What is the Aramid Fiber Market Size?

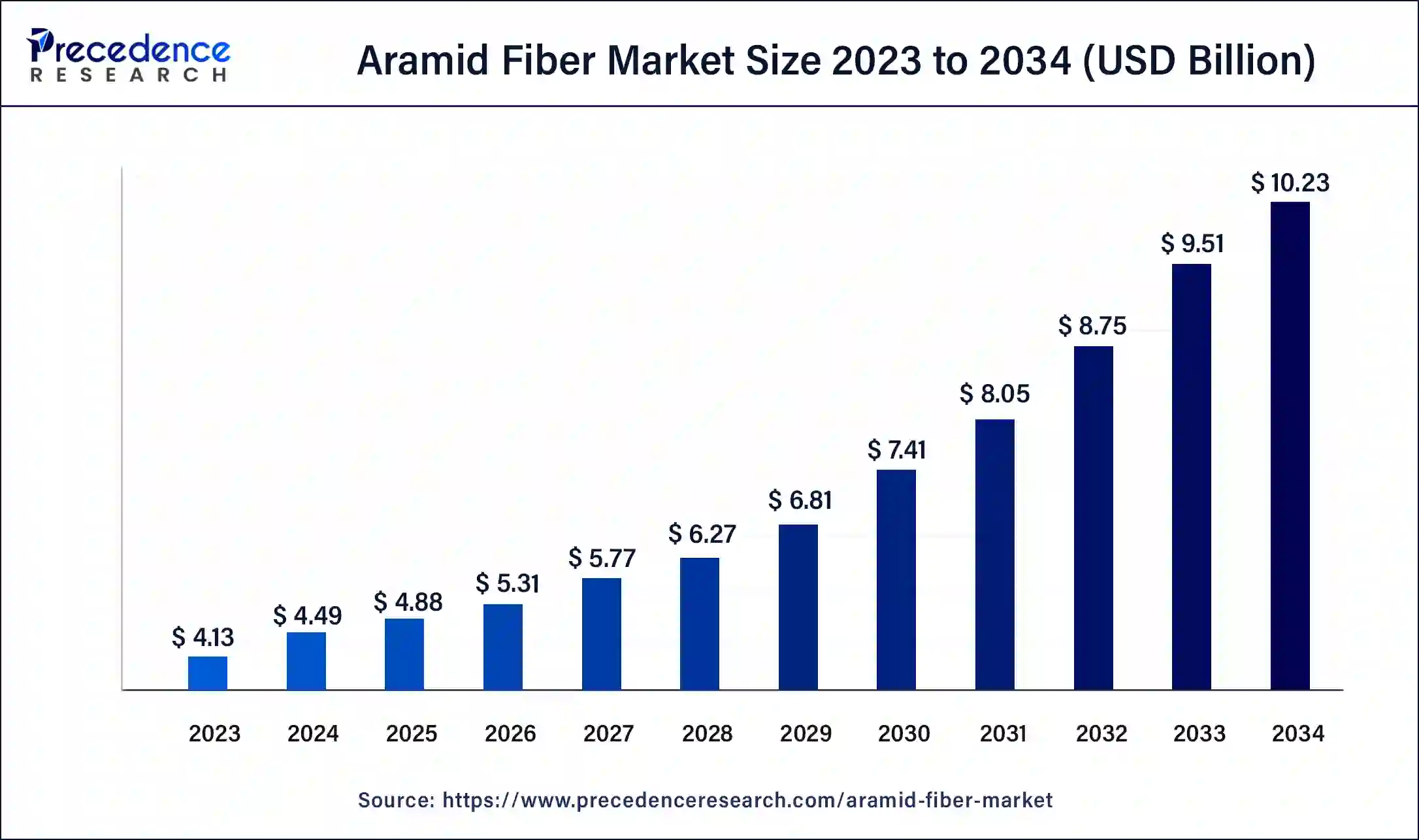

The global aramid fiber market size accounted for USD 4.88 billion in 2025 and is expected to be worth around USD 10.97 billion by 2035, at a CAGR of 8.44% from 2026 to 2035.

Market Highlights

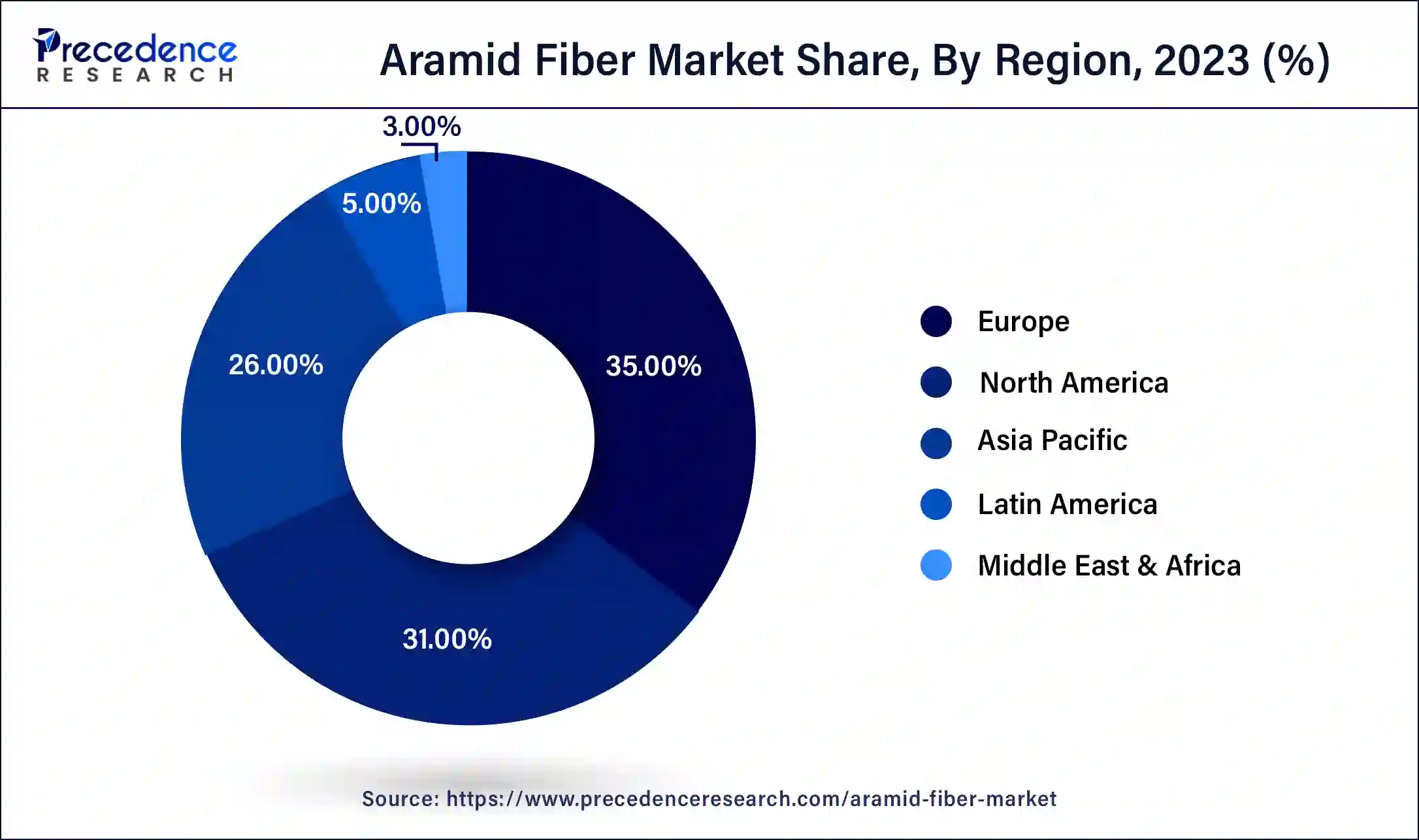

- By Region, Europe holds the largest market share of about 35% in 2025, North America is expected to show a significant increase during the forecast period. At the same time, Asia Pacific is expected to witness a noticeable growth during the forecast period.

- By Product, the para-aramid segment held a significant market share of over 76% in 2025. Additionally, the meta-aramid segment is expected to have significant growth in the forecast period.

- By Application, the security and protection segment has generated more than 36% of revenue share in 2025 and is expected to dominate the global aramid fiber market during the forecast period. The frictional Material segment accounted for a significant market share in 2025.

Market Overview

Aramid fiber is an organic component that has high tensile strength and modulus. Compared to steel and glass fibers of comparable weight, they offer substantially better mechanical characteristics. Due to their innate resistance to heat and flame, aramid fibers maintain these qualities even at high temperatures. The market is anticipated to increase throughout the forecast period as a result of rising demand for the product from a variety of industries, including oil & gas, healthcare, manufacturing, and others, as a result of severe government regulations on worker safety.

The six main aramid compositions that are transformed into industrial fiber products are listed below. Few aramid compositions are made on a commercial basis, despite the fact that many of them are known. Both technology and business are to blame. Technologically speaking, the degree of fiber properties which are influenced by the polymer composition, material selection, polymer molecular weight, and fiber production process is the most crucial aspect.

Aramid Fiber Market Growth Factors

Aramid fibers are the first-ever organic component that is used for advanced composites with high tensile modules and strengths. It has way better mechanical properties than steel and iron and glass fiber so it has more resistance power than others. Aramid fibers are highly temperature and fire and heat-resistive. Aramid fibers are highly resistant to organic solvents, superior resistance to heat and flame. The increasing demand for safety products like arm forces and the increasing requirement for bulletproof jackets, safety helmets, etc. results in an increase in the demand for the aramid fibers market.

The aramid fibers are sensitive to acids, ultraviolet lights, and certain salts. Due to the highly tensile module and incredible strength, it is useful for making body armor suits, fireproof suits for firefighters, bulletproof suits, military helmets, etc. the growing industrialization such as oil and gas, pharmaceuticals automation, technology, and manufacturing there is the increasing cases of accidents of labors in the workplace to avoid these accidents there is the greater demand for the safety measures and products. This is attributed to the rising demand for the aramid fibers market.

Across the world there is increasing industrialization demand for the growth of aramid fibers. Due to its tensile properties, it can be used for various machines in the industries for operating the workflow efficiently and effectively. The aramid fiber can be useful in industrial types of equipment like conveyor belts system, bucket elevators, wagon tipplers, etc.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 4.88 Billion |

| Market Size in 2026 | USD 5.31 Billion |

| Market Size by 2035 | USD 10.97 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 8.44% |

| Largest Market | Europe |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

The rising demand of aramid fibers for automobile applications

Aramid fibers are used in various commercial industries like oil and gas, chemicals, pharmaceuticals, automobiles, etc. The automobile sector is one of the major end-users of aramid fibers due to their high heat and fire resistance. Aramid fiber has high-temperature resistance and is lower in weight as compared to the other component. In the automobile industry, aramid fiber is used in the manufacturing of racing cars. Aramid fibers are replacing fiberglass-reinforced plastics in racing cars. Recently automobile manufacturers shifted towards lighter vehicles by making leaner cars by replacing metal with aramid fiber-based components. It is stronger than other composites, lighter and recyclable. An increase in the demand for electric and hybrid cars in the consumers will benefit the aramid fiber market.

Restraints

High in moisture absorbency and difficulties in processing

The aramid fiber is highly moisture absorbing so it needs to be properly coated. Usually, the top of the product made from aramid fiber should be coated properly. For resistance from moisture, the topcoat must be coated from glass fiber that creates adhesive bonds to topcoats and improves the life cycle of the product made from aramid fiber.

The product made from aramid fiber is difficult to cut and has difficulties in processing on it. All these factors could hamper the aramid fiber market. Such difficulties make it complicated for manufacturers during the manufacturing processes as compared to other conventional fibers. Manufacturers may require specialized equipment and techniques to effectively utilize aramid fibers, such requirements deter small-scale manufacturers from entering the market.

The cutting process and other manufacturing processes associated with aramid fibers are quite time-consuming and labor-intensive. These factors affect the overall efficiency and cost-effectiveness of using aramid fibers, making them less attractive for certain applications.

Opportunities

Rising geopolitical conflicts around the world

One of the most common uses for aramid fibers is security and protection. Due to the growing number of internal and international conflicts, military personnel and geopolitical concerns now require more safety precautions. This will lead to a rise in the requirement for cutting-edge weapons and personal protective equipment (PPE), which will in turn drive demand for aramid fiber. Security and protection applications make up the majority of uses for para-aramid fiber. Due to its extremely high strength and highly orientated, rigid molecular structure, it is utilized in protective clothing such as bulletproof vests, helmets, and vehicle armor. These factors collectively increase the worldwide market prospects for aramid fiber.

Segments Insights

Product Insights

The para-aramid segment had the largest market share in 2025. The para-aramid fibers are used in industries like ballistics protection and cut-resistant protective materials have been able to use fabric systems to replace steel or other metal components since the fabric is several times stronger than steel. The product's low elongation to break, outstanding ballistic qualities, and superior chemical, heat, and flame resistance are likely to support demand.

The Meta-aramid fibers segment is expected to carry a significant market share in the analyzed period. There has been a lot of interest in meta-aramid fibrils (MAF). Due to the chemical inertness of its surface, this high mechanical performance fiber finds it challenging to generate enough interface adhesion between the MAF and polyurethane (PU) matrix. Therefore, it is necessary to increase MAF's surface activity in order to create a high-performance MAF/PU composite. Increasing use of the product in electrical insulation, motor racing, protective apparel for military personnel, and protective

Application Insights

The protection and security segments held the largest market in2025, the segment will sustain its position during the forecast period. The growth of the segment is attributed to the increase in global disputes over nations and the increasing demand for the security gadgets like bulletproof suits, protection gloves, protecting helmets, fireproof suits, etc. the rising demand for these products may increase the demand for the segment in aramid fiber market.

The product's properties include its high resistance power of heat and fire, temperature resistance, superior strength, and lower weight so can be easily transferred from one place to another. Other segments include applications such as rope & cables, recreational groups, filtration, and others.

Regional Insights

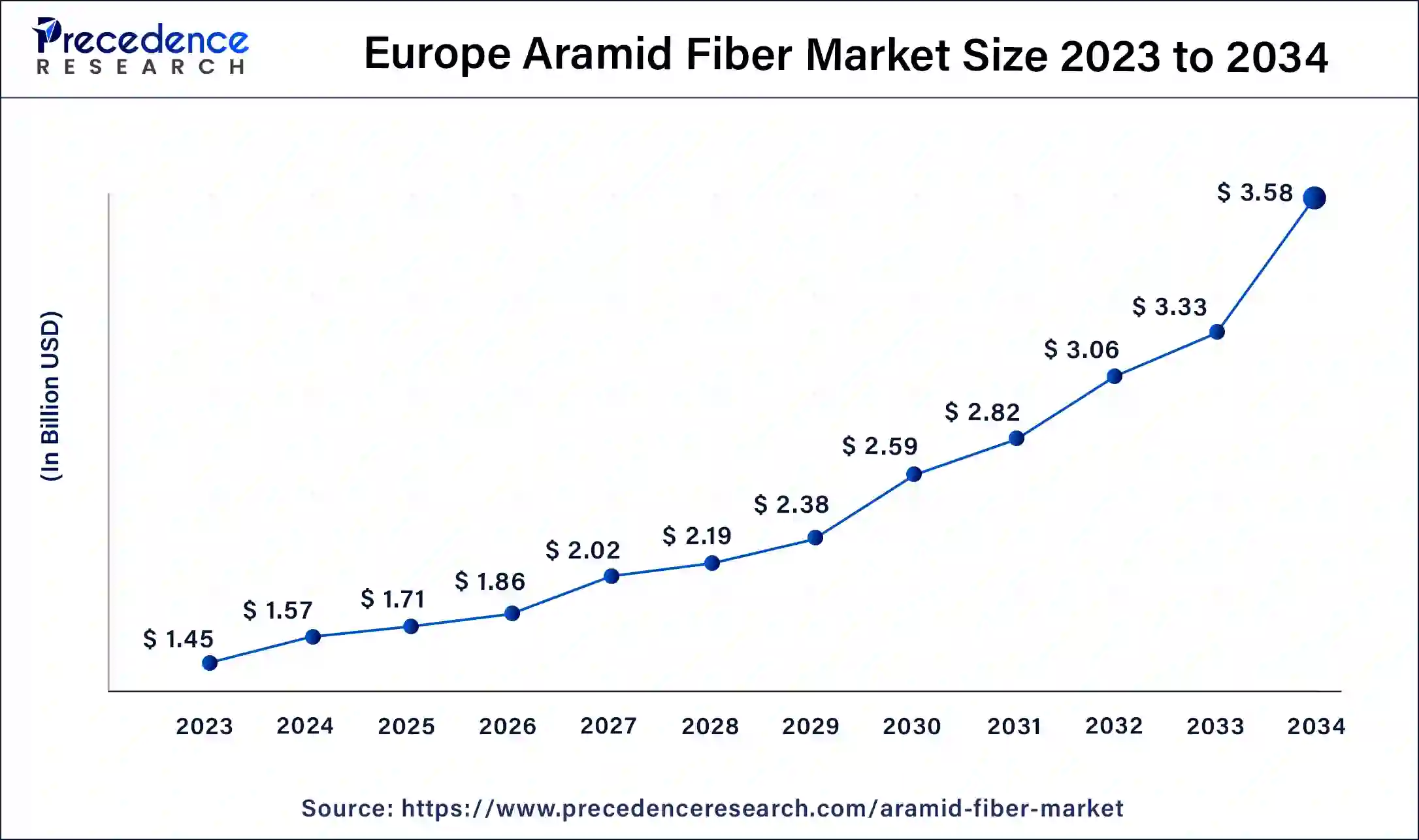

Europe Aramid Fiber Market Size and Growth 2026 to 2035

The Europe aramid fiber market size is estimated at USD 1.71 billion in 2025 and is predicted to be worth around USD 3.84 billion by 2035, at a CAGR of 8.43% from 2026 to 2035.

Europe dominated the aramid market in terms of market share in 2025.The growth of the region is attributed to the increasing demand for security and protection types of equipment in the military and other sectors. The rising requirement for industrialization and rising economies in these regions are expected to grow in the demand for aramid fibers in the region.

In addition, increasing consumer awareness regarding the benefits of aramid fibers, especially in automobiles, will boost the market's development. The European aramid fibers market is competitive, with multiple key players in the market. Key players present in the European market are investing in research and development activities and are significantly focused on enhancing the performance of product applications. Such applications are observed to boost the region's growth in the region.

North America is expected to witness significant growth in the market over the forecast period.The increasing use of the aramid fiber market due to the increasing automobile sector in this region, the requirement of lightweight components for automobiles is attributed to the higher demand of the market in the region. The aramid fibers are recyclable components so they will be used as a sustainable component for various manufacturing uses. Additionally, the increasing conflicts between the nations would expect a higher demand for aramid fibers for manufacturing protection products like helmets, bulletproof jackets, fireproof suits, etc.

Multiple countries in North America have stringent regulations and standards associated with environmental protection and workplace safety. Aramid fibers are subject to these regulations and manufacturers must ensure compliance with relevant norms. The demand for sustainable and environmentally friendly aramid fibers is increasing, this leads to the development of bio-based options in the region in the upcoming period. Moreover, the ongoing research and development will support the market's growth in North America.

What are the Advancements in the Aramid Fiber Market in Asia-Pacific?

Asia Pacific is set to experience a significant amount of growth in the market. This growth is driven by factors like rapid industrialization, a strong automotive manufacturing landscape and the region's expanding defense capabilities. China, Japan, and South Korea are key players in the region due to rising investments in infrastructure and electronics. Government-backed initiatives are also promoting innovation and boosting foreign investments, thus maintaining the region's market position.

China Aramid Fiber Market Trends

The country has a strong focus on infrastructure and telecom development, which helps to further support aramid fiber consumption. Domestic manufacturers are also seen improving product quality to compete with global leaders.

What are the Key Trends in the Aramid Fiber Market in Latin America?

Latin America is expected to witness substantial growth in the market, driven by expanding automotive manufacturing and increasing adoption of industrial safety standards. Brazil and Mexico are leading players as they have a strong focus on vehicle components. Moreover, the presence of partnerships with international aramid producers further helps to enhance the region's supply capabilities and boost market position.

Brazil Aramid Fiber Market Trends:

The country is witnessing an increasing demand for protective equipment, especially in the mining, oil and gas, and manufacturing sectors, which further supports market growth. The expansion of automotive production in select countries also contributes to rising consumption.

How is the Middle East and Africa Region Growing in the Aramid Fiber Market?

The Middle East and Africa region is set to experience steady growth in the upcoming years. This growth is driven by rising investments in defense modernization and industrial safety initiatives. UAE, Saudi Arabia, and South Africa are leading players as they are seen rapidly adopting aramid-based protective solutions for military and oil and gas applications. Strategic collaborations with global fiber producers and expanding local manufacturing also help to enhance the region's global market presence.

Saudi Arabia Aramid Fiber Market Trends

The region relies heavily on imports due to limited manufacturing capacity. Safety regulations are gradually strengthening across industries. Overall, the market shows stable long-term growth potential. Saudi Arabia's push to diversify its economy under Vision 2030, boosting local manufacturing, automotive production, and infrastructure projects, is strengthening demand for aramid fibers across multiple end-use markets.

Value Chain Analysis of the Aramid Fiber Market

- Raw Material Sourcing

The stage deals with the selection and sourcing of specific polyamides, such as poly (paraphenylene terephthalamide) (PPTA) for para-aramids and poly (meta-phenylenediamine) for meta-aramids.

Key Players: Kolon, Teijin, DuPont - Manufacturing Process

This stage deals with various production processes such as polymerization, spinning, drawing as well as other treatments like heat setting or chemical treatments. It is then followed by cutting and finishing.

Key Players: Teijin, Hyosung, Toray - Fabrication Process

This stage includes weaving or knitting the fibers into fabrics, combining them with other materials for composites, or molding them into specific shapes for various applications.

Key Players: Hexcel, DuPont, DSM

Aramid Fiber Market Companies

- Teijin Ltd.

- Yantai Tayho Advanced Materials Co

- E. I. du Pont de Nemours and Company (DowDuPont)

- Hyosung Corp.

- Toray Chemicals South Korea, Inc.

- Kermel S.A

- Kolon Industries, Inc.

- Huvis Corp.

- China National Bluestar (Group) Co., Ltd.

- SRO Aramid (Jiangzu) Co., Ltd.

Recent Development

- In March 2025, Hyosung Advanced Materials showcased aramid innovations. The firm presented ALKEX at Tire Technology Expo and JEC World. The focus was on mobility safety and composites. The company plans to promote its position as the world's top tire cord manufacturer and raise global awareness of its proprietary carbon fiber brand TANSOME and aramid yarn brand ALKEX, as it expands its reach in international markets. (Source:https://www.hshyosung.com)

- In Sep 2022, Mussel Polymers a specialty material and costing company announced the multifunctional aramid fiber coating for strong and lighter reinforced composites. The reinforced material is mostly used in products from golf clubs to the most advanced aircraft.

- In Sep 2023, PIKATA, a technology accessory company pioneering a sustainable and smarter product ecosystem launched the sustainable made aerospace-grade aramid fiber cases for iPhone 14 series. Made with 100% biodegradable and sustainable products.

- In April 2023, a new ultra-high-performance all-season tire made for SUVs has been added to the extensive Ventus product line by Hankook Tire, a leading worldwide tire manufacturer. For premium SUVs, the Ventus S1 evo Z AS X offers unmatched comfort, the best handling at high speeds, and exceptional traction in all-weather situations.

Segments Covered in the Report

By Product

- Para-Aramid

- Meta-Aramid

By Application

- Security & Protection

- Frictional Materials

- Rubber Reinforcement

- Optical Fibers

- Tire Reinforcement

- Electrical Insulation

- Aerospace

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting