What is the Composites Market Size?

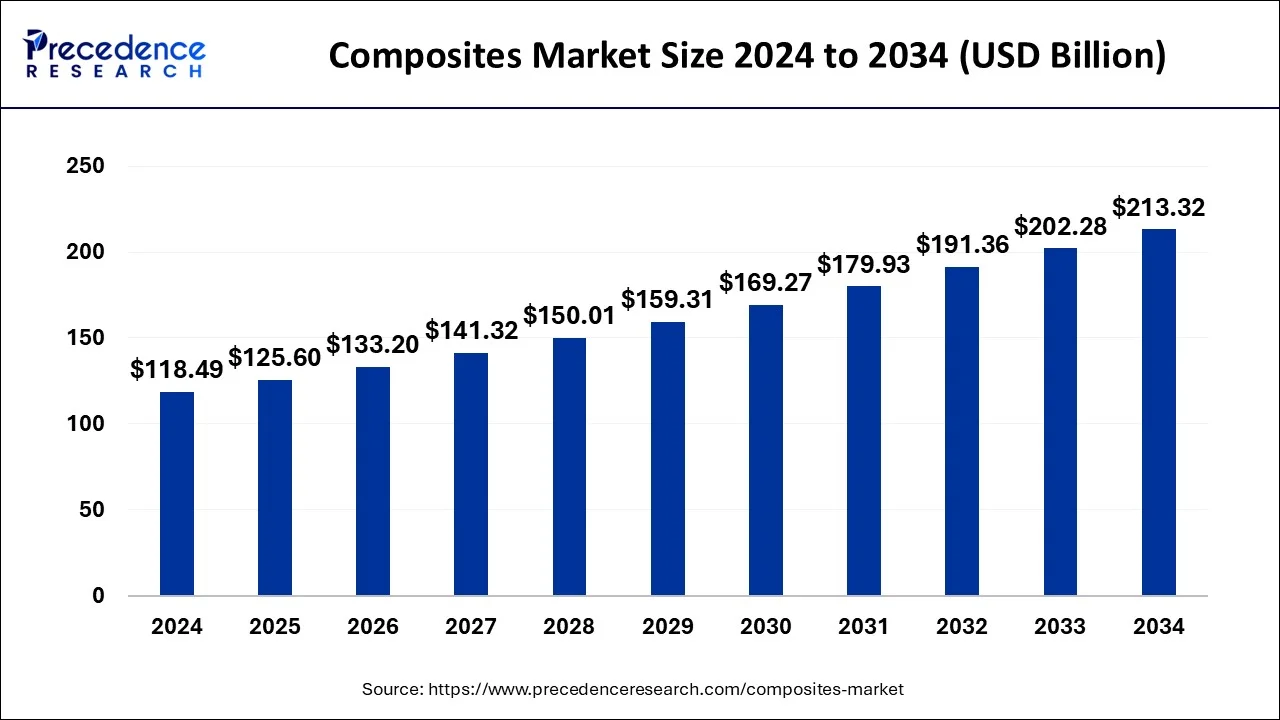

The global composites market size is valued at USD 125.60 billion in 2025 and is predicted to increase from USD 133.20 billion in 2026 to approximately USD 224.28 billion by 2035, expanding at a CAGR of 5.97% from 2026 to 2035. The composites market is driven by the increasing demand for lightweight materials in industries such as aerospace, automotive, and construction.

Composites Market Key Takeaways

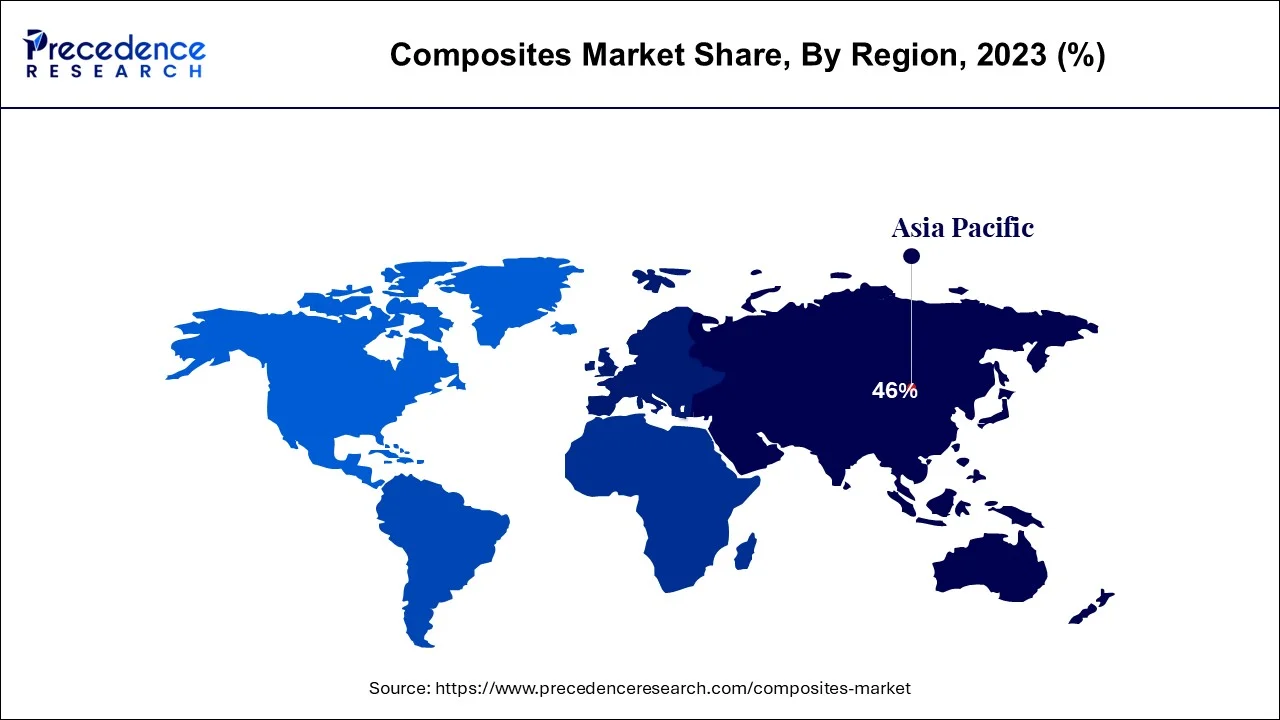

- Asia Pacific dominated the composites market with the largest market share of 46% in 2025.

- By product, the glass fiber segment contributed the highest market share of 61% in 2025.

- By manufacturing process, the layup process segment has held the largest market share of 36% in 2025.

- By end-use, the automotive and transportation segment accounted for the highest market share of 22% in 2025.

Market Size and Forecast

- Market Size in 2025: USD 125.60 Billion

- Market Size in 2026: USD 133.20 Billion

- Forecasted Market Size by 2035: USD 224.28 Billion

- CAGR (2025-2034): 5.97%

- Largest Market in 2025: Asia Pacific

- Fastest Growing Market: North America

What are composites?

The composites market is generally driven by the rapid investment in the advanced materials industry coupled with increasing demand for light-weight automotive components. A composite is an advanced material that is manufactured from two or more distinct constituent substances that are combined to form a new material with unique properties.

Integration of AI in the composites industry

By predicting material properties using machine learning algorithms, data-driven approaches for material optimization, and generative models for exploring novel material compositions. AI algorithms can help researchers evaluate many variables more efficiently, reducing the time and costs associated with experimental testing.

Composites Market Outlook

- Industry Growth Overview: Between 2025 and 2030, this market is expected to grow significantly due to the growing demand for advanced composites from the aerospace sector coupled with surging use of carbon fiber composites in the sports industry.

- Major Investors: Various composite manufacturers and strategic investors are actively entering this market, drawn by joint ventures, R&D and launches. Several composite brands such as SGL Carbon SE, Endeavor Composites, Plafco Fibertech and some others have started investing rapidly for developing advanced composites for the end-user industries.

- Sustainability Trends: The rising emphasis of composite manufacturers to develop eco-friendly composites is an ongoing trend in this market.

- Startup Ecosystem: Several startup companies are engaged in developing composites for the end-user industry. The top startup brands dealing in composites includes 9T Labs, CompPair Technologies, Plafco Fibertech and some others.

- Global Expansion: The market is growing worldwide due to increasing demand for lightweight, high-strength materials across automotive, aerospace, construction, and renewable energy sectors. Emerging countries offer significant opportunities as rapid industrialization, infrastructure development, and adoption of advanced manufacturing technologies drive demand for cost-effective and durable composite materials.

Composites Market Scope

| Report Highlights | Details |

| Market Size in 2025 | USD 125.60 Billion |

| Market Size in 2026 | USD 133.20 Billion |

| Market Size by 2035 | USD 224.28 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 6.05% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, End User, Resin, Manufacturing Process, Region |

Market Dynamics

Drivers

Easy Production of Composites:

Previously, engineers had to create composites via a complicated lay-up procedure, which was time-consuming and limited the design geometry. This has been altered via Digital Composite Manufacturing (DCM). A unique manufacturing method called DCM creates composite parts devoid of physical labor. With DCM, composites can be locally or globally customized in three dimensions to produce the ideal strength, density, and flexibility for the project. Engineers may now design with the freedom of 3D printing and the high performance of composites thanks to DCM. As a result, this factor will likely contribute to growth in the composites market.

Demand for new design opportunities:

Design alternatives are available with composites that are difficult to attain with conventional materials. Item consolidation is possible with composites; a single composite part can take the place of an entire assembly of metal parts. Any finish, from smooth to textured, can be imitated by changing the surface texture. Because fibreglass can be moulded into a variety of boat designs, composite materials make up over 90% of recreational boat hulls. These advantages, which can be used in numerous industries, shorten manufacturing times and lower maintenance costs over time.

Restraints

High Cost of Composites:

Compared to other structural building materials that are utilized for similar tasks, carbon fibre products are more expensive. However, initially less expensive materials like aluminum and steel demand more labor due to their weight. Additionally, carbon fibre carries heat and electricity, making it a poor choice for building projects involving either of these substances. Consequently, this might hamper the market for composites.

Opportunities

Increase in the Production of eVTOLs:

Electric vertical takeoff and landing (eVTOL) aircraft are not the only application for composites in the transportation sector. It is no secret that composites are successful in the aerospace, automotive, and marine end sectors. An advantage for the composites industry is the eVTOL sector. For instance, the Boeing 787, which served as a trailblazer for the use of composites in aircraft, contains almost 50% composite material in its structure. The figures are substantially lower for the automotive sector, with composite materials making up 8–12% of the weight of light automobiles. However, regardless of the manufacturer, that percentage increases to an average of 70% of the material mix for eVTOLs.

Since battery power will be used by the majority of eVTOLs, lightweight is required in several ways, i.e., making lighter components and choosing designs that require fewer components. Additionally, eVTOLs have stringent structural specifications. Composites are a logical solution for eVTOL producers as a result. Composites will be used in every cubic meter of an eVTOL, from large secondary components like clips and brackets to small secondary structures like fuselages and wings. As a result, the composites industry will experience lucrative growth in the near future.

Segment Insights

Product Insights

Among different product type segmentation, in 2024, The glass fiber segment contributed the highest market share of 61% in 2024. This tremendous growth is attributed to its large requirement demand in construction, electronics and electrical,wind energyand transportation sector. Glass fiber also names as fiberglass, is prepared from fine fibers of glass. It provides improved properties like lightweight, high durability, high strength and weather-resistant among others. Such superior qualities propel their demand in countless application sectors.

Increased acceptance of more environment-friendly construction materials is a result of the widespread implementation of strict environmental rules in both developed and developing nations. Carbon fibers and the related composites they are made of can reduce weight and improve fuel efficiency. As a result, the market for premium and sports cars is driving up demand for activated carbon fiber. For the production of 3D-printed car parts, carbon fibre is widely used in the automotive sector. Since carbon fibre is so powerful, it makes the filament stronger and more rigid. As a result, the 3D-printed parts will be significantly lighter and more dimensionally stable since the fibre will help stop the object from shrinking as it cools. The market for composites is growing in segments thanks to these most recent trends.

End use Insights

The automotive and transportation segment accounted the highest market share of 22% in 2024. The outlook of the global composites market seems eye-catching with alluring prospects in numerous end-use sectors such as wind energy, electrical and electronics, construction, pipe & tank, marine, transportation, consumer goods, and aerospace among others. Transportation sector that includescommercial vehicles, coaches, buses and automobiles, is projected emerge as one of the major U.S. markets in during coming few years. At present several prominent vehicle manufacturers are spending in composite materials technology in order to decrease weight and address the targets of authorized carbon emission reduction.

Composites also find great demand in construction industry. It finds application in GFRP include paneling, shower stalls, bathrooms, windows and doors. Growth of construction sector is mainly compelled by low mortgage rates, continuous surge in employment, and reducing house price inflation.

Around the world, composites are used to build and repair a wide range of infrastructure applications, including roads, bridges, buildings, and railroads. Because of their great strength, resistance to rust and corrosion, and low maintenance requirements, these applications endure lengthier. To increase the tensile strength and longevity of concrete buildings and construction components, several polymers are used. The composites can be utilized for both new construction and retrofit circumstances and can be applied prefabricated or on-site. Additionally, composite materials are used more frequently for new and renovated bridge construction. The benefits include excellent strength-to-weight ratios, noncorrosive characteristics, prefabrication possibilities, and design freedom.

Resin Insights

In 2024, among various resins type segment of global composites market, thermosetting resin segment lead the market. This considerable growth is attributed to climbing demand in aerospace, transportation and defense sector. Thermoset composite is typically based on glass, carbon, aramid fibers, and commonly combined with resins such as vinyl esters, epoxies, phenolics, cyanate esters, polyesters, and polyimides.

Thermoplastics are non-toxic in nature, weldable, recyclable for other processes, and have augmented toughness and are less expensive. A comprehensive range of thermoplastic resins are employed in composites including PET, PVC andpolypropylene. Thermoplastics resins are preferably utilized on account of their improved impact resistance and capacity to reform than thermosetting resins.

Manufacturing process Insights

Out of various manufacturing process involved in the global composites market, The layup process segment has held the largest market share of 36% in 2024. This method is very frequently employed for manufacturing of composite. This process includes insertion of layers of composite fiber in an order with the help of matrix of resin and hardener. Then layup is permitted to cool at room temperature. At present, rising production of boats,wind turbineblades and architectural moldings is expected to spur substantially the demand of layup process segment.

The process of filament winding is typically applied to the production of hollow, prismatic, or spherical objects, such as pipes and tanks. A customized winding machine is used to wound continuous fibre tows onto a rotating mandrel. The aerospace, energy, and consumer product industries frequently use filament wound parts. The cost of the fibre is further reduced because there is no additional process needed to turn the fibre into the fabric before usage, making this technique of material application incredibly quick and cost-effective. Since straight fibres can be put in a complicated arrangement to match the applied loads, laminates' structural qualities can be quite good.

Regional Insights

What is the Asia Pacific Composites Market Size?

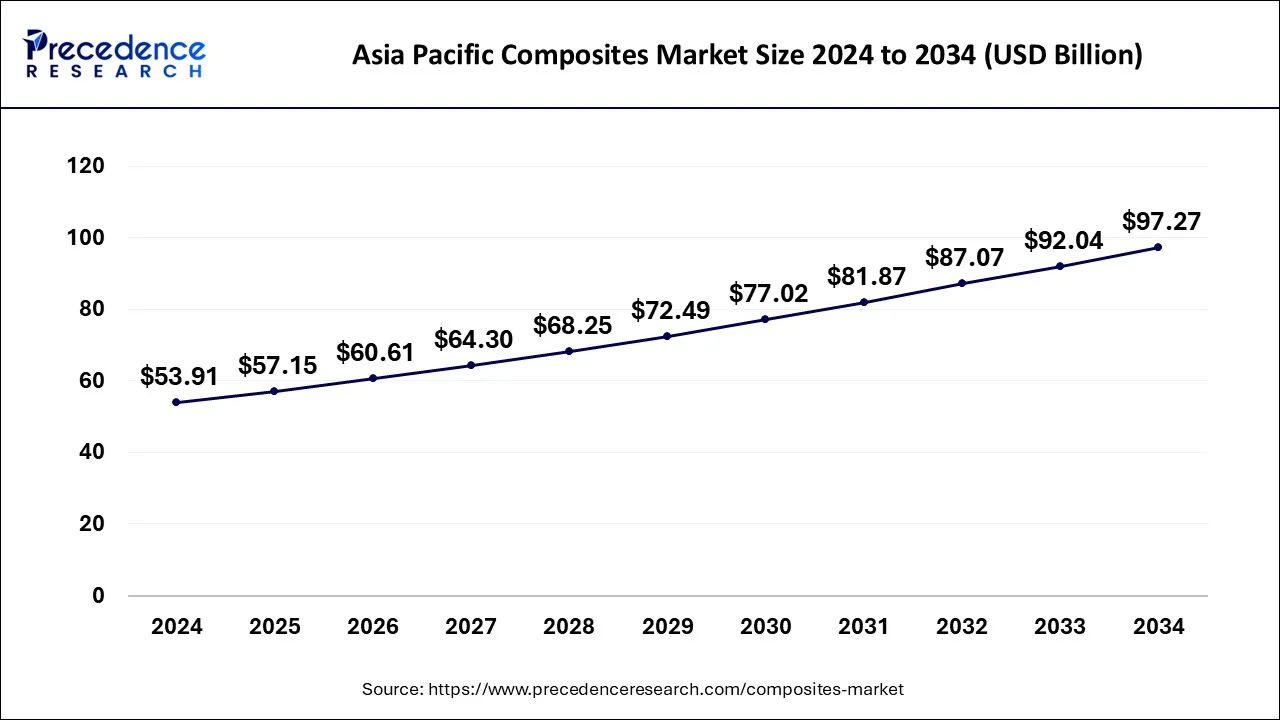

The Asia Pacific composites market size is evaluated at USD 57.15 billion in 2025 and is predicted to be worth around USD 102.33 billion by 2035, rising at a CAGR of 6% from 2026 to 2035.

Due to the strong demand from end-user sectors like construction, automotive, electrical & electronics, aerospace & defense, industrial, etc., the Asia-Pacific region holds the largest share of the global composite material market. As a result of the fast industrialization taking place in nations like China, India, and Japan, the demand for composite materials in the Asia-Pacific area is increasing at an astounding rate.

With more and more sectors using composites, demand them is rising annually. For instance, CompositesWorld estimates that China's supply of Carbon fibre, an advanced composite fibre, will be roughly 19,250 metric tonnes in past years. The International Organization of Motor Vehicle Manufacturers estimates that in 2021 when production was at about 25.22 million units, China's automobile production climbed by 3% annually. During the examined period, the composite market would rise due to the automotive industry's consistent growth.

The total domestic medical device output in Japan, according to the International Trade Administration, was estimated to be over USD 24 billion in 2021 because of the country's growing reliance on medical technology in the aftermath of COVID-19. Furthermore, due to demand and OEM adoption, India has a significant impact on the penetration of thermoplastics and thermoset composites in the automotive industry. Additionally, according to Indian government regulations, suppliers in the aerospace industry are required to source around 30% of their components domestically. Consequently, this element encourages the expansion of the composite market.

Asia Pacific dominated the composites market with the largest market share of 46% in 2024. This dominance is due to proliferating demand from different end-use sectors of major countries such as Japan, India and China. Governments of various nations such as Canada, Japan, the U.S., South Korea, China, India Mexico, and Brazil have suggested greenhouse gas emission and fuel economy standards for light commercial vehicles/light trucks and passenger vehicles. These suggested regulations in these nations are likely to support the requirement for composites from the automotive segment.

The composites sector is an economic force that energies the American economy. This industry contributes around USD 22 billion to the U.S. economy annually. Further, as per 2016 UK Composites Strategy, the UK composites product market with nearby 1500 British companies engaged was assessed at around Euro 2.3 billion in 2015, and is projected to reach around Euro 12 billion by 2030.

North America shows a significant growth in the composites market during the forecast period.

The increasing need for lightweight materials is one of the primary drivers for the composites market in the United States. In the aerospace and defense industry, the demand for composites is propelled by factors such as the growth in air passenger traffic and expanding commercial space aircraft manufacturing activities for space exploration missions. Carbon fiber reinforced polymer is formed by molding carbon fiber with plastic resin. In the aircraft field, sandwich structures made of carbon fiber-reinforced polymer composite materials are extensively used for interior and exterior applications.

United States

- In February 2024, Owens Corning and Masonite International Corporation declared they have entered into a definitive agreement under which Owens Corning will obtain all outstanding shares of Masonite for $133.00 per share in cash.

Why Europe held a significant share of the industry?

Europe held a significant share of the market. The increasing preference of automotive brands to adopt advanced composites for manufacturing vehicle components has boosted the market expansion. Also, technological advancements in the advanced materials industry coupled with the presence of numerous composite manufacturers is expected to drive the growth of the composites market in this region

Germany is a major contributor to the European composites market, driven by its strong automotive, aerospace, and construction industries that demand high-performance, lightweight materials. The country's advanced manufacturing infrastructure and focus on research and development support innovation in composite technologies. Additionally, stringent environmental regulations and a push for energy-efficient solutions further boost the adoption of composites across various sectors in Germany.

What made Latin America to held a considerable share of the market?

Latin America held a considerable share of the industry. The increasing use of high-quality composites from the construction sector has driven the market growth. Also, rise in number of composite startups coupled with rapid investment in the composite industry is expected to propel the growth of the composites market in this region.

Brazil is a major player in the Latin American composites market, owing to its large automotive, aerospace, and construction sectors that increasingly rely on lightweight and durable materials. The country's ongoing industrialization, infrastructure development, and investments in advanced manufacturing technologies drive strong demand for composite materials. Additionally, growing focus on sustainable and energy-efficient solutions further supports the adoption of composites in Brazil.

How did Middle East and Africa to hold a notable share of the industry?

Middle East and Africa held a notable share of the market. The rising demand for high-quality composites from the defense and marine sector has boosted the market expansion. Additionally, the increasing focus of market players for opening up new production plants to increase the production of composites is expected to foster the growth of the composites market in this region.

The UAE is a major contributor to the Middle East & Africa composites market, driven by its rapidly growing construction, aerospace, and automotive sectors. Significant investments in infrastructure projects and smart city developments are increasing the demand for lightweight, high-performance, and durable composite materials. Additionally, government initiatives promoting advanced manufacturing and sustainable building practices further support the adoption of composites in the UAE.

Value Chain Analysis

- Raw Material Production

This stage involves the manufacturing of base materials such as polymers, fibers, resins, and additives that form the foundation of composite materials.

Key players: DuPont, BASF, Toray Industries, Mitsubishi Chemical, Owens Corning - Composite Material Manufacturing

Raw materials are processed into intermediate or finished composite forms such as prepregs, laminates, sheets, and molded parts using techniques like pultrusion, filament winding, and resin transfer molding.

Key players: Hexcel Corporation, Gurit Holding AG, SGL Carbon, Huntsman Corporation, Solvay - Component Fabrication

Composite materials are converted into specific components for industries such as aerospace, automotive, wind energy, and construction.

Key players: Boeing, Airbus, General Motors, Ford, Siemens Gamesa

Key Players: Offerings and strategies to shape the industrial landscape

- PPG Industries, Inc.: PPG Industries, Inc. is a global company based in Pittsburgh, Pennsylvania, that manufactures and distributes a wide variety of paints, coatings, and specialty materials. Founded in 1883 as the Pittsburgh Plate Glass Company, it serves numerous markets, including automotive, aerospace, construction, and consumer products.

- Toray Industries, Inc.: Toray Industries is a Japanese multinational corporation specializing in advanced materials and chemical manufacturing, founded in 1926. The company operates in a wide range of sectors, including fibers and textiles, performance chemicals, carbon fiber composite materials, life sciences, and environmental engineering.

- Owens Corning: Owens Corning is a global building and composite materials company that develops and manufactures insulation, roofing, and fiberglass composites. This company was founded in 1938 that is known for its material science expertise and operates in various markets, with products used in commercial and residential buildings, and in applications for automotive, transportation, and energy industries.

- Hexcel Corporation: Hexcel Corporation is an American company that develops and manufactures high-performance, lightweight composite materials such as carbon fibers, honeycomb, and prepregs for commercial aerospace, defense, space, and industrial markets. Its products are used in numerous applications such as aircraft structures, wind turbine blades, satellites, and high-performance sporting goods and vehicles

- DuPont: DuPont is a global science and innovation leader that develops and provides technology-based materials and solutions across a wide range of industries, including electronics, water, healthcare, and transportation. Founded in 1802, the company has a long history of innovation, and its products are used in applications from water purification and medical devices to automotive components and safety materials such as Kevlar and Tyvek.

Recent Developments

- In October 2025, AnalySwift collaborated with Purdue. This collaboration is done for developing CompositesAI.

(Source: purdue.edu) - In May 2025, Tata AutoComp joined hands with Katcon. This joint venture is done for developing advanced composites in Mexico.

(Source: autocarpro.in) - In April 2025, PolySpectra joined hands with Tethon 3D. This joint venture is aimed at launching ThOR 10 glass-filled composites.

(Source: voxelmatters.com)

Segments Covered in the Report

By ProductType

- Glass Fiber

- Carbon Fiber

- Others

By ResinType

- Thermoplastic

- Thermosetting

- Others

By Manufacturing Process Type

- Injection Molding Process

- Resin Transfer Molding Process

- Pultrusion Process

- Layup Process

- Filament Winding Process

- Compression Molding Process

- Others

By End Use

- Electrical & Electronics

- Automotive & Transportation

- Wind Energy

- Aerospace & Defense

- Pipes & Tanks

- Construction & Infrastructure

- Marine

- Others

By Geography

- North America

- U.S.

- Canada

- Europe

- U.K.

- Germany

- France

- Asia Pacific

- China

- India

- Japan

- South Korea

- Middle East & Africa

- Latin America

Get a Sample

Get a Sample

Table Of Content

Table Of Content