What is the Refractories Market Size?

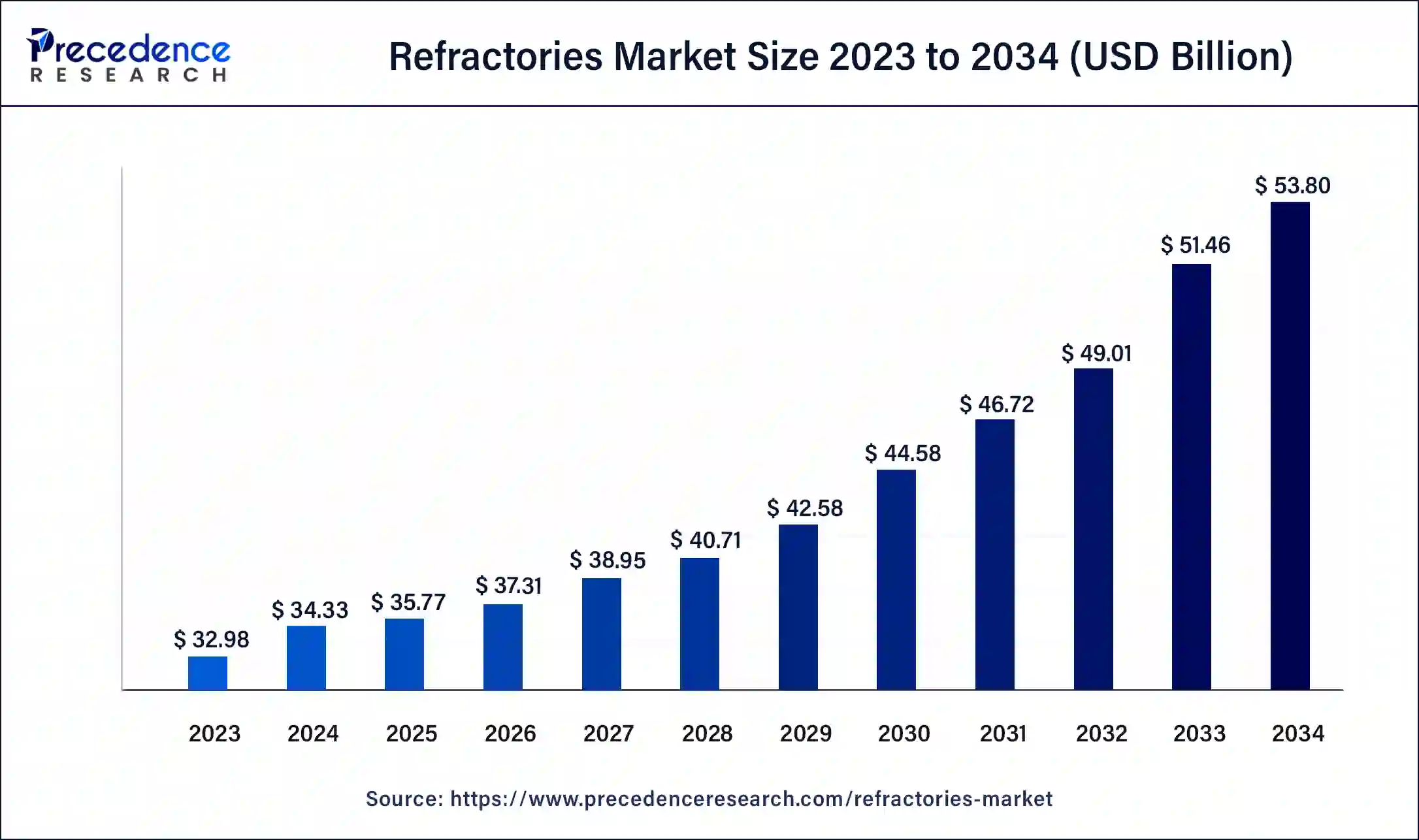

The global refractories market size was calculated at USD 35.77billion in 2025 and is expected to reach around USD 56.21 billion by 2035, expanding at a CAGR of 4.62% from 2026 to 2035.

Refractories Market Key Takeaways

- The global AA market was valued at USD 35.77 billion in 2025.

- It is projected to reach USD 56.21 billion by 2035.

- The market is expected to grow at a CAGR of 4.62% from 2026 to 2035.

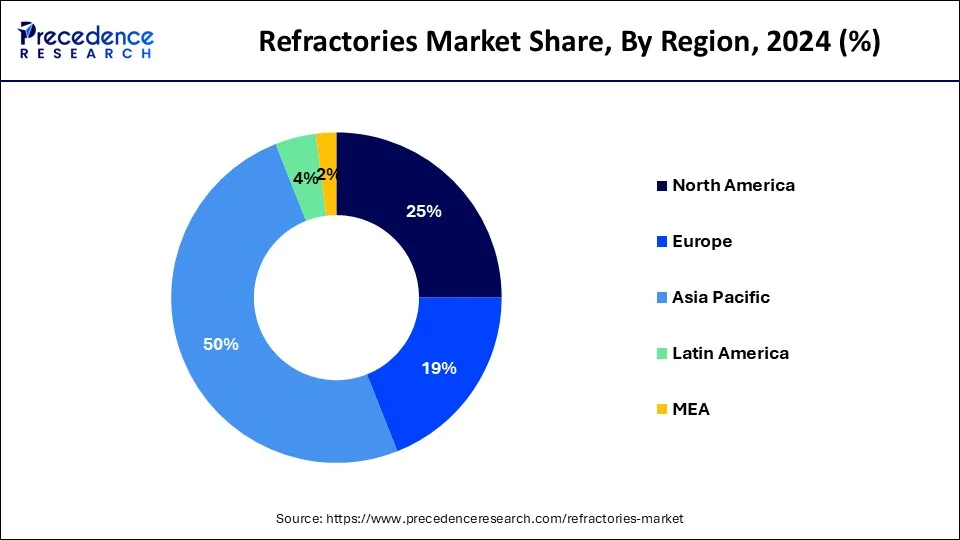

- Asia Pacific contributed more than 49.28% of the market share in 2025.

- North America is estimated to expand the fastest CAGR between 2026 to 2035.

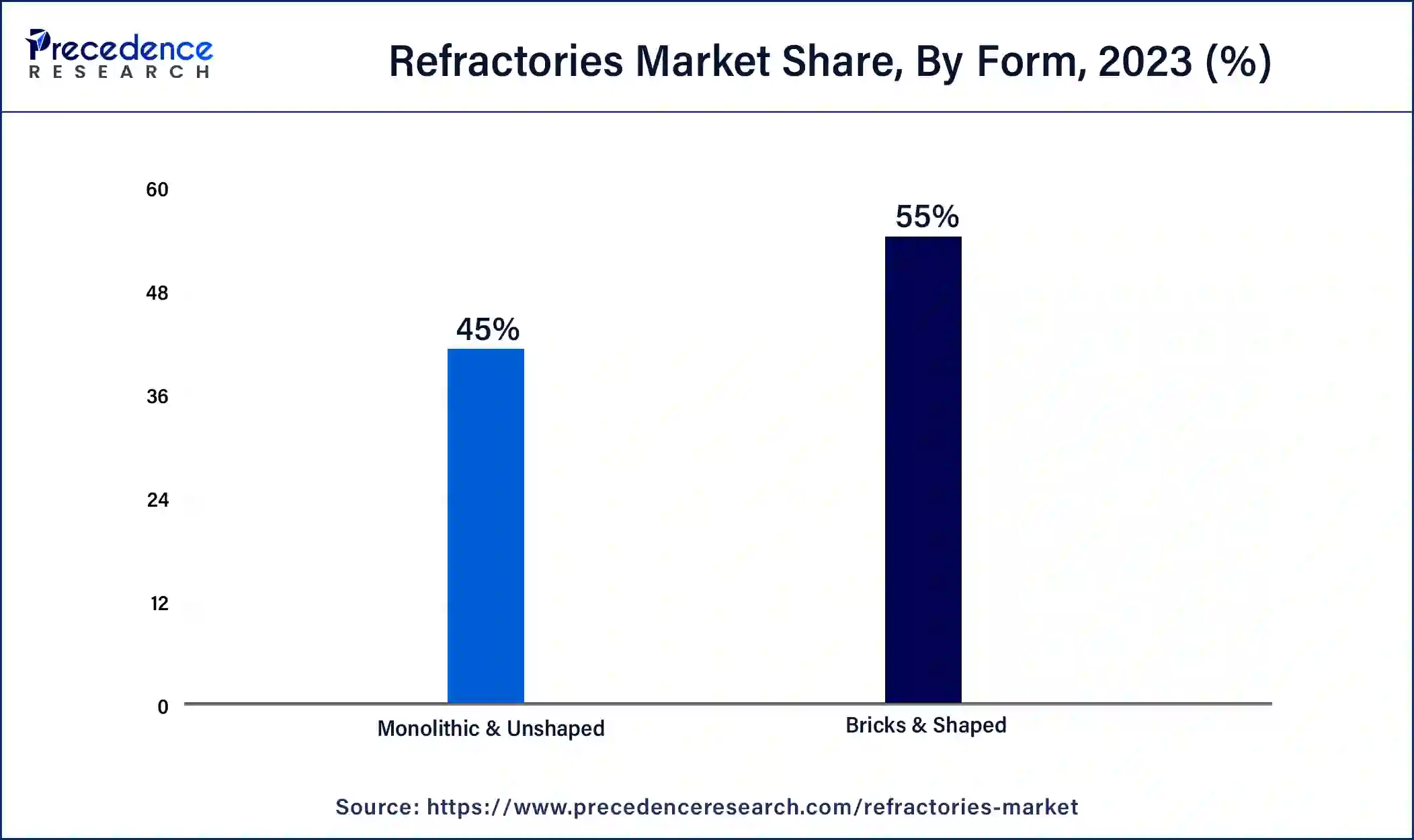

- By form, the bricks & shaped segment has held the largest market share of 55% in 2025.

- By form, the monolithic & unshaped segment is anticipated to grow at a remarkable CAGR of 5.8% between 2026 and 2035.

- By product, the clay segment generated over 66% of the market share in 2025.

- By product, the non-clay segment is expected to expand at the fastest CAGR over the projected period.

- By alkalinity, the basic segment generated over 59% of the market share in 2025.

- By alkalinity, the acidic & neutral segment is expected to expand at the fastest CAGR over the projected period.

- By end-use industry, the iron & steel segment generated over 36% of market share in 2025.

- By end-use industry, the cement segment is expected to expand at the fastest CAGR over the projected period.

What are the Refractories?

Refractories, specialized materials designed to withstand high temperatures and harsh conditions, play a crucial role in industries like metallurgy and glass manufacturing. Crafted from robust minerals such as alumina and silica, these materials maintain their structural integrity and chemical properties even under extreme heat. They function as protective linings and insulators in furnaces and kilns, shielding industrial equipment from the intense temperatures generated during processes like metal smelting. This durability ensures the effectiveness and longevity of industrial operations in sectors where the ability to withstand high temperatures is paramount. Essentially, refractories are essential elements that contribute significantly to the dependability and extended life of various manufacturing processes.

How is AI contributing to the Refractories Industry?

The AI enhances refractory operation based on predictive maintenance and intelligent production control. Cracks and hot spots are detected in real-time by computer vision and IR cameras. Process optimization and process automation tools predict wear-out before shutdown. Machine learning optimizes chemical composition on long-lasting formulations. The production of waste is reduced with the help of raw material optimization.

Refractories Market Data and Statistics

- As per the World Refractory Association, the expenditure on refractory products typically constitutes less than 3%, and frequently even falls below the 1% mark of the overall manufactured goods.

- In September of 2022, Essar unveiled its intentions to allocate a substantial USD 4 billion for the establishment and operationalization of a four-million-ton-per-annum steel complex in Saudi Arabia by the year 2025.

- The foremost 10 nations in terms of steel production during the month of February 2023 featured China at the forefront (80.1 million tons), followed by India (10 million tons), Japan (6.9 million tons), the United States (6 million tons), and Russia (5.6 million tons), along with several other contributors to the global steel production landscape.

Refractories Market Growth Factors

- The prosperity of the refractories market is intricately linked to the steel industry, where refractory materials play a vital role in the production of steel. The escalating global demand for steel, fueled by infrastructure growth and industrialization, significantly boosts the expansion of the refractories market.

- A thriving construction sector, especially in developing nations, acts as a driving force for the refractories market. Increased construction activities create a demand for refractory materials essential in high-temperature applications for producing construction materials like cement and ceramics.

- The widespread expansion of manufacturing, spanning automotive, aerospace, and electronics industries, generates a need for refractories. These materials play a critical role in preserving the structural integrity of equipment subjected to high temperatures during manufacturing processes.

- The global emphasis on energy efficiency and sustainability is prompting increased adoption of advanced refractory materials. These materials contribute to more efficient and environmentally friendly industrial processes, marking a pivotal growth factor for the refractories market.

- Ongoing research and development in refractory materials introduce advanced and high-performance products. Innovations in formulations and manufacturing processes enhance the durability and effectiveness of refractories, propelling market growth.

- The growth of industries like petrochemicals, characterized by high-temperature processes, drives demand for refractory materials. The increasing necessity for reliable and heat-resistant linings in petrochemical equipment contributes significantly to the forward momentum of the refractories market.

Market Outlook

- Industry Growth Overview: Iron steel infrastructure development is a high-performance refractory demand driver.

- Sustainability Trends: Closed-loop recycling systems based on low-carbon binders are on the rise.

- Global Expansion: North America & Europe place emphasis on green steel developed linings.

- Major investors: RHI Magnesita Vesuvius Saint Gobain Imerys Krosaki Harima Calderys Shinagawa HarbisonWalker Morgan Advanced Materials Dalmia OCL.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 56.21Billion |

| Market Size in 2025 | USD 35.77Billion |

| Market Size in 2026 | USD 37.31 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 4.62% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Form, Product, Alkalinity, and End-Use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Expansion of the manufacturing sector

- As of 2022, the global manufacturing Purchasing Managers' Index (PMI) stood at 53.3, indicating sustained expansion and driving the need for heat-resistant materials.

The expanding manufacturing sector is a key catalyst for the growing demand in the refractories market. As global manufacturing activities surge, there is a parallel need for sturdy and heat-resistant materials capable of withstanding the high temperatures inherent in industrial processes. Refractories, crucial linings for furnaces and kilns, become indispensable in ensuring the smooth functioning of manufacturing operations. The escalating demand for a variety of manufactured goods, spanning from vehicles to electronic devices, directly correlates with an increased necessity for refractory materials to uphold the efficiency and reliability of these production processes.

Moreover, the continuous evolution of manufacturing technologies necessitates refractories that can withstand more extreme conditions. With the global manufacturing Purchasing Managers' Index (PMI) consistently indicating growth, currently standing at 53.3 as of the latest data, the demand for refractories is poised to continue its upward trajectory, ensuring the resilience and longevity of industrial operations worldwide.

Restraint

Slow adoption of innovations

The slow adoption of innovations poses a notable constraint on the market demand for refractories. Despite continuous advancements in refractory technologies, certain industries exhibit a cautious approach towards adopting new materials. This reluctance can be attributed to the conservative nature of industrial practices and the need for extensive testing and validation processes before integrating innovative refractories into existing systems. The hesitation to deviate from established methods and the perceived risks associated with adopting novel materials contribute to a delayed uptake of these innovations.

Moreover, the refractories market faces challenges in convincing industries to transition from traditional refractory solutions to more advanced alternatives. The time and resources required for thorough testing and the conservative mindset prevalent in certain sectors can hinder the swift incorporation of innovative refractories. This slow adoption impedes market growth, as the full potential of advanced materials may not be realized until broader acceptance and implementation occur across diverse industrial applications.

Opportunity

Renewed Focus on Energy Efficiency

The renewed emphasis on energy efficiency is creating significant opportunities in the refractories market. As industries globally prioritize sustainable practices, there is a growing demand for refractory materials that contribute to more energy-efficient operations. Advanced refractories, designed to withstand high temperatures while minimizing heat loss, align with this focus on energy conservation. Industries, such as steel and cement production, are actively seeking refractory solutions that not only endure harsh conditions but also enhance overall process efficiency, thereby reducing energy consumption.

- For instance, advanced refractories have contributed to a 15% reduction in energy consumption in certain high-temperature industrial processes.

This shift towards energy-efficient refractories presents opportunities for manufacturers to innovate and develop products that align with environmental sustainability goals. The implementation of these advanced materials not only meets regulatory requirements but also allows industries to improve their carbon footprint. As a result, the refractories market is well-positioned to capitalize on the increasing awareness and commitment to energy efficiency, providing solutions that address both environmental concerns and the operational efficiency of industrial processes.

Segment Insights

Form Insights

The bricks & shaped segment had the highest market share of 55% in 2025 based on the form. In the refractories market, bricks refer to moulded and fired ceramic blocks with standardized shapes, offering durability and heat resistance. Shaped segments encompass various pre-formed refractory components designed for specific applications, providing ease of installation. A notable trend in the refractories market involves an increased demand for advanced brick and shaped segment solutions, driven by innovations in material formulations. These developments aim to enhance the longevity and performance of refractory linings in high-temperature industrial processes, meeting the evolving needs of sectors like steel, cement, and petrochemicals.

The monolithic & unshaped segment is anticipated to expand at a significant CAGR of 5.8% during the projected period. In the refractories market, the monolithic or unshaped segment refers to a category of materials that are applied in a pliable state and then hardened in place. Monolithic refractories, such as castables and plastic refractories, offer versatility and ease of application, adapting to complex shapes and varying installations. Recent trends in the refractories market indicate a growing preference for monolithic formulations due to their efficiency, time-saving application, and adaptability to diverse industrial processes. This trend reflects the industry's inclination towards innovative solutions that enhance ease of use and overall performance in high-temperature applications.

Product Insights

The clay segment has held 66% market share in 2025. In the realm of refractories, the clay segment involves products derived from natural clay minerals. These refractories, valued for their versatility and cost-efficiency, are widely applied in industries like ceramics and steel production. Recent trends show an increasing inclination towards high-alumina clay refractories due to their superior performance under high temperatures. As industries prioritize durability and resilience in challenging conditions, the clay segment is adapting to meet evolving needs with advanced formulations, showcasing a continuous effort to provide effective and reliable refractory solutions.

The non-clay segment is anticipated to expand fastest over the projected period. In the realm of refractories, the non-clay sector encompasses materials that extend beyond those originating from clay. This category includes refractory products like alumina, silica, magnesia, and zirconia. Recent market dynamics showcase a growing inclination toward non-clay refractories, driven by their superior resistance to high temperatures and effectiveness in demanding applications. Industries, notably steel, cement, and glass, are increasingly gravitating towards non-clay refractories due to their resilience, resistance to corrosion, and capacity to endure extreme conditions. This trend is instrumental in the expanding prevalence and adoption of non-clay refractory solutions.

Alkalinity Insights

The basic segment has held 59% market share in 2025. In the refractories market, the basic segment of alkaline refractories encompasses materials with a high alkali metal oxide content, such as magnesia and dolomite. These refractories exhibit resistance to basic slag and are commonly used in applications like steelmaking and cement production. A notable trend in this segment involves ongoing research to enhance the performance and longevity of alkaline refractories, ensuring they meet the evolving demands of industries. Innovations focus on optimizing compositions and production processes to bolster the alkalinity of refractories, contributing to increased durability and efficiency in high-temperature applications.

The acidic & neutral segment is anticipated to expand fastest over the projected period. In the refractories market, the acidic segment comprises materials with high silica content, offering excellent resistance to acidic environments. These refractories find application in industries where corrosive conditions prevail, such as in the chemical and petrochemical sectors. Conversely, the neutral segment involves materials with balanced compositions, suitable for applications requiring resistance to both acidic and basic conditions. A trend in the refractories market involves the continual development of neutral refractories with enhanced thermal shock resistance, catering to the evolving needs of industries for versatile and durable refractory solutions.

End-use Insights

According to the end-use industry, the iron & steel segment has held 36% market share in 2025. The iron and steel segment in the refractories market pertains to the use of refractory materials in the production of iron and steel. These materials are essential in maintaining the integrity of furnaces, converters, and ladles subjected to extreme temperatures in the steelmaking process. A notable trend in this segment involves a growing demand for high-performance refractories, capable of withstanding harsh conditions and optimizing energy efficiency. As the iron and steel industry continues to expand globally, the refractories market is witnessing increased adoption of advanced materials to enhance durability and productivity in steel manufacturing processes.

The cement segment is anticipated to expand fastest over the projected period. In the refractories market, the cement segment refers to the utilization of refractory materials in the production of cement. These materials are crucial for lining kilns and furnaces in cement plants, withstanding extreme temperatures and chemical reactions involved in the cement-making process. A significant trend in this segment is the increasing demand for high-performance refractories that enhance the durability and efficiency of cement manufacturing, aligning with the industry's focus on sustainable practices and energy efficiency. Manufacturers are continually innovating to provide solutions that contribute to both environmental goals and operational excellence in the cement sector.

Regional Insights

What is the Asia-Pacific Refractories Market Size?

The Asia-Pacific refractories market size was valued at USD 17.89 billion in 2025 and is projected to reach USD 28.46 billion by 2035, registering a CAGR of 4.75% from 2026 to 2035.

- As part of its 14th Five-Year Plan (2021-2025), China has established ambitious goals for coal-power capacity, aiming to reach approximately 1,100 GW.

The region's thriving steel, cement, and manufacturing sectors propel the demand for refractory materials essential in high-temperature processes. Additionally, the construction boom in Asia-Pacific further contributes to the market's growth. The region's economic growth, coupled with increased infrastructure development, underscores its pivotal role in the refractories market, making it a major contributor to both production and consumption within the industry.

North America is poised for rapid growth in the refractories market due to a surge in industrial activities and a revival of construction projects. The region's robust manufacturing sector, particularly in steel, glass, and cement industries, is driving increased demand for refractory materials. Additionally, infrastructure development and the growing focus on energy efficiency are propelling the adoption of advanced refractories. As industries seek sustainable solutions, the market in North America is expected to witness significant expansion, creating opportunities for innovation and market development in the coming years.

On the other hand, Europe is witnessing notable growth in the refractories market due to increased demand from the flourishing steel and construction industries. The region's commitment to sustainability and stringent environmental regulations is driving the adoption of advanced refractory materials that enhance energy efficiency. Additionally, ongoing infrastructure projects and a resurgence in manufacturing activities contribute to the heightened demand. The focus on innovative solutions and a thriving industrial sector positions Europe as a significant market for refractories, showcasing robust growth driven by a combination of industry expansion and environmental considerations.

Value Chain Analysis of the Refractories Market

- Feedstock Procurement: Strategic sourcing of high-purity chemical precursors of minerals that provides consistency of cost efficiency.

Key players: Almatis, Magnezit Group, Imerys - Chemical Synthesis and Processing: It is a purification of controlled reactions where inputs are converted to desired material characteristics.

Key players: BASF, LANXESS, Albemarle Corporation - Compound Formulation and Blending: Accurate blending of refractory additives, proprietary processed chemicals, and mixes.

Key players: RHI Magnesita, Vesuvius PLC, Saint-Gobain - Quality Testing and Certification: Intense testing ensuring operation in an extreme heat and corrosive environment.

Key players: Bureau Veritas, SGS S.A., Intertek Group - Refractories Packaging and Labelling: The safety specification on refractories usage was outlined through the use of moisture-resistant containers.

Key players: WestRock, Smurfit Kappa, Mondi Group

Refractories Market Companies

- INTOCAST AG: Supplies formed and unformed refractory products, casting auxiliaries, ladles, and tundish systems to world steel and iron manufacturers.

- RHI Magnesita: Supply of magnesia alumina bricks mixes and flow control systems that are designed to take on severe temperature industrial applications across the globe.

- Plibrico Company, LLC: Provides monolithic aluminosilicate and high alumina plastics castables and engineered solutions of refractories to challenging thermal conditions.

Other Major Key Players

- EXUS Refractories S.p.A

- Pyrol

- Redline Industries, Inc.

- Saint-Gobain

- HarbisonWalker International

- Vesuvius plc

- Morgan Advanced Materials

- Shinagawa Refractories Co., Ltd.

- Resco Products, Inc.

- Calderys

- Krosaki Harima Corporation

- Imerys Group

Recent Developments

- In February 2026, The Systems Group launched Systems Refractory Solutions, focusing on refractory maintenance services for the steel industry. This unit aims to provide high-quality, safety-oriented solutions to improve reliability, extend equipment lifespan, and minimize downtime at U.S. steel mills, led by industry veterans Josh Smitsky and Mike Williams. (Source: https://www.prnewswire.com )

- In March 2025, Zhongrong Intelligent Equipment (Jiangsu) Co., Ltd. officially commissioned a new factory, expanding its workshop space by 17,500 m². This enhances production capacity to 6,000 mt of precast components and 200 high-end equipment sets, with unshaped refractory materials' annual capacity reaching 100,000 mt.(Source: https://news.metal.com )

- In June 2023, INTOCAST AG revealed its plan to acquire EXUS Refractories S.p.A, an Italian company, as part of its strategy to enhance its production facility with modern technological advancements. The acquisition is expected to fortify INTOCAST AG's refractory product portfolio, positioning it for sustained growth.

- In April 2023, RHI Magnesita announced its acquisition of the U.S., India, and Europe operations of seven refractories, non-basic monolithic specialists. With a recorded revenue of USD 110 million and PBT of USD 12 million in 2022, this strategic move aims to bring innovative product categories and technological advancements, providing a significant leap in consumer offerings on the global market.

- In October 2021, Intocast expanded its presence in the Americas by acquiring Pyrol, a Mexican manufacturer and trader of refractory products and casting auxiliaries.

- In September 2021, Plibrico Company, LLC completed the acquisition of Redline Industries, Inc., a pioneer in product innovation for high-temperature furnace protection, with a focus on promoting energy efficiency. This acquisition enhances Plibrico's position in the competitive market, offering customers trusted refractory solutions and expanding its product portfolio.

Segments covered in the report

By Form

- Bricks & Shaped

- Monolithic & Unshaped

By Product

- Clay

- Non-Clay

- By Alkalinity:

- Acidic & Neutral

- Basic

By End-Use Industry

- Iron & Steel

- Non-Ferrous Metals

- Glass

- Cement

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting