meet increasingly strict sustainability standards.

Market Overview

Refractory materials are high-tech ceramic materials that can endure severe chemical corrosion at high temperatures as well as thermal and mechanical damage. By offering mechanical strength, corrosion resistance, and thermal insulation they play an essential but often underappreciated role in the everyday operations of practically every sector. For a variety of sectors to create important manufacturing processes, including iron and steel, glass, other metals, paper and pulp, cement, and petrochemicals, these goods have proved crucial.

In some sectors, like steel and other metals, these goods are regarded as consumables, and they must be changed periodically to maintain their function. On the other hand, since they may do their task for up to 10 years, sectors like glass and cement take their capital investment into consideration. The cost of refractory products makes up less than 3% and frequently less than 1% of the cost of produced goods, according to the World Refractory Association. However, refractory product applications and designs that are optimized can cut operational costs for end-use industries by up to 20%. Refractory materials are crucial for the development of the various end-use industries since they are produced in a non-toxic manner and over 90% of them are recycled or used again. However, the market for refractory materials has suffered as a result of the COVID-19 epidemic because of its reliance on the manufacture of cement, glass, steel, and metals, as well as mining, heavy industry, oil and gas, and other industries.

Refractory Material Market Growth Factors

Increasing investments in the iron and steel industries are what are driving the growth of the worldwide market for refractory materials. In both developed and emerging countries, like the U.S., China, and India, where refractory materials are extensively utilized for thermal insulation reasons, iron and steel output has increased due to rapid infrastructure construction and rising demand from the automobile industry. For instance, the Indian Steel Association (ISA) forecasts that the demand for steel would increase by 7.12% between 2020 and 2021. The usage of glass-based materials for a variety of applications has also expanded as a result of features including recyclability, transparency, and low raw material prices. Refractory materials are heavily employed in the manufacture of glass to ensure thermal stability. This is expected to fuel market expansion for refractory materials.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 30.99 Billion |

| Market Size in 2026 | USD 32.37 Billion |

| Market Size by 2034 | USD 46.12 Billion |

| Growth Rate 2025 to 2034 | CAGR of 4.52% |

| Base Year | 2024 |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Chemistry, Chemical Composition, Form, End Use and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Steady Growth in Steel Industries - Materials for refractories cost between two and three percent more than steel. The development of the steel sector would be fueled by expanding infrastructure, the oil and gas, and the automobile industries. Although the cement, glass, and non-ferrous sectors continue to offer prospects for refractory businesses, the steel industry has a significant impact on those businesses' success.

Three-fourths of the demand for refractories worldwide comes from the steel industry, and it is anticipated that this dominance will last the whole projection period. Although the steel sectors have also been hurt by global overproduction, there has been a gradual rebound over the past year. Additionally, since the bulk of the areas focus on self-reliance and reducing imports, investments in the steel industry are projected to rise in emerging and underdeveloped nations.

Increasing Application in the Power Generation Sector - Due to the huge need for electricity globally, the rapid expansion of renewable energy, and other factors for a sustainable future, the power generation industry has experienced significant growth. The Energy Information Administration (EIA) estimates that geothermal energy generated 15.89 billion kilowatt hours of power in 2020 as opposed to 16.22 billion kilowatt hours in 2020. In addition, the Central Electricity Authority (CEA) predicts that India's electricity demand would increase to 817 GW by 2030.

Challenges

- Environmental Hazards and Threats to Health - The environmental effect of refractory raw materials such carbon, carbides, silica, ceramic fibers, and others is significant. Long-term exposure to ceramic fiber can have negative effects on health, including skin irritation, respiratory problems, and even death. Additionally, the production of refractories produces toxic pollutants including nitrogen oxides, carbon monoxide, and others that have a negative impact on the environment. For instance, the Clean Air Act's Environmental Protection Agency (EPA) sets limitations on air pollutants (CAA). As a result, the market application and demand for refractory materials are hindered, which slows down and poses challenges for the refractory business. Refractory materials also pose serious environmental and health risks.

Opportunities

- Recycling of refractory materials: When their lifespan is up, refractory materials can either be disposed of or recycled and then evaluated again. The refractory sector has supported recycling during the past 20 years, minimizing environmental harm and lowering implementation costs. According to research, there is no difference between the thermal stability of newly created refractory materials and those that have been converted. The most recent innovations in recycling systems have made this procedure simpler and more effective than before. Recycling of refractories hence aids businesses in lowering manufacturing costs, providing attractive chances for the expansion of this industry.

- Diversifying their market base - Additionally, refractory manufacturers are expanding their customer base and focusing on companies that make materials other than iron and steel. The resilience and lifetime of refractories are being increased by refractory makers through the use of cutting-edge materials, making them more desirable and secure long-term investments for iron and steel companies. Additionally, producers are becoming more versatile with their product mix thanks to manufacturers who are refining their installation methods to cut down on downtime. Nonmetallics like cement, mineral, and lime have drawn a lot of interest; cement sales are likely to be the main driver of future refractory sales. A rise in infrastructure investment is anticipated by both cement and refractory manufacturers.

Segment Insights

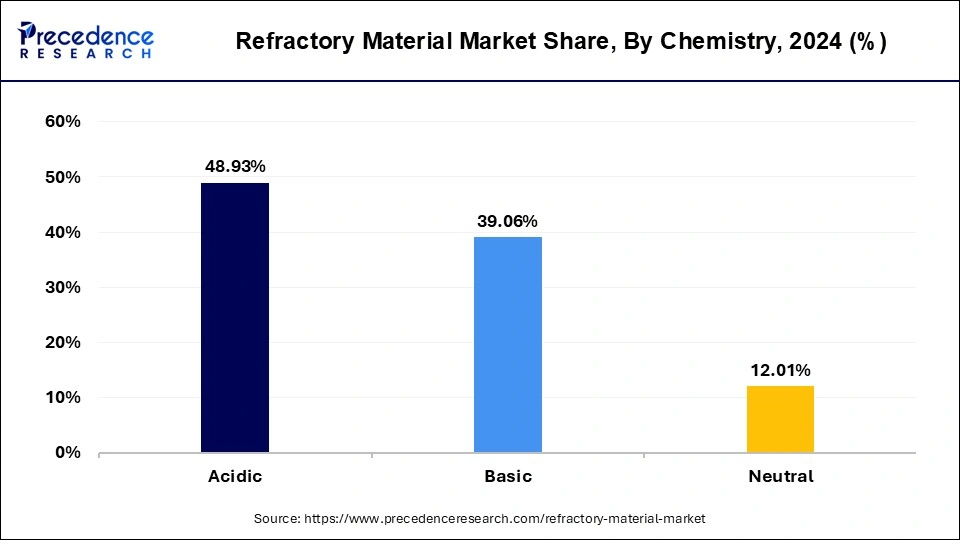

Chemistry Insights

Basic refractories, primarily composed of magnesia, dolomite, and chromite, are registering the fastest growth due to their strong resistance to basic slags and high refractoriness under load. These properties make them indispensable in steelmaking, non-ferrous meta processing because of their basic nature, which resists corrosion from basic nature, which resists corrosion from basic slags and atmospheres.

They also demonstrate superior mechanical strength at elevated temperatures and can withstand thermal shocks better than many other compositions. Growth in steel production, particularly in emerging economies, is driving demand for magnesia refractories, as they are essential for lining furnaces, converters, and kilns, additionally, advancements in sintering and biding technologies are enhancing magnesia's performance, making it more suitable for longer service life and reduced suitable for longer service life and reduced maintenance downtime.

Refractory Material Market Revenue, By Chemistry, 2022 - 2024 (USD Million)

| Chemistry | 2022 | 2023 | 2024 |

| Acidic | 13,333.38 | 13,918.64 | 14,523.09 |

| Basic | 10,542.73 | 11,057.04 | 11,591.53 |

| Neutral | 3,388.23 | 3,474.67 | 3,564.78 |

Chemical Composition Insights

The magnesia segment is set to be the fastest-growing category in the refractory materials market due to its exceptional thermal resistance and stability in high temperature environments. Magnesia-based refractories are widely used in steelmaking, cement production, and nonferrous metal processing because of their basic nature, which resists corrosion from basic slags and atmospheres. They also demonstrate superior mechanical strength at elevated temperatures and can withstand thermal shocks better than many other compositions.

Refractory Material Market Revenue, By Chemical Composition, 2022 - 2024 (USD Million)

| Chemical Composition | 2022 | 2023 | 2024 |

| Alumina | 2,609.71 | 2,724.24 | 2,844.00 |

| Silica | 4,636.52 | 4,879.67 | 5,127.15 |

| Magnesia | 2,279.77 | 2,415.81 | 2,557.41 |

| Fireclay | 17,191.40 | 17,874.97 | 18,579.25 |

| Others | 546.94 | 555.65 | 571.58 |

Growth in steel production, particularly in merging economies, is driving demand for magnesia refractories, as they are essential for lining furnaces, coverts, and kilns. Additionally, advancements in sintering and binding technologies are enhancing magnesia's performance, making it more suitable for longer service life and reduced maintenance downtime.

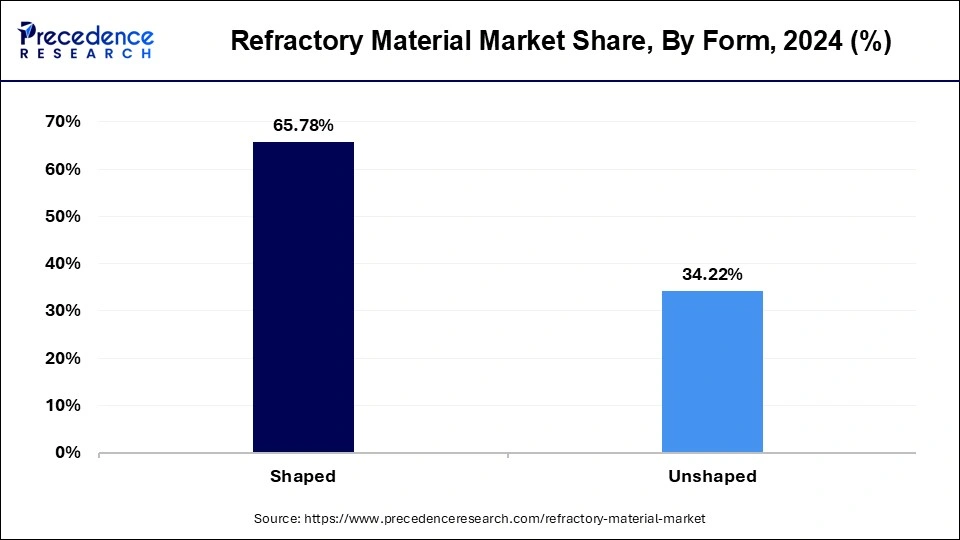

Form Insights

The unshaped segment, also refereed to as monolithic refractories, is experiencing the fastest growth because of its versatility, ease of installation, and reduced labour costs compared to traditional shaped bricks. Unshaped refractories can be cast, gunned, or rammed into place, allowing for rapid repairs and linings of complex structures without the need of cutting or fitting pre formed bricks. Their superior bonding ability assures minimal joints, which improves thermal pre formed bricks.

Their superior bonding ability assures minimal joints, which improves thermal efficiency and reduces weak points in furnace lining. The growing adoption od unshaped materials in industries such as steel, cement, and petrochemicals is fuelled by the need for faster turnaround times during maintenance, as well as the development of advanced bonding agents and additives that enhance durability under extreme conditions.

Refractory Material Market Revenue, By Form, 2022 - 2024 (USD Million)

| Form | 2022 | 2023 | 2024 |

| Shaped | 18,023.28 | 18,761.93 | 19,523.91 |

| Unshaped | 9,241.06 | 9,688.42 | 10,155.49 |

End Use Insights

The cement industry is projected to be the fastest-growing end-use segment for refractory materials, driven by the rising demand for infrastructure and construction worldwide. Cement production involves continuous exposure of equipment to high temperatures, chemical abrasion, and mechanical stress, specially in rotary kilns, preheaters, and clinker coolers.

Refractory Material Market Revenue, By End Use, 2022 - 2024 (USD Million)

| End Use | 2022 | 2023 | 2024 |

| Metals & Metallurgy | 18,409.80 | 19,138.31 | 19,893.54 |

| Cement | 2,013.88 | 2,106.43 | 2,203.61 |

| Glass & Ceramics | 3,461.24 | 3,670.57 | 3,889.95 |

| Power Generation | 2,554.56 | 2,688.83 | 2,829.18 |

| Others | 824.86 | 846.19 | 863.12 |

Refractories in this sector must provide reliable thermal insulation, resist alkali attack, and maintain structural integrity over prolonged cycles. With the surge in urbanization and government investments in infrastructure projects, cement manufacturers are upgrading to more efficient and longer lasting refractory lining to improve energy efficiency, reduce downtime, and meet stringent environmental regulations. Technological advancements, such as alkali resistant and abrasion resistant refractories, are further driving adoption.

Regional Insights

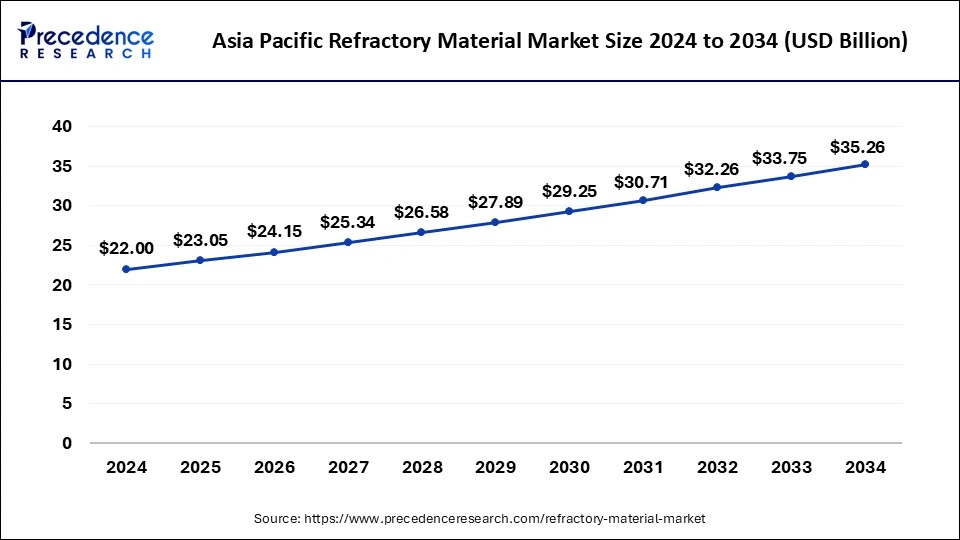

Asia Pacific Refractory Material Market Size and Growth 2025 to 2034

The Asia Pacific refractory material market size is exhibited at USD 23.05 billion in 2024 and is projected to be worth around USD 35.26 billion by 2034, growing at a CAGR of 4.83% from 2025 to 2034.

The Asia-Pacific region's market for refractory materials, which had 74.14% of the worldwide market share in 2024, is anticipated to grow at the highest CAGR of 4.83% during the projected period. This is a result of an increase in production capacity among iron and steel producers where refractory materials are frequently used for temperature stability reasons due to the growing demand for iron and steel from a wide range of end industries, including all of the industrial, constructing and infrastructure, automotive, and others. According to a study published by the India Brands Equity Foundation, 230 metric tons (MT) of finished steel would be used in India by 2030–31, rising from 93.43 tons (MT) in 2020–21. Additionally, the rapidly expanding Chinese cement industry has compelled producers of refractory materials to create high-quality refractory materials for use in furnaces, kilns, incinerators, and other high-temperature applications. For instance, according to a data released by the World Cement Association, China's output of cement clinker was 1.579 billion tons in 2020 and increased by 3.07% year over year.

- North America refractory material market size was valued at USD 2.26 billion in 2024 and is growing at a CAGR of 3.98% from 2025 to 2034, to reach around USD 3.37 billion by 2034.

- Europe refractory material market size could reach around USD 4.65 billion by 2034 from USD 3.22 billion in 2024 and is expanding at a CAGR of 3.81% between 2025 to 2034.

- MEA refractory material market size was accounted at USD 1.29 billion in 2024 and is expected to hit around USD 1.62 billion by 2033 to grow at a CAGR of 2.33% between 2025 to 2034.

What are the Key Drivers of Growth in the Refractory Material Market in Latin America?

The refractory materials market in Latin America is poised for significant growth, driven by several key factors that align with the region's industrial landscape and economic developments. Latin America's industrial sectors, particularly steel, cement, and glass manufacturing, are expanding and modernizing. This growth fuels demand for high-performance refractory materials capable of withstanding extreme temperatures and harsh chemical environments.

Country Analysis

Mexico's manufacturing sector, especially in automotive and aerospace, demands high-quality refractories. An expanding base of industrial activities, combined with foreign investment, promotes innovation in the refractory market. Additionally, the move towards adopting green technologies in manufacturing processes makes refractory products a critical area for development.

Market Value Chain Analysis

- Raw Material Sourcing: Raw materials define both the quality and cost structure of refractory materials. Key sources include natural minerals such as bauxite, magnesite, dolomite, chromite, and silica, synthetic raw materials, including high-purity alumina, sintered magnesia, spinels, and speciality carbides. Supply chains prioritize consistency, purity, and traceability. With environmental norms tightening globally, companies are moving toward responsible mining, local sourcing, and closed-loop raw material systems.

- Technological Advancements: Technological progress is redefining refractory performance through several innovative advancements. Nano-reinforced refractories are now available, offering improved strength and thermal resistance. High-purity synthetic minerals are engineered specifically for extreme environments, enhancing durability and effectiveness.

Recent Developments

- A significant innovation has merged with the introduction of zirconia corundum refractory constables; which experts are calling a game changer for high are calling a game changer for high temperature industrial operations. This new material offers exceptional fire resistance and thermal shock durability, making it highly suitable for extreme environments such as steelmaking and foundry processes. Beyond performance, the constables are also touted for environmental benefits they require less energy to produce and generate fewer pollutants than conventional alternatives, potentially helping industries lower their carbon footprint while enhancing operational efficacy.

- In a landmark move toward collaborative innovation, Wuhan University of Science and Technology (WUST) has established a Refractory Materials Innovation Alliance in partnership with twelve leading domestic and internal refractory companies. This alliance aims to foster breakthroughs in key areas such as strategic refractory technologies, green and low carbon materials, and AI enabled solutions. It represents a new model of industry education integration, blending academic research with enterprise capabilities to cultivate talent, drive research and development, and advance the fired toward more sustainable and intelligent refractory solutions.

Refractory Material Market Companies

- Calderys

- Dalmia Bharat Refractory

- IFGL Refractories Ltd.

- Krosaki Harima Corporation

- Lanexis

- Morgan Advanced Materials

- RHI Magnesita GmbH

- Saint Gobain

- SHINAGAWA REFRACTORIES CO., LTD.

- Vitcas

Segments Covered in the Report

By Chemistry

- Acidic

- Basic

- Neutral

By Chemical Composition

- Alumina

- Silica

- Magnesia

- Fireclay

- Others

By Form

- Shaped

- Unshaped

By End Use

- Metals & Metallurgy

- Cement

- Glass & Ceramics

- Power Generation

- Others

ByRegion

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting